Market Overview

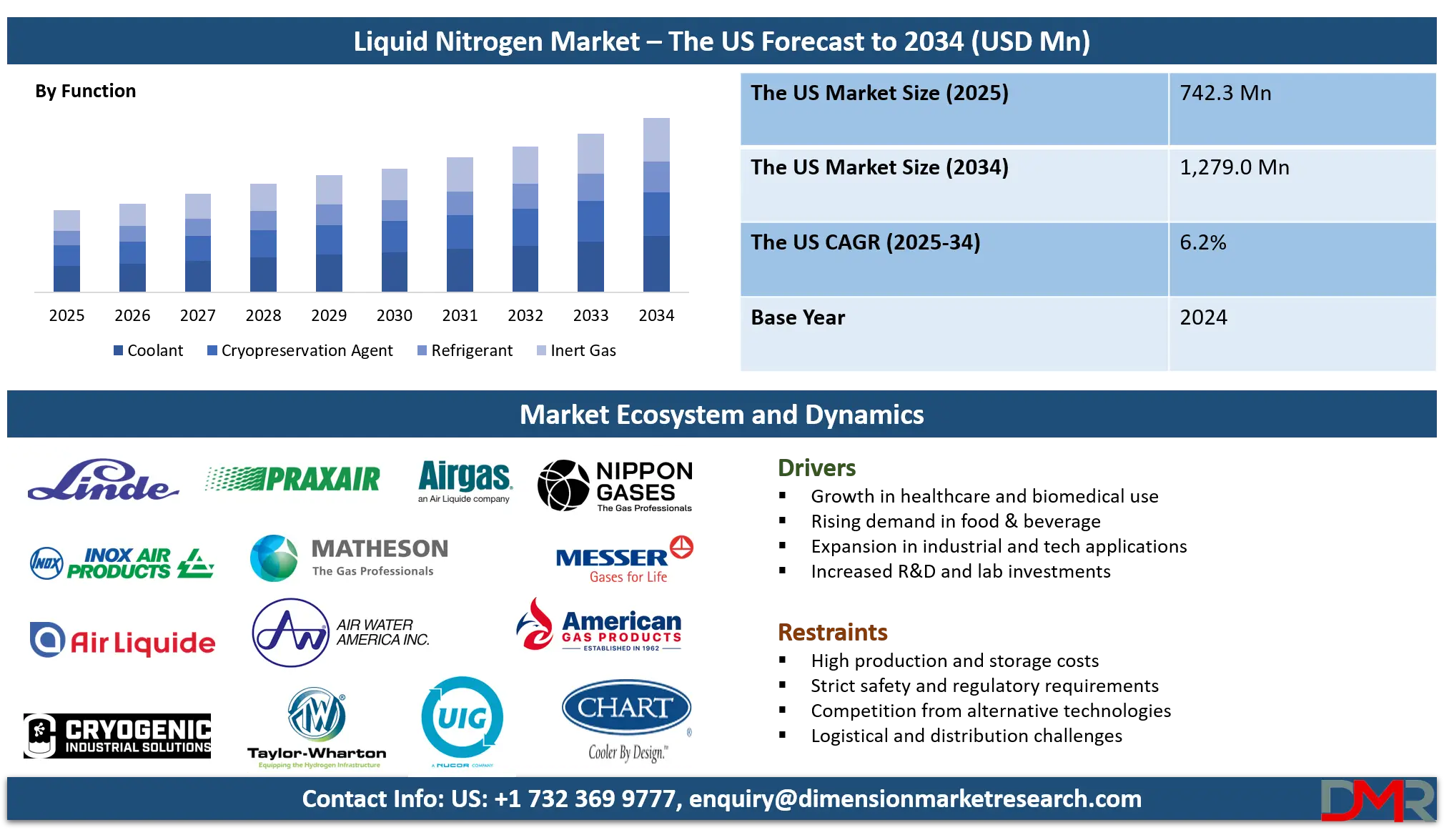

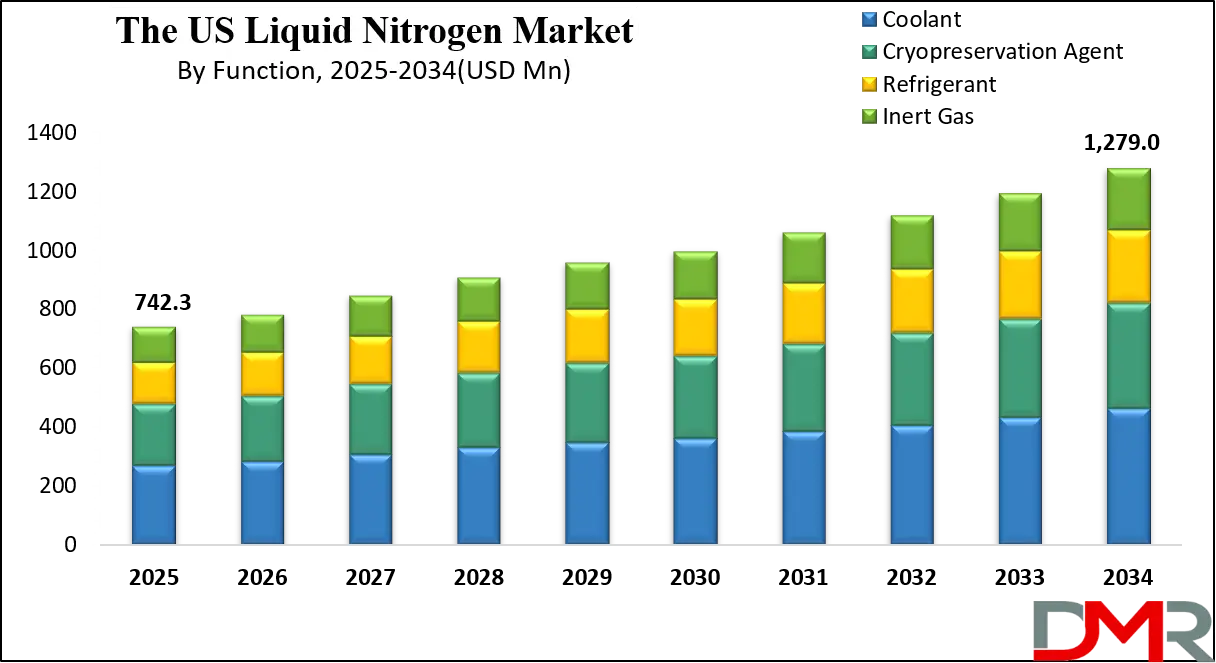

The U.S. Liquid Nitrogen Market is projected to be valued at USD 742.3 million in 2025 and is expected to reach USD 1,279.0 million by 2034, expanding at a CAGR of 6.2% over the forecast period.

This sustained growth is driven by increasing demand across a diverse range of industrial, technological, and medical applications, supported by the country's leadership in advanced manufacturing, healthcare innovation, and food processing technologies. Liquid nitrogen's unique properties, extreme cold temperature, inertness, and non-reactivity make it indispensable in applications ranging from semiconductor manufacturing and pharmaceutical production to food cryo-freezing and advanced medical therapies. The market is further propelled by technological advancements in production and storage, the expansion of cold chain logistics, and significant investments in life sciences, electronics, and aerospace sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States holds a dominant position in the global industrial gases market, with liquid nitrogen serving as a critical utility in modern industrial processes. The country's robust manufacturing base, world-leading semiconductor fabrication capabilities, and cutting-edge pharmaceutical and biotech industries create consistent, high-volume demand.

Furthermore, the rapid growth of the U.S. food processing industry, particularly in frozen foods, ready-to-eat meals, and high-value protein processing, has positioned liquid nitrogen as the preferred cryogenic freezing medium for its speed and quality preservation. The burgeoning fields of regenerative medicine, cell and gene therapies, and biological sample banking have transformed healthcare into one of the fastest-growing end-user segments, reliant on liquid nitrogen for cryogenic preservation at temperatures below -196°C.

Significant growth opportunities are emerging from technological convergence and sustainability initiatives. The ongoing miniaturization and complexity of semiconductor chips demand ultra-pure, inert environments during production, which liquid nitrogen provides for chip testing and wafer cooling. The push toward electric vehicles and advanced battery technologies is creating new use cases in thermal management and manufacturing process cooling.

Concurrently, the trend toward on-site nitrogen generation via membrane or pressure swing adsorption (PSA) technologies is gaining traction among large-volume industrial users seeking supply security, cost control, and reduced carbon footprint associated with transportation. Sustainability initiatives are also driving innovation in liquid nitrogen applications, such as its use in low-temperature grinding for plastic recycling and as a clean alternative to chemical solvents in various processes.

However, the market faces notable challenges related to energy intensity, logistics complexity, and safety regulations. The production of liquid nitrogen via cryogenic air separation is highly energy-intensive, making the industry susceptible to fluctuations in electricity and natural gas prices, which constitute a major portion of operational costs. The specialized logistics required for the safe transportation and handling of cryogenic liquids, involving insulated tankers, trained personnel, and stringent safety protocols, add high cost and complexity to the supply chain.

Furthermore, stringent regulations from agencies like OSHA, DOT, and EPA governing the handling, storage, and transportation of cryogenic materials necessitate continuous compliance investments and limit market entry for smaller players.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite these challenges, the fundamental demand drivers for liquid nitrogen in the U.S. remain robust and expanding. The reshoring of semiconductor manufacturing through initiatives like the CHIPS and Science Act, the continuous advancement of biotechnology and personalized medicine, and the ongoing evolution of food processing and packaging techniques all ensure a dynamic and growing market. Success in this competitive landscape will belong to producers and distributors who can provide a reliable, cost-effective supply while innovating in application development, digital supply chain management, and sustainable production practices.

The US Liquid Nitrogen Market: Key Takeaways

- Strong Market Growth Trajectory: The U.S. market is projected to grow from USD 742.3 million in 2025 to USD 1,279.0 million by 2034, achieving a CAGR of 6.2%. This is driven by deep-seated demand from electronics, healthcare, and food processing industries undergoing technological transformation.

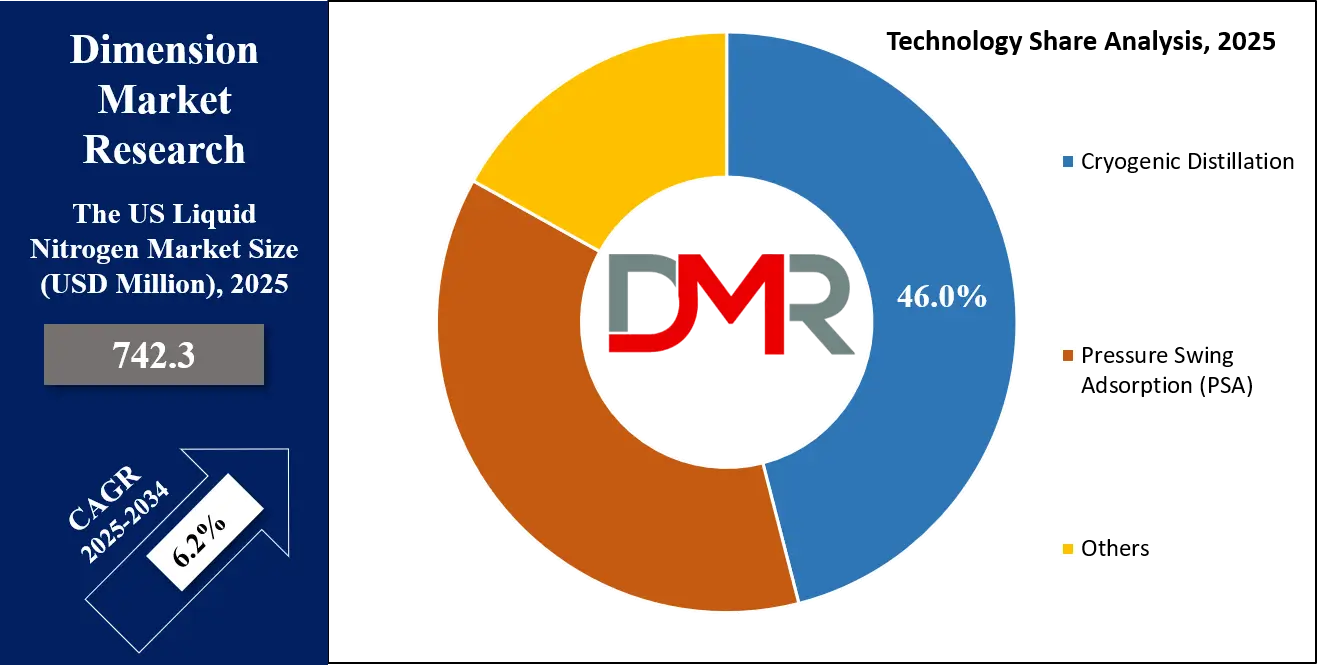

- Technology Leadership: Cryogenic Distillation remains the dominant production method, accounting for over 46.0% of supply, due to its efficiency for large-scale, high-purity production, though Pressure Swing Adsorption (PSA) and on-site generation are growing rapidly among cost-conscious industrial users.

- Electronics Sector as Primary Driver: The Electronics & Semiconductors segment is the largest end-user, consuming over 30.0% of U.S. liquid nitrogen for wafer cooling, chamber purging, and testing applications, fueled by massive domestic investments in chip fabrication plants (fabs).

- Healthcare's High-Value Growth: While smaller in volume, the Healthcare sector represents the highest-value growth segment, with demand for cryopreservation in biobanking, cell therapies, and reproductive medicine expanding at a high CAGR, driven by advancements in regenerative medicine.

- Logistics and Storage Evolution: Bulk tank delivery serves the majority of industrial volume, but microbulk and on-site generation systems are gaining significant market share, offering greater flexibility, reduced logistics costs, and enhanced supply security for medium-volume users.

The US Liquid Nitrogen Market: Use Cases

- Semiconductor Fabrication & Testing: In the production of advanced semiconductor chips, ultra-high-purity liquid nitrogen is critical for creating inert atmospheres during chemical vapor deposition (CVD) and etching processes. It is also used for rapid thermal testing of wafers and for cooling superconducting magnets in semiconductor manufacturing equipment. The extreme purity (>99.999%) is non-negotiable to prevent contamination that could ruin billion-dollar production batches.

- Biological & Pharmaceutical Cryopreservation: Liquid nitrogen is the global standard for long-term preservation of biological specimens, including stem cells, blood products, tissue samples, and reproductive cells (sperm, eggs, embryos). Stored in specialized cryogenic tanks at -196°C, it virtually halts all biological activity, enabling storage for decades. This is foundational for biobanks, fertility clinics, and pharmaceutical companies developing cell and gene therapies.

- Food Processing & Cryogenic Freezing: The food industry utilizes liquid nitrogen for ultra-fast freezing (IQF - Individual Quick Freezing) of high-value products like seafood, berries, and prepared meals. This rapid freezing minimizes ice crystal formation, preserving cellular structure, texture, flavor, and nutritional value far better than mechanical freezing. It is also used for crust freezing, cryogenic grinding of spices, and creating inert atmospheres in food packaging to extend shelf life.

- Metal Processing & Heat Treatment: In metallurgy and manufacturing, liquid nitrogen is employed in shrink-fitting applications, where metal parts are cooled to contract for precise assembly. It is used in cryogenic treatment of tool steels and aerospace alloys to enhance wear resistance, dimensional stability, and durability. Additionally, it serves as a safe, inert coolant in machining operations involving heat-sensitive materials like titanium.

- Chemical & Pharmaceutical Manufacturing: Liquid nitrogen's inert properties make it ideal for blanketing and purging reactors, storage tanks, and pipelines to prevent unwanted oxidation or explosive atmospheres during the production of sensitive chemicals and active pharmaceutical ingredients (APIs). It is also used for temperature control in exothermic reactions and for recovering volatile organic compounds (VOCs) from process streams.

The US Liquid Nitrogen Market: Stats & Facts

U.S. Government & Industry Data Sources

- U.S. Census Bureau & Bureau of Economic Analysis: Track the industrial gas manufacturing sector under NAICS 325120. The latest data indicates the broader U.S. industrial gas market exceeded USD 13 billion in annual revenue.

- U.S. Energy Information Administration (EIA): Monitors energy consumption by the manufacturing sector. Cryogenic air separation plants are among the most energy-intensive facilities, with electricity costs representing 40-60% of the production cost of liquid nitrogen.

- U.S. Food and Drug Administration (FDA) & Department of Agriculture (USDA): Regulate the use of liquid nitrogen in food processing (as a cryogenic fluid) and in the preservation of biologics and pharmaceuticals, providing guidelines for safe handling and purity standards.

- Department of Transportation (DOT) & Occupational Safety and Health Administration (OSHA): Enforce strict regulations (49 CFR, 29 CFR 1910) for the transportation of cryogenic liquids via road and rail and for workplace safety in handling, requiring specialized training, PPE, and engineering controls.

- Compressed Gas Association (CGA): The primary U.S. standards-developing organization for the industrial and medical gas industries, publishing critical safety standards (e.g., CGA G-10.1, CGA P-12) for the production, storage, and handling of liquid nitrogen.

- International Society for Biological and Environmental Repositories (ISBER) & American Association of Tissue Banks (AATB): Set best practice guidelines for cryogenic storage in biobanking, influencing demand for high-reliability liquid nitrogen supply and storage equipment in healthcare.

Market Concentration & Production

- The U.S. market is highly concentrated, with the top four producers, Linde plc, Air Products and Chemicals, Inc., Air Liquide, and Matheson Tri-Gas controlling a significant majority of production capacity and distribution infrastructure.

- Major production facilities (air separation units - ASUs) are strategically located near key industrial corridors with high demand: the Gulf Coast (petrochemicals), the Midwest (food processing, manufacturing), California (electronics), and the Northeast (pharmaceuticals).

Legislative and Investment Impact

- The CHIPS and Science Act of 2022 is a direct, massive driver of demand, providing over USD 52 billion in subsidies and incentives for domestic semiconductor manufacturing, necessitating corresponding investments in supporting industrial gas infrastructure, including liquid nitrogen supply.

- Investment in biotechnology and life sciences remains strong, with both federal (NIH) and private (venture capital) funding continuing to flow into cell therapies, genomics, and personalized medicine, all dependent on cryogenic preservation.

The US Liquid Nitrogen Market: Market Dynamics

Driving Factors in the U.S. Liquid Nitrogen Market

Semiconductor Manufacturing Resurgence and Technological Advancement

The U.S. government's strategic push to reshore semiconductor manufacturing, backed by the CHIPS Act, represents the single most powerful demand driver. Building and operating state-of-the-art fabrication plants (fabs) requires enormous, reliable quantities of ultra-high-purity liquid nitrogen. Its applications are critical: cooling during wafer testing, creating inert environments in process chambers, and supporting ancillary manufacturing steps.

As chip geometries shrink to nanometers, the purity and consistency of process gases become even more crucial. This legislated industrial expansion is creating a multi-decade demand pipeline, prompting industrial gas companies to invest billions in new air separation units (ASUs) and supply networks near new fab clusters in Arizona, Ohio, Texas, and New York.

Revolution in Healthcare and Life Sciences

The fields of biotechnology, regenerative medicine, and personalized healthcare are undergoing a revolution, and liquid nitrogen is an enabling technology at its core. The expansion of cord blood banking, the commercialization of CAR-T and other cell therapies, the growth of IVF services, and the proliferation of biobanks for research all depend absolutely on cryogenic preservation at -196°C. This sector demands not just the liquid nitrogen itself, but also extremely high reliability of supply and advanced monitoring systems for storage tanks. Unlike cyclical industrial demand, healthcare demand is defensive and growing steadily, driven by demographic trends (aging population) and continuous medical innovation, providing a stable, high-margin segment for suppliers.

Restraints in the U.S. Liquid Nitrogen Market

High Energy Intensity and Cost Volatility

The primary method of production, cryogenic distillation, is one of the most energy-intensive industrial processes. Large air separation units consume power equivalent to a small city. Consequently, the cost of liquid nitrogen is intrinsically linked to the price of electricity and natural gas (often used for power generation). Volatility in energy markets directly translates into production cost volatility and margin pressure for manufacturers. This makes long-term, fixed-price contracts challenging and exposes both producers and large customers to energy market risks.

Complex and Regulated Logistics & Safety Imperatives

The supply chain for liquid nitrogen is capital-intensive and complex. It requires a fleet of specially insulated cryogenic tanker trucks, railcars, and a network of bulk storage depots. Drivers and handlers must undergo specialized safety training. The cryogenic nature of the product poses unique hazards: extreme cold causing frostbite or material embrittlement, and rapid expansion (1 liter of LN2 produces ~700 liters of gas), creating risks of over-pressurization or oxygen displacement in confined spaces. Compliance with a web of DOT, OSHA, and EPA regulations adds high operational costs. This logistics complexity also limits the economic delivery radius for bulk supply, making remote or low-volume customers difficult to serve profitably.

Opportunities in the U.S. Liquid Nitrogen Market

Expansion of On-site and Modular Generation Technologies

While cryogenic distillation dominates large-scale production, significant opportunity lies in the growth of on-site and near-site generation systems, particularly Pressure Swing Adsorption (PSA) and membrane technologies. For medium-volume industrial users (e.g., a large food plant or metal fabricator), generating gaseous nitrogen on-site and then liquefying it in a small package can offer compelling advantages: elimination of transportation costs, guaranteed supply security, and potentially a lower carbon footprint if paired with renewable energy. This trend is moving the value proposition from product delivery to providing and servicing capital equipment, creating new business models for gas companies.

Development of New High-Value Applications

Continuous innovation is opening new application frontiers. In electronics, the need for cooling high-performance computing data centers and quantum computing systems is emerging. In sustainability, liquid nitrogen is being explored for cryogenic recycling of plastics and composites, and for carbon capture processes. In transportation, it is being trialed in cryogenic cooling systems for superconducting elements in future maglev trains or for thermal management in electric vehicle batteries. Companies that can partner with end-users to develop and commercialize these novel applications can capture premium, first-mover advantages in new market segments.

Trends in the U.S. Liquid Nitrogen Market

Digitalization of the Supply Chain and Asset Management

The industry is embracing IoT and digitalization to enhance efficiency, safety, and customer service. Smart tanks and cylinders equipped with telemetry sensors provide real-time data on liquid level, pressure, and temperature, enabling predictive refill delivery and preventing stockouts.

Digital platforms allow customers to monitor their inventory, place orders, and access usage analytics. For healthcare and biobanking customers, continuous monitoring with automated alarms for storage conditions is becoming a standard requirement to protect invaluable biological assets. This digital thread improves operational efficiency for suppliers and provides critical peace of mind for end-users.

Focus on Sustainability and Circular Economy

Environmental, Social, and Governance (ESG) pressures are influencing the market. Major producers are investing in technologies to improve the energy efficiency of ASUs and are increasingly powering them with renewable energy via Power Purchase Agreements (PPAs). There is a growing focus on minimizing boil-off losses during transportation and storage.

Furthermore, the concept of a circular economy is being applied: the waste cold from liquid nitrogen vaporization is sometimes recovered for other cooling processes, and nitrogen gas used in blanketing applications is occasionally recovered and re-purified. While liquid nitrogen itself is inert and non-polluting, the industry is working to reduce the carbon footprint of its production and distribution.

The US Liquid Nitrogen Market: Research Scope and Analysis

By Technology Analysis

Cryogenic Distillation is the established, high-capacity backbone of the industry, projected to account for the vast majority of liquid nitrogen produced. This process cools atmospheric air to cryogenic temperatures where it liquefies, then separates it into its primary components (nitrogen, oxygen, argon) through fractional distillation in tall distillation columns. Its dominance is due to unparalleled efficiency at large scale and the ability to produce ultra-high-purity (up to 99.9999%) product simultaneously with other valuable gases like liquid oxygen and argon.

It is the only economically viable method for supplying the massive, steady demand from electronics fabs and large chemical complexes. Modern ASUs are highly integrated, automated facilities, with ongoing R&D focused on lowering energy consumption through advanced heat integration and compressor design.

Pressure Swing Adsorption (PSA) technology represents the primary alternative for on-site or regional production, especially for customers requiring high-purity gaseous nitrogen. PSA systems work by passing compressed air over a bed of carbon molecular sieves that adsorb oxygen, water vapor, and CO2, allowing nitrogen to pass through.

While less common for direct liquid production at small scales, PSA-generated high-purity gas can feed a liquefier to produce liquid nitrogen on-site. Its growth is driven by customers seeking supply independence, reduced logistics costs, and flexibility. It is particularly attractive for food processors, metal heat treaters, and pharmaceutical plants with significant, consistent demand. The trend is toward more efficient, compact, and reliable modular PSA units.

Other Technologies include Membrane Separation, where hollow-fiber membranes selectively permeate oxygen and water vapor, leaving a nitrogen-rich stream. Membranes are used for lower-purity applications but are gaining ground due to lower maintenance and simplicity. Cryogenic Liquid Vaporizers are not production technologies but critical ancillary equipment for converting stored liquid nitrogen back into gas at the point of use, with innovations in ambient air vaporizers improving energy efficiency over traditional steam or electric units.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Function Analysis

As a Refrigerant/Cryogen, liquid nitrogen's primary function is to provide intense, rapid cooling. This is its most volumetrically significant application. In food processing, it flash-freezes products. In electronics, it cools test chambers and manufacturing tools. In medical settings, it freezes tissue for removal (cryosurgery) or preserves biological samples. Its advantage is the extremely low temperature (-196°C or -320°F) and the fact that it leaves no residue as it vaporizes.

As an Inert Gas, nitrogen's unreactive nature is exploited. In its gaseous form (generated by vaporizing liquid nitrogen), it is used for purging and blanketing to prevent fire, explosion, or oxidation. This is critical in chemical reactor blanketing, fuel tank inerting in aerospace, and preserving freshness in food packaging (modified atmosphere packaging - MAP). The liquid form serves as a dense, portable storage medium for this gaseous utility.

As a Cryopreservation Agent, this is a specialized, high-value function. Liquid nitrogen provides the stable, ultra-low temperature environment required to preserve living cells, tissues, and biological materials in a state of suspended animation for decades. This is non-negotiable for sperm/egg banks, stem cell repositories, and seed banks. The reliability and purity of supply are paramount, as any temperature fluctuation or contamination can result in catastrophic, irreversible loss of priceless biological assets.

By Storage and Distribution Method Analysis

Bulk Tanks & Microbulk Systems represent the workhorse distribution method for industrial and large commercial users. Customers have permanently installed, insulated storage tanks (ranging from 500 to 50,000+ gallons) on their premises. Supply is maintained via scheduled deliveries by cryogenic tanker trucks that transfer liquid nitrogen into the customer tank. Microbulk systems (typically 100-500 gallon tanks) are a growing segment for medium-sized users, offering a compromise between the flexibility of cylinders and the economics of bulk supply, often with automated telemetry for monitoring.

Cylinders & Dewars are used for lower-volume, portable, or point-of-use applications. Dewar flasks are insulated containers used in laboratories, hospitals, and small workshops to hold liters to tens of liters of liquid nitrogen for short-term use, such as in a research lab or for dermatological procedures. High-pressure gas cylinders are filled by vaporizing liquid nitrogen on-site and are used where gaseous nitrogen is needed. This channel is critical for serving fragmented, small-volume customers across diverse sectors.

On-site Generation is not a distribution method per se, but a paradigm shift in supply. It eliminates the need for frequent physical delivery of the product. The customer owns or leases a nitrogen generation plant (PSA or membrane) and often a small liquefier and storage tank. The "distribution" becomes the pipeline from the generation unit to the use point. This model is driven by cost savings over long term, supply security, and sustainability goals (reduced truck traffic). It is becoming increasingly viable for facilities with steady demand above a certain threshold.

By End-user Analysis

Electronics & Semiconductors is poised to be the leading end-user segment in terms of volume and strategic importance. Liquid nitrogen is a critical utility in semiconductor fabs. It is used for wafer testing (creating cryogenic temperatures to test chip performance), chamber cooling and purging during deposition and etch processes, and as a clean, dry source of nitrogen gas for the entire facility. The precision and scale of modern fabs make them "anchor tenants" for industrial gas companies, often leading to the construction of dedicated pipeline supply or even a captive ASU on the fab site.

Healthcare is the highest-growth, highest-margin segment. Applications are diverse and expanding: Cryopreservation in biobanks, fertility clinics, and for cell therapies; Cryosurgery for removing cancerous or pre-cancerous lesions; Cryogenic cooling for MRI magnets; and as a source of medical-grade nitrogen gas for surgical tools and lung function tests. The demand is driven by aging demographics, advances in reproductive medicine, and the explosive growth of biopharmaceuticals and personalized medicine. Reliability and documentation of supply purity are critical.

Food & Beverage is a large, stable volume segment. Liquid nitrogen enables high-quality individual quick freezing (IQF) of seafood, fruits, vegetables, and prepared meals. It is used for cryogenic grinding of spices and herbs to retain volatile oils. It creates inert atmospheres in packaging (Modified Atmosphere Packaging - MAP) to dramatically extend the shelf life of snacks, coffee, and prepared foods. The demand correlates with the growth of processed and convenience foods and the need to reduce food waste.

Chemicals & Pharmaceuticals utilizes liquid nitrogen primarily as a source of inert gas for blanketing and purging to prevent fires, explosions, and oxidation during chemical synthesis and storage. It is also used for temperature control in reactors and for cryogenic condensation to recover solvents or control emissions. The stringent safety and purity requirements of these industries make them steady, high-value customers.

Metallurgy & Manufacturing employs liquid nitrogen for cryogenic treatment of metals (deep freezing to improve wear life and dimensional stability of tool steels, aerospace alloys, and racing components), for shrink-fitting assemblies, and as a coolant in machining. The Automotive & Aerospace sectors are sub-segments here, with specific needs for cryogenic treatment of high-performance parts and for inerting aircraft fuel tanks.

The US Liquid Nitrogen Market Report is segmented on the basis of the following:

By Technology

- Cryogenic Distillation

- Pressure Swing Adsorption (PSA)

- Others

By Function

- Coolant

- Cryopreservation Agent

- Refrigerant

- Inert Gas

By Storage and Distribution Method

- Cylinders & Dewars

- Bulk Tanks

- On-site Generation

By End-user

- Food & Beverage

- Healthcare

- Electronics & Semiconductors

- Chemicals & Pharmaceuticals

- Automotive & Aerospace

- Metallurgy

Impact of Artificial Intelligence in the US Liquid Nitrogen Market

- Predictive Demand Forecasting & Dynamic Route Optimization: AI algorithms analyze historical consumption patterns, real-time weather data (which affects vaporization rates), customer production schedules, and even traffic conditions to forecast precise demand at each customer site. This enables optimal scheduling of cryogenic tanker trucks, minimizing empty miles, reducing fuel consumption, and ensuring just-in-time deliveries to prevent costly production stoppages for customers.

- Smart Asset Health Monitoring & Predictive Maintenance: IoT sensors on ASU compressors, distillation columns, vaporizers, and customer storage tanks feed data into AI systems. These systems can detect subtle anomalies in vibration, temperature, or efficiency that precede equipment failure. This enables maintenance to be performed proactively during planned downtimes, maximizing asset uptime and preventing catastrophic failures that could disrupt supply to critical customers like semiconductor fabs or hospitals.

- Optimization of Cryogenic Distillation Processes: AI and machine learning models are being applied to the complex thermodynamics of air separation units. By continuously analyzing thousands of data points, AI can suggest real-time adjustments to pressure, temperature, and flow rates to maximize product yield (nitrogen, oxygen, argon) while minimizing specific energy consumption, leading to significant cost savings and reduced carbon footprint.

- Enhanced Safety Monitoring and Risk Mitigation: Computer vision AI coupled with site cameras can monitor storage areas and handling procedures for safety compliance, detecting issues like improper PPE usage or unauthorized access to cryogenic zones. AI can also model the dispersion of nitrogen gas in the event of a leak in a confined space, predicting oxygen-deficient zones and guiding emergency response protocols.

- Personalized Customer Service and Usage Analytics: AI-powered customer portals can provide clients with deep insights into their nitrogen usage, correlating it with production output or seasonal factors. The system can offer personalized recommendations for optimizing consumption, switching between delivery methods (e.g., from cylinders to microbulk), or even implementing energy-saving measures related to their cryogenic equipment.

The US Liquid Nitrogen Market: Competitive Landscape

The U.S. Liquid Nitrogen Market is an oligopoly, characterized by high barriers to entry and dominated by a few multinational industrial gas giants with integrated production, distribution, and technology portfolios. The competitive landscape is defined by these large players competing on scale, reliability, and long-term contracts, while also facing pressure from regional specialists and the trend toward customer-owned on-site generation.

The market leaders are Linde plc, Air Products and Chemicals, Inc., and Air Liquide. These companies operate extensive networks of large-scale air separation units (ASUs) strategically located near key demand centers. They maintain vast fleets of cryogenic transport equipment and own or manage thousands of customer-owned bulk storage tanks. Their competitive advantage lies in unmatched scale, decades of process engineering expertise, and the ability to offer a full suite of industrial gases and related services. They compete for "anchor tenant" contracts with mega-projects like semiconductor fabs, which often involve building a dedicated, on-site ASU or pipeline.

Matheson Tri-Gas (a subsidiary of Nippon Sanso Holdings Corporation) is another major player, with a strong focus on the electronics, specialty chemicals, and research markets. Other significant competitors include Messer Americas and NexAir, which have strong regional presences.

Competition is multi-faceted. It is a battle for long-term supply contracts with major industrial customers, won through reliability, pricing, and technical service. It is a technology race to offer the most efficient on-site generation solutions and digital monitoring services. It is also a logistics and service competition to efficiently serve the fragmented base of smaller commercial and medical customers via cylinder and dewar delivery. The threat of customer "make-or-buy" decisions where large users invest in their own on-site generation constantly pressures the merchant gas business model, pushing the majors to innovate in service offerings and energy efficiency to retain business.

Some of the prominent players in The US Liquid Nitrogen Market are:

- Linde

- Air Products

- Air Liquide

- Messer Group

- Praxair (Linde)

- Matheson Tri-Gas

- Airgas (Air Liquide)

- Nippon Gases

- Air Water America

- Chart Industries

- Taylor-Wharton

- Cryogenic Industries

- CryoCarb

- PurityPlus

- Coregas USA

- Universal Industrial Gases

- American Gas Products

- Norco Inc.

- Roberts Oxygen

- Welders Supply Company

- Other Key Players

Recent Developments in the US Liquid Nitrogen Market

- April 2025: Air Products announced a final investment decision to build a new, USD 500 million state-of-the-art air separation unit (ASU) and pipeline complex in New York's Hudson Valley, specifically to supply a cluster of new semiconductor fabrication plants attracted by CHIPS Act incentives. The facility will be powered partially by renewable energy.

- February 2025: Linde launched its "Linde Lifeline" digital monitoring service for biomedical cryogenic storage tanks. Using AI-driven analytics of tank telemetry data, the service predicts refill needs with 99.5% accuracy and provides instant alerts for any deviation from set-points, offering unparalleled security for cell therapy and biobank customers.

- December 2024: A consortium led by a major university medical center and a biotech firm signed a 10-year liquid nitrogen supply agreement with Messer, including the installation of a dedicated, hospital-grade microbulk system with redundant backup vaporizers to ensure uninterrupted supply for their newly built advanced cell therapy manufacturing facility.

- October 2024: Matheson Tri-Gas introduced a new modular, skid-mounted "Nitrogen Liquefier Unit" designed to pair with existing on-site PSA nitrogen generators. This system allows medium-sized manufacturers to produce their own liquid nitrogen from self-generated gas, capturing significant savings versus merchant liquid delivery.

- July 2024: In response to rising energy costs, Air Liquide completed a multi-million-dollar efficiency upgrade at its flagship ASU in Louisiana, implementing AI-based process optimization software that reduced the plant's specific energy consumption for nitrogen production by over 5%.

- May 2024: The U.S. FDA issued new draft guidance emphasizing the need for validated, continuous temperature monitoring and alarm systems for cryogenic storage of human cells, tissues, and cellular/tissue-based products (HCT/Ps). This regulatory move is expected to accelerate investment in smart tank technology and high-reliability supply contracts in the healthcare sector.

- March 2024: A leading U.S. frozen food processor expanded its contract with NexAir to include not just liquid nitrogen supply but also co-investment in a new cryogenic freezing tunnel, with costs shared based on a "gas-per-pound-of-product" model, aligning supplier incentives with customer production efficiency.

- January 2024: The Department of Energy awarded a research grant to a team including Air Products and a national lab to develop a novel, low-energy cryogenic carbon capture process that uses liquid nitrogen as a refrigerant, potentially opening a massive new application market in the energy sector.

- September 2023: Praxair Surface Technologies (Linde) developed a new liquid nitrogen-based cryogenic cleaning process for removing contaminants from delicate aerospace components, winning a contract from a major defense contractor as an alternative to chemical solvents.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 742.3 Mn |

| Forecast Value (2034) |

USD 1,279.0 Mn |

| CAGR (2025–2034) |

6.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Cryogenic Distillation, Pressure Swing Adsorption (PSA), Others), By Function (Coolant, Cryopreservation Agent, Refrigerant, Inert Gas), By Storage and Distribution Method (Cylinders & Dewars, Bulk Tanks, On-site Generation), By End-user (Healthcare, Food & Beverage, Electronics & Semiconductors, Chemicals & Pharmaceuticals, Automotive & Aerospace, Metallurgy) |

| Regional Coverage |

The US |

| Prominent Players |

Linde, Air Products, Air Liquide, Messer Group, Praxair (Linde), Matheson Tri-Gas, Airgas (Air Liquide), Nippon Gases, Air Water America, Chart Industries, Taylor-Wharton, Cryogenic Industries, CryoCarb, PurityPlus, Coregas USA, Universal Industrial Gases, American Gas Products, Norco Inc., Roberts Oxygen, Welders Supply Company., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the U.S. Liquid Nitrogen Market?

▾ The U.S. Liquid Nitrogen Market size is estimated to have a value of USD 742.3 million in 2025 and is expected to reach USD 1,279.0 million by the end of 2034.

What is the growth rate in the U.S. Liquid Nitrogen Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 6.2 percent over the forecast period from 2025 to 2034.

Who are the key players in the U.S. Liquid Nitrogen Market?

▾ The market is dominated by large multinational industrial gas companies. The key players are Linde plc, Air Products and Chemicals, Inc., Air Liquide S.A., and Matheson Tri-Gas, Inc. Other significant players include Messer Americas and NexAir, among various regional distributors.