Market Overview

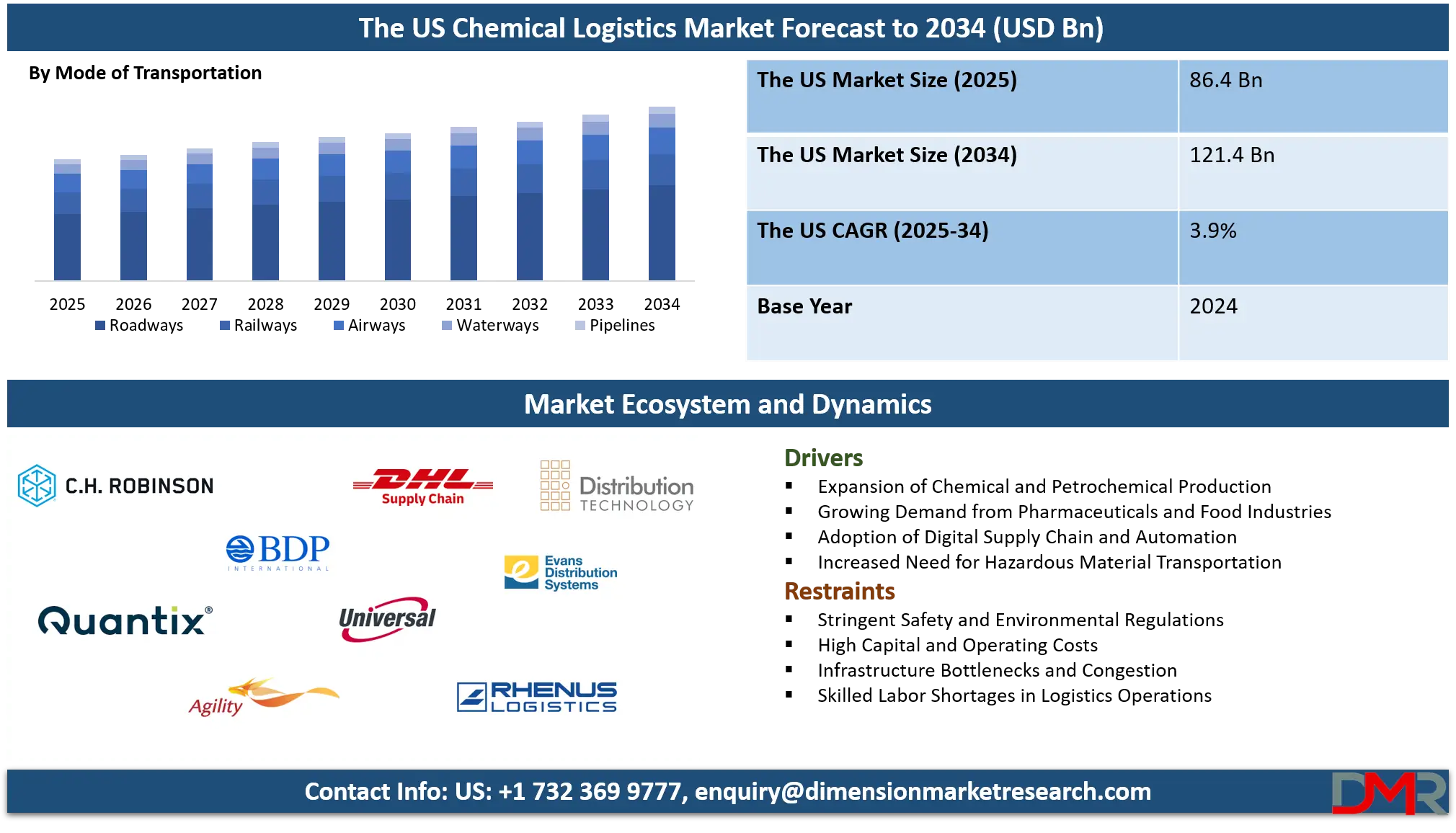

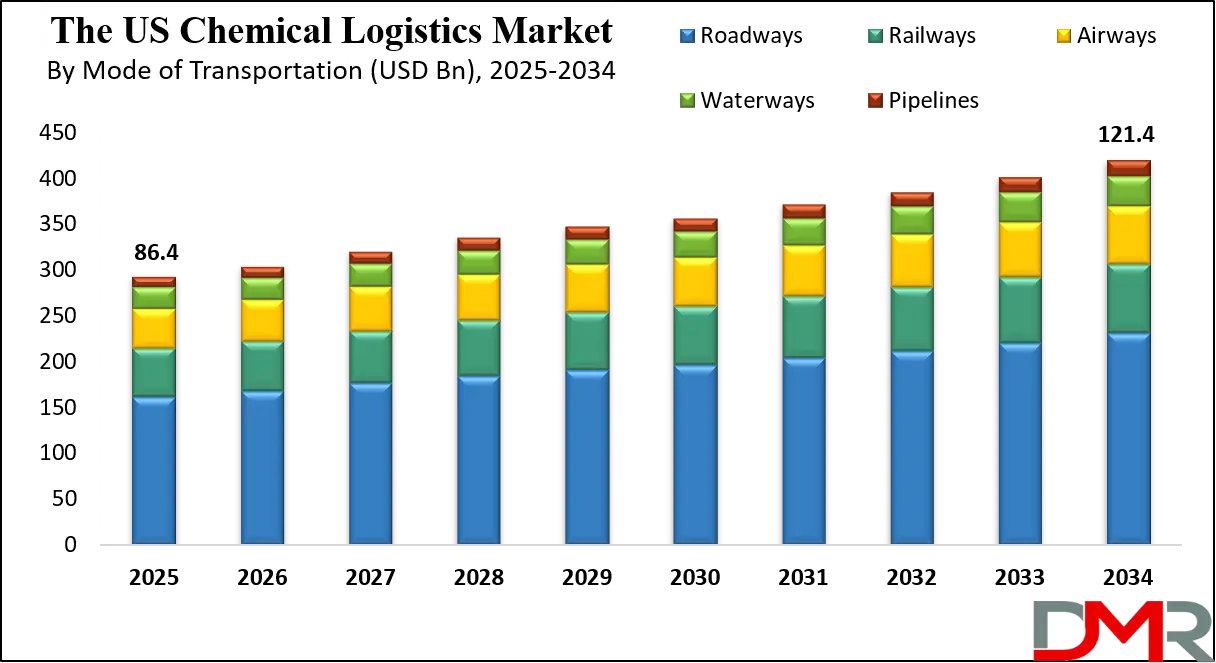

The US Chemical Logistics Market is projected to reach USD 86.4 billion in 2025 and expand to USD 121.4 billion by 2034, growing at a CAGR of 3.9%, supported by rising chemical transportation demand, warehousing expansion, hazardous material handling requirements, and advanced supply chain management adoption.

Chemical logistics refers to the specialized planning, handling, transportation, storage, and distribution of chemical products across the supply chain in compliance with strict safety, environmental, and regulatory standards. It covers a wide range of activities such as hazardous material handling, temperature controlled transport, bulk liquid shipping, packaging, labeling, inventory management, and risk mitigation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Unlike general freight, chemical logistics requires deep expertise in regulatory frameworks like hazmat compliance, REACH, and OSHA norms, along with advanced safety infrastructure, trained personnel, and real time tracking systems to prevent leaks, contamination, or accidents. The sector plays a critical role in ensuring seamless movement of industrial chemicals, specialty compounds, petrochemicals, and life science materials from manufacturers to end users while maintaining safety, quality, and environmental sustainability.

The US Chemical Logistics Market represents a highly mature and technology driven ecosystem that supports one of the world’s largest chemical manufacturing bases. The market is shaped by strong domestic production of petrochemicals, specialty chemicals, and industrial compounds, supported by an extensive network of road, rail, port, and pipeline infrastructure. Rising demand from downstream industries such as pharmaceuticals, agriculture, food processing, construction, and energy continues to drive complex logistics operations across the country. Increased adoption of digital freight management, warehouse automation, cold chain solutions, and real time compliance monitoring is improving operational efficiency, reliability, and transparency across the supply chain.

In addition, the US Chemical Logistics Market is experiencing a significant shift toward sustainable and risk optimized logistics models. Companies are increasingly investing in green transportation, fuel efficient fleets, reusable packaging systems, and emissions tracking technologies to meet tightening environmental regulations and corporate sustainability targets. Growth in e commerce chemical distribution, contract logistics outsourcing, and value added services such as blending, labeling, and reverse logistics is further expanding market scope. At the same time, heightened focus on supply chain resilience, cybersecurity in logistics operations, and regulatory compliance is driving innovation in safety management systems, predictive analytics, and integrated logistics platforms across the US market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Chemical Logistics Market: Key Takeaways

- Market Value: The US chemical logistics market size is expected to reach a value of USD 121.4 billion by 2034 from a base value of USD 86.4 billion in 2025 at a CAGR of 3.9%.

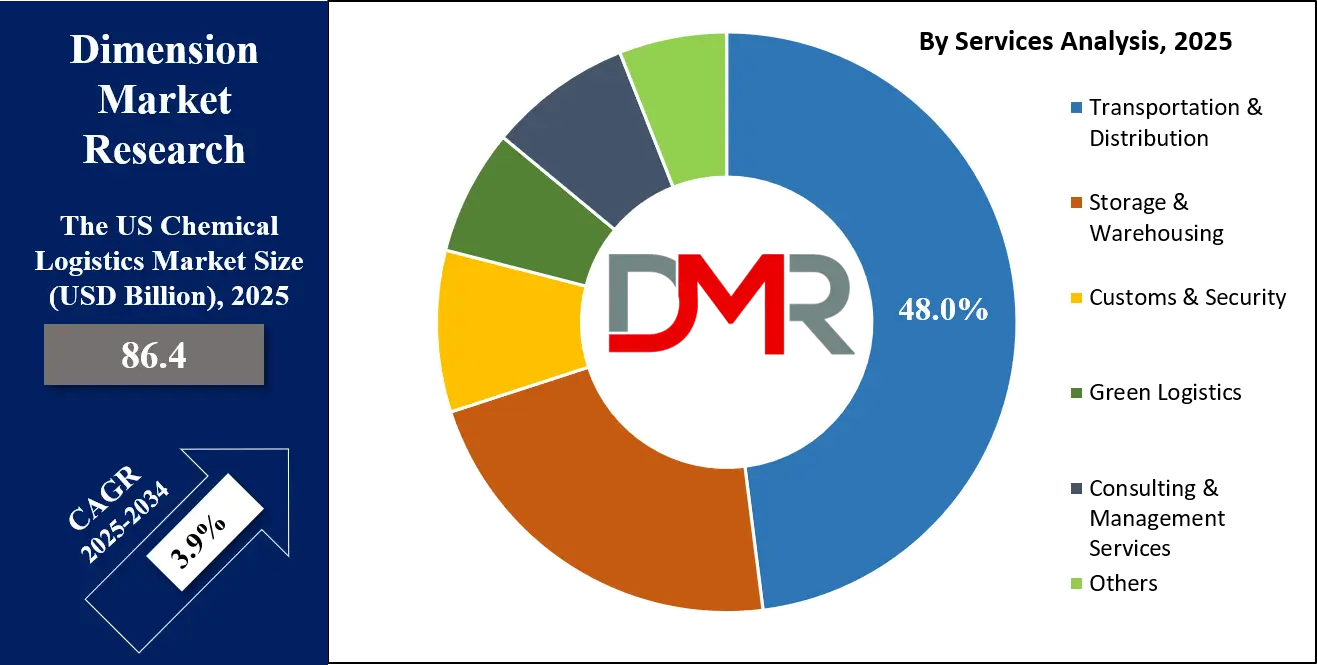

- By Service Segment Analysis: Transportation & Distribution is anticipated to dominate the service segment, capturing 48.0% of the total market share in 2025.

- By Mode of Transportation Segment Analysis: Roadways will account for the maximum share in the mode of transportation segment, capturing 55.0% of the total market value.

- By End User Segment Analysis: Chemical Industry will dominate the end user segment, capturing 36.0% of the market share in 2025.

- Key Players: Some key players in the US chemical logistics market are C.H. Robinson Worldwide, BDP International, Quantix Supply Chain Solutions, Agility Logistics, DHL Supply Chain, Universal Logistics Holdings, Distribution Technology, Evans Distribution Systems, Rhenus Logistics, CEVA Logistics, Kiser Harriss, Quality Carriers, and Others.

The US Chemical Logistics Market: Use Cases

- Bulk Petrochemical Transportation and Distribution: The US chemical logistics market plays a critical role in moving bulk petrochemicals such as ethylene, methanol, solvents, and polymers from refineries to downstream manufacturers. This use case relies heavily on tank trucks, rail freight, inland waterways, and pipeline logistics to ensure cost efficient and safe transportation. Advanced hazmat compliance systems, real time shipment tracking, and temperature controlled transport help reduce leakage risks and ensure regulatory adherence across long distance chemical supply chains.

- Pharmaceutical and Life Sciences Supply Chain: Chemical logistics providers support the pharmaceutical industry through secure handling of active pharmaceutical ingredients, specialty compounds, and sensitive intermediates. This use case depends on cold chain logistics, controlled warehousing, clean room storage, and validated transport systems. Strict quality assurance, serialization, and regulatory documentation ensure product integrity, while value added services such as labeling, repackaging, and last mile delivery improve supply chain responsiveness.

- Specialty Chemicals for Manufacturing and Coatings: Specialty chemical logistics enables the movement of high value chemicals used in paints, coatings, electronics, adhesives, and advanced materials. This use case requires flexible warehousing, small batch handling, inventory optimization, and just in time delivery. Digital supply chain platforms, demand forecasting tools, and multimodal transportation improve responsiveness for manufacturers operating in fast changing industrial environments.

- Food Grade and Consumer Chemical Distribution: In this use case, chemical logistics supports the safe distribution of food grade additives, flavors, preservatives, and cosmetic ingredients used across consumer goods industries. The focus remains on contamination free storage, certified packaging, traceability, and sustainable logistics practices. Increasing demand for eco friendly chemicals and green logistics solutions is further driving innovation in reusable containers, low emission transport, and compliant last mile delivery.

Impact of Artificial Intelligence on the US Chemical Logistics market

Artificial intelligence is transforming the US Chemical Logistics Market by enhancing operational efficiency, safety compliance, and supply chain visibility across transportation, warehousing, and distribution networks. AI powered route optimization systems are helping logistics providers reduce fuel consumption, improve delivery accuracy, and manage congestion in real time, which is critical for hazardous material transport. Predictive analytics is being widely adopted to forecast demand, optimize inventory levels, and prevent equipment failures, enabling more reliable chemical supply chain planning and reduced downtime.

AI is also strengthening risk management and regulatory compliance in chemical logistics operations. Machine learning algorithms are improving hazmat monitoring, anomaly detection, and real time safety alerts during chemical transportation and storage. In warehousing, AI driven automation, robotics, and smart inventory systems are streamlining picking, packing, and container handling while minimizing human exposure to dangerous substances. Additionally, AI enabled digital freight platforms, smart documentation, and automated customs processing are accelerating cross border chemical movements and improving end to end supply chain transparency across the US market.

The US Chemical Logistics Market: Stats & Facts

U.S. Census Bureau / Bureau of Transportation Statistics (BTS) — 2022 Commodity Flow Survey (CFS) / Hazardous Materials Supplement

- In 2022, total goods shipped in the U.S. reached 12.2 billion tons under the CFS.

- Of that total, shipments classified as hazardous materials weighed about 2.6 billion tons in 2022.

- Trucks alone (roadways) transported ~8.3 billion tons, accounting for 68.1% of total shipments in 2022.

- Over half of all shipments (56.4%) traveled less than 50 miles in 2022.

BTS / U.S. Department of Transportation — Freight Ton‑Miles (2023)

- In 2023, the U.S. freight system (all commodities) accommodated approximately 5,465 billion ton‑miles.

- For short‑haul freight (distances under 100 miles), trucking accounted for 75% of ton‑miles; for long‑hauls (1,000–2,000 miles), rail took the lead with 37.8% of ton‑miles.

Pipeline and Hazardous Materials Safety Administration (PHMSA) + CFS‑EHM (Expanded Hazardous Materials Supplement) — 2021‑2022 Hazmat Shipment Data

- The 2021–2022 EHM dataset marks the first publicly released data set on shipments of hazardous materials (HAZMAT) by U.S. shippers under DOT‑regulated packaging, covering ~ 6,500 businesses that shipped at least one HAZMAT in that period.

- The dataset includes classification by hazard class, packaging type, mode of transport, UN/NA numbers, giving structured insight into the number of shippers and kinds of hazardous products moving through the U.S. freight network.

The US Chemical Logistics Market: Market Dynamics

The US Chemical Logistics Market: Driving Factors

Expansion of US Chemical and Petrochemical Production

The rapid expansion of chemical manufacturing, petrochemical refining, and specialty chemical production across the US is a major growth driver for the chemical logistics market. Rising output of industrial chemicals, polymers, and intermediates is directly increasing demand for bulk chemical transportation, tank container logistics, and contract warehousing services. Strong demand from pharmaceuticals, agriculture, food processing, and construction further strengthens chemical supply chain activity across domestic trade routes.

Growing Adoption of Digital Supply Chain and Automation

The integration of transport management systems, warehouse automation, real time fleet tracking, and predictive logistics analytics is significantly improving efficiency within the US chemical logistics ecosystem. Digital platforms enable better inventory visibility, regulatory documentation, and route optimization for hazardous material transportation, allowing logistics providers to reduce operational risks, improve delivery reliability, and enhance overall supply chain performance.

The US Chemical Logistics Market: Restraints

Stringent Safety and Environmental Regulations

The US chemical logistics industry operates under strict hazmat transportation laws, environmental protection regulations, emissions standards, and occupational safety norms. Continuous compliance with federal and state level regulations increases operating costs related to safety audits, certifications, specialized equipment, and workforce training, limiting margin expansion for logistics providers.

High Capital Investment and Operating Costs

Chemical logistics requires heavy capital investment in corrosion resistant warehouses, temperature controlled storage systems, certified tank fleets, and safety infrastructure. Rising fuel prices, insurance costs, labor shortages, and maintenance expenses further increase the cost burden, especially for small and mid-sized logistics operators.

The US Chemical Logistics Market: Opportunities

Growth of Green Logistics and Sustainable Transportation

The rising focus on carbon emission reduction, fuel efficiency, and environmentally responsible logistics is creating strong growth opportunities for green chemical logistics services. Demand for electric fleet adoption, alternative fuels, reusable chemical containers, and sustainable warehousing solutions is increasing among chemical producers and contract logistics providers across the US.

Expansion of Contract Logistics and Value Added Services

Outsourcing of chemical warehousing, blending, labeling, repackaging, and reverse logistics is gaining momentum among chemical manufacturers. This shift is opening new revenue streams for third party logistics companies offering integrated chemical supply chain solutions, especially for specialty chemicals, pharmaceuticals, and food grade chemicals.

The US Chemical Logistics Market: Trends

Rising Use of Artificial Intelligence and Predictive Analytics

AI driven logistics platforms are increasingly being deployed for demand forecasting, route planning, preventive maintenance, and risk monitoring in chemical transportation networks. Machine learning based safety analytics and real time anomaly detection are improving accident prevention, compliance tracking, and end to end supply chain visibility across the US chemical logistics market.

Increasing Demand for Cold Chain and Secure Warehousing

The surge in pharmaceutical chemicals, biologics, and temperature sensitive compounds is driving demand for cold storage logistics, controlled environment warehousing, and validated transportation systems. Secure storage, high value cargo protection, and real time condition monitoring are becoming standard requirements for chemical logistics providers serving life sciences and specialty chemical industries.

The US Chemical Logistics Market: Research Scope and Analysis

By Services Analysis

Transportation & Distribution is anticipated to dominate the US Chemical Logistics Market service segment with a 48.0% share in 2025, driven by the high volume movement of bulk chemicals, petrochemicals, specialty compounds, and hazardous materials across domestic and cross border supply chains. The strong dependence of industries such as oil and gas, pharmaceuticals, food processing, and specialty manufacturing on time sensitive and safety compliant deliveries continues to accelerate demand for advanced chemical transportation services.

Extensive road, rail, pipeline, and intermodal networks across the US support large scale chemical distribution, while growing adoption of real time tracking, route optimization, and regulatory compliance technologies further strengthens the role of transportation as the backbone of the chemical logistics ecosystem.

Storage and Warehousing also holds a significant position within this market segment due to the critical need for safe, compliant, and strategically located chemical storage facilities. Rising production of industrial chemicals, pharmaceutical ingredients, and specialty compounds is driving demand for temperature controlled warehouses, corrosion resistant infrastructure, and hazardous material certified storage units.

Additionally, the increasing reliance on inventory buffering, contract warehousing, and value added services such as packaging, labeling, blending, and repackaging is expanding the role of chemical warehousing in enhancing supply chain flexibility, reducing transit risks, and ensuring uninterrupted availability of chemicals across diverse end use industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Mode of Transportation Analysis

Roadways will account for the maximum share in the mode of transportation segment, capturing 55.0% of the total market value, primarily due to their unmatched flexibility, accessibility, and efficiency in handling chemical shipments across short and long distances. Road transport plays a vital role in connecting chemical manufacturing plants, storage terminals, ports, and end user facilities, making it the primary mode for last mile and regional distribution.

The widespread availability of certified tank trucks, specialized hazardous material carriers, and temperature controlled vehicles continues to support the safe movement of bulk liquids, specialty chemicals, and packaged chemical products. In addition, advancements in fleet telematics, real time tracking systems, and route optimization software are further strengthening roadways as the backbone of the US chemical supply chain.

Railways also hold an important position in the US Chemical Logistics Market, particularly for the transportation of large volume bulk chemicals over long distances. Rail networks offer cost effective and energy efficient movement of petrochemicals, industrial gases, fertilizers, and liquid chemicals between major industrial hubs and port terminals. The high load carrying capacity of tank railcars, along with enhanced safety standards and real time monitoring of rail shipments, supports the secure handling of hazardous materials. Rail transport also helps reduce highway congestion and lowers per unit transportation costs, making it an essential complementary mode within the overall chemical logistics ecosystem.

By End User Analysis

The Chemical Industry will dominate the end user segment, capturing 36.0% of the market share in 2025, owing to the massive production and continuous movement of bulk chemicals, petrochemicals, intermediates, and specialty compounds across the US. Large scale manufacturing of polymers, solvents, industrial gases, resins, and fertilizers requires highly reliable chemical transportation, bulk liquid logistics, and hazardous material handling services.

The strong integration of chemical plants with refineries, export terminals, and downstream processing units further drives demand for multimodal transportation, contract warehousing, and compliant distribution networks. In addition, the growing focus on supply chain optimization, digital freight systems, and real time tracking is strengthening operational efficiency for chemical producers across domestic markets.

The Pharmaceutical Industry also represents a key end user within the US Chemical Logistics Market, driven by the rising demand for active pharmaceutical ingredients, clinical trial materials, specialty chemicals, and temperature sensitive compounds. This segment relies heavily on cold chain logistics, controlled warehousing, validated transportation, and strict regulatory documentation to maintain product quality and safety.

Increasing pharmaceutical manufacturing, biotech research activity, and drug export volumes are boosting demand for secure storage, contamination free handling, and time critical deliveries. The growing emphasis on serialization, traceability, and regulatory compliance continues to elevate the role of specialized chemical logistics services tailored for the pharmaceutical supply chain.

The US Chemical Logistics Market Report is segmented on the basis of the following:

By Services

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

By End User

- Chemical industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food Industry

- Other End User

The US Chemical Logistics Market: Competitive Landscape

The competitive landscape of the US Chemical Logistics Market is highly fragmented yet intensely competitive, characterized by the presence of large integrated logistics providers, specialized chemical carriers, and regional contract logistics operators. Market participants compete primarily on safety performance, regulatory compliance expertise, service reliability, and the ability to offer end to end chemical supply chain solutions including transportation, warehousing, and value added services.

Increasing investments in digital freight platforms, warehouse automation, real time tracking, and risk management systems are becoming key differentiators. In addition, sustainability initiatives, fleet modernization, network expansion near major chemical hubs, and strategic partnerships with manufacturers are shaping long term competitive positioning across the US market.

Some of the prominent players in the US Chemical Logistics market are:

- C.H. Robinson Worldwide

- BDP International

- Quantix Supply Chain Solutions

- Agility Logistics

- DHL Supply Chain

- Universal Logistics Holdings

- Distribution Technology

- Evans Distribution Systems

- Rhenus Logistics

- CEVA Logistics

- Kiser Harriss

- Quality Carriers

- XPO Logistics

- FedEx

- GEODIS

- Kuehne + Nagel

- DB Schenker

- Maersk Logistics & Services

- DSV

- A&R Logistics

- Other Key Players

The US Chemical Logistics Market: Recent Developments

- Dec 2025: A US‑based investment manager rolled out a new unified brand for its global logistics real estate platform, creating a vertically integrated logistics real estate entity managing more than 600 billion ft² of warehousing and distribution centers across multiple continents.

- Nov 2025: A major contract‑logistics provider announced plans to expand its network of warehouses within U.S. Foreign‑Trade Zones (FTZs), responding to increased demand following new trade tariffs, benefiting chemical warehousing and distribution.

- Oct 2025: A robotics and warehouse‑automation company raised about US$165 billion to expand its operations in the US, including supplying autonomous robots for large warehouses, supporting chemical warehousing and inventory management.

- Apr 2025: A major e‑commerce and supply‑chain business committed US$1 billion over five years to expand and upgrade its U.S. distribution and cold‑chain infrastructure, impacting the handling of specialty and temperature‑sensitive chemical products.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 86.4 Bn |

| Forecast Value (2034) |

USD 121.4 Bn |

| CAGR (2025–2034) |

3.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Services (Transportation & Distribution, Storage & Warehousing, Customs & Security, Green Logistics, Consulting & Management Services, Others), By Mode of Transportation (Roadways, Railways, Airways, Waterways, Pipelines), and By End User (Chemical Industry, Pharmaceutical Industry, Cosmetic Industry, Oil & Gas Industry, Specialty Chemicals Industry, Food Industry, Other End User) |

| Regional Coverage |

The US |

| Prominent Players |

C.H. Robinson Worldwide, BDP International, Quantix Supply Chain Solutions, Agility Logistics, DHL Supply Chain, Universal Logistics Holdings, Distribution Technology, Evans Distribution Systems, Rhenus Logistics, CEVA Logistics, Kiser Harriss, Quality Carriers, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Chemical Logistics market?

▾ The US Chemical Logistics market size is estimated to have a value of USD 86.4 billion in 2025 and is expected to reach USD 121.4 billion by the end of 2034, with a CAGR of 3.9%.

Who are the key players in the US Chemical Logistics market?

▾ Some of the major key players in the US Chemical Logistics market are C.H. Robinson Worldwide, BDP International, Quantix Supply Chain Solutions, Agility Logistics, DHL Supply Chain, Universal Logistics Holdings, Distribution Technology, Evans Distribution Systems, Rhenus Logistics, CEVA Logistics, Kiser Harriss, Quality Carriers, and Others.