Market Overview

The US Enterprise Content Management Market size is projected to reach USD 17.0 billion in 2025 and grow at a compound annual growth rate of 10.2% from there until 2034 to reach a value of USD 40.9 billion.

Enterprise Content Management (ECM) is a system used by companies to organize, store, and manage documents and digital content. It helps businesses handle all kinds of files, such as emails, contracts, and images, by making them easy to find, use, and keep safe. ECM systems are used to support daily operations, keep records in order, and follow industry rules. In the U.S., companies use ECM to reduce paperwork, improve teamwork, and make better decisions with faster access to information.

In recent years, more businesses in the U.S. have started using ECM systems, as the companies now deal with more digital content than ever before. With people working from different places, employees need to be able to access files online. Also, many businesses need to follow strict data and privacy rules. ECM helps them stay compliant by tracking who views and changes documents. Cloud-based ECM systems are becoming more common, as they allow companies to manage content without needing their servers.

The need for ECM systems has grown due to changing work habits. Remote work became widespread after COVID, and companies needed better ways to manage digital files, which led to higher interest in ECM tools that support mobile access and real-time sharing. ECM also helps protect content by using permissions and keeping track of document versions. U.S. organizations are using these tools to replace older systems like shared drives or paper filing cabinets.

Several trends have shaped ECM in the U.S. recently. One trend is the use of artificial intelligence (AI) to organize documents automatically. AI helps tag, sort, and search for content faster. Another trend is the move toward integrated platforms. Instead of using separate tools for storage, emails, and editing, companies prefer systems that connect all these features. Security is also a growing focus. With cyber threats increasing, ECM providers are adding stronger tools for encryption and data protection.

Events in the last few years have pushed ECM forward in the U.S. Data privacy laws like the California Consumer Privacy Act (CCPA) have made companies more aware of how they store and share information. High-profile data breaches also made businesses review their document management systems. In response, many turned to ECM to reduce risks. Mergers between ECM vendors and cloud service providers also brought more powerful and flexible options to the market.

US Enterprise Content Management Market: Key Takeaways

- Market Growth: The Enterprise Content Management Market size in the US is expected to grow by USD 22.2 billion, at a CAGR of 10.2%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the US Enterprise Content Management Market in 2025.

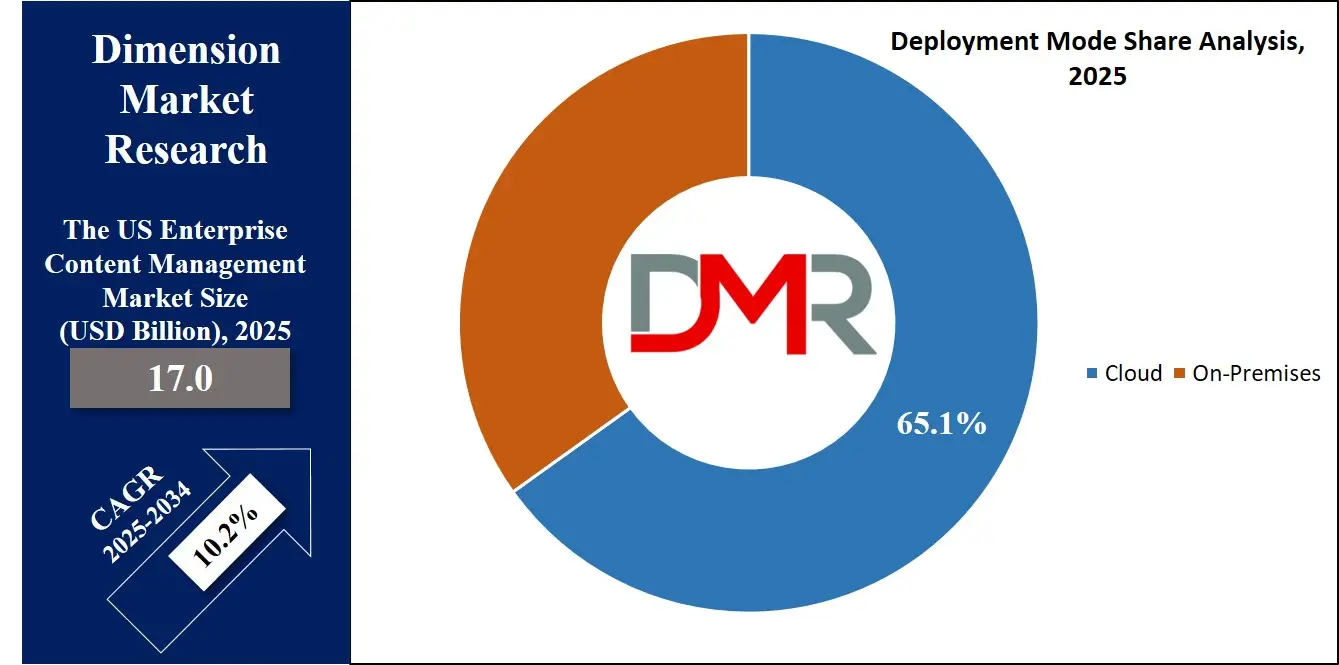

- By Deployment Mode: The cloud segment is expected to get the largest revenue share in 2025 in the US Enterprise Content Management Market.

- Use Cases: Some of the use cases of Enterprise Content Management in the US include remote work support, workflow automation, and more.

US Enterprise Content Management Market: Use Cases

- Remote Work Support: Many U.S. companies use ECM systems to allow employees to access files from anywhere. These tools help teams share, edit, and store documents securely in real time. This is especially useful for hybrid or fully remote workplaces.

- Regulatory Compliance: Organizations in fields like healthcare, finance, and government use ECM to follow strict data and recordkeeping laws. ECM systems help track document changes, manage retention schedules, and provide audit trails. This reduces the risk of legal issues.

- Workflow Automation: Businesses use ECM to automate tasks like approvals, document routing, and notifications. This speeds up processes, reduces human errors, and ensures that important steps aren’t missed. It also helps teams stay on the same page.

- Data Security and Access Control: ECM systems help protect sensitive information by controlling who can view or change certain documents. They use tools like encryption, user roles, and version tracking. This keeps business data safe and organized.

Stats & Facts

- Coolest Gadget reports that as of June 2024, Oracle leads the global relational database management system (RDBMS) market with a score of 08. This score reflects its dominant position in a segment that comprised 72% of all database usage by December 2022. This underscores Oracle’s continued strength in enterprise data infrastructure.

- Vena Solutions highlights that 73% of companies still spend significant time on manual tasks that AI could automate, indicating a major opportunity for efficiency gains. This inefficiency persists even as staff using AI report an 80% boost in productivity, suggesting a gap between potential and actual implementation.

- According to Coolest Gadget, only 2% of the data generated in 2020 was retained in 2021, despite global data creation, copying, and consumption being expected to soar to 149 zettabytes in 2024 and surpass 394 zettabytes by 2028. This points to massive underutilization of data amid exponential digital growth.

- Based on data from Vena Solutions, corporate profits surged by 45% between January and April 2023, largely due to heightened interest in AI models. This profit spike suggests AI is not only transformative in operations but also directly impacts financial performance at a corporate level.

- Coolest Gadget reveals that 65% of CTOs and IT professionals view real-time data access as essential for AI success, aligning closely with the 90% who say their data management strategies are either somewhat or fully aligned with AI objectives, which illustrates a strong interdependence between effective data management and successful AI deployment.

- As per Enterprise Data Management Statistics via Coolest Gadget, 90% of IT professionals believe that improving data literacy will positively influence AI initiatives, with 40% asserting that it will have a significant impact. This finding underlines the growing emphasis on workforce readiness in supporting AI maturity.

Market Dynamic

Driving Factors in the US Enterprise Content Management Market

Digital Transformation Across Industries

One of the main drivers of growth in the U.S. Enterprise Content Management (ECM) market is the push toward digital transformation. Companies in nearly every industry are moving away from paper-based processes and traditional file storage systems. They are adopting ECM tools to digitize records, simplify document handling, and improve overall efficiency, which change is especially noticeable in industries with large volumes of data, like healthcare, finance, and legal services. ECM systems help these organizations manage content faster, reduce manual errors, and save time. As more businesses aim to become fully digital, the demand for reliable and scalable ECM solutions continues to rise. This transformation is not just a trend but a necessary shift to stay competitive.

Rising Focus on Data Security and Compliance

Another key factor driving ECM growth in the U.S. is the increasing importance of data security and compliance with regulations. With new laws like the California Consumer Privacy Act (CCPA) and others focused on protecting personal data, businesses are under pressure to handle information more carefully. ECM systems provide tools to control access, manage permissions, and track document activity. These features help companies meet legal requirements while also keeping sensitive information secure. At the same time, concerns over data breaches and cyberattacks have made security a top priority for organizations. As a result, more companies are investing in ECM platforms that offer strong protection, detailed audit trails, and support for regulatory standards.

Restraints in the US Enterprise Content Management Market

High Implementation and Maintenance Costs

One major restraint in the U.S. Enterprise Content Management (ECM) market is the high cost of setup and ongoing maintenance. Many ECM solutions need a significant investment in software, hardware, and IT staff to ensure smooth operation. Smaller businesses, in particular, may struggle to afford the upfront costs or the expense of customizing the system to fit their needs. In addition, training employees to use these platforms can take time and add to overall costs. Even with cloud-based options, long-term subscription fees and data storage expenses can be challenging. These financial barriers often delay adoption or lead companies to stick with outdated document management methods, slowing the market’s overall growth.

Complex Integration with Existing Systems

Another restraint is the difficulty of integrating ECM systems with a company’s existing tools and workflows. Many businesses already use a mix of software for tasks like communication, accounting, and project management. Adding ECM into this environment can be complex and time-consuming, especially if legacy systems are involved. Compatibility issues may arise, requiring additional development work or support services, which can lead to delays and frustration during implementation. For some organizations, the fear of disrupting daily operations holds them back from adopting ECM altogether. Without smooth integration, the full benefits of ECM—like automation and centralization can be hard to achieve, limiting its appeal.

Opportunities in the US Enterprise Content Management Market

Growth of Cloud-Based Solutions

A major opportunity in the U.S. Enterprise Content Management (ECM) market is the rapid expansion of cloud-based platforms. As more organizations shift to flexible work models, cloud ECM systems allow employees to access, edit, and share content from anywhere. These solutions also reduce the need for physical infrastructure, making them attractive to companies looking to cut IT costs. Cloud platforms offer scalability, easier updates, and faster deployment compared to on-premise systems. Additionally, service providers continue to improve security and compliance features, making cloud adoption more appealing. This trend creates space for new vendors to enter the market and for existing providers to offer more advanced, user-friendly tools tailored to cloud environments.

Increased Demand for AI and Automation Features

The growing interest in artificial intelligence (AI) and automation presents a strong opportunity for ECM providers in the U.S. Businesses want smarter systems that can automatically tag documents, detect duplicate content, and suggest file organization methods. AI can also enhance search features, making it easier for users to find the information they need quickly.

Automation tools built into ECM platforms help streamline workflows, reduce manual tasks, and improve accuracy. As companies aim to increase productivity and reduce errors, they look for solutions that go beyond simple storage and retrieval. Integrating AI-driven capabilities can give ECM systems a competitive edge, encouraging adoption across industries seeking smarter content management.

Trends in the US Enterprise Content Management Market

Rise of Generative AI in ECM

A major trend in the U.S. Enterprise Content Management (ECM) market is the integration of Generative AI (GenAI) into content systems. These AI tools help users in creating, summarizing, and transforming documents using simple prompts, streamlining tasks like drafting reports or designing intranet pages. By understanding the context of user workspaces and respecting security settings, GenAI enhances productivity without compromising data integrity. This development allows employees to interact with content repositories more naturally, improving both efficiency and user experience.

Emergence of Agentic AI and Autonomous Workflows

Another emerging trend is the adoption of

agentic AI—advanced models capable of making decisions and managing complex workflows. These AI agents can function as virtual assistants, automating tasks across departments such as HR and finance. They collaborate with other AI tools and integrate with third-party systems, facilitating seamless operations, which enables organizations to handle intricate processes more efficiently, reducing manual intervention and enhancing overall productivity.

Research Scope and Analysis

By Component Analysis

Software will be dominating in 2025 with a share of

66.9% in the U.S. Enterprise Content Management market, driven by growth in demand for content capture, document management, and workflow automation tools. Businesses are turning to software solutions that help manage growing volumes of digital content more efficiently. The rise in remote and hybrid work models has also boosted the need for cloud-based ECM platforms that allow real-time collaboration and secure access.

Many companies prefer customizable software that can integrate easily with their existing systems. Advanced features like searchability, file versioning, and data classification are also helping users find and manage information faster. As organizations across healthcare, finance, and legal sectors prioritize digital transformation, software continues to be the backbone of ECM strategies, making it a critical component of overall content and information lifecycle management.

Further, services are expected to have a significant growth over the forecast period in the U.S. Enterprise Content Management market, largely due to the growing need for support in implementation, training, system integration, and ongoing maintenance. As ECM systems become more advanced and tailored to specific industry needs, businesses rely on expert services to ensure smooth deployment and to avoid disruptions.

Services also help companies navigate complex compliance requirements and optimize content workflows. With frequent updates, user support, and consulting, service providers play an essential role in helping organizations get the most value from their ECM investments. Small and mid-sized businesses, in particular, turn to these services to manage their content effectively without needing large in-house IT teams.

By Solution Type Analysis

Document management is expected to lead in 2025 with a share of 23.5% in the U.S. Enterprise Content Management market, as organizations focus on organizing and securing large volumes of digital files. This solution helps businesses store, track, and retrieve documents quickly, improving workflow and cutting down on paper-based tasks. With growing regulatory demands and the need for data privacy, document management systems provide better control over access and compliance.

Companies across industries such as healthcare, legal, and finance rely on these tools to manage records, streamline audits, and maintain organized archives. The shift to digital workplaces and remote teams has made centralized, cloud-ready document management essential for efficient operations. These systems also reduce time spent searching for files, enhance productivity, and improve collaboration by allowing teams to work on shared content from different locations.

Web content management is expected to have significant growth over the forecast period in the U.S. Enterprise Content Management market due to the increasing importance of digital presence and user engagement. Businesses are using these systems to create, manage, and publish content across websites, mobile apps, and online platforms without needing complex coding skills. With more consumers and clients engaging online, companies aim to keep their content up-to-date, relevant, and consistent.

Web content management solutions offer easy editing tools, content templates, and media management features, helping marketing and communication teams work faster. These systems also support SEO, localization, and personalization, allowing businesses to reach wider audiences effectively. As digital marketing and online branding continue to grow, web content tools become a vital part of modern ECM strategies.

By Business Function Analysis

Based on business function, sales & marketing will be leading in 2025 with a share of 24.1% in the U.S. Enterprise Content Management market, driven by the growing need to manage large volumes of promotional materials, client communications, and digital assets. These teams rely on ECM systems to organize brochures, campaigns, presentations, and customer data in one secure place. With the shift to digital channels, sales and marketing professionals need quick access to updated content to support customer engagement and brand consistency.

ECM tools also help track content usage, version control, and compliance with branding guidelines. By making information easy to find and share across teams, businesses can respond faster to market trends and customer needs. This improves lead generation, campaign effectiveness, and customer relationship management, making ECM a key part of sales and marketing success.

Further, the HR segment will be having significant growth over the forecast period in the U.S. Enterprise Content Management market as organizations aim to better manage employee records, training documents, and recruitment files. HR departments use ECM systems to safely store sensitive data such as contracts, performance reviews, and benefits information.

These systems help simplify onboarding, support compliance with labor laws, and make it easier to track employee lifecycle documents. With remote work becoming more common, HR teams benefit from secure digital access to files, minimizing delays and improving response times. Automated workflows help with approvals, notifications, and document updates, saving time and lowering the chance of errors. As workforce management becomes more complex, ECM supports HR in staying organized, efficient, and compliant.

By Deployment Mode Analysis

Cloud is set to dominate in 2025 with a share of 65.1% in the U.S. Enterprise Content Management market, owing to its flexibility and ease of access. Many organizations prefer cloud-based ECM solutions because they allow employees to access documents and collaborate from anywhere, supporting remote and hybrid work styles.

Cloud deployment minimizes the need for heavy upfront investment in hardware and IT maintenance, making it cost-effective for businesses of all sizes. It also offers scalability, so companies can easily adjust storage and features as their needs grow. Security features like encryption and regular updates are managed by providers, giving organizations peace of mind. Cloud ECM systems also simplify disaster recovery and ensure continuous availability, which helps companies stay productive and protect their valuable content.

Further, on-premises deployment is having significant growth over the forecast period in the U.S. Enterprise Content Management market because some organizations prefer to keep full control over their data and infrastructure. This deployment mode appeals to businesses with strict security and compliance requirements, such as government agencies and financial institutions.

On-premises ECM allows companies to customize systems deeply to fit specific workflows and IT policies. It also offers faster access to data within local networks and can be more reliable in environments with limited internet connectivity. While it requires higher upfront costs and ongoing maintenance, many organizations see on-premises solutions as a safer choice for managing sensitive documents and maintaining control over their digital content.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Enterprise Size Analysis

In 2025, large enterprises are set to dominate with a share of

64.8% in the U.S. Enterprise Content Management market, driven by their need to handle large volumes of data and complex business processes. These organizations have many departments and locations, making it vital to use ECM systems for better document organization, collaboration, and compliance management. Large companies invest in advanced ECM solutions that provide strong security, scalability, and integration with other enterprise software.

They also benefit from automated workflows that speed up approvals and require minimal manual work. Managing regulatory requirements and ensuring data privacy are top priorities, and ECM helps meet these demands. Because of their bigger budgets and complex needs, large enterprises play a key role in driving the adoption and growth of ECM technologies across various industries.

Further, SMEs are having significant growth over the forecast period in the U.S. Enterprise Content Management market as more small and medium businesses recognize the benefits of digital content organization. These companies are adopting ECM solutions to improve efficiency, reduce paperwork, and support remote work. Cloud-based ECM platforms, in particular, attract SMEs due to lower upfront costs and easy scalability.

With limited IT staff, SMEs depend on user-friendly systems that require minimal technical expertise. ECM helps them manage contracts, invoices, and customer information securely and stay compliant with regulations. As SMEs grow and face more complex workflows, ECM solutions become vital for streamlining operations and improving collaboration, as the adoption by smaller businesses contributes significantly to the overall market expansion.

By Industrial Vertical Analysis

BFSI will be leading in 2025 with a share of 22.7% in the U.S. Enterprise Content Management market, driven by the sector’s heavy reliance on managing large volumes of sensitive documents and regulatory compliance. Banks, insurance companies, and financial firms handle vast amounts of customer data, loan applications, policies, and transaction records that must be securely stored and easily accessed.

ECM systems help BFSI organizations automate workflows, reduce manual errors, and speed up approval processes. The need to comply with strict regulations around data privacy and security also pushes these institutions to adopt advanced content management solutions. With the rise in digitalization of financial services, ECM plays a crucial role in improving operational efficiency, supporting customer service, and protecting critical information within the BFSI sector.

Further, Retail & e-commerce are having significant growth over the forecast period in the U.S. Enterprise Content Management market as these industries deal with vast amounts of product information, customer data, and transaction records. ECM systems help retailers organize digital assets, manage contracts, and handle invoices efficiently. The growth of online shopping and omnichannel sales strategies requires businesses to keep content consistent and up to date across websites, apps, and stores.

ECM solutions support marketing campaigns by storing promotional materials and ensuring easy collaboration across teams. With the rise in competition and customer expectations, retail and e-commerce companies rely on ECM to streamline operations, improve customer experience, and comply with data protection regulations, driving market growth in this sector.

The US Enterprise Content Management Market Report is segmented on the basis of the following:

By Component

By Solution Type

- Document Management

- Record Management

- Content Workflow

- Case Management

- Web Content Management

- Digital Asset Management

- E-Discovery

- Mobile Content Management

By Business Function

- Human Resources

- Sales and Marketing

- Accounting and Legal

- Procurement and Supply Chain

- Others

By Deployment Mode

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Healthcare

- Retail and E-commerce

- Government

- Manufacturing

- IT and Telecom

- Energy and Utilities

- Education

- Others

Competitive Landscape

The U.S. Enterprise Content Management (ECM) market has many players offering different tools and services, creating strong competition. Some focus on cloud-based solutions, while others provide on-site systems for companies that want more control. A few offer full platforms with document storage, search, sharing, and workflow tools all in one place. Others specialize in specific features like security, automation, or integration with popular business software.

As businesses shift to digital operations, the demand for flexible, secure, and easy-to-use ECM solutions has grown. New companies often bring fresh ideas, while long-time providers update their systems to stay ahead. This mix of old and new keeps the market active, with each trying to offer better tools, support, and user experience than the rest.

Some of the prominent players in the US Enterprise Content Management are:

- Microsoft

- IBM

- Oracle

- Adobe

- Xerox

- Nuxeo

- SAP

- Capgemini

- KYOCERA

- Fabasoft

- SER Group

- iManage

- Zoho Docs

- Everteam

- SpringCM

- Kofax

- DocuSign

- Medius

- PaperSave

- Other Key Players

Recent Developments

- In April 2025, OpenText™ launched Project Titanium X with the release of Cloud Editions 25.2 (CE 25.2), marking two years of development focused on advancing Business Clouds, AI, and Technology. CE 25.2 delivers robust capabilities in automation, data, security, and AI, empowering organizations to enhance productivity, transform cloud and supply chain operations, and elevate customer experiences. It also introduces AI agents to support knowledge workers through a powerful, next-generation Digital Workforce.

- In September 2024, Box, Inc. announced the general availability of Box Hubs, customizable portals designed to transform how teams curate and share content across the enterprise. These hubs make it easier for users to access accurate, up-to-date information, enhancing collaboration and productivity. Box Hubs support secure content sharing both internally and externally and can be tailored for HR, Sales, or Marketing needs. When combined with Box AI, they offer powerful insights and smarter content management for today’s digital workplaces.

- In July 2024, OpenText continues advancing generative AI in enterprise content management with its latest Cloud Editions 24.3 release. Its AI Aviators tools are now available across all three ECM platforms: Core, Documentum, and Extended ECM. The update enhances support for various media types by integrating technology from the Micro Focus acquisition, enabling advanced metadata capture and analytics, which allows users to analyze unstructured content, including text, audio, video, and images, helping organizations better manage and extract insights from diverse content formats.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 17.0 Bn |

| Forecast Value (2034) |

USD 40.9 Bn |

| CAGR (2025–2034) |

10.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Solution Type (Document Management, Record Management, Content Workflow, Case Management, Web Content Management, Digital Asset Management, E-Discovery, aMobile Content Management), By Business Function (Human Resources, Sales and Marketing, Accounting and Legal, Procurement and Supply Chain, and Others), By Deployment Mode (On-Premise and Cloud), By Enterprise Size (Small and Medium Enterprises (SMEs) and Large Enterprises), By Industry Vertical (BFSI, Healthcare, Retail and E-commerce, Government, Manufacturing, IT and Telecom, Energy and Utilities, Education, Others) |

| Regional Coverage |

The US |

| Prominent Players |

Microsoft, IBM, Oracle, Adobe, Xerox, Nuxeo, SAP, Capgemini, KYOCERA, Fabasoft, SER Group, iManage, Zoho Docs, Everteam, SpringCM, Kofax, DocuSign, Medius, PaperSave, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |