Market Overview

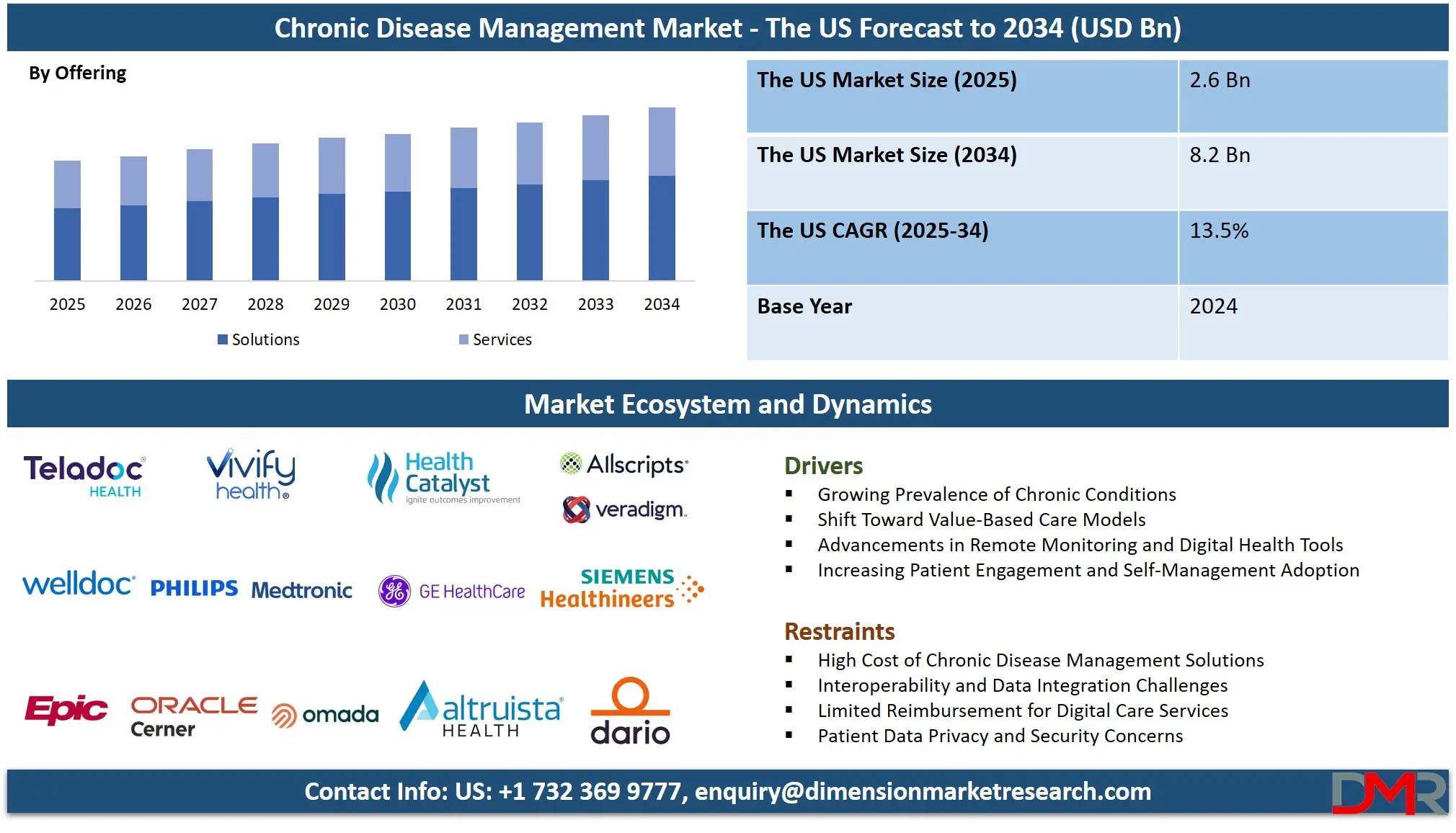

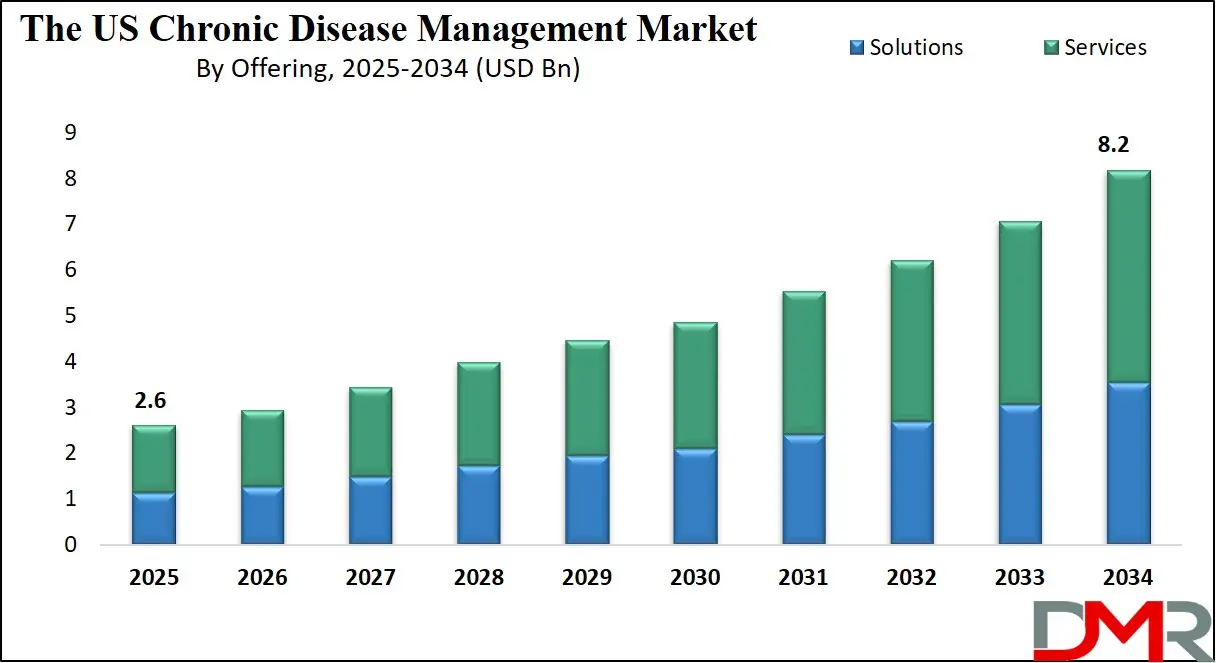

The US Chronic Disease Management Market is projected to reach USD 2.6 billion in 2025, driven by the high and rising prevalence of chronic conditions, an aging population, and a strong shift toward value-based care and digital health integration nationwide. The market is expected to expand at a compound annual growth rate (CAGR) of 13.5% from 2025 to 2034, reaching a projected value of USD 8.2 billion by 2034.

Growth is fueled by the widespread adoption of remote patient monitoring (RPM) and telehealth, strategic integration of artificial intelligence (AI) and predictive analytics, evolving regulatory and reimbursement frameworks (such as CMS guidelines and FDA digital health policies), and increasing demand for cost-effective, patient-centered care models. Furthermore, expanding applications across Diabetes, Cardiovascular Diseases (CVD), and Chronic Respiratory Diseases, alongside the push for interoperable solutions and comprehensive population health management, are expected to significantly accelerate market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US chronic care landscape is rapidly transitioning from reactive, episodic care to continuous, data-driven management ecosystems. A pivotal trend is the strategic convergence of disease-specific digital therapeutics and telehealth, where CDM platforms are evolving into integrated care delivery hubs. These hubs enable personalized monitoring, virtual visits, and automated interventions, which are essential for meeting quality metrics and patient self-management goals under value-based reimbursement models.

This integration empowers proactive health management and provides real-time clinical decision support for complex conditions like heart failure and COPD. Concurrently, CDM solution providers are embedding sophisticated analytics and clinical decision support (CDS) tools, offering risk stratification and personalized care pathway automation as core features, making data intelligence central to the chronic care value chain. The fusion of AI with population health platforms is also gaining prominence, optimizing resource allocation and preemptively identifying high-risk patient cohorts across diverse US healthcare settings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market's expansion is underpinned by significant opportunities in personalized and preventive chronic care, particularly for managing multimorbidity and supporting integrated care networks that require seamless coordination. Providers and Payers have emerged as primary adopters, leveraging CDM technology for scalable management of chronic populations, medication adherence programs, and post-acute care coordination, which are seeing rapid utilization growth.

Moreover, the continuous development of novel, integrated service models, including remote monitoring services and AI-driven insights, is creating new avenues for dynamic care experiences that are highly responsive and engaging. These innovations are poised to address critical challenges in fragmented care delivery, such as oncology survivorship and mental health comorbidity management, providing outcome-based guarantees essential for sustainable healthcare in the US.

US Chronic Disease Management Market: Key Takeaways

- US Market Size Insights: The US Chronic Disease Management Market is projected to be valued at USD 2.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 8.2 billion in 2034.

- The US Market Growth Rate: The market is growing at a CAGR of 13.5 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the high prevalence of chronic diseases and aging demographics, the integration of RPM and telehealth solutions, supportive federal and state digital health policies and reimbursement changes (e.g., CMS expansions), and increasing emphasis on data security and HIPAA compliance.

- Competitive Landscape: The market is highly competitive and features a mix of global medtech and health IT giants (Philips, Medtronic, GE HealthCare), specialized digital health and DTx startups, hyperscale cloud platforms (AWS, Google, Microsoft), and established EHR vendors (Epic, Cerner, Allscripts).

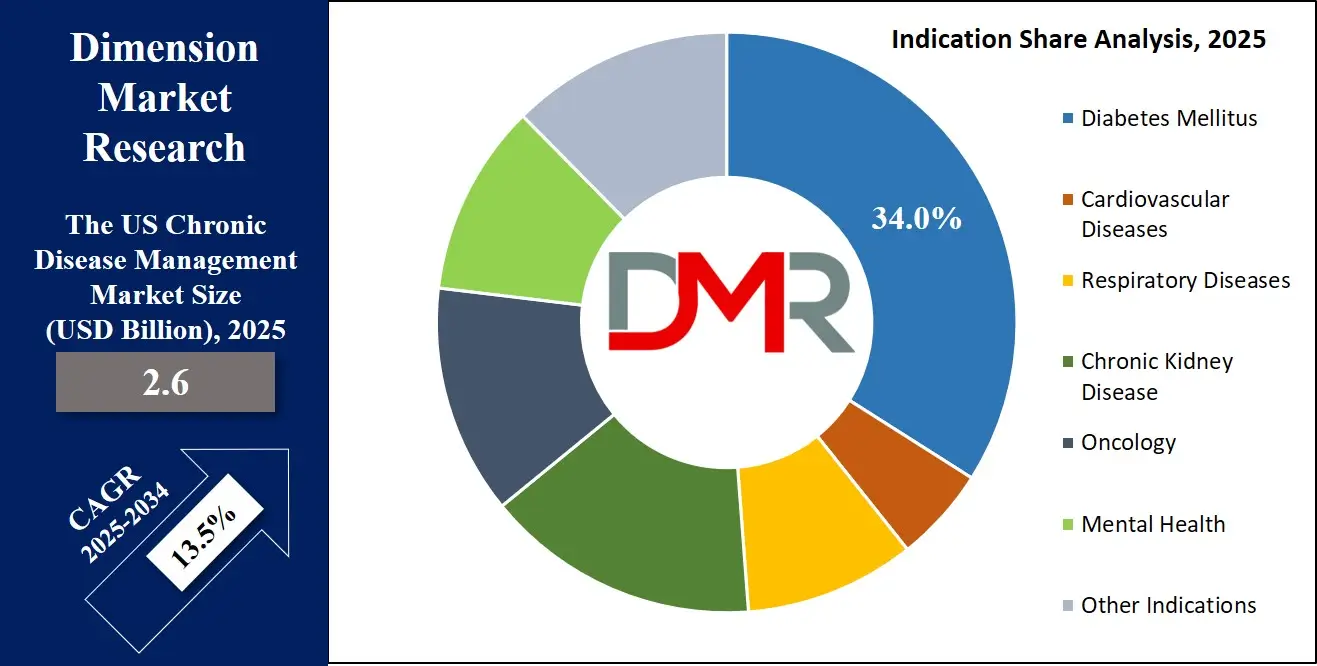

- Segment Insights: Within offerings, Solutions, particularly RPM and Disease-Specific Platforms, are the largest component, while Diabetes Mellitus remains the dominant indication segment due to high prevalence and a well-developed ecosystem of digital tools and devices.

US Chronic Disease Management Market: Use Cases

- Integrated CHF Management for a Health System: A large hospital system uses a dedicated CHF platform integrated with RPM (connected scales, blood pressure cuffs) and telehealth to manage heart failure patients post-discharge. AI-driven analytics flag weight gain trends, triggering automated nurse alerts and virtual consultations, drastically reducing 30-day readmission rates and meeting value-based care targets.

- National Diabetes Prevention & Management Program: A major health insurer partners with a vendor to deploy a diabetes management platform combined with mHealth apps and connected glucose monitors. The program offers personalized coaching, dietary logging, and integrates data into primary care EHRs, improving HbA1c control at a population level and demonstrating clear ROI through reduced complications.

- Oncology Survivorship Care via Hybrid Platform: A leading cancer center implements a hybrid oncology CDM platform offering teleconsultation for follow-ups, a patient app for symptom tracking (PROs), and analytics for monitoring long-term effects. This ensures continuity of care, reduces unnecessary clinic visits, and improves quality of life for survivors.

- COPD Exacerbation Prediction with RPM: A large pulmonary care provider utilizes an IoT-enabled platform with smart inhalers and home spirometers. ML algorithms analyze usage patterns and lung function data to predict exacerbation risk, enabling pre-emptive interventions by a remote monitoring service team, preventing emergency hospitalizations and lowering costs.

- Value-Based Contract Enablement for a Health Plan: A national health plan deploys a comprehensive population-health analytics platform with risk stratification tools to identify high-cost members with multiple chronic conditions. It then offers tailored disease management programs (e.g., for hypertension and depression comorbidity) to provider networks, sharing data and outcomes to manage value-based contracts effectively.

US Chronic Disease Management Market: Stats & Facts

Centers for Disease Control and Prevention (CDC)

- Chronic diseases such as heart disease, cancer, and diabetes are the leading causes of death and disability in the United States.

- Six in ten Americans live with at least one chronic disease, and four in ten have two or more.

- Chronic respiratory diseases affect millions and are a major cause of morbidity and healthcare utilization.

American Heart Association (AHA)

- Cardiovascular diseases account for approximately 1 in every 3 deaths in the United States.

- Annual direct and indirect costs of CVD are estimated to exceed USD 400 billion.

- Heart failure affects about 6.2 million Americans, with high readmission rates driving CDM adoption.

American Diabetes Association (ADA)

- Approximately 38.4 million Americans have diabetes (about 11.6% of the population), with another 97.6 million adults aged 18 years or older having prediabetes.

- The total estimated cost of diagnosed diabetes in the US in 2022 was USD 412.9 billion.

- Digital diabetes management tools have shown significant improvements in glycemic control and patient engagement.

National Cancer Institute (NCI)

- An estimated 2.0 million new cancer cases were diagnosed in the US in 2024.

- The number of cancer survivors is projected to rise to over 22 million by 2030, increasing demand for long-term management solutions.

- Cancer care is increasingly shifting toward chronic disease management models for survivorship.

Centers for Medicare & Medicaid Services (CMS)

- Chronic conditions are a major driver of Medicare and Medicaid spending.

- CMS has expanded reimbursement for RPM and telehealth services, providing a significant tailwind for CDM adoption.

- Value-based care programs increasingly tie reimbursement to outcomes and quality metrics for chronic conditions.

Kaiser Family Foundation (KFF) & Other Health Policy Institutes

- People with chronic conditions account for a vast majority of healthcare spending.

- The US has seen a steady rise in the prevalence of multiple chronic conditions (multimorbidity), particularly among older adults.

- Employer-sponsored health plans are increasingly investing in chronic disease management programs to control costs and improve productivity.

The US Chronic Disease Management Market: Market Dynamics

Driving Factors in the US Chronic Disease Management Market

Convergence of Telehealth, RPM, and Data Analytics into Unified Platforms

A major trend is the rapid market shift from standalone point solutions to integrated platforms that combine telehealth/teleconsultation, RPM data ingestion, and advanced analytics. US health systems and providers are demanding unified workflows to avoid clinician burnout from multiple logins and to gain a holistic patient view.

This convergence is critical for managing multimorbidity, where data from different conditions must be correlated. Regulatory and reimbursement pushes for interoperability (via FHIR, TEFCA) and value-based care contracts further accelerate investment in platforms that can aggregate and analyze data from diverse sources, including wearables, EHRs, and patient-reported outcomes, to drive coordinated action and measure results.

Proliferation of FDA-Cleared Digital Therapeutics and Connected Medical Devices

Another powerful driver is the burgeoning ecosystem of FDA-cleared Digital Therapeutics (DTx) and medical-grade connected devices for specific chronic conditions. Regulated DTx for conditions like diabetes, hypertension, and substance use disorders are increasingly being prescribed and reimbursed. This formalizes digital interventions as part of standard care. Simultaneously, connected insulin pens, smart inhalers, and cardiac implantable monitors generate continuous, clinically actionable data. CDM platforms that seamlessly integrate these prescribed digital tools into care pathways create significant value, enabling closed-loop management and providing robust evidence for outcomes-based reimbursement.

Restraints in the US Chronic Disease Management Market

Unsustainable Burden of Chronic Disease and Demographic Shift

One of the most powerful, underlying growth drivers is the demographic and epidemiological reality: The aging US population is leading to a steep rise in the prevalence of multimorbidity. The healthcare system is financially strained by the costs of hospitalizations, emergency care, and long-term complications associated with poorly managed chronic conditions. This crisis creates an urgent, non-negotiable imperative for cost-effective management tools. Payers (commercial and public) and providers are increasingly compelled to invest in CDM solutions as strategic assets for preventive care, improving medication adherence, and enabling early intervention, directly targeting the reduction of high-cost acute episodes.

Accelerating Digital Health Policy and Reimbursement Evolution

The accelerated evolution of supportive digital health policies and reimbursement frameworks in the US is a major growth catalyst. Initiatives like expanded CMS reimbursement for RPM and telehealth, FDA's Digital Health Center of Excellence, and the creation of new payment codes for chronic care management (CCM) and principal care management (PCM) are reducing adoption barriers.

These policies are funding programs, clarifying regulatory pathways, and creating sustainable payment models. This environment de-risks investment for providers and stimulates innovation from vendors, fueling widespread adoption of CDM platforms as core infrastructure for modern healthcare delivery.

Opportunities in the US Chronic Disease Management Market

Advanced AI/ML for Predictive and Prescriptive Analytics

The application of advanced AI and machine learning beyond basic analytics represents a significant high-value opportunity. The next frontier involves prescriptive analytics that not only predict a patient's risk but also recommend specific, personalized interventions with estimated probabilities of success.

Furthermore, AI for operational optimization, predicting no-shows, optimizing staff schedules for remote monitoring centers, or automating prior authorizations for chronic therapies can deliver substantial efficiency gains. Vendors that can embed these sophisticated, explainable AI capabilities into their platforms will capture premium opportunities, especially with large payers and integrated delivery networks focused on population health management.

Expansion into Complex Chronic Indications and Comorbidity Management

While diabetes and CVD are established markets, substantial growth opportunities lie in expanding robust CDM solutions into more complex and underserved chronic indications. This includes oncology survivorship care, chronic kidney disease (CKD) management, and especially integrated mental and physical health comorbidity (e.g., diabetes and depression).

Platforms that can handle the intricate, longitudinal care pathways, polypharmacy, and multidisciplinary coordination required for these conditions will address critical gaps in care. The development of indication-specific modules within broader platforms, or best-of-breed solutions that interoperate, presents a major avenue for innovation and market capture.

Trends in the US Chronic Disease Management Market

High Integration Complexity and Persistent Interoperability Hurdles

A major restraint is the significant technical and operational complexity involved in integrating new CDM solutions into the US's fragmented and legacy-heavy health IT landscape. Ensuring seamless interoperability with multiple, often siloed EHR systems, health information exchanges (HIEs), and medical devices from various manufacturers requires substantial customization, ongoing maintenance, and vendor cooperation.

These challenges are amplified by varying implementation of standards like FHIR across organizations. For healthcare organizations, this results in high upfront and ongoing costs, extended deployment timelines, and clinician frustration, which can stall or derail projects, particularly for smaller providers with limited IT resources.

Fragmented Reimbursement and Challenges in Demonstrating Tangible ROI

Despite progress, reimbursement for digital chronic care services remains complex and variable across different payers (Medicare, Medicaid, private insurers) and states. While CMS has made strides, coverage policies for platform licensing, data integration, and clinical staff time for monitoring are not always consistent or fully adequate.

This creates financial uncertainty for providers. Linked to this is the challenge of demonstrating clear, short-term Return on Investment (ROI) in hard financial terms. While improved outcomes and patient satisfaction are evident, translating them into immediate, attributable cost savings for a specific budget holder can be difficult, making procurement decisions slower and more risk-averse.

The US Chronic Disease Management Market: Research Scope and Analysis

By Offering Analysis

Solutions are projected to constitute the dominant and core value segment of the US CDM market. This category encompasses the essential software and technology platforms. Disease-Specific Software (e.g., dedicated Diabetes, CHF/CVD, COPD Platforms) provides tailored workflows, guidelines, and device integrations for optimal condition management. Remote Patient Monitoring (RPM) Platforms form the data backbone, ingesting and managing streams from connected devices.

Telehealth/Teleconsultation Platforms enable virtual care delivery. Analytics & Population-Health Platforms with Clinical Decision Support and Risk Stratification turn data into actionable intelligence. Mobile Apps & Patient Engagement Tools (mHealth) are critical for adherence and self-management. Integration & EHR Connectors are non-negotiable components for realizing value in real-world clinical settings. The demand for these solutions is driven by the need to operationalize digital-first chronic care models.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Services segment is the fastest-growing component, reflecting the market's maturation. As solutions become more powerful, their implementation and effective use require deep expertise. Disease Management Programs offered by vendors provide turnkey clinical operations.

Remote Monitoring Services involve clinical staff monitoring data feeds and acting on alerts. Consulting & Implementation services are vital for navigating complex health system IT environments and change management. Training & Support ensure ongoing clinician and patient engagement. This shift towards solution-and-service bundles indicates a market moving from selling software to delivering measurable health outcomes.

By Deployment Type Analysis

Cloud-based deployment is expected to be the unequivocally dominant and fastest-growing model, projected to hold over 70% market share by 2034. Its technological and economic advantages elastic scalability, reduced upfront capital expenditure (CapEx), automated software updates, and built-in disaster recovery are perfectly aligned with the dynamic, data-intensive needs of modern value-based healthcare. The subscription-based Software-as-a-Service (SaaS) model transforms large capital outlays into predictable operating expenses, a critical factor for budget-constrained providers and health systems.

Major cloud providers (AWS, Microsoft Azure, Google Cloud) offer robust, HIPAA-compliant infrastructure with advanced security frameworks that individual healthcare organizations would struggle to implement independently. This model democratizes access, enabling solo practices or small clinics to leverage enterprise-grade CDM capabilities, including AI analytics and telehealth tools, via a scalable subscription. The inherent agility of the cloud also supports rapid innovation, allowing vendors to deploy new features and compliance updates seamlessly across their customer base.

By Indication Analysis

Diabetes Mellitus remains the largest and most dynamic indication segment, accounting for approximately 34.0% of the solution-focused market revenue. It is characterized by a mature, innovation-rich ecosystem of connected devices, including Continuous Glucose Monitors (CGMs), smart insulin pens/pumps, and connected glucose meters that generate a continuous, actionable data stream. The condition has a strong, well-established evidence base demonstrating that digital interventions improve glycemic control (HbA1c), reduce hypoglycemic events, and enhance quality of life.

This evidence directly supports reimbursement arguments. Furthermore, diabetes management inherently requires frequent daily decision-making by the patient, leading to high patient motivation for self-management tools. Modern CDM solutions for diabetes are highly sophisticated platforms that integrate real-time CGM data with AI-driven pattern recognition (predicting highs/lows), automated insulin dosing calculators, personalized coaching, and seamless data sharing with clinicians. The market is further segmented into Type 1 and Type 2, with digital prevention programs for pre-diabetes representing a high-growth adjacent segment.

Cardiovascular Diseases (CVD), and particularly Heart Failure (HF), represent another dominant, high-acuity, and high-value segment. The management of HF is highly protocolized and relies on the daily monitoring of key vitals such as weight, blood pressure, and symptoms, making it an ideal use case for Remote Patient Monitoring (RPM). CDM platforms for CVD are mission-critical for health systems aiming to reduce 30-day readmission rates, a key quality and financial metric tied to value-based care contracts and penalties.

By Technology Analysis

Wearables & Connected Devices and the underlying Internet of Things (IoT) & Sensor technologies form the indispensable data acquisition layer of the CDM ecosystem. This sector is moving beyond consumer fitness trackers to a proliferation of prescribed, medical-grade devices. These include continuous glucose monitors (CGMs), connected blood pressure cuffs and weight scales, smart inhalers, adhesive ECG patches, and implantable cardiac monitors. These devices provide a continuous, objective, and passive stream of clinical-grade data, moving management from episodic clinic visits to a longitudinal, real-time understanding of a patient's health status. The integration of this data into CDM platforms is a core technical function and a primary source of value creation.

AI / ML & Predictive Analytics and Clinical Decision Support (CDS) systems constitute the intelligence and insights layer that transforms raw data into actionable clinical knowledge. This is where the highest value creation and competitive differentiation occur. Machine Learning (ML) models are trained on vast datasets to identify subtle patterns and predict events such as heart failure hospitalization, hypoglycemia, or COPD exacerbation days before they occur.

By End User Analysis

Providers are the primary clinical end-users, directly responsible for care delivery. Hospitals, Physician Groups & Integrated Delivery Networks (IDNs) use CDM for care transition management, virtual wards, and specialist-led chronic disease clinics. Ambulatory Care Centers and Primary Care leverage these tools for population health management, preventive screening, and longitudinal care of their patient panels. Home Healthcare Agencies are natural adopters, using RPM and telehealth to monitor patients remotely, improving efficiency and visit scheduling. Pharmaceutical & Medtech Companies are increasingly partnering with or deploying CDM platforms to support patient adherence, gather real-world evidence, and differentiate their therapeutic offerings.

Payers are the primary economic and strategic end-users, focused on cost containment and member health. Public Payers (Medicare, Medicaid) deploy CDM strategies for population-level disease prevention and management, aiming to improve outcomes and sustainability. Private Insurers use CDM for risk-based member segmentation, offering value-added wellness programs, and managing high-cost claimants. Employer-Sponsored Health Plans are emerging as a growing segment, investing in CDM solutions to improve employee health, reduce absenteeism, and control corporate healthcare spend.

The US Chronic Disease Management Market Report is segmented on the basis of the following:

By Offering

- Solutions

- Disease-Specific Software

- Diabetes Management Platforms

- CHF/CVD Platforms

- COPD Platforms

- Remote Patient Monitoring (RPM) Platforms

- Telehealth / Teleconsultation Platforms

- Analytics & Population-Health Platforms

- Clinical Decision Support

- Risk Stratification

- Mobile Apps & Patient Engagement Tools (mHealth)

- Integration & EHR Connectors

- Services

- Disease Management Programs

- Remote Monitoring Services

- Consulting & Implementation

- Training & Support

By Deployment Type

- Cloud-based

- On-premises

- Hybrid

By Indication

- Diabetes Mellitus

- Cardiovascular Diseases

- Heart Failure

- Hypertension

- Coronary Artery Disease

- Respiratory Diseases

- Chronic Kidney Disease

- Oncology

- Mental Health

- Depression

- Anxiety

- Chronic Behavioral Health Comorbidity

- Other Indications

By Technology

- Wearables & Connected Devices

- IoT & Sensors

- AI / ML & Predictive Analytics

- Clinical Decision Support

- Mobile Apps & SMS Platforms

By End User

- By Providers

- Ambulatory Care Centers

- Hospitals, Physician Groups & Integrated Delivery Networks

- Home Healthcare Agencies

- Nursing Homes & Assisted Living Facilities

- Diagnostic & Imaging Centers

- Pharmaceutical & Medtech Companies

- By Payer

- Public Payers (Medicare, Medicaid)

- Private Insurers

- Employer-Sponsored Health Plans

Impact of Artificial Intelligence on the US Chronic Disease Management Market

- Predictive Risk Stratification & Population Segmentation: AI/ML models analyze combined EHR, claims, and wearable data to segment populations by risk of hospitalization, complications, or cost, enabling targeted care management resources.

- Personalized Intervention & Dynamic Care Pathways: ML algorithms tailor patient education, behavioral nudges, and treatment suggestions in real-time by learning from outcomes of similar patient cohorts, moving beyond static care plans.

- Proactive Alerting for Clinical Deterioration: AI-powered monitoring of RPM data streams detects subtle, early signs of clinical decline (e.g., in heart failure or COPD) before patients become symptomatic, enabling timely intervention.

- Intelligent Clinical Decision Support: AI-enhanced CDS integrates latest guidelines and real-world evidence to suggest optimal medication adjustments or diagnostic steps to clinicians during virtual or in-person consultations.

- Optimization of Resource Allocation & Program ROI: AI analyzes program data to identify which interventions are most effective for specific patient subgroups, helping payers and providers optimize service design and maximize return on investment.

The US Chronic Disease Management Market: Competitive Landscape

The competitive landscape of the US chronic Disease Management market is dynamic and moderately fragmented, characterized by diverse players from adjacent sectors converging on digital health. Established Medtech & Health IT Giants like Philips, Medtronic, and GE HealthCare leverage their deep clinical relationships, device portfolios, and enterprise software expertise to offer integrated solutions. Specialized Digital Health & DTx Providers (e.g., Livongo, Omada Health, Welldoc) compete with best-in-class, indication-specific applications known for superior user engagement and clinical evidence.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hyperscale Cloud Providers (AWS, Google, Microsoft) play a dual role as infrastructure partners and increasingly as platforms offering healthcare-specific AI/ML and data analytics services, upon which many CDM solutions are built. Major EHR Vendors (Epic, Oracle Cerner) are expanding native chronic care management modules. Competition is intensifying around who can best deliver interoperability, proven outcomes, and a seamless user experience for both clinicians and patients.

Some of the prominent players in the US Chronic Disease Management Market are

- Epic Systems Corporation

- Philips Healthcare

- Medtronic plc

- Siemens Healthineers

- GE Healthcare

- Veradigm (formerly Allscripts)

- Oracle Health (Cerner)

- Teladoc Health

- Omada Health

- Welldoc Inc.

- DarioHealth Corp.

- Health Catalyst

- Altruista Health

- Vivify Health

- Cedar Gate Technologies

- Pegasystems Inc.

- EXL Health

- TriZetto Corporation

- ZeOmega Inc.

- NextGen Healthcare

- Other Key Players

Recent Developments in the US Chronic Disease Management Market

- June 2025: Sumitomo Corporation finalized full acquisition of ActivStyle, strengthening its U.S. chronic-care supply operations. The deal expands access to home-based products for patients managing long-term conditions, supporting integrated service models and improving distribution efficiency within the national chronic-disease management ecosystem.

- May 2025: Omada Health expanded its chronic-care portfolio by launching an advanced cardiovascular-disease program supported by partnerships with major insurers. The initiative enhances digital monitoring, coaching, and personalized interventions, broadening Omada’s role in managing complex comorbidities across large employer and health-plan populations nationwide.

- May 2025: The FDA and NIH introduced the Nutrition Regulatory Science Program to strengthen chronic-disease prevention and evidence-based management. The initiative focuses on diet-linked conditions, aiming to support regulated digital tools and improve national standards for clinically validated nutrition-related interventions within chronic-care pathways.

- April 2025: Longevity Health Holdings merged with 20/20 BioLabs, integrating chronic-care management and early-risk detection capabilities. The combined organization aims to improve longitudinal patient monitoring, expand predictive analytics, and deliver coordinated services for individuals managing multiple chronic conditions across diverse healthcare environments.

- March 2025: CVS Health launched a dedicated digital-health hub focused on chronic-disease management, combining remote monitoring, virtual consultations, and personalized care plans. This expansion supports multi-condition populations and strengthens CVS’s strategy to deliver scalable, technology-enabled care across its nationwide clinical ecosystem.

- December 2024: Cigna introduced an upgraded virtual-care platform designed to enhance chronic-care continuity. The solution integrates monitoring, care coordination, and condition-specific support, helping members better manage long-term illnesses while enabling providers to deliver more standardized interventions across distributed care settings.

- November 2024: Teladoc Health completed its merger with Livongo, establishing a unified virtual-care and chronic-disease management ecosystem. The integration combines advanced monitoring, coaching, and analytics, enabling a comprehensive approach to whole-person care for patients with multiple ongoing health conditions.

- October 2024: Medtronic launched a connected insulin pen designed to enhance real-time diabetes management. The device integrates glucose data sharing and digital insights, supporting clinicians and patients with improved visibility, treatment adherence, and streamlined integration into broader chronic-care platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.6 Mn |

| Forecast Value (2034) |

USD 8.2 Mn |

| CAGR (2025–2034) |

13.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions, Services), By Deployment Type (Cloud-based, On-premises, Hybrid), By Indication (Diabetes Mellitus, Cardiovascular Diseases, Respiratory Diseases, Chronic Kidney Disease, Oncology, Mental Health, Other Indications), By Technology (Wearables & Connected Devices, IoT & Sensors, AI/ML & Predictive Analytics, Clinical Decision Support, Mobile Apps & SMS Platforms), By End User (By Providers, By Payer) |

| Regional Coverage |

The US |

| Prominent Players |

Epic Systems, Philips Healthcare, Medtronic, Siemens Healthineers, GE Healthcare, Veradigm, Oracle Health, Teladoc Health, Omada Health, Welldoc, DarioHealth, Health Catalyst, Altruista Health, Vivify Health, Cedar Gate Technologies, Pegasystems, EXL Health, TriZetto, ZeOmega, NextGen Healthcare, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Chronic Disease Management Market?

▾ The US Chronic Disease Management Market size is estimated to have a value of USD 2.6 billion in 2025 and is expected to reach USD 8.2 billion by the end of 2034.

What is the growth rate in the US Chronic Disease Management Market?

▾ The market is growing at a CAGR of 13.5 percent over the forecasted period from 2025 to 2034.

Which are the key players in the US Chronic Disease Management Market?

▾ Some of the major key players are Philips, Medtronic, Omada Health, Livongo, Epic Systems, Oracle Cerner, Amazon Web Services, Google LLC, and Microsoft Corporation, among others.