Market Overview

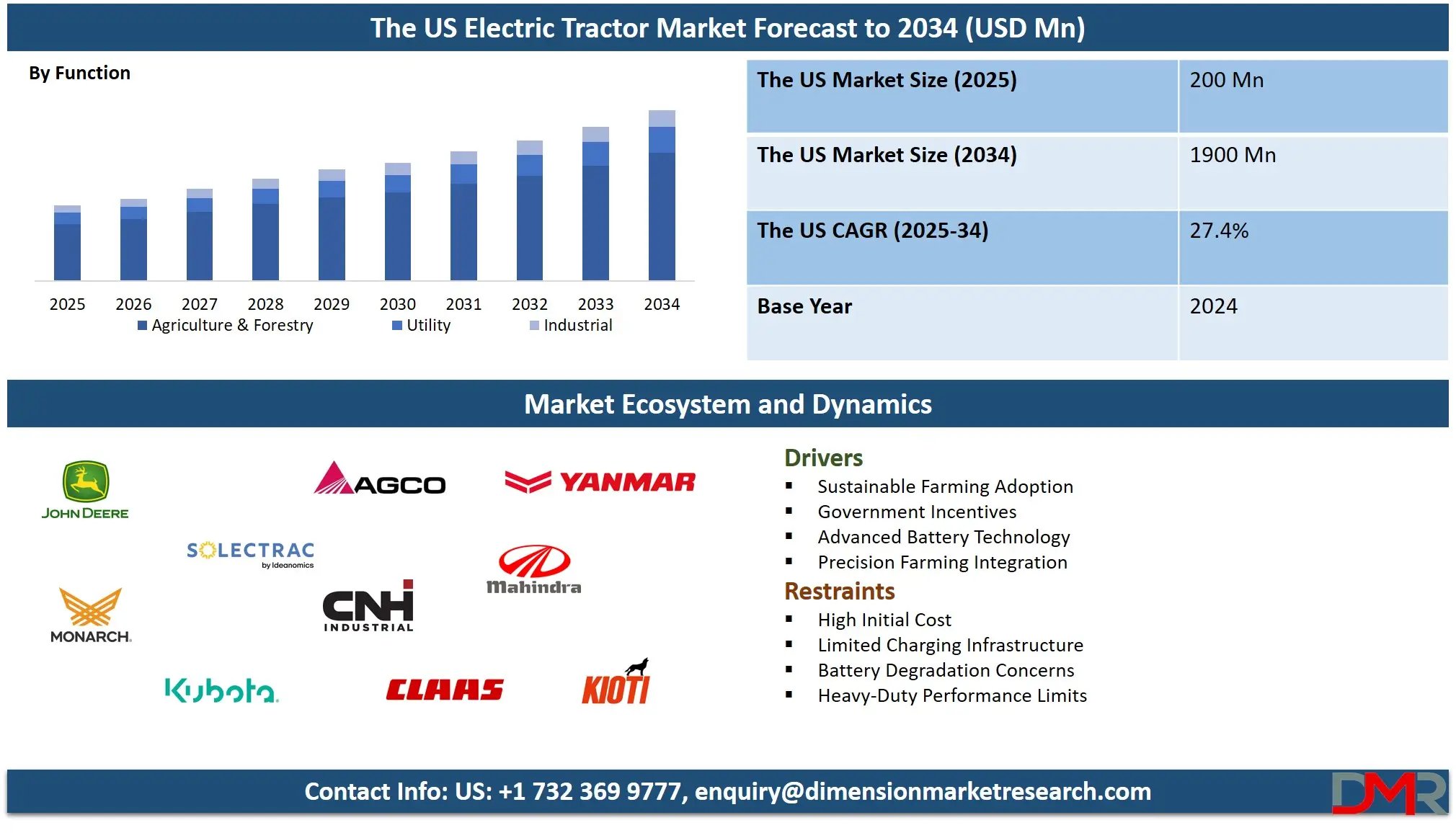

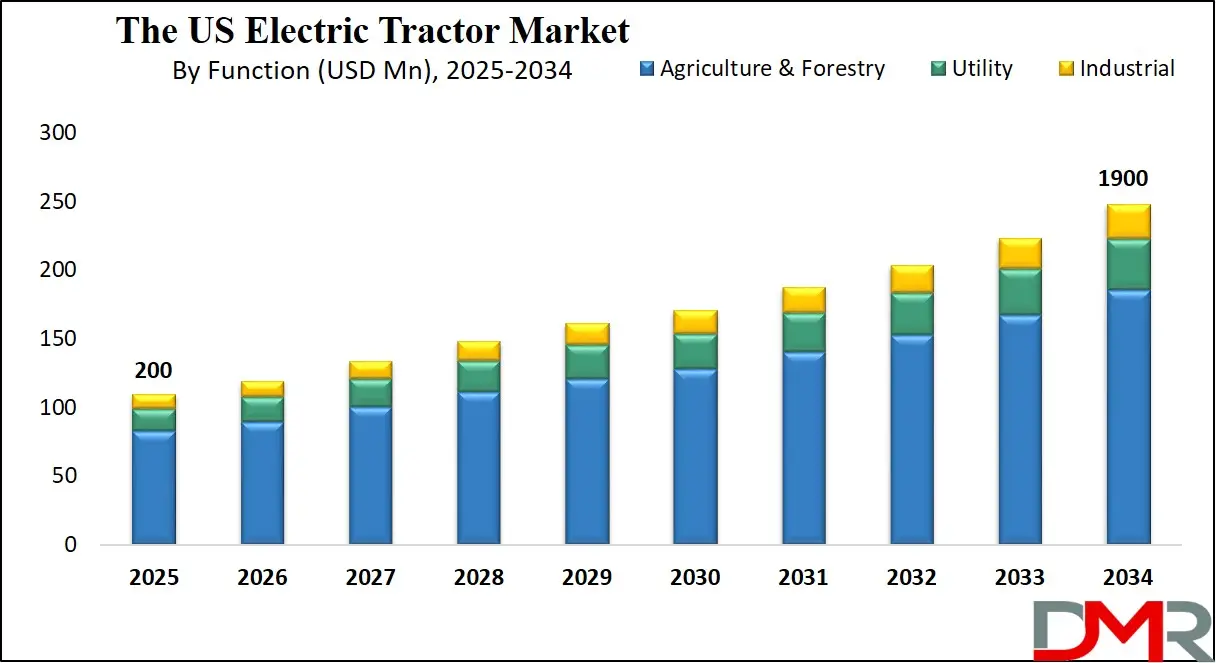

The US electric tractor market is expected to reach nearly USD 200 million in 2025 and is projected to grow significantly to about USD 1900 million by 2034, reflecting a strong CAGR of 27.4%. This rapid expansion highlights the accelerating adoption of battery powered farm machinery, emissions free tractors, and sustainable agriculture technologies across the country.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

An electric tractor is an advanced agricultural vehicle powered entirely by electric motors and onboard battery packs rather than traditional diesel engines, offering farmers a cleaner, quieter, and more efficient alternative for field operations. It uses high-capacity lithium ion or lithium iron phosphate batteries to deliver strong torque for tasks such as plowing, hauling, mowing, or material handling while reducing operational costs through lower maintenance and zero fuel consumption.

Electric tractors also enable precision farming by integrating digital controls, regenerative braking, and smart connectivity features that support automated workflows, remote monitoring, and optimized energy use, making them ideal for sustainable farming practices and eco-friendly cultivation.

The US electric tractor market refers to the growing ecosystem of manufacturers, technology providers, and agriculture users adopting battery powered tractors across farms, horticulture sites, vineyards, government landscaping programs, and commercial agri fleets. This market is shaped by the rapid rise in sustainable agriculture initiatives, government incentives for zero emission equipment, and the shift toward renewable energy powered machinery. Increasing labor shortages, rising diesel prices, and the need for low noise operations in residential or peri urban farming are also pushing farmers to consider electric alternatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In the United States, the electric tractor market is expanding due to strong innovation from domestic players, improvements in battery efficiency, and the integration of autonomous driving systems that improve productivity. The market benefits from advancements in telematics, GPS guidance, lightweight materials, and energy storage technologies that make electric tractors competitive with compact diesel models. With growing adoption in small and mid-sized farms and rising interest in clean energy agriculture solutions, the US electric tractor landscape is moving toward a more sustainable and technologically advanced farming environment.

The US Electric Tractor Market: Key Takeaways

- Market Value: The US electric tractor market size is expected to reach a value of USD 1900 million by 2034 from a base value of USD 200 million in 2025 at a CAGR of 27.4%.

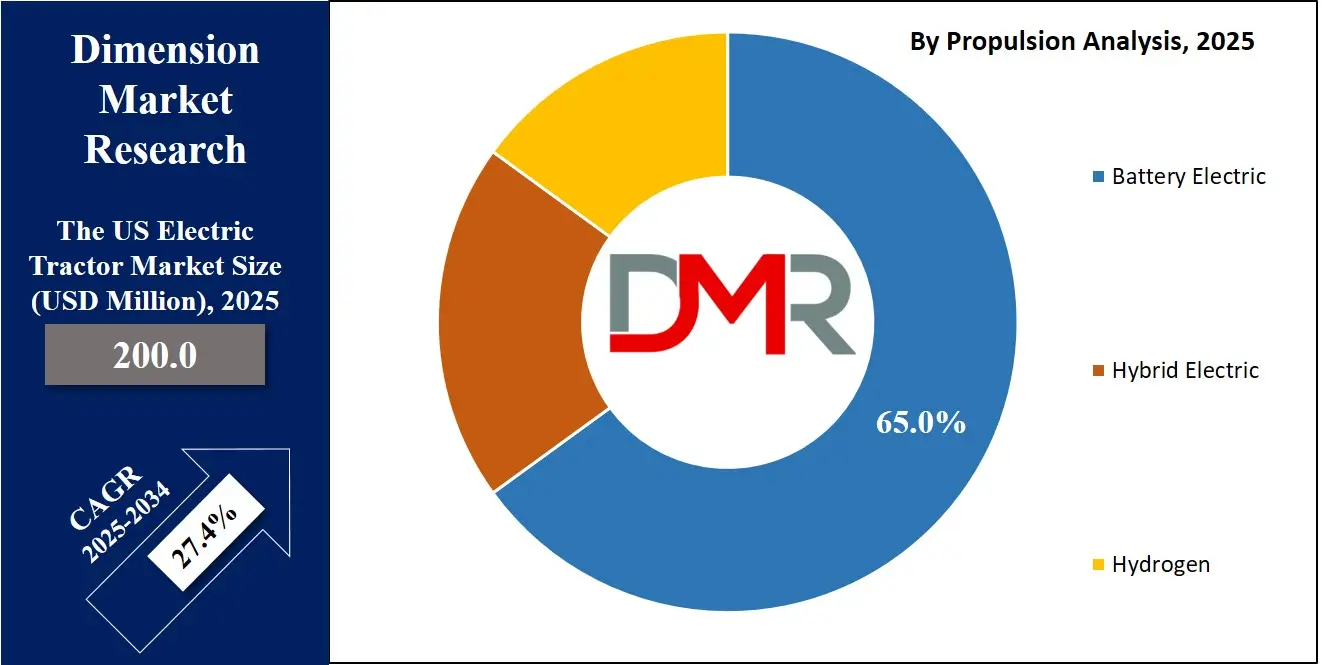

- By Propulsion Segment Analysis: Battery electric is anticipated to dominate the propulsion segment, capturing 65.0% of the total market share in 2025.

- By Battery Chemistry Segment Analysis: Lithium Iron Phosphate (LFP) is expected to maintain its dominance in the battery chemistry segment, capturing 62.0% of the total market share in 2025.

- By Battery Capacity Segment Analysis: Less than 50 kWh will account for the maximum share in the battery capacity segment, capturing 48.0% of the total market value.

- By Power Output Segment Analysis: Less than 50 HP will dominate the power output segment, capturing 55.0% of the market share in 2025.

- By Function Segment Analysis: Agriculture & Forestry functions will dominate the function segment, capturing 75.0% of the market share in 2025.

- By Equipment Type Segment Analysis: Electric Sprayers will capture the maximum share in the equipment type segment, capturing 58.0% of the market share in 2025.

- Key Players: Some key players in the US electric tractor market are John Deere, Solectrac, Monarch Tractor, Kubota, AGCO Corporation, New Holland (CNH Industrial), Fendt (AGCO), Massey Ferguson (AGCO), Yanmar, Ztractor, Escorts Kubota, Mahindra & Mahindra, Claas, Kioti (Daedong), CATL, BYD, and Others.

The US Electric Tractor Market: Use Cases

- Precision Farming and Automated Field Operations: Electric tractors are increasingly used in precision farming applications where low noise, instant torque, and digital connectivity enhance productivity. Farmers deploy electric tractors for automated tilling, row preparation, and GPS-guided field operations that require consistent power and high maneuverability. The integration of sensors, telematics, and smart farming software allows real time monitoring of soil conditions, energy consumption, and operational patterns, helping US farms reduce input costs and adopt data driven agriculture practices.

- Sustainable Orchard and Vineyard Management: Electric tractors are becoming popular in US vineyards and orchards that require clean, quiet, and compact machinery for daily activities. Their zero emission performance allows farm operators to work in confined spaces without fumes, making them ideal for pruning, spraying, mowing, and material handling. Battery powered tractors minimize soil compaction, reduce operational costs, and support eco friendly cultivation, aligning with sustainability certification programs increasingly adopted across California and Washington specialty crop farms.

- Commercial Landscaping and Grounds Maintenance: Municipalities, schools, commercial estates, and government parks are using electric tractors for low noise mowing, hauling, and grounds maintenance operations. Their ability to run quietly in residential zones and public spaces makes them suitable for early morning or evening operations where diesel engines create disturbances. Lower maintenance requirements, reduced operating expenses, and compatibility with electric implements support widespread adoption in the US professional landscaping equipment market.

- Greenhouse and Indoor Farming Applications: Electric tractors are being deployed in greenhouses, controlled environment agriculture sites, and indoor farming facilities where emissions free machinery is essential to protect crops and maintain air quality. Their compact form factor, smooth torque delivery, and precise control enable efficient material handling, bed preparation, and movement of supplies within enclosed spaces. This use case is growing quickly as US farmers shift toward sustainable indoor cultivation and renewable energy powered farm equipment.

Impact of Artificial Intelligence on the US Electric Tractor market

Artificial intelligence is accelerating the evolution of the US electric tractor market by transforming how modern farm equipment operates, communicates, and optimizes energy use. AI enables autonomous driving capabilities, allowing electric tractors to perform repetitive field tasks such as plowing, spraying, and soil preparation with minimal human intervention. Through machine learning models and real time sensor data, electric tractors can analyze crop conditions, adjust power output, and navigate fields with high accuracy, reducing labor dependency and improving productivity for small and large US farms.

AI also enhances battery performance management by predicting charging cycles, monitoring thermal behaviour, and optimizing energy consumption to extend runtime during demanding agricultural operations. Intelligent telematics platforms powered by AI help farmers track machine health, detect faults early, and schedule predictive maintenance, lowering downtime and operational costs. In addition, smart connectivity and AI-based decision systems support precision agriculture practices by generating actionable insights related to soil variability, crop stress, and field efficiency.

The integration of AI further strengthens sustainability goals by automating resource use, minimizing wastage, and enabling emissions free farming aligned with US clean energy targets. As electric tractors evolve into smart, autonomous agricultural machines, AI is becoming a key driver of market competitiveness, influencing OEM innovation, farm automation strategies, and long term adoption across diverse agriculture segments.

The US Electric Tractor Market: Stats & Facts

- U.S. Department of Agriculture / National Agricultural Statistics Service (NASS) — 2023 Irrigation & Water Management Survey (released Oct 2024)

- There were 212,714 farms reporting irrigated acreage in 2023.

- Total irrigated acreage in 2023 was 53.1 million acres.

- Total water applied through irrigation in 2023 was 81 million acre‑feet.

- Of irrigated open‑field cropland acres, 49.6 million acres were harvested in 2023.

- Ground water from on‑farm wells supplied 54% of the irrigation water applied to open‑field acres.

- The average well depth for on‑farm wells used for irrigation in 2023 was 241 feet.

- USDA / NASS — 2022 Census of Agriculture (data released Feb 2024; relevant for 2023–2025 baseline)

- There were about 1.9 million farms and ranches in the U.S. as of the 2022 census.

- The average farm size was 463 acres.

- Total farmland amounted to approximately 880 million acres (about 39% of U.S. land).

- Among those farms, 153,101 used renewable‑energy producing systems in 2022 (up from 133,176 in 2017) — a 15% increase.

- 79% of farms reported having internet access in 2022, up from 75% in 2017.

- United States Environmental Protection Agency (EPA) — 2022 Greenhouse Gas Inventory (released April 2024)

- The agriculture sector (including on‑farm energy use and electricity consumption) accounted for 10.5% of total U.S. greenhouse gas emissions in 2022.

- Total U.S. greenhouse gas emissions in 2022 were 6,343 million metric tons CO₂ equivalent, with net emissions (after land‑use sinks) at 5,489 million metric tons CO₂ equivalent.

The US Electric Tractor Market: Market Dynamics

The US Electric Tractor Market: Driving Factors

Rising Demand for Sustainable and Zero Emission Farm Equipment

The shift toward clean energy agriculture is a major growth driver for the US electric tractor market. Farmers are increasingly adopting battery powered tractors to reduce diesel dependency, lower carbon emissions, and comply with emerging sustainability guidelines. Government incentives, renewable energy programs, and the push for low noise operations in peri urban and greenhouse farming further accelerate demand. Electric tractors offer lower operating costs, reduced maintenance needs, and improved efficiency, making them attractive for small and medium sized farms transitioning to eco friendly machinery.

Advancements in Battery Technology and Energy Storage Systems

Rapid improvements in lithium iron phosphate and lithium nickel manganese cobalt batteries are enhancing the performance and reliability of electric tractors. Longer cycle life, improved thermal stability, and higher energy density enable extended runtimes and better torque output for demanding agricultural activities. The availability of fast charging solutions, regenerative braking systems, and intelligent battery management software is also boosting market adoption as farmers seek high productivity equipment with reliable energy performance.

The US Electric Tractor Market: Restraints

High Initial Investment and Limited Charging Infrastructure

Despite long term cost benefits, the upfront price of electric tractors remains a key barrier for many US farmers. High battery costs and the need for compatible chargers make adoption challenging, especially for small agricultural businesses. The lack of widespread rural charging infrastructure slows down large scale deployment, as many farming communities still rely on traditional fueling networks rather than renewable energy powered charging stations.

Performance Limitations in Heavy Duty and Large Scale Farming

Electric tractors currently face operational limitations in heavy duty applications that require continuous high power output. Large row crop farms and extensive field operations often demand higher horsepower and longer runtimes than existing battery systems can support. Challenges such as battery weight, long charging times, and reduced efficiency during peak loads restrict the use of electric tractors in certain high intensity agricultural segments.

The US Electric Tractor Market: Opportunities

Expansion of Autonomous and AI Enabled Farm Equipment

The integration of artificial intelligence and autonomous technologies presents a major opportunity for market growth. Electric tractors equipped with AI based navigation, precision farming tools, and advanced telematics can enhance productivity and support labor constrained farms. Autonomous electric tractors reduce operational costs, optimize field patterns, and enable real time decision making, opening new growth avenues for equipment manufacturers and technology providers.

Growing Adoption across Specialty Crops and Controlled Environment Agriculture

Electric tractors are gaining traction in vineyards, orchards, greenhouses, and indoor farming facilities where zero emissions, low noise operations, and compact designs are essential. These niche markets offer a high adoption potential as farmers seek sustainable machinery for fruit cultivation, horticulture operations, and premium crop production. Expanding use in specialty farming creates new sales channels and strengthens market penetration across diverse agricultural regions.

The US Electric Tractor Market: Trends

Shift toward Smart Farming and Connected Ecosystems

The US electric tractor market is witnessing a strong trend toward digital connectivity, smart dashboards, and data driven farming tools. Manufacturers are integrating IoT sensors, telematics, GPS guidance, and cloud based monitoring systems that allow farmers to track performance, energy consumption, and machine health in real time. This trend supports precision agriculture and enables more efficient farm management practices.

Development of Modular and Swappable Battery Solutions

To overcome charging and runtime limitations, companies are exploring modular battery packs and swappable energy systems. This trend is driven by the need for longer operational hours, reduced downtime, and greater flexibility in field operations. Modular battery systems allow farmers to replace depleted packs quickly, enabling continuous farm activity and improving the practicality of electric tractors for high duty cycles.

The US Electric Tractor Market: Research Scope and Analysis

By Propulsion Analysis

Battery electric tractors are expected to hold about 65.0% of the total market share in 2025, driven by the rapid shift toward zero-emission agricultural machinery, declining battery costs, and strong adoption across small and mid-sized farms. Their lower maintenance requirements, high energy efficiency, and compatibility with precision farming tools make them more attractive for vineyards, orchards, horticulture farms, and greenhouse operations. Farmers increasingly prefer fully electric propulsion due to quieter performance, reduced fuel expenses, and the availability of incentives that support clean farming equipment. Improved charging solutions, better lithium-ion battery chemistries, and integrated smart controls are also contributing to the strong dominance of battery electric tractors in the US market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hybrid electric tractors hold a smaller but steadily expanding share of this segment, primarily due to their ability to combine electric propulsion with a backup combustion engine for longer runtime and higher power availability. They offer advantages in demanding field operations where continuous power output is essential and charging infrastructure may be limited. Hybrid systems provide flexibility for large farms that need extended operating hours, making them suitable for heavy hauling, deep tillage, and long-duration fieldwork. Although hybrids do not deliver zero-emission performance, they act as a transition technology for farmers who want reduced fuel consumption and lower emissions without fully depending on battery capacity.

By Battery Chemistry Analysis

Lithium Iron Phosphate is expected to command about 62.0% of the battery chemistry segment in 2025 due to its strong safety profile, long cycle life, and stable thermal performance, all of which are essential for agricultural machinery operating in varying field conditions. Farmers prefer LFP batteries because they offer consistent discharge rates, lower risk of overheating, and reduced maintenance needs, making them ideal for compact and mid-sized electric tractors used in vineyards, orchards, and small farms. The lower cost of LFP cells compared to other chemistries also supports wider adoption among budget-conscious buyers, while their ability to handle frequent charging cycles without significant degradation enhances operational reliability. These advantages allow LFP to remain the leading chemistry for electric tractors in the US market.

Lithium Nickel Manganese Cobalt Oxide occupies a smaller but meaningful share of this segment, primarily due to its higher energy density and superior power output, which make it suitable for more demanding farm applications. LI-NMC batteries are often used in mid-duty and advanced electric tractor models that require longer runtime, higher torque, and greater efficiency during intensive fieldwork. Although LI-NMC batteries tend to be more expensive and have relatively lower thermal stability than LFP, their performance advantages support adoption in commercial farms that prioritize productivity and extended operational hours. As manufacturers continue improving cell chemistry and battery management systems, LI-NMC remains an important option for farmers seeking premium electric tractor capabilities.

By Battery Capacity Analysis

Less than 50 kWh is projected to account for around 48.0% of the total market value because most electric tractors currently adopted in the US fall into the compact and utility class category, which requires moderate battery capacity for short to medium daily operations. These tractors are widely used in vineyards, orchards, horticulture farms, landscaping activities, and greenhouse applications where operators typically work within limited acreage and prefer lightweight machines that are easy to charge. The lower cost of small-capacity battery packs also makes these models more affordable for small and mid-sized farms, supporting strong adoption. Their quick-charging capability, reduced operating expenses, and suitability for low horsepower tractors further contribute to the dominance of this capacity segment in the overall market.

The 51 to 100 kWh segment holds a significant and steadily growing share because it supports electric tractors designed for more intensive farm applications requiring longer runtime and higher power output. Farmers managing larger fields or mixed-crop operations prefer this capacity range as it offers extended energy availability for tasks such as soil preparation, plowing, mowing, and hauling. Tractors equipped with 51 to 100 kWh batteries deliver better performance for mid-duty agricultural workloads while maintaining reasonable charging times and operational cost advantages. This segment is gaining traction among commercial farms transitioning to cleaner machinery but still needing strong torque and durability for multi-hour operations, making it an important contributor to overall market expansion.

By Power Output Analysis

Tractors with less than 50 HP are expected to dominate the power output segment with around 55.0% market share in 2025, as most US electric tractors currently cater to small and medium-sized farms, vineyards, orchards, and greenhouse operations. These compact models are preferred for their maneuverability, lower energy consumption, and suitability for tasks such as mowing, spraying, light plowing, and material handling. The lower horsepower reduces battery strain, extends operational hours, and allows for smaller, more affordable battery packs, making these tractors cost-effective for farmers transitioning to sustainable, emissions-free equipment. Their ease of use and compatibility with precision farming tools further support their widespread adoption in diverse agricultural applications.

Tractors in the 51 to 100 HP range hold a substantial share due to their ability to handle more demanding farm operations while still benefiting from electric propulsion. This segment is suitable for mid-sized farms and commercial agricultural setups that require higher torque and longer working hours for plowing, tilling, and hauling heavier loads. While these tractors consume more energy than sub-50 HP models, they provide a balance between performance and efficiency, making them ideal for farmers seeking a reliable electric alternative for moderately intensive operations. Their growing adoption reflects the market’s gradual shift toward higher power electric machinery capable of meeting diverse field requirements.

By Function Analysis

Agriculture and forestry functions are expected to dominate the function segment with around 75.0% market share in 2025, as electric tractors are primarily designed to support crop cultivation, soil preparation, planting, and timber handling operations across US farms and forested areas. These tractors offer benefits such as zero emissions, low noise, and precise power delivery, which are essential for maintaining soil health, reducing environmental impact, and ensuring safe operation in sensitive agricultural and forestry environments. The integration of smart farming technologies, GPS guidance, and automated implements further enhances efficiency and productivity, making electric tractors highly suitable for traditional and modern farming practices.

Utility functions hold a smaller but growing share in the market, serving applications such as municipal maintenance, landscaping, material hauling, and grounds keeping in residential and commercial spaces. Electric tractors in this category are valued for their compact size, maneuverability, and quiet operation, making them ideal for work in confined areas or near residential zones where noise and emissions are a concern. While utility tractors do not require high horsepower or long battery runtime compared to agriculture-focused models, they benefit from the same low-maintenance, energy-efficient advantages, supporting broader adoption in non-farm sectors.

By Equipment Type Analysis

Electric sprayers are expected to capture the largest share of the equipment type segment, around 58.0% in 2025, as they are widely used in vineyards, orchards, horticulture farms, and greenhouse operations across the US. These machines provide precise chemical application, reduce labor requirements, and minimize environmental impact through controlled spraying, making them highly suitable for sustainable farming practices. The quiet operation, zero emissions, and compatibility with compact electric tractors further enhance their adoption, especially in sensitive crop areas and regions with strict environmental regulations. Their efficiency, ease of use, and integration with precision agriculture technologies contribute to their dominance in the equipment type segment.

Electric weeders hold a smaller but steadily increasing share as farmers adopt them for automated weed control in specialty crops and small to mid-sized farms. These machines help reduce manual labor, lower herbicide usage, and improve crop yields by targeting weeds precisely without damaging plants. While their adoption is currently limited by higher initial investment and specialized operational requirements, ongoing improvements in battery capacity, autonomous navigation, and lightweight design are expanding their practicality. As a result, electric weeders are gradually gaining traction in the US electric tractor market, complementing other sustainable farming equipment.

The US Electric Tractor Market Report is segmented on the basis of the following:

By Propulsion

- Battery Electric

- Hybrid Electric

- Hydrogen

By Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (LI-NMC)

- Others

By Battery Capacity

- Less than 50 KWH

- 51 to 100 KWH

- More than 100 KWH

By Power Output

- Less than 50 HP

- 51 to 100 HP

- More than 100 HP

By Function

- Agriculture & Forestry

- Utility

- Industrial

By Equipment Type

- Electric Sprayers

- Electric Weeders

The US Electric Tractor Market: Competitive Landscape

The US electric tractor market features a highly competitive landscape driven by innovation in battery technology, autonomous capabilities, and precision farming solutions. Key players focus on developing energy-efficient, zero-emission tractors with advanced telematics, smart connectivity, and modular battery systems to meet diverse farm requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Competition is fueled by the need for longer runtime, higher torque output, and compact designs suitable for vineyards, orchards, greenhouses, and utility operations. Companies are investing in research and development to enhance performance, reduce costs, and introduce AI-enabled autonomous tractors, while also forming strategic partnerships to expand market reach, strengthen service networks, and accelerate adoption across small, medium, and commercial farms in the United States.

Some of the prominent players in the US Electric Tractor market are:

- John Deere

- Solectrac

- Monarch Tractor

- Kubota

- AGCO Corporation

- New Holland (CNH Industrial)

- Fendt (AGCO)

- Massey Ferguson (AGCO)

- Yanmar

- Ztractor

- Escorts Kubota (formerly Escorts Ltd.)

- Mahindra & Mahindra

- Claas

- Kioti (Daedong)

- CATL (battery supplier influence)

- BYD (battery systems/integrations)

- Greenworks Commercial

- Torqeedo (battery & electric propulsion systems)

- Electric Tractor Corporation

- White Tractor Company

- Other Key Players

The US Electric Tractor Market: Recent Developments

- November 2025: A major tractor manufacturer unveiled a next‑generation electric‑hybrid tractor combining battery and conventional powertrain, signalling a shift toward electrified and hybrid farm machinery that can operate in zero‑emission electric mode for light-duty tasks and switch to hybrid mode for heavier fieldwork.

- January 2025: A new entrant in the electric‑tractor space secured seed investment of about USD 2.2 million to develop cost‑effective battery technology, enhance electric drive systems, and accelerate access to affordable electric tractors for small and mid-sized farms.

- October 2023: A US-based agricultural-machinery firm revealed an e‑tractor prototype at a major equipment expo, marking its first publicly shown electric-tractor concept and demonstrating intent to offer an alternative powertrain to conventional diesel tractors.

- November 2023: The previously acquired electric‑tractor manufacturer was declared “assets held for sale” by its parent company, indicating a potential divestment or re‑structuring move in the EV tractor segment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 200 Mn |

| Forecast Value (2034) |

USD 1900 Mn |

| CAGR (2025–2034) |

27.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Propulsion (Battery Electric, Hybrid Electric, and Hydrogen), By Battery Chemistry (Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (LI-NMC), and Others), By Battery Capacity (Less than 50 KWH, 51 to 100 KWH, and More than 100 KWH), By Power Output (Less than 50 HP, 51 to 100 HP, and More than 100 HP), By Function (Agriculture & Forestry, Utility, and Industrial), and By Equipment Type (Electric Sprayers and Electric Weeders) |

| Country Coverage |

The US |

| Prominent Players |

John Deere, Solectrac, Monarch Tractor, Kubota, AGCO Corporation, New Holland (CNH Industrial), Fendt (AGCO), Massey Ferguson (AGCO), Yanmar, Ztractor, Escorts Kubota, Mahindra & Mahindra, Claas, Kioti (Daedong), CATL, BYD, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US electric tractor market?

▾ The US electric tractor market size is estimated to have a value of USD 200 million in 2025 and is expected to reach USD 1900 million by the end of 2034, with a CAGR of 27.4%.

Who are the key players in the US electric tractor market?

▾ Some of the major key players in the US electric tractor market are John Deere, Solectrac, Monarch Tractor, Kubota, AGCO Corporation, New Holland (CNH Industrial), Fendt (AGCO), Massey Ferguson (AGCO), Yanmar, Ztractor, Escorts Kubota, Mahindra & Mahindra, Claas, Kioti (Daedong), CATL, BYD, and Others.