Market Overview

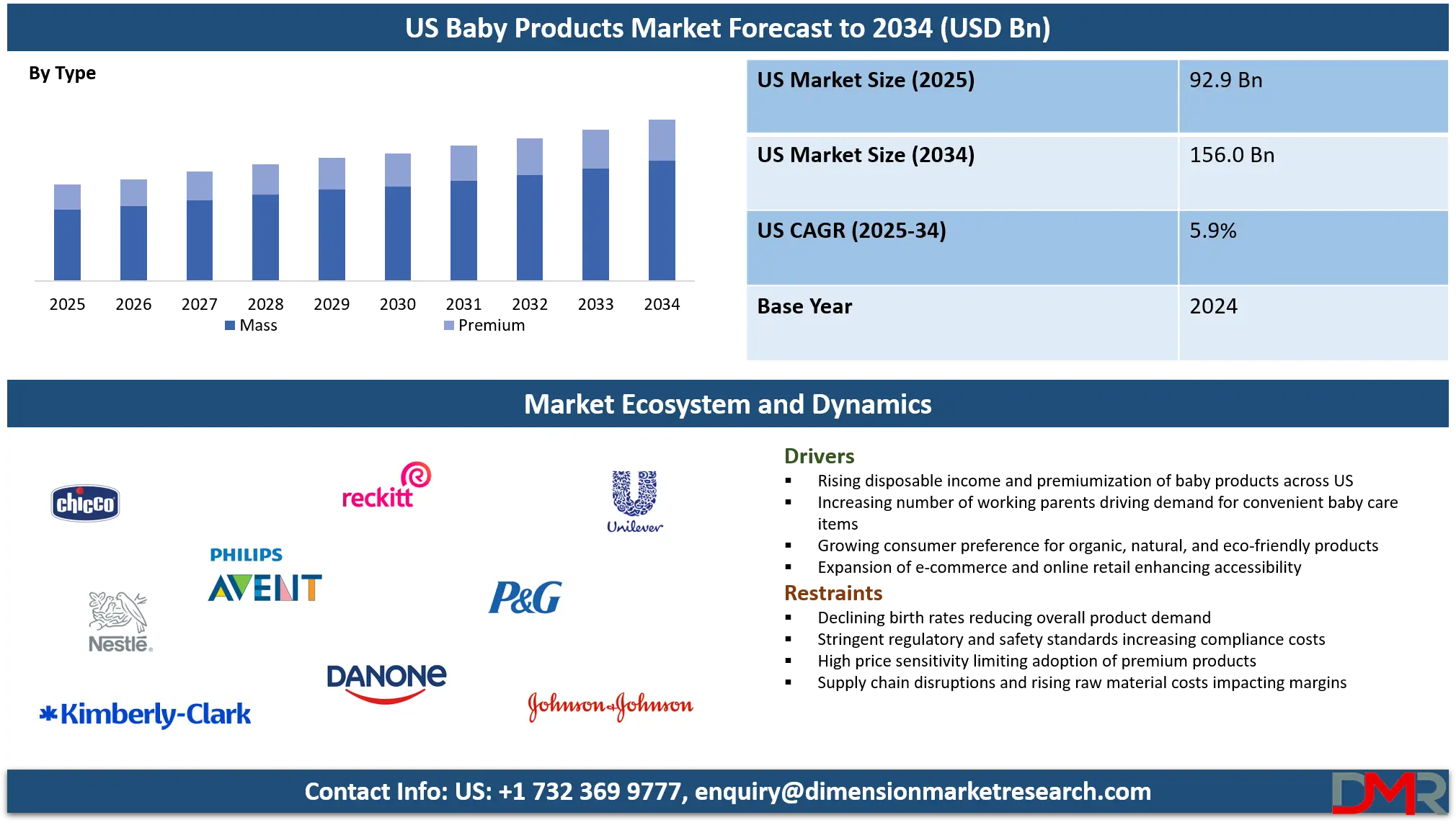

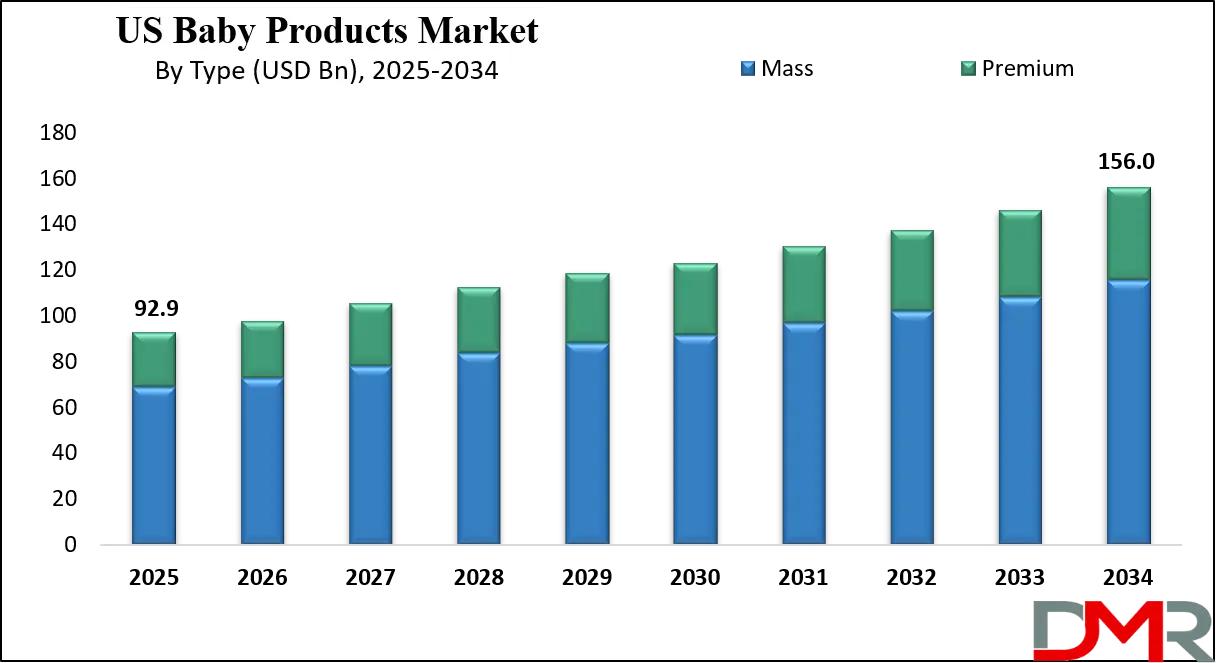

The US Baby Products Market size is projected to reach USD 92.9 billion in 2025 and grow at a compound annual growth rate of 5.9% to reach a value of USD 156.0 billion in 2034.

Baby products are items specially designed to support the health, safety, comfort, and development of infants and toddlers. These include baby food, clothing, diapers, cosmetics, toys, strollers, furniture, feeding accessories, and nursery essentials. They are created to meet the sensitive needs of babies, with strict attention to safety standards, gentle materials, and easy usability for parents. The market also reflects a growing demand for eco-friendly and sustainable products, as parents increasingly prefer items that are safe for both their child and the environment. Baby products are not only functional but also help in nurturing early childhood growth and ensuring everyday convenience for families.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, demand for baby products in the United States has been driven by rising awareness of child health and safety, urban lifestyles, and the availability of a wide variety of premium and organic options. Working parents increasingly seek time-saving and high-quality products, which has boosted sales of ready-to-use baby food, multifunctional strollers, and advanced nursing equipment. Social media exposure has also influenced parents’ buying habits, encouraging them to try new brands and innovations. Alongside this, an increase in dual-income households and rising purchasing power has fueled consistent growth in this sector.

One of the major trends is the shift toward organic and natural baby care products. Parents prefer chemical-free skincare, organic food, and sustainable clothing materials. Another important trend is the integration of technology in products like smart baby monitors and connected nursery devices. Online shopping platforms have also grown significantly, making it easier for parents to access a wide range of products quickly. Subscription-based baby essentials services are gaining popularity, offering parents convenience and reliability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Parents today are more informed and research-driven than ever before. They spend time reading reviews, comparing ingredients, and looking for certifications before making a purchase. Many are loyal to brands that maintain transparency and demonstrate safety, while others experiment with new products introduced through influencer marketing. Emotional appeal also plays a role, as baby products are closely tied to feelings of care and responsibility. This consumer mindset has shaped the competitive landscape, where trust and brand reputation matter as much as affordability.

US Baby Products Market: Key Takeaways

- Market Growth: The US Baby Products Market size is expected to grow by USD 58.1 billion, at a CAGR of 5.9%, during the forecasted period of 2026 to 2034.

- By Type: The mass segment is anticipated to get the majority share of the US Baby Products Market in 2025.

- By Distribution Channel: The hypermarkets & supermarkets segment is expected to get the largest revenue share in 2025 in the US Baby Products Market.

- Use Cases: Some of the use cases of Baby Products includes health & nutrition products, safety & convenience products and more

US Baby Products Market: Use Cases:

- Health & Nutrition Products: Baby food, formula, and nutritional supplements are widely used to support infant growth and development. Parents rely on these products for balanced diets, often preferring organic and preservative-free options. The demand is also driven by busy lifestyles that require ready-to-feed and convenient meal solutions.

- Safety & Convenience Products: Items such as strollers, car seats, cribs, and baby monitors are essential for ensuring infant safety while providing ease for parents. These products are designed with strict safety standards and modern features. Many parents look for multifunctional and durable solutions that can adapt as the child grows.

- Hygiene & Personal Care Products: Diapers, wipes, lotions, and toiletries are everyday essentials in baby care routines. Parents seek gentle, hypoallergenic, and chemical-free options to protect delicate skin. Growing awareness of eco-friendly choices has also boosted demand for biodegradable diapers and sustainable packaging.

- Entertainment & Developmental Products: Toys, play equipment, and learning tools are used to engage babies while supporting cognitive and motor skill development. Parents often choose products that combine fun with educational value. Digital innovations, such as interactive learning apps and smart toys, are becoming increasingly popular in this category.

Market Dynamic

Driving Factors in the US Baby Products Market

Rising Awareness of Infant Health and Safety

The U.S. baby products market is experiencing growth due to increasing awareness among parents regarding the importance of infant health and safety. Modern parents are more conscious about the products they purchase, often seeking items that are free from harmful chemicals, certified safe, and approved by healthcare professionals. This has driven demand for organic baby food, hypoallergenic skincare, and eco-friendly diapers. Health campaigns and greater access to information have empowered families to make informed choices, pushing brands to improve transparency. The focus on safety and nutrition has also encouraged product innovation, shaping the industry toward higher-quality offerings.

Shift in Lifestyle and Purchasing Behavior

Another strong growth driver is the lifestyle changes in U.S. households, where dual-income families and working parents increasingly rely on convenient, premium, and time-saving baby products. Busy schedules have fueled demand for ready-to-use meals, multifunctional strollers, subscription-based diaper services, and smart nursery devices. Online shopping platforms and e-commerce expansion have made it easier for parents to access a wide variety of products, further strengthening market reach. Social media influence and targeted marketing campaigns also play a key role in shaping purchasing habits. These evolving behaviors have created opportunities for both established brands and new entrants to meet rising expectations.

Restraints in the US Baby Products Market

High Cost of Premium and Organic Products

One of the key restraints in the U.S. baby products market is the high cost associated with premium and organic items. While parents prefer safe, eco-friendly, and chemical-free products, the price difference compared to conventional options often limits adoption. Many families, especially those with budget constraints, find it difficult to regularly purchase premium baby food, organic clothing, or sustainable diapers. This price sensitivity creates a challenge for brands to balance affordability with quality. As a result, the market experiences a divide between high-end and mass products, restricting uniform growth across consumer groups.

Regulatory Challenges and Product Recalls

Another significant restraint comes from strict regulations and the risk of product recalls. Baby products must meet high safety standards, and any failure can lead to trust issues and financial losses for companies. Recent cases of formula shortages and recalls have highlighted how sensitive this market is to disruptions. Parents are highly cautious, and negative publicity spreads quickly, impacting overall brand reputation. Compliance with evolving safety and labeling requirements also increases operational costs. These factors can delay product launches and make it harder for smaller brands to compete, slowing down overall market expansion.

Opportunities in the US Baby Products Market

Growing Demand for Eco-Friendly and Sustainable Products

An important opportunity in the U.S. baby products market lies in the rising preference for eco-friendly and sustainable solutions. Parents are increasingly choosing biodegradable diapers, organic fabrics, and products with recyclable packaging to reduce environmental impact. This shift is also supported by awareness campaigns and a cultural move toward greener lifestyles.

Companies that introduce innovative, safe, and planet-friendly options can capture strong loyalty among environmentally conscious families. The push for sustainability creates room for new product lines, partnerships, and premium offerings that align with long-term consumer values.

Expansion of E-Commerce and Subscription Models

Another major opportunity comes from the growth of online retail and subscription-based services. Parents value the convenience of doorstep delivery for essentials such as diapers, wipes, and formula, reducing the stress of frequent shopping. Personalized subscription boxes and curated bundles allow companies to strengthen customer relationships and ensure repeat sales.

E-commerce platforms also provide smaller brands with equal visibility alongside established players. With digital marketing, social media, and influencer-driven promotions, companies can reach wider audiences and create targeted engagement. This digital expansion presents significant growth prospects for the U.S. baby products industry.

Trends in the US Baby Products Market

Shift Toward Organic and Natural Baby Care

A key trend shaping the U.S. baby products market is the strong shift toward organic and natural options. Parents are increasingly avoiding products with artificial additives, synthetic fragrances, and harmful chemicals, instead choosing organic baby food, plant-based skincare, and natural fabrics. This trend is reinforced by rising health consciousness and greater access to product information online. Brands are responding by launching certified organic lines and highlighting clean labels. The preference for gentle, safe, and environmentally responsible products continues to grow, making organic and natural offerings a central part of the market’s evolution.

Integration of Technology in Baby Care Solutions

Another recent trend is the adoption of technology-driven products designed to improve convenience and safety for parents. Smart baby monitors, connected cribs, wearable health trackers, and app-enabled feeding devices are gaining traction in households. These innovations allow parents to monitor sleep patterns, feeding schedules, and overall well-being in real time. With busy lifestyles and dual-income families, tech-enabled baby care solutions provide peace of mind and efficiency. The growing role of the Internet of Things (IoT) and AI in this sector reflects a wider trend of digital parenting, creating new growth avenues for the market.

Impact of Artificial Intelligence in US Baby Products Market

- Personalized Product Recommendations: AI enables tailored shopping experiences by analyzing consumer behavior, helping parents find the most suitable baby products based on age, needs, and preferences.

- Demand Forecasting and Inventory Optimization: Retailers use AI-driven analytics to predict purchasing trends, ensuring better stock management and reducing product shortages or overstock.

- Product Innovation and Design: AI supports the development of safer, smarter baby products, such as AI-powered monitors and adaptive feeding solutions, enhancing both functionality and safety.

- Enhanced Marketing and Consumer Engagement: Machine learning tools allow brands to target specific parent segments with personalized ads and promotions, improving conversion rates.

- Quality Control and Safety Assurance: AI-based vision systems and sensors help manufacturers maintain stringent safety standards by detecting product defects and ensuring regulatory compliance.

Research Scope and Analysis

By Product Analysis

Baby food will be leading in 2025 with a share of 27.8%, playing a central role in the overall growth of the U.S. baby products market. The segment benefits from rising demand for organic, natural, and ready-to-feed options that align with parents’ focus on nutrition and convenience. With busy lifestyles and dual-income households, packaged baby meals, purees, and fortified formulas are becoming everyday essentials.

Increasing awareness of child health, coupled with innovative product launches featuring clean labels and allergen-free ingredients, strengthens the category’s appeal. E-commerce platforms and subscription services are also boosting accessibility and trust among parents. This steady demand positions baby food as a key growth driver, shaping the future of the baby products industry with ongoing advancements in quality, safety, and variety.

Baby clothing is having significant growth over the forecast period, contributing strongly to the expansion of the U.S. baby products market. Parents are placing greater emphasis on comfort, safety, and style, leading to demand for soft fabrics, skin-friendly materials, and fashionable designs. Growing awareness of eco-friendly textiles and organic cotton clothing is also influencing purchase decisions.

Seasonal collections, premium apparel lines, and gender-neutral styles are widening the market scope, appealing to diverse consumer preferences. E-commerce platforms and online boutiques have further increased availability and affordability, making baby apparel an accessible category across regions. With continuous innovation in design and materials, the baby clothing segment is set to play a vital role in driving overall market momentum.

By Type Analysis

Mass will be leading in 2025 with a share of 74.2%, driving the largest portion of growth in the U.S. baby products market. This type remains dominant because parents prioritize affordability, accessibility, and practicality when purchasing everyday essentials like diapers, wipes, baby food, and clothing. Mass products are widely available across supermarkets, hypermarkets, drugstores, and online platforms, ensuring easy access for families of all income levels.

The segment benefits from consistent demand, as these essentials are non-discretionary and frequently purchased. Companies focus on maintaining quality while keeping prices competitive, appealing to cost-conscious households. With expanding distribution channels and growing online sales, the mass category is expected to retain its leadership position, shaping the foundation of the baby products industry while meeting the needs of a broad consumer base.

Premium is having significant growth over the forecast period, playing a crucial role in the evolution of the U.S. baby products market. Parents are increasingly drawn to high-quality, organic, and innovative options that offer enhanced safety, comfort, and style. This shift is supported by rising disposable incomes, changing lifestyles, and growing awareness of eco-friendly and chemical-free alternatives.

Premium baby products, including organic food, luxury apparel, smart monitors, and designer nursery items, cater to parents seeking both function and sophistication. E-commerce platforms and social media influence are also expanding the visibility of premium brands. With continuous product innovation and personalization, the premium type is set to attract a loyal consumer base, fueling overall market expansion alongside the mass segment.

By Distribution Channel Analysis

Hypermarkets and supermarkets dominate the U.S. baby product market, accounting for approximately 43.5% of total sales. Their leadership stems from an extensive product variety, a trusted brand, and the convenience of one-stop shopping experiences for parents. These stores provide easy access to essential baby care products such as diapers, formula, food, and toiletries under one roof, often complemented by attractive discounts and loyalty programs. The physical presence of products also builds trust among consumers who prefer examining quality and authenticity before purchase.

Moreover, strategic collaborations with major baby care brands, competitive pricing, and widespread store networks across urban and suburban areas reinforce their market dominance, making hypermarkets and supermarkets the primary shopping channel for U.S. baby products.

The online segment is emerging as the fastest-growing distribution channel in the U.S. baby product market, driven by shifting consumer behavior toward digital convenience. Parents increasingly prefer e-commerce platforms for their flexibility, doorstep delivery, and access to a wide range of products, including premium and niche brands unavailable in physical stores.

Subscription-based services for essentials like diapers and baby food, coupled with AI-driven product recommendations, enhance the user experience and encourage repeat purchases. Social media marketing, influencer endorsements, and the growing trust in online reviews further boost digital sales.

Additionally, post-pandemic lifestyle changes have accelerated online adoption, as working parents seek time-saving and contactless shopping options. This ongoing digital transformation, supported by improved logistics and personalized shopping technologies, continues to redefine how U.S. consumers purchase baby products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Baby Products Market Report is segmented on the basis of the following:

By Product

- Baby Food

- Baby Cosmetics & Toiletries

- Baby Toys & Play Equipment

- Baby Safety & Convenience

- Baby Clothing

- Baby Nursery & Furniture

- Baby Feeding & Nursing

By Type

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

- Pharmacies & Drugstores

- Others

Competitive Landscape

The competitive landscape of the U.S. baby products market is shaped by a mix of established global players and emerging local brands that constantly innovate to meet changing consumer needs. Competition is intense as companies focus on quality, safety, and product variety while also adapting to trends like organic ingredients, eco-friendly packaging, and smart baby care solutions.

E-commerce has intensified rivalry by giving smaller brands visibility alongside larger ones, while subscription models and direct-to-consumer sales have added new layers of competition. Marketing strategies often rely on trust, transparency, and emotional appeal, making brand reputation a crucial factor for success.

Some of the prominent players in the US Baby Products are:

- Procter & Gamble

- Kimberly-Clark

- Johnson & Johnson

- Nestlé

- Danone

- Reckitt

- Abbott

- Unilever

- The Honest Company

- Babyganics

- Carter’s

- Philips Avent

- Pigeon

- Medela

- Munchkin

- Dr. Brown’s

- Newell Brands

- Dorel Juvenile

- Evenflo

- Chicco

- Other Key Players

Recent Developments

- In May 2025, Nestlé introduced a new range of organic baby food products in Europe, emphasizing sustainable sourcing and packaging to meet the increasing demand for organic options.

- In April 2025, Procter & Gamble introduced a new line of eco-friendly baby diapers made from biodegradable materials, aimed at reducing the environmental footprint

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 92.9 Bn |

| Forecast Value (2034) |

USD 156.0 Bn |

| CAGR (2025–2034) |

5.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Baby Food, Baby Cosmetics & Toiletries, Baby Toys & Play Equipment, Baby Safety & Convenience, Baby Clothing, Baby Nursery & Furniture, and Baby Feeding & Nursing), By Type (Mass and Premium), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online, Pharmacies & Drugstores, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

Procter & Gamble, Kimberly-Clark, Johnson & Johnson, Nestlé , Danone, Reckitt, Abbott, Unilever, The Honest Company, Babyganics, Carter’s, Philips Avent, Pigeon, Medela, Munchkin, Dr. Brown’s, Newell Brands, Dorel Juvenile, Evenflo, Chicco, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Baby Products Market?

▾ The US Baby Products Market size is expected to reach a value of USD 92.9 billion in 2025 and is expected to reach USD 156.0 billion by the end of 2034.

Who are the key US Baby Products Market?

▾ Some of the major key players in the US Baby Products Market are Nestle, P&G, Unilever, and others

What is the growth rate in the US Baby Products Market?

▾ The market is growing at a CAGR of 5.9 percent over the forecasted period.