Market Overview

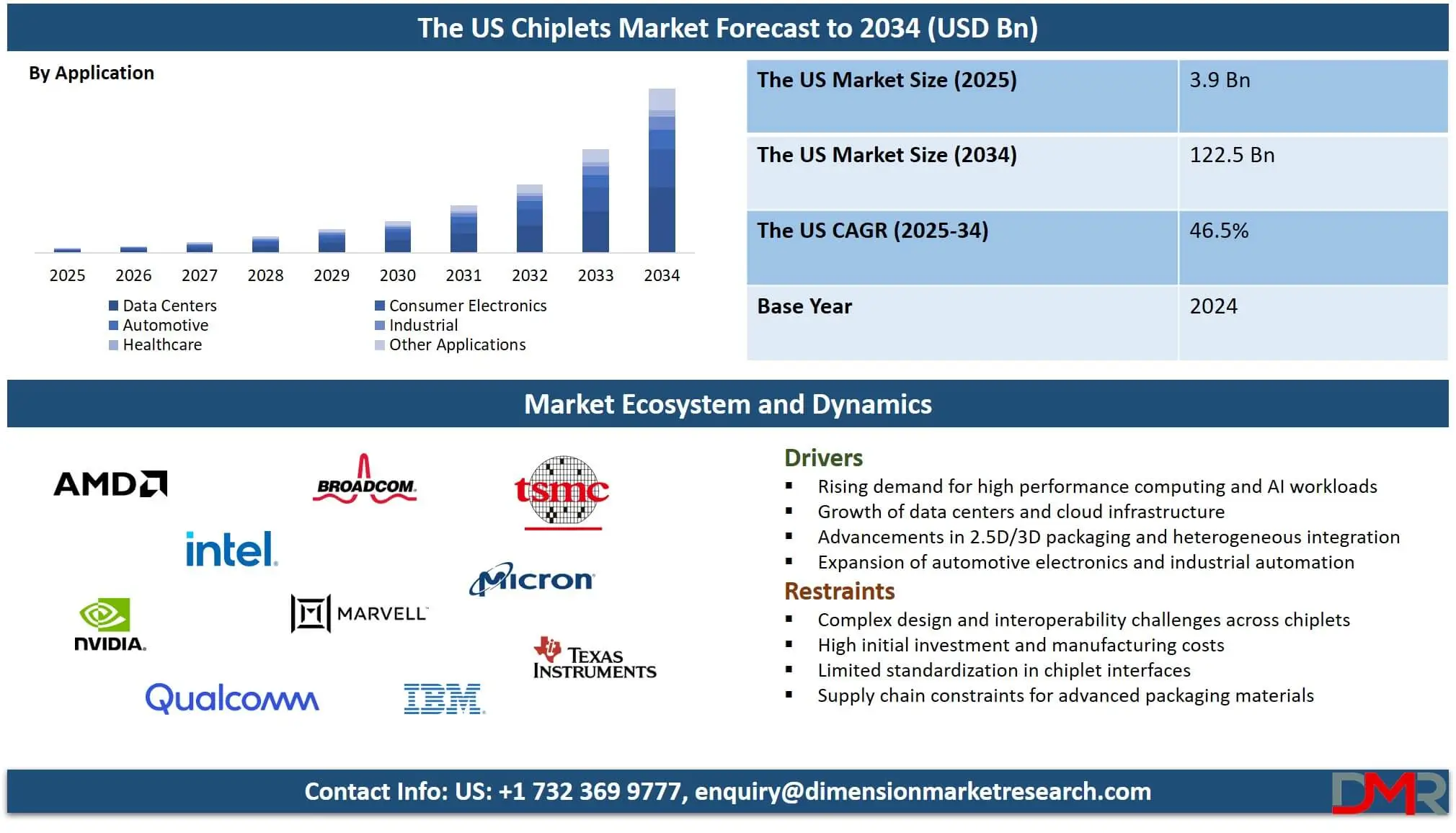

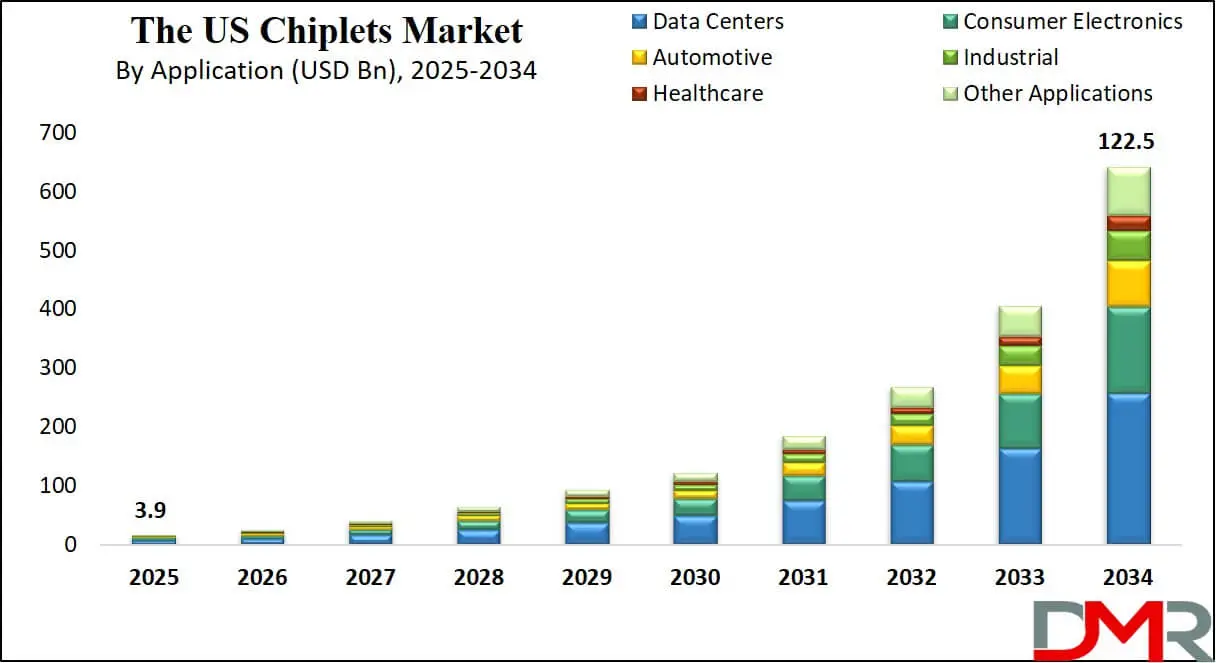

The US chiplets market is projected to reach a value of USD 3.9 billion in 2025 and is expected to grow rapidly to USD 122.5 billion by 2034, reflecting a strong CAGR of 46.5%. This accelerated growth highlights the rising adoption of modular semiconductor architectures, advanced packaging technologies, and heterogeneous integration solutions across data centers, AI computing, consumer electronics, and automotive applications.

Chiplets refer to small, modular semiconductor blocks that are designed to perform specific functions and can be combined on a single package to create a high-performance integrated circuit. Instead of building one large monolithic chip, manufacturers use chiplets that allow heterogeneous integration, improved yield, faster development cycles, and greater flexibility in processor design. This modular architecture supports advanced workloads such as AI cloud computing data data-intensive applications, and next-generation consumer electronics while helping reduce manufacturing complexity and cost.

The US chiplets market represents a rapidly expanding ecosystem of companies, technologies, and applications that drive the adoption of modular semiconductor architectures within the country. This market is shaped by strong investments in advanced packaging, high-performance computing, heterogeneous integration, and AI-optimized processors, supported by a robust domestic innovation environment. Growth is fueled by rising demand for data center accelerators, consumer electronics, processors, automotive electronics, and industrial automation hardware.

Across the US semiconductor landscape, chiplets are emerging as a strategic solution for boosting performance density and energy efficiency while supporting customization for multiple industries. The market benefits from collaboration among IDMs, foundries, design tool providers, cloud hyperscalers, and fabless companies who are adopting chiplet-based architectures to address scaling limitations of traditional semiconductor fabrication.

The rise of 3D packaging, silicon interposers, high bandwidth memory, advanced interconnects, and AI accelerators is reinforcing the dominance of chiplet technology in enabling next-generation computing systems.

The US Chiplets Market: Key Takeaways

- Market Value: The US chiplets market size is expected to reach a value of USD 122.5 billion by 2034 from a base value of USD 3.9 billion in 2025 at a CAGR of 46.5%.

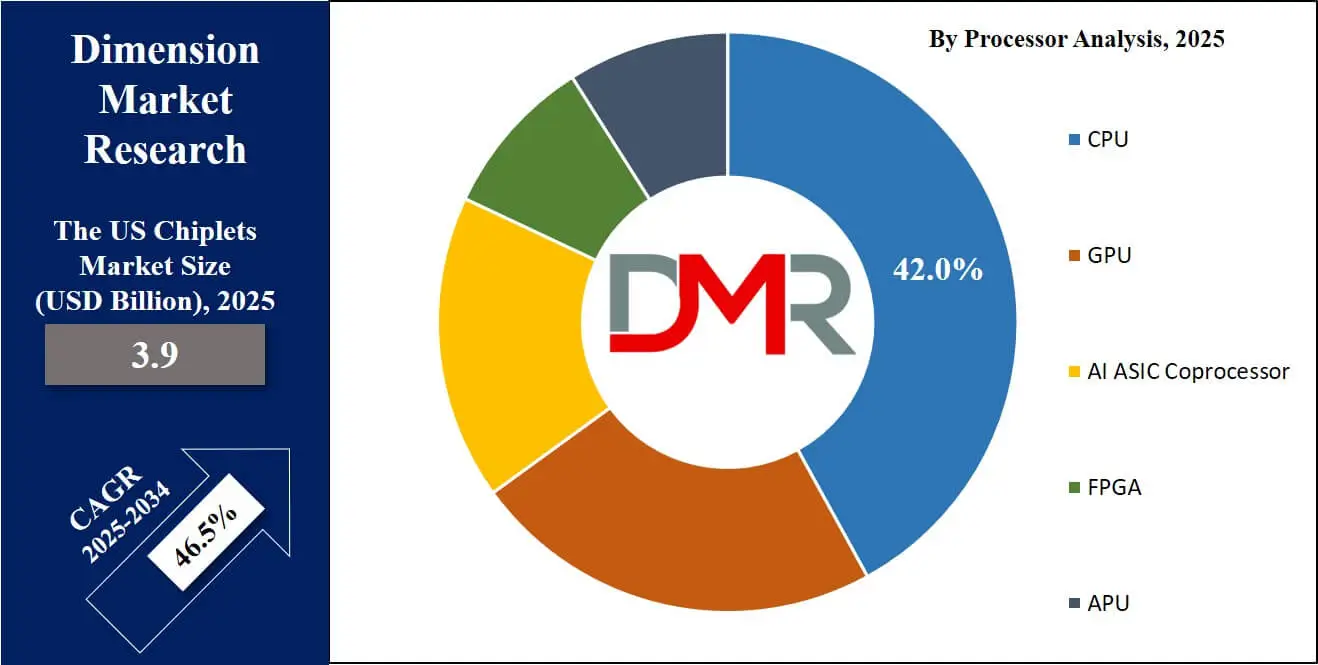

- By Processor Segment Analysis: CPU is anticipated to dominate the processor segment, capturing 42.0% of the total market share in 2025.

- By Packaging Technology Segment Analysis: 2.5D / 3D technology is expected to maintain its dominance in the packaging technology segment, capturing 50.0% of the total market share in 2025.

- By Application Segment Analysis: Data Center applications will account for the maximum share in the application segment, capturing 40.0% of the total market value.

- By End User Segment Analysis: IT & Telecommunication Services will dominate the end user segment, capturing 38.0% of the market share in 2025.

- Key Players: Some key players in the US chiplets market are AMD, Intel, NVIDIA, Qualcomm, Broadcom, Marvell Technology, IBM, TSMC U.S. operations, Micron Technology, Analog Devices, Texas Instruments, Cisco Systems, Apple, and Others.

The US Chiplets Market: Use Cases

- High performance AI and data center processors: Chiplets enable hyperscalers and cloud providers to build scalable AI accelerators and server CPUs with higher bandwidth and lower latency. In the US market this architecture supports advanced workloads including generative AI model training edge inference and large scale cloud computing. Modular design allows seamless integration of GPU chiplets CPU chiplets AI ASIC units and high bandwidth memory which improves performance per watt and reduces development time for next generation data center platforms.

- Advanced automotive electronics and ADAS systems: US automotive OEMs are adopting chiplets to support autonomous driving features electric vehicle control units and high speed sensor fusion systems. Chiplet based architectures allow integration of AI compute blocks imaging processors and safety modules within compact automotive grade designs. This improves thermal efficiency functional safety and processing capability for ADAS LiDAR radar and infotainment applications while enabling long term scalability.

- Next generation consumer electronics and edge devices: Chiplets support the development of high performance smartphones laptops AR VR devices and edge AI hardware manufactured in the US. Their modular structure allows brands to combine CPU GPU and AI accelerators into energy efficient platforms optimized for gaming streaming and real time AI processing. This flexibility helps reduce silicon cost improves battery efficiency and accelerates innovation cycles in the consumer electronics ecosystem.

- Industrial automation and robotics compute systems: The US industrial sector uses chiplets to power robotics controllers smart manufacturing equipment high precision sensing units and predictive maintenance platforms. By combining heterogeneous compute modules manufacturers can build rugged high throughput industrial processors that support real time analytics edge computing and machine vision. Chiplets enhance reliability and allow easier upgrades across factory automation and industrial IoT deployments.

Impact of Artificial Intelligence on the US Chiplets market

- Acceleration of heterogeneous integration for AI compute: Artificial Intelligence workloads require high bandwidth low latency architectures which pushes US chiplet designers to combine CPU GPU AI ASIC and memory chiplets in a single package. This demand accelerates adoption of 2.5D and 3D packaging and drives rapid innovation in advanced interconnects.

- Rising demand from hyperscalers and data centers: Generative AI model training and inference dramatically increase the need for scalable modular processors. US cloud providers such as Amazon Google and Meta are developing custom AI accelerators built on chiplet based designs which expands the overall chiplets ecosystem.

- Expansion of specialized AI focused semiconductor IP: AI intensifies demand for domain specific chiplets such as neural processing units high bandwidth memory modules and AI optimized interposers. This trend encourages US semiconductor firms to invest in AI ready chiplet IP libraries design tools and co optimized chiplet ecosystems.

The US Chiplets Market: Stats & Facts

- U.S. Department of Commerce / CHIPS for America

- Jan 2025: The CHIPS National Advanced Packaging Manufacturing Program (NAPMP) finalized USD 1.4 billion in awards to support domestic advanced packaging capacity in the United States, aimed at enabling high-volume manufacturing of advanced-node chips as well as packaging and integration in the U.S.

- Nov 2024: Under CHIPS for America, up to USD 300 million was committed to projects for advanced substrates and material research, a foundational step to build a U.S. based packaging ecosystem including substrates required for chiplets and heterogeneous integration.

- Jul 2024: The program issued a funding notice estimating up to USD 1.6 billion to support R&D in advanced packaging technologies, marking a committed push to scale domestic capacity in wafer‑level and advanced packaging, supporting chiplet‑friendly manufacturing infrastructure across the country.

- Dec 2024: A grant of up to USD 407 million was awarded to a leading U.S.-based assembly and test company to build a new advanced packaging and test facility, expected to support advanced packaging capacity that is critical for chiplet integration.

- Semiconductor Industry Association (SIA)

- 2024 / 2025: The U.S. semiconductor industry directly employed approximately 345,000 people. The industry further supported nearly 2 million additional indirect and induced jobs across the broader U.S. economy, underlining the broad economic footprint of semiconductor manufacturing and packaging.

- 2023: According to SIA, total U.S. semiconductor sales reached USD 264 billion, underscoring the scale and domestic demand strength of the semiconductor ecosystem that enables chiplet adoption and growth.

The US Chiplets Market: Market Dynamics

The US Chiplets Market: Driving Factors

Growing demand for high performance computing and AI workloads

The rapid expansion of generative AI data center acceleration and cloud computing is pushing US semiconductor companies to adopt chiplet based architectures. Modular chip design improves performance per watt enables heterogeneous integration and supports high bandwidth data movement required for AI training and inference. This surge in compute intensive applications is accelerating adoption of chiplets across hyperscalers and enterprise infrastructure providers.

Advancements in advanced packaging and 2.5D or 3D integration

The US market benefits from continuous progress in advanced packaging technologies such as silicon interposers hybrid bonding and 3D stacking. These innovations allow manufacturers to combine different chiplets including CPU GPU and AI ASIC modules within compact energy efficient packages. This technological maturity is a major catalyst for scaling next generation semiconductor platforms.

The US Chiplets Market: Restraints

Complex design ecosystem and interoperability challenges

Chiplet design requires alignment across multiple vendors including IP providers foundries and EDA tool partners. Lack of universal chiplet standards and limited cross vendor plug and play compatibility increases complexity and cost. These issues slow down large scale commercialization despite strong demand in AI computing and data centers.

High initial investment and manufacturing infrastructure barriers

Developing chiplet architectures demands significant capital in advanced packaging facilities testing equipment and co optimization workflows. Smaller US semiconductor firms may struggle to fund multi layer integration processes which limits wider market participation. High development cost continues to be a barrier for rapid adoption.

The US Chiplets Market: Opportunities

Expansion of AI optimized chiplets across hyperscalers and OEMs

US cloud providers and device manufacturers are investing heavily in custom silicon for AI workloads. This opens large scale opportunities for chiplet based NPUs GPUs memory stacks and interconnect solutions. Growing interest in AI PCs edge AI hardware and autonomous systems strengthens opportunity pipelines for modular chiplet ecosystems.

Government incentives and reshoring of semiconductor manufacturing

Federal programs supporting domestic semiconductor production and advanced packaging R&D are creating favorable conditions for chiplet innovation. Investments in CHIPS Act funded facilities 3D packaging labs and regional semiconductor clusters offer long term opportunities for US based chip design and manufacturing expansion.

The US Chiplets Market: Trends

Rise of open chiplet standards and ecosystem collaboration

The US market is witnessing increased momentum behind open chiplet standards modular IP libraries and multi-vendor interoperability frameworks. Collaboration between IDMs fabless companies EDA vendors and hyperscalers is driving a unified ecosystem that supports scalable heterogeneous integration.

Shift toward AI centric chip architectures and domain specific modules

AI is transforming chiplet design strategies with companies focusing on specialized compute modules including neural engines high bandwidth memory chiplets and advanced interconnect fabrics. This trend supports next generation AI accelerators AI PCs and automotive AI processors while reshaping the broader semiconductor landscape.

The US Chiplets Market: Research Scope and Analysis

By Processor Analysis

CPU is anticipated to dominate the processor segment with a projected 42% share in 2025, reflecting its central role in handling general purpose computing, enterprise workloads, and large scale data center operations. As the US chiplets market expands, CPU chiplets continue to serve as the foundational control and coordination units within heterogeneous architectures, enabling efficient communication between GPU, AI ASIC, and memory chiplets.

Their strong compatibility with advanced packaging technologies and ability to support high bandwidth data processing make them essential for next generation cloud platforms, AI enabled devices, and high performance consumer electronics.

GPU chiplets are also gaining strong traction in this market as demand for parallel processing and graphics intensive workloads accelerates. The rise of generative AI model training, real time inference, immersive gaming, and high performance visualization tools increases reliance on GPU based architectures. Within chiplet based systems, GPU modules provide superior throughput for matrix computations and large scale neural processing, making them a key growth driver for AI data centers, edge computing platforms, and advanced computing applications across the US semiconductor ecosystem.

By Packaging Technology Analysis

2.5D and 3D packaging technology is expected to maintain its dominance in the US chiplets market with an estimated 50% share in 2025, driven by its ability to deliver superior performance density, higher bandwidth, and reduced power consumption. These advanced architectures enable the vertical or side by side integration of CPU, GPU, AI ASIC, and memory chiplets through high speed interconnects and silicon interposers, supporting the demanding requirements of AI computing, data center accelerators, and high performance consumer devices.

The growing need for compact designs capable of handling complex workloads and fast data movement continues to push manufacturers toward 2.5D and 3D solutions, making them the preferred packaging platform for next generation semiconductor development.

System in Package (SiP) technology is also gaining relevance in this market as companies seek flexible and cost effective integration methods that combine multiple functional blocks within a single compact module. SiP supports the integration of RF components, sensors, processors, and power management units, making it suitable for applications such as smartphones, IoT devices, wearables, and automotive electronics. Although it holds a smaller market share compared to 2.5D or 3D packaging, SiP remains essential for designs that require versatility, lower development cost, and fast time to market, contributing to the broader adoption of heterogeneous system architectures in the US semiconductor ecosystem.

By Application Analysis

Data center applications will account for the maximum share in the US chiplets market with 40% of the total value, driven by the rapidly increasing demand for high performance computing, AI model training, cloud infrastructure scalability, and low latency data processing. Chiplet based architectures allow data centers to integrate CPU, GPU, AI accelerators, and high bandwidth memory modules in a single package, significantly improving compute density and energy efficiency.

As hyperscalers expand their AI clusters and deploy custom silicon for advanced workloads, chiplets offer the flexibility and modularity required to build scalable, cost efficient server platforms capable of handling massive data volumes and next generation AI applications.

Consumer electronics also represent a major application segment as chiplets support the development of high performance smartphones, laptops, AR and VR devices, and smart home technologies. Their modular design enables manufacturers to integrate CPU, GPU, AI processing units, and connectivity modules into compact, power efficient systems optimized for everyday use.

The shift toward AI enabled devices, immersive user experiences, and energy efficient architecture is encouraging consumer electronics brands to adopt chiplet based processors to achieve faster performance, longer battery life, and greater design versatility in next generation consumer products.

By End User Analysis

IT and telecommunication services will dominate the US chiplets market in 2025 with a 38% share, driven by the rapid expansion of cloud infrastructure, 5G deployments, network virtualization, and AI enhanced connectivity solutions. Chiplet based architectures enable telecom providers and IT service companies to build high performance network equipment, scalable servers, and low latency edge computing platforms.

The integration of CPU, GPU, AI ASIC, and memory chiplets within a compact package enhances throughput, reduces power consumption, and improves processing efficiency for data intensive operations. As network operators accelerate investments in hyperscale data centers, software defined networks, and AI powered telecom infrastructure, chiplets play a central role in supporting reliable high bandwidth computing across national communication networks.

Consumer electronics also form a significant portion of the end user landscape as chiplets help manufacturers design powerful and energy efficient devices including smartphones, tablets, laptops, wearables, gaming consoles, and AR or VR systems. By combining multiple compute units and specialized accelerators, chiplet based processors enable smoother user experiences, faster application performance, and optimized battery usage.

The growing ecosystem of smart devices and connected home technologies further strengthens the role of chiplets in consumer electronics. Chiplets offer the flexibility to customize processing power, integrate AI capabilities, and support advanced graphics within compact form factors. The modular structure reduces development time and cost, allowing manufacturers to update specific functions without redesigning entire chips.

This adaptability is increasingly valuable as the market shifts toward AI centric capabilities such as real time translation, intelligent imaging, voice recognition, and extended reality applications. Chiplets therefore provide a scalable pathway for continuous innovation while meeting the rising expectations of US consumers for speed, efficiency, and enhanced digital experiences.

The US Chiplets Market Report is segmented on the basis of the following:

By Processor

- Field-Programmable Gate Array (FPGA)

- Graphics Processing Unit (GPU)

- Central Processing Unit (CPU)

- Application Processing Unit (APU)

- Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor

By Packaging Technology

- System-in-Package (SiP)

- Flip Chip Chip Scale Package (FCCSP)

- Flip Chip Ball Grid Array (FCBGA)

- 2.5D/3D

- Wafer-Level Chip Scale Package (WLCSP)

- Fan-Out (FO)

By Application

- Consumer Electronics

- Data Centers

- Automotive

- Industrial

- Healthcare

- Other Applications

By End User

- IT and Telecommunication Services

- Automotive

- Healthcare and Life Sciences

- Consumer Electronics

- Other End-Users

The US Chiplets Market: Competitive Landscape

The competitive landscape of the US chiplets market is characterized by rapid innovation, strategic partnerships, and significant investment in advanced packaging and heterogeneous integration technologies. Companies are focusing on developing high performance, energy efficient modular architectures to meet the growing demand from data centers, AI workloads, consumer electronics, and automotive applications.

Collaboration between design tool providers, foundries, and system integrators is driving ecosystem development and enabling faster time to market for chiplet based solutions. Continuous advancements in 2.5D and 3D packaging, high bandwidth interconnects, and AI optimized modules are intensifying competition, as players strive to deliver scalable, customizable, and cost effective semiconductor platforms across multiple end user segments.

Some of the prominent players in the US Chiplets market are

- AMD

- Intel

- NVIDIA

- Qualcomm

- Broadcom

- Marvell Technology

- IBM

- TSMC (U.S. operations/customer ecosystem)

- Micron Technology

- Analog Devices (ADI)

- Texas Instruments (TI)

- Cisco Systems

- Apple (Silicon development)

- Google (Tensor chip design)

- Amazon (AWS chip design)

- Meta (AI accelerator development)

- Xilinx (AMD Adaptive Computing)

- Synopsys

- Cadence Design Systems

- Arm (U.S. ecosystem for chiplet IP)

- Other Key Players

The US Chiplets Market: Recent Developments

- Dec 2025: U.S. government commits up to USD 150 billion to a startup developing free-electron laser technology for advanced chip manufacturing, signaling public-sector support for next-generation lithography needed for advanced chiplet fabrication.

- Nov 2025: A silicon-photonics specialist was acquired by a global chip manufacturer in a strategic move to boost optical interconnect capabilities for AI and data-center oriented chiplet solutions.

- Jul 2025: A major electronic design automation (EDA) firm completed a USD 35 billion acquisition of a leading simulation-software provider, unifying chip design, simulation and multi-die integration tools, expected to enhance design efficiency for chiplet-based architectures.

- Apr 2025: A Silicon Valley startup released a new photonics-based interposer and chiplet platform using silicon-photonics technology aimed at speeding up inter-chip communication and boosting bandwidth for AI chips and data-center applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.9 Bn |

| Forecast Value (2034) |

USD 122.5 Bn |

| CAGR (2025–2034) |

46.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Processor (Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor), By Packaging Technology (System-in-Package (SiP), Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), 2.5D/3D, Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO)), By Application (Consumer Electronics, Data Centers, Automotive, Industrial, Healthcare, Other Applications), and By End User (IT and Telecommunication Services, Automotive, Healthcare and Life Sciences, Consumer Electronics, Other End-Users). |

| Country Coverage |

The US |

| Prominent Players |

AMD, Intel, NVIDIA, Qualcomm, Broadcom, Marvell Technology, IBM, TSMC U.S. operations, Micron Technology, Analog Devices, Texas Instruments, Cisco Systems, Apple, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analyst working days, and 5 analyst working days respectively. |

Frequently Asked Questions

The US chiplets market size is estimated to have a value of USD 3.9 billion in 2025 and is expected to reach USD 122.5 billion by the end of 2034, with a CAGR of 46.5%.

Some of the major key players in the US chiplets market are AMD, Intel, NVIDIA, Qualcomm, Broadcom, Marvell Technology, IBM, TSMC U.S. operations, Micron Technology, Analog Devices, Texas Instruments, Cisco Systems, Apple, and Others.