The US High-Speed Steel Market

The

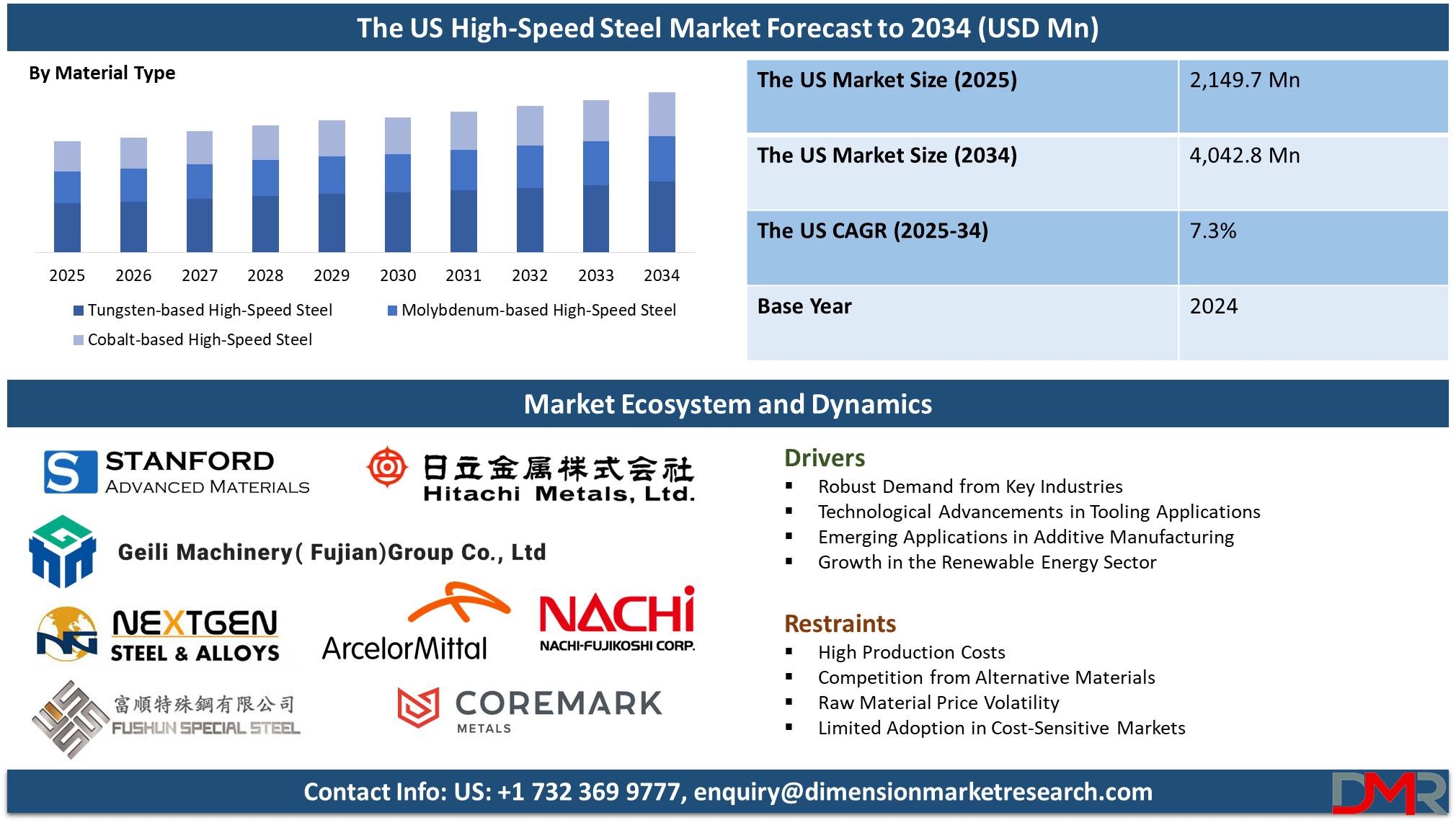

US High-Speed Steel Market is projected to be

valued at USD 2,149.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 4,042.8 million in 2034 at a

CAGR of 7.3%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US HSS market recorded stable growth due to its increased demand in strategic industries such as automotive, aerospace, and manufacturing industries. HSS is a high temperature-tolerant material used for cutting purposes without losing hardness; hence, it sees a huge demand for applications in precision and durable tooling. The factors contributing to the market determinants are improvement in manufacturing technologies, demand from end-use industries, and performance improvement needs of tools. Some other factors that contribute to the growth in the overall market are an increase in the adoption rate of precision engineering and automation.

US HSS market trends are towards high-performance materials that enhance tool life and efficiency. HSS based on powder metallurgy is finding increased applications because of its superior properties, such as improved wear resistance and higher cutting performance, compared to conventional HSS. Cobalt-based and tungsten-based high-speed steels will be increasingly in demand due to their improved durability and resistance to thermal degradation. The emergence of sustainable production and the adoption of energy-efficient manufacturing will further prompt the producers to make greener HSS solutions.

The US HSS market provides good opportunities, as there is continuous innovation within material science. The high-performance cutting tools manufactured within HSS will continue to be an essential element in automotive and aerospace applications excellent opportunity that manufacturers can capitalize on. The need for tailored superior steel grades keeps pace with growth through increased capability in the manufacture of high-value, complex, and novel sectors of industry, especially robots and additive manufacturing. Therefore, firms can also try to pursue product development niches and geographical expansion to exploit the emerging demands of the market.

However, there are also some constraints that the US HSS market faces. The cost of raw material inputs is very high. Tungsten and molybdenum are also pretty costly. So, making low-cost HSS tools might be difficult. Also, moving to alternative cycle materials such as carbide bases may lead to a decline in demand for HSS in certain applications. Other challenges include increased competition from the international supplier side, mainly from countries in a position where active costs of manufacturing are lower because this can dent the competitiveness status of the domestic manufacturers of HSS. These have been the reasons that can reduce profit margins and keep growth factors at subdued levels in the short run too.

Growth prospects for the US HSS market remain positive, nevertheless. Demand for precision engineering in automotive and aerospace component manufacturing is likely to go up further. Advances in technology related to manufacturing processes, including the development of additive manufacturing and advanced machining techniques, are foreseen to drive demand for specialty grades of HSS. Besides, all of this will be further supplemented through the continuous development of high-performance cutting tools, which promise to bring down operational costs while enhancing productivity. Again, sustainability and resource efficiency could develop into key concerns that also ensure the availability of recyclable, eco-friendly HSS solutions to further bolster the market's potential.

In other words, the US High-Speed Steel market holds much promise on fronts of growth, innovation, and opportunities for diversification. Focusing on product improvements, new application areas, challenges of raw material costs, and competition, the future certainly looks robust. The US HSS market will continue to be an important segment in the manufacturing world, given the changing industrial landscape and growing demand for precision tools.

The US High-Speed Steel Market: Key Takeaways

- The US Market Size: The US High-Speed Steel Market size is estimated to have a value of USD 2,129.7 million in 2025 and is expected to reach USD 4,042.8 million by the end of 2034.

- Key Player: Some of the major key players in The US High-Speed Steel Market are Stanford Advanced Materials, COREMARK Metals, Griggs Steel Co., NACHI-FUJIKOSHI CORP., Hitachi Metals, Ltd., Fushun Special Steel Co., and many others.

- By Product Type Segment Analysis: Metal Cutting Tools are projected to dominate this segment with 37.1% of market share by the end of 2025.

- By Material Type Segment Analysis: Tungsten-based High-Speed Steel, is anticipated to dominate this segment with 44.9% of market share in 2025.

- Market Growth Rate: The market is growing at a CAGR of 7.3 percent over the forecasted period.

The US High-Speed Steel Market: Use Cases

- Automotive Industry: High-speed steel material is imperative in the production of precision-cutting tools like drills and taps used for the manufacture of auto parts, and it imparts very good strength, highly productive machining, and precision into the making of complicated components related to gears, engine parts, and transmission mechanisms.

- Aerospace Engineering: HSS tools are indispensable in the machining of difficult materials, such as titanium and nickel alloys that are essential in aerospace applications. With superior wear resistance and the capability to withstand high temperatures, the precise machining of turbine blades, structural parts, and casings is possible.

- Metalworking & Manufacturing: High-speed steel is widely used in drilling, milling, and turning operations for general metalworking industries due to its very high hardness and heat resistance, along with toughness for long tool life in production environments that require consistent performance.

- Tool and die-making: HSS finds its vast applications in mold and die-making and in tool-making for repetition jobs. That would mean a long and stable life or reproducibility against the high stresses the stamps, forge pieces, and extrusions endure.

The US High-Speed Steel Market Dynamic

Driving Factors in The US High-Speed Steel Market

Robust Demand from Key IndustriesOne main growth driver for the US High-Speed Steel market is continuous demand emanating from major industries, such as the automotive, aerospace, and construction industries. All these industries require cutting tools that bear extreme conditions of high temperature and heavy wear. High-speed steel maintains hardness even when at high temperatures and hence is an ideal material in manufacturing precision tools used for machining intricate parts in these industries. As a matter of fact, in the automotive industry, for example, HSS tools are applied to manufacturing parts of engines, gears, and transmissions that need great accuracy and strength.

Similarly, in aerospace engineering, with a widespread application of advanced materials such as titanium and high-strength alloys, HSS tools are indispensable to guarantee the accuracy and reliability of machining. With these industries continuing to show growth, especially in the US, it is also bound to increase the demand for HSS-made high-performance tools and, in return, ensure market growth. Greater automation and precision in manufacturing, among other needs, further create demands for advanced tooling solutions using high-speed steel to meet such exacting production requirements.

Technological Advancements in Tooling Applications

The continuous evolution of tooling technologies is considered one of the major factors responsible for growth in the US High-Speed Steel market. As manufacturing becomes increasingly complex, so also does the requirement for high-performance materials such as HSS, which can successfully meet the increasing demands for advanced machining applications. For instance, industries such as precision engineering or general manufacturing need to be able to achieve finer tolerances and higher surface finishes. Hence, HSS hand tools make manufacturers' jobs very easy to meet such a requirement; it is impossible to replace them within the modern line of production. The introduction of automation and more specifically the increased demand for qualitative and durable cutters further contributed to creating demand for their CNC machines.

During high-speed machining operations, which involve tools undergoing repetitive stresses, HSS does provide the reliability necessary for their processing successfully. These factors, along with increasing demand for more accurate and high-performance parts, have driven the growth of the HSS market, with both manufacturers and end-users seeking durable, cost-effective solutions for their machining needs. As technology evolves, manufacturers continually update and improve HSS products to keep competitive and meet industry-specific needs.

Restraints in The US High-Speed Steel Market

High Production Costs

One of the major constraints on the US High-Speed Steel market is the high production cost for the manufacturing of high-speed steel tools. The raw materials required in HSS, such as tungsten, molybdenum, cobalt, and vanadium, are pricey and their cost keeps fluctuating; this accounts for a high share of the overall cost of production. Besides, the complicated manufacturing processes that are involved while making high-performance HSS, which includes powder metallurgy and heat treatment, make it even more expensive.

These very high production costs are normally passed on to the consumer; hence, compared to other tools, such as carbide-based ones, the HSS tools usually turn out to be relatively more expensive. This, in turn, makes companies in industries where their budgets are tight use much cheaper alternatives, thus limiting the demand for HSS in certain applications.

This would be a factor of raw material price volatility that would further reduce profitability for the producers of HSS at a high cost, thus stagnating the market when the manufacturers fail to find ways of cutting the production cost in economical ways and producing good-quality products.

Competition from Alternative Materials

Another major restraint factor for the High-Speed Steel market in the US is the emerging competition from alternate materials, such as carbide-based tools. Carbide, in particular tungsten carbide, is much harder and more wear-resistant than the conventional HSS, making it a very good alternative for a lot of machining applications. Generally, carbide tools tend to last longer and can be used with greater efficiency during high-speed machining, which may lower overall operational costs.

Carbide tools have gained favor in industries looking to optimize their manufacturing processes and cut costs, especially for high-volume and precision-cutting jobs. This change in preference, in favor of carbide due to its higher performance and longer tool life, is driving demand pressure onto high-speed steel. Therefore, the producers in the HSS market are facing tough competition from carbide tool suppliers and must innovate/develop superior HSS products to ensure their market positioning.

Opportunities in The US High-Speed Steel Market

Emerging Applications in Additive Manufacturing

Further opportunity for growth in the US High-Speed Steel market is its application in the fast-expanding additive manufacturing sector, popularly known as 3D printing. The usage of HSS in the technologies of 3D printing presents certain advantages in the manufacturing of highly customized and complex geometries for tools with difficulties or impossibilities under traditional manufacturing methods.

As additive manufacturing continues to gain traction, especially in industries such as aerospace, automotive, and medical devices, demand for specialty materials like HSS is forecasted to rise accordingly. Currently, HSS is utilized to print high-performance cutting tools and parts that need high strength, toughness, and wear resistance. This technology enables manufacturers to optimize production processes, reduce waste, and shorten lead times.

Additive manufacturing also orients the production of parts on demand toward a growing trend in the direction of localization of production and small-scale batching. As 3D printing technology continues to evolve, more and more industries will increasingly use HSS for custom tooling solutions, thus offering the HSS producer a lucrative opportunity to innovate in the emergent market.

Growth in the Renewable Energy Sector

Growth in the Renewable Energy Sector Another promising avenue for the US High-Speed Steel market is the increasing demand coming from the renewable energy sector. As the global energy landscape continues to shift toward sustainability, renewable sources of energy like wind, solar, and hydroelectricity are suddenly pulling in great traction. The production of renewable energy machinery, such as wind turbine blades and parts of solar panels, calls for materials with superior performance that can support the most extreme wear and tear, as well as corrosion.

High-speed steel provides a durable means, with heat resistance, necessary in the production of components of renewable energy technologies. HSS tools are used in the making of precision parts for wind turbine gearboxes and other machinery of importance. This, therefore, calls for increased usage of quality and durable HSS tools with the expansion of the renewable energy industry, more so in the US. This trend allows the companies to be at the forefront of producing specifically designed HSS products for the renewable energy sector to capture a huge, fast-growing market base and product differentiation.

Trends in The US High-Speed Steel Market

Advancements in Manufacturing Technology

Another striking trend now observable within the US market of High-Speed Steels involves certain enhancements in their technology, such as that made particularly in powder metallurgy. There had, thus far, been great increases in acceptance from the wider customer base since, against HSS with ordinary types of products, Powder metallurgies presented various improvements of superiority regarding wearing properties and improved general thermal stability at cut places. This allows the production of quality steels with certain desirable characteristics, such as finer microstructures and higher hardness, which are very important in specific, more demanding applications like aerospace and automotive manufacturing.

Besides, additive manufacturing or 3D printing is developing to extend traditional production methods in manufacturing HSS tools, thus allowing significant customization and probably very complicated geometries that are impossible to produce by any other manufacturing route. Precision components made with the help of rapid prototyping and production open completely new avenues of innovation in tool design. This automatically provides extra value to the producers in the manufacture of longer tool life, reduction of downtimes, and increased overall productivity. As this technology is evolving, the producers of HSS are reinvesting their funds into the modernization of processes so that competitive varieties with high performances can be availed for fast-growing demands in end-user industries.

Sustainability and Eco-Friendly Solutions

Sustainability has emerged as one of the key trends in the US High-Speed Steel market, considering increasing environmental concerns and pressures related to regulatory requirements. Manufacturing companies are focused on the production of eco-friendly and sustainable HSS solutions that would minimize environmental impact during the production process. The recovery and reutilization of tungsten, molybdenum, and cobalt-three of the key raw materials that go into the making of HSS-can be enabled, among other high-value metals, by recent technology development of recycling facilities.

Companies seek ways to reduce their carbon footprint while optimizing energy usage through environmentally friendly production methods according to industrial standards and regulatory requirements. Additionally, recycling metals for the manufacture of HSS tools saves the environment and reduces dependency on mining, thus providing cost benefits to the manufacturers. Besides, tools manufactured from eco-friendly HSS solutions will also enable end-users to achieve sustainability goals, especially in industries like automotive and construction, where environmental performance is turning out to be a key driver of product development. This trend reflects the growing commitment to environmental stewardship along the value chain in manufacturing, hence promoting the circular economy model in the HSS market.

Research Scope and Analysis

By Product Type Analysis

Metal cutting tools are projected to dominate this segment in the US High-Speed Steel (HSS) market with 37.1% of market share by the end of 2025. The dominant segment in the US HSS market is metal cutting tools because they are deeply essential in most precision machining operations in industries. This sector has been considered indispensable in applications related to drilling, milling, turning, and grinding due to its high accuracy and toughness. The demand for metal-cutting tools has been rising during the past twenty years due to the growth in manufacturing industries, mainly in the automotive, aerospace, and general engineering sectors. HSS provides the hardness and wear resistance necessary in tools to cut or shape metals.

It has come to dominate the material in application because it has combined good sharpness, and high cutting speed without sacrificing tool life, and the continuous trend toward automation and precision manufacturing in general has increased the requirement for high-performance cutting tools capable of withstanding very high temperatures and stresses, boosting the demand for HSS-based metal-cutting tools. With the increasing complexity of manufacturing processes and the demand for quality output, the segment of metal-cutting tool applications is likely to retain its dominance in the HSS market. The versatility of these tools in various machining applications, along with ongoing technological developments in the manufacturing of HSS, keeps them continuously important and prominent in the market.

By Material Type Analysis

Tungsten-based High-Speed Steel (HSS) is projected to dominate the US market because of its hardness, wear resistance, and heat resistance; it is widely used in industrial cutting applications. Tungsten is a vital constituent in this material, enhancing the strength of HSS, hence enabling it to resist high temperatures and strong mechanical stresses. This is particularly important in industries like automotive, aerospace, and construction, where tools need to endure high-speed operations and extended use. Tungsten-based HSS can maintain its hardness at temperatures higher than other materials, which is a crucial feature for tools that operate under extreme conditions.

Its resistance to thermal deformation and wear means that Tungsten-based HSS tools have a longer tool life, reducing downtime and replacement costs. Besides, tungsten-based HSS also has very good edge retention, ensuring precision and high-quality finishes in machining processes. All these advantages put together make it very suitable for the manufacture of high-performance cutting tools and hence dominate the market. The demand for Tungsten-based HSS is thus expected to continue with ongoing demands for superior performance tools in the automotive and aerospace industries. Besides these advantages, Tungsten-based HSS will continue to be the material of choice, with further technology advances along with manufacturing requirements for materials that will satisfy the ever-increasing demands of more difficult and sophisticated applications.

By Manufacturing Process Analysis

Conventional High-Speed Steel (HSS) is projected to remain the dominant manufacturing process in the production of HSS since production techniques are well-developed, relatively low-cost, and very reliable for a wide range of applications. In this traditional technique, the mixture of high-grade raw materials is melted and then goes through several heat treatment processes to achieve the required hardness and toughness. This process has been perfected over the years and finds wide application in the manufacture of quality HSS, especially for applications that require superior tool performance under very harsh conditions. The conventional manufacturing process of HSS is less expensive compared to newer processes like powder metallurgy; it therefore remains an attractive option when balancing performance with production cost is a concern.

Besides, the conventional method of making HSS has an understood and optimized production cycle that allows for making even large batches consistently. Even with the advent and proliferation of alternative processes like powder metallurgy, conventional HSS remains the standard manufacturing technique for drills, taps, and mills in general applications related to the automotive, aerospace, and metalworking industries. It is especially valued for applications in which reliability and durability are required due to its great hardness, resistance to wear, and edge retention.

In addition, conventional HSS manufacturing processes are easy and inexpensive; therefore, conventional HSS would still dominate in the market, particularly for applications requiring more standard applications where the performance of cutting tools is important but the manufacturing cost needs to be controlled.

By Application Analysis

The automotive industry is projected to dominate the application segment for the US High-Speed Steel market application of cutting tools in the automotive segment is wider in the US. Needless to say, high precision for components, coupled with developments within the technological sector of the automotive sector, has ultimately rendered HSS tools indispensable in the different sections of vehicle manufacturing. From machining engine parts to transmission systems and chassis components, with complex features such as gears and camshafts, the contribution of HSS cutting tools is essential for determining the high level of quality that has increasingly set the pace in the manufacture of automobiles.

With its capability for sustaining hardness in tempering at high temperatures, besides other features such as great wear resistance, HSS becomes the suitable material for high-speed machining processes like milling, turning, and drilling that characterize automotive production lines. As design complications increase, along with high-performance cars, there is a constant demand for advanced tooling materials that can provide precision and toughness, thereby driving the demand for HSS. Moreover, demand for EVs and the complexities of parts used in EVs further contribute to relying on high-performance HSS tools.

The focus of the automotive sector on automation and efficient production also enhances the demand for HSS cutting tools, as manufacturers want to increase productivity without compromising on high precision levels. While changes are continuously occurring within the automobile industry, which is oriented toward precision, reliability, and performance, HSS will remain the go-to choice for machining the parts required for modern vehicles.

The US High-Speed Steel Market Report is segmented on the basis of the following

By Product Type

- Metal Cutting Tools

- Drills

- Taps

- Milling Cutters

- Reamers

- Others

- Metal Forming Tools

- Blades

- Band Saw Blades

- Circular Saw Blades

- Other Saw Blades

- Others

By Material Type

- Tungsten-based High-Speed Steel

- Molybdenum-based High-Speed Steel

- Cobalt-based High-Speed Steel

By Manufacturing Process

- Conventional HSS

- Powder Metallurgy HSS

By Application

- Automotive Industry

- Aerospace and Defense

- Construction

- General Engineering

- Energy

Competitive Landscape

The competitive landscape of the US HSS market is characterized by a mix of established global players and regional manufacturers vying for market share. Key players like ArcelorMittal, Hitachi Metals, Ltd., Stanford Advanced Materials, and Vishal Steel Industries dominate the market with a strong presence in high-performance steel production and extensive distribution networks. These companies have a record of quality supply of HSS products in the automotive, aerospace, and construction industries.

Such players maintain a competitive edge with continuous technological innovations, investment in advanced manufacturing technologies, and strategic collaborations to enhance product offerings.

Besides, regional players consolidate the market dynamics with their specialized HSS solution contributions: Griggs Steel Co., Fushun Special Steel Co., Ltd., and Nextgen Steel & Alloys. Moreover, all of them have customer-centric approaches to meet the demand from industries. Further, this market puts much emphasis on sustainability initiatives wherein the players involve themselves in activities that fall under the ambit of increasing demand for eco-friendly practices relating to the production of steel, with cases like ERASTEEL.

Mergers, acquisitions, and expansions also shape the competitive advantages in the market, where companies seek to increase their production capacities and reach more markets. Continuous development of manufacturing techniques and strong customer relationships provide a competitive but dynamic environment for the US HSS market.

Some of the prominent players in the US High-Speed Steel Market are

- Stanford Advanced Materials

- COREMARK Metals

- Griggs Steel Co.

- NACHI-FUJIKOSHI CORP.

- Hitachi Metals, Ltd.

- Fushun Special Steel Co., Ltd.

- Dalian Jingtai Industry Trade Co., Ltd.

- Vishal Steel Industries

- Simply Tool Steel

- Geili Machinery Fujian Group Co., Ltd.

- Nextgen Steel & Alloys

- ArcelorMittal

- ERASTEEL

- Other Key Players

Recent Developments

December 2024

- Merger Discussions: U.S. Steel and Nippon Steel have been engaged in merger discussions, with Nippon proposing a $14.9 million acquisition. The U.S. government has expressed national security concerns, leading to a temporary halt in the merger process.

- Source: ASIA MATTERS FOR AMERICA

November 2024

- Investment in Advanced Manufacturing: A leading U.S. steel manufacturer, ArcelorMittal, announced a $500 million investment in advanced manufacturing technologies, including the adoption of CNC machines and robotics, to enhance the production of high-speed steel components.

- Source: MARKET RESEARCH FUTURE

October 2024

- Industry Conference: The American Iron and Steel Institute (AISI) hosted the "Steel Industry Roadmap 2025" conference, focusing on policies, trends, and innovations shaping the steel sector, with a significant emphasis on high-speed steel applications.

- Source: TATANEX ARC BLOG

September 2024

- Strategic Partnership: Griggs Steel Co., a U.S.-based high-speed steel manufacturer, entered into a strategic partnership with a European technology firm to co-develop next-generation high-speed steel alloys, aiming to meet the evolving demands of the automotive and aerospace industries.

August 2024

- Market Expansion: Hitachi Metals, Ltd., a prominent U.S. high-speed steel producer, expanded its operations by opening a new manufacturing facility in the Midwest, increasing its production capacity to cater to the growing demand in the automotive sector.

July 2024

- Research Collaboration: A collaboration was announced between Stanford Advanced Materials and a leading U.S. university to research enhancing the wear resistance and heat tolerance of high-speed steel alloys.

June 2024

- Industry Expo: The "Advanced Materials Expo 2024" was held in Chicago, showcasing the latest advancements in high-speed steel technologies and attracting industry leaders from around the globe.

May 2024

- Acquisition: Fushun Special Steel Co., Ltd. acquired a smaller competitor in the U.S., expanding its product portfolio and market share in the North American region.

April 2024

- Government Policy: The U.S. government implemented new trade policies aimed at protecting domestic high-speed steel manufacturers from foreign competition, including the imposition of tariffs on imported high-speed steel products.

March 2024

- Technological Innovation: Vishal Steel Industries, a U.S. high-speed steel manufacturer, unveiled a new line of high-performance cutting tools designed for the aerospace industry, featuring enhanced durability and precision.

February 2024

- Industry Conference: The "Global Steel Summit 2024" took place in New York, bringing together experts to discuss the future of high-speed steel in various applications, including automotive and construction.

January 2024

- Sustainability Initiative: ERASTEEL launched a sustainability initiative aimed at reducing carbon emissions in the production of high-speed steel, aligning with global environmental standards.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.149.7 Mn |

| Forecast Value (2033) |

USD 4,042.8 Mn |

| CAGR (2024-2033) |

7.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Metal Cutting Tools, Metal Forming Tools, Blades, Others), By Material Type (Tungsten-based High-Speed Steel, Molybdenum-based High-Speed Steel, Cobalt-based High-Speed Steel), By Manufacturing Process (Conventional HSS, Powder Metallurgy HSS), By Application (Automotive Industry, Aerospace and Defense, Construction, General Engineering, Energy) |

| Regional Coverage |

The US

|

| Prominent Players |

Stanford Advanced Materials, COREMARK Metals, Griggs Steel Co., NACHI-FUJIKOSHI CORP., Hitachi Metals, Ltd., Fushun Special Steel Co., Ltd., Dalian Jingtai Industry Trade Co., Ltd., Vishal Steel Industries, Simply Tool Steel, Geili Machinery Fujian Group Co., Ltd., Nextgen Steel & Alloys, ArcelorMittal, ERASTEEL, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (, to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is The US High-Speed Steel Market?

▾ The US High-Speed Steel Market size is estimated to have a value of USD 2,129.7 million in 2025 and is expected to reach USD 4,042.8 million by the end of 2034.

Who are the key players in The US High-Speed Steel Market?

▾ Some of the major key players in The US High-Speed Steel Market are Stanford Advanced Materials, COREMARK Metals, Griggs Steel Co., NACHI-FUJIKOSHI CORP., Hitachi Metals, Ltd., Fushun Special Steel Co., and many others.

What is the growth rate in The US High-Speed Steel Market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.