Market Overview

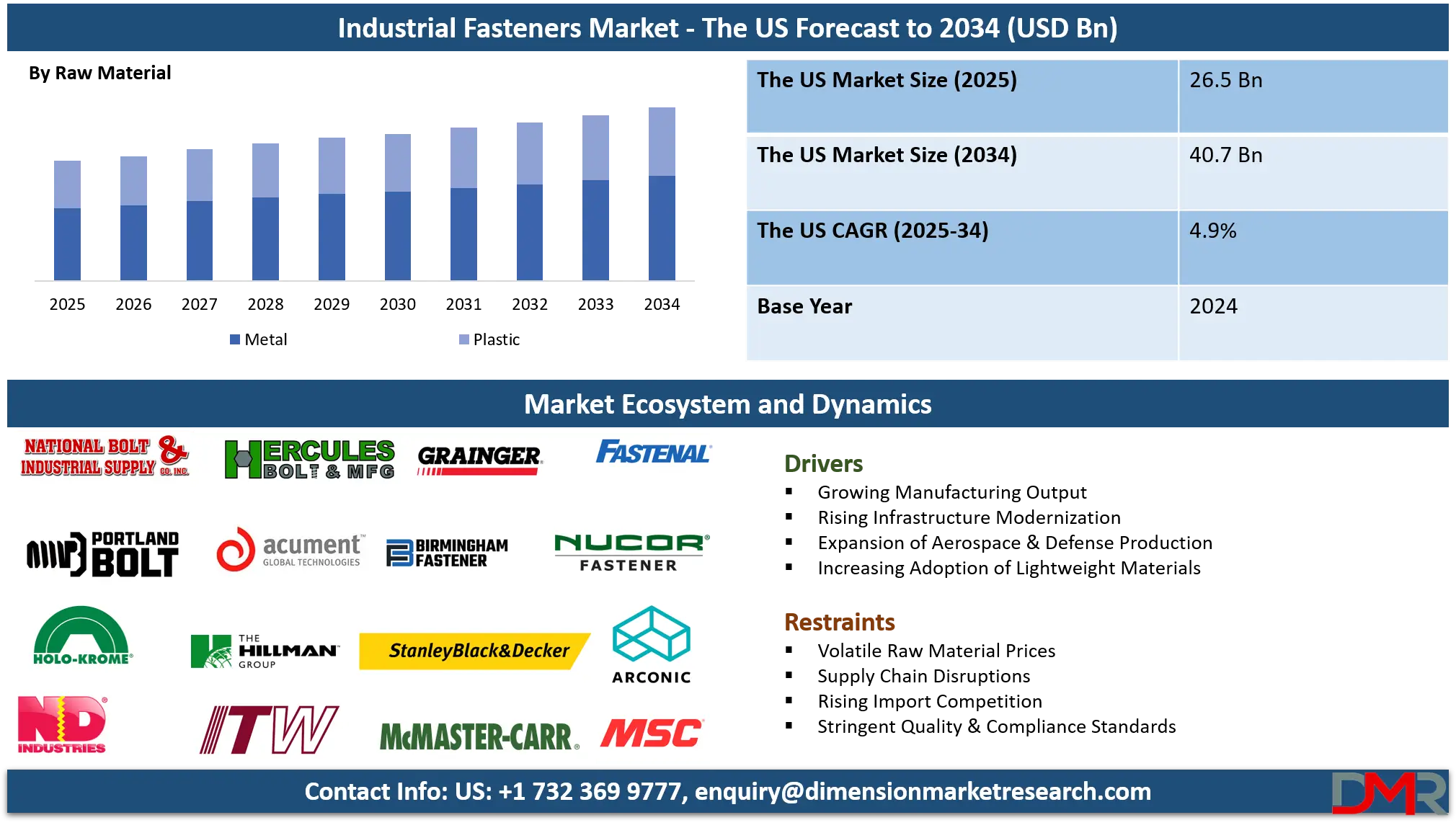

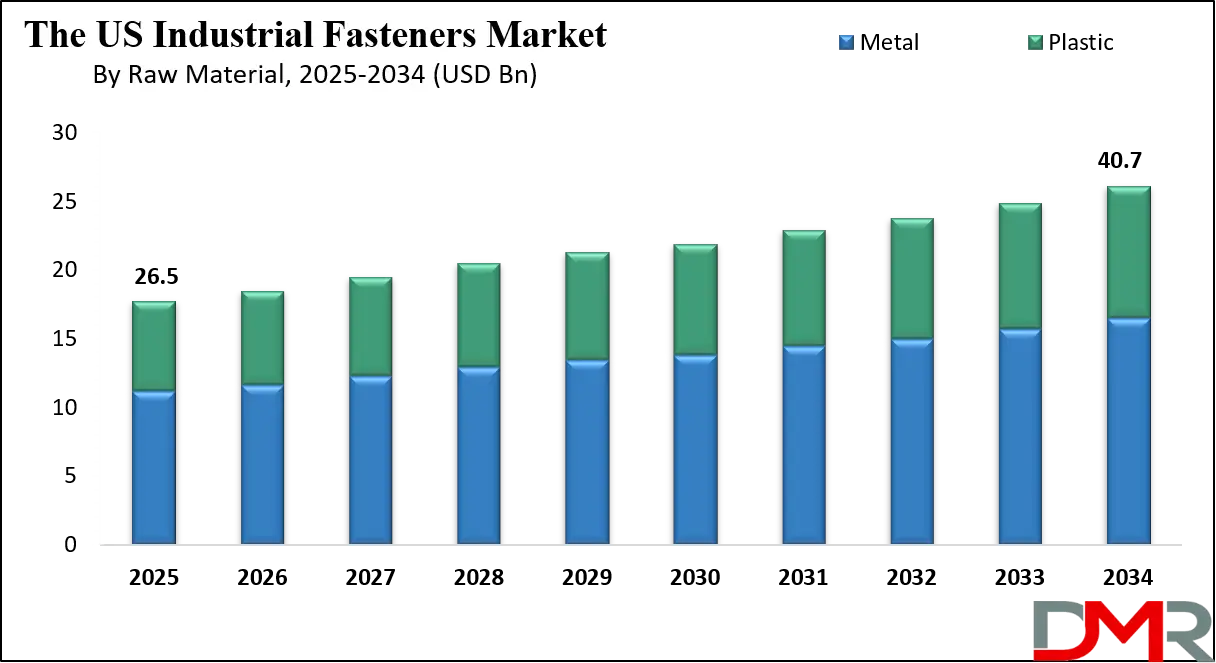

The U.S. Industrial Fasteners Market is projected to be valued at USD 26.5 billion in 2025, is set for steady expansion, further expected to reach USD 40.7 billion by 2034 at a CAGR of 4.9%.

This growth is driven by accelerating demand from automotive manufacturing, aerospace production, industrial machinery, construction, and energy infrastructure, alongside rising adoption of lightweight fasteners, advanced materials, and automated fabrication technologies across the United States.

This steady expansion is fueled by the nation's robust manufacturing base and its leadership in aerospace innovation and automotive transformation. The rapid electrification of vehicles is generating substantial demand for a new generation of lightweight, high-strength fasteners essential for

battery systems and lightweight chassis, while the world-leading aerospace and defense sector continues to drive innovation for ultra-reliable components that meet extreme performance standards.

Furthermore, landmark federal initiatives like the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) are translating into massive investments in transportation infrastructure, renewable energy projects, and grid modernization, which rely on vast quantities of durable, corrosion-resistant fastening solutions, creating a robust and sustained demand pipeline.

Significant opportunities are emerging from the country's dual focus on supply chain resilience and sustainability. The strong policy push toward reshoring and "Made in America" procurement opens a premium segment for manufacturers investing in domestic production and secure supply chains. Concurrently, corporate ESG commitments and federal incentives are accelerating the adoption of fasteners made from recycled or low-carbon materials, catering to environmentally conscious supply chains.

The U.S.'s strength in digital technology and IoT positions it to lead the adoption of smart fasteners equipped with sensors for predictive maintenance, offering high-value solutions in aerospace, defense, and critical infrastructure. The trend towards deep customization and technical specialization is also pronounced, with manufacturers increasingly co-engineering application-specific fasteners with OEMs, featuring advanced coatings and designs tailored for challenging environments like offshore wind and hydrogen economy applications.

However, the market faces notable restraints, primarily from persistent volatility in raw material prices and intense global competition. U.S. manufacturers remain highly dependent on globally sourced steel, aluminum, and specialty alloys, with energy-intensive production processes facing cost pressures from domestic energy price fluctuations, particularly impacting small and medium-sized enterprises. Simultaneously, competition from lower-cost producers in Asia in standard fastener segments compels continuous investment in automation and innovation to maintain market share, all while navigating complex U.S. environmental regulations (e.g., EPA standards), international trade policies, and tariffs that add to operational complexity and cost.

The growth prospects for the U.S. market remain fundamentally strong, underpinned by resilient end-use sectors and technological advancement. Beyond automotive and aerospace, the modernization of aging transportation infrastructure under the BIL and sustained construction activity in the Sunbelt and Western regions provide stable demand.

The nation's focus on industrial automation and Industry 4.0 further necessitates precision fasteners compatible with robotic assembly. With its unique blend of engineering expertise, a regulatory and policy environment promoting domestic manufacturing and innovation, and a strategic push towards high-value and sustainable manufacturing, the U.S. industrial fasteners market is well-positioned for technologically sophisticated growth, albeit within a competitive and cost-conscious global landscape.

The US Industrial Fasteners Market: Key Takeaways

- Steady Market Expansion: The U.S. market is projected to grow from USD 26.5 billion in 2025 to USD 40.7 billion by 2034, representing a CAGR of 4.9%. This growth is underpinned by durable, non-cyclical demand from infrastructure, energy transition, and advanced manufacturing.

- Automotive Sector is the Demand Engine: Fasteners for automotive and EV applications constitute over 35% of total U.S. fastener consumption as of 2024. The shift to electric powertrains is a primary catalyst, driving the need for specialized fasteners for battery systems, lightweight structures, and autonomous vehicle sensors.

- Aerospace & Defense: The High-Value Core: The aerospace-grade fastener segment represents approximately 18% of the market's high-value demand. It is sustained by strong commercial aviation backlogs, next-generation military aircraft programs (NGAD, B-21), and growing public and private space exploration initiatives.

- Sustainability Becomes a Market Driver: Fueled by federal incentives and corporate procurement policies, over 40% of U.S. fastener manufacturers have committed to investments in sustainable materials (recycled steel, low-carbon alloys) and production technologies by 2027, creating a new premium product segment.

- Strategic Rebalancing of Supply Chains: While the U.S. still imports roughly 30% of its standard fasteners, there is a clear and accelerating trend toward nearshoring (to Mexico) and reshoring of production. This shift is driven by supply chain security mandates, total cost of ownership calculations, and government incentives, compelling domestic producers to invest heavily in automation for competitiveness.

The US Industrial Fasteners Market: Use Cases

- Automotive & Electric Vehicle Assembly: U.S. automakers and their Tier-1 suppliers utilize a vast array of high-strength threaded fasteners, specialty pins, and advanced rivets in the construction of vehicle platforms.

- Construction & Heavy Civil Infrastructure: The nation's infrastructure renewal is a major consumer of fasteners. Projects ranging from bridge deck rehabilitation and seismic retrofits to the construction of data centers and modular hospitals rely on heavy-duty anchors, high-strength structural bolts, and chemical fixing systems.

- Aerospace, Defense & Space Systems: This sector represents the apex of fastener technology and certification. Applications include airframe assembly, jet engines, missile systems, and satellite structures. Materials range from high-strength steels and titanium to superalloys like Inconel, each selected for specific strength-to-weight, temperature, and corrosion resistance properties.

- Industrial Machinery & Heavy Equipment: Manufacturers of agricultural, mining, construction, and material handling equipment demand fasteners that can endure extreme vibration, shock loads, and harsh environmental conditions over decades of service.

- Renewable Energy & Utility Infrastructure: The build-out of wind, solar, and modernized grid infrastructure creates specialized demand. Wind turbine towers and nacelles require thousands of large, high-tensile bolts with precise pre-load tensioning.

The US Industrial Fasteners Market: Stats & Facts

U.S. Government & Industry Data Sources

- U.S. Census Bureau (Annual Survey of Manufacturers): Reports the value of shipments for NAICS 33272 – "Bolt, Nut, Screw, Rivet, and Washer Manufacturing." The latest full-year data (2023) indicated a value of approximately USD 34.2 billion.

- Bureau of Labor Statistics (BLS): Publishes the monthly Producer Price Index (PPI) for this industry. The index, a key measure of wholesale price inflation, stood at 122.4 in December 2024 (2015=100), reflecting ongoing input cost pressures.

- U.S. International Trade Commission (USITC) DataWeb: Provides detailed import/export statistics under Harmonized System codes such as 7318 (screws, bolts, nuts) and 8308 (clasps, frames). The data consistently shows a significant trade deficit in standard fasteners, with China, Taiwan, and Japan as top import sources, while the U.S. maintains a strong export position in high-value aerospace fasteners.

- Federal Reserve Board (Industrial Production Index): Tracks monthly output for the manufacturing sector. The "Durable Goods" sub-index often serves as a leading indicator for broader industrial fastener demand.

- Industrial Fasteners Institute (IFI): The leading U.S.-based trade association, responsible for establishing and maintaining many industry-wide technical standards. IFI also conducts market analysis and serves as a primary advocacy voice for domestic manufacturers.

- Fastener Distributor Association (FDA): Represents the interests of fastener distributors across North America, providing critical data on channel inventory levels, lead times, and market sentiment through regular business surveys.

Geographic Concentration & Employment

- Fastener manufacturing is geographically concentrated, with Ohio, Michigan, Illinois, Pennsylvania, and Texas accounting for a disproportionately large share of both production facilities and employment. This distribution aligns with the nation's traditional manufacturing and automotive corridors.

Legislative Impact

- The Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) are not merely policy documents but are active, multi-year funding mechanisms directly generating demand for fasteners used in construction, transportation, and clean energy projects.

- "Made in America" and related federal procurement rules (Buy American Act, Build America, Buy America) are increasingly influencing sourcing decisions for public works and federally subsidized private projects, creating a tangible advantage for domestic producers.

The US Industrial Fasteners Market: Market Dynamics

Driving Factors in the U.S. Industrial Fasteners Market

Historic Infrastructure Investment and the Clean Energy Build-Out

The passage of the Bipartisan Infrastructure Law and the Inflation Reduction Act represents the most significant public investment in U.S. infrastructure and industrial policy in generations. These laws are not abstract concepts but are actively funding thousands of discrete projects from bridge replacements and airport modernizations to the construction of wind farms, solar parks, and hydrogen hubs. Each of these projects consumes vast quantities of fasteners, often with specific performance requirements for durability, corrosion resistance, and certification. This legislated demand provides a multi-year visibility and stability that is rare in industrial markets, underpinning capital investment decisions across the fastener supply chain.

The Automotive Industry's Technological Pivot

The U.S. automotive sector is undergoing a parallel transformation toward electrification, connectivity, and autonomy. This pivot is fundamentally redesigning the vehicle, creating entirely new fastener applications. Securing a 1,000-pound EV battery pack requires engineered solutions that address crash energy management, thermal cycling, and electrical safety far beyond the requirements of a traditional engine mount.

Furthermore, the use of aluminum and composites to reduce weight and extend range demands compatible fasteners that prevent galvanic corrosion and maintain clamp load. This technological shift is moving fastener specification deeper into the design phase, fostering closer co-engineering relationships between OEMs and suppliers.

Restraints in the U.S. Industrial Fasteners Market

Persistent Raw Material Cost Volatility

Fastener manufacturing is fundamentally a materials transformation business, making it highly sensitive to the prices of key inputs: steel wire rod, aluminum, nickel, and other alloys. These commodities are traded on global markets and are susceptible to sharp price swings driven by factors beyond any single manufacturer's control geopolitical conflict, trade policy shifts, global supply chain disruptions, and energy costs. For the many energy-intensive processes involved (heat treating, plating), volatile U.S. natural gas and electricity prices add a second layer of cost uncertainty. This environment makes long-term pricing and margin stability a constant challenge, particularly for smaller firms with less purchasing power.

The Dual Challenge of Global Competition and Regulatory Complexity

U.S. manufacturers of standard fasteners operate in a fiercely competitive global market. Producers in Asia benefit from lower labor costs, economies of scale, and, in some cases, state support. While tariffs have altered the competitive landscape, pressure remains intense, forcing domestic companies to compete on factors like reliability, technical service, and speed, all of which add cost. Simultaneously, operating in the U.S. entails navigating a dense thicket of regulations: environmental compliance (EPA), workplace safety (OSHA), international trade rules (e.g., USMCA), and now, increasingly complex rules of origin for federal projects. This regulatory burden adds administrative expense and requires dedicated expertise, acting as a barrier to entry and an ongoing cost of doing business.

Opportunities in the U.S. Industrial Fasteners Market

Capitalizing on the Reshoring and Sustainability Megatrends

Current U.S. industrial policy has created a powerful, aligned incentive structure. The desire for supply chain resilience ("reshoring") and the push for a lower-carbon economy ("sustainability") are no longer just trends but are being actively funded and legislated. This creates a golden opportunity for forward-thinking fastener companies. Investing in domestic production capacity, especially when paired with sustainable practices like using recycled steel scrap or renewable energy, allows a manufacturer to tap into multiple demand streams: federal infrastructure projects with "Buy American" rules, corporate supply chains with ambitious ESG goals, and state-level clean energy incentives. Companies that can authentically market a "Made in USA, Sustainable" value proposition are building a powerful competitive moat.

Pioneering the Smart Fastener and Digital Service Ecosystem

The integration of digital intelligence into physical components is the next frontier. The U.S., with its world-leading tech sector, is ideally positioned to develop and deploy "smart" fastener components with embedded micro-sensors that monitor preload, vibration, temperature, or strain. This transforms fasteners from passive parts into active sentinels, enabling predictive maintenance for wind turbines, aircraft, bridges, and industrial machinery, thereby preventing costly failures and optimizing operations. Beyond the hardware, the digital thread of traceability using RFID or QR codes to track a fastener from mill to installation is becoming a baseline requirement in aerospace and automotive, creating opportunities for software and data service offerings alongside physical products.

Trends in the U.S. Industrial Fasteners Market

Deep Customization and the Rise of the Technical Partner

The demand for generic, off-the-shelf fasteners for critical applications is diminishing. Instead, there is a strong trend toward deep, early-stage collaboration between fastener engineers and OEM design teams, a process often called "co-engineering" or "concurrent engineering." This partnership aims to solve specific application challenges that standard products cannot address, such as developing a fastener with a novel coating to resist hydrogen embrittlement in fuel cell systems, or designing a custom titanium bracket via additive manufacturing for a satellite. This trend elevates the fastener supplier from a component vendor to an integral technical partner, competing on engineering expertise and problem-solving capability rather than price per piece.

Full-Spectrum Automation and Data-Driven Supply Chains

To address chronic skilled labor shortages, improve quality consistency, and compete on cost with global rivals, U.S. fastener producers are relentlessly automating their factories. This includes robotic cold-forming cells, AI-powered visual inspection systems, and automated packaging lines. This automation, in turn, influences fastener design, favoring geometries that are optimized for robotic handling and driving. In parallel, the entire supply chain is undergoing digital transformation.

Cloud-based platforms provide real-time inventory visibility across a network of manufacturers, master distributors, and local branches. These systems use algorithms to predict demand, automate replenishment, and optimize logistics, creating a more resilient and responsive network capable of supporting the just-in-time (JIT) and just-in-sequence (JIS) delivery models demanded by major automotive and aerospace customers.

The US Industrial Fasteners Market: Research Scope and Analysis

By Raw Material Analysis

The metal fasteners segment forms are projected to be the indispensable, value-dominant core of the U.S. market, directly reflecting the country's heavy industrial base. Carbon and alloy steels remain the workhorse materials, valued for their high strength, toughness, and cost-effectiveness in applications from construction girders to truck frames. However, innovation is continuous, with advanced high-strength steels (AHSS) and ultra-high-strength steels (UHSS) enabling down-gauging and weight reduction without sacrificing performance.

Stainless steels see robust demand where corrosion resistance is paramount, with duplex and super-duplex grades specified for the most aggressive environments like offshore oil platforms and chemical plants. The drive for lightweighting powerfully fuels the aluminum fastener segment, particularly in automotive body structures and renewable energy frameworks. Titanium occupies the premium apex, essential in aerospace for its exceptional strength-to-weight ratio and in medical implants for its biocompatibility, though its cost confines it to the most performance-critical applications. The segment also includes specialized nickel-based superalloys and copper alloys, serving niche needs in extreme-temperature and high-conductivity applications, respectively.

In contrast, the plastic fasteners segment, while smaller in total value, is projected to exhibit the highest growth rate. This surge is propelled by their unique properties: inherent corrosion resistance, electrical insulation, light weight, and often lower cost for high-volume production. Engineering thermoplastics like PEEK (Polyetheretherketone), PPA (Polyphthalamide), and glass- or carbon-fiber reinforced nylons are replacing metals in demanding roles within automotive engine bays (for weight savings), electronics enclosures (for non-conductivity), and food processing equipment (for cleanliness and chemical resistance). This segment's expansion is closely tied to material science advancements and the growing acceptance of polymers in structural and semi-structural applications.

By Product Analysis

Externally Threaded Fasteners (bolts, screws, studs) are forecasted to maintain their overwhelming dominance in terms of unit volume. They are the versatile, reversible backbone of mechanical assembly. Their evolution is focused on enhancing performance and manufacturability: new drive styles (e.g., Torx Plus®) improve tool engagement and reduce cam-out; sophisticated thread-locking patches (e.g., nylon, vibra-tite) provide reliable vibration resistance without separate washers; and consistent head geometries are engineered for high-speed automated driving systems in assembly plants.

Aerospace-Grade Fasteners represent the pinnacle of the product spectrum in terms of value, technology, and certification rigor. This category includes high-strength bolts, close-tolerance pins, lockbolts, and blind rivets manufactured to exacting standards like NASM (National Aerospace Standards) and MS (Military Standards). Every step of their production, from material sourcing and heat treatment to plating and testing, is meticulously controlled and documented. This segment is a hotbed of innovation, driven by new aircraft platforms that demand fasteners compatible with carbon-fiber composites and capable of withstanding higher operational temperatures.

Non-threaded fasteners serve crucial roles where permanent joining or rapid assembly is needed. Rivets, especially blind and self-piercing varieties, are fundamental in automotive body shops and aerospace assembly for creating strong, leak-proof joints in sheet metal. Pins (dowel, clevis, cotter) are essential for alignment and securing rotating components. Clips, clamps, and retainers provide fast, tool-less attachment for wiring harnesses, fluid lines, and trim panels across countless industries, valued for their assembly speed and reduction in part count.

Internally Threaded Fasteners (nuts, inserts) complete the threaded assembly system. Innovations here include prevailing-torque locknuts that maintain clamp load under vibration, and weld nuts or rivet nuts that provide strong threaded points in sheet metal where only one side is accessible.

By Application Analysis

The Automotive sector is poised to be the largest single application segment by volume and is undergoing its most significant transformation in a century. While traditional internal combustion engine vehicles still consume vast quantities of fasteners, the growth engine is unequivocally Electric Vehicles (EVs). This creates specialized demand clusters: fasteners for battery tray and module assembly (requiring electrical isolation and thermal management properties); fasteners for aluminum-intensive e-axles and subframes; and fasteners for the sensor suites of autonomous vehicles. The sector's needs are a primary driver for advanced high-strength steels and aluminum fasteners.

The Aerospace & Defense sector is the undisputed leader in value-per-part and technological sophistication. Demand is bifurcated between high-volume commercial narrow-body programs (e.g., Boeing 737 MAX, Airbus A320neo) and lower-volume but extremely high-value military and space programs. Every fastener is mission-critical, driving demand for titanium, corrosion-resistant steels, and superalloys. The sector's stringent requirements for traceability, certification, and performance under extreme conditions create a high-barrier, high-margin market for qualified suppliers.

Building & Construction is experiencing a renaissance driven by federal infrastructure spending, a boom in data center construction, and strong residential and commercial building activity in Sunbelt states. This segment consumes massive quantities of structural bolts, concrete anchors, façade fixing systems, and roofing fasteners. Performance is dictated by building codes (IBC) and material standards (ASTM), with an increasing focus on the speed of installation and the total installed cost.

Industrial Machinery (encompassing agricultural, construction, mining, and packaging equipment) provides cyclical but essential demand for durable, vibration-resistant fasteners. This sector values reliability and total cost of ownership, driving partnerships for inventory management and maintenance kits rather than just transactional part sales.

Other significant application segments include Home Appliances (for assembly and aesthetic trim), Furniture Manufacturing (for knock-down fittings and structural joints), Electric Motors & Pumps, and Renewable Energy Equipment, each with its own specific material and performance requirements.

The US Industrial Fasteners Market Report is segmented on the basis of the following:

By Raw Material

- Metal Fasteners

- Steel

- Stainless Steel

- Aluminum

- Titanium

- Brass & Other Alloys

- Plastic Fasteners

- Nylon

- Polypropylene

- PVC

- High-Performance Polymers

By Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-Threaded Fasteners

- Washers

- Rivets

- Pins

- Clips & Clamps

- Aerospace-Grade Fasteners

- High-Strength Bolts

- Titanium Fasteners

- Lockbolts & Blind Rivets

- Specialty Engine & Airframe Fasteners

By Application

- Automotive

- Industrial Machinery

- Aerospace & Defense

- Building & Construction

- Home Appliances

- Electric Motors & Pumps

- Furniture Manufacturing

- Plumbing Products & Fixtures

- Lawn & Garden Equipment

- Other Application

Impact of Artificial Intelligence on the US Industrial Fasteners Market

- Hyper-Accurate Predictive Quality Control: AI-powered computer vision systems are being deployed on production lines to perform real-time, microscopic inspection of millions of fasteners. These systems detect surface flaws, thread imperfections, and coating inconsistencies with a precision and consistency far beyond human capability, driving toward true "zero-defect" manufacturing, a critical requirement for safety-certified components in automotive and aerospace.

- Demand Sensing and Dynamic Production Optimization: Advanced AI algorithms analyze a complex mix of data streams: historical order patterns, real-time customer inventory levels (via IoT links), raw material futures prices, and even macroeconomic indicators. This enables manufacturers to forecast demand with unprecedented accuracy, optimize production schedules across multiple plants, minimize finished goods inventory, and proactively prevent stockouts, thereby enhancing capital efficiency and customer service levels.

- Prescriptive Maintenance for Manufacturing Assets: Moving beyond basic scheduling, AI analyzes sensor data from critical production machinery, cold headers, thread rollers, and heat treat furnaces. By identifying subtle patterns indicative of impending failure, the system can prescribe specific maintenance actions and optimal timing, transforming maintenance from a reactive cost center to a proactive strategy that maximizes equipment uptime and product quality consistency.

- Accelerated Discovery of Advanced Materials: AI and machine learning models are drastically reducing the time and cost required to develop new fastener alloys and coatings. By simulating material behavior under countless combinations of stress, temperature, and corrosive environments, AI can identify promising candidate compositions for specific applications (e.g., a lightweight alloy for EV batteries resistant to thermal cycling), streamlining the R&D process and bringing innovative products to market faster.

- Creating Autonomous, Self-Optimizing Supply Networks: AI is the brain behind next-generation digital supply chain platforms. These systems autonomously manage inventory across a distributed network of factories, distribution centers, and customer sites. They optimize logistics routes in real-time, calculate landed cost under varying tariff scenarios, and even automate procurement and replenishment, creating a resilient, efficient, and cost-effective supply web that can adapt to disruption.

The US Industrial Fasteners Market: Competitive Landscape

The competitive environment of the U.S. Industrial Fasteners Market is multifaceted and dynamic, characterized by a distinct stratification of players and intensifying competition along several axes. At the top tier sit global industrial conglomerates and large-scale specialists such as Illinois Tool Works (ITW), Stanley Black & Decker, and Fastenal. These giants compete on the basis of unparalleled scale, vast and diversified product portfolios, deep R&D resources, and fully integrated, nationwide (or global) supply and service networks. They are deeply embedded in the supply chains of major automotive and aerospace OEMs, often providing comprehensive "fastening solutions" that include design support, logistics, and inventory management.

A vital and vibrant second layer consists of leading domestic manufacturers and master distributors, including companies like MW Industries, Nucor Fastener, and Würth Industry North America. These players often compete through deep expertise in specific material families (e.g., stainless steel, titanium) or product categories (e.g., large structural bolts, precision nuts). They combine significant manufacturing capability with strong technical sales and distribution networks.

The foundation of the industry's agility and innovation, however, is the extensive ecosystem of small and medium-sized enterprises (SMEs) and specialized regional distributors. These companies are the niche experts, competing not on volume but on deep application knowledge, extreme customization capabilities, rapid prototyping services, and mastery of difficult-to-manufacture products. They thrive by solving unique engineering challenges for their customers.

Competition today is multi-dimensional. It is a battle on cost against imported standard parts, fought through automation and operational excellence. It is a battle for innovation to develop the lighter, stronger, smarter, and more sustainable fasteners demanded by next-generation products. It is increasingly a battle for service and data, requiring digital tools for e-commerce, inventory visibility, and traceability. Ultimately, competitive advantage is shifting from selling discrete parts to acting as a technical and supply chain partner, providing certifiable quality, sustainable credentials, and seamless digital integration into the customer's operations.

Some of the prominent players in the US Industrial Fasteners Market are:

- Illinois Tool Works

- Fastenal

- W.W. Grainger

- McMaster-Carr

- MSC Industrial Supply

- The Hillman Group

- Birmingham Fastener

- Stanley Black & Decker

- Arconic Fastening Systems

- Nucor Fastener Division

- Acument Global Technologies

- Holo-Krome

- ND Industries

- Hercules Bolt

- Portland Bolt

- National Bolt & Nut

- Dale Fastener Supply

- KD Fasteners

- American Fastener Technologies

- U.S. Titanium Industry

- Other Key Players

Recent Developments in The US Industrial Fasteners Market

- March 2025: Illinois Tool Works (ITW) launched its proprietary "Dyna-Grip EV" series, a new line of fasteners with engineered damping polymers integrated into the washer system, specifically designed to mitigate vibration and noise in electric vehicle battery pack and motor assemblies.

- January 2025: Fastenal Company expanded its "Faster" digital procurement platform with new AI-driven predictive analytics modules, allowing industrial customers to model future fastener demand based on their own production forecasts and automatically generate optimized replenishment orders.

- November 2024: A consortium including MW Industries, Inc. and a national laboratory was awarded a significant grant from the U.S. Department of Energy to pioneer the development of a new class of low-carbon, high-strength steel fasteners optimized for hydrogen service, targeting applications in future hydrogen fueling stations and pipelines.

- September 2024: Precision Castparts Corp. (PCC) officially opened its Advanced Manufacturing Innovation Center in Hillsboro, Oregon. The center is focused exclusively on using metal additive manufacturing (3D printing) to produce highly complex, consolidated aerospace and spaceflight fastener assemblies that are impossible to make with traditional forging.

- July 2024: Hilti North America introduced its "ON! Track Sense" smart anchoring system for the construction market. The system combines a specially designed anchor with an NFC sensor tag that, when scanned with a smartphone, provides installers and inspectors with real-time data on installed torque and can monitor long-term load conditions in critical structural connections.

- May 2024: Nucor Corporation announced a USD 150 million capital investment to expand the melt, re-roll, and fastener manufacturing capacity at its Nucor Fastener division in Illinois. The expansion is explicitly linked to anticipated demand from infrastructure projects and reshoring trends, emphasizing the use of domestically recycled scrap steel.

- March 2024: Howmet Aerospace secured a landmark, multi-year agreement to be the sole-source supplier of titanium fasteners for a next-generation, fuel-efficient commercial aircraft program, underscoring the strength of the aerospace recovery and the value of deep technical partnerships.

- January 2024: Würth Industry North America commissioned a new, highly automated Regional Distribution Center in Atlanta, Georgia. The facility utilizes autonomous mobile robots (AMRs) and AI-based picking systems to enable next-day delivery of a vast catalog of fasteners and components to industrial customers across the fast-growing Southeastern U.S.

- November 2023: The Industrial Fasteners Institute (IFI) published a comprehensive update to its flagship technical standard, IFI-500. The new edition incorporates guidelines for calculating and reporting the embodied carbon of fastener products, directly responding to the market's growing focus on sustainability and Environmental Product Declarations (EPDs).

- June 2023: With facilitation from the U.S. Department of Commerce, a group of U.S. fastener manufacturers launched the "Critical Fastener Reshoring Initiative." This pilot program aims to collectively onshore the production of a defined list of fasteners deemed essential for the defense industrial base, addressing vulnerabilities identified in supply chain risk assessments.

- April 2023: Stanley Engineered Fastening inaugurated a state-of-the-art Technical Center in Auburn Hills, Michigan, adjacent to the heart of the U.S. auto industry. The center is dedicated to collaborative engineering (co-location) with automotive OEM and Tier-1 customers, focusing specifically on fastening challenges related to electric vehicles, battery systems, and autonomous driving hardware.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 26.5 Bn |

| Forecast Value (2034) |

USD 40.7 Bn |

| CAGR (2025–2034) |

4.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Raw Material (Metal, Plastic), By Product (Externally Threaded, Non-threaded, Internally Threaded, Aerospace Grade), By Application (Automotive, Industrial Machinery, Aerospace, Building & Construction, Home Appliances, Furniture, Plumbing Products, Lawn & Garden, Others) |

| Regional Coverage |

The US |

| Prominent Players |

Illinois Tool Works, Fastenal, W.W. Grainger, McMaster-Carr, MSC Industrial Supply, The Hillman Group, Birmingham Fastener, Stanley Black & Decker, Arconic Fastening Systems, Nucor Fastener Division, Acument Global Technologies, Holo-Krome, ND Industries, Hercules Bolt, Portland Bolt, National Bolt & Nut, Dale Fastener Supply, KD Fasteners, American Fastener Technologies, U.S. Titanium Industry, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Industrial Fasteners Market size is estimated to have a value of USD 26.5 billion in 2025 and is expected to reach USD 40.7 billion by the end of 2034.

The market is growing at a Compound Annual Growth Rate (CAGR) of 4.9 percent over the forecast period from 2025 to 2034.

The market features a mix of global conglomerates, large domestic specialists, and nimble SMEs. Some of the major key players include Illinois Tool Works Inc. (ITW), Stanley Black & Decker, Fastenal Company, Hilti Corporation, Howmet Aerospace, Precision Castparts Corp. (PCC), MW Industries, Inc., and Nucor Fastener, among many others.