Market Overview

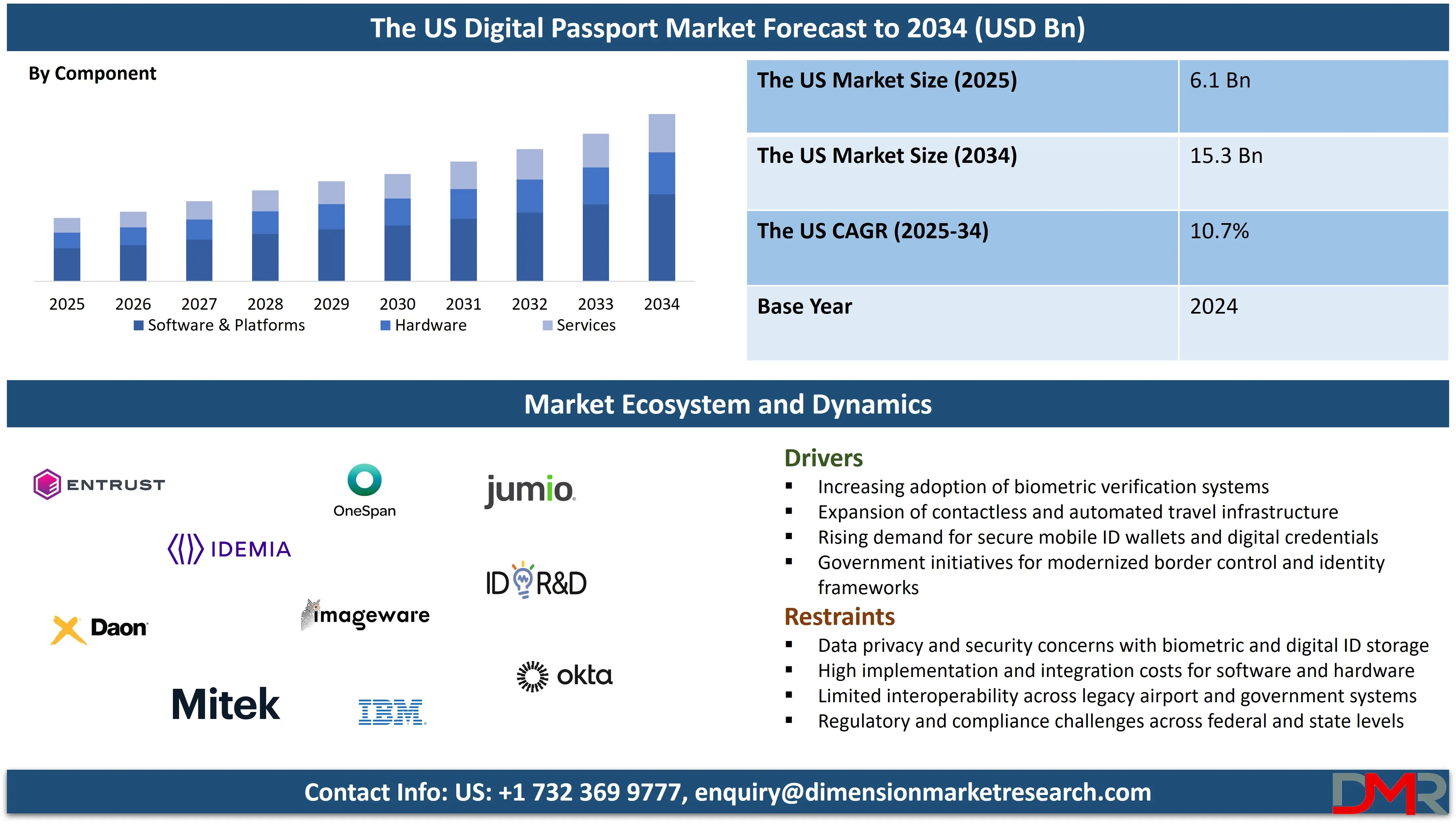

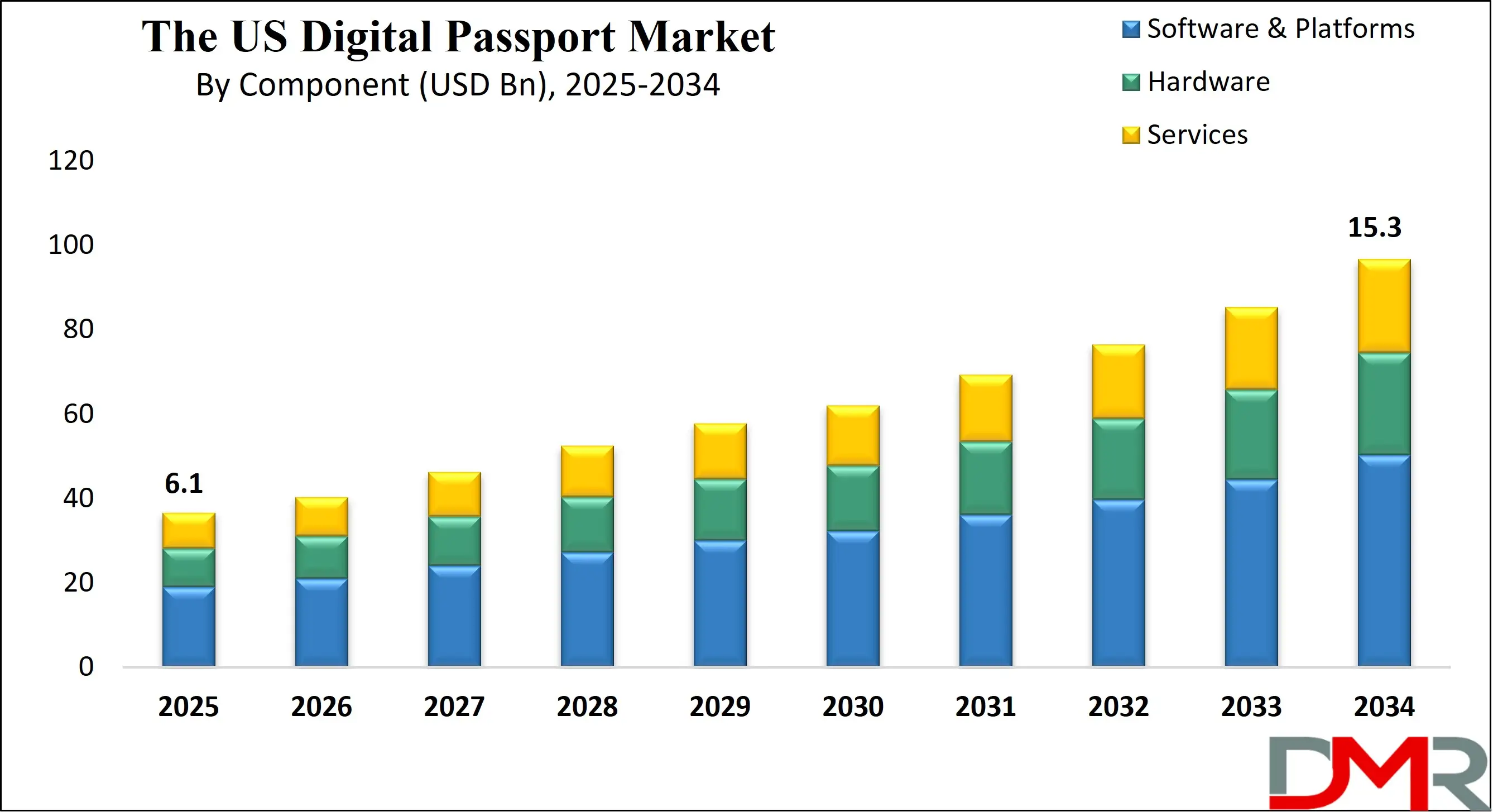

The U.S. digital passport market is projected to reach USD 6.1 billion by 2025 and expand to USD 15.3 billion by 2034, reflecting a robust CAGR of 10.7%. This growth highlights rising demand for secure digital travel credentials, biometric identity verification, mobile ID adoption, and advanced e-passport technologies supporting streamlined border control and enhanced traveler authentication.

A digital passport is an electronically enabled identity document that uses secure digital credentials, biometric verification, and encrypted data to authenticate a traveler on physical and digital platforms. It functions as a modern extension of traditional passports by storing identity information in a digital format accessible through secure apps, mobile wallets, and machine-readable systems. This allows border authorities, airlines, and government agencies to validate identity with advanced technologies such as facial recognition, NFC-based e-passport chips, and cloud-backed authentication systems. By reducing manual checks and improving fraud resistance, digital passports streamline travel processes while enhancing national security, data integrity, and convenience for global travelers.

The US digital passport market refers to the ecosystem of technologies, platforms, and solutions enabling the country to transition toward secure digital travel credentials and next-generation identity verification. This market includes biometric software providers, digital identity platforms, cryptographic security vendors, e-passport chip manufacturers, and mobile identity wallet developers working to modernize passport issuance and border management. Growth in this space is supported by the increasing demand for contactless verification, enhanced airport automation, strong cybersecurity frameworks, and compliance with international travel standards.

The US digital passport market is evolving as government agencies and private enterprises collaborate to build reliable digital trust frameworks, streamline immigration workflows, and integrate real time identity authentication across airports and travel touchpoints. Expansion is also driven by rising adoption of mobile ID solutions, increased concerns around identity fraud, and the need for interoperable digital travel credentials that align with global aviation and border security guidelines. This creates opportunities for technology companies offering biometric authentication, digital onboarding, cloud based identity management, and secure document processing tailored to the future of cross border mobility.

The US Digital Passport Market: Key Takeaways

- Market Value: The US Digital Passport market size is expected to reach a value of USD 15.3 billion by 2034 from a base value of USD 6.1 billion in 2025 at a CAGR of 10.7%.

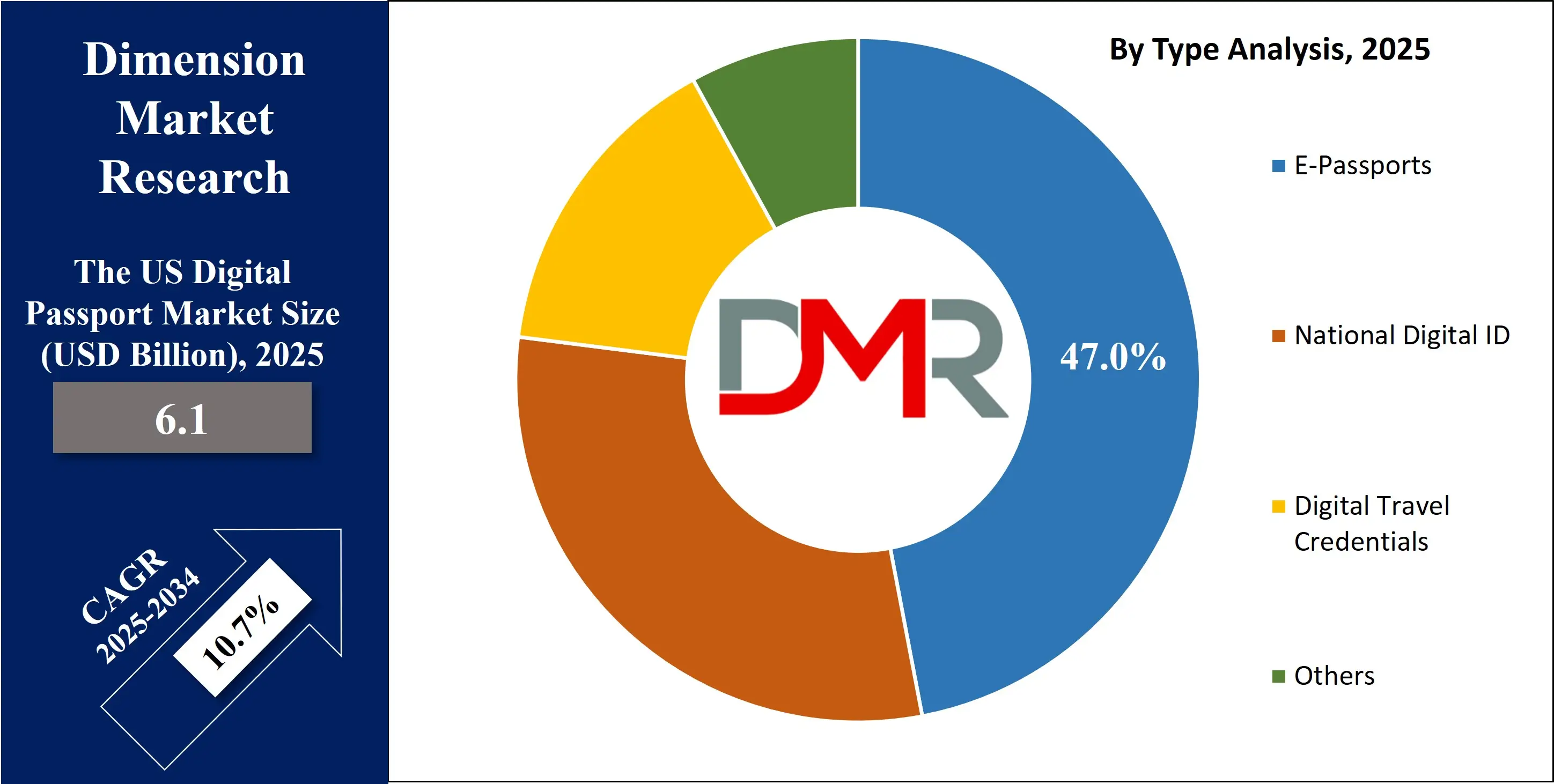

- By Type Segment Analysis: E-Passports are expected to maintain their dominance in the type segment, capturing 47.0% of the total market share in 2025.

- By Component Segment Analysis: Software & Platforms are anticipated to dominate the component segment, capturing 52.0% of the total market share in 2025.

- By Technology Segment Analysis: Biometrics will dominate the technology segment, capturing 42.0% of the market share in 2025.

- By Deployment Model Segment Analysis: Cloud-based deployment will account for the maximum share in the deployment model segment, capturing 64.0% of the total market value.

- By Application Segment Analysis: Border Control & Immigration will dominate the application segment, capturing 45.0% of the market share in 2025.

- By End User Segment Analysis: Government Agencies will capture the maximum share in the end user segment, capturing 68.0% of the market share in 2025.

- Key Players: Some key players in the US Digital Passport market are Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others.

The US Digital Passport Market: Use Cases

- Border Control Modernization: Digital passports support faster and more secure border processing by enabling automated identity checks, biometric authentication, and NFC based e-passport validation. U.S. agencies use these systems to reduce manual verification, lower congestion at entry points, and strengthen national security through real time traveler screening and digital identity verification.

- Airport Self Service Ecosystem: Airports across the U.S. leverage digital passport solutions to power self service kiosks, automated gates, and touchless boarding systems. These platforms use facial recognition, mobile ID wallets, and encrypted traveler credentials to streamline passenger flow, enhance user experience, and minimize wait times during check in and departures.

- Government Digital Identity Integration: Government programs increasingly adopt digital passports to connect with broader digital identity frameworks. These systems link verified credentials with public services, secure authentication portals, and high assurance identity management platforms, enabling safer citizen onboarding and improved compliance across federal travel and immigration processes.

- Airline and Travel Industry Automation: Airlines and travel service providers use digital passport technologies to automate identity validation, reduce fraud risk, and support seamless travel journeys. With biometric verification, cloud based credentialing, and mobile travel credentials, carriers can accelerate check ins, improve operational efficiency, and enhance digital trust across the travel ecosystem.

Impact of Artificial Intelligence on the US Digital Passport market

Artificial intelligence is reshaping the US digital passport market by accelerating identity verification, strengthening security, and enabling fully automated travel journeys. AI driven biometric recognition such as facial matching, liveness detection, and behavior analytics significantly improves the accuracy and speed of digital identity verification, reducing reliance on manual checks at border control points. Machine learning algorithms help detect forged documents, synthetic identities, and identity fraud attempts in real time, supporting stronger cybersecurity and compliance with national security frameworks.

AI also enhances passenger processing in airports through predictive analytics, automated risk assessment, and intelligent workflow optimization, enabling faster check ins, touchless boarding, and smoother immigration clearance. Integration of AI with mobile ID wallets and digital travel credentials supports seamless authentication across the travel ecosystem and improves user experience. As U.S. agencies and airlines continue adopting AI powered identity solutions, the digital passport market is set to advance toward more secure, interoperable, and frictionless travel operations.

The US Digital Passport Market: Stats & Facts

-

Department of Homeland Security (DHS) / CBP / TSA

- In the FY 2024 Annual Performance Report, TSA PreCheck’s Touchless Identity Solution (TIS) using facial comparison is being expanded.

- According to the 2024 DHS update, face‑detection algorithms for TSA’s Travel Document Checker portals showed accuracy between 88%–97%, varying by demographic parameters.

- Per the “Implementation of DHS Directive 026‑11” report, CBP’s Traveler Verification Service (TVS) does not permanently store U.S. citizens’ face photos; photos are deleted within 12 hours, while non‑citizen photos are deleted within 14 days.

- As of FY 2024, TSA had deployed 1,065 AIT (Advanced Imaging Technology) units with biometric facial recognition technology across U.S. security checkpoints.

- According to the FY 2024 Budget in Brief, CBP’s Office of Field Operations (OFO) used biometric facial comparison at 205 airports, including Preclearance and seaports.

- The DHS AI Use Case Inventory (2024) states that CBP’s TVS Biometric Air Exit solution is a cloud-based facial matching service used by CBP and external partners.

- GSA’s FY 2024 Annual Performance Report reports 72 million active users on Login.gov by end of FY 2024.

- In the same report, 3.3 million Login.gov users had completed identity verification (IAL2 level) by FY 2024.

- By FY 2024, the number of Federal agencies and state partners using Login.gov rose to 52.

The US Digital Passport Market: Market Dynamics

The US Digital Passport Market: Driving Factors

Rising demand for secure digital identity verification

Growth is driven by the increasing adoption of biometric authentication, facial recognition systems, and encrypted travel credentials that support secure identity validation. The need to reduce identity fraud, strengthen national security, and enhance airport automation is accelerating the shift toward digital passports and mobile ID ecosystems across the U.S.

Expansion of contactless travel infrastructure

Airports and airlines are rapidly adopting self-service gates, automated boarding, and digital check in systems that rely on AI powered identity matching and NFC e passport technology. This push for frictionless passenger journeys fuels the market’s expansion as digital travel credentials become essential for modernized travel operations.

The US Digital Passport Market: Restraints

Concerns around data privacy and biometric storage

The market faces challenges due to heightened scrutiny over personal data protection, centralized biometric databases, and compliance with evolving privacy regulations. Fear of misuse, unauthorized access, and surveillance risks slows adoption among certain government and commercial entities.

High implementation and integration costs

Deploying digital passport infrastructure requires significant investments in biometric equipment, cloud based authentication systems, secure chips, and cross platform interoperability. Smaller airports and agencies struggle with budget limitations, limiting widespread adoption in the short term.

The US Digital Passport Market: Opportunities

Growing adoption of mobile digital IDs and travel wallets

The rise of smartphone based identity wallets and digital travel credentials opens new opportunities for vendors to deliver secure, interoperable, and cloud backed identity solutions. This shift enables seamless onboarding, real time verification, and stronger digital trust frameworks across the U.S. travel ecosystem.

Emergence of AI driven border security systems

AI and machine learning create opportunities for next generation risk assessment, predictive analytics, and automated traveler screening. Companies offering intelligent identity verification, liveness detection, and fraud prevention solutions can capture strong growth as the U.S. modernizes border control.

The US Digital Passport Market: Trends

Integration of digital passports with multi factor authentication systems

A key trend is the adoption of hybrid verification models using biometrics, cryptographic keys, and mobile identity credentials. These advanced authentication frameworks support secure travel journeys and align with global digital identity standards.

Shift toward interoperable digital travel credentials

The U.S. market is moving toward globally compatible digital passport formats that support international travel, cross border identity exchange, and secure digital credential sharing. This trend aligns with ICAO digital travel credential standards and the broader push for unified digital identity ecosystems.

The US Digital Passport Market: Research Scope and Analysis

By Type Analysis

E passports are expected to maintain their dominance in the type segment with a projected 47.0% share in 2025 due to their rising adoption across U.S. travel infrastructure, increased deployment of NFC enabled chips, and the growing need for secure biometric verification at border control points. These digitally enhanced passports enable faster machine readable processing, automated identity authentication, and encrypted data handling, making them essential for modern airport systems, e gates, and automated clearance programs. Their strong reliability, global interoperability, and alignment with international travel standards continue to drive widespread acceptance across government and aviation networks.

National Digital ID solutions are also gaining momentum within the U.S. digital identity ecosystem as states and federal bodies move toward secure digital credentials for broader verification needs beyond travel. These IDs integrate seamlessly with mobile identity wallets, biometric verification platforms, and cloud based authentication systems to offer citizens a unified and trusted digital identity. Although they serve a wider purpose than travel, National Digital IDs complement digital passport adoption by enhancing identity assurance across public services, digital government portals, and secure online transactions.

By Component Analysis

Software and platforms are expected to dominate the component segment with a 52.0% share in 2025 because digital passport systems rely heavily on advanced identity management software, biometric matching engines, cloud based authentication platforms, and secure credentialing solutions. These software frameworks power real time identity verification, automate airport workflows, manage encrypted digital credentials, and support integration with government databases. As the U.S. moves toward AI enabled identity validation, mobile ID wallets, and interoperable digital travel credentials, the demand for scalable and secure software ecosystems continues to grow faster than hardware based components.

Hardware remains essential in the U.S. digital passport landscape because it provides the physical infrastructure that enables secure identity capture and verification. This includes e passport chips, biometric scanners, document readers, RFID and NFC enabled devices, border control kiosks, and automated e gates used across airports and immigration checkpoints. Hardware supports real time data capture, high precision biometric enrollment, and reliable communication between digital credentials and verification systems. Although its share is lower compared to software, hardware forms the backbone of operational identity checks and remains critical for enabling contactless processing, secure access control, and efficient traveler authentication.

By Technology Analysis

Biometrics are expected to dominate the technology segment with a 42.0% share in 2025 due to their central role in enhancing identity accuracy, strengthening security, and enabling seamless verification across U.S. travel systems. Biometric modalities such as facial recognition, fingerprint scanning, and iris matching are increasingly integrated into airport e-gates, automated immigration lanes, and mobile ID applications. These technologies significantly reduce identity fraud, accelerate passenger processing, and support AI driven verification workflows. As the U.S. continues adopting automated border control, smart travel corridors, and digital identity frameworks, biometric authentication remains the core technology powering secure and frictionless travel experiences.

RFID and NFC technologies also play a vital role within the digital passport ecosystem by enabling fast and secure contactless data exchange between e-passport chips and verification systems. These technologies ensure that traveler information is read accurately through proximity scanning, supporting smooth identity checks at kiosks, inspection points, and automated gates. RFID and NFC provide strong encryption, high reliability, and low latency, making them essential for touchless authentication and efficient document reading. Their use across U.S. airports and border control systems reinforces the transition toward digital travel credentials and streamlined passenger journeys.

By Deployment Model Analysis

Cloud based deployment will account for the maximum share at 64.0% in 2025 because digital passport systems increasingly rely on scalable, flexible, and secure cloud infrastructures to manage identity verification workflows, biometric processing, and encrypted credential storage. Cloud platforms enable real time data synchronization across airports, border control points, and government databases while supporting AI driven authentication and high volume transaction handling. The ability to integrate mobile ID wallets, streamline updates, reduce hardware dependency, and ensure faster interoperability across agencies makes cloud deployment the preferred model for modernizing digital identity systems in the U.S.

On premises deployment continues to hold relevance in this market, especially for agencies and institutions requiring full control over sensitive identity data and mission critical verification systems. On premises infrastructure is preferred by organizations that prioritize stringent data governance, localized storage, and customized security protocols. It supports high assurance environments where biometric data, e passport information, and authentication logs must be processed within secured internal networks. Although it offers stronger control, on premises deployment involves higher maintenance, limited scalability, and greater operational costs compared to cloud based models, which is why its growth is comparatively slower.

By Application Analysis

Border Control and Immigration will dominate the application segment with a 45.0% share in 2025 because digital passports are primarily designed to enhance identity assurance, automate traveler screening, and strengthen security at U.S. entry and exit points. Advanced biometric verification, AI assisted risk assessment, and NFC based e passport reading systems help reduce wait times, eliminate manual document checks, and improve the accuracy of traveler authentication. Airports and immigration authorities increasingly rely on digital travel credentials to manage high passenger volumes, ensure compliance with global travel standards, and minimize identity fraud. This makes border control the core application where digital passport technologies deliver the greatest operational impact and security value.

Citizen services are also becoming an important application area as digital identity frameworks expand beyond travel to support everyday verification needs. Digital passports and mobile identity credentials integrate with government portals, public service platforms, and secure online authentication systems to allow citizens to access benefits, verify identity remotely, and interact with government agencies more efficiently. These services rely on the same biometric validation and secure credentialing technologies used in travel environments, enabling consistent identity assurance across multiple touchpoints. While not the largest segment, citizen services represent a growing application as the U.S. moves toward broader digital identity adoption.

By End User Analysis

Government agencies will capture the maximum share at 68.0% in 2025 because they are the primary entities responsible for issuing digital passports, managing national identity frameworks, and enforcing border security protocols across the U.S. These agencies rely heavily on biometric authentication systems, digital credential issuance platforms, and secure data management tools to support immigration control, law enforcement checks, and passport lifecycle management. Their need for high assurance identity verification, compliance with global travel standards, and secure interagency data exchange drives large scale investment in digital passport infrastructure. As federal and state bodies expand digital identity initiatives, the government segment remains the central force behind the adoption and modernization of digital passport technologies.

Airports and airlines also represent a key end user segment as they implement digital passport solutions to enhance passenger processing, streamline check in workflows, and reduce congestion at security checkpoints. These stakeholders utilize biometric boarding, automated e gates, mobile ID integration, and RFID enabled document readers to support touchless travel experiences and faster identity validation. With rising passenger volumes and growing demand for efficient travel operations, airports and airlines increasingly depend on digital travel credentials to improve operational efficiency and strengthen security. While their share is smaller compared to government agencies, this segment is rapidly expanding as aviation hubs accelerate their shift toward smart, technology driven travel ecosystems.

The US Digital Passport Market Report is segmented on the basis of the following

By Type

- E-Passports

- National Digital ID

- Digital Travel Credentials

- Others

By Component

- Software & Platforms

- Hardware

- Chips

- Readers

- Biometric Devices

- Integration

- Managed Services

By Technology

- Biometrics

- RFID/NFC

- PKI & Encryption

- Blockchain/DLT

- Others

By Deployment Model

By Application

- Border Control & Immigration

- Citizen Services

- Travel & Tourism

- Law Enforcement & Security

- Others

By End User

- Government Agencies

- Airports & Airlines

- Enterprises

- Others

The US Digital Passport Market: Competitive Landscape

The competitive landscape of the U.S. digital passport market is characterized by intense innovation and rapid technological adoption, with key players focusing on advanced biometric solutions, cloud based identity platforms, and secure mobile credentialing. Companies are increasingly investing in AI powered verification systems, NFC and RFID enabled devices, and interoperable digital identity frameworks to enhance security, streamline border control, and improve traveler experience.

Strategic partnerships with government agencies, technology integrators, and airport authorities are common, aimed at accelerating deployment, ensuring compliance with international standards, and capturing a larger share of the expanding digital travel credential ecosystem. Continuous research and development, along with a focus on scalable and secure solutions, defines the competitive dynamics of this market.

Some of the prominent players in the US Digital Passport market are

- Entrust

- IDEMIA

- Daon

- Mitek Systems

- OneSpan

- ImageWare Systems

- Jumio

- ID R&D

- IBM

- Okta

- Ping Identity

- ForgeRock

- NEC Corporation

- HID Global

- 1Kosmos

- Duo Security (Cisco)

- Transmit Security

- Incode Technologies

- Socure

- ID.me

- Other Key Players

The US Digital Passport Market: Recent Developments

- November 2025: Apple launched a new Digital ID feature allowing U.S. passport holders to store their passport details securely in Apple Wallet and use it for identity verification at over 250 TSA checkpoints for domestic travel.

- September 2025: ID.me raised USD 65 million in Series E funding (along with a larger credit facility) to accelerate deployment of its reusable digital identity platform and expand its government‑grade identity verification services.

- August 2025: The GSA’s Login.gov service began supporting U.S. passports for remote identity proofing, enabling users to submit a scan of their passport biographical page during verification and cross-checking it against State Department records via a privacy-preserving API.

- August 2025: 1Kosmos secured USD 57 million in a Series B funding round led by Forgepoint Capital and Origami’s Oquirrh Ventures to scale its passwordless authentication and identity-first security solutions across enterprise and government sectors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.1 Bn |

| Forecast Value (2034) |

USD 15.3 Bn |

| CAGR (2025–2034) |

10.7% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (E-Passports, National Digital ID, Digital Travel Credentials, Others); By Component (Software & Platforms, Hardware, Services); By Technology (Biometrics, RFID/NFC, PKI & Encryption, Blockchain/DLT, Others); By Deployment Model (Cloud-based, On-Premises); By Application (Border Control & Immigration, Citizen Services, Travel & Tourism, Law Enforcement & Security, Others); By End User (Government Agencies, Airports & Airlines, Enterprises, Others) |

| Regional Coverage |

The US |

| Prominent Players |

Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Digital Passport market size is estimated to have a value of USD 6.1 billion in 2025 and is expected to reach USD 15.3 billion by the end of 2034, with a CAGR of 10.7%.

Some of the major key players in the US Digital Passport market are Entrust, IDEMIA, Daon, Mitek Systems, OneSpan, ImageWare Systems, Jumio, ID R&D, IBM, Okta, Ping Identity, ForgeRock, NEC Corporation, HID Global, 1Kosmos, and others.