Market Overview

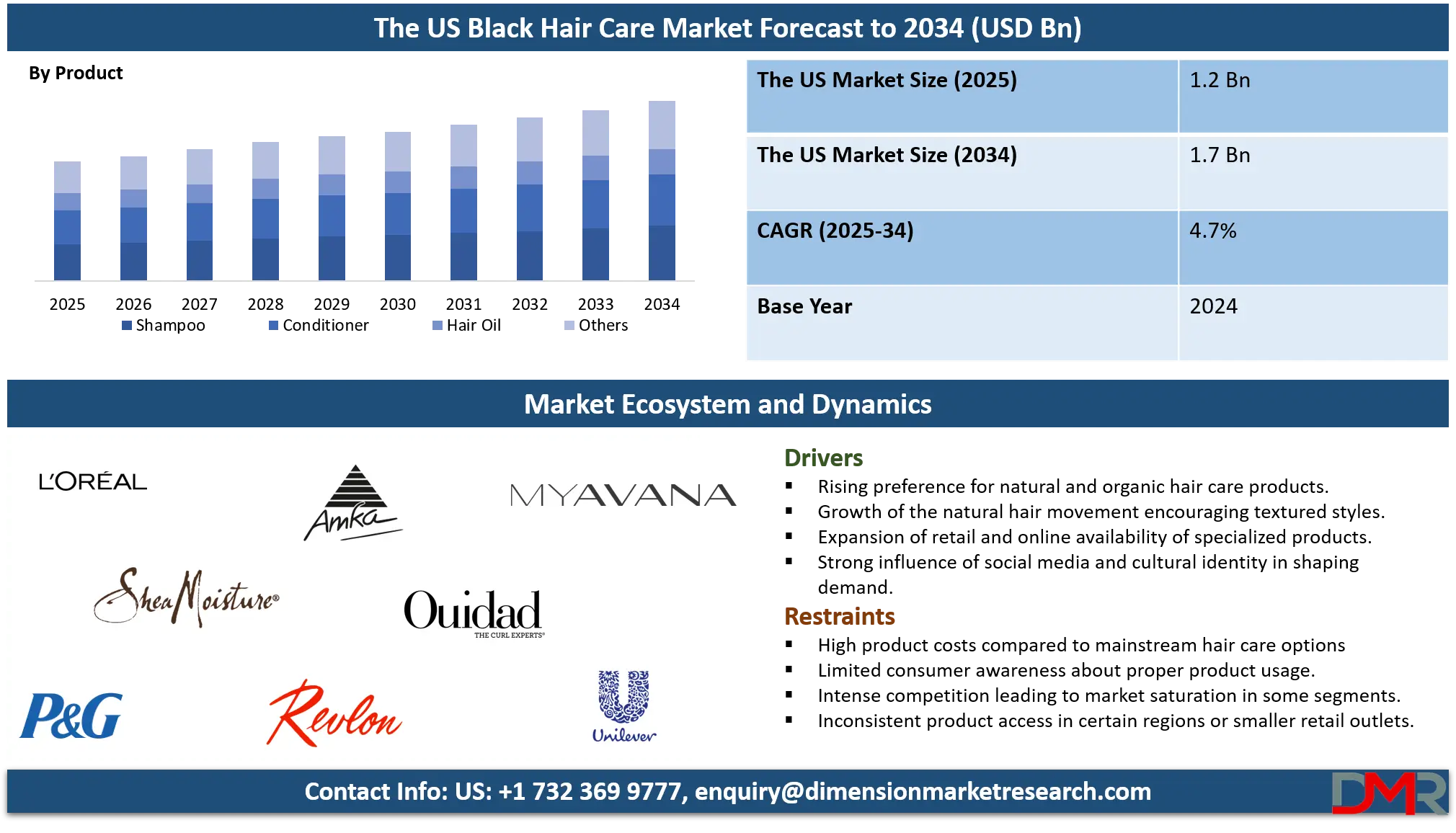

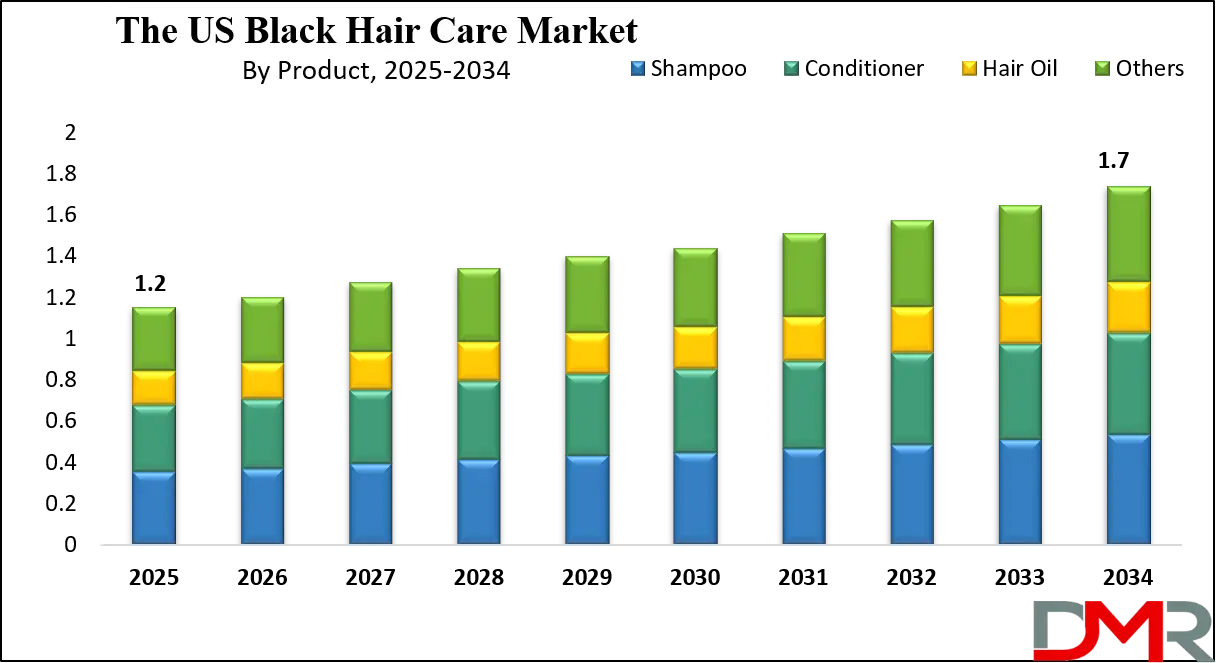

The US Black Hair Care Market size is projected to reach USD 1.2 billion in 2025 and grow at a compound annual growth rate of 4.7% from there until 2034 to reach a value of USD 1.7 billion.

Black hair care refers to the specialized products, treatments, and services created to meet the unique needs of textured hair, including curly, coily, and kinky hair types. This category covers shampoos, conditioners, hair oils, relaxers, styling products, and protective treatments. It also includes services such as braiding, weaving, and natural hair styling. The focus is on moisture retention, scalp health, and protective care, which are essential for maintaining hair strength and preventing breakage.

The growth demand for Black hair care has been influenced by increasing awareness of natural hair health and the desire to embrace cultural identity. Consumers are moving away from chemical relaxers and harsh treatments toward natural and organic products. The demand has also grown due to the expansion of product ranges specifically designed for different curl patterns, protective styles, and scalp nourishment. Both established companies and new entrants are competing to meet this rising demand.

Recent years have shown a strong shift toward natural hair movement, where many individuals are choosing to wear their natural textures rather than straightening. This trend has fueled the market for natural oils, curl creams, and sulfate-free shampoos. Social media influencers and online communities have also played a role in shaping preferences and educating consumers on hair care routines.

Events in the Black hair care space include the rise of independent brands founded by entrepreneurs who focus on cultural authenticity and ingredient transparency. These brands have gained attention for addressing long-overlooked consumer needs. At the same time, large retailers have begun to dedicate more shelf space to textured hair products, creating better access for consumers.

Another key trend is the emphasis on inclusivity in beauty. Many mainstream brands have extended their product lines to feature formulas suitable for coily and curly hair types. This change reflects the growing recognition of diversity within the beauty industry and has made specialized products more widely available.

US Black Hair Market: Key Takeaways

- Market Growth: The US Black Hair Care Market size is expected to grow by USD 500 million, at a CAGR of 4.7%, during the forecasted period of 2026 to 2034.

- By Product: The Shampoo segment is anticipated to get the majority share of the US Black Hair Care Market in 2025.

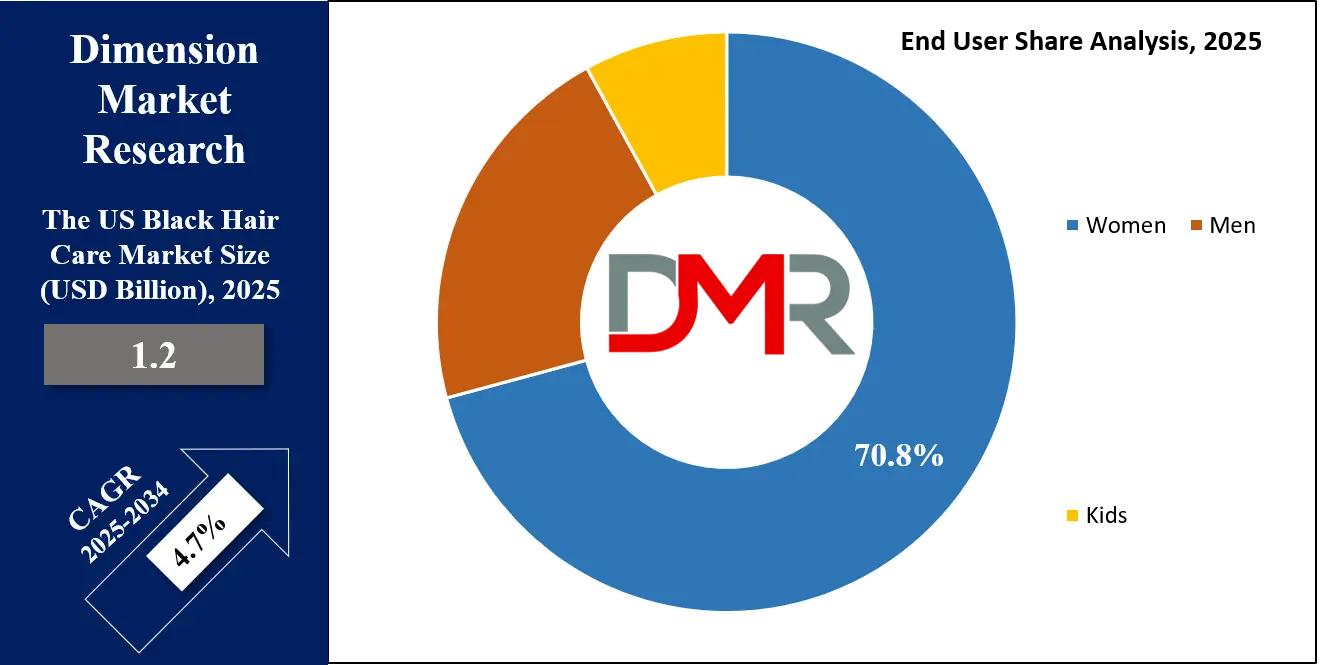

- By End User: The Women segment is expected to get the largest revenue share in 2025 in the US Black Hair Care Market.

- Use Cases: Some of the use cases of Black Hair Care include scalp health, curl definition, and more.

US Black Hair Market: Use Cases:

- Moisture Retention: Products are used to keep textured hair hydrated, preventing dryness and breakage while maintaining softness and shine.

- Protective Styling: Specialized treatments support styles like braids, twists, and weaves by reducing tension and protecting the scalp and hair strands.

- Scalp Health: Oils, conditioners, and treatments are applied to address issues such as dryness, dandruff, and irritation, promoting healthier hair growth.

- Curl Definition: Creams, gels, and styling products are used to enhance natural curl patterns, providing shape, control, and long-lasting hold.

Market Dynamic

Driving Factors in the US Black Hair Market

Rising Preference for Natural and Organic Products

One of the main growth drivers of the US Black hair care market is the increasing shift toward natural and organic products. Consumers are avoiding harsh chemicals like sulfates, parabens, and relaxers, opting instead for plant-based and gentle formulations. This change is strongly influenced by the natural hair movement, which encourages embracing natural textures. Brands are responding by developing products that promote moisture retention, scalp health, and curl definition without damaging ingredients. The growing awareness about overall wellness and sustainability further strengthens the demand for clean and eco-friendly solutions.

Expansion of Retail and Online Accessibility

Another major driver is the wider availability of Black hair care products across different distribution channels. Traditionally sold in beauty supply stores, these products are now easily found in supermarkets, pharmacies, and large retail chains. The growth of e-commerce has also opened new opportunities, making it convenient for consumers to explore diverse product ranges. Online platforms and social media influence help brands reach broader audiences while educating customers about usage and benefits. Increased shelf space and visibility in mainstream outlets highlight the recognition of textured hair needs. This expanded access supports higher adoption rates and market growth.

Restraints in the US Black Hair Market

High Product Costs and Affordability Issues

A key restraint in the US Black hair care market is the relatively high cost of specialized products compared to standard hair care items. Many formulations require premium natural ingredients, which raise production expenses and final retail prices. For budget-conscious consumers, this can limit regular purchases or reduce brand loyalty. The higher price point also makes it harder for some products to compete with mainstream options. As a result, while demand is strong, affordability challenges slow down the overall adoption rate. This issue is particularly noticeable among younger or lower-income groups seeking consistent care solutions.

Limited Product Awareness and Education

Another restraint is the lack of widespread awareness and knowledge about proper textured hair care routines. Many consumers still struggle to identify which products best suit their specific curl patterns and scalp needs. Without proper education, trial-and-error purchasing can lead to frustration and wasted money, reducing long-term trust in certain brands. This challenge is amplified in areas where product variety is limited, leaving fewer choices for consumers. Although social media has helped, misinformation or inconsistent advice can confuse buyers. This gap in clear education slows the pace of market growth despite rising product innovation.

Opportunities in the US Black Hair Market

Innovation in Customized and Specialized Solutions

An important opportunity in the US Black hair care market lies in developing more customized solutions for different curl types and scalp conditions. Consumers increasingly look for products that address specific needs such as low-porosity hair, protective styling care, or scalp sensitivity. Advances in product formulation and technology make it possible to deliver more tailored benefits. Offering personalized kits or regimen-based collections can further attract loyal customers. This focus on specialization not only builds trust but also strengthens long-term relationships with consumers. Such innovation can set brands apart in a competitive and growing market.

Growth Through Digital Platforms and Community Engagement

Another key opportunity comes from the expansion of digital platforms, which allow direct engagement with consumers. Online retail, tutorials, and influencer partnerships create strong awareness and encourage trial of new products. Social media communities have become vital spaces where people share routines, reviews, and results, making them powerful tools for brand visibility. By tapping into this digital ecosystem, companies can build authentic connections and trust with diverse audiences. Virtual consultations and subscription models can further enhance convenience and loyalty. Leveraging these online channels opens pathways for sustained growth and deeper market penetration.

Trends in the US Black Hair Market

Shift Toward Clean and Transparent Ingredients

A recent trend in the US Black hair care market is the strong preference for clean, transparent, and safe ingredients. Consumers are reading labels more carefully and avoiding products with harsh chemicals like sulfates, parabens, and silicones. Natural oils, shea butter, aloe vera, and plant-based extracts are gaining popularity as trusted options. This movement aligns with broader wellness and sustainability goals, where people want healthier solutions for themselves and the environment. Brands that clearly highlight ingredient transparency and eco-friendly sourcing are earning greater trust. This trend continues to redefine product development and consumer expectations.

Rise of Inclusive Representation in Beauty

Another significant trend is the push for greater inclusivity and representation in the beauty industry. Black hair care is no longer treated as a niche category but as an essential part of mainstream offerings. Major retailers and brands are expanding product lines to embrace the diversity of curl patterns and styling needs. Marketing campaigns now feature more authentic voices and cultural pride, resonating strongly with consumers. This inclusivity helps normalize natural textures and strengthens acceptance of different hair identities. The trend is shaping a more equitable market environment with broader consumer recognition.

Impact of Artificial Intelligence in US Black Hair Market

- Personalized Recommendations: AI-powered tools analyze hair texture, scalp condition, and consumer preferences to suggest customized product routines, improving satisfaction and loyalty.

- Virtual Try-On Experiences: AI enables apps and platforms that allow users to digitally preview hairstyles, colors, or protective styles, helping them make informed purchase decisions with confidence.

- Product Innovation Insights: By processing large amounts of consumer feedback and trend data, AI enables brands to design formulas that cater to the specific needs of textured and curly hair.

- Efficient Supply Chain Management: AI-driven demand forecasting enables retailers and manufacturers to stock popular products more accurately, thereby reducing shortages and waste.

- Enhanced Marketing Strategies: AI tracks online behavior and social media trends, allowing brands to target Black hair care consumers with more relevant campaigns and promotions.

Research Scope and Analysis

By Product Analysis

The shampoo segment will be leading in 2025 with a share of 30.7%, supported by its essential role in maintaining scalp health and cleansing textured hair. Regular washing is crucial for removing product buildup, excess oils, and environmental impurities while preserving moisture balance. In the US Black hair care market, shampoos designed with sulfate-free, hydrating, and nourishing formulas are increasingly popular as they protect curls and coils from dryness.

The shift toward natural and organic blends has further strengthened demand, as consumers prefer gentle ingredients like aloe vera, shea butter, and coconut extracts. With growing awareness about scalp care routines and the importance of clean foundations for healthy growth, shampoo remains a staple purchase, contributing strongly to market expansion across both traditional and online retail channels.

The hair oil segment is expected to have significant growth over the forecast period, driven by its vital role in nourishing and protecting textured hair. Oils help lock in moisture, reduce breakage, and support scalp health, making them a key step in daily and protective styling routines. In the US Black hair care market, natural options such as argan, castor, jojoba, and coconut oils are becoming increasingly favored for their restorative properties. Rising consumer interest in natural remedies and multifunctional care has boosted their usage not only for hydration but also for promoting hair strength and shine. With more brands introducing lightweight, easy-to-use blends, the demand for oils is set to expand steadily, supporting long-term growth in the market.

By End User Analysis

The women segment will be leading in 2025 with a share of 70.8%, as they remain the primary drivers of demand in the US Black hair care market. Women often invest in a wide range of products, from shampoos and conditioners to oils, styling creams, and treatments, to maintain healthy and versatile hair routines. The rise of the natural hair movement has encouraged many to embrace curls, coils, and protective styles, which require specialized products and consistent care.

Social media platforms and influencer communities have also played a large role in shaping trends and promoting new regimens. Women are more likely to experiment with new launches, driving innovation and growth across retail channels. Their focus on scalp health, moisture retention, and styling versatility continues to make them the most influential end users in shaping overall market expansion.

Men segment is expected to have significant growth over the forecast period, supported by rising awareness of grooming and hair health among male consumers. Men are increasingly seeking solutions for dryness, scalp irritation, and style maintenance, which has fueled demand for shampoos, oils, and leave-in products. Protective and low-maintenance styling options, along with barber-driven product recommendations, have encouraged more men to adopt consistent routines.

The availability of men-focused marketing and gender-neutral product lines is also broadening appeal. Social media trends and cultural pride are reinforcing the importance of textured hair care among male users. With growing product accessibility and more targeted offerings, men are set to become an expanding consumer base in the US Black hair care market.

By Distribution Channel Analysis

Retail stores segment will be leading in 2025 with a share of 41.7%, as they remain the most trusted and accessible distribution channel for Black hair care products in the US. Many consumers prefer shopping in physical stores where they can see, touch, and compare products before purchasing. Beauty supply shops, supermarkets, and pharmacies offer a wide selection of shampoos, oils, conditioners, and styling items tailored to textured hair needs.

In-store promotions, discounts, and personal recommendations also play an important role in driving purchases. Retail outlets provide immediate access, avoiding shipping delays, and allow shoppers to explore new product launches. With expanded shelf space dedicated to natural and inclusive hair care, retail stores continue to strengthen their role as the dominant channel for product visibility and market growth.

The online platform segment is expected to have significant growth over the forecast period, supported by rising digital adoption and e-commerce expansion. Consumers are increasingly turning to online platforms for convenience, wider product variety, and easy access to niche or newly launched brands. Social media influence, tutorials, and reviews have also boosted confidence in online purchases.

Subscription models and direct-to-consumer websites provide personalized shopping experiences, encouraging repeat orders. Virtual consultations and targeted recommendations are helping consumers select the right products for specific hair types. With more people seeking flexibility and at-home shopping solutions, online platforms are set to play a larger role in expanding the Black hair care market across the US.

The US Black Hair Market Report is segmented on the basis of the following:

By Product

- Shampoo

- Conditioner

- Hair Oil

- Others

By End User

By Distribution Channel

- Hypermarket/Supermarket

- Online Platform

- Retail Stores

Competitive Landscape

The competitive landscape of the US Black hair care market is diverse, with a mix of long-standing players and newer brands focused on natural and culturally inspired products. The market is shaped by high consumer loyalty, where trust and authenticity play a major role in product choice. Innovation is a key factor, with companies introducing formulas that address scalp health, moisture retention, and protective styling needs.

Distribution has expanded from traditional beauty supply stores to mainstream retailers and online platforms, making products more accessible. Social media influence and community-driven trends also create intense competition for attention and market share.

Some of the prominent players in the US Black Hair are:

- L’Oreal

- Unilever

- Revlon

- Procter & Gamble

- Ouidad

- Shea Moisture

- Afrocenchix

- Uhuru Naturals

- Amka Products

- Alodia Hair Care

- MYAVANA

- Other Key Players

Recent Developments

- In June 2025, MYAVANA, a leader in personalized hair care through technology, announced its partnership with The Beauty Genie®, known for its AI-powered vending solutions for multicultural hair care. The partnership aims to revolutionize beauty retail by merging MYAVANA’s data-driven personalization with Beauty Genie’s smart retail tech, making innovative, inclusive solutions more accessible for textured hair consumers through a blend of culture, care, and technology.

- In January 2025, MYAVANA, the innovative AI-driven hair care platform recently valued at USD 50M, launched its first Certified Stamp for Healthy Hair Care, setting a new benchmark across the hair care industry. This certification highlights safe, high-performing products, personalized services, and beauty tech training for brands, professionals, retailers, and salons. The initiative supports MYAVANA’s mission to transform hair care through innovation, community, and smarter, future-ready services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.2 Bn |

| Forecast Value (2034) |

USD 1.7 Bn |

| CAGR (2025–2034) |

4.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Shampoo, Conditioner, Hair Oil, and Others), By End User (Men, Women, and Kids), By Distribution Channel (Hypermarket/Supermarket, Online Platform, and Retail Stores) |

| Regional Coverage |

The US |

| Prominent Players |

L’Oreal, Unilever, Revlon, Procter & Gamble, Ouidad, Shea Moisture, Afrocenchix, Uhuru Naturals, Amka Products, Alodia Hair Care, MYAVANA, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Black Hair Care Market size is expected to reach a value of USD 1.2 billion in 2025 and is expected to reach USD 1.7 billion by the end of 2034.

Some of the major key players in the US Black Hair Care Market are L’Oreal, Unilever, Revlon, and others

The market is growing at a CAGR of 4.7 percent over the forecasted period.