Market Overview

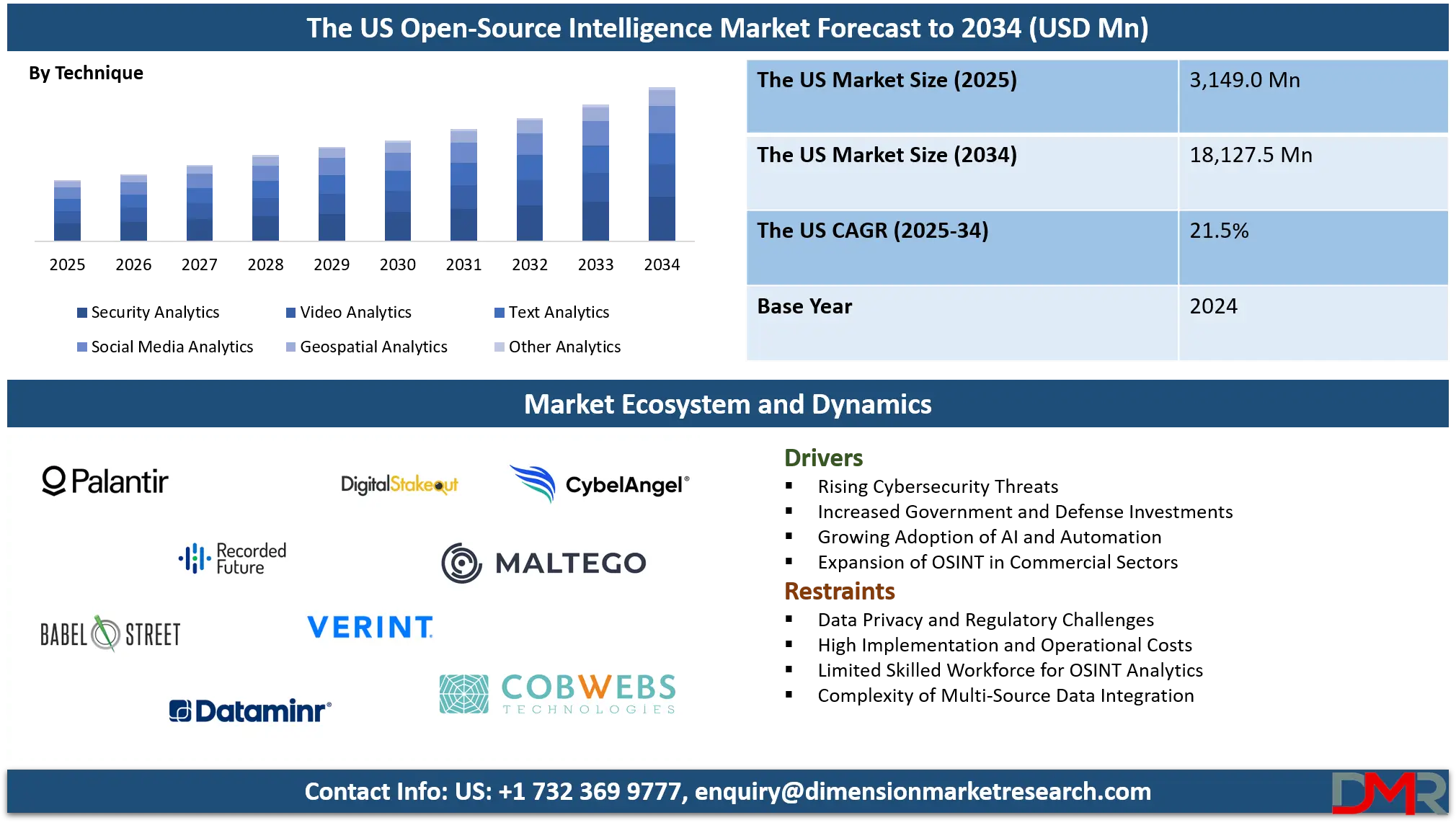

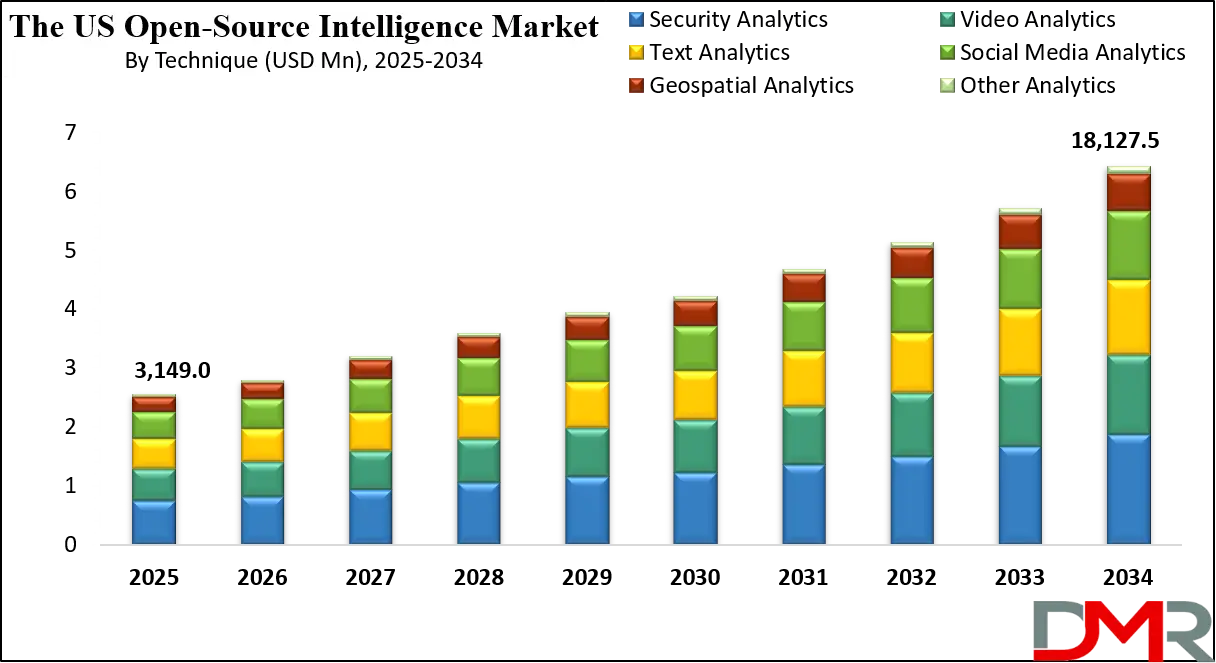

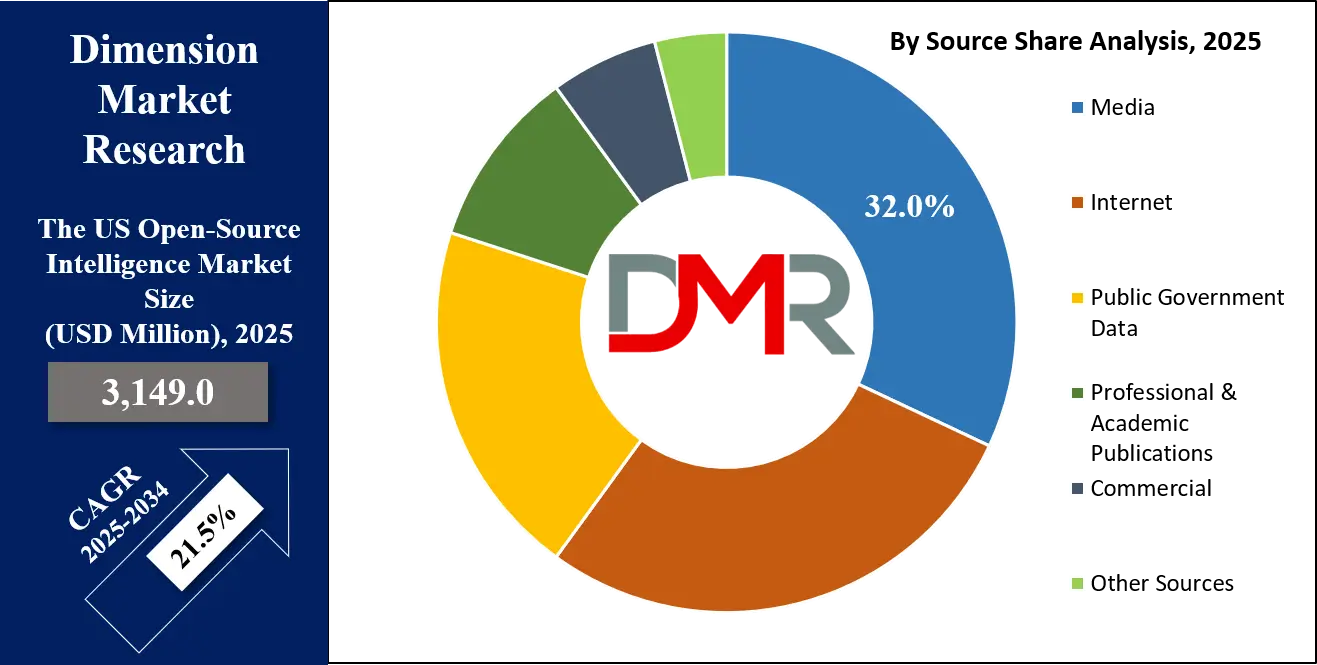

The US Open-Source Intelligence market is expected to expand from USD 3,149.0 million in 2025 to USD 18,127.5 million by 2034, driven by rising demand for threat detection, cybersecurity intelligence, social media monitoring, and real-time data analytics, reflecting a robust CAGR of 21.5%.

Open-Source Intelligence (OSINT) refers to the systematic collection, analysis, and interpretation of publicly available information to generate actionable insights for decision-making, security, and strategic planning. It involves leveraging diverse sources such as news media, social media platforms, government publications, academic journals, corporate websites, and digital databases to monitor trends, identify threats, and assess opportunities.

OSINT integrates advanced technologies including data mining, artificial intelligence, machine learning, and

natural language processing to efficiently process vast volumes of information, uncover hidden patterns, and provide real-time intelligence. Its applications span national security, cybersecurity, corporate risk management, law enforcement, and competitive analysis, making it an indispensable tool in modern information-driven environments where timely and accurate intelligence is critical.

The US Open-Source Intelligence market represents the growing ecosystem of solutions, services, and platforms designed to collect, process, and analyze publicly accessible information to support security, defense, and commercial intelligence needs. The market encompasses software tools for social media monitoring, threat detection, sentiment analysis, geospatial intelligence, and digital forensics, alongside professional services that provide advisory, integration, and analytical support. Driven by increasing cybersecurity concerns, regulatory compliance requirements, and the need for real-time situational awareness, the market is witnessing significant adoption across federal and state agencies, law enforcement, defense contractors, and private enterprises seeking to leverage data for strategic decision-making.

With continuous advancements in artificial intelligence, machine learning, and cloud computing, the US Open-Source Intelligence market is evolving to offer more sophisticated data aggregation, predictive analytics, and automated reporting capabilities. Market growth is further fueled by rising investments in homeland security, intelligence modernization programs, and the demand for actionable insights to counter threats and support operational planning. Companies in this market are focusing on developing scalable and interoperable OSINT platforms that can handle multi-source data streams, ensure data integrity, and provide analytical depth, positioning the United States as a leading hub for innovation and deployment of open-source intelligence solutions.

The US Open-Source Intelligence Market: Key Takeaways

- Market Value: The US chiplets market size is expected to reach a value of USD 18,127.5 million by 2034 from a base value of USD 3,149.0 million in 2025 at a CAGR of 21.5%.

- By Source Segment Analysis: The Internet is anticipated to dominate the source segment, capturing 32.0% of the total market share in 2025.

- By Technique Segment Analysis: Security analytics will account for the maximum share in the technique segment, capturing 29.0% of the total market value.

- By End User Segment Analysis: Cybersecurity organizations will dominate the end user segment, capturing 23.0% of the market share in 2025.

- Key Players: Some key players in the US Open-Source Intelligence market are Palantir Technologies, Recorded Future, Babel Street, Dataminr, DigitalStakeout, Verint Systems, CybelAngel, Maltego Technologies, Cobwebs Technologies, Raytheon Technologies, BAE Systems, IBM Corporation, Microsoft Corporation, Thales Group, ShadowDragon, ZeroFOX, Skopenow, and Others.

The US Open-Source Intelligence Market: Use Cases

- Cyber Threat Detection: US organizations use OSINT to monitor cyber threats, social media, and dark web activity for early risk detection and enhanced cybersecurity.

- Law Enforcement Investigations: Agencies leverage OSINT for suspect tracking, social media profiling, and digital forensics to support faster investigations and crime prevention.

- Corporate Intelligence: Businesses utilize OSINT to track competitors, market trends, and consumer sentiment, enabling informed decision-making and strategic planning.

- National Security: Government agencies apply OSINT to analyze geopolitical risks, terrorism threats, and public data, supporting intelligence assessments and defense planning.

Impact of Artificial Intelligence on the US Open-Source Intelligence market

Artificial Intelligence is transforming the US Open-Source Intelligence market by enabling faster and more accurate data collection, analysis, and threat detection. Machine learning algorithms and natural language processing help process vast amounts of social media posts, news articles, and public records, uncovering patterns and insights that were previously difficult to detect.

AI-driven automation enhances real-time monitoring, predictive analytics, and anomaly detection, improving decision-making for cybersecurity, law enforcement, and national security agencies. This integration of AI not only increases efficiency and accuracy but also expands the scope of actionable intelligence, making OSINT solutions more sophisticated and indispensable in the United States.

The US Open-Source Intelligence Market: Stats & Facts

Office of the Director of National Intelligence (ODNI) / Federal Bureau of Investigation (FBI) — Section 702 Surveillance Reporting

- In calendar year 2024, the number of “U.S.‑person queries” under Section 702 dropped from 57,094 (2023) to 5,518.

- For non‑U.S. person targets under Section 702, the estimated number rose from 268,590 (2023) to 291,824 (2024).

- The number of U.S.‑person query terms approved/used by agencies like the National Security Agency (NSA), the Central Intelligence Agency (CIA), and the National Counterterrorism Center (NCTC) for querying Section 702‑acquired content rose from 3,755 in 2023 to 7,845 in 2024.

- The number of NSA‑disseminated Section 702 reports containing U.S.‑person identities was 3,944 in 2024, similar to 3,968 in 2022 and 4,028 in 2023.

- In 2024, of those reports containing U.S.‑person identities, the number where identities were openly included was 1,531 — up from 1,243 in 2023.

Government Accountability Office (GAO) / U.S. Federal Agencies (cybersecurity incidents)

- In fiscal year 2023, U.S. federal agencies reported a total of 32,211 information security incidents.

- That 32,211 reflects a 9.9% year‑on‑year increase in government‑wide reported cybersecurity incidents in 2023 compared to 2022.

Cybersecurity and Infrastructure Security Agency (CISA) — Engagements and Outreach (2023)

- In 2023, the agency completed nearly 6,700 stakeholder engagements with government and private‑sector participants.

The US Open-Source Intelligence Market: Market Dynamics

The US Open-Source Intelligence Market: Driving Factors

Rising Cybersecurity Threats

The surge in cyberattacks, ransomware incidents, and data breaches across industries is accelerating the adoption of OSINT platforms in the US. Organizations increasingly rely on threat intelligence, social media monitoring, and dark web analysis to proactively detect vulnerabilities, respond to incidents, and enhance overall digital security posture.

Government and Defense Investments

Significant funding and modernization initiatives by federal and state agencies are fueling growth in the OSINT market. Programs focused on intelligence gathering, national security, and law enforcement operations drive demand for advanced OSINT tools, predictive analytics, and real-time data monitoring solutions.

The US Open-Source Intelligence Market: Restraints

Data Privacy and Regulatory Challenges

Strict data protection regulations and privacy concerns in the US limit the collection and use of certain public data sources. Compliance requirements, such as handling sensitive information responsibly, pose challenges for OSINT providers and can slow market adoption.

High Implementation Costs

Deploying sophisticated OSINT platforms with AI-driven analytics, multi-source integration, and continuous monitoring can involve substantial capital and operational expenses. Smaller enterprises often face budget constraints, limiting widespread adoption of these advanced intelligence solutions.

The US Open-Source Intelligence Market: Opportunities

Integration with Artificial Intelligence

The growing application of machine learning, natural language processing, and predictive analytics offers opportunities to enhance OSINT capabilities. AI integration enables automated threat detection, sentiment analysis, and anomaly identification, creating more intelligent and actionable insights for businesses and government agencies.

Expansion into Commercial Sectors

Beyond defense and law enforcement, industries such as finance, healthcare, and energy are increasingly exploring OSINT for market intelligence, risk management, and fraud detection. This expansion creates new revenue streams and encourages development of specialized tools tailored to commercial needs.

The US Open-Source Intelligence Market: Trends

Real-Time Social Media and Dark Web Monitoring

Organizations are increasingly using OSINT solutions to monitor social media, forums, and dark web channels in real time. This trend allows for proactive threat identification, situational awareness, and rapid response to emerging risks across cybersecurity and intelligence domains.

Cloud-Based OSINT Platforms

The shift toward cloud deployment is enabling scalable, cost-efficient, and accessible OSINT solutions. Cloud-based platforms facilitate multi-source data aggregation, real-time analytics, and collaborative intelligence sharing, supporting faster decision-making for government agencies and private enterprises.

The US Open-Source Intelligence Market: Research Scope and Analysis

By Source Analysis

In the US Open-Source Intelligence market, the Internet is expected to be the leading source segment, accounting for 32.0% of the total market share in 2025. This dominance is driven by the vast availability of publicly accessible information, including websites, blogs, forums, and social media platforms. Analysts and organizations utilize advanced OSINT tools to collect, filter, and analyze this online data to generate actionable insights for cybersecurity, corporate intelligence, law enforcement, and national security purposes. The Internet offers real-time access to a wide range of structured and unstructured data, making it an essential source for monitoring trends, identifying threats, and conducting comprehensive intelligence assessments.

Media also plays a significant role as a source segment in the OSINT market. News outlets, television broadcasts, online publications, and press releases provide timely and verified information that can complement data collected from digital platforms. Media sources are particularly valuable for understanding public sentiment, tracking geopolitical developments, and monitoring events as they unfold. By integrating media content with other OSINT sources, organizations can enhance situational awareness, validate intelligence findings, and improve the accuracy and reliability of their analyses.

By Technique Analysis

In the US Open-Source Intelligence market, security analytics is expected to lead the technique segment, capturing 29.0% of the total market value. This prominence is driven by the increasing need for organizations and government agencies to proactively detect threats, monitor vulnerabilities, and respond to security incidents in real time. Security analytics leverages tools such as machine learning, artificial intelligence, and big data processing to analyze information from multiple sources, identify patterns, and generate actionable insights. By integrating structured and unstructured data from the Internet, social media, and other public sources, security analytics enables more accurate threat assessments, predictive intelligence, and effective risk mitigation strategies, making it a critical technique for cybersecurity and operational intelligence.

Video analytics also plays an important role in this market segment by processing and interpreting visual data captured through surveillance cameras, public footage, and online video content. It enables real-time monitoring, object detection, behavior analysis, and anomaly identification, which can be used for security enforcement, law enforcement investigations, and public safety. Integrating video analytics with other OSINT techniques enhances situational awareness and provides a richer context for intelligence assessments, allowing agencies and organizations to make more informed and timely decisions.

By End User Analysis

In the US Open-Source Intelligence market, cybersecurity organizations are expected to dominate the end user segment, capturing 23.0% of the market share in 2025. The growing sophistication of cyber threats, including ransomware, phishing, and data breaches, has increased the demand for advanced OSINT solutions that can provide real-time threat intelligence and vulnerability assessments. Cybersecurity firms leverage these tools to monitor social media, forums, and dark web activities, enabling early detection of potential attacks and proactive risk mitigation. The use of machine learning and automated analytics allows these organizations to process large volumes of data efficiently, improving incident response, threat hunting, and overall digital security posture.

Government intelligence agencies also represent a major end user segment in this market. These agencies utilize OSINT platforms to gather and analyze publicly available information for national security, counterterrorism, and strategic planning purposes. By integrating social media monitoring, geospatial intelligence, news analysis, and open government data, intelligence agencies can identify emerging threats, monitor geopolitical developments, and support decision-making at both federal and state levels. The use of OSINT enhances situational awareness, operational efficiency, and the accuracy of intelligence assessments, making it a critical tool for national defense and law enforcement initiatives.

The US Open-Source Intelligence Market Report is segmented on the basis of the following:

By Source

- Media

- Internet

- Public Government Data

- Professional & Academic Publications

- Commercial

- Other Sources

By Technique

- Security Analytics

- Video Analytics

- Text Analytics

- Social Media Analytics

- Geospatial Analytics

- Other Analytics

By End User

- Cyber Security Organizations

- Government Intelligence Agencies

- Military & Defense Intelligence Agencies

- Law Enforcement Agencies

- Financial Services

- Private Specialized Business

- Other End User

The US Open-Source Intelligence Market: Competitive Landscape

The competitive landscape of the US Open-Source Intelligence market is characterized by intense innovation, technological advancements, and strategic collaborations among key players. Companies are focusing on developing AI-driven analytics, cloud-based platforms, and integrated multi-source intelligence solutions to enhance threat detection, cybersecurity, and real-time monitoring capabilities.

Continuous investments in research and development, partnerships with government agencies, and expansion into commercial sectors are shaping market dynamics. The landscape is also influenced by the growing demand for scalable, automated, and user-friendly OSINT tools that can process large volumes of data efficiently, providing actionable insights for defense, law enforcement, and enterprise intelligence applications.

Some of the prominent players in the US Open-Source Intelligence market are:

- Palantir Technologies

- Recorded Future

- Babel Street

- Dataminr

- DigitalStakeout

- Verint Systems

- CybelAngel

- Maltego Technologies

- Cobwebs Technologies

- Raytheon Technologies

- BAE Systems

- IBM Corporation

- Microsoft Corporation

- Thales Group

- ShadowDragon

- ZeroFOX

- Skopenow

- Expert System S.p.A. (Expert.ai)

- Sail Labs Technology

- DataWalk

- Other Key Players

The US Open-Source Intelligence Market: Recent Developments

- November 2025: Two major OSINT and investigative software vendors completed a merger to form a unified intelligence and case management platform, aiming to deliver end to end investigative workflows, from open source data collection and analytics to secure case documentation, increasing efficiency for law enforcement, corporate security, and intelligence agencies.

- July 2025: A newly founded AI enabled threat hunting startup secured USD 8.5 million in seed funding to further develop its autonomous platform that monitors and responds to cyber threats in real time, underscoring rising investor interest in OSINT adjacent, AI driven cyber defense solutions.

- June 2025: A web based open source intelligence platform originally launched in 2024 gained recognition in 2025 for its enhanced multi intelligence capabilities, combining social media intelligence, cyber and financial intelligence, dark web monitoring, and geospatial data, offering a unified environment for threat hunting and digital investigations.

- May 2025: A mid-size cybersecurity and exposure management firm was acquired by a larger security company to integrate its automated vulnerability and threat exposure analytics into a broader security offering, reflecting consolidation trends in threat intelligence and exposure management.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,149.0 Mn |

| Forecast Value (2034) |

USD 18,127.5 Mn |

| CAGR (2025–2034) |

21.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source (Media, Internet, Public Government Data, Professional & Academic Publications, Commercial, and Others), By Technology (Big Data Software, Video Analytics, Text Analytics, Web Analysis, Social Media Analytics, Geospatial Analytics, and Security Analytics), By End User (Cyber Security Organizations, Government Intelligence Agencies, Military & Defense Intelligence Agencies, Law Enforcement Agencies, Financial Services, Private Specialized Business, and Others)

|

| Regional Coverage |

The US |

| Prominent Players |

Palantir Technologies, Recorded Future, Babel Street, Dataminr, DigitalStakeout, Verint Systems, CybelAngel, Maltego Technologies, Cobwebs Technologies, Raytheon Technologies, BAE Systems, IBM Corporation, Microsoft Corporation, Thales Group, ShadowDragon, ZeroFOX, Skopenow, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Open-Source Intelligence market size is estimated to have a value of USD 3,149.0 million in 2025 and is expected to reach USD 18,127.5 million by the end of 2034, with a CAGR of 21.5%.

Some of the major key players in the US Open-Source Intelligence market are Palantir Technologies, Recorded Future, Babel Street, Dataminr, DigitalStakeout, Verint Systems, CybelAngel, Maltego Technologies, Cobwebs Technologies, Raytheon Technologies, BAE Systems, IBM Corporation, Microsoft Corporation, Thales Group, ShadowDragon, ZeroFOX, Skopenow, and Others.