Market Overview

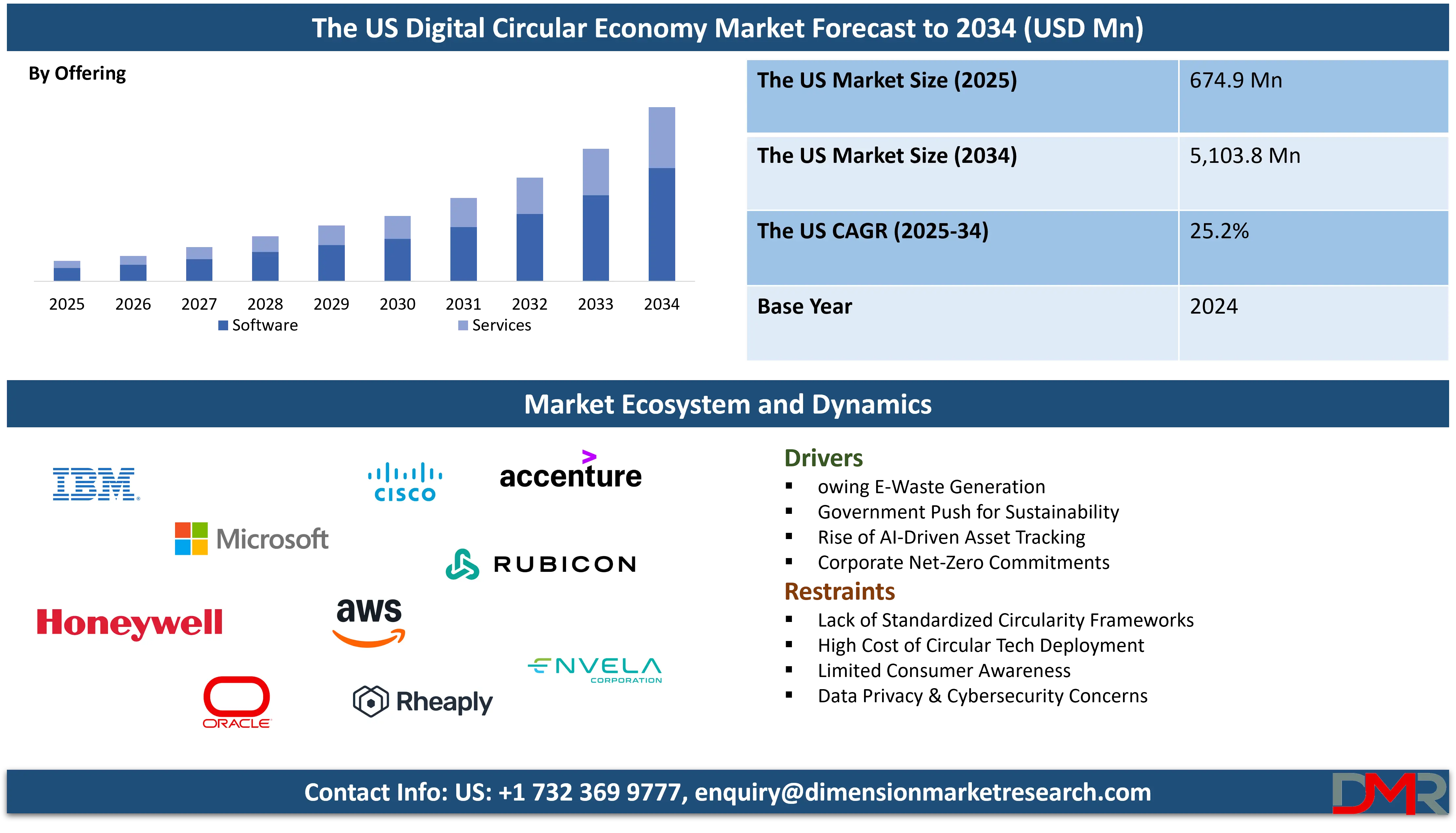

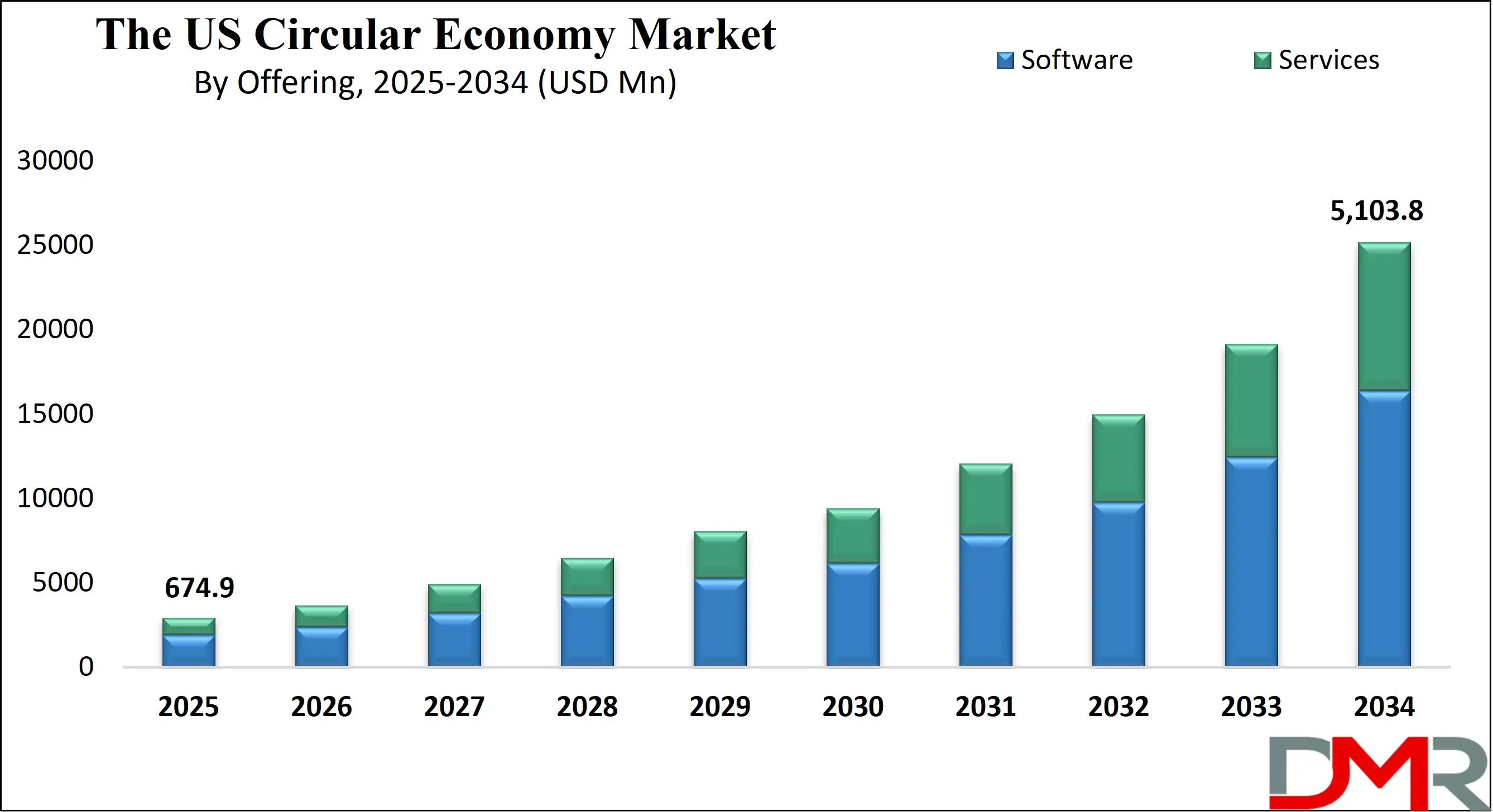

The US digital circular economy market is projected to reach USD 674.9 million in 2025 and is expected to grow to USD 5,103.8 million by 2034, registering a robust CAGR of 25.2%. This growth reflects rising adoption of digital sustainability platforms, advanced recycling technologies, IoT-enabled resource optimization, and data-driven circular solutions across manufacturing, electronics, and retail industries.

Digital circular economy refers to an economic framework where digital technologies enable smarter resource use, long-life product cycles, and regenerative value streams. It integrates IoT-driven asset tracking, AI-powered waste prediction, cloud-based material marketplaces, and data platforms that optimize reuse, refurbishment, and recycling. Instead of the traditional linear model of take-make-dispose, digital circular systems allow businesses to monitor product lifecycles, recover materials with precision, reduce environmental impact, and drive efficiency across supply chains. This creates a closed-loop ecosystem where data intelligence, automation, and digital workflows enhance sustainability, cost savings, and operational resilience.

The US digital circular economy market is expanding as enterprises adopt digital asset management, predictive maintenance, advanced recycling platforms, and cloud-based reverse logistics systems. Growing regulations around e-waste, rising consumer expectations for sustainable products, and the shift toward data-driven industrial operations are accelerating investment in circular digital platforms. Technologies such as IoT sensors, blockchain material tracking, AI lifecycle analytics, and digital resale networks are transforming how organizations manage resources and reduce waste across manufacturing, retail, and electronics sectors.

The market is also shaped by the rise of digital marketplaces for refurbished goods, intelligent sorting systems, and enterprise sustainability software that enables real-time reporting and carbon footprint visibility. US companies increasingly rely on automation, digital twins for material flow optimization, and smart waste analytics to create circular value chains that reduce landfill dependency and improve material recovery rates. As sustainability becomes a competitive advantage, digital circular solutions are evolving into core components of operational strategy, driving innovation across both public and private sectors.

The US Digital Circular Economy Market: Key Takeaways

- Market Value: The US digital circular economy market size is expected to reach a value of USD 5,103.8 million by 2034 from a base value of USD 674.9 million in 2025 at a CAGR of 25.2%.

- By Offering Segment Analysis: Services are anticipated to dominate the offering segment, capturing 65.0% of the total market share in 2025.

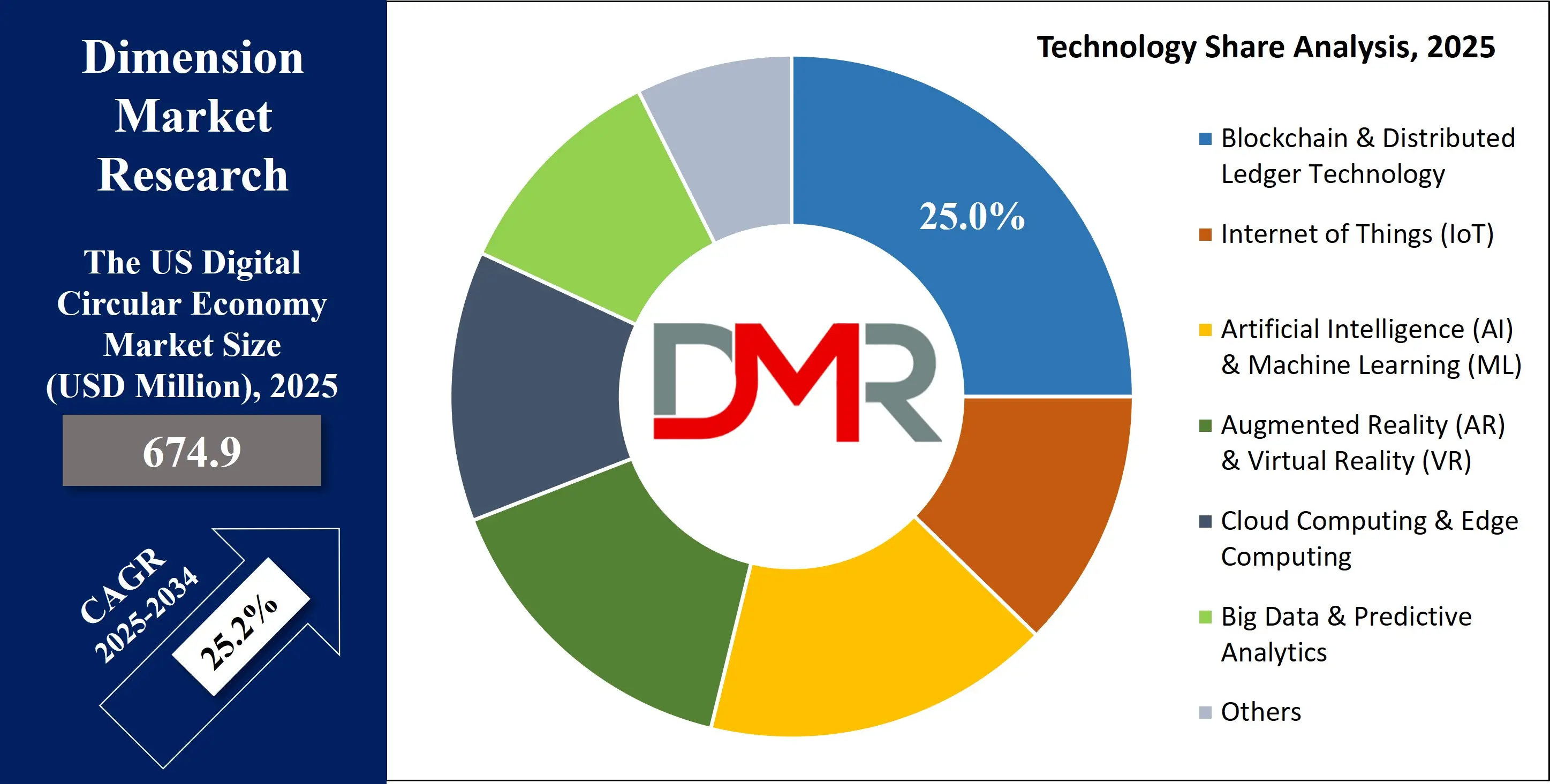

- By Technology Segment Analysis: Blockchain & Distributed Ledger Technology is expected to maintain its dominance in the technology segment, capturing 25.0% of the total market share in 2025.

- By Application Segment Analysis: Supply Chain & Material Tracking applications will dominate the application segment, capturing 20.0% of the market share in 2025.

- By End User Segment Analysis: Consumer Electronics are anticipated to maintain their dominance in the end user segment, capturing 25.0% of the market share in 2025.

- Key Players: Some key players in the US digital circular economy market are IBM, Oracle, Microsoft, Google, Cisco, AWS, Honeywell, Accenture, Rubicon, Rheaply, Envela, CWG, People Power, Samsara, Dell, Procter & Gamble, Unilever, Siemens, and Others.

The US Digital Circular Economy Market: Use Cases

- Digital Asset Tracking and Lifecycle Optimization: US enterprises are increasingly using IoT sensors, cloud dashboards, and AI analytics to track products from manufacturing to end-of-life. This helps organizations optimize asset utilization, extend product lifespan, and enable predictive maintenance. By monitoring real-time performance and failure patterns, companies reduce material waste, improve circular workflows, and support sustainable resource management across large distributed operations.

- Advanced E-waste Recovery and Intelligent Recycling: Digital circular platforms are transforming e-waste processing through automation, smart sorting, and material recognition powered by computer vision. US recyclers use AI-driven systems to identify components, recover valuable materials, and improve recycling efficiency. These intelligent recycling models enhance material recovery rates, reduce landfill loads, and create closed-loop value chains for electronics and IT equipment.

- Digital Marketplaces for Refurbished Products: The rise of online circular marketplaces allows companies and consumers to buy, sell, and repurpose refurbished electronics, machinery, and industrial equipment. These platforms leverage verification algorithms, digital twins, and transparent material tracking to ensure quality and traceability. This boosts reuse, lowers procurement costs, and supports sustainable consumption across the US commercial and consumer landscape.

- Circular Supply Chain Intelligence and Waste Analytics: US manufacturers and retailers are adopting AI-based sustainability software that maps material flows, identifies waste hotspots, and forecasts circular opportunities. These systems integrate data from suppliers, logistics networks, and production lines to improve resource efficiency. With digital waste analytics, companies optimize procurement, reduce carbon footprints, and build resilient circular supply chains aligned with national sustainability goals.

Impact of Artificial Intelligence on the US Digital Circular Economy market

Artificial intelligence is accelerating the shift toward a fully digital circular economy in the US by enabling smarter resource management, automated waste handling, and data-driven sustainability decisions. AI-powered lifecycle analytics help organizations forecast product failures, extend asset life, and reduce material consumption through predictive maintenance and intelligent refurbishment planning. In recycling operations, machine learning models enhance material recognition, automate sorting lines, and significantly improve recovery efficiency for plastics, metals, and e-waste, strengthening closed-loop systems.

AI also supports digital marketplaces by validating refurbished product quality, detecting inconsistencies, and optimizing pricing based on demand patterns, making reuse and resale more reliable for businesses and consumers. In supply chains, AI-driven optimization tools map resource flows, identify inefficiencies, and simulate circular pathways using digital twins, allowing companies to minimize waste and lower carbon footprints. Overall, artificial intelligence acts as the core enabler of circular value creation by transforming raw data into actionable sustainability insights, accelerating adoption of circular practices across manufacturing, electronics, retail, and industrial ecosystems in the US.

The US Digital Circular Economy Market: Stats & Facts

-

U.S. Environmental Protection Agency (EPA) – Two-Year Anniversary Report, BIL / SWIFR

- The Solid Waste Infrastructure for Recycling (SWIFR) program under the Bipartisan Infrastructure Law provides USD350 million to modernize U.S. recycling and solid-waste systems.

- The Bipartisan Infrastructure Law allocates USD 10 million to support development of safe battery-collection practices to increase battery recycling.

- The law also provides USD 15 million to create voluntary battery labeling guidelines that support circular-economy implementation.

- Over two years, EPA has awarded over USD105 million in grants to expand recycling infrastructure, improve material recovery, and strengthen community circular-economy projects.

-

U.S. EPA – Recycling Infrastructure Assessment / State Data Reports

- EPA estimates the U.S. needs USD 36.5 to 43.4 billion in recycling-infrastructure investment by 2030 to modernize material recovery facilities, composting systems, and waste-processing operations.

- With this investment, the U.S. could recover 82 to 89 million additional tons of packaging and organic waste annually.

- This gain represents a 91 percent increase over existing material-recovery levels.

The US Digital Circular Economy Market: Market Dynamics

The US Digital Circular Economy Market: Driving Factors

Rising adoption of digital sustainability platforms

US enterprises are rapidly integrating digital sustainability software, IoT sensors, and AI lifecycle tools to streamline resource use and reduce operational waste. Growing pressure to improve material efficiency, meet ESG commitments, and transition to data-driven circular models is pushing companies to adopt advanced digital circular solutions across manufacturing, electronics, and retail sectors.

Increasing regulatory focus on e-waste and material recovery

Federal and state-level initiatives supporting responsible recycling, product take-back mandates, and improved waste tracking systems are boosting demand for digital circular technologies. Regulations encouraging transparent material flows, automated waste reporting, and enhanced recovery processes accelerate the adoption of intelligent recycling and digital asset management platforms.

The US Digital Circular Economy Market: Restraints

High implementation costs for digital transformation

Deploying IoT sensors, AI-driven recycling systems, and cloud-based circular platforms requires significant upfront investment, making it difficult for small and mid-sized organizations to adopt these solutions. Cost challenges related to integration, workforce training, and legacy system upgrades limit wider market penetration.

Lack of standardized data frameworks across industries

Circular operations rely heavily on accurate, unified data about product lifecycle, material composition, and waste flows. Variations in digital infrastructure, incompatible systems, and limited interoperability reduce the effectiveness of circular analytics and create barriers to scaling digital circular ecosystems in the US.

The US Digital Circular Economy Market: Opportunities

Expansion of digital marketplaces for refurbished products

The growing demand for refurbished electronics, industrial machinery, and consumer goods is creating strong opportunities for AI-verified resale platforms and digital material exchanges. These marketplaces support reuse, improve asset value recovery, and foster sustainable consumption trends across the US commercial sector.

Growth in AI-driven waste analytics and intelligent recycling

Advancements in computer vision, robotics, and machine learning enable smarter material identification and automated sorting. This opens opportunities for recyclers and municipal systems to improve recovery rates, enhance operational efficiency, and reduce landfill dependency using advanced digital circular tools.

The US Digital Circular Economy Market: Trends

Integration of digital twins for material flow optimization

US companies are increasingly implementing digital twin models to simulate resource cycles, identify waste hotspots, and optimize product lifecycles. This trend supports real-time monitoring, predictive resource planning, and more efficient circular supply chain operations.

Rise of carbon accounting and circular reporting software

Demand for accurate sustainability insights is driving adoption of carbon footprint tracking tools, circular performance dashboards, and automated reporting platforms. Businesses are using these solutions to meet ESG disclosure requirements, improve transparency, and align with circular economy targets using reliable data intelligence.

The US Digital Circular Economy Market: Research Scope and Analysis

By Offering Analysis

Services are expected to hold the largest share of the US digital circular economy market, accounting for nearly 65.0% of total revenue in 2025. This dominance is driven by the rising demand for consulting, integration support, digital sustainability strategy development, and advanced lifecycle management services. Companies increasingly rely on specialized service providers to deploy IoT-enabled tracking systems, implement AI-powered waste analytics, optimize material recovery workflows, and build digital circular roadmaps tailored to industry-specific needs.

As organizations shift from linear to circular operational models, service-led offerings become essential for system training, data migration, process redesign, and continuous performance optimization. This strong dependence on expertise accelerates the adoption of digital circular solutions while helping enterprises reduce waste, improve resource efficiency, and meet compliance requirements.

Software in this market is also gaining rapid traction as AI-driven platforms, cloud-based dashboards, and circular management applications enable smart resource planning and real-time waste monitoring. These tools provide predictive insights, automate material tracking, support digital twin simulations, and help businesses manage refurbished inventory or recycling operations efficiently.

Software solutions enhance transparency across supply chains, enable carbon accounting, and streamline reporting for sustainability goals. As data becomes central to circular operations, the software segment continues to play a critical role by offering scalable, analytical, and automation-driven capabilities that complement the services ecosystem and support long-term digital circular transformation.

By Technology Analysis

Blockchain and distributed ledger technology is expected to lead the technology segment with a 25.0% share in 2025, primarily due to its strong ability to provide transparency, traceability, and trust across circular value chains. In the US digital circular economy, blockchain supports accurate tracking of material flows, verifies product origins, enables tamper-proof recycling records, and strengthens accountability in refurbishment and reverse logistics systems.

Industries such as electronics, manufacturing, and retail increasingly depend on decentralized ledgers to ensure authenticity, manage digital product passports, and validate sustainability claims with immutable data. This technology also helps streamline multi-stakeholder collaboration, reduces fraud in refurbished marketplaces, and enhances compliance with evolving environmental regulations, making it a central pillar of the digital circular infrastructure.

Internet of Things technologies also play a crucial role in this market by enabling real-time monitoring of products, assets, and waste streams across their lifecycle. IoT sensors embedded in equipment, packaging, and recycling units generate continuous data on usage patterns, condition, and end-of-life status, supporting predictive maintenance and resource optimization.

These connected devices improve material recovery processes, enhance efficiency in waste sorting systems, and help organizations reduce operational inefficiencies through data-driven insights. IoT-powered visibility allows businesses to track refurbishable goods, monitor carbon footprints, and automate circular workflows, making it a foundational technology that drives smarter, faster, and more sustainable decision-making within the US digital circular ecosystem.

By Application Analysis

Supply chain and material tracking is set to lead the application segment with a 20.0% share in 2025, driven by the surge in demand for real-time visibility, transparent material flows, and traceability across circular operations. US manufacturers, logistics providers, and recycling companies increasingly rely on digital tracking systems, RFID tags, blockchain records, and cloud-based dashboards to follow products from production to end-of-life. These applications support better inventory recovery, enhance accountability in reverse logistics, and reduce waste by identifying materials suitable for reuse or refurbishment. With growing emphasis on ESG reporting, digital product passports, and closed-loop supply chains, material tracking tools are becoming essential for ensuring authenticity, improving compliance, and enabling data-driven circular strategies.

Resource optimization and efficiency applications are also gaining strong momentum as businesses focus on minimizing material consumption, reducing operational waste, and improving energy efficiency through digital tools. AI-driven analytics, IoT-enabled monitoring, and predictive maintenance systems help organizations identify inefficiencies, extend asset lifespan, and optimize resource allocation across industrial and commercial environments. These applications support circular workflows by lowering inputs, reducing downtime, and improving recovery value from existing assets. As sustainability targets become more stringent, resource efficiency platforms play a key role in helping companies achieve measurable improvements in circular performance and long-term operational resilience.

By End User Analysis

Consumer electronics are expected to lead the end-user segment with a 25.0% share in 2025 due to the high volume of devices entering the market, shorter product lifecycles, and growing e-waste generation in the US. The sector increasingly depends on digital circular solutions to manage take-back programs, enable intelligent recycling, and support large-scale refurbishment of smartphones, laptops, wearables, and home electronics. Digital product passports, AI-driven grading tools, and blockchain-enabled material tracking are helping brands improve transparency and maximize recovery value from used devices. With rising consumer interest in refurbished electronics and stricter e-waste regulations, manufacturers and retailers are adopting advanced platforms to streamline reverse logistics, enhance component recovery, and reduce environmental impact across the entire product lifecycle.

Information technology and telecom companies are also becoming major adopters of digital circular technologies as they manage extensive hardware infrastructure, data center equipment, and networking systems. These organizations rely on IoT monitoring, asset lifecycle analytics, and automated recycling solutions to optimize equipment utilization, reduce electronic waste, and extend the life of high-value components. The sector increasingly uses AI-enabled diagnostics for device refurbishment, digital marketplaces for reselling used equipment, and cloud-based platforms to track material flows. With growing pressure to meet sustainability targets and manage large volumes of obsolete hardware, IT and telecom firms are leveraging digital circular strategies to enhance resource efficiency, lower operational costs, and support eco-friendly technology ecosystems.

The US Digital Circular Economy Market Report is segmented on the basis of the following

By Offering

- Circularity Analytics Platforms

- Digital Twin Platforms

- Lifecycle Assessment Software

- Circular Supply Chain Management Software

- Consulting & Implementation

- Integration & Deployment

- Support & Maintenance

- Training & Education

By Technology

- Blockchain & Distributed Ledger Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Augmented Reality (AR) & Virtual Reality (VR)

- Cloud Computing & Edge Computing

- Big Data & Predictive Analytics

- Others

By Application

- Supply Chain & Material Tracking

- Resource Optimization & Efficiency

- Digital Resale & Reuse

- Reverse Logistics & Remanufacturing

- Circular Economy Reporting & Compliance

- Circular Waste Management & Recycling

- Smart Material Selection & Testing

- Others

By End User

- Consumer Electronics

- Information Technology & Telecom

- Automotive & Transportation

- Industrial Manufacturing

- Construction & Building Materials

- Retail & E-Commerce

- Others

The US Digital Circular Economy Market: Competitive Landscape

The US digital circular economy market features a diverse and rapidly evolving competitive landscape driven by technology innovators, sustainability platforms, and circular service providers. The space includes major tech companies offering AI, IoT, and cloud-based circular solutions alongside specialized players focused on digital asset management, intelligent recycling, refurbished goods marketplaces, and material tracking systems. Established enterprises are expanding their circular capabilities through advanced analytics, digital product passports, and lifecycle optimization tools, while emerging startups are introducing niche platforms for reuse, repair, and reverse logistics automation.

Competition is intensifying as companies prioritize transparent supply chains, regulatory compliance, and waste reduction initiatives, leading to strategic partnerships, platform integrations, and investments in advanced digital infrastructure that strengthen circular value creation across US industries.

.webp)

Some of the prominent players in the US Digital Circular Economy market are

- IBM

- Oracle

- Microsoft

- Alphabet / Google

- Cisco Systems

- Amazon Web Services (AWS)

- Honeywell

- Accenture

- Rubicon Technologies

- Rheaply

- Envela Corporation

- CWG (Communications Wireless Group)

- People Power Company

- Samsara

- Dell Technologies

- Procter & Gamble

- Unilever

- Siemens (Siemens-Advanta)

- Landbell Group

- Anthesis Group

- Other Key Players

The US Digital Circular Economy Market: Recent Developments

- October 2025: Redwood Materials announced a significant USD 350 million funding round led by Eclipse Ventures with participation from Nvidia’s NVentures to scale its advanced battery recycling operations and expand recovery of lithium, nickel, cobalt, and copper for circular energy systems.

- October 2025: Redwood Materials launched its new Redwood Energy division focused on repurposing used EV batteries into large-scale energy storage units designed to support AI data centers and stabilize the US power grid.

- April 2025: Refiberd secured USD 300,000 from eBay Ventures through the CFDA x eBay Circular Fashion Fund after demonstrating innovation in AI-powered textile identification and fiber-sorting technology for circular fashion applications.

- April 2025: Dell introduced modular commercial laptops developed using recycled cobalt and low-emission aluminum, strengthening its circular design portfolio through improved repairability, component reusability, and sustainable material integration.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 674.9 Mn |

| Forecast Value (2034) |

USD 5,103.8 Mn |

| CAGR (2025–2034) |

25.2% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Software, Services), By Technology (Blockchain & Distributed Ledger Technology, Internet of Things (IoT), Artificial Intelligence (AI) & Machine Learning (ML), Augmented Reality (AR) & Virtual Reality (VR), Cloud Computing & Edge Computing, Big Data & Predictive Analytics, Others), By Application (Supply Chain & Material Tracking, Resource Optimization & Efficiency, Digital Resale & Reuse, Reverse Logistics & Remanufacturing, Circular Economy Reporting & Compliance, Circular Waste Management & Recycling, Smart Material Selection & Testing, Others), and By End User (Consumer Electronics, Information Technology & Telecom, Automotive & Transportation, Industrial Manufacturing, Construction & Building Materials, Retail & E-Commerce, Others) |

| Regional Coverage |

The US |

| Prominent Players |

Prominent Players IBM, Oracle, Microsoft, Google, Cisco, AWS, Honeywell, Accenture, Rubicon, Rheaply, Envela, CWG, People Power, Samsara, Dell, Procter & Gamble, Unilever, Siemens, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Digital Circular Economy market is projected to be valued at USD 674.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5,103.8 million in 2034 at a CAGR of 25.2%.

Some of the major key players in the US digital circular economy market are IBM, Oracle, Microsoft, Google, Cisco, AWS, Honeywell, Accenture, Rubicon, Rheaply, Envela, CWG, People Power, Samsara, Dell, Procter & Gamble, Unilever, Siemens, and Others.