Market Overview

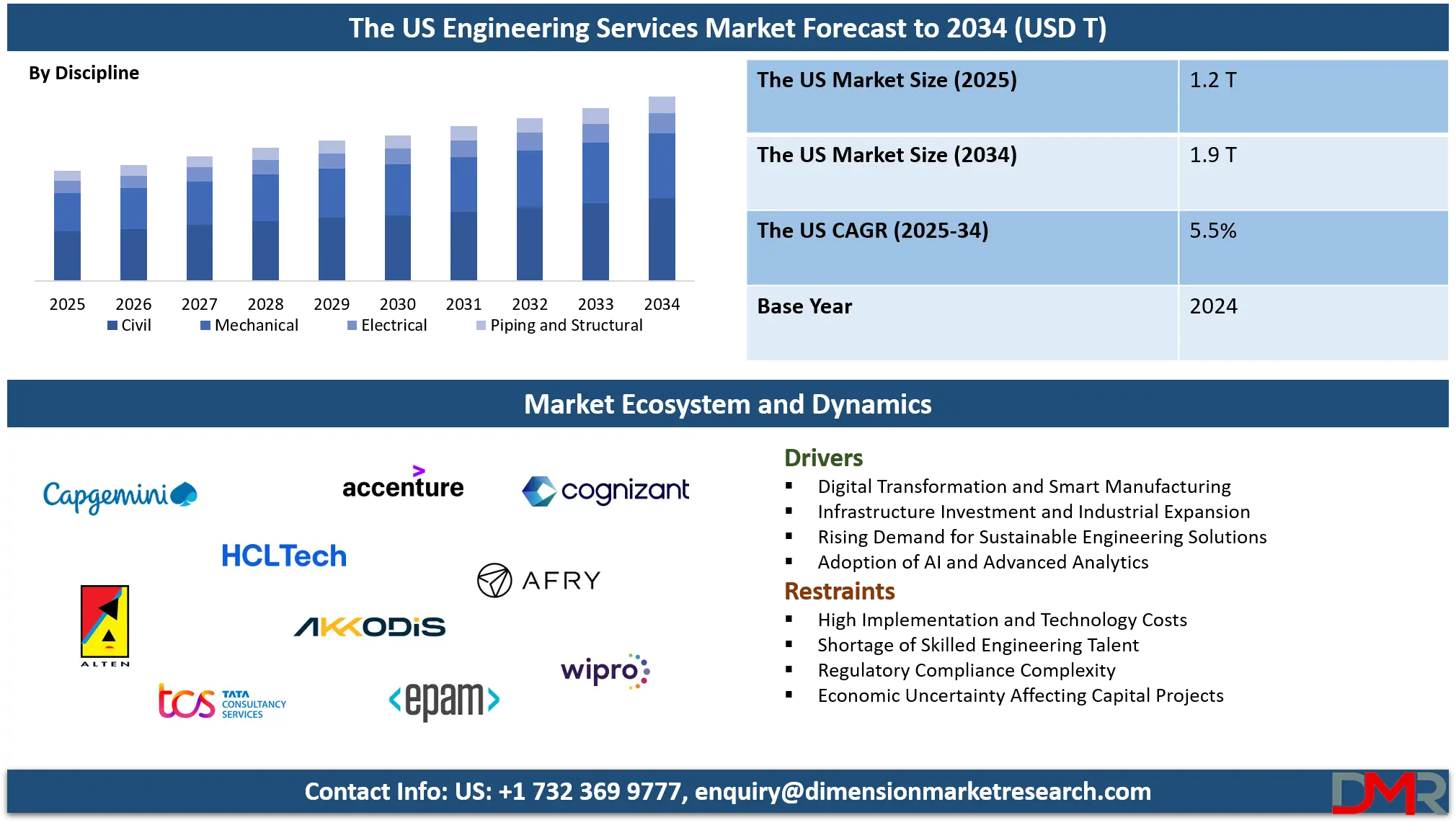

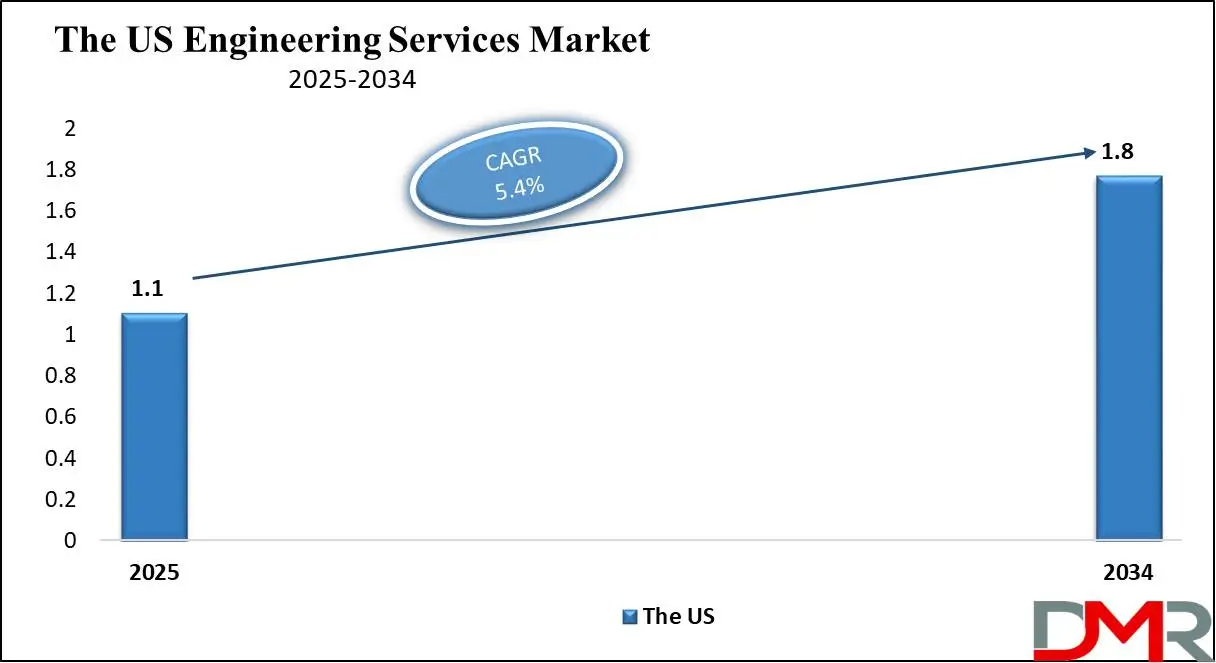

The US Engineering Services Market is expected to grow from USD 1.2 trillion in 2025 to USD 1.9 trillion by 2034 at a 5.5% CAGR, driven by digital engineering, smart manufacturing, R&D, and infrastructure development.

Engineering services encompass a broad range of professional activities that apply scientific principles, mathematical methods, and technical knowledge to design, develop, analyze, and maintain systems, products, and infrastructure across multiple industries. These services include research and development, product design, prototyping, testing, consulting, project management, and systems integration. Engineering services also focus on improving operational efficiency, ensuring compliance with safety and regulatory standards, and leveraging advanced technologies such as automation, digital twins, and artificial intelligence to optimize processes. Organizations rely on engineering services to innovate, reduce costs, and accelerate time-to-market for new products and solutions while maintaining high-quality standards and sustainable practices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US engineering services market represents a dynamic segment of the country’s economy, driven by the demand for advanced technological solutions, infrastructure development, and digital transformation across industrial, automotive, aerospace, and energy sectors. This market includes specialized service providers offering mechanical, electrical, civil, and software engineering support to optimize design, manufacturing, and operational processes. Increasing adoption of

Industry 4.0, smart manufacturing, and digital engineering solutions has created opportunities for service providers to deliver customized solutions that enhance productivity, efficiency, and product lifecycle management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth in the US market is further fueled by government infrastructure projects, renewable energy initiatives, and private sector investments in research and innovation. Companies are leveraging cloud-based platforms, simulation tools, and data analytics to provide predictive maintenance, process automation, and sustainable engineering solutions. The integration of emerging technologies, including artificial intelligence, Internet of Things, and additive manufacturing, is transforming traditional engineering practices, enabling faster product development cycles and enhanced competitiveness in the global market.

The US Engineering Services Market: Key Takeaways

- Market Value: The US Engineering Services market size is expected to reach a value of USD 1.9 trillion by 2034 from a base value of USD 1.2 trillion in 2025 at a CAGR of 5.5%.

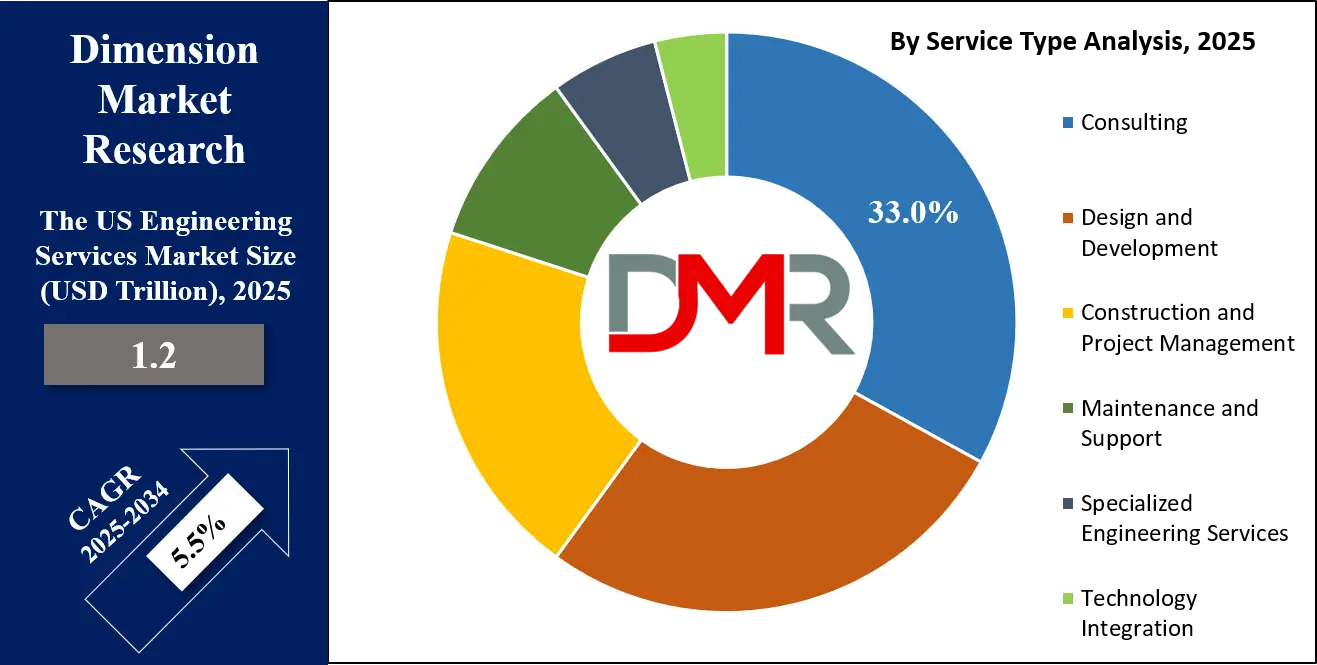

- By Services Type Segment Analysis: Consulting services are anticipated to dominate the services type segment, capturing 33.0% of the total market share in 2025.

- By Discipline Segment Analysis: Civil discipline is expected to maintain its dominance in the discipline segment, capturing 45.0% of the total market share in 2025.

- By Application Segment Analysis: Environmental Projects will account for the maximum share in the application segment, capturing 27.0% of the total market value.

- By End User Segment Analysis: Telecommunication will dominate the end user segment, capturing 23.0% of the market share in 2025.

- Key Players: Some key players in the US Engineering Services market are Capgemini, HCLTech, Alten, Tata Consultancy Services, Accenture, Akkodis, Cognizant, AFRY, EPAM, Wipro, AECOM, WSP Global, Worley Limited, Fluor Corporation, Arcadis, Bechtel Corporation, John Wood Group, Babcock International, and Others.

The US Engineering Services Market: Use Cases

- Digital Twin and Simulation Solutions: US companies are increasingly adopting digital twin technology to create virtual models of products and processes, enabling real-time monitoring, predictive maintenance, and design optimization. This enhances operational efficiency, reduces downtime, and accelerates product development in sectors like aerospace, automotive, and industrial manufacturing.

- Smart Manufacturing and Automation: Advanced automation and robotics are transforming US manufacturing operations. Engineering service providers offer solutions for process optimization, production line integration, and IoT-enabled monitoring, helping manufacturers reduce costs, improve quality, and scale operations efficiently.

- Infrastructure Design and Development: Engineering services support large-scale infrastructure projects, including transportation, energy, and urban development. Services include structural design, project management, and sustainable engineering solutions, ensuring compliance with safety standards and environmental regulations.

- Product Lifecycle and R&D Support: Companies leverage engineering services for research and development, prototyping, testing, and product lifecycle management. This enables faster innovation, efficient resource utilization, and integration of advanced technologies such as AI and additive manufacturing across the product design and development stages.

Impact of Artificial Intelligence on the US Engineering Services market

Artificial Intelligence (AI) is reshaping the US engineering services market by enabling smarter, data-driven decision-making across design, manufacturing, and maintenance processes. AI-powered tools help engineers optimize product designs, predict equipment failures, and automate repetitive tasks, reducing errors and accelerating project timelines. In manufacturing, AI-driven analytics enhance process efficiency, quality control, and resource utilization, while in infrastructure and energy sectors, predictive modeling and simulation improve safety and sustainability outcomes. The integration of AI with IoT, digital twins, and cloud platforms is creating opportunities for customized solutions, driving innovation, and strengthening competitiveness for US engineering service providers.

The US Engineering Services Market: Stats & Facts

U.S. Bureau of Labor Statistics — “Architecture and Engineering Occupations” data

- In May 2024, median annual wage for architecture & engineering occupations was USD 97,310.

- The group is projected to have about 186,500 job openings per year on average from 2024–2034 (due to growth plus replacements).

- Employment of Civil Engineers was ~ 368,900 jobs in 2024.

- Civil engineer employment is projected to grow 5 % from 2024 to 2034, with about 23,600 openings per year (on average) over the decade.

- In May 2024, median annual wage for civil engineers was USD 99,590.

- In May 2024, median annual wage for Mechanical Engineers was USD 102,320.

- Mechanical engineers held ~ 293,100 jobs in 2024.

- Mechanical engineer employment is projected to grow 9 % from 2024 to 2034, with ~ 18,100 openings per year (on average).

- In May 2024, median annual wage for Electrical and Electronics Engineers was USD 118,780.

- Electrical and electronics engineers held ~ 287,900 jobs in 2024.

- This occupation group is projected to grow 7 % from 2024 to 2034, with ~ 17,500 openings per year.

- In May 2024, median annual wage for Architectural and Engineering Managers was USD 167,740.

- Architectural/engineering managers held ~ 212,500 jobs in 2024.

- Manager roles projected to grow 4 % from 2024 to 2034, with ~ 14,500 openings per year.

The US Engineering Services Market: Market Dynamics

The US Engineering Services Market: Driving Factors

Digital Transformation and Smart Manufacturing

The US engineering services market is driven by widespread adoption of digital transformation initiatives. Companies are increasingly integrating IoT, cloud computing, and automation into manufacturing and design processes, enabling smart manufacturing solutions that enhance operational efficiency, reduce production costs, and accelerate product development cycles.

Infrastructure Investment and Industrial Expansion

Rising government and private sector investments in infrastructure projects, renewable energy, and industrial expansion are fueling demand for engineering services. Providers offering structural design, project management, and sustainable engineering solutions benefit from increased demand for optimized, compliant, and future-ready infrastructure.

The US Engineering Services Market: Restraints

High Implementation Costs

The adoption of advanced engineering technologies such as AI, digital twins, and automation involves significant upfront costs, which can restrain small and medium enterprises from fully leveraging these solutions. Budget constraints and ROI concerns limit market penetration in certain sectors.

Skill Shortages and Talent Gap

The market faces a shortage of skilled engineers proficient in advanced software, simulation tools, and digital engineering technologies. This talent gap slows project execution, limits innovation, and increases dependency on specialized service providers.

The US Engineering Services Market: Opportunities

AI and Predictive Analytics Integration

Integrating artificial intelligence and predictive analytics into engineering processes presents significant growth opportunities. These technologies improve predictive maintenance, process optimization, and resource management, allowing companies to deliver high-value, data-driven solutions.

Sustainable and Green Engineering Solutions

The increasing focus on sustainable development, green building, and renewable energy projects creates opportunities for engineering service providers to offer eco-friendly design, energy-efficient solutions, and lifecycle optimization services, catering to regulatory compliance and environmental standards.

The US Engineering Services Market: Trends

Adoption of Digital Twin and Simulation Tools

US companies are rapidly implementing digital twin and simulation technologies to model real-world systems, optimize operations, and reduce errors. This trend is reshaping design, testing, and maintenance processes across multiple sectors.

Cloud-Based Engineering and Collaboration Platforms

The shift towards cloud-based engineering platforms is enabling real-time collaboration, remote design reviews, and faster project delivery. These platforms support data centralization, version control, and seamless integration across teams and geographies.

The US Engineering Services Market: Research Scope and Analysis

By Services Type Analysis

In the US engineering services market, consulting services are expected to lead the services type segment, accounting for approximately 33.0% of the total market share in 2025. Consulting services play a crucial role in helping organizations navigate complex engineering challenges, optimize processes, and implement advanced technologies such as digital engineering, automation, and predictive analytics.

Service providers offer strategic guidance on project management, regulatory compliance, risk assessment, and operational efficiency, enabling companies to make informed decisions and enhance overall productivity. The increasing focus on innovation, cost optimization, and sustainable solutions further strengthens the demand for specialized consulting services across industrial, aerospace, automotive, and energy sectors.

Design and development services are another critical component of this market segment, focusing on transforming concepts into functional products and solutions. These services encompass product design, prototyping, simulation, testing, and systems integration, leveraging tools such as computer-aided design, digital twins, and advanced simulation software. By streamlining product development cycles and ensuring high-quality outcomes, design and development services help companies accelerate time-to-market, reduce operational costs, and maintain competitiveness in a rapidly evolving engineering landscape. The growing emphasis on innovation, advanced manufacturing, and technology-driven solutions continues to drive demand for these services in the US market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Discipline Analysis

In the US engineering services market, the civil discipline is projected to dominate the discipline segment, holding approximately 45.0% of the total market share in 2025. Civil engineering services encompass the design, planning, and execution of infrastructure projects such as roads, bridges, airports, railways, and urban development initiatives. These services involve structural analysis, project management, sustainability assessment, and regulatory compliance, ensuring that large-scale projects are safe, efficient, and cost-effective. The increasing government and private sector investments in infrastructure modernization, smart city initiatives, and renewable energy facilities are driving the demand for civil engineering expertise, making it the largest segment in terms of market share.

Mechanical engineering services represent another significant segment within the US market, focusing on the design, analysis, and optimization of machinery, engines, HVAC systems, and industrial equipment. These services leverage advanced tools such as computer-aided design, simulation, and prototyping to enhance efficiency, reduce maintenance costs, and improve product performance.

Mechanical engineering is critical across manufacturing, automotive, aerospace, and energy sectors, supporting product development, operational optimization, and innovation. The growing emphasis on automation, energy efficiency, and precision engineering is further boosting demand for mechanical engineering services in the US market.

By Application Analysis

In the US engineering services market, environmental projects are expected to capture the largest share of the application segment, accounting for approximately 27.0% of the total market value. This growth is driven by increasing regulatory pressure, sustainability initiatives, and corporate commitments to reducing environmental impact. Engineering services in this area include environmental impact assessments, waste management solutions, renewable energy integration, and sustainable infrastructure design.

Companies leverage these services to comply with environmental standards, implement energy-efficient systems, and support green building initiatives. The focus on sustainability and climate-conscious development is fueling demand for specialized engineering expertise in environmental projects across industrial, municipal, and energy sectors.

Technology implementation services form another important application segment, focusing on deploying advanced engineering solutions and digital tools across operations. This includes the integration of automation systems, digital twins, IoT-enabled monitoring, simulation software, and AI-driven analytics into existing processes. By enabling real-time monitoring, predictive maintenance, and process optimization, technology implementation services help organizations enhance productivity, reduce operational costs, and accelerate innovation. The increasing reliance on digital engineering solutions across manufacturing, infrastructure, and energy sectors is driving strong growth in this segment of the US market.

By End User Analysis

In the US engineering services market, the telecommunication sector is expected to dominate the end-user segment, accounting for approximately 23.0% of the market share in 2025. Engineering services in this sector focus on network design, deployment, and optimization, including 5G infrastructure, fiber optic networks, and wireless communication systems. Providers offer solutions for system integration, performance testing, and regulatory compliance, enabling telecom companies to enhance coverage, improve data transmission efficiency, and reduce operational costs. The growing demand for high-speed connectivity, IoT applications, and digital communication services is driving the need for specialized engineering support, making telecommunications the largest end-user segment in the US market.

The construction sector represents another key end-user segment, relying on engineering services for structural design, project management, and infrastructure development. Services include civil and mechanical engineering support, building information modeling, safety assessments, and sustainable construction solutions. By leveraging these services, construction companies can optimize project timelines, reduce costs, and ensure compliance with environmental and safety regulations. The ongoing expansion of residential, commercial, and industrial projects in the US continues to drive strong demand for engineering services in the construction industry.

The US Engineering Services Market Report is segmented on the basis of the following:

By Services Type

- Design and Development

- Consulting

- Construction and Project Management

- Maintenance and Support

- Specialized Engineering Services

- Technology Integration

By Discipline

- Civil

- Mechanical

- Electrical

- Piping and Structural

By Application

- Environmental Projects

- Technology Implementation

- Infrastructure Development

- Industrial Projects

- Others

By End User

- Construction

- Manufacturing

- Energy and Utilities

- Transportation

- Healthcare

- Telecommunications

- Others

The US Engineering Services Market: Competitive Landscape

The US engineering services market is highly competitive, dominated by large multinational firms such as AECOM, Jacobs Engineering, Fluor Corporation, Black & Veatch, and Tetra Tech, which leverage broad service portfolios, global talent, and integrated capabilities across infrastructure, energy, industrial, and environmental projects. At the same time, smaller and mid-size players maintain competitiveness by focusing on niche expertise, local presence, and flexible, client-driven solutions, particularly in areas like sustainable design, digital engineering, and regulatory compliance. The growing demand for digital transformation, design-build integration, and specialized engineering services is driving innovation and attracting new entrants, making the market increasingly fragmented and dynamic.

Some of the prominent players in the US Engineering Services market are:

- Capgemini

- HCLTech

- Alten

- Tata Consultancy Services

- Accenture

- Akkodis

- Cognizant

- AFRY

- EPAM

- Wipro

- AECOM

- WSP Global

- Worley Limited

- Fluor Corporation

- Arcadis

- Bechtel Corporation

- John Wood Group

- Babcock International

- Kiewit Corporation

- NV5 Global

- Other Key Players

The US Engineering Services Market: Recent Developments

- Dec 2025: CoreOps.AI unveiled its new platform “AgentCORE,” targeting enterprise operations modernization and enabling firms to deploy AI agents for workflow automation and legacy-system transformation.

- Dec 2025: CoreOps.AI raised USD 3.5 million in a pre-Series A round led by Siana Capital Management to scale its AI-driven enterprise-modernization platform and expand its engineering and product-development teams.

- Oct 2025: M/E Engineering merged with Salas O’Brien, combining their mechanical, electrical, and plumbing design capabilities, signalling consolidation in the US AEC services space.

- Jul 2025: Ciroos came out of stealth mode, launching its AI-powered SRE agents designed to autonomously monitor, detect, and remediate production issues, offering a new kind of engineering-operations tool for software and infrastructure teams.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.2 T |

| Forecast Value (2034) |

USD 1.9 T |

| CAGR (2025–2034) |

5.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Services Type (Design and Development, Consulting, Construction and Project Management, Maintenance and Support, Specialized Engineering Services, Technology Integration), By Discipline (Civil, Mechanical, Electrical, Piping and Structural), By Application (Environmental Projects, Technology Implementation, Infrastructure Development, Industrial Projects, Others), and By End User (Construction, Manufacturing, Energy and Utilities, Transportation, Healthcare, Telecommunications, Others) |

| Regional Coverage |

The US |

| Prominent Players |

Capgemini, HCLTech, Alten, Tata Consultancy Services, Accenture, Akkodis, Cognizant, AFRY, EPAM, Wipro, AECOM, WSP Global, Worley Limited, Fluor Corporation, Arcadis, Bechtel Corporation, John Wood Group, Babcock International, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

Who are the key players in the US Engineering Services market?

▾ Some of the major key players in the US Engineering Services market are Capgemini, HCLTech, Alten, Tata Consultancy Services, Accenture, Akkodis, Cognizant, AFRY, EPAM, Wipro, AECOM, WSP Global, Worley Limited, Fluor Corporation, Arcadis, Bechtel Corporation, John Wood Group, Babcock International, and Others.