Market Overview

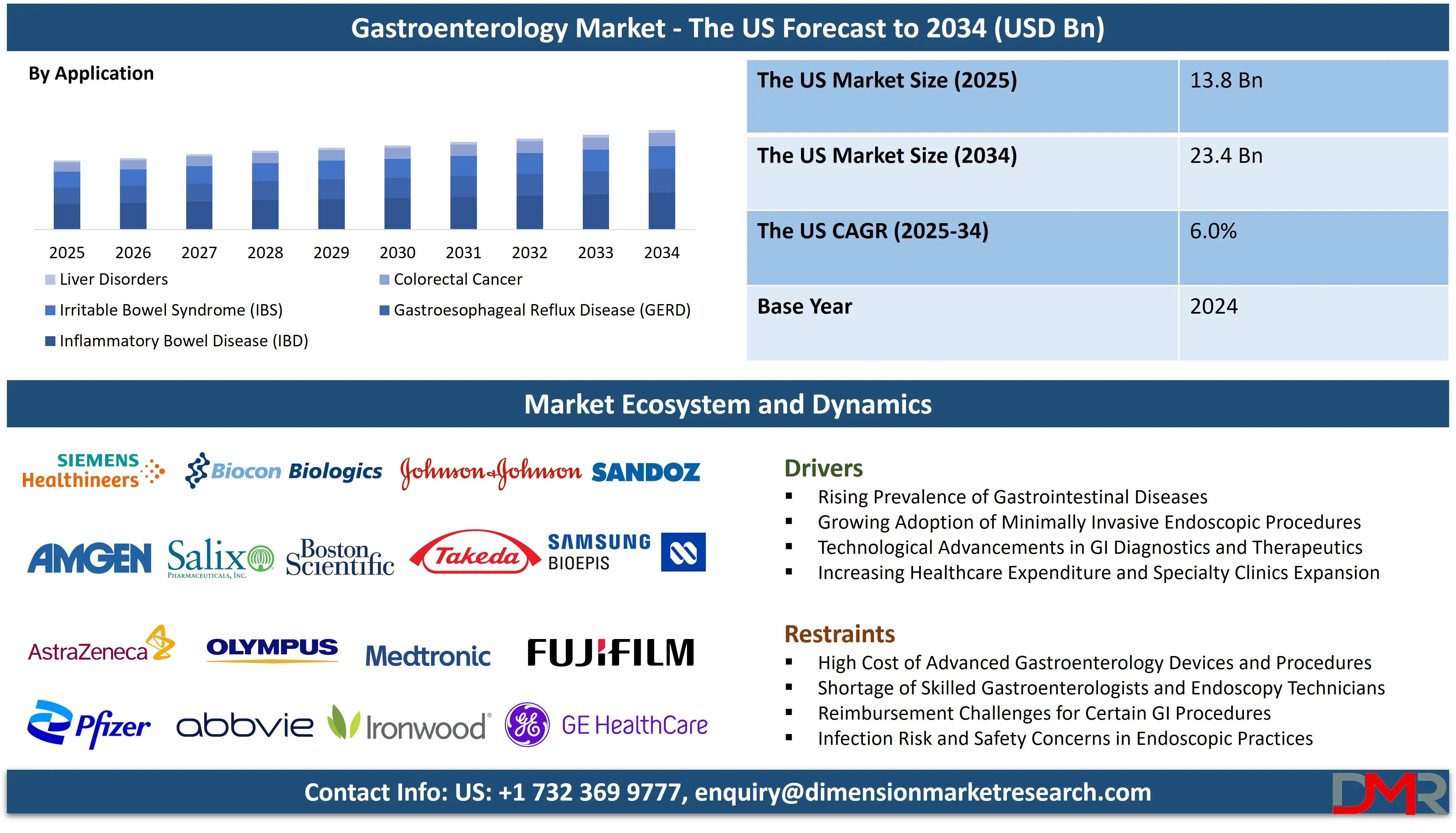

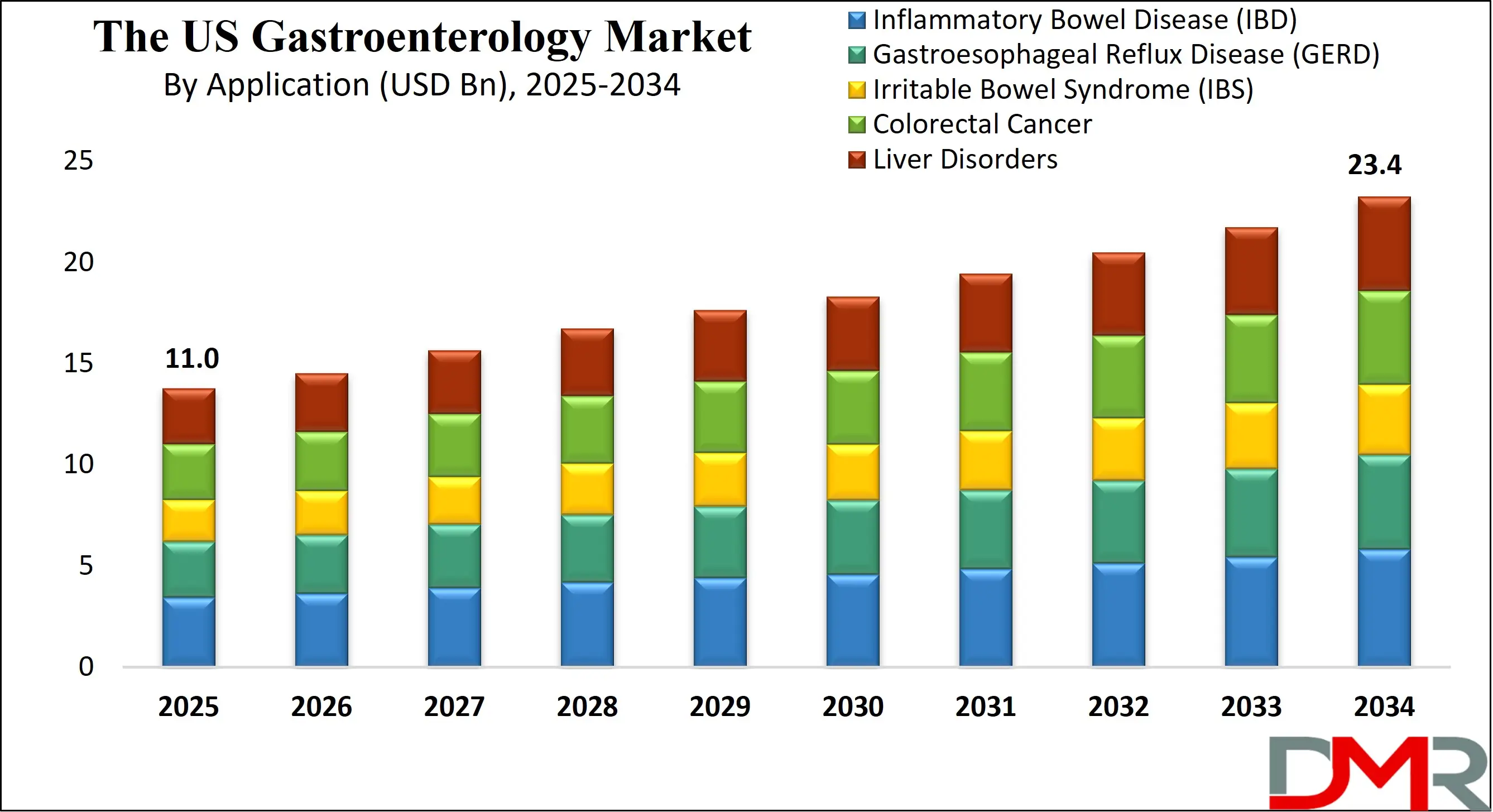

The US gastroenterology market is projected to grow from USD 13.8 billion in 2025 to reach a value of USD 23.4 billion by 2034, at a CAGR of 6.0%. reflecting robust growth driven by the high and rising prevalence of gastrointestinal disorders, advanced healthcare infrastructure, and significant investment in medical innovation.

The US market is the largest globally, characterized by a high volume of diagnostic and therapeutic procedures, extensive adoption of cutting-edge technologies, and a strong focus on specialty care. The growing incidence of inflammatory bowel disease, gastroesophageal reflux disease, colorectal cancer, and metabolic liver disorders such as NASH is fueling demand for advanced pharmaceuticals, endoscopic devices, and minimally invasive interventions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This growth is underpinned by rapid technological adoption, including AI-enhanced endoscopy platforms, capsule endoscopy, and precision medicine approaches. High levels of healthcare expenditure, a complex but active private insurance landscape, and substantial research and development investment from leading pharmaceutical and medical device firms further propel market expansion. The increasing shift towards ambulatory surgery centers and specialized GI clinics enhances patient access to advanced diagnostics and therapies, solidifying the US's dominant position in the global gastroenterology landscape.

Gastroenterology is a major medical specialty in the US, focused on the comprehensive management of digestive system disorders. The market is technologically advanced and dynamic, distinguished by high procedural volumes, significant R&D expenditure, and an emphasis on early detection and chronic disease management. It encompasses a wide array of products and services, from diagnostic imaging and endoscopy to pharmaceutical therapeutics and surgical devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Market dynamics are heavily influenced by an aging population, high obesity rates, lifestyle factors, and a complex regulatory and reimbursement environment. Emerging trends, including the integration of artificial intelligence in diagnostics and pathology, the expansion of telemedicine, and the growing emphasis on value-based and personalized care, are actively shaping the future of gastroenterology practice across the US healthcare system.

The US Gastroenterology Market: Key Takeaways

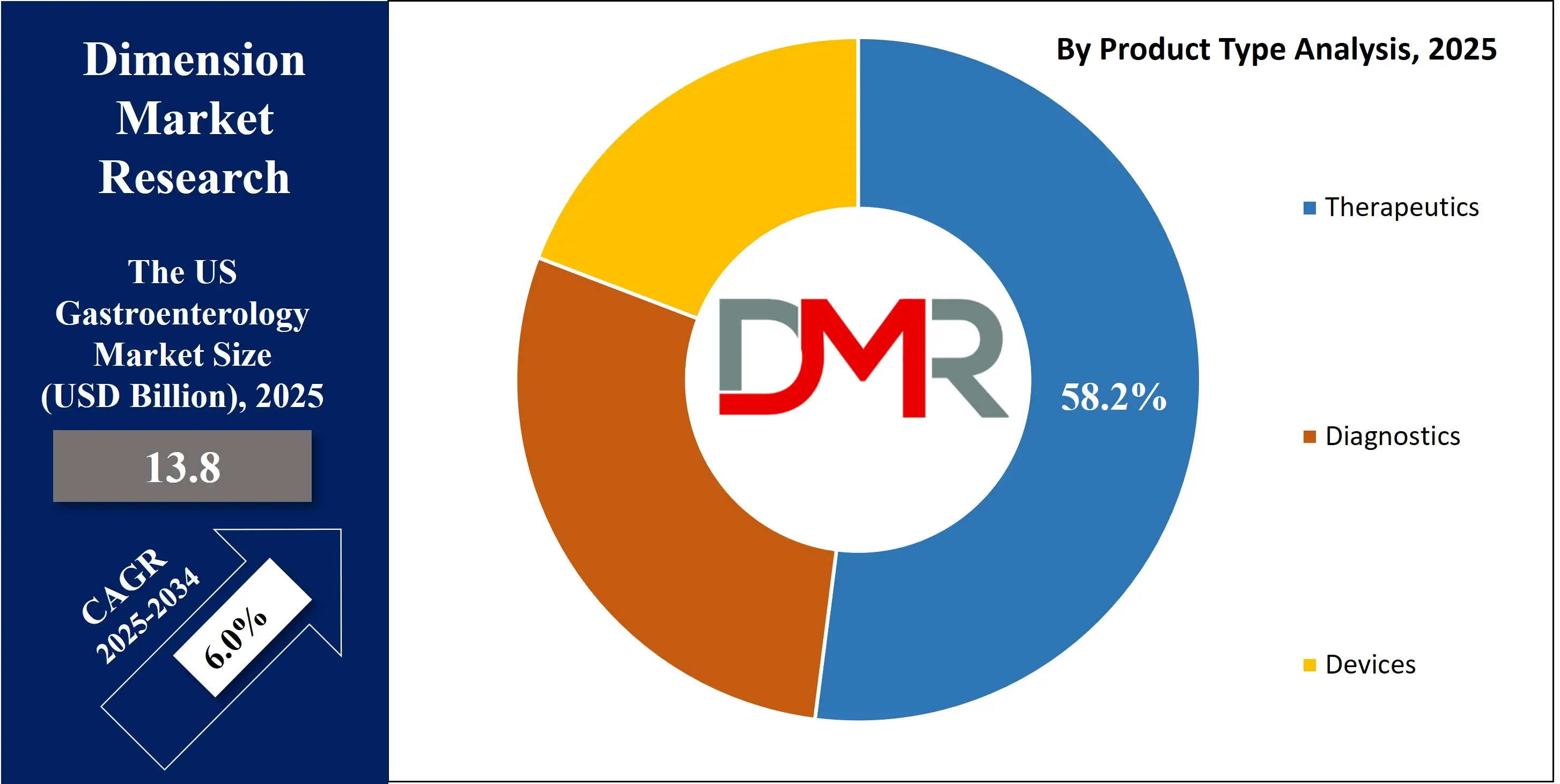

- Market Value: The US gastroenterology market is projected to be valued at USD 13.8 billion in 2025, growing at a CAGR of 6.0% over the forecast period.

- By Product Type Segment Analysis: Therapeutics are anticipated to dominate the product type segment, capturing the leading share of the total US market in 2025, driven by high spending on chronic condition management.

- By Route of Administration Segment Analysis: Injectables are expected to maintain dominance, fueled by the widespread use of high-cost biologics for complex conditions like inflammatory bowel disease.

- By Drug Type Segment Analysis: Branded Drugs is poised to dominate the drug type segment in value, supported by the US market's premium pricing environment and rapid adoption of novel therapies.

- By Application Segment Analysis: Inflammatory Bowel Disease (IBD) is projected to dominate the application segment in terms of revenue, representing a major clinical and economic burden requiring advanced, costly treatments.

- By End-User Segment Analysis: Hospitals is poised to account for the maximum share in the end-user segment, serving as the primary site for complex procedures, surgeries, and infusion-based therapies.

- Regional Position: The US represents the single largest and most advanced national market within the global gastroenterology landscape.

- Key Players: Leading players in the US market include AbbVie Inc., Johnson & Johnson, Takeda Pharmaceutical Company, Pfizer Inc., Bristol Myers Squibb, Eli Lilly and Company, Medtronic plc, Boston Scientific Corporation, Olympus Corporation, and Steris PLC, among others.

The US Gastroenterology Market: Use Cases

- Early Cancer Detection: Advanced endoscopy, AI-assisted imaging, and molecular stool tests enable early identification of colorectal and gastric cancers, improving survival rates. Hospitals and diagnostics centers use these tools to detect precancerous polyps and lesions before symptoms arise, supporting preventive care pathways.

- Inflammatory Bowel Disease (IBD) Management: Biologics, biosimilars, and non-invasive monitoring tools help manage Crohn’s disease and ulcerative colitis. Providers use therapeutic drug monitoring, imaging, and endoscopy to personalize treatment, reduce flare-ups, and improve long-term outcomes for millions of patients requiring continuous care in the U.S.

- GERD and Acid Reflux Treatment: Endoscopic procedures, minimally invasive surgical interventions, and optimized drug therapies support accurate diagnosis and long-term management of GERD. Clinics use pH monitoring, imaging, and targeted medications to reduce symptoms, prevent esophageal damage, and decrease chronic complications among high-risk patient groups.

- Liver Disease Assessment: Non-invasive elastography, lab biomarkers, and imaging technologies enable early diagnosis and monitoring of fatty liver disease, hepatitis, and cirrhosis. Providers rely on advanced tools to assess fibrosis, guide therapy, reduce biopsy dependency, and manage the rising burden of metabolic-related liver disorders.

- GI Infection and Microbiome Testing: Rapid molecular panels, stool tests, and microbial profiling help identify bacterial, viral, and parasitic gastrointestinal infections. Healthcare settings use these tools for precise diagnosis, antibiotic stewardship, and personalized microbiome-based treatment strategies that enhance patient outcomes and reduce unnecessary broad-spectrum therapies.

Impact of Artificial Intelligence on The US Gastroenterology market

- Enhanced Polyp Detection: AI-powered colonoscopy systems improve real-time identification of polyps and early cancer lesions, reducing miss rates. This strengthens colorectal cancer screening accuracy, supports physicians during procedures, and significantly increases diagnostic confidence across hospitals and endoscopy centers nationwide.

- Automated Image Interpretation: AI algorithms analyze endoscopic and imaging data rapidly, helping classify abnormalities, detect inflammation, and differentiate tissue types. This reduces diagnostic variability, shortens interpretation time, and supports gastroenterologists in making faster clinical decisions for complex gastrointestinal disorders.

- Personalized Treatment Planning: AI-driven predictive models use patient history, biomarkers, and imaging results to tailor treatment plans for IBD, GERD, and liver diseases. This supports individualized therapy selection, improves medication response rates, and enhances long-term disease management outcomes.

- Workflow Optimization in Endoscopy Units: AI software streamlines scheduling, documentation, and quality benchmarking in endoscopy departments. By automating procedure reports and reducing administrative workload, it boosts operational efficiency, increases patient throughput, and supports high-quality care across large hospital systems.

- Microbiome and Lab Data Analysis: AI tools analyze complex microbiome, genomic, and lab datasets to identify infection patterns, gut dysbiosis, and emerging biomarkers. This enhances precision diagnostics, supports targeted therapies, and accelerates research advancements across gastrointestinal diseases in the U.S. healthcare ecosystem.

The US Gastroenterology Market: Stats & Facts

Centers for Disease Control and Prevention (CDC)

- Colorectal cancer is the third leading cause of cancer-related deaths in the US. Screening prevalence has increased, but disparities remain across populations.

- The prevalence of diagnosed IBD in the US adult population is estimated at over 3 million, with significant direct and indirect healthcare costs.

American Cancer Society (ACS)

- Estimated new colorectal cancer cases in the US (2024): 152,810.

- Estimated colorectal cancer deaths in the US (2024): 53,010.

- The 5-year relative survival rate for colorectal cancer is 65%, highlighting the critical importance of early detection through screening.

National Institutes of Health (NIH)

- NIH research funding supports extensive basic and clinical research in digestive diseases, including IBD, liver disease, and GI cancers, fostering innovation that translates into market advancements.

- Conditions like GERD and IBS are among the most common diagnoses in outpatient clinical settings, representing a massive patient population driving primary and specialty care visits.

Food and Drug Administration (FDA)

- The FDA's Center for Drug Evaluation and Research (CDER) and Center for Devices and Radiological Health (CDRH) are key regulators for new GI drugs and devices. The FDA's Breakthrough Therapy and Priority Review designations often accelerate the market entry of innovative GI therapies.

- The FDA maintains surveillance and approval pathways for novel endoscopic tools, AI-based software as a medical device (SaMD), and in vitro diagnostic tests for GI conditions.

Agency for Healthcare Research and Quality (AHRQ)

- AHRQ data on hospital utilization shows that diseases of the digestive system account for millions of hospital discharges annually, with significant associated costs.

- AHRQ supports research on improving the quality, safety, and efficiency of GI care, including work on appropriate use of endoscopy and management of GI bleeding.

The US Gastroenterology Market: Market Dynamics

The US Gastroenterology Market: Driving Factors

High Disease Prevalence and Aging Demographics

The substantial and growing burden of chronic digestive diseases is the primary market driver. The high prevalence of GERD, IBS, IBD, colorectal cancer, and NAFLD/NASH, compounded by an aging population more susceptible to GI conditions, ensures sustained demand for diagnostic, therapeutic, and management solutions. Lifestyle factors, including obesity and dietary patterns, further contribute to disease incidence. This large and growing patient base creates a continuous need for services and products, from screening colonoscopies to lifelong pharmaceutical therapies, providing a stable foundation for market growth.

Technological Innovation and Early Adoption

The US market's role as a primary launchpad and rapid adopter of medical technology significantly propels growth. Innovations such as AI-integrated endoscopy systems, disposable endoscopes, advanced hemostasis devices, and novel biologic and small-molecule drugs are quickly integrated into clinical practice. This environment drives market renewal, creates demand for next-generation equipment, and encourages manufacturers to continuously innovate. The pursuit of improved clinical outcomes, procedural efficiency, and competitive differentiation fosters a dynamic landscape focused on technological advancement.

The US Gastroenterology Market: Restraints

Cost Containment and Reimbursement Pressures

Intense pressure to control healthcare spending is a major market restraint. Payers, including Medicare, Medicaid, and private insurers, increasingly demand demonstrated value and cost-effectiveness, leading to rigorous prior authorization, step therapy, and utilization management for high-cost drugs and procedures. Health Technology Assessment (HTA)-like considerations are influencing coverage decisions. This environment can delay or restrict patient access to innovative therapies and technologies, forcing manufacturers into challenging pricing and reimbursement negotiations and prioritizing cost savings over clinical novelty unless superior outcomes are unequivocally proven.

Regulatory Complexity and Market Access Hurdles

Navigating the US regulatory landscape for drugs (FDA) and devices (FDA/CDRH) is complex and resource-intensive. Beyond initial approval, achieving favorable coverage and reimbursement from a multitude of public and private payers adds significant challenge. The lack of a unified national reimbursement policy creates a patchwork of coverage criteria and payment rates. This complexity increases the time, cost, and uncertainty of commercialization, potentially stifling innovation for smaller companies and leading to unequal patient access based on insurance type and geographic location.

The US Gastroenterology Market: Opportunities

Expansion of Digital Health and Tele-Gastroenterology

Significant opportunity lies in digital health solutions, including AI diagnostics for endoscopy and pathology, remote patient monitoring platforms for chronic IBD management, and robust telemedicine consultation services. The COVID-19 pandemic accelerated the adoption and reimbursement of telehealth, creating a lasting shift. These technologies improve access to specialty care, enable proactive management, enhance patient engagement, and can optimize clinic workflow efficiency. This digital transformation opens new revenue streams and care delivery models for technology companies and healthcare providers alike.

Growth of Ambulatory Surgery Centers (ASCs) and Outpatient Care

The migration of GI procedures from hospital outpatient departments to specialized ASCs represents a major opportunity. ASCs offer cost efficiencies, patient convenience, and streamlined workflows for routine endoscopies and many therapeutic procedures. This trend drives demand for devices compatible with ASC settings, fosters the development of ASC-focused service models, and reflects the broader shift towards value-based, site-of-care optimization. The growing volume of procedures performed in ASCs expands the accessible market for device manufacturers and service providers.

The US Gastroenterology Market: Trends

Accelerated Integration of Artificial Intelligence

AI and machine learning are moving from pilot studies to mainstream clinical integration. Real-time AI assistance for polyp detection (CADe) during colonoscopy is becoming a standard of care for quality improvement. AI applications are expanding to disease characterization in capsule endoscopy, prediction of bleeding risk, and analysis of pathological samples. This trend drives demand for compatible hardware/software, fosters partnerships between tech and medtech firms, and represents a paradigm shift towards data-driven, augmented clinical decision-making to improve detection rates and standardize care.

Shift Towards Value-Based and Personalized Care Models

The overarching trend is a systemic shift from fee-for-service to value-based care, emphasizing patient outcomes, quality metrics, and total cost of care. This favors minimally invasive techniques that reduce complications and enable faster recovery. It drives demand for therapies and devices that demonstrate superior long-term value through improved quality of life and reduced hospitalizations. The trend also reinforces personalized medicine, using biomarkers and patient data to tailor treatments for conditions like IBD and GI cancers, aligning product development with efficient, patient-centric care pathways.

The US Gastroenterology Market: Research Scope and Analysis

By Product Type Analysis

In the US Gastroenterology Market, the therapeutics segment is projected to hold the largest revenue share, contributing over 58.2% of total market value in 2025. This dominance stems from the country’s exceptionally high burden of chronic gastrointestinal disorders such as IBD, GERD, IBS, NASH, and motility disorders. The US remains the global demand center for biologics, including anti-TNF, anti-integrin, anti-IL-12/23, JAK inhibitors, and emerging S1P receptor modulators. High biologic utilization is supported by strong payer reimbursement, widespread insurance coverage, a premium pricing environment, and physician preference for biologic-first treatment strategies. Direct-to-consumer advertising, which is unique to the US, further amplifies therapeutic adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The devices segment forms the second-largest revenue pillar, driven by massive procedure volumes across colonoscopy, flexible sigmoidoscopy, ERCP, EUS, and therapeutic endoscopy. The US leads global adoption of AI-enabled endoscopic systems, single-use duodenoscopes, robotic endoscopy platforms, and next-generation visualization technologies. Strong replacement cycles in hospitals and ASCs ensure continuous capital spending.

The diagnostics segment is expanding steadily due to mandated colorectal cancer screening for adults aged 45+, higher uptake of fecal immunochemical tests (FIT), stool DNA tests, non-invasive breath tests, and advanced imaging such as FibroScan and MR elastography for liver disease. Precision diagnostics for IBD and gut microbiome panels are gaining traction. Collectively, these factors position therapeutics, devices, and diagnostics as a triad supporting the market’s high-value structure.

By Route of Administration Analysis

In the US Gastroenterology Market, the injectables segment is expected to holds the largest revenue share—approximately 45% in 2025—primarily due to the dominance of biologics delivered either intravenously or subcutaneously. The treatment landscape for Crohn’s disease, ulcerative colitis, eosinophilic esophagitis, liver inflammatory disorders, and severe motility issues is heavily dependent on high-cost infused or injected therapies. Widespread availability of hospital infusion centers and standalone biologic infusion clinics supports this uptake. The US reimbursement environment encourages adoption of specialty injectables, making them the financial backbone of GI therapeutics.

While injectables dominate revenue, oral medications command the largest share in prescription volume. Common GI disorders such as GERD, functional dyspepsia, IBS, gastritis, and mild IBD are mostly treated with oral drugs including PPIs, H2 blockers, antispasmodics, prokinetics, immunomodulators, corticosteroids, and newer targeted small-molecule drugs. The convenience, affordability, ease of long-term therapy, and prominent role of primary care providers drive volume dominance. Emerging oral options for IBD, such as JAK inhibitors and S1P modulators, are accelerating growth within the oral category.

The others category includes rectal formulations, sprays, topical agents, and nutritional therapeutics used in niche indications. While smaller in scale, it remains relevant for conditions like ulcerative proctitis and hepatic encephalopathy. Overall, the route-of-administration structure reflects a contrast: injectables drive revenue due to high-cost biologics, while oral medications drive mass utilization due to their accessibility and alignment with chronic disease management.

By Drug Type Analysis

The US Gastroenterology Market is poised to characterized by a strong skew toward branded drugs, which account for over 70% of market revenue in 2025. This leadership is driven by the substantial use of innovative biologics and newly launched small-molecule therapies. Premium pricing protected by patents, a slower decline in prices after patent expiry, extended exclusivity through litigation, and robust brand recognition contribute to sustained branded drug dominance. Companies operating in the US benefit from favorable reimbursement and extensive marketing capabilities, further strengthening brand-driven demand across IBD, EoE, NASH, chronic gastritis, and severe GERD.

In contrast, generic drugs dominate prescription volume due to widespread utilization of older, well-established medications such as PPIs, aminosalicylates, and conventional immunomodulators. These generics ensure cost-accessible care especially for chronic, non-life-threatening GI disorders. However, despite high volume, the revenue contribution of generics remains limited due to significantly lower pricing and intense competition.

Biosimilars represent a growing yet slower-moving category compared to Europe. Although biosimilar versions of infliximab, adalimumab, and ustekinumab are gradually gaining adoption, their penetration is moderated by payer contracts, physician caution, brand loyalty, reimbursement differences, and interchangeability policies. Nevertheless, biosimilars are expected to accelerate cost savings for health systems and expand IBD biologic access over the next decade.

Overall, the drug-type structure reflects a classic US market pattern: branded drugs lead revenue due to innovation and pricing power, generics drive accessibility and volume, and biosimilars serve as a slowly emerging middle layer that will reshape biologic cost dynamics.

By Application Analysis

In the US Gastroenterology Market, Inflammatory Bowel Disease (IBD)—encompassing Crohn’s disease and ulcerative colitis—is poised to represents the largest revenue-generating application. The segment is driven by the chronic, lifelong nature of IBD, the high cost of biologic and advanced oral therapies, and frequent requirements for monitoring, imaging, endoscopy, and hospitalization. The US has among the highest IBD prevalence worldwide, with rapid adoption of next-generation biologics and combination treatment strategies.

Gastroesophageal Reflux Disease (GERD) represents the largest application by patient volume. Despite generating lower per-patient revenue, its enormous prevalence results in high total prescriptions for PPIs, H2 blockers, prokinetics, and diagnostic procedures such as endoscopy and pH monitoring. GERD remains one of the most frequently managed GI disorders in primary and specialty care.

Colorectal Cancer (CRC) forms another major segment, driven by the US emphasis on early detection, mandatory screening guidelines starting at age 45, and strong demand for colonoscopy, FIT tests, stool DNA tests, and therapeutic interventions. CRC also stimulates significant oncology drug use, endoscopic polypectomy, and surgical procedures.

Liver Disorders, especially NASH and advanced fatty liver disease, represent a rapidly expanding application. With multiple late-stage drug candidates nearing approval, this segment is expected to become one of the fastest-growing areas.

Overall, application segmentation reveals a dual structure: chronic inflammatory diseases generate high revenue through biologics, while prevalent conditions such as GERD drive mass utilization across diagnostics and oral therapies.

By End User Analysis

Hospitals are projected to dominate the US Gastroenterology Market end-user landscape, capturing the largest revenue share. They serve as the primary hubs for complex GI surgeries, advanced therapeutic endoscopy, inpatient management of acute GI bleeding, pancreatitis, liver failure, and cancer care. Hospitals invest heavily in advanced endoscopes, AI-supported imaging, robotic systems, and infusion centers for biologic administration. Large hospital networks often integrate gastroenterology with oncology, hepatology, and general surgery, creating high-volume multidisciplinary pathways that reinforce their dominance.

Ambulatory Surgery Centers (ASCs) represent the fastest-growing end-user segment. ASCs have become preferred sites for routine procedures such as colonoscopy, flexible sigmoidoscopy, upper GI endoscopy, polypectomy, and certain EUS and ERCP interventions. Their growth is propelled by lower procedure costs, faster scheduling, shorter patient wait times, and payer incentives to shift care away from hospitals. Many gastroenterology groups operate their own ASCs, strengthening vertical integration and procedural control.

Specialty Gastroenterology Clinics continue to play an essential role in diagnosis, long-term disease management, monitoring, and prescribing. These clinics are central to managing IBD, IBS, GERD, chronic constipation, and metabolic liver disorders. Increasing telemedicine integration is expanding access to outpatient GI care.

Retail and Online Pharmacies form the primary distribution channel for oral medications, driving convenience-driven prescription fulfillment. The rise of mail-order pharmacies, especially for chronic GI therapies, further strengthens this segment.

The US Gastroenterology Market Report is segmented on the basis of the following

By Product Type

- Biologics

- Biosimilars

- Small Molecules

- Endoscopic Procedures

- Imaging

- Lab Tests

- Biopsy Tools

- Surgical Instruments

By Route of Administration

- Injectables

- Oral Medications

- Others

By Drug Type

- Branded Drugs

- Generic Drugs

By Application

- Inflammatory Bowel Disease (IBD)

- Gastroesophageal Reflux Disease (GERD)

- Irritable Bowel Syndrome (IBS)

- Colorectal Cancer

- Liver Disorders

By End-User

- Hospitals

- Diagnostic Centers

- Retail Pharmacies

- Online Pharmacies

By Region

The US

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of The US

The US Gastroenterology Market: Competitive Landscape

The US competitive landscape is intense and defined by innovation in both pharmaceuticals and medical devices. In pharmaceuticals, dominant players like AbbVie (Humira, Skyrizi, Rinvoq), Johnson & Johnson (Stelara, Remicade), and Takeda (Entyvio) fiercely compete in the high-stakes IBD space, while others target GERD, IBS, and NASH. The pipeline for novel biologics, oral small molecules, and microbiome therapies is robust, with companies leveraging direct-to-physician marketing, outcomes data, and payer contracting strategies.

In medical devices, companies like Medtronic (GI Solutions), Boston Scientific, Olympus America, and Steris (CONMED) compete through technological leadership in endoscopy platforms, visualization, therapeutic devices, and single-use endoscopes. Innovation cycles are rapid, with a focus on improving procedural efficacy, safety, and integration with digital/AI tools. Strategic mergers, acquisitions, and partnerships are common to broaden portfolios and access new technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Some of the prominent players in The US Gastroenterology market are

- AbbVie

- Takeda

- Johnson & Johnson / Janssen

- Pfizer

- Salix Pharmaceuticals

- AstraZeneca

- Ironwood Pharmaceuticals

- Amgen

- Biocon Biologics

- Sandoz

- Samsung Bioepis

- Olympus

- Boston Scientific

- Medtronic

- Fujifilm

- GE HealthCare

- Siemens Healthineers

- Philips

- Exact Sciences

- Quest Diagnostics

- Other Key Players

The US Gastroenterology Market: Recent Developments

- November 2025: Abbott announced the acquisition of Exact Sciences’ Cologuard business, strengthening its leadership in non-invasive colorectal cancer diagnostics and expanding its GI-focused molecular testing portfolio.

- October 2025: The American College of Gastroenterology (ACG) held its Annual Scientific Meeting, showcasing advances in AI-assisted endoscopy, new biologics for IBD, and next-generation screening technologies.

- October 2025: Major GI practice consolidation accelerated, with several large private equity–backed platforms expanding their national presence through ASC acquisitions and physician-group integrations.

- August 2025: The FDA granted accelerated approval for semaglutide (Wegovy) for MASH/NASH, marking the first major therapy for metabolic liver diseases and reshaping the U.S. hepatology treatment landscape.

- August 2025: The American Association for the Study of Liver Diseases (AASLD) updated its guidance to incorporate new diagnostic pathways and treatment recommendations for MASH following recent drug approvals.

- Early 2025: SCA Health (Optum/UnitedHealth) completed the acquisition of U.S. Digestive Health, expanding its nationwide gastroenterology and ambulatory surgery center network.

- November 2024: Cardinal Health acquired GI Alliance, one of the largest U.S. gastroenterology physician platforms, strengthening its footprint in specialty care services and GI diagnostics distribution.

- October 2024: The American Gastroenterological Association (AGA) expanded its innovation ecosystem, launching new investment programs to support GI startups in diagnostics, digital therapeutics, and minimally invasive technologies.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.8 Bn |

| Forecast Value (2034) |

USD 23.4 Bn |

| CAGR (2025–2034) |

6.0% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Therapeutics, Diagnostics, Devices), By Route of Administration (Injectables, Oral Medications, Others), By Drug Type (Branded Drugs, Generic Drugs), By Application (Inflammatory Bowel Disease, Gastroesophageal Reflux Disease, Irritable Bowel Syndrome, Colorectal Cancer, Liver Disorders), By End-User (Hospitals, Diagnostic Centers, Retail Pharmacies, Online Pharmacies) |

| Regional Coverage |

The US |

| Prominent Players |

AbbVie, Takeda, Johnson & Johnson, Pfizer, Salix Pharmaceuticals, AstraZeneca, Ironwood Pharmaceuticals, Amgen, Biocon Biologics, Sandoz, Samsung Bioepis, Olympus, Boston Scientific, Medtronic, Fujifilm, GE HealthCare, Siemens Healthineers, Philips, Exact Sciences, Quest Diagnostics, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |