Market Overview

The US Identity & Access Management Market size is projected to reach USD 7.5 billion in 2025 and grow at a compound annual growth rate of 8.2% from there until 2034 to reach a value of USD 15.2 billion.

Identity and Access Management (IAM) is a system of policies, processes, and technologies that help organizations make sure the right people can access the right resources at the right times. In the US, IAM plays an important role in protecting data and systems. It controls how users are identified and what they are allowed to do. Whether it's logging into a company network, accessing cloud apps, or using sensitive business data, IAM ensures that only authorized people can take certain actions. This helps reduce the risks of security breaches and data misuse.

In recent years, the need for IAM solutions in the US has grown quickly. One reason is the rise in remote work and cloud computing. More people are working from home or using personal devices, which increases the need for strong security controls. Organizations are looking for tools that help them track and manage user access from anywhere. IAM systems provide this by using methods like multi-factor authentication (MFA), single sign-on (SSO), and identity governance. These tools make it easier to manage users while keeping systems safe.

Several important trends are shaping the IAM landscape in the US. One major trend is the move toward "Zero Trust" security, which assumes that no user or device is trusted by default, even if they are inside the network. Every access request must be verified. IAM plays a key role in supporting this model. Another trend is the use of artificial intelligence and machine learning in IAM tools. These technologies help detect unusual behavior and alert security teams to possible threats.

Recent events have also pushed IAM into the spotlight. High-profile cyberattacks, like those involving ransomware or stolen credentials, have shown the need for better access control. US government agencies and private companies alike have responded by improving their IAM systems. For example, following certain attacks, the federal government has issued new rules that require stronger authentication and better identity verification practices.

IAM is not only important for security but also helps organizations follow laws and regulations. In the US, industries like healthcare and finance have strict rules about data protection. IAM helps meet these requirements by ensuring only approved users can access sensitive information. It also helps companies keep detailed records of who accessed what and when.

As digital systems grow more complex, IAM will continue to be a critical part of cybersecurity in the US. It supports safe access across cloud services, mobile devices, and traditional networks. Companies are now investing more in IAM, not just to avoid risks, but to enable smoother operations. Strong IAM systems are becoming a basic need for modern business and government services.

US Identity & Access Management Market: Key Takeaways

- Market Growth: The Identity & Access Management Market size is expected to grow by USD 7.2 billion, at a CAGR of 8.2%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the US Identity & Access Management Market in 2025.

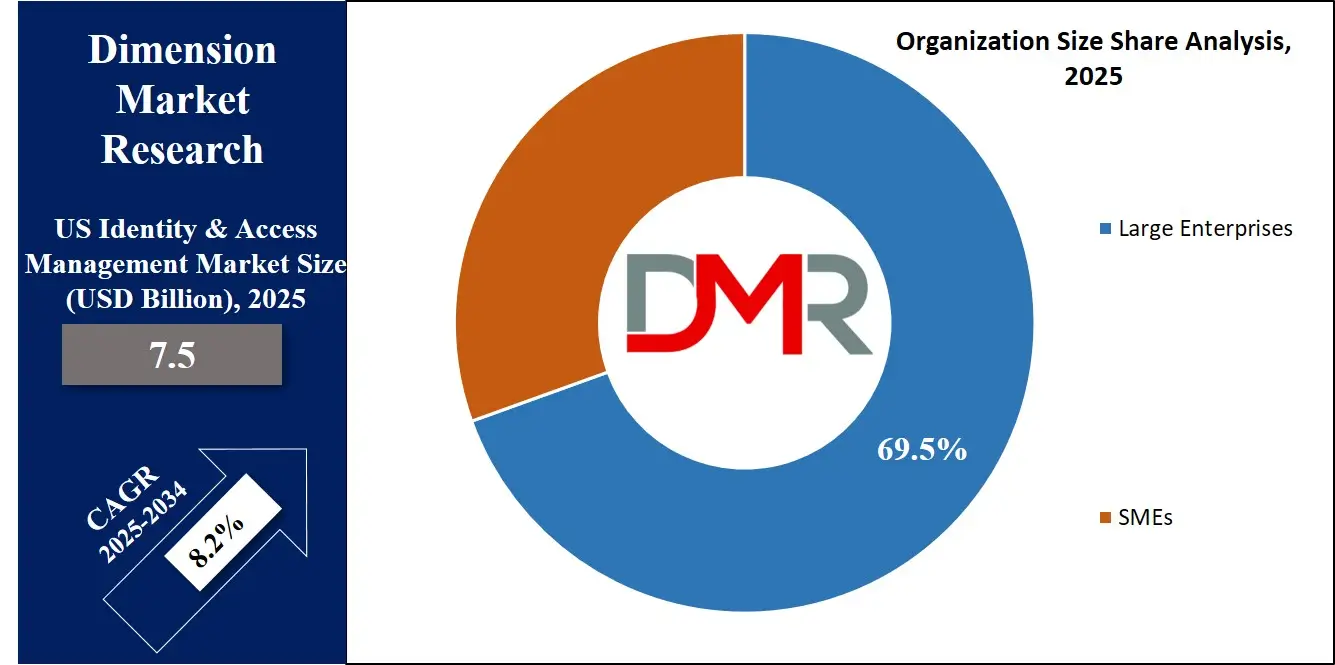

- By Organization Size: The Large enterprises is expected to get the largest revenue share in 2025 in the US Identity & Access Management Market.

- Use Cases: Some of the use cases of Identity & Access Management in the US include cloud application security, healthcare data protection, and more.

US Identity & Access Management Market: Use Cases

- Remote Workforce Access Control: As more employees work from home, IAM helps organizations control access to company systems from various locations and devices. It ensures only verified users can log in using methods like multi-factor authentication. This keeps remote work secure without slowing down productivity.

- Healthcare Data Protection: It supports hospitals and clinics in protecting patient records by allowing only authorized medical staff to access sensitive information. It aids in meeting privacy rules and provides detailed logs of access history. This reduces the risk of data leaks or misuse.

- Financial Services Compliance: Banks and financial institutions use IAM to control who can view or handle customer data and transaction systems. These tools help meet strict regulations by enforcing access limits and tracking user activity. IAM also prevents unauthorized financial actions.

- Cloud Application Security: As companies move their operations to the cloud, IAM ensures that only permitted users can access cloud-based tools and data. Features like single sign-on make it easier for staff to log in securely. IAM helps prevent breaches caused by weak or reused passwords.

Stats & Facts

• According to CyberArk, 99% of security decision makers believe their organizations will experience an identity-related compromise within the next year, driven by the expanding number of identities and the increasing complexity of IT environments. Further, it reveals that the number of identities—both human and machine—is expected to grow by 240% in just 12 months, significantly widening the attack surface.

• IBM reports that 40% of data breaches involve data stored across multiple environments, with public cloud-stored data breaches resulting in the highest average cost of USD 5.17 million. The use of generative AI and IoT further complicates cloud security, requiring organizations to implement better governance and monitoring practices across hybrid infrastructures.

• CrowdStrike highlights that 80% of all cyberattacks use identity-based techniques, such as credential theft and privilege escalation, to infiltrate systems, indicating that identity is now the primary target for threat actors across most sectors.

• Mimecast research finds that 3 out of 4 CISOs believe collaboration tools bring significant new risks, and 94% say the native security features in Microsoft 365 are not sufficient. This shows a growing need for enhanced email and collaboration tool security in enterprise environments.

• IBM found that organizations implementing AI and automation in their cybersecurity strategies saved an average of USD 2.22 million in breach costs compared to those that did not. These technologies enhance threat detection, reduce response times, and support prevention strategies such as red-teaming and posture management.

• One Identity reports that 80% of organizations believe improved identity and access management could have prevented some or all of the cyberattacks they experienced. This emphasizes how central IAM has become to building effective cybersecurity defenses.

• According to Mimecast, 97% of 1,700 IT professionals reported being targeted by phishing emails within the past year, and 75% noted a rise in email-based threats. Additionally, 59% say attacks have grown more sophisticated, suggesting phishing remains a leading entry point for attackers.

• Microsoft observed an average of 156,000 daily attempts of business email compromise over the course of a year, illustrating the persistent and large-scale nature of phishing and impersonation attacks targeting enterprise users.

Market Dynamic

Driving Factors in the US Identity & Access Management Market

Shift to Cloud and Remote Work Environments

One major growth driver for the US Identity & Access Management (IAM) market is the broad shift to cloud computing and remote work. As businesses move their operations and data to the cloud, the demand for secure user access becomes more urgent. Remote work has created complex access scenarios, with employees logging in from multiple devices and locations.

IAM solutions support organizations in managing these access points by verifying identities and enforcing strict login rules. They also provide features like single sign-on (SSO) and multi-factor authentication (MFA) to make remote access both safe and convenient. This shift has made IAM a key part of IT strategies. As remote and hybrid work models continue, demand for IAM is expected to grow steadily.

Rising Cybersecurity Threats and Data Breach Concerns

Another strong driver of IAM market growth in the US is the increase in cybersecurity threats and the rising number of data breaches. Attacks using stolen or weak credentials have become common, pushing companies to look for better identity controls. IAM solutions reduce these risks by limiting access based on user roles, monitoring login behavior, and alerting teams to unusual activity.

Regulations like HIPAA, SOX, and others also push businesses to take access management seriously. With growing awareness of digital risks, companies across sectors are investing more in IAM to protect sensitive data. As hackers become more advanced, IAM tools continue to evolve to meet the challenge. This makes IAM a core investment for long-term cybersecurity planning.

Restraints in the US Identity & Access Management Market

High Implementation Complexity and Cost

One key restraint in the US Identity & Access Management (IAM) market is the complexity and high cost of implementation. Setting up a full IAM system often involves integrating with many existing IT systems, cloud services, and applications. This process can be time-consuming and requires skilled technical staff, which many smaller organizations may lack.

Additionally, the cost of licenses, ongoing maintenance, and system upgrades can be high. These challenges can delay IAM adoption, especially in businesses with limited budgets. Customization needs and compliance requirements further increase the complexity. As a result, some organizations hesitate to fully invest in IAM or choose basic solutions that may not provide complete protection.

Lack of Skilled Workforce and User Awareness

Another major challenge limiting IAM market growth in the US is the shortage of skilled professionals and low user awareness. Identity management tools often require proper setup, continuous monitoring, and regular updates, which demand trained IT and cybersecurity experts. However, the demand for these professionals is higher than the supply, making it hard for companies to find and keep qualified staff.

At the same time, end users may lack awareness about secure login practices, password hygiene, or phishing risks. This can weaken even strong IAM systems if users don’t follow best practices. Without enough education and training, IAM solutions may not deliver full security benefits.

Opportunities in the US Identity & Access Management Market

Growth in Small and Medium-Sized Enterprises (SMEs)

An emerging opportunity in the US Identity & Access Management (IAM) market lies in the growing interest among small and medium-sized enterprises (SMEs). These businesses are increasingly adopting digital tools and cloud platforms, making secure access a critical need. Until recently, many SMEs found IAM solutions too expensive or complex.

Now, with the rise of more affordable, cloud-based IAM tools, they can adopt solutions that fit their size and budget. Vendors offering simplified and scalable IAM services have a strong chance to tap into this expanding segment. As cybersecurity risks grow for businesses of all sizes, SMEs are realizing the importance of identity protection. This trend opens new growth potential for IAM providers focusing on user-friendly and cost-effective products.

Expansion of Identity-as-a-Service (IDaaS) Solutions

The growing demand for Identity-as-a-Service (IDaaS) presents a key opportunity in the US IAM market. IDaaS allows companies to use cloud-based IAM solutions without managing infrastructure themselves. This model offers flexibility, easier updates, and lower upfront costs, making it attractive for both large and small businesses.

As more organizations migrate to cloud systems, IDaaS adoption is expected to rise sharply. It supports remote work, mobile device access, and real-time security updates. Vendors providing strong IDaaS offerings with features like adaptive authentication and user behavior analytics can gain a competitive edge. With cybersecurity needs growing and IT budgets tightening, IDaaS is becoming a smart, scalable option for modern IAM deployment.

Trends in the US Identity & Access Management Market

Integration of AI and Machine Identities in IAM

A major trend in the U.S. Identity & Access Management (IAM) market is the integration of artificial intelligence (AI) and the management of machine identities. As organizations highly adopt AI technologies, there's a growing need to secure not just human users but also non-human entities like AI agents and automated systems. These entities require distinct identity and access controls to prevent unauthorized actions and data breaches.

IAM solutions are transformed to include features that manage these machine identities effectively, ensuring that AI systems operate within defined security parameters. This development is crucial as AI becomes more embedded in business operations, necessitating robust IAM frameworks that can handle the complexities of both human and machine users.

Emphasis on Zero Trust Security Models

Another prevailing trend is the adoption of Zero Trust security models within IAM strategies. Zero Trust operates on the principle that no user or system should be trusted by default, regardless of whether they are inside or outside the organization's network. This approach requires continuous verification of user identities and access privileges, minimizing the risk of unauthorized access.

IAM solutions are incorporating Zero Trust principles by implementing multi-factor authentication, real-time monitoring, and adaptive access controls. This shift is driven by the increasing sophistication of cyber threats and the need for more resilient security postures. Organizations are recognizing that traditional perimeter-based security models are insufficient, leading to a broader implementation of Zero Trust frameworks in IAM practices.

Research Scope and Analysis

By Component Analysis

Solution as a component plays a vital role in the growth of the US Identity & Access Management (IAM) market, leading with a share of 57.1% in 2025. Solutions like multi-factor authentication (MFA), single sign-on (SSO), and identity governance systems help organizations control access, reduce fraud, and protect sensitive data. As businesses continue to expand digital operations, demand for these advanced IAM solutions grows, making them a critical part of any cybersecurity strategy.

Solutions enable organizations to scale their operations securely, especially with the increasing number of cloud applications and remote workers. The market's strong demand for effective, easy-to-use solutions to enhance security drives significant growth in the IAM industry, particularly as businesses face more complex security threats.

Services are a key driver of the growth in the US Identity & Access Management market, showing significant growth over the forecast period. Services such as consulting, implementation, and maintenance are essential for businesses adopting IAM solutions. These services ensure seamless integration of IAM tools with existing systems, providing tailored solutions to meet specific business needs.

As companies seek to improve their security posture, the demand for expert services grows. Moreover, ongoing support and updates from service providers ensure that IAM systems remain effective as cyber threats evolve. The increasing need for organizations to maintain secure access control practices boosts the demand for these services, resulting in strong market growth.

By Deployment Mode Analysis

Cloud mode is crucial to the growth of the US Identity & Access Management (IAM) market, leading with a share of 63.4% in 2025. Cloud-based IAM solutions offer businesses greater flexibility, scalability, and cost efficiency, making them ideal for companies of all sizes. These solutions simplify the management of user access across various platforms, especially with the rise of remote work and cloud-based applications. Cloud IAM systems enable organizations to securely manage users and data while reducing the complexity and costs of maintaining on-premises infrastructure.

As businesses continue to migrate to the cloud, the demand for cloud-based IAM solutions is expected to grow rapidly, offering businesses advanced features such as adaptive authentication and real-time monitoring for better security.

Moreover, on-premises remains an important option for many businesses, showing significant growth over the forecast period in the US IAM market. Some organizations prefer on-premises IAM solutions for greater control over their data and systems, especially in industries with strict security and compliance requirements. On-premises systems allow businesses to customize their IAM solutions to fit specific needs and ensure sensitive data stays within their internal networks.

Despite the rise of cloud technologies, the demand for on-premises deployment remains strong as organizations prioritize full control and tailored security features. As cybersecurity concerns increase, many businesses are choosing hybrid approaches, combining on-premises and cloud systems to maximize security and flexibility.

By Solution Type Analysis

In terms of solution type, Identity Lifecycle Management will be the leading towards the growth of US Identity & Access Management (IAM) market, by having a share of 41.8% in 2025. This solution helps organizations efficiently manage the entire lifecycle of user identities, from creation and usage to deactivation.

By automating processes like onboarding, role assignments, and offboarding, it reduces manual work and ensures that users have the appropriate access rights throughout their tenure. It also enhances security by ensuring that when employees leave or change roles, their access is properly updated or removed.

As businesses increasingly prioritize secure access control and regulatory compliance, identity lifecycle management solutions are becoming more important, driving strong demand for IAM systems that can streamline and secure the identity management process. Also, authentication as a solution type is crucial to the growth of the US Identity & Access Management market, showing significant growth over the forecast period.

Authentication methods like multi-factor authentication (MFA) and biometric recognition provide a higher level of security by verifying the identity of users before granting access to systems. As cyber threats evolve, businesses are increasingly adopting stronger authentication techniques to protect sensitive data and prevent unauthorized access.

These methods help ensure that only legitimate users can access critical systems, reducing the risk of data breaches and fraud. With the growing emphasis on cybersecurity and compliance, the demand for advanced authentication solutions is expected to rise, further contributing to the growth of the IAM market.

By Organization Type Analysis

As an organization, large enterprises play a key role in the growth of the US Identity & Access Management (IAM) market, leading with a share of 69.5% in 2025. Large enterprises handle vast amounts of sensitive data and have complex IT infrastructures, making strong IAM systems crucial for security and regulatory compliance.

These organizations require sophisticated IAM solutions to manage access across numerous systems, applications, and remote workforces. As cyber threats become more advanced, large enterprises are increasingly adopting IAM to ensure that only authorized personnel can access critical resources. The need for compliance with strict data protection laws, combined with the scale of their operations, continues to drive strong demand for IAM solutions in large enterprises, contributing significantly to the market’s growth.

Further, SMEs are also contributing to the growth of the US Identity & Access Management market, showing significant growth over the forecast period. Small and medium-sized enterprises (SMEs) are becoming more aware of the importance of securing their data and systems as cyber threats grow. As SMEs move more of their operations to the cloud and adopt digital tools, they face the challenge of managing user access securely.

IAM solutions are helping these businesses maintain control over their digital assets while ensuring compliance with industry regulations. With the availability of affordable, scalable IAM solutions tailored to SMEs, more of these businesses are investing in IAM, thus contributing to the expanding market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Authentication Type Analysis

Single Factor authentication as an authentication type plays a significant role in the growth of the US Identity & Access Management (IAM) market, and will be leading with a share of

58.6% in 2025. This method, typically based on a username and password, continues to be widely used because of its simplicity and ease of implementation. While it may not be the most secure method on its own, single-factor authentication is often sufficient for lower-risk applications or systems that don’t handle sensitive data.

Many businesses, especially small organizations, use single-factor authentication because it is cost-effective and quick to deploy. However, as the security landscape evolves, businesses are increasingly seeking more secure methods, which fuels the growth of multi-factor solutions alongside single-factor authentication in the IAM market.

Further, multi-factor authentication as an authentication type is contributing significantly to the growth of the US Identity & Access Management market over the forecast period. With growing cyber threats and data breaches, businesses are turning to multi-factor authentication (MFA) to add an extra layer of security.

MFA requires users to provide two or more verification factors, such as a password combined with a fingerprint or one-time passcode, ensuring that access is granted only to legitimate users. This method greatly reduces the risk of unauthorized access and is becoming a standard in many industries. As businesses prioritize stronger security, the adoption of MFA solutions is expected to rise, driving continued growth in the IAM market.

By Industry Vertical Analysis

BFSI (Banking, Financial Services, and Insurance) as an industry vertical plays a crucial role in the growth of the US Identity & Access Management (IAM) market, leading with a share of 31.6% in 2025. The BFSI sector handles a large volume of sensitive financial data and faces high regulatory scrutiny, making robust IAM solutions essential. These solutions help secure online banking, mobile payments, and insurance platforms by ensuring that only authorized users can access financial accounts and services.

Additionally, IAM helps minimize fraud and prevent unauthorized access to personal and financial data. As digital banking grows, like the adoption of mobile and online platforms, BFSI organizations are heavily investing in IAM systems to enhance security, build customer trust, and meet compliance requirements, further driving market growth.

On the other hand, healthcare as an industry vertical is significantly driving the growth of the US Identity & Access Management market over the forecast period. The healthcare sector deals with vast amounts of sensitive patient data that requires strict protection. IAM solutions help healthcare organizations control access to electronic health records (EHR) and other sensitive systems, ensuring that only authorized medical personnel can view or update patient information.

These solutions also support compliance with regulations like HIPAA, which require secure access and audit trails. As healthcare continues to digitize and expand its use of cloud-based systems, the demand for IAM to manage access securely is increasing, thus contributing to the growth of the IAM market in this sector.

The US Identity & Access Management Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Solution Type

- Identity Lifecycle Management

- Authentication

- Authorization

- Audit, Compliance, and Governance

- Password Management

- Directory Services

- Access Management

- Privileged Access Management (PAM)

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Authentication Type

- Single-Factor Authentication

- Multi-Factor Authentication

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Government & Public Sector

- Retail & E-commerce

- Energy & Utilities

- Manufacturing

- Education

- Others

Competitive Landscape

The US Identity & Access Management market is highly fragmented, with many technology providers offering various solutions to meet growing security needs. These companies compete by enhancing their products with features like strong user authentication, cloud integration, and better user experience. Some focus on large businesses with complex systems, while others serve smaller companies with simpler tools.

Many also partner with cloud platforms or cybersecurity firms to offer complete security packages. As threats become more advanced, providers are racing to include smarter technologies like behavior tracking and AI. The market is also seeing a push for easy-to-use systems that don’t slow down work. Overall, the competition is strong and keeps driving better, more secure IAM solutions.

Some of the prominent players in the US Identity & Access Management are:

- Microsoft

- IBM

- Oracle

- One Identity

- ForgeRock

- Avatier

- OneLogin

- HID Global

- SecureAuth

- Curity

- Optimal IdM

- Centrify

- NetIQ

- Atos

- Bitium

- Janrain

- iWelcome

- Ubisecure

- EmpowerID

- PlainID

- Other Key Players

Recent Developments

- In April 2025, 1Password introduced new features to its platform that secure every sign-in across all apps and devices, including unmanaged ones. These updates boost visibility, control, and automation with extended device compliance, agentic AI security, a unified admin console, and a central app launcher.

- In April 2025, CyberArk launched its Secure AI Agents Solution to help organizations apply identity-first security to agentic AI through the CyberArk Identity Security Platform. As AI agents autonomously interact, access sensitive data, and escalate privileges, the solution addresses emerging identity-related risks. With AI agents forming a new class of digital identities, CyberArk’s end-to-end approach secures their privileged access.

- In March 2025, Axonius introduced Axonius Identities, an advanced solution that combines identity management, governance, and security into a single platform powered by asset intelligence. Launched at the Axonius Adapt conference, the product assists organizations in tackling identity and access challenges by aligning IT and security functions.

- In November 2024, Eviden launched Evidian Orbion, a next-gen Identity-as-a-Service (IDaaS) solution that unifies IGA, AM, and PAM for hybrid environments. Designed for scalability and security, it simplifies identity and access management while supporting regulatory and sovereignty needs. As organizations shift beyond traditional security perimeters, Evidian Orbion enables secure access for employees and partners from anywhere. It minimizes IAM complexity through features like self-enrolment and integration with Identity Proofing tools, making it ideal for mid-market and large enterprises.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.5 Bn |

| Forecast Value (2034) |

USD 15.2 Bn |

| CAGR (2025–2034) |

8.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (On-Premises and Cloud), By Solution Type (Identity Lifecycle Management, Authentication, Authorization, Audit, Compliance, and Governance, Password Management, Directory Services, Access Management, and Privileged Access Management (PAM)), By Organization Size( Small and Medium Enterprises (SMEs) and Large Enterprises), By Authentication Type (Single-Factor Authentication and Multi-Factor Authentication), By Industry Vertical (BFSI, IT & Telecom, Healthcare, Government & Public Sector, Retail & E-commerce, Energy & Utilities, Manufacturing, Education, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

Microsoft, IBM, Oracle, One Identity, ForgeRock, Avatier, OneLogin, HID Global, SecureAuth, Curity, Optimal IdM, Centrify, NetIQ, Atos, Bitium, Janrain, iWelcome, Ubisecure, EmpowerID, PlainID, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Identity & Access Management Market?

▾ The Global Identity & Access Management Market size is expected to reach a value of USD 7.5 billion in 2025 and is expected to reach USD 15.2 billion by the end of 2034.

Who are the key players in the US Identity & Access Management Market?

▾ Some of the major key players in the US Identity & Access Management Market are IBM, Microsoft, Oracle, and others

What is the growth rate in the US Identity & Access Management Market?

▾ The market is growing at a CAGR of 8.2 percent over the forecasted period.