Market Overview

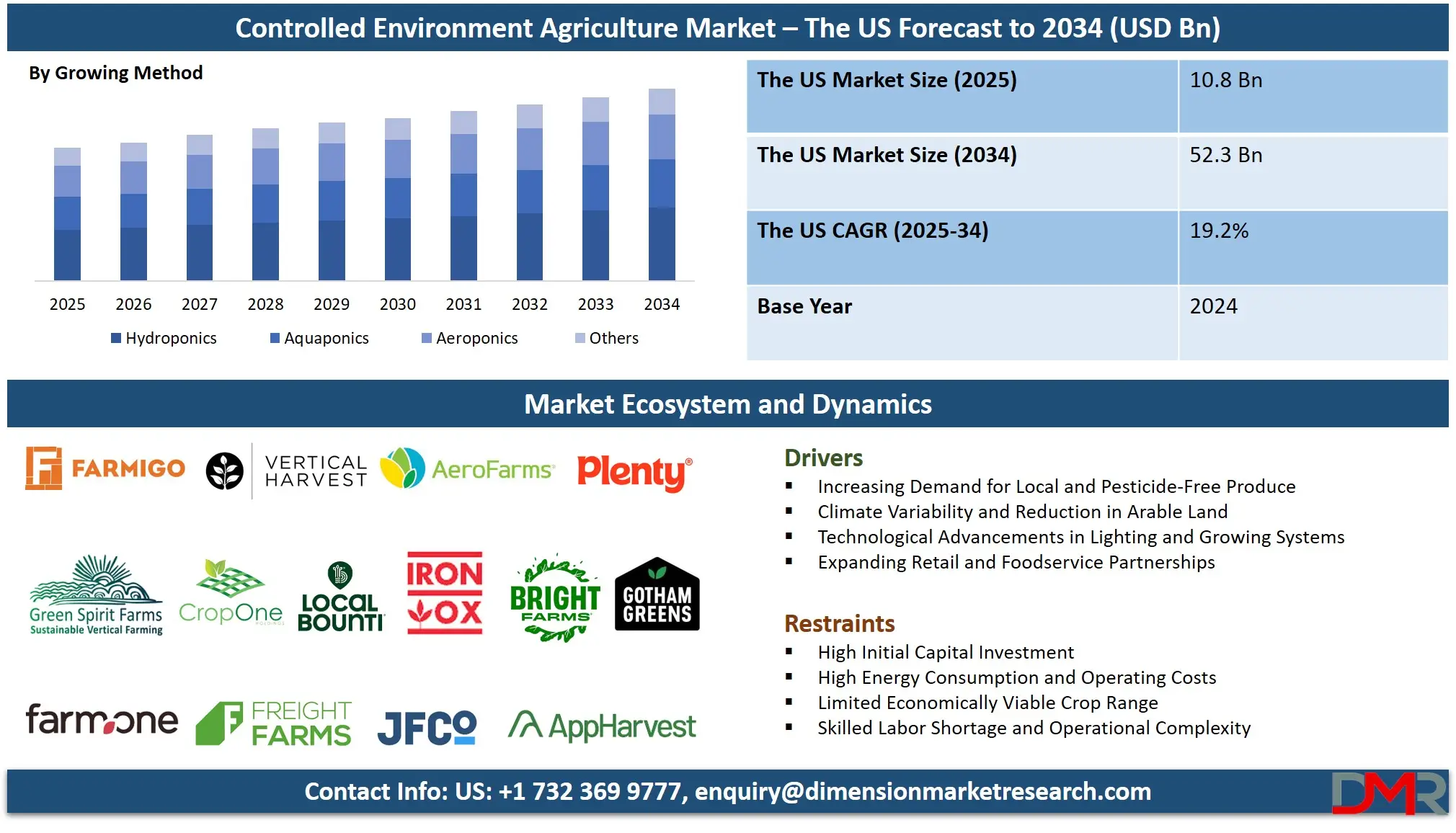

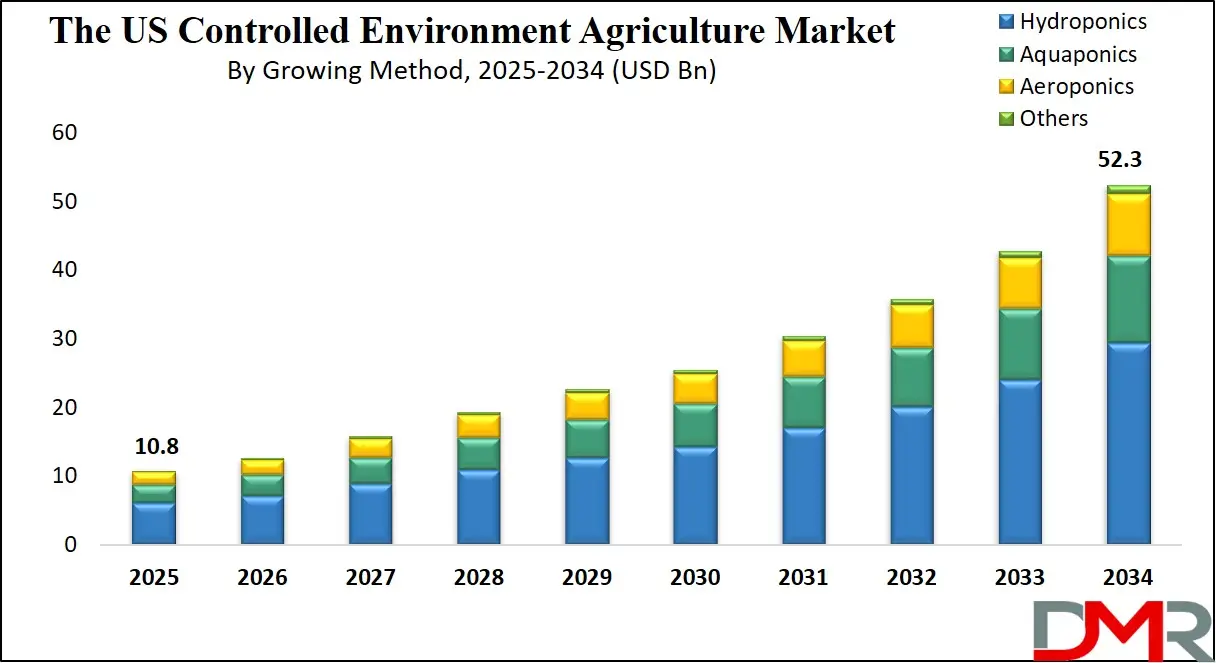

The US Controlled Environment Agriculture (CEA) Market is anticipated to reach USD 10.8 billion in 2025, driven by the rising demand for local, sustainable, and pesticide-free produce, alongside increasing challenges from climate variability. The market is expected to expand at a robust compound annual growth rate (CAGR) of 19.2% from 2025 to 2034, reaching a projected value of USD 52.3 billion by 2034.

Growth is fueled by technological advancements in LED lighting and climate control systems, the integration of IoT sensors and AI for farm management, and supportive government policies for food security. Additionally, expanding applications in urban vertical farming, cannabis cultivation, and research institutions, coupled with the growing consumer preference for transparent and hyper-local supply chains, are expected to further accelerate market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US landscape for Controlled Environment Agriculture is experiencing a profound transformation, moving beyond simple greenhouse production into sophisticated, technology-driven food ecosystems. A significant trend is the shift towards fully automated, data-driven vertical farms, where CEA systems leverage IoT and AI to optimize every variable of plant growth. This precision agriculture approach maximizes yield per square foot, minimizes resource waste, and enables consistent, year-round production.

Concurrently, CEA providers are advancing into integrated farm management software, offering real-time analytics, predictive maintenance, and automated climate control as standard features, making operational efficiency a core component of the CEA value proposition. The integration of artificial intelligence with growth optimization algorithms is also emerging, dynamically adjusting light spectra, nutrient dosing, and irrigation in real-time based on plant phenotype.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market's expansion is fueled by substantial opportunities in high-value crop production, particularly in leafy greens, herbs, and pharmaceuticals that require unparalleled consistency and quality control compared to traditional agriculture. The commercial cannabis sector has become a major adopter, leveraging CEA technology for the precise, scalable, and compliant cultivation of medicinal and recreational products, which have stringent environmental requirements.

Furthermore, the ongoing development of novel, integrated systems, including closed-loop aquaponics and bioreactor-based food production, opens new avenues for creating sustainable, decentralized food systems that are highly resilient and efficient. These innovations are poised to address complex challenges in food deserts and for specialty crops used in nutraceuticals, providing supply chain guarantees that were previously unimaginable.

Key Takeaways

- US Market Size Insights: The US Controlled Environment Agriculture Market is projected to be valued at USD 10.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 52.3 billion in 2034.

- The US Market Growth Rate: The market is growing at a CAGR of 19.2 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the rising consumer demand for local and sustainable produce, the integration of IoT and AI for precision farming, and increasing investment in urban and vertical farming.

- Competitive Landscape: The market is competitive and features a mix of specialized hardware manufacturers (Philips, Signify), integrated system providers (AeroFarms, Bowery), technology giants (IBM, Google), and traditional agricultural companies.

- Dominant Segment: The Leafy Greens & Herbs category is the largest crop segment, driven by short growth cycles and high urban demand, while fully automated vertical farms have become a standard expectation for new large-scale facilities.

Use Cases

- Urban Vertical Farming: A major vertical farm operator in New York uses a fully automated, multi-layer CEA system with AI-driven climate control and LED lighting to produce over 100 tons of leafy greens annually within city limits, supplying local supermarkets with zero food miles.

- Cannabis Cultivation: A licensed cannabis producer in Colorado utilizes a precision CEA facility with integrated environmental controls and spectral lighting to optimize cannabinoid and terpene profiles, ensuring consistent, high-quality product for both medical and recreational markets.

- Research & Pharmaceutical Crops: A university-affiliated research institute employs modular container farms with precise environmental manipulation to grow genetically consistent plant specimens for pharmaceutical research, accelerating drug discovery timelines.

- Hyper-Local Restaurant Supply: A high-end restaurant group partners with an on-site container farm provider to grow rare microgreens and herbs directly in their kitchen, guaranteeing ultimate freshness and menu uniqueness.

- Food Desert Intervention: A non-profit organization installs a community-based hydroponic container farm in an underserved urban area, providing fresh produce and agricultural education while creating local jobs.

The US Controlled Environment Agriculture Market: Impact of Artificial Intelligence

- Predictive Growth Optimization: AI algorithms analyze real-time data from plant sensors, predicting growth stages and dynamically adjusting light spectra, CO2 levels, and nutrient formulas to maximize yield and quality.

- Automated Pest & Disease Detection: ML models process images from cameras to identify early signs of plant stress, pest infestation, or disease, triggering targeted interventions and preventing crop loss.

- Resource Efficiency Analytics: AI-powered systems monitor and optimize water and energy consumption in real-time, identifying inefficiencies and automating systems to reduce waste and operational costs.

- Yield Forecasting & Harvest Planning: AI analyzes historical and real-time growth data to accurately forecast harvest volumes and timing, improving supply chain coordination and reducing spoilage.

- Genetic Phenotype Analysis: AI analyzes plant growth data under different conditions to identify optimal genotypes for specific CEA environments, guiding breeding programs for higher-performing crops.

The US Controlled Environment Agriculture Market: Stats & Facts

USDA National Agricultural Statistics Service (NASS) – Floriculture & Greenhouse Data

- The U.S. had 8,951 floriculture producers in 2022.

- Total floriculture crop sales reached USD 6.69 billion in 2022.

- 833 million sq ft of area was used for floriculture production in 2022.

- 6,349 operations employed hired workers in 2022.

- Average peak workforce per operation was 17.7 employees.

- Florida reported USD 1.17 billion in floriculture sales; California reported USD 958 million.

- Top states by number of floriculture operations included Pennsylvania (741), New York (596), and Florida (558).

USDA NASS – Census of Agriculture (Greenhouse & Protected Agriculture)

- U.S. greenhouse vegetable & fresh-cut herb area exceeded 869 million sq ft in the latest Census tables.

- Greenhouse vegetables alone accounted for 133 million sq ft in 2022.

- Greenhouse vegetable sales reached USD 982 million.

- 1–999 sq ft farms represent the largest share, with 4,197 greenhouse operations falling in this size class.

- Greenhouse vegetable production area more than doubled between 2012 and 2022.

USDA Economic Research Service (ERS) – Controlled Environment Agriculture Reporting

- 60–70% of crops produced in CEA are tomatoes, lettuce, and cucumbers.

- Hydroponics is reported as the dominant CEA cultivation method nationally.

- Inflation-adjusted CEA tomato sales fell from USD 387M to USD 307M between 2014 and 2019.

- Cucumber production area in CEA dropped from 11 million sq ft to 6.34 million sq ft over the same period.

- Herb production volume fell by ~8%, to approximately 326,000 cwt.

- USDA began national-level CEA data reporting in 2009.

USDA ERS – Vegetables & Pulses Outlook

- ERS reconfirmed 133 million sq ft of U.S. greenhouse vegetable area in 2022.

- Greenhouse vegetable sales were reported at USD 982 million the same year.

FDA – Food Safety and Leafy Greens Investigations

- A multi-state E. coli outbreak linked to leafy greens in 2019 resulted in 188 illnesses.

- FDA has recorded multiple contamination incidents tied to leafy greens, prompting national traceability investigations.

Centers for Disease Control & Prevention (CDC) – Foodborne Outbreak Surveillance

- CDC’s contributing-factor analysis (2014–2022) examined 2,677 outbreaks with detailed factors.

- The 2018 romaine lettuce E. coli outbreak impacted 62 people across multiple states.

ATTRA / National Center for Appropriate Technology (using USDA data)

- North America had approximately 15,000 acres of protected food-crop production in 2017.

- The U.S. accounted for ~2,990 acres of protected cultivation that year.

SDA ERS – Specialty Crops

- Specialty crops generated USD 64.7 billion in U.S. crop receipts (2017 reference).

- Specialty crops represent about one-third of all crop receipts and one-sixth of all agricultural receipts.

U.S. Department of Energy (DOE) / Energy Information Administration (EIA)

- Solar power accounted for roughly 3% of U.S. electricity-generation share in 2020, used extensively in discussions about powering energy-intensive CEA operations.

USDA National Agricultural Library (NAL) – Hydroponics Program Data

- Hydroponics is recognized as a national-scale production system spanning hobbyists, small farms, and commercial operations, according to USDA NAL guidance.

Congressional Research Service (CRS) – Using USDA Census Data

- Ten U.S. states account for 78% of national vegetable sales.

- California alone produces 41% of U.S. vegetables by sales value.

Market Dynamic

Driving Factors in the US Controlled Environment Agriculture Market

Increasing Demand for Local, Resilient, and Sustainable Food Production

The growing consumer preference for transparent, locally-grown produce with a lower environmental footprint is a primary driver for the CEA market. Climate change-induced weather volatility and supply chain disruptions have highlighted the need for resilient food production systems. CEA is uniquely positioned to address these needs by enabling predictable, year-round production independent of external weather, using significantly less water and land, and eliminating the need for pesticide runoff, directly enhancing food security and sustainability.

Technological Advancements and Falling Costs of Key Components

Rapid innovation and economies of scale in LED lighting, sensors, automation robotics, and AI software have dramatically reduced the capital and operational costs of CEA facilities. The integration of IoT for real-time monitoring and control allows for unprecedented precision and labor savings. This technological maturation makes large-scale, economically viable CEA operations a reality, providing a compelling reason for investors and agribusinesses to adopt or expand their CEA footprint.

Restraints in the US Controlled Environment Agriculture Market

High Initial Capital Expenditure and Operational Energy Costs

Establishing a state-of-the-art CEA facility, especially a vertical farm, requires very high upfront investment in specialized hardware, construction, and systems integration. Furthermore, the operational costs, particularly for electricity to power LED lights and climate control systems, remain a significant financial hurdle. This high cost barrier can limit market entry and scale, putting pressure on operators to achieve premium pricing or very high throughput to reach profitability.

Technical Complexity and Skilled Labor Shortage

Operating a high-tech CEA facility requires a multidisciplinary skill set combining horticulture, data science, engineering, and systems management. There is a significant shortage of skilled professionals adept at managing these complex agro-tech systems. This operational complexity can lead to suboptimal performance, crop losses, and high training costs, creating a significant management hurdle that can deter some investors and traditional farmers from entering the market.

Opportunities in the US Controlled Environment Agriculture Market

Expansion into High-Value Pharmaceutical and Nutraceutical Crops

The convergence of CEA and biotechnology represents a major growth frontier. By offering perfectly controlled environments, CEA enables the consistent, high-quality cultivation of plants used for pharmaceuticals, nutraceuticals, and cosmetic active ingredients. This allows for the standardization of bioactive compound levels, a critical requirement for these industries, opening a completely new and high-margin revenue stream beyond traditional food production.

Integration with Local Food Systems and Retail Partnerships

The retail and food service sector presents a massive opportunity for branded CEA produce. Partnerships between CEA operators and supermarkets or restaurants can create reliable, branded supplies of ultra-fresh, locally-grown produce. This capability for "farm-to-shelf in hours" directly translates to longer shelf life, reduced waste, and a powerful marketing story, offering a clear and compelling value proposition for retailers and positioning CEA as a critical engine for supply chain transformation.

Trends in the US Controlled Environment Agriculture Market

The Rise of Fully Automated and Robotic Farming Systems

A dominant trend is the evolution of CEA into lights-out, fully robotic production facilities. Providers are deploying automated seeding, transplanting, harvesting, and packaging systems integrated with central AI management platforms. This shift significantly reduces labor costs, minimizes human contact with crops (improving food safety), and enables 24/7 operation, fundamentally changing the economics and scalability of indoor farming.

AI and Data-Driven Closed-Loop Agriculture

The industry is witnessing rapid innovation in the application of AI and machine learning to create fully closed-loop, resource-positive systems. AI algorithms are now used to optimize every input (water, nutrients, energy) in real-time based on plant uptake, to recycle 99% of water, and to generate renewable energy on-site. This proactive, data-driven approach maximizes resource efficiency, minimizes environmental impact, and pushes the boundaries of sustainable production.

Research Scope and Analysis

By Offering Analysis

Lighting systems are projected to dominate the U.S. Controlled Environment Agriculture (CEA) market's offering segment. This dominance stems from the fundamental role of light as the primary energy source for photosynthesis, making it the most critical and actively managed input in indoor and greenhouse production. Across the diverse American CEA landscape from sun-rich California greenhouses to vertical farms in New York City supplemental or sole-source LED lighting is essential for ensuring consistent, year-round growth cycles, maximizing yield per square foot, and influencing critical crop qualities like flavor, color, and nutrient density.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The adoption of advanced LED systems has accelerated in the U.S. due to rising energy costs, improved efficacy (μmol/J), and the ability to use customizable light spectra to optimize specific crops, such as manipulating terpene profiles in cannabis or enhancing anthocyanin production in leafy greens. Federal and state incentives for energy-efficient technologies further propel investment. As U.S. operators relentlessly pursue higher productivity and product differentiation to justify premium pricing in competitive retail markets, advanced lighting remains the dominant, innovation-driven capital expenditure, directly shaping farm economics and crop success.

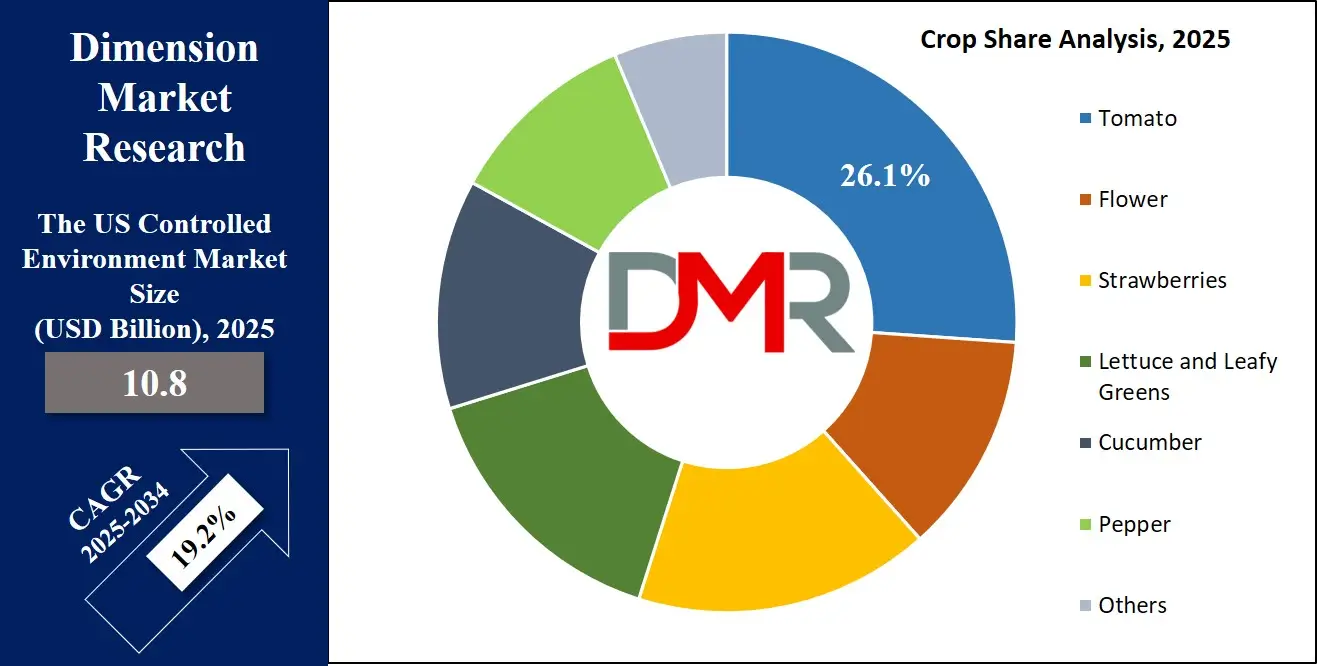

By Crop Analysis

Tomatoes are the poised to be the leading crop segment in the U.S. Controlled Environment Agriculture market, commanding a dominant share. This position is anchored in robust and consistent consumer demand, high economic value, and exceptional suitability for advanced greenhouse systems. The U.S. market for fresh tomatoes is vast, with a growing consumer preference for flavorful, locally-grown, and vine-ripened varieties that often underperform in long-distance supply chains. CEA, particularly high-tech greenhouses concentrated in regions like the Southwest, Midwest, and Northeast, fulfills this demand by delivering superior, blemish-free produce year-round.

The high revenue per square foot achievable with tomatoes, especially specialty and heirloom varieties, provides a clear economic rationale for the significant upfront investment in CEA infrastructure. Furthermore, the crop's physiological response to controlled environments thriving with optimized temperature, humidity, CO2 enrichment, and hydroponic nutrient delivery results in yields that can be 10-20 times greater than open-field production. This combination of strong market pull, proven agronomic success in U.S. greenhouse operations, and favorable economics solidifies the tomato's leading role in the American CEA sector.

By Growing Method Analysis

Hydroponics is projected to dominate the growing method segment within the U.S. Controlled Environment Agriculture market. Its dominance is attributed to its technological maturity, scalability, and alignment with core American agricultural drivers: efficiency, consistency, and resource conservation. In a market characterized by both large-scale commercial operations and a proliferation of urban farms, hydroponics provides a versatile and proven platform. It forms the backbone of the vast majority of U.S. greenhouse vegetable production (tomatoes, cucumbers, peppers) and is the preferred system for most vertical farms focusing on leafy greens.

The method's precision in delivering water and nutrients directly to the root zone translates into faster growth rates, higher yields, and significant water savings a critical advantage in water-scarce regions like the American West. Furthermore, the soil-less nature of hydroponics eliminates weed pressure and reduces soil-borne pathogens, aligning with the consumer-driven demand for "cleaner" produce and reducing reliance on chemical pesticides. For U.S. investors and operators, the extensive domestic knowledge base, available technology, and predictable outcomes associated with hydroponics make it the default, low-risk, and high-efficiency choice, ensuring its continued market leadership.

The Controlled Environment Agriculture Market Report is segmented based on the following:

By Offering

- Lighting Systems

- Heating Systems

- Growing Media

- Nutrients

- Others

By Crop

- Tomato

- Flowers

- Strawberries

- Lettuce and Leafy Greens

- Cucumber

- Pepper

- Others

By Growing Method

- Hydroponics

- Aquaponics

- Aeroponics

- Others

Competitive Landscape

The competitive landscape of the US Controlled Environment Agriculture market is fragmented and dynamic, characterized by a mix of pure-play vertical farming companies, technology providers, and established agricultural giants. Dominant players like AeroFarms, Bowery Farming, and Plenty leverage their proprietary growing systems, data science capabilities, and brand recognition to secure large-scale commercial and retail partnerships.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These companies compete on yield efficiency, product quality, and unit economics. A significant trend is the entry of technology giants and HVAC/lighting specialists, such as Signify (Philips), IBM, and Google, which are providing critical AI, IoT, and hardware components to the ecosystem. Simultaneously, the market sees competition from numerous regional startups and greenhouse operators adopting high-tech solutions, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the US Controlled Environment Agriculture Market are

- AeroFarms

- Plenty Unlimited Inc.

- Bowery Farming

- BrightFarms

- Gotham Greens

- AppHarvest Inc.

- Green Spirit Farms

- Iron Ox

- Local Bounti

- Freight Farms

- Vertical Harvest

- Crop One Holdings

- Farm.One

- Green Sense Farms

- Jones Food Company

- Edenworks

- Square Roots

- Urban Crop Solutions

- Farmigo

- Agrilution

- Other Key Players

Recent Development

- May 2024: AeroFarms announces a new partnership with a major supermarket chain to co-locate mini-vertical farms in distribution centers for hyper-local supply.

- April 2024: Bowery Farming unveils its next-generation, fully automated farm design, claiming a 30% reduction in energy consumption per head of lettuce.

- March 2024: Signify introduces new AI-powered light recipes that automatically adjust spectrum based on real-time plant stress indicators.

- February 2024: Plenty completes a new funding round specifically for R&D into strawberry cultivation in its vertical farm towers.

- January 2024: The "Indoor Ag-Con" conference is held in Las Vegas, featuring keynotes on the role of AI and robotics in scaling CEA.

- November 2023: The USDA announces new grant funding targeted at CEA research for climate resilience in specialty crops.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.8 Bn |

| Forecast Value (2034) |

USD 52.3 Bn |

| CAGR (2025–2034) |

19.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Lighting Systems, Heating Systems, Growing Media, Nutrients, and Others), By Crop (Tomato, Flowers, Strawberries, Lettuce and Leafy Greens, Cucumber, Pepper, and Others), By Growing Method (Hydroponics, Aquaponics, Aeroponics, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

AeroFarms, Plenty Unlimited Inc., Bowery Farming, BrightFarms, Gotham Greens, AppHarvest Inc., Green Spirit Farms, Iron Ox, Local Bounti, Freight Farms, Vertical Harvest, Crop One Holdings, Farm.One, Green Sense Farms, Jones Food Company, Edenworks, Square Roots, Urban Crop Solutions, Farmigo, Agrilution, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Controlled Environment Agriculture Market?

▾ The US Controlled Environment Agriculture Market size is estimated to have a value of USD 10.8 billion in 2025 and is expected to reach USD 52.3 billion by the end of 2034.

What is the growth rate in the US Controlled Environment Agriculture Market?

▾ The market is growing at a CAGR of 19.2 percent over the forecasted period from 2025 to 2034.

Which are the key players in the US Controlled Environment Agriculture Market?

▾ Some of the major key players are AeroFarms, Bowery Farming Inc., Plenty Unlimited Inc., Signify N.V., and BrightFarms.