Market Overview

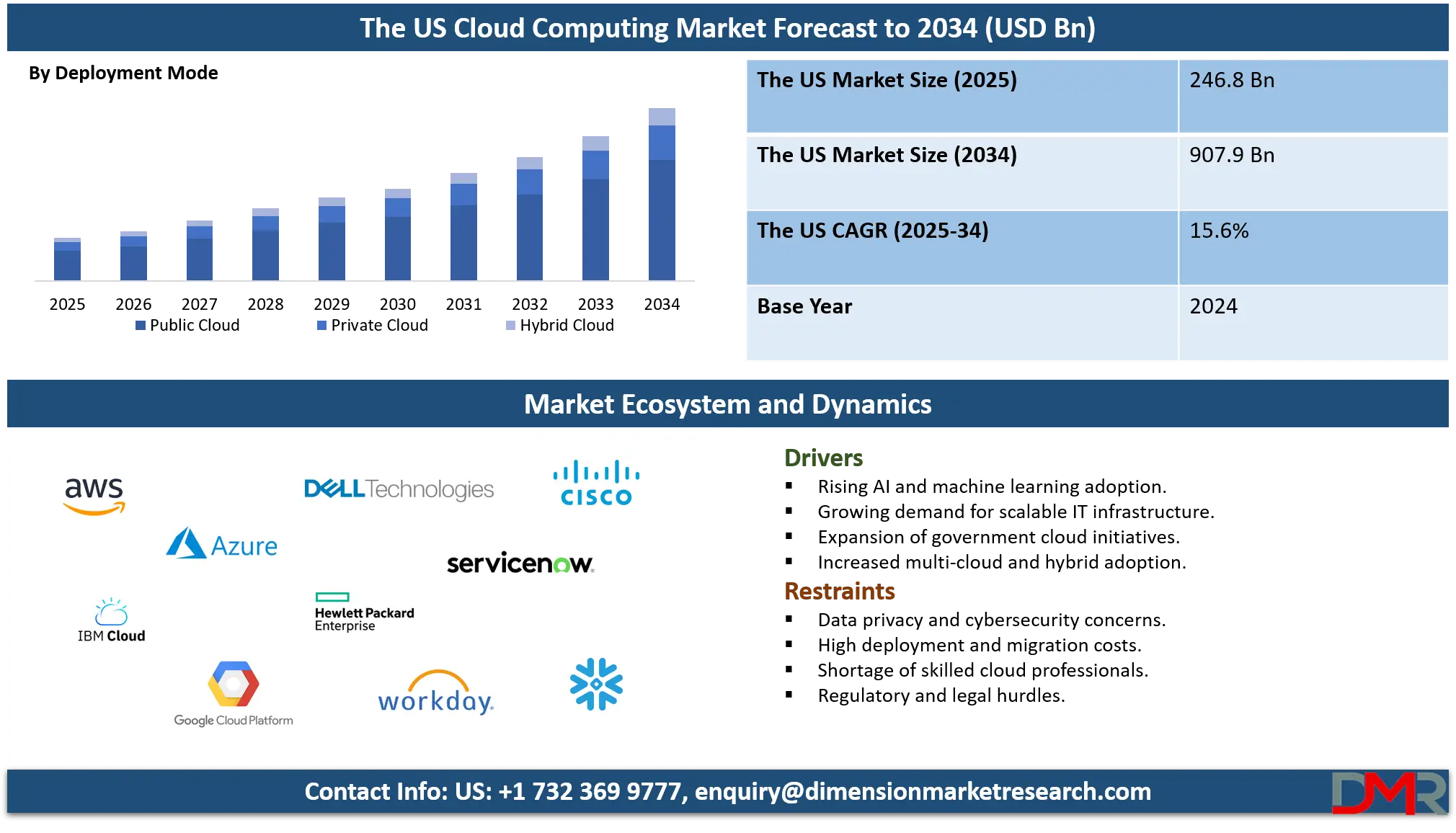

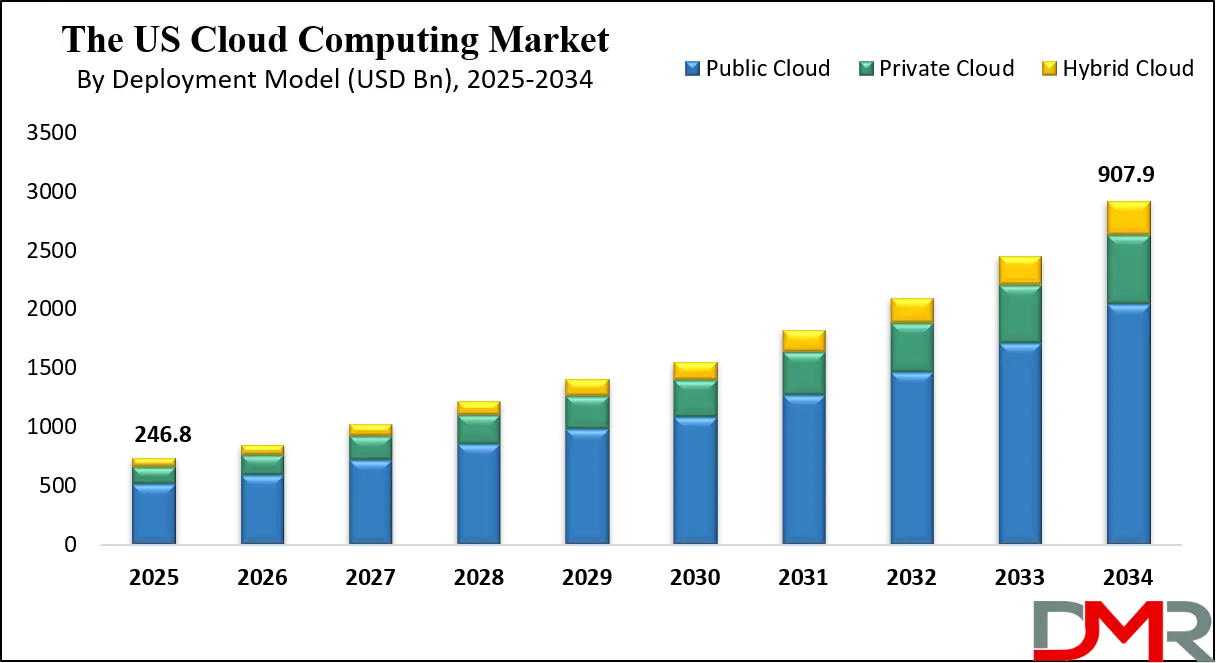

The U.S. cloud computing market is projected to reach USD 246.8 billion in 2025 and further expand to USD 907.9 billion by 2034, growing at a CAGR of 15.6%, driven by rising adoption of SaaS, hybrid cloud solutions, AI integration, and increasing demand for scalable digital infrastructure across industries.

Cloud computing is a modern technology model that enables the delivery of computing services including servers, storage, databases, networking, software, and analytics over the internet, eliminating the need for organizations to invest in on-premises infrastructure. It provides businesses and individuals with scalable resources on demand, allowing them to pay only for what they use while enhancing efficiency, flexibility, and cost optimization. By leveraging cloud solutions, companies can drive innovation, support digital transformation, and gain agility to quickly adapt to evolving market needs.

The US cloud computing market has emerged as a global leader, supported by strong technological infrastructure, widespread digital adoption, and the presence of major providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. Enterprises across industries like banking, healthcare, retail, and manufacturing are increasingly investing in cloud solutions to modernize IT systems, accelerate application deployment, and improve operational efficiency. The US market is also benefiting from favorable policies, cybersecurity advancements, and the rapid growth of artificial intelligence and machine learning applications powered by cloud platforms.

Moreover, the demand for hybrid and multi-cloud environments is growing in the United States as businesses seek more flexibility, enhanced data management, and compliance with strict regulatory standards. Cloud services are also driving innovation in edge computing, 5G adoption, and Internet of Things applications, making the US a key hub for global cloud innovation. With rising investments from enterprises and government sectors, the US cloud computing market is set to expand further, offering opportunities for both established players and emerging startups to transform industries with scalable, secure, and intelligent cloud-based solutions.

The US Cloud Computing Market: Key Takeaways

- Market Value: The US Cloud Computing market size is expected to reach a value of USD 907.9 billion by 2034 from a base value of USD 246.8 billion in 2025 at a CAGR of 15.6%.

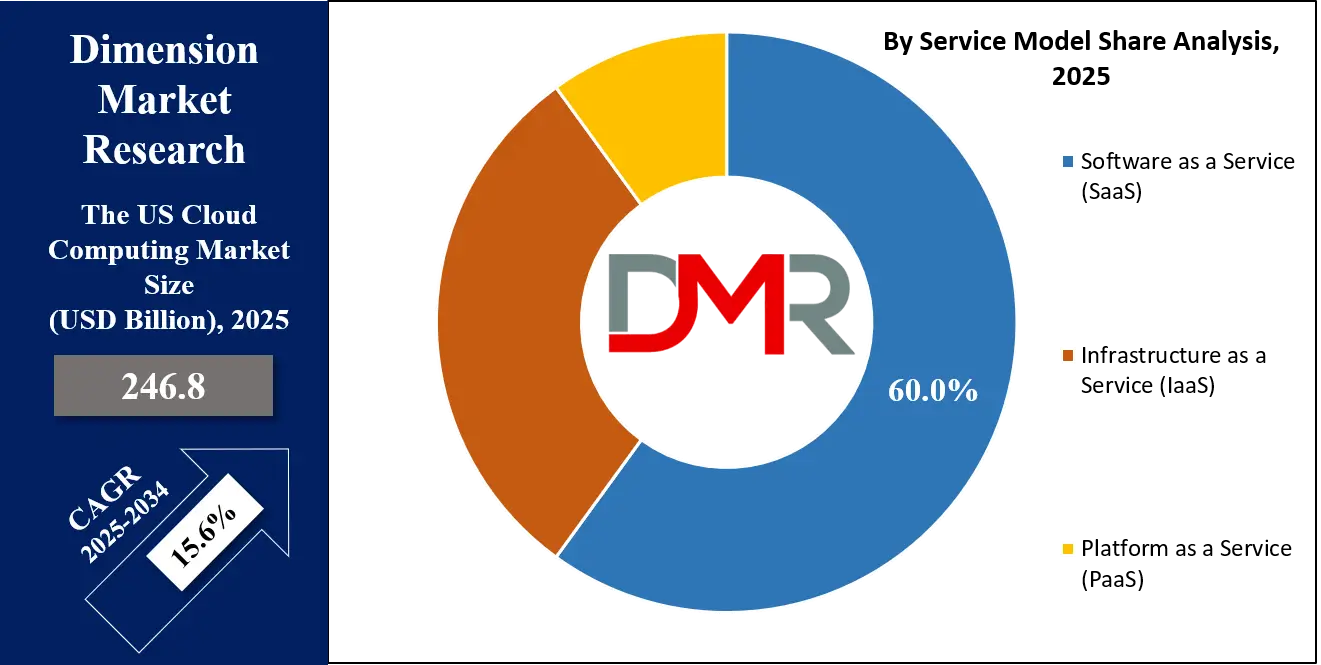

- By Service Model Segment Analysis: Software as a Service (SaaS) is anticipated to dominate the service model segment, capturing 60.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud is expected to maintain its dominance in the deployment model segment, capturing 70.0% of the total market share in 2025.

- By Organization Size Analysis: Large Enterprises will dominate the organization size, capturing 75.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will account for the maximum share in the industry vertical segment, capturing 25.0% of the total market value.

- Key Players: Some key players in the US Cloud Computing market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others.

The US Cloud Computing Market: Use Cases

- Cloud Adoption in Healthcare and Life Sciences: In the U.S., healthcare providers are increasingly leveraging cloud computing for secure storage, telemedicine platforms, and AI-driven diagnostic tools. Cloud-based electronic health records and HIPAA-compliant solutions improve patient care, enhance data interoperability, and reduce operational costs while ensuring compliance with strict U.S. healthcare regulations.

- Cloud Computing in Financial Services: The U.S. BFSI sector utilizes cloud solutions for fraud detection, real-time payment processing, and regulatory compliance. Financial institutions benefit from the scalability of cloud-based infrastructure, allowing them to manage large volumes of transactions securely while supporting digital banking and mobile payment innovations.

- Government and Public Sector Transformation: Federal and state agencies in the U.S. are adopting cloud platforms to modernize legacy IT systems, enhance cybersecurity, and enable secure citizen services. Initiatives like FedRAMP compliance have accelerated cloud adoption in public services, driving efficiency, transparency, and cost savings.

- Cloud Integration in Media and Entertainment: The U.S. media and entertainment industry relies on cloud platforms for content creation, storage, and distribution. Streaming platforms, gaming companies, and digital media firms use cloud infrastructure for seamless content delivery, high-speed performance, and real-time analytics to improve user engagement and monetization.

Impact of Artificial Intelligence on the US Cloud Computing Market

Artificial intelligence is significantly shaping the U.S. cloud computing market by enhancing scalability, automation, and intelligent data processing across industries. AI-powered cloud platforms enable predictive analytics, natural language processing, and advanced machine learning applications, which are transforming business operations and customer experiences. Companies in the U.S. are leveraging AI-integrated cloud services to optimize workflows, strengthen cybersecurity, and reduce costs while fostering innovation in sectors such as healthcare, finance, retail, and manufacturing.

The US Cloud Computing Market: Stats & Facts

U.S. Federal Cloud Computing Market (FY 2023–2025)

- FY 2023: Federal cloud computing spending reached USD 16.5 billion, marking a significant increase from previous years.

- FY 2024: The U.S. federal government allocated USD 18.2 billion for cloud computing services, reflecting continued investment in digital infrastructure.

- FY 2025: Projected federal cloud spending is expected to surpass USD 20 billion, driven by modernization initiatives and increased reliance on cloud technologies.

U.S. Data Center Power Consumption (2023–2030)

- 2023: Approximately 80% of U.S. data center load was concentrated in 15 states, led by Virginia and Texas.

- 2030: U.S. data center power consumption could range from 4.6% to 9.1% of the country's total electricity generation.

FedRAMP (Federal Risk and Authorization Management Program)

- 2023: Over 200 cloud service providers were authorized under FedRAMP, ensuring compliance with federal security standards.

- 2024: The number of FedRAMP-authorized cloud services increased to over 250, reflecting growing adoption across federal agencies.

- 2025: Projected to exceed 300 authorized cloud services, indicating continued expansion of secure cloud adoption in the federal sector.

U.S. Cloud Computing Employment & Skills (2023–2025)

- 2023: Approximately 1.2 million U.S. workers were employed in cloud computing-related roles.

- 2023: 60% of U.S. organizations reported a shortage of cloud computing talent, impacting their ability to scale cloud initiatives.

- 2024: The talent gap narrowed slightly, with 55% of organizations reporting difficulties in hiring qualified cloud professionals.

- 2024: The number of cloud computing jobs increased to 1.4 million, driven by industry growth and demand for skilled professionals.

- 2025: Projected to reach 1.6 million cloud computing-related jobs, highlighting the sector's expanding workforce.

- 2025: Expected to see a further reduction in the talent gap, with 50% of organizations facing challenges in cloud hiring.

U.S. Cloud Computing Adoption & Usage (2023–2025)

- 2023: 85% of U.S. enterprises had adopted at least one cloud service model (IaaS, PaaS, SaaS).

- 2023: 70% of U.S. organizations reported using public cloud services.

- 2023: 50% of U.S. businesses utilized private cloud solutions.

- 2024: Adoption increased to 90%, with a significant rise in multi-cloud strategies.

- 2024: Usage increased to 75%, reflecting growing trust in public cloud providers.

- 2024: Adoption rose to 55%, with increased focus on data security and compliance.

- 2025: Projected to reach 95%, with hybrid and multi-cloud environments becoming the norm.

- 2025: Expected to reach 80%, indicating widespread adoption across industries.

The US Cloud Computing Market: Market Dynamics

The US Cloud Computing Market: Driving Factors

Growing Demand for Digital Transformation

Enterprises across the U.S. are rapidly adopting cloud computing solutions to accelerate digital transformation, streamline IT infrastructure, and improve operational efficiency. Cloud-based applications provide scalability, cost-effectiveness, and flexibility, which are essential for businesses adapting to evolving consumer needs and dynamic market conditions.

Expansion of Remote Work and Hybrid Models

The rise of remote work and hybrid workplace models has significantly increased reliance on cloud computing platforms. Organizations are investing in secure cloud infrastructure to support collaboration tools, virtual desktops, and enterprise communication platforms that enable seamless business continuity across distributed teams.

The US Cloud Computing Market: Restraints

Data Security and Privacy Concerns

Despite advancements in cybersecurity, data protection remains a major restraint in the U.S. cloud computing market. Industries like healthcare and banking face strict compliance requirements under regulations such as HIPAA and PCI-DSS, limiting the adoption of certain cloud services due to concerns over breaches and unauthorized access.

High Cost of Cloud Migration and Management

For many enterprises, especially mid-sized businesses, the initial migration to the cloud and ongoing management expenses are challenging. The cost of data transfer, customization, integration, and skilled workforce for cloud operations can delay adoption and reduce return on investment.

The US Cloud Computing Market: Opportunities

Integration of Edge Computing with Cloud Platforms

The growing adoption of IoT devices and real-time analytics is creating opportunities for integrating edge computing with cloud systems. U.S. companies are leveraging hybrid cloud-edge models to enhance latency-sensitive applications, improve efficiency, and deliver better customer experiences in industries like manufacturing, healthcare, and retail.

Government Initiatives and Cloud Adoption in the Public Sector

The U.S. government’s push for digital modernization through initiatives such as FedRAMP and cloud-first policies is creating new opportunities for cloud providers. Federal and state agencies are increasingly shifting workloads to cloud environments to improve efficiency, security, and service delivery.

The US Cloud Computing Market: Trends

Rise of Multi-Cloud and Hybrid Strategies

A notable trend in the U.S. market is the shift toward multi-cloud and hybrid cloud strategies. Businesses are combining services from multiple cloud vendors to avoid vendor lock-in, optimize costs, and ensure greater resilience and flexibility in managing workloads.

AI and Machine Learning Integration into Cloud Platforms

The integration of artificial intelligence and machine learning into cloud computing services is becoming a transformative trend. U.S. enterprises are adopting AI-enabled cloud platforms for predictive analytics, automation, and advanced decision-making to gain a competitive edge in their respective sectors.

The US Cloud Computing Market: Research Scope and Analysis

By Service Model Analysis

Software as a Service (SaaS) is anticipated to dominate the U.S. cloud computing landscape, accounting for 60.0% of the total market share in 2025. The growing preference for SaaS is fueled by its flexibility, ease of deployment, and cost-effectiveness, making it a preferred choice for enterprises across industries. From CRM and ERP platforms to collaboration and productivity tools, SaaS enables organizations to streamline operations without the need for heavy infrastructure investments. Its subscription-based model, automatic updates, and robust security frameworks are further driving its penetration among both large enterprises and SMBs.

In comparison, Platform as a Service (PaaS) is witnessing steady growth as U.S. businesses increasingly seek solutions to accelerate software development and digital transformation initiatives. PaaS provides developers with pre-configured environments, integrated tools, and middleware to build, test, and deploy applications efficiently. It reduces the complexities of infrastructure management, allowing teams to focus on innovation and faster time-to-market. Sectors like finance, healthcare, and retail are leveraging PaaS for building customized applications that enhance customer engagement and operational efficiency, positioning it as a key enabler of future innovation despite its relatively smaller market share.

By Deployment Model Analysis

Public cloud is expected to maintain its dominance in the U.S. cloud computing market, accounting for 70.0% of the total market share in 2025. Its leadership stems from scalability, cost-efficiency, and accessibility, making it highly attractive for enterprises seeking to modernize IT infrastructure and reduce capital expenditure. The rise of digital transformation across sectors such as BFSI, healthcare, and retail is further fueling demand for public cloud services, particularly for workloads like data storage, analytics, and AI-driven applications.

Additionally, hyperscale providers such as AWS, Microsoft Azure, and Google Cloud continue to expand their U.S. presence with advanced solutions and localized data centers, reinforcing the strong adoption of public cloud among businesses of all sizes.

Private cloud, while smaller in comparison, holds critical importance in industries that prioritize stringent data security, compliance, and control over infrastructure. Sectors such as government, defense, and healthcare are increasingly leveraging private cloud to ensure data sovereignty and meet regulatory frameworks like HIPAA and FedRAMP. It offers dedicated resources, higher customization, and robust control, enabling organizations to safeguard sensitive data while enjoying the benefits of cloud computing. Though it may not rival the scale of public cloud adoption, private cloud continues to serve as a strategic choice for mission-critical applications and enterprises with specialized IT requirements.

By Organization Size Analysis

Large enterprises are projected to dominate the U.S. cloud computing market, capturing 75.0% of the market share in 2025. Their strong adoption is driven by the need to handle massive data volumes, support global operations, and leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics. These organizations are heavily investing in hybrid and multi-cloud strategies to achieve flexibility, scalability, and business continuity.

Additionally, large enterprises often collaborate with leading cloud providers like AWS, Microsoft Azure, and Google Cloud to optimize IT infrastructure, reduce operational costs, and enhance digital transformation efforts across diverse industry verticals.

Small and medium enterprises (SMEs), while accounting for a smaller share, are emerging as a high-growth segment in the U.S. cloud computing market. Driven by cost efficiency, scalability, and ease of deployment, SMEs are increasingly adopting cloud solutions to streamline operations, enable remote work, and enhance customer engagement. Cloud-based SaaS applications are particularly attractive to SMEs due to their affordability and ability to provide enterprise-grade tools without large capital investments. As digital adoption accelerates among smaller businesses, their role in driving incremental growth in the cloud market is becoming increasingly significant.

By Industry Vertical Analysis

The BFSI industry is expected to capture 25.0% of the total market value in the U.S. cloud computing sector by 2025, making it the leading industry vertical. The adoption of cloud services in banking, financial services, and insurance is largely driven by the demand for secure data storage, real-time analytics, and digital payment processing. Financial institutions are leveraging cloud computing to improve risk management, enhance customer experience through AI-driven services, and support the rapid shift toward mobile and online banking.

Moreover, regulatory compliance requirements in the U.S. are encouraging BFSI firms to adopt advanced cloud solutions that provide both scalability and robust security frameworks. In the energy and utilities sector, cloud computing adoption is gaining momentum as companies seek to modernize infrastructure and improve efficiency.

Cloud platforms enable utilities to manage smart grids, monitor energy consumption patterns, and integrate renewable energy sources into their operations. The sector also benefits from cloud-based predictive analytics, which supports maintenance of critical infrastructure and reduces downtime. With the U.S. energy industry undergoing a significant transition toward sustainability and decarbonization, cloud technologies are becoming essential in driving digital innovation and enabling a more resilient and adaptive energy ecosystem.

The US Cloud Computing Market Report is segmented on the basis of the following:

By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (Paas)

- Software as a Service (SaaS)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- BFSI

- Energy & Utilities

- Government & Public Sector

- Telecommunications

- Retail & Consumer Goods

- Media & Entertainment

- IT & ITeS

- Healthcare & Life Science

- Others

The US Cloud Computing Market: Competitive Landscape

The US cloud computing market is highly competitive, characterized by the dominance of leading technology players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, alongside strong contributions from IBM, Oracle, and Salesforce. These companies compete through innovation in cloud infrastructure, AI integration, cybersecurity, and industry-specific solutions, while continuously expanding their service portfolios to capture larger market share.

The landscape is further shaped by partnerships, mergers, and acquisitions, as well as the rise of niche providers focusing on hybrid cloud, edge computing, and specialized SaaS platforms. This dynamic environment fosters rapid technological advancements, enabling businesses across diverse industries to adopt scalable and cost-efficient cloud solutions that enhance digital transformation.

Some of the prominent players in the US Cloud Computing market are:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud

- Salesforce

- VMware

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- ServiceNow

- Workday

- Snowflake

- DigitalOcean

- Dropbox

- Box Inc.

- Red Hat (an IBM company)

- NetApp

- Akamai Technologies

- Rackspace Technology

- Other Key Players

The US Cloud Computing Market: Recent Developments

- September 2025: Google announced a USD 9 billion investment in Virginia to expand its cloud and artificial intelligence infrastructure through 2026. This initiative enhances capacity and supports scalable digital infrastructure development.

- July 2025: AWS unveiled Amazon Bedrock AgentCore, a suite for deploying and managing AI agents securely at scale, along with a USD 100 million investment in its Generative AI Innovation Center, reinforcing AWS’s leadership in agentic AI platforms.

- July 2025: CoreWeave agreed to acquire Core Scientific in a USD 9 billion all-stock deal, securing control over 1.3 GW of data center capacity and targeting more than USD 500 million in annual cost savings.

- June 2025: Hewlett Packard Enterprise finalized its USD 14 billion acquisition of Juniper Networks after resolving antitrust concerns with the DOJ, strengthening its AI networking and cloud-native portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 246.8 Bn |

| Forecast Value (2034) |

USD 907.9 Bn |

| CAGR (2025–2034) |

15.6% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Model (Infrastructure as a Service, Platform as a Service, and Software as a Service), By Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), By Organization Size (Large Enterprises and Small & Medium Enterprises), and By Industry Vertical (BFSI, Energy & Utilities, Government & Public Sector, Telecommunications, Retail & Consumer Goods, Media & Entertainment, IT & ITeS, Healthcare & Life Science, and Others). |

| Regional Coverage |

The US |

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP, VMware, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Rackspace Technology, Tencent Cloud, Baidu AI Cloud, Huawei Cloud, DigitalOcean, Snowflake, and Others

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |