Market Overview

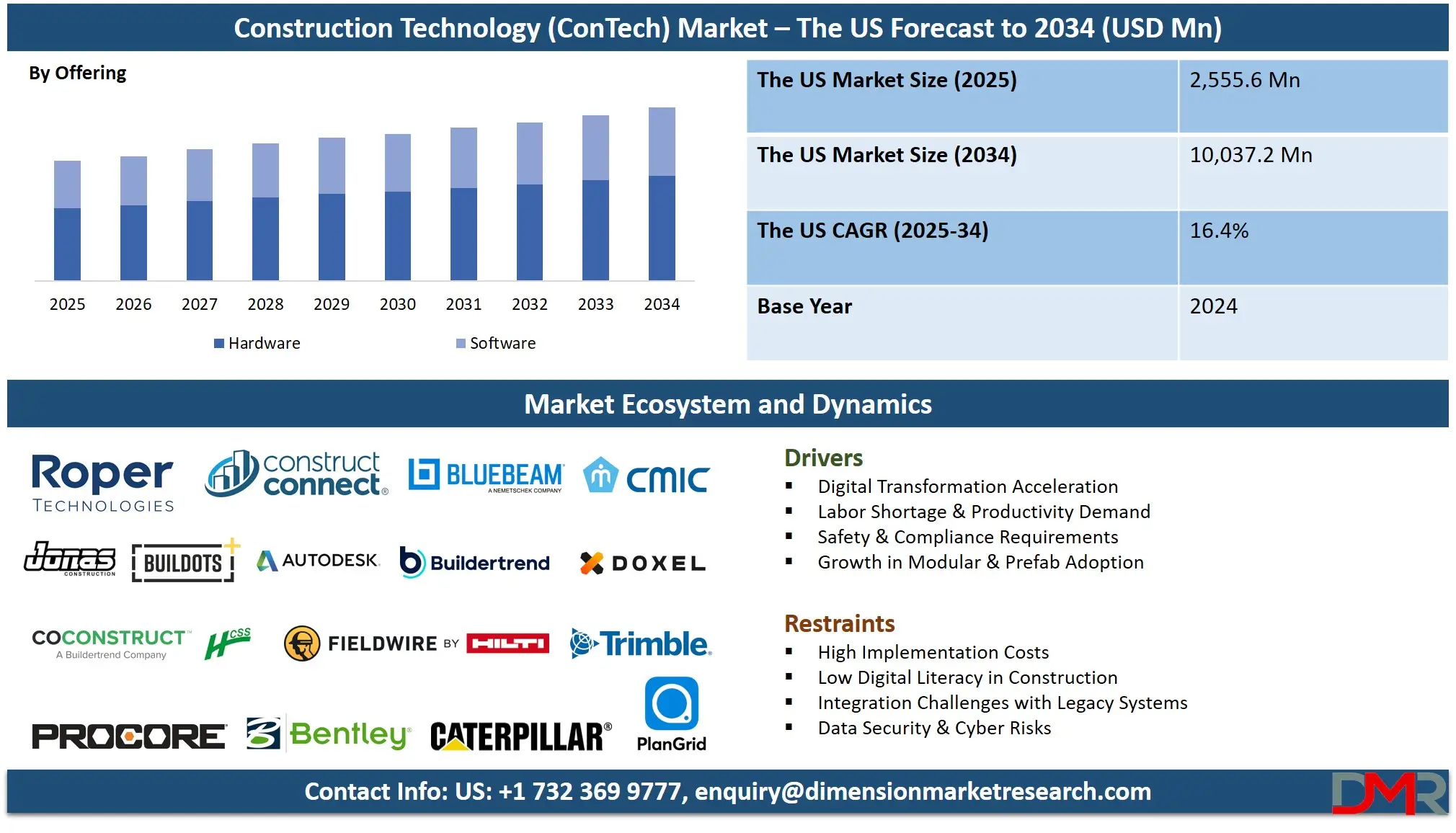

The US Construction Technology Market is anticipated to reach USD 2,555.6 million in 2025, driven by the accelerated adoption of digital solutions, rising investment in infrastructure modernization, and growing emphasis on productivity, safety, and sustainability across the construction sector. The market is expected to expand at a strong compound annual growth rate (CAGR) of 16.4% from 2025 to 2034, reaching a projected value of USD 10,037.2 million by 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth is fueled by the integration of Building Information Modeling (BIM), Internet of Things (IoT) sensors, artificial intelligence (AI), and autonomous equipment, alongside increased federal and private funding for smart infrastructure projects. Additionally, the demand for modular construction, green building technologies, and real-time project management tools is further accelerating market expansion.

The US construction technology landscape is evolving rapidly, shifting from traditional manual processes to digitally integrated, data-driven workflows. A key trend is the convergence of AI and machine learning with construction management platforms, enabling predictive analytics for project delays, cost overruns, and safety risks. IoT-enabled wearables and site sensors are becoming standard for monitoring worker health, equipment utilization, and environmental conditions.

Simultaneously, cloud-based collaboration platforms are transforming stakeholder coordination, allowing architects, contractors, and clients to interact seamlessly across geographies. The push toward net-zero construction and stricter regulatory standards is also driving innovation in energy-efficient materials and carbon-tracking software, making sustainability a core component of the construction tech value proposition. The market's expansion is fueled by substantial opportunities in prefabrication and off-site construction, which reduce timelines and waste while improving quality control.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The rise of digital twins virtual replicas of physical assets allows for real-time simulation, maintenance forecasting, and lifecycle management. Moreover, the adoption of drones and LiDAR for site surveying, progress tracking, and inspection is enhancing accuracy and safety. These advancements address critical industry challenges such as labor shortages, cost escalation, and project complexity, providing measurable ROI for firms adopting integrated tech stacks and enabling dynamic project delivery essential for large-scale public and private developments.

The US Construction Technology Market: Key Takeaways

- US Market Size Insights: The US Construction Technology (ConTech) Market is projected to be valued at USD 2,555.6 million in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 10,037.2 million in 2034.

- The US Market Growth Rate: The market is growing at a CAGR of 16.4 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the surge in federal infrastructure spending, the integration of AI and IoT on job sites, the widespread adoption of BIM, and stringent sustainability and safety regulations.

- Competitive Landscape: The market is highly competitive and features a mix of global software giants (Autodesk, Trimble), specialized construction tech firms (Procore, Buildertrend), and emerging robotics and AI startups.

- Segment Insights: The Project Management & Scheduling application is the largest segment, driven by cloud-based adoption, while AI-powered analytics and safety features have become a standard expectation.

US Construction Technology Market: Use Cases

- Federal Highway Project Digital Oversight: A state Department of Transportation uses a cloud-based BIM platform integrated with IoT sensors to monitor real-time progress, material usage, and compliance on a multi-billion-dollar highway expansion, reducing delays by 15% and improving reporting accuracy.

- Modular Hospital Construction during Crisis: A healthcare developer employs off-site fabrication combined with AR-assisted assembly to rapidly construct a modular hospital. Digital twin technology allows for real-time adjustments and ensures compliance with medical facility standards, cutting construction time by 40%.

- AI-Driven Safety Monitoring on High-Rise Site: A commercial contractor implements AI-powered video analytics and wearable sensors to detect unsafe behavior, predict hazardous scenarios, and reduce incident rates by over 30% on a high-rise construction project in New York.

- Sustainable Smart Building Deployment: A real estate developer utilizes green building software to track carbon emissions, energy performance, and material sustainability across a LEED-certified smart building project, ensuring regulatory compliance and achieving a 25% reduction in projected operational energy use.

- Drone-Based Infrastructure Inspection: A civil engineering firm uses drones equipped with LiDAR and thermal cameras to inspect bridges and tunnels, automating defect detection and reducing manual inspection time by 70% while improving data accuracy for maintenance planning.

US Construction Technology Market: Impact of Artificial Intelligence

- Predictive Project Analytics: AI algorithms analyze historical project data, weather patterns, and supply chain variables to forecast potential delays and budget overruns, enabling proactive mitigation strategies and resource reallocation.

- Automated Design Optimization: Generative AI assists architects and engineers in creating structurally efficient, cost-effective, and sustainable building designs by simulating thousands of material and layout iterations in minutes.

- Real-Time Risk and Safety Intelligence: Computer vision on site cameras continuously monitors for safety violations, near-misses, and unauthorized access, alerting supervisors instantly to prevent accidents and ensure protocol adherence.

- Smart Resource Allocation: AI tools optimize labor scheduling, equipment deployment, and material ordering based on real-time site progress and external factors such as traffic or weather disruptions, minimizing downtime.

- Quality Control via Image Recognition: AI compares site-captured images with BIM models to detect construction defects, misalignments, or missing components early in the build process, reducing costly rework.

US Construction Technology Market: Stats & Facts

Autodesk, Inc.

- Autodesk’s BIM 360 platform is used in over 60% of major US infrastructure projects, with its cloud collaboration tools reportedly reducing rework by an average of 25% and improving design coordination efficiency.

Procore Technologies

- Procore’s construction management software manages more than USD 1 trillion in projects annually across the US, with a user base growing at 30% year-over-year and particularly strong adoption among top-tier general contractors.

Trimble, Inc.

- Trimble’s connected construction solutions integrate surveying, modeling, and field execution, with case studies showing a 20% improvement in project efficiency and a 15% reduction in survey time for adopters in heavy civil sectors.

U.S. Department of Transportation

- The 2021 Infrastructure Investment and Jobs Act allocates over USD 120 billion for projects encouraging digital construction technologies, with mandates emphasizing BIM, IoT, and advanced materials for federally funded projects.

Dodge Construction Network

- A 2024 industry survey found that 87% of US contractors now use at least one form of construction technology, up from 65% in 2020, with cloud software, drones, and wearables being the most rapidly adopted tools.

National Institute of Standards and Technology (NIST)

- NIST’s 2024 report highlights that digitized construction workflows can reduce total project costs by up to 15% and improve schedule adherence by 20% compared to traditional, paper-based methods.

International Code Council (ICC)

- The ICC’s recent building code updates include provisions for digital submission of construction plans and the use of AI in automated compliance checking, accelerating tech integration in municipal permitting processes across the US.

Market Dynamic

Driving Factors in the US Construction Technology Market

Rising Federal Investment and Mandates for Digital Delivery

A major trend shaping the US Construction Technology (ConTech) Market is the substantial increase in federal funding for infrastructure, coupled with mandates requiring digital project delivery methods like BIM for public works. Initiatives like the Infrastructure Investment and Jobs Act are channeling billions into roads, bridges, and utilities, with stipulations that encourage or require the use of advanced technologies for planning, building, and maintaining assets. This government push is accelerating the adoption of cloud-based platforms, digital twins, and IoT monitoring across engineering and contracting firms, transforming how public projects are scoped, bid, and executed to improve transparency, efficiency, and long-term asset management.

Growing Integration of AI, IoT, and Robotics on Job Sites

Another strong market driver is the rapid integration of artificial intelligence, Internet of Things sensors, and robotics into daily construction operations. AI is being used for everything from predictive scheduling and safety monitoring to automated design optimization. IoT sensors embedded in equipment, materials, and wearables provide real-time data on utilization, location, and environmental conditions, enabling proactive maintenance and resource management. Robotics are increasingly deployed for repetitive, dangerous, or precision tasks such as bricklaying, rebar tying, and site inspection. This convergence addresses persistent industry challenges like labor shortages, safety incidents, and productivity plateaus, creating a more controlled, efficient, and data-rich job site environment.

Restraints in the US Construction Technology Market

High Initial Costs and Complex Integration Challenges

One of the most significant restraints for the US Construction Technology (ConTech) Market is the high upfront capital and operational expenditure required for software licenses, hardware, sensor networks, and comprehensive employee training. Many small and mid-sized contractors operate on thin margins and struggle to justify the initial investment despite evidence of long-term ROI. Additionally, integrating new technology stacks with legacy systems such as existing accounting software or field management tools poses substantial technical and operational complexity. Ensuring interoperability between different vendors' platforms remains a major hurdle, often leading to data silos, workflow disruptions, and underutilization of purchased technologies, which can stall broader market penetration.

Skilled Labor Shortage and Cultural Resistance to Change

The construction industry faces a chronic shortage of workers skilled in both traditional trades and new digital tools. This talent gap makes it difficult for companies to fully leverage advanced technologies. Compounding this issue is a deep-seated cultural resistance to change within many established firms. A workforce accustomed to analog processes and paper-based workflows can be skeptical of digital tools, leading to slow adoption rates, inadequate training engagement, and reliance on familiar but less efficient methods. This resistance hinders the pace of innovation and can limit the scalability of technology solutions across organizations, particularly among older demographics in the workforce.

Opportunities in the US Construction Technology Market

AI-Driven Predictive Analytics and Generative Design

AI-driven analytics represent a significant growth opportunity for construction technology providers in the US, enabling predictive insights into project risks, supply chain bottlenecks, and equipment failures. Advanced machine learning models can forecast delays, optimize schedules, and improve budgeting accuracy. Furthermore, generative design AI allows architects and engineers to rapidly produce and evaluate thousands of design options based on goals like cost, sustainability, and structural performance. This capability supports the creation of more efficient, resilient, and innovative buildings and infrastructure. As data collection on job sites grows, the demand for AI tools that can synthesize information and provide actionable intelligence will rise, creating value across the project lifecycle.

Expansion of Modular Construction and Off-Site Fabrication

The expansion of modular and prefabricated construction methods presents substantial growth opportunities for supporting technologies. This approach requires sophisticated digital design tools for precision engineering, logistics software for supply chain coordination, and on-site AR/VR tools for assembly guidance. Technologies that enable the seamless flow of information from the design office to the factory floor and then to the installation site are critical. As demand grows for faster project delivery, reduced waste, and improved quality control particularly in sectors like healthcare, education, and multi-family housing the market for integrated tech solutions supporting off-site construction is poised for significant expansion.

Trends in the US Construction Technology Market

Proliferation of Cloud-Based Collaboration and Mobile Platforms

A dominant trend is the industry-wide shift towards cloud-based platforms that centralize project data and enable real-time collaboration among all stakeholders owners, architects, general contractors, and subcontractors. These platforms break down information silos, reduce version control errors, and provide a single source of truth. Complementing this is the rise of mobile-first applications that empower field crews with instant access to drawings, daily logs, issue tracking, and timecards directly from smartphones or tablets. This trend enhances transparency, accelerates decision-making, and improves accountability across distributed teams, making it a foundational element of modern construction management.

Rising Focus on Sustainability and Green Building Tech

Sustainability is transitioning from a niche concern to a core business driver, fueling demand for technologies that support green building practices. This includes software for energy modeling, carbon footprint tracking, and material lifecycle analysis, as well as tools for managing certifications like LEED and WELL. The market is also seeing growth in technologies related to renewable energy integration, smart building systems, and circular economy principles (e.g., material reuse platforms). Regulatory pressures, corporate ESG commitments, and incentives for sustainable construction are converging to make green tech a critical area of investment and differentiation for construction firms and technology vendors alike.

Research Scope and Analysis

By Offering Analysis

Software is projected to dominate the US Construction Technology (ConTech) Market’s offering segment, with Building Information Modeling (BIM) platforms serving as the central driver of adoption. BIM has evolved into the standard for digital project delivery, mandated or strongly encouraged by numerous federal, state, and municipal agencies for public works and large-scale infrastructure projects. Its capacity to enable multi-stakeholder collaboration, detect design clashes early, streamline documentation, and support lifecycle asset management makes it indispensable in an industry under intense pressure to improve productivity, safety, and cost predictability.

Cloud-based BIM further accelerates software dominance by enabling real-time coordination among geographically dispersed teams, seamless integration with ERP and project management ecosystems, and data fusion with IoT sensors and digital twin platforms. As the US construction sector prioritizes resilient infrastructure and energy-efficient buildings, BIM becomes critical for environmental compliance, energy modeling, embodied carbon analysis, and material optimization. Federal funding tied to the Infrastructure Investment and Jobs Act and other initiatives includes provisions encouraging digital delivery methods, pushing contractors from large nationals to regional players to modernize their technology stacks. Software-driven solutions such as Common Data Environments (CDEs), advanced takeoff and estimating platforms, reality capture processing tools, and modular design systems complement the core BIM ecosystem. Faced with persistent skilled labor shortages, volatile material costs, and liability concerns, contractors find immense value in software that reduces rework, optimizes complex workflows, improves design quality, and ensures transparent governance from preconstruction through facility management, ensuring BIM-centric software remains the dominant offering category.

By Technology Analysis

Artificial Intelligence (AI) and Machine Learning (ML) are poised to lead the technology landscape of the US Construction Technology (ConTech) Market, driven by their transformative potential to solve the industry's most persistent inefficiencies. AI-powered tools are advancing rapidly into predictive scheduling, generative design, automated code compliance checking, real-time safety and risk analytics, and precision cost forecasting functions that directly mitigate risk, reduce rework, and compress project timelines.

The US's robust ecosystem of tech giants, venture capital, and specialized ConTech startups provides a fertile ground for AI innovation and rapid commercialization. The practical, ROI-focused nature of the American market accelerates the adoption of technologies that demonstrate clear bottom-line impact. AI generates substantial economic value by enabling hyper-efficient resource allocation, automating documentation and administrative burdens, and identifying spatial or sequencing conflicts before they become costly field errors. Machine learning models integrated with BIM enable rapid generative design exploration, structural and MEP optimization, and sophisticated carbon-impact simulations that far exceed manual capabilities. Furthermore, AI's integration with pervasive IoT networks on job sites allows for predictive equipment maintenance, real-time productivity tracking, and dynamic safety monitoring.

AI adoption is reinforced by highly publicized pilot successes by leading contractors and developers, particularly in commercial, data center, and large-scale civil sectors, where AI-driven logistics and planning have demonstrated double-digit percentage gains in productivity. The scalability of cloud-native AI platforms also allows smaller and midsize firms to access capabilities previously reserved for industry giants. This powerful combination of market demand for efficiency, a strong innovation pipeline, proven financial returns, and deepening integration with core digital workflows cements AI and ML as the most influential and dynamic technology segment shaping the future of US construction.

By Application Analysis

Project Management, Scheduling, & Coordination is projected to dominate the application segment within the US Construction Technology (ConTech) Market due to the fundamental and universal industry challenge of delivering projects on time and on budget. US construction projects are characterized by complex networks of general contractors, numerous specialty trade subcontractors, suppliers, and owners, all requiring seamless coordination. Digital project management platforms centralize communication, document control, and workflow, minimizing misalignment and creating a single, verifiable source of truth an essential function for mitigating disputes and ensuring accountability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The maturation of cloud-based collaboration has transformed this application from simple scheduling software into a comprehensive command center. These platforms now integrate seamlessly with BIM for 4D sequencing, incorporate real-time data from mobile field applications for daily reporting and issue tracking, and provide dashboards for owner transparency. The need to manage lean construction principles, just-in-time material deliveries in a strained supply chain, and stringent safety and quality documentation makes these technologies indispensable. Applications that offer robust scheduling, change order management, submittal tracking, and financial forecasting deliver immediate, measurable improvements to a contractor's operational efficiency and risk profile, directly impacting profitability and client satisfaction, securing this segment's dominant position.

By End User Analysis

The US Construction Technology (ConTech) Market is shaped by diverse end users, each adopting digital solutions to address specific operational needs and market pressures.

General Contractors & Construction Managers, who account for the largest share, are the primary drivers of ConTech adoption. They leverage integrated platforms for end-to-end project control, using tools for BIM coordination, detailed scheduling, cost management, field productivity, and safety compliance to maintain margins and manage risk on complex projects.

Owners & Developers, particularly in institutional, commercial, and industrial sectors, are increasingly influential adopters. They invest in technology to improve cost and schedule predictability, enhance lifecycle asset management via digital twins, and ensure projects meet sustainability (ESG) and operational performance goals from the outset.

Specialty Trade Contractors (electrical, mechanical, plumbing, etc.) represent a rapidly growing segment. They adopt field-focused technologies like layout robotics, BIM detailing software, and prefabrication management tools to improve installation accuracy, reduce waste, and streamline their workflows within the larger project ecosystem.

Engineering & Architectural Firms are foundational users, relying heavily on advanced BIM, generative design, and performance analysis software to drive design innovation, ensure constructability, and meet evolving sustainability codes.

By Project Type Analysis

Commercial & Industrial (C&I) projects are projected to dominate the US Construction Technology (ConTech) Market’s project type segment. This sector encompassing offices, warehouses, data centers, manufacturing plants, retail, and healthcare facilities has been the most aggressive and sophisticated adopter of advanced digital solutions. C&I projects are typically driven by private owners and developers with strong ROI requirements, tight schedules, and complex operational needs, creating a compelling business case for technology investment.

The boom in e-commerce driving warehouse and logistics center construction, the massive expansion of data centers to support AI and cloud computing, and the modernization of healthcare and manufacturing facilities all involve high complexity and capital intensity. These projects strongly benefit from technologies like BIM for intricate MEP coordination, digital twins for smart building operations, AI for optimizing logistics and scheduling, and modular construction techniques for speed. Furthermore, stringent energy codes, corporate ESG commitments, and the demand for future-ready smart buildings make digital tools essential for compliance and long-term value creation. The combination of scale, complexity, owner sophistication, and performance demands ensures the C&I segment remains the primary testing ground and revenue driver for ConTech innovation.

The Construction Technology Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Drones

- 3D Printing

- Autonomous Equipment

- Robotic Bricklaying

- Others

- Software

- Building Information Modelling (BIM)

- Construction Automation

- Wearable Technologies

- Visual Technologies

By Technology

- Artificial Intelligence (AI) & Machine Learning

- Robotics & Automation

- Internet of Things (IoT) & Smart Sensors

- Augmented Reality (AR) & Virtual Reality (VR)

- Prefabrication & Modular Construction

- Digital Twin Technology

- Blockchain & Smart Contracts

By Application

- Site Management & Monitoring

- Workforce Productivity

- Risk & Safety Management

- Cost & Financial Control

- Construction Management

- Green Construction & Sustainability

- Equipment & Asset Management

By End User

- Contractors

- Builders & Owners

- Architects & Designers

- Government & Public Sector

- Material Suppliers & OEMs

- Facilities Managers

By Project Type

- Residential

- Commercial

- Industrial

- Mega Projects

Competitive Landscape

The competitive landscape of the US Construction Technology (ConTech) Market is fragmented and dynamic, characterized by a mix of established software incumbents, major cloud platform providers, and innovative specialist startups. Dominant players like Autodesk, Trimble, and Procore leverage their comprehensive software ecosystems, deep industry integrations, and large customer bases to maintain a stronghold, particularly in the general contractor and large enterprise segments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A significant trend is the aggressive expansion of hyperscale cloud providers, such as Microsoft (through Azure integration partnerships) and Amazon Web Services (providing underlying infrastructure), whose platforms host and power many leading construction tech applications. Simultaneously, specialist innovators in robotics (e.g., for bricklaying, rebar tying), AI safety, and generative design compete effectively by solving acute pain points, ensuring continuous innovation and intensifying competition across all segments. The market is also seeing consolidation as larger players acquire niche innovators to fill capability gaps in their portfolios.

Some of the prominent players in the US Construction Technology (ConTech) Market are:

- Autodesk, Inc.

- Trimble Inc.

- Procore Technologies, Inc.

- Bentley Systems, Incorporated

- Oracle Corporation (Construction & Engineering GBU)

- Bluebeam, Inc.

- Buildertrend Solutions, Inc.

- CMiC, Inc.

- ConstructConnect, Inc.

- Fieldwire (Hilti Group)

- Caterpillar Inc. (CAT Digital)

- Buildots Ltd.

- Doxel, Inc.

- Heavy Construction Systems Specialists (HCSS)

- CoConstruct Services LLC

- PlanGrid (Autodesk)

- Viewpoint (Roper Technologies)

- Sage CRE (Sage Group)

- Jonas Construction Software

- e-Builder, Inc

- Other Key Players

Recent Developments in the US Construction Technology Market

- November 2025: The US Army Corps of Engineers initiated a pilot program mandating the use of digital twins for all major facility projects over USD 50 million, partnering with a consortium of technology vendors to establish standard implementation protocols.

- October 2025: At ENR FutureTech 2025 in Chicago, major contractors unveiled widespread adoption of AI-powered "site intelligence" platforms that synthesize data from drones, wearables, and cameras to provide a real-time dashboard of project health, safety, and productivity.

- September 2025: Autodesk and NVIDIA announced a deepened partnership to integrate generative AI models directly into the Autodesk Construction Cloud, enabling automated design option generation and construction sequence simulation powered by high-performance computing.

- September 2025: Procore Technologies announced a strategic collaboration with several leading insurance underwriters to integrate its safety and quality data directly into risk assessment models, offering premium incentives for contractors with high technology adoption and strong safety metrics.

- August 2025: A coalition of top-20 US general contractors formed a joint venture to develop an open-data standard for construction equipment telematics, aiming to break down data silos between different machinery brands and streamline fleet management analytics.

- December 2024: Trimble completed its acquisition of DroneDeploy, a leading reality capture and analytics platform, significantly enhancing its portfolio of field-to-office data workflows and expanding its capabilities in automated progress tracking and site documentation.

- May 2024: Buildertrend, a leader in residential construction software, secured a major round of funding to accelerate the development of its integrated financial management and homeowner communication portals, targeting the fragmented custom home builder market.

- May 2024: A prominent robotics startup focused on autonomous interior finishing tasks (drywall sanding, painting) announced a successful Series C funding round and partnerships with several national contractors to pilot its technology on commercial sites.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,555.6 Mn |

| Forecast Value (2034) |

USD 10,037.2 Mn |

| CAGR (2025–2034) |

16.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Hardware, Software), By Technology (Artificial Intelligence (AI) & Machine Learning, Robotics & Automation, Internet of Things (IoT) & Smart Sensors, Augmented Reality (AR) & Virtual Reality (VR), Prefabrication & Modular Construction, Digital Twin Technology, Blockchain & Smart Contracts), By Application (Site Management & Monitoring, Workforce Productivity, Risk & Safety Management, Cost & Financial Control, Construction Management, Green Construction & Sustainability, Equipment & Asset Management), By End User (Contractors, Builders & Owners, Architects & Designers, Government & Public Sector, Material Suppliers & OEMs, Facilities Managers), By Project Type (Residential, Commercial, Industrial, Mega Projects) |

| Regional Coverage |

The US |

| Prominent Players |

Autodesk Inc., Trimble Inc., Procore Technologies Inc., Bentley Systems Inc., Oracle Construction & Engineering, Bluebeam Inc., Buildertrend, CMiC, ConstructConnect, Fieldwire, Caterpillar (CAT Digital), Buildots, Doxel, HCSS, CoConstruct, PlanGrid, Viewpoint, Sage CRE, Jonas Construction Software, e-Builder., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Construction Technology (ConTech) Market?

▾ The US Construction Technology (ConTech) Market size is estimated to have a value of USD 2,555.6 million in 2025 and is expected to reach USD 10,037.2 million by the end of 2034.

What is the growth rate in the US Construction Technology (ConTech) Market?

▾ The market is growing at a CAGR of 16.4 percent over the forecasted period from 2025 to 2034.

Which are the key players in the US Construction Technology (ConTech) Market?

▾ Some of the major key players are Autodesk, Inc., Trimble Inc., Procore Technologies, Inc., Oracle Corporation, and Buildertrend.