The US Energy Storage Market

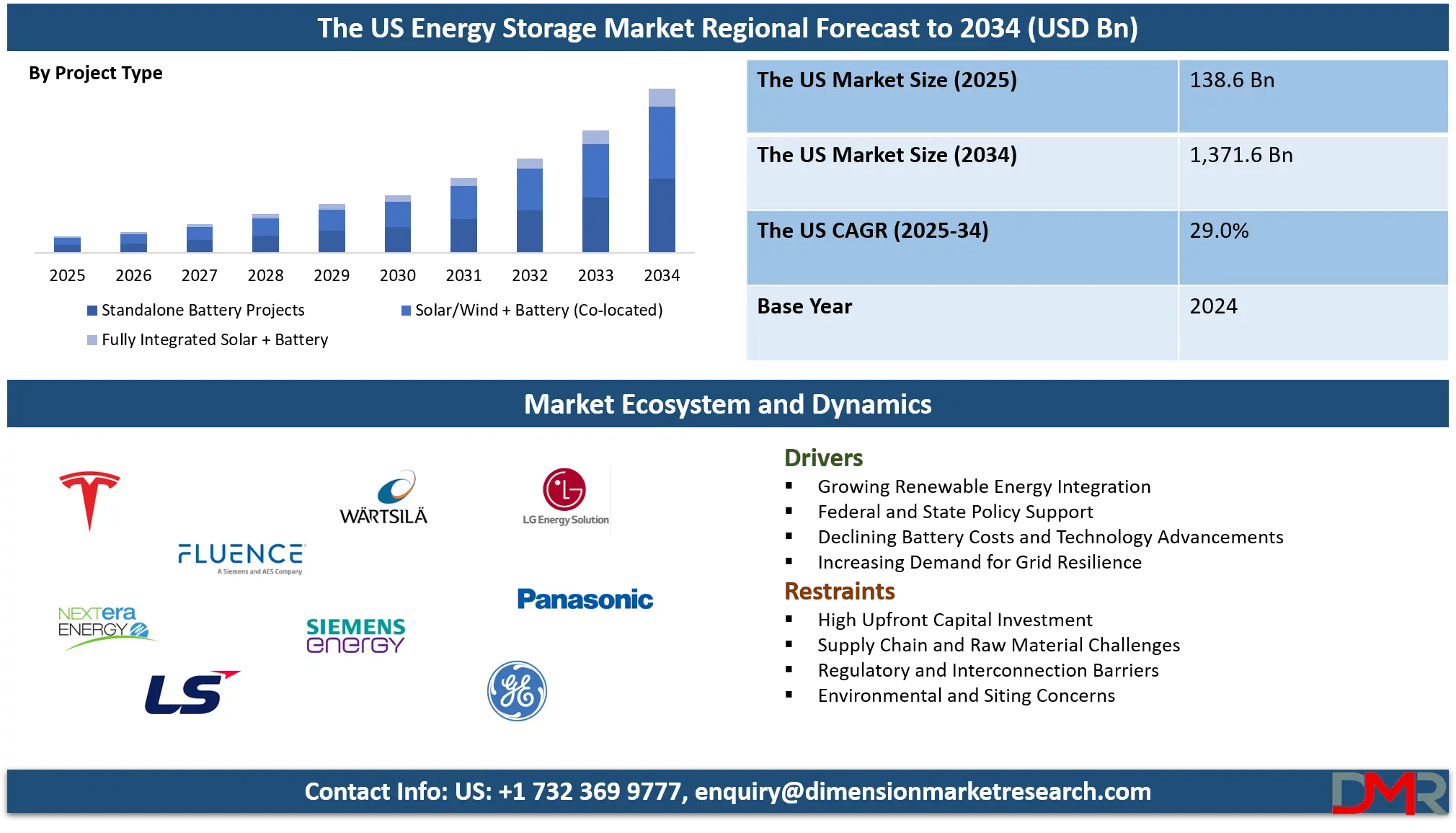

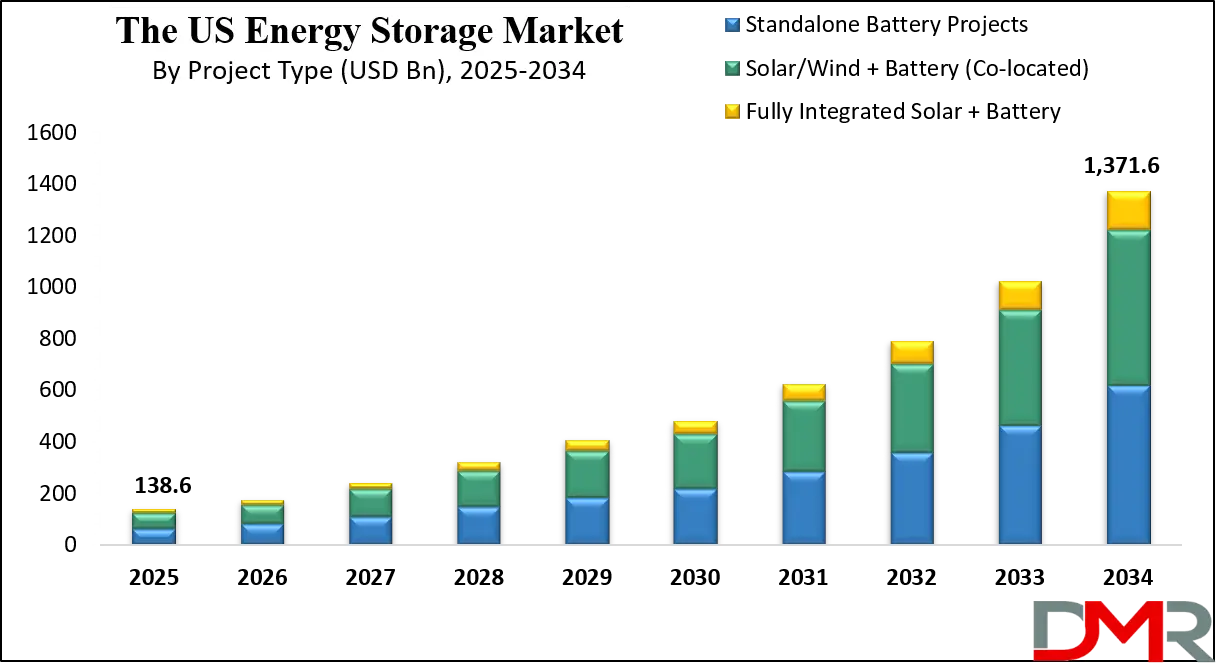

The US energy storage market is projected to reach USD 138.6 billion in 2025 and is expected to grow rapidly to USD 1,371.6 billion by 2034, registering a strong CAGR of 29.0%. This growth reflects the rising deployment of battery energy storage systems, growing renewable energy integration, and the expanding demand for grid stability and peak load management across the country.

U.S. energy storage refers to the deployment and utilization of advanced technologies that capture electricity when supply is abundant and release it when demand is high or when renewable generation is low. It plays a critical role in balancing the grid, supporting the integration of variable renewable sources like solar and wind, and enhancing overall system flexibility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technologies such as

lithium ion batteries, pumped hydro storage, and emerging long duration storage solutions are central to ensuring reliability, managing peak loads, and providing backup power. Energy storage not only reduces dependence on fossil fuel generation but also optimizes the efficiency of existing grid infrastructure, making it a cornerstone of the nation’s clean energy transition.

The U.S. energy storage market represents a rapidly expanding industry driven by large scale utility projects, residential adoption, and commercial installations. It has evolved from being a niche segment focused mainly on pilot projects to becoming an integral part of the country’s power sector, backed by federal incentives, state-level mandates, and private investment.

Market growth is fueled by the need to stabilize an increasingly renewable-heavy grid, manage peak demand, and enable energy shifting capabilities. California, Texas, Arizona, and Nevada have emerged as leaders, accounting for the majority of utility-scale deployments, while other regions are accelerating adoption through renewable integration initiatives and grid modernization plans.

Beyond its role in power management, the U.S. energy storage market is also shaping new business models and investment opportunities. Companies are innovating hybrid solutions that pair batteries with solar or wind projects, enabling more efficient use of renewable energy and opening avenues for revenue generation through grid services and virtual power plants.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

At the same time, declining technology costs and advancements in lithium iron phosphate batteries are lowering barriers for residential and commercial users to adopt storage systems. With expanding federal support, rising electricity demand, and growing emphasis on decarbonization, the market is positioned to become a critical driver of the country’s clean energy economy over the next decade.

The US Energy Storage Market: Key Takeaways

- Market Value: The US energy storage market size is expected to reach a value of USD 1,371.6 billion by 2034 from a base value of USD 138.6 billion in 2025 at a CAGR of 29.0%.

- By Technology Segment Analysis: Lithium-ion Batteries are anticipated to dominate the technology segment, capturing 99.0% of the total market share in 2025.

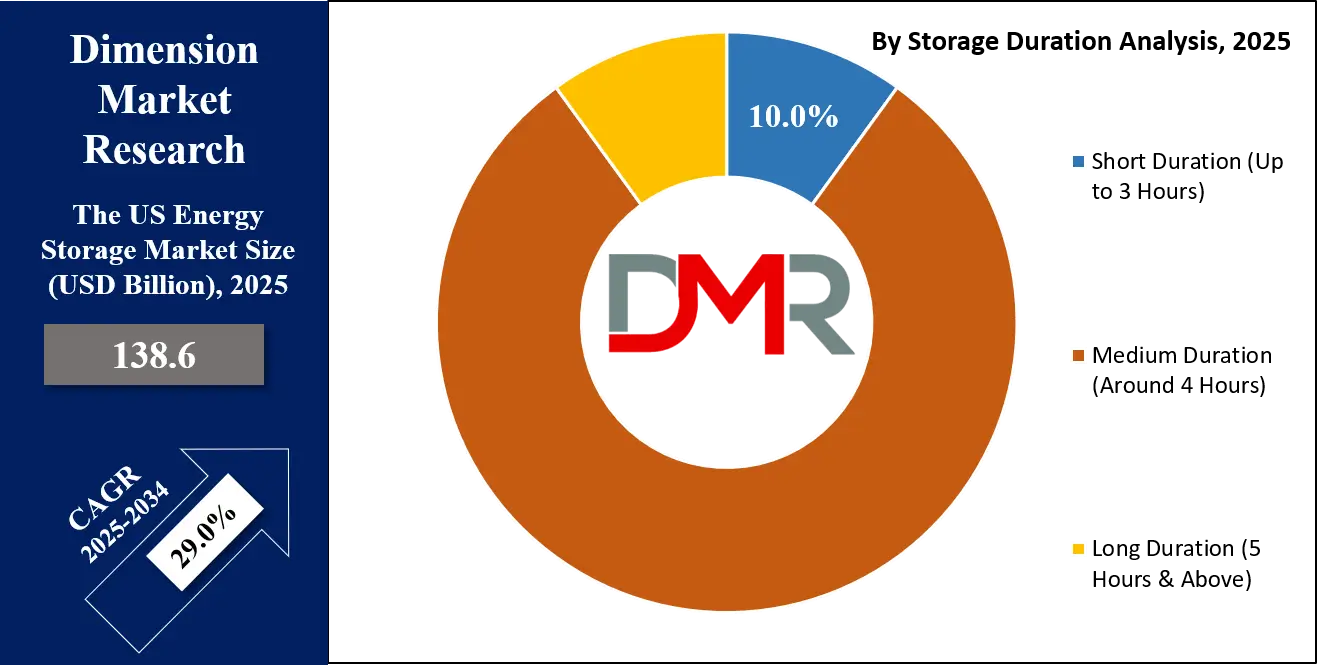

- By Storage Duration Segment Analysis: Medium Duration (Around 4 Hours) is expected to maintain its dominance in the storage duration segment, capturing 80.0% of the total market share in 2025.

- By Overall Storage Type Segment Analysis: Battery Storage is poised to consolidate its dominance in the overall storage type segment, capturing 53.0% of the market share in 2025.

- By Project Type Segment Analysis: Standalone Battery Projects will hold the maximum market share in the project type segment, capturing 45.0% of the market share in 2025.

- By Application Segment Analysis: Energy Shifting & Peak Demand Management applications are expected to dominate the application segment, capturing 55.0% of the market share in 2025.

- By End User Segment Analysis: Utility-scale / Grid Projects will dominate the end user segment, capturing 98.0% of the market share in 2025.

- Key Players: Some key players in the US energy storage market are Tesla, Fluence, NextEra Energy, LS Energy Solutions, Wärtsilä, Siemens Energy, General Electric, LG Energy Solution, Panasonic, Samsung SDI, CATL, BYD, Eos Energy Enterprises, Form Energy, and Others.

The US Energy Storage Market: Use Cases

- Renewable Energy Integration: Energy storage systems play a critical role in supporting the large-scale integration of renewable energy sources like solar and wind. By storing excess electricity generated during periods of high renewable output and releasing it during peak demand, storage ensures grid stability and maximizes renewable penetration. This use case is particularly important in states like California and Texas where renewable energy capacity is rapidly expanding and battery energy storage systems help reduce curtailment and improve power system efficiency.

- Peak Load Management and Energy Shifting: Utility-scale storage solutions enable shifting of electricity from off-peak to on-peak hours, providing cost-effective peak demand management. By reducing reliance on expensive peaker plants, storage lowers operational costs for utilities and contributes to a cleaner energy mix. The ability to discharge stored power during evening peak hours ensures reliability, prevents blackouts, and enhances economic returns for grid operators.

- Grid Reliability and Ancillary Services: Batteries and other storage technologies provide essential ancillary services such as frequency regulation, voltage support, and spinning reserve. In the US, grid operators are increasingly using storage for fast response capabilities to maintain system balance and prevent disruptions. With advanced energy management software, storage assets can deliver millisecond-level grid support, making them more efficient and flexible than traditional fossil-fuel backup systems.

- Residential and Commercial Energy Resilience: On-site storage for homes and businesses has become an attractive solution for backup power, energy bill optimization, and resilience against grid outages. Companies like Tesla, Enphase, and Sunrun are offering residential battery solutions that complement rooftop solar, enabling households to achieve energy independence. Similarly, commercial and industrial users deploy storage to reduce demand charges, integrate renewable energy, and ensure continuous operations during power disruptions.

Impact of Artificial Intelligence on the US Energy Storage Market

Artificial Intelligence is emerging as a transformative force in the US energy storage sector, particularly as large-scale AI data centers surge in demand. Infrastructure scale-ups such as Terraflow Energy's vanadium flow battery projects are specifically designed to act as “shock absorbers,” stabilizing the grid in high-demand regions like Texas by supporting electricity loads tied to AI operations.

At the same time, companies like Redwood Materials are repurposing second-life EV batteries for storage, powering AI data centers with systems like the 12 MW / 63 MWh installation in Nevada, the largest of its kind in North America. These developments highlight how AI is not just a consumer of energy but also a driver of energy storage innovation, reinforcing the synergy between AI’s energy appetite and next-generation storage technologies.

Beyond infrastructure, AI is significantly improving energy storage system performance and management. Machine learning algorithms enhance battery health diagnostics through predictive maintenance, extending lifespan and minimizing failures by identifying deterioration before it becomes critical.

Advanced AI tools optimize charge-discharge scheduling based on real-time demand, price signals, and weather forecasts, enabling smarter, cost-effective energy utilization and deeper grid integration with distributed renewable resources. This convergence of AI and energy storage is positioning the US market for greater resilience, efficiency, and scalability in the transition to a clean energy future.

The US Energy Storage Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- By end-2024, U.S. utility-scale battery capacity exceeded 26 GW; batteries made up 21% of planned 2025 capacity additions.

- Developers added more than 10.4 GW of utility-scale battery capacity in 2024, more than doubling 2023 additions.

- Batteries were 23% of all new U.S. capacity additions in 2024 (second only to solar).

- As of July 2024, installed utility-scale battery capacity reached 20.7 GW.

- Developers planned 14.3 GW of battery additions in 2024 and about 9 GW in 2025 (as of late-2023 filings).

- California had 7.3 GW and Texas 3.2 GW of installed battery capacity as of October 2023; Moss Landing (CA) remained the largest single site at 750 MW.

- In 2023, the U.S. added 6.4 GW of utility-scale batteries, a 70% year-over-year increase from 2022.

- Solar was projected to account for 62% of 2025 additions, batteries 21%, natural gas 16% (developer plans).

- USD 9.3 billion was invested in battery storage generators installed in 2023 across 102 new units.

- Average battery unit size at new plants in 2023 was 59 MW (nameplate power).

- EIA capital cost reference (AEO2025 assumptions) provides standardized 2023 USD overnight cost inputs used for battery storage modeling.

- Four-to-eight-hour batteries are typically daily-cycled for energy shifting in high-solar regions.

- Developers expected more than 300 grid-scale battery projects operating by the end of 2025 (based on late-2023 filings).

- Texas was slated to host nearly half of 2025 battery additions per developer plans.

- Batteries are identified by EIA as the fastest-growing source of new capacity, climbing to 20.7 GW by mid-2024.

- In addition to 102 new battery plants in 2023, 25 units were added at existing plants (repowers/expansions).

Federal Energy Regulatory Commission (FERC)

- FERC’s 2025 Summer Assessment highlighted rapid battery growth alongside solar and gas in the national capacity mix.

- The report emphasized concentration of battery additions in CAISO and ERCOT for system reliability support.

U.S. Department of Energy – Office of Clean Energy Demonstrations (OCED)

- DOE launched a Long-Duration Energy Storage (LDES) Pilot Program, with final applications due in March 2025 and selections expected by Q3 2025.

- OCED issued a Notice of Intent in July 2024 and a full funding announcement in September 2024 to accelerate LDES demonstrations.

- A USD 325 million federal initiative was announced in September 2023 to fund LDES projects aimed at enhancing grid resilience.

- DOE’s local investment datasets in 2024–2025 list site-level LDES demonstration projects funded by the program.

U.S. Department of Energy – Office of Electricity (OE)

- DOE launched the Storage Innovations 2030: Technology Liftoff FOA in July 2023 with USD 15 million to advance LDES pathways.

- DOE/OE rolled out technical assistance voucher programs in 2024, providing USD 1 million each for technology acceleration and community deployment support.

Lawrence Berkeley National Laboratory (LBNL)

- By end-2023, about 7.5 GW of storage operated within PV+storage hybrids, nearly equal to standalone storage (7.5 GW).

- In energy terms, PV+storage totaled 24.2 GWh compared to 17.5 GWh for standalone storage.

- Interconnection queues at end-2023 included roughly 1,030 GW of proposed storage capacity nationwide (not all will be built).

National Renewable Energy Laboratory (NREL)

- The U.S. installed 26.0 GWh / 8.8 GWac of grid energy storage in 2023, up about 34% from 2022.

- The first half of 2024 saw 14.1 GWh (4.3 GWac) of storage added, the largest H1 on record, concentrated in CA, NV, AZ, and TX.

- NREL’s 2024 Annual Technology Baseline documented cost and performance ranges for 2–10 hour lithium-ion systems and confirmed LFP as the primary stationary chemistry since 2022.

- Four-hour batteries paired with solar were found to deliver high effective capacity credits in multiple U.S. regions.

The US Energy Storage Market: Market Dynamics

The US Energy Storage Market: Driving Factors

Expansion of Renewable Energy Capacity

The rapid growth of solar and wind power installations across the US is fueling demand for energy storage systems. Utilities are increasingly investing in battery energy storage to absorb excess renewable generation and deliver reliable power during evening peak hours. This alignment of clean energy with storage technologies strengthens grid flexibility and supports federal decarbonization goals.

Supportive Government Policies and Incentives

Federal tax credits, state-level mandates, and funding programs have created a favorable policy framework for energy storage deployment. Initiatives such as the Inflation Reduction Act and state renewable portfolio standards provide strong financial and regulatory backing, accelerating both utility-scale and distributed storage adoption.

The US Energy Storage Market: Restraints

High Initial Capital Costs

Despite falling battery prices, the upfront investment required for large-scale storage projects remains significant. Utilities and businesses often face challenges in securing financing due to long payback periods, which slow down adoption compared to other grid modernization technologies.

Supply Chain Vulnerabilities

Dependence on global supply chains for lithium, cobalt, and other critical raw materials exposes the US market to price fluctuations and geopolitical risks. Limited domestic manufacturing capacity adds further pressure, potentially delaying project timelines and growing costs.

The US Energy Storage Market: Opportunities

Growth of Long-Duration Energy Storage

As the grid moves beyond four-hour solutions, technologies such as flow batteries, compressed air storage, and iron-air batteries present new opportunities. These systems can provide multi-day backup, enabling higher renewable integration and reducing reliance on natural gas peaker plants.

Rising Adoption of Distributed and Behind-the-Meter Storage

The growing popularity of residential solar paired with batteries and commercial storage solutions is opening new growth avenues. Businesses and households are adopting storage for resilience, demand charge reduction, and energy independence, creating a decentralized layer of energy management.

The US Energy Storage Market: Trends

Hybrid Renewable and Storage Projects

The US market is witnessing a surge in hybrid projects where solar farms are directly paired with large-scale batteries. These projects deliver firm renewable power, improve project economics, and dominate interconnection queues across major grid operators.

Integration of Artificial Intelligence and Smart Energy Management

Advanced analytics, AI-driven forecasting, and energy management platforms are transforming how storage assets are operated. Intelligent dispatch improves profitability, enhances grid services, and optimizes renewable integration, making software-driven innovation a core trend in the sector.

The US Energy Storage Market: Research Scope and Analysis

By Technology Analysis

Lithium-ion batteries are expected to retain near total dominance in the US energy storage market through 2025, capturing almost 99.0% of the technology segment. This leadership comes from their unmatched combination of high efficiency, modular design, and rapidly declining manufacturing costs that make them the preferred solution for grid-scale storage.

They are widely adopted in both utility-scale installations and behind-the-meter systems due to their ability to provide fast response, excellent round-trip efficiency, and flexible deployment in diverse environments. Within lithium-ion, lithium iron phosphate has emerged as the most suitable chemistry for stationary applications because it offers better safety, thermal stability, and a longer cycle life compared to nickel manganese cobalt batteries, while also being more cost-effective for projects requiring four-hour storage durations.

NMC chemistries, on the other hand, continue to find applications in cases where higher energy density is necessary, although their role in the stationary storage market is gradually decreasing. The large-scale adoption of lithium ion batteries is further supported by established supply chains, strong participation of global manufacturers, and a high level of industry confidence in the technology.

Other batteries, although representing a small share, are gradually gaining traction through pilot projects and emerging use cases. Flow batteries, such as vanadium redox systems, are valued for their long duration capability and ability to deliver stable output for many hours. Sodium ion batteries are also gaining attention for their cost competitiveness and reliance on abundant raw materials. Technologies like iron-air are in early stages but show promise for multi-day storage. While these alternatives are not yet commercially widespread, they represent the next wave of innovation in long duration energy storage and may complement lithium ion solutions in the future.

By Storage Duration Analysis

Medium duration storage, typically defined as systems capable of discharging power for around four hours, is projected to remain the dominant segment in the US energy storage market, holding close to 80.0% of the total share in 2025. This duration has become the industry standard because it aligns well with the evening peak demand period when solar generation drops and electricity consumption rises sharply.

Four-hour battery systems are widely deployed by utilities to shift midday solar output into evening hours, reducing reliance on peaker plants and supporting renewable integration. They strike a balance between cost, efficiency, and operational needs, making them the most attractive choice for both developers and grid operators. The dominance of this segment is further reinforced by state-level procurement mandates, especially in California and Texas, where four-hour batteries are considered the benchmark for capacity and grid reliability.

Medium duration systems, typically providing around four hours of discharge, have established themselves as the industry standard in the US market. These systems are particularly suited to shifting midday solar output into evening peaks, ensuring reliable supply when demand is at its highest.

They offer the right balance between cost and performance, making them the most attractive option for utilities and developers. Four-hour batteries are also favored by regulatory frameworks and procurement rules, especially in markets like California and Texas, where renewable penetration is high. Their flexibility in providing energy shifting, peak shaving, and capacity services ensures that they remain the preferred choice in new deployments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Overall Storage Type Analysis

Battery storage is expected to consolidate its position as the leading technology in the overall storage type segment, accounting for nearly 53 percent of the US energy storage market share in 2025. The rise of battery energy storage systems is being driven by their flexibility, modular deployment, and compatibility with renewable energy projects. Unlike traditional storage methods, batteries can be installed quickly at various scales, from residential to large utility projects, and provide immediate support for grid balancing, peak demand management, and renewable integration.

Declining lithium ion battery costs, supportive policy measures, and the ability to co-locate with solar and wind farms are accelerating widespread adoption. In addition, advancements in chemistry such as lithium iron phosphate and emerging alternatives like sodium ion and flow batteries are further strengthening the role of battery storage as the cornerstone of the US clean energy transition.

Pumped hydro storage, which historically dominated the US market for decades, still represents a significant portion of installed capacity and continues to play a crucial role in providing long duration storage. It works by moving water between reservoirs at different elevations, generating electricity during periods of high demand.

While highly reliable and capable of delivering power for many hours, pumped hydro projects are limited by geographic and environmental constraints that make new development challenging. Most existing facilities were built decades ago, and the high capital investment required for new projects has slowed fresh deployment. Despite these barriers, pumped hydro remains an important part of the energy storage mix, offering unmatched scale and duration that complement battery systems, particularly in providing grid stability and seasonal storage support.

By Project Type Analysis

Standalone battery projects are projected to account for the largest share of the US energy storage market in 2025, holding about 45.0% of the overall project type segment. These projects are designed to operate independently of renewable energy plants and are directly connected to the grid, giving them flexibility to provide multiple services such as peak demand management, energy arbitrage, and frequency regulation.

Their ability to be sited near load centers or substations makes them attractive to utilities and grid operators that need fast and scalable storage solutions. Standalone systems also benefit from shorter development timelines compared to integrated renewable projects, as they do not require the coordination of multiple technologies at the same site. With strong revenue opportunities from wholesale markets and ancillary services, standalone battery projects have become the preferred choice for developers seeking quick returns and broad market participation.

Solar and wind plus battery projects, also known as co-located storage, are growing in importance as renewable energy deployment accelerates. These projects combine renewable generation with batteries at the same site, allowing stored renewable power to be dispatched during periods of higher demand. They improve project economics by sharing interconnection infrastructure and optimizing land use while providing grid operators with more reliable and dispatchable renewable capacity. Co-located projects are particularly valuable in regions with high solar penetration, where they help manage midday oversupply and reduce curtailment.

By Application Analysis

Energy shifting and peak demand management are expected to dominate the application segment of the US energy storage market in 2025, capturing about 55.0 of the share. This application focuses on storing excess electricity during periods of low demand, typically when solar and wind generation is high, and discharging it during peak hours when consumption surges. Utilities and grid operators rely on this capability to reduce dependence on costly peaker plants, optimize the use of renewable energy, and ensure reliable power supply during evening peaks.

The economic benefits of lowering peak electricity prices, combined with regulatory incentives and renewable portfolio standards, are driving widespread adoption of energy shifting as the primary application for large scale battery deployments. It also plays a critical role in enabling higher penetration of intermittent renewable energy by providing firm, dispatchable capacity to the grid.

Grid stability and frequency regulation are also vital applications that highlight the fast-response capabilities of modern storage systems. By injecting or absorbing power in milliseconds, batteries help maintain grid frequency within safe operating limits and prevent system disturbances. With more renewable energy displacing conventional power plants, storage has become essential for delivering ancillary services that keep the grid stable. Advanced controls and artificial intelligence are further enhancing the precision and efficiency of storage assets in providing these services, making them an indispensable part of the modern power system.

By End User Analysis

Utility-scale and grid connected projects are expected to dominate the end user segment of the US energy storage market, capturing 98.0% of the market share in 2025. These projects are central to national and state level renewable integration goals as they provide the scale, flexibility, and reliability needed to support large volumes of solar and wind generation.

Utilities rely heavily on grid scale storage to manage peak demand, stabilize frequency, and defer costly infrastructure upgrades. Their ability to deliver multi hundred megawatt installations makes them the most effective option for balancing supply and demand across interconnected power networks. Supportive policies, investment incentives, and growing wholesale market opportunities further reinforce the leadership of utility scale projects in driving overall storage capacity growth.

Residential and commercial installations, though representing a much smaller share of the market, are gaining importance as end users seek energy independence and resilience. Homeowners are increasingly pairing rooftop solar with battery systems to store excess generation for evening use and as a backup during outages.

In the commercial and industrial sector, businesses deploy batteries to manage demand charges, ensure operational continuity, and enhance sustainability goals. These systems also enable participation in demand response programs and improve overall energy cost savings. While their contribution to total installed capacity remains limited compared to utility projects, the rising adoption of behind the meter storage reflects a growing trend toward decentralized energy solutions and consumer driven participation in the clean energy transition.

The US Energy Storage Market Report is segmented on the basis of the following:

By Technology

- Lithium-ion Batteries

- Other Batteries

By Storage Duration

- Short Duration (Up to 3 Hours)

- Medium Duration (Around 4 Hours)

- Long Duration (5 Hours & Above)

By Overall Storage Type

- Battery Storage

- Pumped Hydro Storage

By Project Type

- Standalone Battery Projects

- Solar/Wind + Battery (Co-located)

- Fully Integrated Solar + Battery

By Application

- Energy Shifting & Peak Demand Management

- Grid Stability & Frequency Regulation

- Other Grid Services

By End User

- Utility-scale/ Grid Projects

- Residential & Commercial

The US Energy Storage Market: Competitive Landscape

The US energy storage market is highly competitive, characterized by the presence of global battery manufacturers, utility-scale developers, technology innovators, and renewable energy integrators. Leading players such as Tesla, Fluence, NextEra Energy, Wärtsilä, Siemens Energy, and AES Corporation dominate large-scale deployments with advanced lithium ion solutions, while companies like LG Energy Solution, Panasonic, Samsung SDI, CATL, and BYD supply critical battery technologies to the market.

Alongside these, emerging firms including Form Energy, Eos Energy Enterprises, Powin Energy, Stem Inc., and Enphase Energy are expanding their footprint with innovations in long duration storage, grid optimization software, and residential energy solutions. The competitive landscape is further shaped by strategic partnerships, mergers, and extensive investment in hybrid renewable and battery projects, underscoring a dynamic market environment that blends established incumbents with disruptive newcomers.

Some of the prominent players in the US Energy Storage market are:

- Tesla

- Fluence

- NextEra Energy

- LS Energy Solutions

- Wärtsilä

- Siemens Energy

- General Electric (GE)

- LG Energy Solution

- Panasonic

- Samsung SDI

- CATL (Contemporary Amperex Technology)

- BYD

- Eos Energy Enterprises

- Form Energy

- Powin Energy

- Stem Inc.

- Enphase Energy

- Sunrun

- EnerSys

- AES Corporation

- Other Key Players

The US Energy Storage Market: Recent Developments

- August 2025: Tesla finalized a major supply agreement with LG Energy Solution valued at approximately USD 4.3 billion, securing U.S.-made lithium iron phosphate batteries intended for its stationary storage products, including the Megapack line.

- July 2025: Sunrun introduced an innovative home energy plan in partnership with Tesla Electric, pairing the Sunrun Flex solar-plus-storage system with a tailored Tesla retail electric plan. The new offering aims to provide Texas homeowners with lower energy costs, seamless backup power, and enhanced energy independence.

- July 2025: Solar investment firm SolaREIT committed over USD 125 million in financing to support U.S. battery storage projects, backing more than 1.6 GWac of deployment since its expansion into energy storage in early 2024.

- April 2025: Exowatt, a renewable energy startup focused on powering AI data centers, secured a USD 70 million Series A funding round (including USD 35 million in equity and USD 35 million in debt) to scale commercial deployments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 138.6 Bn |

| Forecast Value (2034) |

USD 1,371.6 Bn |

| CAGR (2025–2034) |

29.0%

|

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Lithium-ion Batteries and Other Batteries), By Storage Duration (Short Duration up to 3 Hours, Medium Duration around 4 Hours, and Long Duration 5 Hours & Above), By Overall Storage Type (Battery Storage and Pumped Hydro Storage), By Project Type (Standalone Battery Projects, Solar/Wind + Battery Co-located, and Fully Integrated Solar + Battery), By Application (Energy Shifting & Peak Demand Management, Grid Stability & Frequency Regulation, and Other Grid Services), and By End User (Utility-scale/Grid Projects and Residential & Commercial). |

| Regional Coverage |

The US |

| Prominent Players |

Tesla, Fluence, NextEra Energy, LS Energy Solutions, Wärtsilä, Siemens Energy, General Electric, LG Energy Solution, Panasonic, Samsung SDI, CATL, BYD, Eos Energy Enterprises, Form Energy, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

What is the size of the US energy storage market?

▾ The US energy storage market is projected to be valued at USD 138.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,371.6 billion in 2034 at a CAGR of 29.0%.

The US energy storage market is projected to be valued at USD 138.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,371.6 billion in 2034 at a CAGR of 29.0%.

▾ Some of the major key players in the US energy storage market are Tesla, Fluence, NextEra Energy, LS Energy Solutions, Wärtsilä, Siemens Energy, General Electric, LG Energy Solution, Panasonic, Samsung SDI, CATL, BYD, Eos Energy Enterprises, Form Energy, and Others.