The U.S. Cloud Storage Market is set to surge, reaching an impressive valuation of

in 2025. Driven by the rising adoption of cloud computing, scalable infrastructure demands, and accelerated digital transformation across industries, the market is forecasted to achieve a remarkable

As enterprises continue to prioritize secure, agile, and cost-efficient data storage solutions, the U.S. is poised to remain at the forefront of the global cloud ecosystem, reinforcing its dominance in next-generation storage technologies.

The U.S. cloud storage market continues to showcase rapid technological evolution, driven by the widespread adoption of digital transformation initiatives across industries such as banking, healthcare, retail, and government sectors. Enterprises are shifting from traditional on-premises data storage systems to scalable, cost-effective cloud storage solutions that enable faster access, enhanced data security, and seamless collaboration across geographically dispersed teams. Cloud computing models like Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) have strengthened the reliance on cloud storage, offering dynamic scalability and advanced disaster recovery capabilities.

Moreover, the growing need for hybrid cloud environments, AI-powered data management, and regulatory compliance has pushed organizations to seek customized storage strategies, combining public, private, and on-premise infrastructures. The rising concerns around cyber threats and ransomware attacks have also led U.S. businesses to invest heavily in encrypted cloud storage and multi-layered security solutions.

Simultaneously, the surge in demand for edge computing, Internet of Things (IoT) integration, and remote work solutions is reshaping the landscape of the U.S. cloud storage market. Enterprises are prioritizing low-latency storage access, high-availability architectures, and intelligent data tiering to optimize operational efficiency and user experience. The popularity of object storage for unstructured data management, combined with the growing use of analytics and machine learning models, is amplifying the value proposition of cloud storage platforms.

U.S. cloud providers are focusing on offering energy-efficient, carbon-neutral data centers in response to sustainability goals and ESG compliance requirements. As innovation continues, the market is witnessing intense competition among hyperscalers and specialized providers to deliver differentiated services like serverless storage, automated backup solutions, and industry-specific storage frameworks tailored for sectors such as media and entertainment, life sciences, and manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. Cloud Storage Market: Key Takeaways

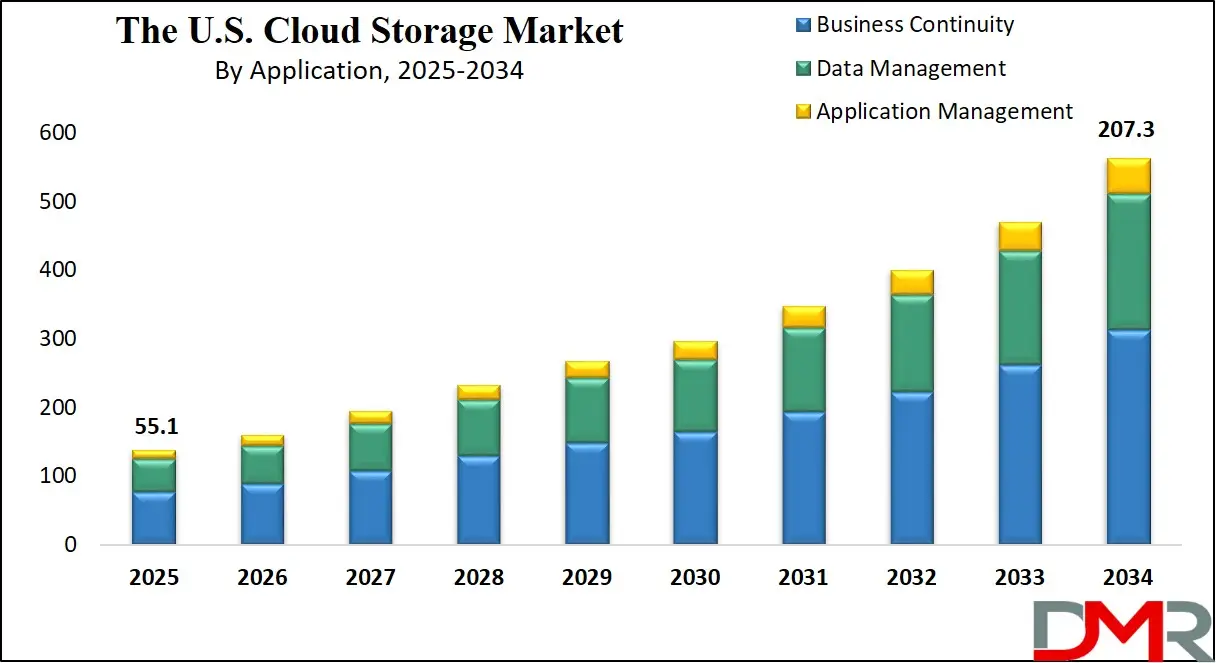

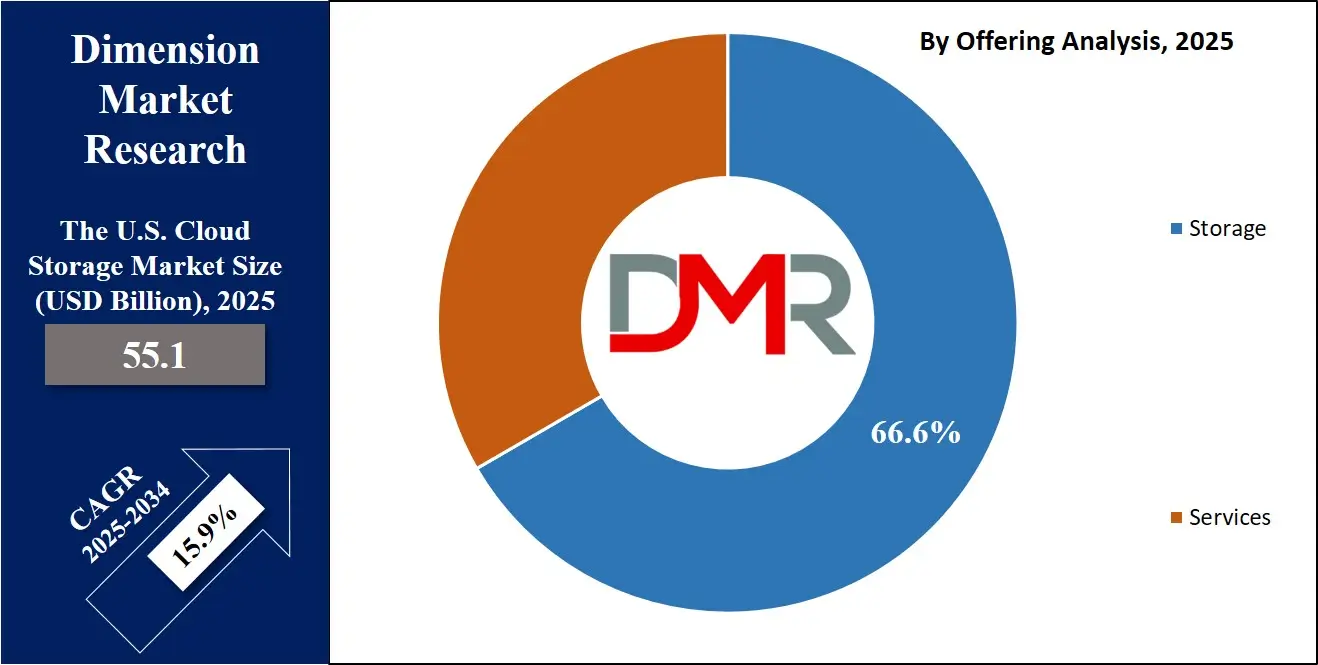

- Market Value: The U.S. cloud storage size is expected to reach a value of USD 207.3 billion by 2034 from a base value of USD 55.1 billion in 2025 at a CAGR of 15.9%.

- By Offering Segment Analysis: Storage offerings are poised to consolidate their dominance in the offering type segment, capturing 66.6% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are anticipated to maintain their dominance in the organization type segment, capturing 79.2% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud deployment model is expected to maintain its dominance in the deployment model type segment, capturing 48.7% of the total market share in 2025.

- By Application Type Segment Analysis: Business Continuity applications are poised to consolidate their market position in the application type segment, capturing 55.5% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry is anticipated to maintain its dominance in the industry vertical segment, capturing 37.4% of the total market share in 2025.

- Key Players: Some key players in the U.S. cloud storage market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure (OCI), Dell Technologies, Hewlett-Packard Enterprise (HPE), NetApp, Dropbox, Box, Inc., Wasabi Technologies, Backblaze, Citrix Systems, Pure Storage, Snowflake, Veeam Software, Cohesity, Rubrik, Egnyte, Nutanix, and Other Key Players.

The U.S. Cloud Storage Market: Use Cases

- Enterprise Data Backup and Disaster Recovery: One of the primary use cases driving the U.S. cloud storage market is enterprise data backup and disaster recovery. Organizations across sectors such as finance, healthcare, and retail are adopting cloud-based backup solutions to ensure data resilience in the event of cyberattacks, hardware failures, or natural disasters. With rising cybersecurity threats and the growing cost of downtime, businesses are leveraging cloud storage to maintain real-time backups, enable rapid data restoration, and achieve business continuity. Cloud storage providers in the U.S. offer geographically distributed data centers, automated failover mechanisms, and encrypted backup solutions that align with industry compliance requirements like HIPAA and SOC 2.

- Hybrid and Multi-Cloud Data Management: Another significant use case in the U.S. cloud storage market is hybrid and multi-cloud data management. Many enterprises are adopting hybrid cloud models, combining private and public cloud infrastructures to balance scalability, security, and cost-efficiency. This model enables businesses to keep sensitive data on private clouds while leveraging the scalability of public clouds for non-sensitive workloads. Additionally, multi-cloud strategies allow organizations to diversify their cloud providers to avoid vendor lock-in, enhance system resilience, and tailor storage services to specific application needs.

- Big Data Storage and Analytics Acceleration: With the exponential growth of structured and unstructured data from IoT devices, social media, and business applications, the demand for big data storage and analytics solutions is expanding rapidly in the U.S. market. Cloud storage plays a critical role in enabling enterprises to store vast datasets economically while providing instant access for real-time analytics, artificial intelligence, and machine learning applications. Cloud platforms are offering specialized object storage services designed for massive scalability and high-throughput data processing.

- Content Delivery and Media Asset Management: The U.S. media and entertainment industry is heavily investing in cloud storage solutions to manage, distribute, and protect vast volumes of digital content. Streaming services, news organizations, and production studios rely on cloud platforms to store high-resolution videos, enable collaborative editing, and deliver seamless content experiences to global audiences. Cloud storage not only supports scalable content repositories but also integrates with Content Delivery Networks (CDNs) to ensure low-latency content delivery.

The U.S. Cloud Storage Market: Stats & Facts

- Bureau of Economic Analysis (BEA)

- In 2021, cloud services contributed & in gross output, marking a 21.8% increase from 2020.

- The digital economy accounted for $2.41 trillion of U.S. GDP in 2021, representing 10.3% of the total GDP.

- Real gross output of the digital economy rose by 9.8% from 2020 to 2021, surpassing the five-year average of 4.8%.

- Priced digital services, including cloud solutions, generated $1.59 trillion in gross output in current dollars in 2021.

- National Science Foundation (NSF)

- Over 60% of firms in the Information sector adopted cloud computing for operations and data services.

- 45% of Professional, Scientific, and Technical Services companies leveraged cloud services for scalability and flexibility.

- 30% of manufacturing firms reported cloud usage primarily for supply chain and production data storage.

- In the Legal Services sector, 61.5% cited laws and regulations as primary barriers to cloud adoption.

- 47.2% of Transportation Equipment manufacturers identified legal restrictions impacting cloud migration.

- 49.4% of non-manufacturing industries used cloud to enhance reliability and operational efficiency.

- 47.6% of firms in Agriculture, Forestry, Fishing, and Hunting implemented cloud solutions to modernize outdated systems.

- The Mining industry reported 46.7% adoption aimed at replacing legacy IT infrastructure.

- Government Accountability Office (GAO)

- Federal agencies reported top cloud adoption challenges, including cybersecurity risks, procurement limitations, and workforce skills gaps.

- The FedRAMP program was established to standardize and secure federal cloud implementations.

- Delays in FedRAMP authorization were commonly cited as a bottleneck by both vendors and agencies.

- Agencies noted inefficiencies in managing cloud-based software licensing contracts.

- Recommended private-sector best practices for cloud adoption include proactive acquisition planning and staff training programs.

- National Renewable Energy Laboratory (NREL)

- Data centers in the U.S. are projected to consume up to 9% of the nation’s electricity by 2030 due to increasing digital workloads.

- Approximately 40% of the energy used in data centers goes toward cooling infrastructure to support storage systems.

- International Energy Agency (via NREL)

- U.S. data centers consumed about 200 billion kilowatt-hours of electricity in 2022, equivalent to around 4% of total national power consumption.

The U.S. Cloud Storage Market: Market Dynamics

The U.S. Cloud Storage Market: Driving Factors

Rapid Digital Transformation across IndustriesThe ongoing wave of digital transformation is significantly propelling the demand for cloud storage services across the U.S. economy. Sectors like healthcare, retail, BFSI, and manufacturing are accelerating their migration to digital platforms, requiring reliable and scalable data storage solutions to manage vast and growing datasets. Enterprises are prioritizing cloud storage to enhance operational efficiency, enable real-time analytics, and create customer-centric solutions.

The need for agility in launching digital products, services, and experiences further pushes companies toward cloud-native architectures. Cloud storage enables businesses to seamlessly handle structured and unstructured data while maintaining flexibility for future scaling. Additionally, the adoption of cloud storage supports disaster recovery, regulatory reporting, and automation goals essential for competitive advantage. As the 5G rollout continues and digital platforms expand, cloud storage becomes a critical foundation for modern enterprises. This trend is also boosting demand for advanced cloud services like storage optimization, intelligent archiving, and secure file collaboration.

Expansion of Remote and Hybrid Work Models

The dramatic shift toward remote work and hybrid work arrangements following the pandemic has permanently reshaped enterprise IT needs, placing cloud storage at the center of collaboration and productivity strategies. Organizations now require decentralized storage systems that allow employees to access, share, and manage files securely from any location. Cloud storage solutions have become critical for enabling real-time document collaboration, version control, and centralized data governance across distributed teams.

Businesses across the U.S. are adopting platforms like Google Drive, OneDrive, and Dropbox Business to facilitate smoother workflows without sacrificing security. Cloud storage also ensures business continuity in the event of localized disruptions or outages. Moreover, organizations are seeking integrated solutions that combine cloud storage with communication tools, project management platforms, and CRM systems. This widespread adoption of flexible storage infrastructures is expected to drive continued innovation around access control, mobile-first storage, and zero-trust security models.

The U.S. Cloud Storage Market: Restraints

Data Privacy and Compliance Challenges

Data privacy concerns represent one of the most pressing challenges slowing the full-scale adoption of cloud storage in the U.S. market. Regulatory frameworks such as the California Consumer Privacy Act (CCPA), Health Insurance Portability and Accountability Act (HIPAA), and the Sarbanes-Oxley Act impose strict rules around data collection, storage, and sharing practices. Organizations, especially those in healthcare, finance, and legal sectors, must navigate complex legal obligations when transferring sensitive information to the cloud.

Non-compliance can lead to hefty fines, reputational damage, and legal liabilities, making many enterprises cautious about cloud adoption. Even with leading cloud providers offering compliance certifications and audit support, concerns persist regarding cross-border data transfers, third-party data access, and encryption management. Enterprises must also ensure that their cloud storage vendors offer detailed transparency into security measures, access controls, and incident response protocols to satisfy auditors and regulators.

Concerns over Cloud Security Breaches

Security remains a top barrier preventing some organizations from fully migrating critical workloads to the cloud. Despite advancements in cloud security technologies, incidents of data breaches, ransomware attacks, and unauthorized access continue to pose significant threats. Enterprises are particularly worried about vulnerabilities related to multi-tenancy environments, where resources are shared across multiple clients on the same server. Cloud misconfigurations, human error, and inadequate identity and access management can expose sensitive files to cybercriminals.

Furthermore, insider threats and phishing attacks targeting cloud credentials are on the rise. For many businesses, perceived risks associated with losing control over their data once it resides off-premises slow down cloud adoption strategies. As a result, companies are demanding more sophisticated encryption techniques, multi-factor authentication, threat detection services, and security information and event management (SIEM) integration with their storage solutions.

The U.S. Cloud Storage Market: Opportunities

Growing Adoption of Multi-Cloud and Hybrid Cloud Architectures

The growing preference for multi-cloud and hybrid cloud deployments presents a major growth opportunity for the U.S. cloud storage market. Organizations are no longer relying on a single cloud vendor; instead, they are diversifying storage environments to achieve greater flexibility, minimize risks, and optimize costs. Multi-cloud strategies enable businesses to select the best storage services from different providers based on performance, price, or geographic reach. Meanwhile, hybrid cloud storage allows companies to maintain sensitive data on private infrastructure while leveraging public clouds for scalability and innovation.

This shift creates strong demand for solutions that can ensure seamless data movement, unified management, consistent security policies, and real-time visibility across clouds. Companies offering cloud interoperability services, unified APIs, and centralized monitoring platforms are well-positioned to capture this emerging market segment. Hybrid and multi-cloud adoption is also critical for enabling data sovereignty compliance and facilitating edge computing initiatives.

Emergence of AI-Driven Cloud Storage Solutions

Artificial Intelligence and Machine Learning are rapidly transforming cloud storage services in the U.S., offering new avenues for innovation and efficiency. AI-driven cloud storage solutions can intelligently categorize, archive, and retrieve files based on metadata and usage patterns, dramatically improving data management processes. Predictive analytics can forecast storage capacity needs, enabling businesses to optimize costs and avoid downtime. Advanced AI models are also enhancing backup strategies by identifying critical data sets that require higher redundancy levels.

Moreover, AI is used for proactive threat detection, anomaly recognition, and automated incident response within storage environments. Cloud providers are integrating machine learning algorithms to enhance deduplication, compression, and tiered storage capabilities, leading to significant operational savings. As demand for smarter, self-managing storage systems grows, companies investing in AI-enhanced storage platforms are likely to gain a competitive edge in the evolving U.S. market.

The U.S. Cloud Storage Market: Trends

Rising Demand for Edge Storage and Decentralized Data Management

The surge in IoT deployments, smart cities initiatives, and real-time analytics is driving strong interest in edge storage solutions across the United States. Enterprises now require cloud storage systems that can process and store data closer to its generation point rather than relying solely on centralized data centers. Edge storage reduces latency, improves application performance, and enhances security by limiting data exposure during transmission.

This trend is particularly pronounced in industries such as manufacturing, healthcare, automotive, and energy, where time-sensitive operations depend on ultra-fast data access. Cloud storage providers are developing decentralized architectures that offer hybrid edge-cloud storage models, ensuring seamless data movement and policy enforcement across distributed sites. Additionally, advances in micro data centers, 5G connectivity, and AI at the edge are making decentralized cloud storage a mainstream necessity rather than an experimental approach.

Focus on Sustainable and Green Cloud Storage Solutions

Sustainability has become a major priority among U.S. enterprises and cloud storage providers alike. Businesses are under pressure from regulators, investors, and consumers to minimize their environmental footprint, leading to a surge in demand for green cloud solutions. Major cloud providers are investing heavily in renewable energy-powered data centers, carbon-neutral initiatives, and energy-efficient storage technologies. Storage platforms are now incorporating features like automated cold storage for infrequently accessed data, reducing energy usage significantly.

Some companies are even leveraging machine learning algorithms to optimize server load distribution and cooling mechanisms for greater sustainability. Certifications like LEED (Leadership in Energy and Environmental Design) and the use of modular data center designs are becoming common industry standards. As environmental, social, and governance (ESG) factors grow in importance, enterprises are likely to prioritize cloud partners that demonstrate tangible commitments to green practices.

The U.S. Cloud Storage Market: Research Scope and Analysis

By Offering Analysis

In the U.S. cloud storage market, storage offerings are expected to maintain a dominant position in the offering type segment, projected to capture 66.6% of the total market share in 2025. This continued leadership is driven by the growing demand for scalable, cost-effective, and easily accessible storage solutions that cater to various industries across the country. As businesses in the U.S. continue to undergo digital transformation, there is a growing need for flexible infrastructure capable of supporting critical operations such as data archiving, backup and recovery, file synchronization, and managing unstructured data.

Cloud-based storage solutions, particularly object storage and file storage, are being adopted due to their versatility, high performance, and ability to support high-availability systems. Enterprises are turning to cloud storage not only to streamline their data management processes but also to ensure they can scale operations efficiently to meet fluctuating workloads, user demands, and compliance requirements.

The services segment in the U.S. cloud storage market plays an equally crucial role by providing the technical expertise, operational support, and strategic guidance necessary for businesses to successfully deploy and manage cloud storage environments. As organizations in the U.S. move from traditional IT infrastructures to cloud-based architectures, the complexity surrounding data migration, integration, governance, and system optimization has grown significantly. This complexity makes cloud storage services indispensable, helping companies navigate the challenges of cloud adoption and ensuring a seamless transition to cloud environments.

These services support enterprises through the entire lifecycle of cloud storage adoption, offering everything from initial consultations and infrastructure design to ongoing system management and optimization. As companies strive to unlock the full potential of cloud storage, service providers are stepping in to offer specialized expertise, ensuring long-term scalability, security, and operational efficiency. This growing demand for specialized services is essential for businesses aiming to stay competitive in today’s fast-paced digital landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

Large enterprises are projected to maintain a dominant presence in the U.S. cloud storage market, accounting for

79.2% of the total market share in 2025. This stronghold is primarily driven by their extensive digital infrastructures, high volumes of data generation, and significant financial resources, which allow them to embrace large-scale cloud adoption. Large organizations, often spanning multiple regions and industries, require robust, scalable, and secure cloud storage solutions to ensure real-time data access, compliance with both local and international regulations, and seamless collaboration across departments.

Their usage of cloud storage goes beyond basic needs, extending to complex applications such as predictive analytics, machine learning model training, large-scale content distribution, and disaster recovery strategies. To maintain operational efficiency and business continuity, large enterprises are investing in hybrid and multi-cloud strategies, which combine public and private storage options to provide flexibility, cost optimization, and enhanced control.

On the other hand, small and medium-sized enterprises (SMEs) are gradually growing their share of the U.S. cloud storage market as cloud technology becomes more accessible and affordable. Historically, SMEs have faced barriers to adopting cloud storage due to limited IT budgets and a lack of in-house expertise. However, the rise of pay-as-you-go cloud models and simplified management platforms has significantly lowered these barriers, making cloud adoption more viable.

SMEs are using cloud storage for practical needs such as data backup, document sharing, and secure remote access. As more SMEs embrace digital-first strategies, cloud storage is being recognized as a key enabler of growth, offering the scalability required to support expansion and allowing these businesses to leverage remote work models and stay competitive in a digital marketplace. Cloud vendors are specifically targeting this segment with solutions tailored to their needs, including user-friendly interfaces, integrated security features, and compliance-ready storage systems that address the evolving demands of small businesses across industries like e-commerce, healthcare, education, and professional services.

By Deployment Model Analysis

The public cloud deployment model is set to dominate the U.S. cloud storage market, capturing 48.7% of the total market share in 2025. This widespread adoption is largely fueled by the flexibility, scalability, and cost-efficiency that public cloud platforms offer to businesses of all sizes. Companies are drawn to public cloud environments because they eliminate the need for large-scale on-premises infrastructure, providing quick deployment and global accessibility. The ability to provision storage resources on demand enables organizations to handle dynamic workloads more effectively while benefiting from continuous updates, advanced security protocols, and multi-tenant architecture support.

Public cloud providers, including major players such as AWS, Microsoft Azure, and Google Cloud, offer a variety of storage solutions like object storage, block storage, and archive storage, which can be seamlessly integrated for applications ranging from backup and recovery to media streaming, web hosting, and big data analytics. The incorporation of artificial intelligence, data redundancy, and disaster recovery features further amplifies the appeal of public cloud storage, particularly for industries undergoing digital transformation that demand agility and speed.

In contrast, private cloud deployment models are becoming popular among organizations that prioritize enhanced control, security, and compliance in their data infrastructure. Private cloud environments are particularly favored by highly regulated industries, such as banking, government, and healthcare, where the need for data sovereignty and customized security configurations is critical. These deployment models are typically hosted on-premises or through dedicated third-party infrastructure, offering a single-tenant architecture that ensures a higher degree of isolation and governance.

Organizations opting for private cloud storage benefit from increased customization options, predictable performance, and better integration with legacy systems. This model is ideal for mission-critical workloads and allows businesses to tailor their environments to meet specific regulatory requirements, such as GDPR or HIPAA, all while maintaining scalability to accommodate growth and expanding digital needs.

By Application Analysis

Business continuity applications are set to dominate the U.S. cloud storage market, projected to account for 55.5% of the total market share in 2025. This dominance is driven by the growing demand for uninterrupted business operations, effective disaster recovery solutions, and dependable data backup systems in an era marked by constant digital transformation and rising security threats. As organizations continue to expand their digital presence, the risk of cyberattacks, system failures, and natural disasters grows, making business continuity planning an essential investment.

Cloud storage solutions provide robust backup and recovery capabilities, enabling fast data restoration, geographical redundancy, and seamless failover processes. These features are crucial in helping businesses minimize downtime, protect data integrity, and ensure consistent operational continuity across various functions, from customer service to financial operations. Sectors such as finance, healthcare, and e-commerce, where even minor service disruptions can lead to significant revenue loss and brand damage, rely heavily on cloud-based continuity applications to meet regulatory requirements and customer expectations.

At the same time, data management applications are emerging as a vital component of the U.S. cloud storage market, driven by the explosive growth of both structured and unstructured data across organizations. These applications extend beyond mere storage capabilities by offering intelligent tools for organizing, categorizing, analyzing, and optimizing data throughout its lifecycle. Cloud-based data management systems enable businesses to handle massive datasets efficiently across multiple platforms, ensuring easy access, data governance, and smooth integration with analytics systems.

Features like metadata tagging, versioning, and tiered storage allow organizations to make data-driven decisions, extract valuable insights from big data environments, and enhance overall operational productivity. These capabilities are particularly beneficial for industries such as retail, telecommunications, and manufacturing, where the ability to leverage real-time data can streamline supply chain processes, improve customer engagement, and optimize predictive maintenance strategies.

By Industry Vertical Analysis

The BFSI (Banking, Financial Services, and Insurance) industry is projected to hold a dominant position in the U.S. cloud storage market, commanding 37.4% of the total market share in 2025. This leadership is driven by the growing need for secure, scalable, and highly compliant data storage solutions that are essential for supporting critical financial operations. The BFSI sector generates large volumes of sensitive data, including customer information, transaction records, and regulatory documentation, which need to be securely stored, accessed, and protected.

With growing reliance on cloud storage, financial institutions can maintain real-time access to crucial data for functions like fraud detection, risk management, digital banking services, and portfolio analysis. Furthermore, strict regulatory frameworks such as PCI-DSS, GDPR, and Basel III are pushing BFSI organizations to adopt cloud environments that provide advanced security features such as encryption, access control, and audit trails. As digital banking grows and fintech services expand, the sector is adopting hybrid cloud models, which combine security with the flexibility needed to accelerate innovation and improve the customer experience.

In contrast, the IT and IT-enabled services (ITES) industry is rapidly becoming a key driver in the U.S. cloud storage market, fueled by the growing volume of data transactions, the growing trend of remote and distributed workforces, and the rise of cloud-native development methodologies. The IT & ITES sector spans a broad spectrum of services, including software development, application testing, IT consulting, and business process outsourcing, all of which require seamless data management and high-performance collaboration tools.

Cloud storage plays a pivotal role by enabling centralized data storage, supporting agile workflows, and ensuring data accessibility and security across global teams. IT and ITES companies leverage cloud environments to store code repositories, manage large application datasets, and scale storage capacity up or down based on project needs, effectively managing costs while maintaining optimal performance. The flexibility of cloud storage also facilitates version control, continuous integration, and secure data sharing, empowering IT teams to collaborate dynamically and innovate more quickly while ensuring that all operational and data-sharing practices comply with industry standards.

The U.S Cloud Storage Market Report is segmented on the basis of the following

By Offering

- Storage

- Object Storage

- Block Storage

- File Storage

- Services

- Training & Consulting

- Integration & Implementation

- Support & Maintenance

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Business Continuity

- Backup & Recovery

- Data Archiving

- Data Management

- Big Data & Analytics

- Database Storage Management

- Application Management

- Content Delivery & Distribution

- Other Applications

By Industry Vertical

- Banking, Financial Services, and Insurance

- Fraud Detection & Risk Management

- Expansion & Compliance

- Customer Personalization

- Other Application Areas

- IT & ITES

- Scalable Development Environments

- Collaboration

- Automated Testing & Continuous Integration

- Others

- Telecommunications

- Network Function Virtualization (NFV)

- Edge Computing

- IoT Data Management

- Others

- Healthcare & Life Sciences

- Secure Health Data Sharing

- Telemedicine & Remote Patient Monitoring

- Interoperability & Health Information Exchange

- Others

- Media & Entertainment

- Scalable Content Distribution

- Collaborative Content Creation

- Flexible Digital Asset Management

- Others

- Retail & Consumer Goods

- Personalized Customer Experiences

- Inventory Optimization

- Unified Commerce

- Others

- Manufacturing

- Digital Twin

- 3D Printing

- Quality Control & Process Optimization

- o Others

- Government & Utilities

- E-government Services

- Smart City Initiatives

- Emergency Response & Crisis Management

- Others

- Energy & Utilities

- Grid Optimization with Big Data

- Asset Performance Management

- Energy Consumption Analytics

- Others

- Other Verticals

The U.S. Cloud Storage Market: Competitive Landscape

The U.S. cloud storage market is characterized by intense competition, with both established players and emerging innovators vying for market share. The competitive landscape is shaped by factors such as technological innovation, customer service offerings, price competitiveness, security features, and industry-specific solutions. Major public cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominate the U.S. market, providing a broad array of storage solutions, including object, file, and block storage.

These companies are recognized for their robust infrastructure, global reach, and extensive service offerings that cater to a wide variety of industries, including BFSI, healthcare, retail, and IT services. Their ability to offer integrated cloud platforms that combine storage with analytics, artificial intelligence, machine learning, and advanced security features makes them highly competitive, ensuring their continued leadership in the market.

On the other hand, companies specializing in private and hybrid cloud solutions also play a significant role in the U.S. market, offering tailored solutions for clients with specific needs regarding data sovereignty, security, and compliance. Companies like IBM, Oracle, and VMware are strong players in this segment, providing private cloud solutions that focus on high customization, integration with legacy systems, and compliance with regulatory frameworks such as HIPAA and GDPR.

Their cloud storage solutions cater to enterprises with demanding security requirements, including government agencies, financial institutions, and large enterprises. As the demand for hybrid cloud environments grows, these companies are developing hybrid offerings that enable businesses to blend public and private cloud storage for greater flexibility, cost control, and performance optimization.

Some of the prominent players in the U.S Cloud Storage are

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure (OCI)

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- NetApp

- Dropbox

- Box, Inc.

- Wasabi Technologies

- Backblaze

- Citrix Systems

- Pure Storage

- Snowflake

- Veeam Software

- Cohesity

- Rubrik

- Egnyte

- Nutanix

- Other Key Players

The U.S. Cloud Storage Market: Recent Developments

- April 2025: Microsoft Acquires OpenAI’s Cloud Storage Assets to expand its cloud storage capabilities and enhance its AI and machine learning offerings, boosting performance for enterprise customers leveraging Azure.

- March 2025: Amazon Web Services Acquires StorageTech Solutions, a U.S.-based cloud storage firm, to improve its hybrid cloud offerings and integrate advanced storage management technologies for large enterprises.

- December 2024: Google Cloud Acquires DataMesh Technologies, a leader in data management and storage for AI-driven environments, to enhance its cloud storage platform's capabilities and cater to data-heavy industries such as finance and healthcare.

- October 2024: IBM Acquires CloudSafe Systems, a provider of advanced cloud backup and disaster recovery solutions, to bolster its hybrid cloud storage services and strengthen its enterprise clientele across sectors like banking and government.

- September 2024: Oracle Acquires BlockStorage Labs, a cloud storage and block storage technology firm, enhancing its database and cloud storage capabilities, specifically for large-scale enterprise clients in the U.S. and abroad.

- July 2024: Dropbox Acquires SecureSync Technologies, specializing in real-time file synchronization and backup, allowing Dropbox to enhance its business-focused storage solutions for teams and small businesses.

- June 2024: Hewlett-Packard Enterprise Acquires StratusCloud, a U.S.-based cloud storage provider with a focus on high-performance computing environments, helping HPE solidify its leadership in the enterprise cloud storage space.

- April 2024: Box Inc. Acquires WorkFiles, a secure cloud storage provider for regulated industries, improving its offerings in compliance-heavy sectors such as healthcare and finance, where data security and storage governance are paramount.

- March 2024: Veeam Software Acquires CloudStorage Pro, expanding its capabilities in multi-cloud backup solutions and offering enhanced hybrid storage management tools to businesses in North America.

- January 2024: Microsoft Acquires StorageTech Innovations, a U.S.-based startup specializing in high-performance data storage for cloud-native applications, enabling Microsoft to better cater to the growing demand for cloud storage services within industries like gaming, e-commerce, and finance.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 55.1 Bn |

| Forecast Value (2034) |

USD 562.8 Bn |

| CAGR (2025–2034) |

15.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Storage and Services), By Organization Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Application (Business Continuity, Data Management, and Application Management) and By Industry Vertical (Banking, Financial Services, and Insurance, IT & ITES, Telecommunications, Healthcare & Life Sciences, Media & Entertainment, Retail & Consumer Goods, Manufacturing, Government & Utilities, Energy & Utilities and Other Verticals) |

| Regional Coverage |

The US |

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure (OCI), Dell Technologies, Hewlett-Packard Enterprise (HPE), NetApp, Dropbox, Box, Inc., Wasabi Technologies, Backblaze, Citrix Systems, Pure Storage, Snowflake, Veeam Software, Cohesity, Rubrik, Egnyte, Nutanix, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|