Market Overview

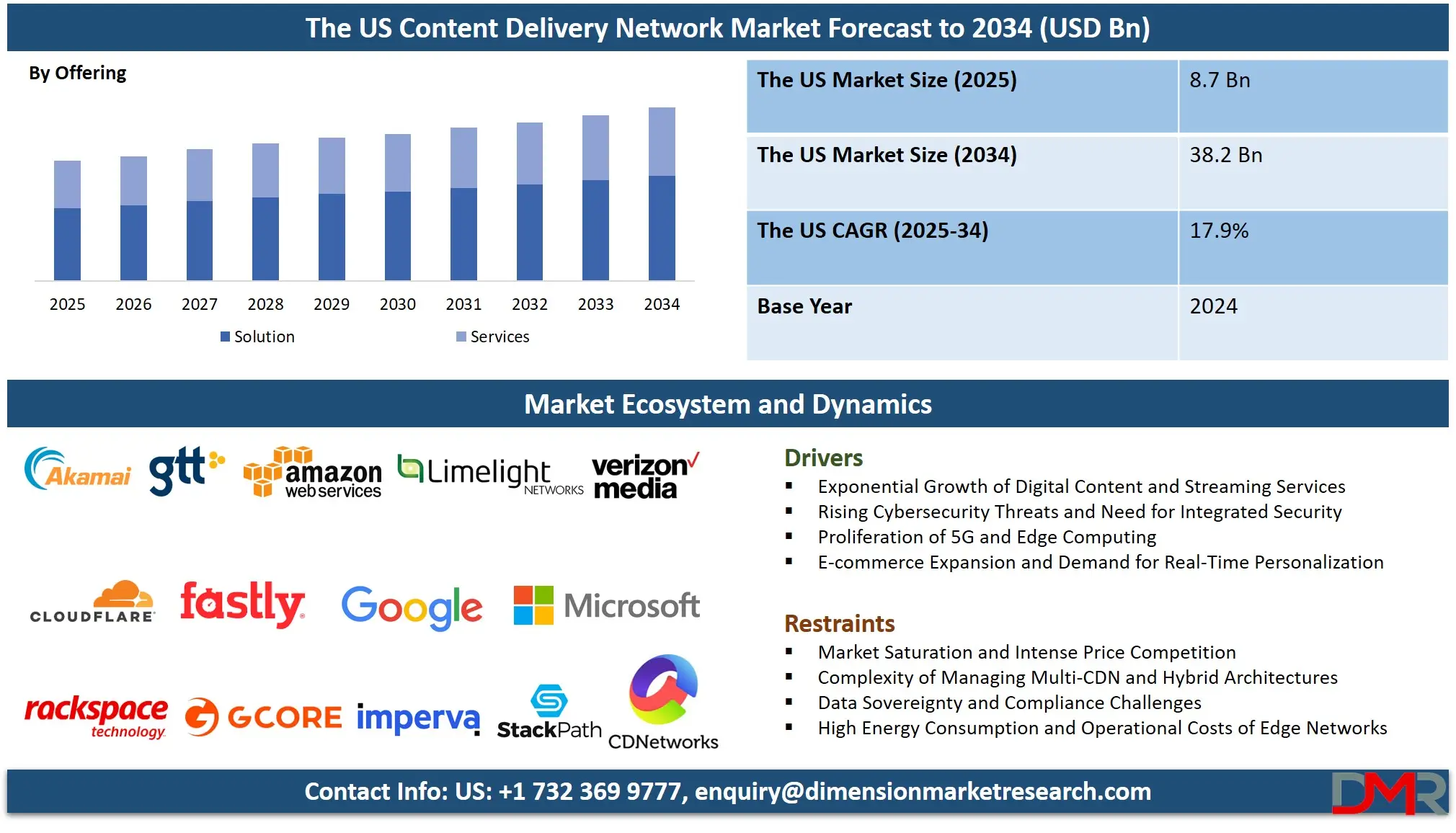

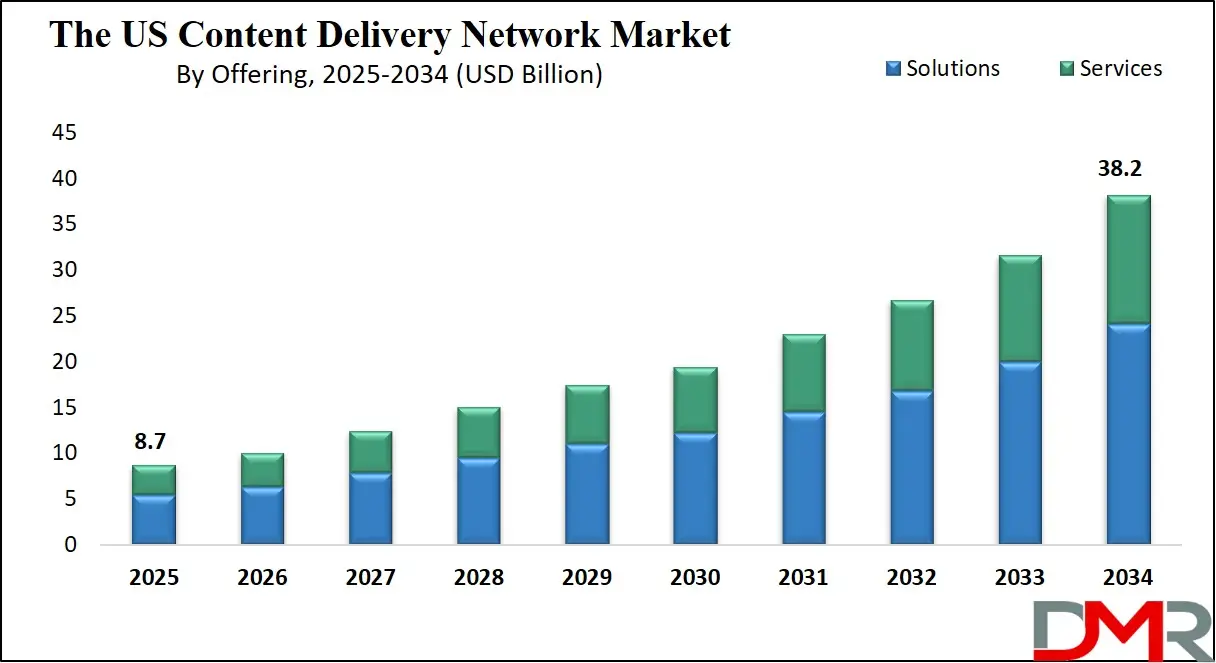

The US Content Delivery Network Market is anticipated to reach USD 8.7 billion in 2025, driven by the exponential growth in video streaming, e-commerce, and online gaming. The market is expected to expand at a robust compound annual growth rate (CAGR) of 17.9% from 2025 to 2034, reaching a projected value of USD 38.2 billion by 2034.

Growth is fueled by the increasing adoption of edge computing and 5G networks, rising demand for low-latency and high-throughput content delivery, and the integration of AI and ML for traffic optimization and security. Additionally, expanding applications in media & entertainment, retail, and online education sectors, coupled with the growing availability of advanced security and analytics features, are expected to further accelerate market expansion.

The US landscape for Content Delivery Networks is experiencing a profound transformation, moving beyond simple content caching into the core of digital experience delivery. A significant trend is the shift towards edge computing, where CDNs are evolving into distributed computing platforms that process data closer to the end-user. This decentralization of computing accelerates application performance and enables real-time interactivity for services like cloud gaming and IoT.

Concurrently, CDN providers are advancing into security, offering integrated Web Application Firewalls (WAF) and DDoS mitigation as standard features, making security a core component of the content delivery value proposition. The integration of artificial intelligence with CDN orchestration is also emerging, optimizing traffic routing in real-time and automating the detection of performance anomalies or security threats.

The market's expansion is fueled by substantial opportunities in personalized content delivery, particularly in streaming media and dynamic e-commerce sites that require unparalleled speed and reliability compared to traditional hosting solutions. The media and entertainment industry has become a major adopter, leveraging CDN technology for the seamless and scalable delivery of live sports, Video-on-Demand (VoD), and Over-the-Top (OTT) services, which have revolutionized consumer viewing habits.

Furthermore, the ongoing development of novel, integrated services, including real-time analytics and serverless computing at the edge, opens new avenues for creating dynamic digital experiences that are highly responsive and engaging. These innovations are poised to address complex challenges in latency-sensitive applications like financial trading platforms and telemedicine, providing performance guarantees that were previously unimaginable.

The US Content Delivery Network Market: Key Takeaways

- US Market Size Insights: The US Content Delivery Network Market is projected to be valued at USD 8.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 38.2 billion in 2034.

- The US Market Growth Rate: The market is growing at a CAGR of 17.9 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the exponential demand for video streaming, the integration of edge computing and security services, and the rise of 5G networks.

- Competitive Landscape: The market is highly competitive and features a mix of traditional CDN giants (Akamai, Cloudflare), hyperscale cloud providers (AWS, Google, Microsoft), and specialized security firms.

- Dominant Segment: The Media & Entertainment sector is the largest application segment, driven by OTT and live streaming, while integrated security features have become a standard expectation.

The US Content Delivery Network Market: Use Cases

- Live Sports Streaming: A major broadcaster uses a global CDN to deliver a high-profile sporting event to millions of concurrent viewers worldwide, leveraging dynamic routing and multi-CDN strategies to ensure zero buffering and broadcast-quality video.

- E-commerce Acceleration: A leading online retailer uses a CDN with edge computing capabilities to dynamically assemble personalized product pages and promotional content in real-time based on a user's location and browsing history, significantly increasing conversion rates.

- DDoS Mitigation for Financial Services: A banking institution leverages a CDN's integrated Web Application Firewall (WAF) and DDoS protection to absorb and mitigate a massive multi-vector attack, ensuring its online trading platform remains available and secure for customers.

- Global Software Distribution: A technology company uses a CDN to distribute large software updates and patches to its global user base, offloading traffic from its origin servers and ensuring fast, reliable downloads regardless of the user's geographic location.

- Zero-Trust Security Access: An enterprise implements a CDN provider's Zero-Trust network access solution to provide secure, remote access to internal business applications for its employees without the need for a traditional VPN, improving both security and performance.

The US Content Delivery Network Market: Impact of Artificial Intelligence

- Intelligent Traffic Routing: AI algorithms analyze real-time network conditions, predicting congestion and dynamically routing user requests to the optimal edge server, minimizing latency and packet loss.

- Predictive Caching: ML models forecast content popularity and pre-position assets at edge locations before demand spikes, ensuring instant availability for end-users and reducing origin offload.

- Proactive Security: AI-powered systems detect and mitigate DDoS attacks and malicious bot traffic in real-time by identifying anomalous patterns that traditional rule-based systems miss.

- Automated Performance Optimization: AI continuously monitors performance metrics, automatically tuning cache policies and network configurations to maintain Service Level Agreements (SLAs) without manual intervention.

- Enhanced Analytics and Insights: AI analyzes vast delivery data sets to provide actionable insights into user behavior, content performance, and security threats, enabling data-driven business decisions.

The US Content Delivery Network Market: Stats & Facts

Akamai Technologies

- Akamai's platform reportedly serves over 3000 Tbps of peak traffic during major global internet events.

Cloudflare, Inc.

- Cloudflare's global edge network spans over 310 cities in more than 120 countries (as of the latest company reporting).

- Cloudflare reported mitigating an HTTP DDoS attack exceeding 2 Tbps in early 2024, one of the largest on record.

Amazon Web Services (AWS)

- AWS Shield, its DDoS protection service, is reported to mitigate over 100,000 application-layer DDoS events per month across its global infrastructure.

Google Cloud

- A 2023 case study with a major streaming service reported that Google's Media CDN reduced video rebuffering by 35% compared to their previous provider.

Federal Communications Commission (FCC)

- The FCC's 2024 "Measuring Broadband America" report found that the average download speed in the U.S. increased to 210 Mbps, up from 160 Mbps in 2022, partly enabled by improved content delivery infrastructure.

Cybersecurity and Infrastructure Security Agency (CISA)

- CISA's reporting indicates that DDoS attacks remain a top threat to national critical infrastructure, with attacks growing in scale and complexity year-over-year.

International Organization for Standardization (ISO)

- The ISO/IEC 27017 standard for cloud security controls is increasingly referenced in CDN service level agreements (SLAs) for regulated industries.

Market Dynamic

Driving Factors in the US Content Delivery Network Market

Exponential Growth of Digital Content and Streaming Services

The massive surge in video traffic, driven by OTT platforms, live streaming, and social media, is a primary driver for the CDN market. Consumers demand broadcast-quality video with zero buffering, necessitating robust, scalable, and low-latency delivery networks. CDNs are uniquely positioned to address these needs by caching content at geographically dispersed edge servers, ensuring high availability and performance during peak demand, such as during major sporting events or product launches, directly enhancing user engagement and satisfaction.

Rising Cybersecurity Threats and Need for Integrated Security

The increasing frequency and sophistication of DDoS attacks and application-layer threats have made security a non-negotiable requirement for any online business. CDN providers have responded by bundling powerful security features, including DDoS protection, WAF, and bot mitigation, directly into their delivery services. This integrated "secure delivery" model offers a more efficient and effective defense posture than standalone security solutions, providing a compelling reason for businesses to adopt or upgrade their CDN services.

Restraints in the US Content Delivery Network Market

Market Saturation and Intense Price Competition

The core CDN services market, particularly for static content delivery, is becoming highly commoditized. This has led to intense price competition among providers, squeezing profit margins and making it challenging for vendors to differentiate on delivery speed and cost alone. This price pressure can slow down innovation for basic services and force providers to compete on value-added features and specialized solutions to maintain growth.

Complexity of Managing Multi-CDN and Hybrid Architectures

To achieve maximum redundancy and performance, many large enterprises deploy multi-CDN strategies, sourcing services from several providers. While beneficial, this approach introduces significant operational complexity. It requires sophisticated traffic management systems, consistent configuration across different platforms, and specialized expertise to monitor and optimize performance, creating a significant technical and management hurdle that can deter some organizations from pursuing the most robust architectures.

Opportunities in the US Content Delivery Network Market

Integration with Edge Computing Platforms

The convergence of CDN and edge computing represents one of the largest growth frontiers. By offering serverless computing capabilities at the edge, CDN providers enable developers to run application logic closer to users. This allows for the personalization of web content in real-time, the execution of complex AI models for image recognition, and ultra-low-latency processing for interactive applications, opening a completely new and substantial revenue stream beyond traditional content caching.

Expansion in E-commerce and Real-Time Personalization

The e-commerce sector presents a massive opportunity for advanced CDN services. CDNs can be leveraged to dynamically assemble and deliver personalized web pages, product recommendations, and promotional content based on a user's location, device, and browsing history in milliseconds. This capability for real-time customization directly translates to higher conversion rates and average order values, offering a clear and compelling ROI for online retailers and positioning the CDN as a critical engine for revenue growth.

Trends in the US Content Delivery Network Market

The Shift to Edge Computing as a Service

A dominant trend is the evolution of CDNs into full-fledged edge computing platforms. Providers are deploying micro-data centers at the network edge, enabling customers to deploy code and applications alongside cached content. This shift allows for the execution of custom logic, A/B testing, and data aggregation at the edge, fundamentally changing application architectures by reducing backhaul to origin servers and enabling a new class of real-time, interactive web and mobile experiences.

AI-Driven Traffic Management and Predictive Caching

The industry is witnessing rapid innovation in the application of AI and machine learning to core CDN operations. AI algorithms are now used to predict traffic spikes, pre-position content at optimal edge locations, and intelligently route user requests along the least congested network paths. This proactive, data-driven approach maximizes cache-hit ratios, minimizes latency, and enhances overall network resilience, pushing the boundaries of what is possible in content and application delivery performance.

Research Scope and Analysis

By Component Analysis

The Solutions segment is projected to remain the dominant component category in the U.S. Content Delivery Network market, primarily due to the critical role CDN platforms play in accelerating content distribution, reducing latency, and enhancing end-user experience across websites, mobile platforms, and streaming services. This segment includes core CDN delivery engines, caching layers, video delivery platforms, API acceleration systems, application firewalls, DDoS mitigation layers, and real-time analytics.

The rising demand for immersive digital experiences, fueled by HD/4K/8K video streaming, cloud gaming, VR/AR, and API-driven applications, continues to strengthen the revenue share of CDN Solutions. Enterprises rely on these platforms as strategic enablers of uptime, reliability, and performance, especially as users expect instantaneous delivery regardless of traffic surges or geography.

The Services segment is the fastest-growing component category, driven by the increasing architectural complexity of hybrid CDNs, multi-CDN routing, and edge compute integrations. Enterprises now require expert consulting, migration support, traffic optimization, secure configuration, and ongoing performance monitoring. Managed services are becoming indispensable as organizations seek proactive threat mitigation and continuous tuning of delivery paths across globally distributed edge nodes.

The rise of microservices-based architectures and API-heavy workloads also increases dependence on tailored professional services for integration, compliance, and performance validation. Additionally, the shift toward real-time streaming, low-latency edge delivery, and zero-trust application security has created a strong recurring revenue opportunity for CDN service providers. As digital services scale, enterprises prefer long-term advisory partnerships that guarantee consistent performance, resilience, and tactical improvements, positioning the Services segment as a high-velocity growth driver.

By Content Type Analysis

The Static Content segment is poised to continue to serve as the foundational layer of the U.S. CDN market, supporting high-volume delivery of images, scripts, HTML files, and static web components. Static delivery helps ensure lightweight site performance, rapid load times, and enhanced caching efficiency across distributed nodes.

Despite its foundational importance, the static segment contributes more steady-state revenue rather than a high-growth opportunity, as optimizations are mature and standardized. Most enterprises consider static CDN delivery as a baseline requirement rather than a differentiating capability, keeping its market share stable but not explosive.

The Dynamic/Streaming Content segment contributes the largest share of commercial value, driven by the rising dominance of OTT platforms, e-learning portals, live sports broadcasting, personalized content engines, and interactive media.

Dynamic content, such as personalized dashboards, e-commerce product recommendations, gaming interactions, and real-time financial or healthcare data, requires sophisticated routing, edge logic processing, and adaptive acceleration mechanisms due to its non-cacheable nature. Streaming video, particularly 4K and 8K HDR, creates enormous bandwidth and performance demands, making advanced CDN features like multi-bitrate encoding, load balancing, instant purge, and server-side logic indispensable.

Live streaming of concerts, sports, news, and user-generated content introduces unpredictable traffic surges, requiring adaptive scaling and latency-sensitive optimization. Furthermore, the proliferation of AI-driven dynamic experiences, such as real-time personalization and machine-learning-enhanced content delivery, pushes dynamic CDN architectures to the forefront of innovation. As enterprises prioritize experience differentiation, the dynamic/streaming segment remains the most commercially critical and high-growth category across the U.S. CDN landscape.

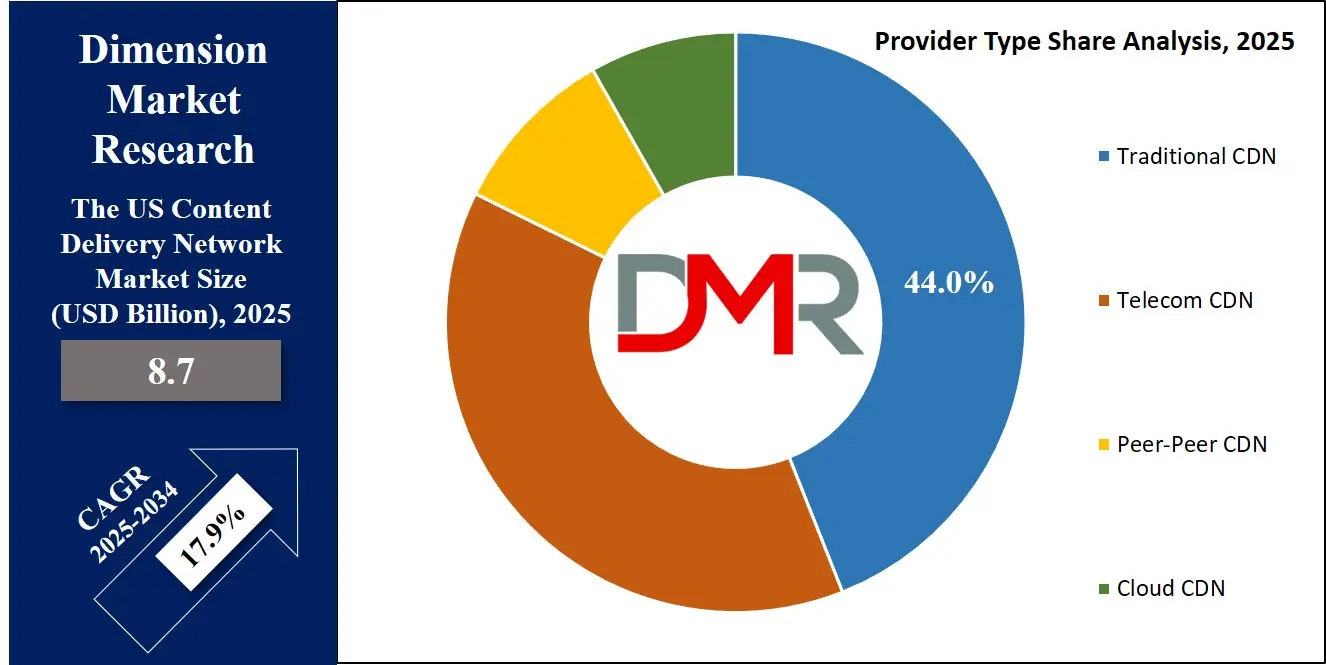

By Provider Type Analysis

Traditional CDN Providers such as Akamai, Limelight (Edgio), and Fastly are poised to continue dominating the U.S. market due to decades of infrastructure investment and globally distributed PoPs engineered for high availability, redundancy, and superior traffic management.

Their purpose-built delivery networks, optimized routing algorithms, and end-to-end security stacks allow them to serve high-volume enterprise workloads across media, gaming, and e-commerce sectors. These providers also maintain strong multicloud interoperability, advanced edge compute environments, and proprietary performance enhancement technologies, strengthening their leadership.

Telecom/CDN Hybrids, including Verizon, AT&T, and Lumen Technologies, combine CDN capabilities with their existing broadband, fiber, and backbone infrastructures. This convergence allows them to deliver content closer to the last mile, reducing hops and enhancing real-time delivery performance. Their integrated approach offers a key advantage for latency-sensitive applications such as video conferencing, cloud gaming, IoT analytics, and low-latency streaming. Telecom operators also benefit from leveraging existing customer relationships, enterprise contracts, and wide network footprints.

Cloud CDN Providers (AWS CloudFront, Google Cloud CDN, Azure CDN) represent the fastest-growing provider type. They integrate CDN delivery deeply within broader cloud ecosystems, enabling seamless access to storage, compute, AI/ML, serverless functions, security suites, and APIs in a unified environment. Developers and enterprises value this simplicity, pay-as-you-go pricing, and direct integration with cloud-native architectures.

As microservices, containerization, edge computing, and multicloud deployments scale, cloud CDN adoption accelerates rapidly. These providers benefit from massive hyperscale infrastructure and automated global distribution, making them highly attractive for digital-native businesses and scalable enterprise applications.

By Application Analysis

The Media & Entertainment Delivery segment is poised to account for the highest commercial adoption within the U.S. CDN market, driven by the booming OTT streaming ecosystem powered by platforms such as Netflix, Disney+, Amazon Prime Video, Hulu, and ESPN+. These companies depend on ultra-reliable, low-latency content delivery for HD, 4K, and 8K streaming, as well as adaptive bitrate optimization for varying network conditions.

Live events, including sports, concerts, and political broadcasts, require massive scalability and instant response to sudden traffic surges. CDNs enable broadcasters to ensure uninterrupted viewing experiences, real-time buffering reduction, rapid content refresh, and audience-based personalization. With the rise of cloud gaming, virtual events, live commerce, and user-generated content, CDNs form the backbone of next-generation digital entertainment experiences.

The Web & E-commerce Acceleration segment is equally crucial, driven by the need for millisecond-level responsiveness in online retail. Leading e-commerce platforms rely on CDNs to ensure that product pages, search results, and transaction flows load instantly across geographies. Even minor delays can significantly impact cart abandonment rates, customer satisfaction, and overall revenue.

CDNs support critical functions such as dynamic content acceleration, image optimization, API performance enhancement, bot protection, fraud mitigation, and personalized shopping experiences. The increasing adoption of headless commerce, AI-driven product recommendations, and omnichannel retail strategies is further elevating CDN demand within this segment. As competition intensifies in digital commerce, high-performance CDN architectures become foundational to driving conversions, customer loyalty, and seamless multidevice interactions.

By End-User Analysis

Media & Entertainment Companies are expected to remain the most dominant end-users within the U.S. CDN market due to their reliance on uninterrupted, high-quality content delivery. Streaming giants, broadcast networks, digital publishers, gaming platforms, and music services require robust latency mitigation, bandwidth scalability, and adaptive bitrate delivery to ensure an immersive user experience.

Content demand surges during live releases, events, and premieres necessitate a strong CDN infrastructure capable of real-time load balancing and multi-region delivery. This segment’s dependency on quality-of-experience metrics, buffering ratios, startup delays, and playback smoothness makes CDN performance indispensable, keeping M&E companies at the top of revenue contribution.

Retail & E-commerce Businesses represent another dominant user base, as website speed directly correlates with customer conversion rates, average order value, and competitive differentiation. CDNs help accelerate dynamic pages, optimize media assets, and secure payment gateways. As e-commerce integrates with AI-driven personalization, live shopping, and omnichannel workflows, CDNs become even more essential.

BFSI and Healthcare are among the fastest-growing end-user segments. In BFSI, real-time financial dashboards, digital banking portals, trading platforms, and authentication systems require ultra-secure and ultra-fast delivery. CDNs support encrypted data transfer, API acceleration, and fraud protection. In Healthcare, CDNs enable patient portals, telehealth sessions, diagnostic imaging transfers, and HIPAA-compliant data delivery. Rising digital transformation, cybersecurity threats, and remote service models drive strong adoption in both sectors. Their escalating performance, compliance, and security needs ensure long-term momentum in CDN usage.

The Content Delivery Network Market Report is segmented on the basis of the following:

By Offering

- Solutions

- Media Delivery

- Web Performance Optimization

- Cloud Security

- Services

- Design & Consulting Services

- Storage Services

- Analytics & Performance Monitoring

- Website & API Management

- Network Optimization Services

- Digital Rights Management

- Others

By Content Type

- Static Content

- Dynamic Content

By Provider Type

- Traditional CDN Provider

- Cloud CDN Provider

- Telecom/CDN Hybrid

- Peer-to-Peer (P2P) CDN

By Application

- Media & Entertainment Delivery

- Web & E-commerce Acceleration

- Website & API Security

- Cloud Security & DDoS Mitigation

- Online Gaming & Software Distribution

- Other Application

By End User

- Media & Entertainment

- E-commerce

- Advertising

- Healthcare

- Financial Services

- Research & Education

- Others

Competitive Landscape

The competitive landscape of the US Content Delivery Network market is fragmented and highly dynamic, characterized by a mix of established CDN giants, major cloud providers, and specialized security firms. Dominant players like Akamai Technologies, Cloudflare, and Fastly leverage their extensive global networks, integrated security suites, and sophisticated software platforms to maintain a stronghold, particularly in the realms of media delivery and large enterprise accounts.

These companies compete not only on network scale but also on the strength of their security capabilities and developer experience. A significant trend is the deep foray of hyperscale cloud providers, such as Amazon Web Services (AWS CloudFront), Google Cloud (Cloud CDN), and Microsoft Azure (Azure CDN), which are aggressively bundling CDN services with their broader cloud ecosystems.

This integration offers a compelling value proposition for businesses already invested in a specific cloud platform. Simultaneously, the market sees intense competition from specialized and regional players focusing on disruptive applications like edge computing and ultra-low-latency streaming for gaming, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the US Content Delivery Network are

- Akamai Technologies

- Cloudflare, Inc.

- Amazon Web Services, Inc.

- Google LLC

- Microsoft Corporation

- Fastly, Inc.

- Limelight Networks

- Verizon Digital Media Services (Edgio)

- StackPath, LLC

- Imperva Inc.

- CDNetworks

- GTT Communications, Inc.

- G-Core Labs S.A.

- Rackspace Technology, Inc.

- Other Key Players

Recent Developments

- May 2024: Akamai Technologies announces the launch of its new "Edge Compute" platform, designed to allow developers to run serverless functions across its entire edge network.

- April 2024: Cloudflare announces a strategic partnership with a major e-commerce platform to provide integrated CDN and security services, aiming to improve site performance and resilience for online merchants.

- March 2024: Google Cloud introduces new AI-powered features for its Cloud CDN, offering predictive load balancing and automated cache optimization.

- February 2024: Fastly completes its acquisition of a niche edge computing startup, enhancing its capabilities in real-time data processing at the edge.

- January 2024: The "Content Delivery Summit" is held in New York, featuring keynotes on the future of edge computing and its impact on media delivery.

- November 2023: AWS launches new "Application Load Balancer" integrations with CloudFront, simplifying the architecture for global web applications.

- October 2023: A major telecom provider announces the expansion of its own CDN services, focusing on low-latency delivery for 5G-connected devices.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.7 Bn |

| Forecast Value (2034) |

USD 38.2 Bn |

| CAGR (2025–2034) |

17.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions and Services), By Content Type (Static Content and Dynamic Content), By Provider Type (Traditional CDN, Telecom CDN, Peer-to-Peer CDN, and Cloud CDN), By Application (Media & Entertainment Delivery, Web & E-commerce Acceleration, Website & API Security, Cloud Security & DDoS Mitigation, Online Gaming & Software Distribution, Other Applications), By End User (Media & Entertainment, E-commerce, Advertising, Healthcare, Financial Services, Research & Education, Others) |

| Country Coverage |

The US |

| Prominent Players |

Akamai Technologies, Cloudflare Inc., Amazon Web Services Inc., Google LLC, Microsoft Corporation, Fastly Inc., Limelight Networks, Verizon Digital Media Services (Edgio), StackPath LLC, Imperva Inc., CDNetworks, Gcore, GTT Communications Inc., G-Core Labs S.A., Rackspace Technology Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The US Content Delivery Network Market size is estimated to have a value of USD 8.7 billion in 2025 and is expected to reach USD 38.2 billion by the end of 2034.

The market is growing at a CAGR of 17.9 percent over the forecasted period from 2025 to 2034.

Some of the major key players are Akamai Technologies, Cloudflare, Inc., Amazon Web Services, Inc., Google LLC, Microsoft Corporation, and Fastly, Inc.