Market Overview

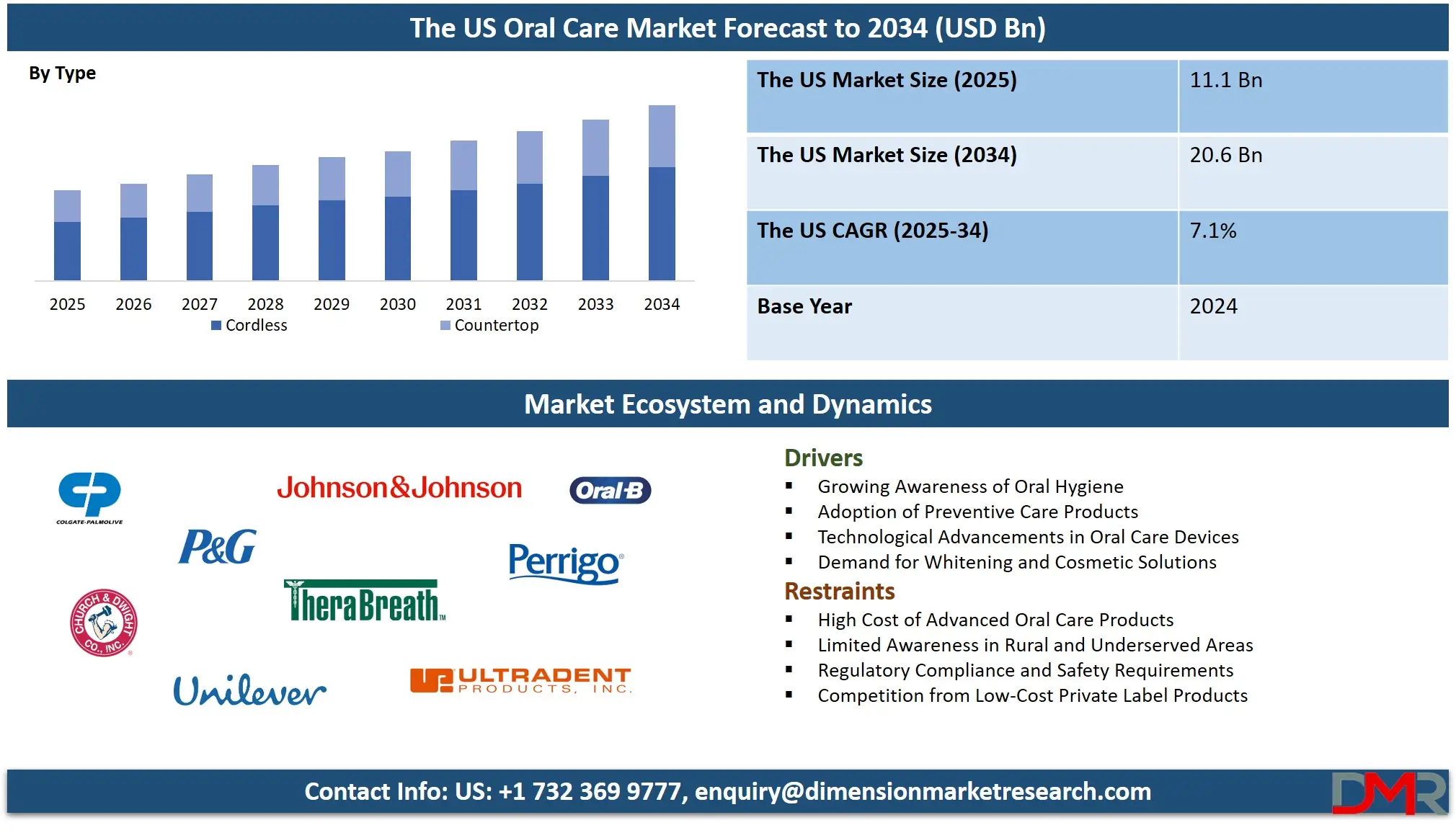

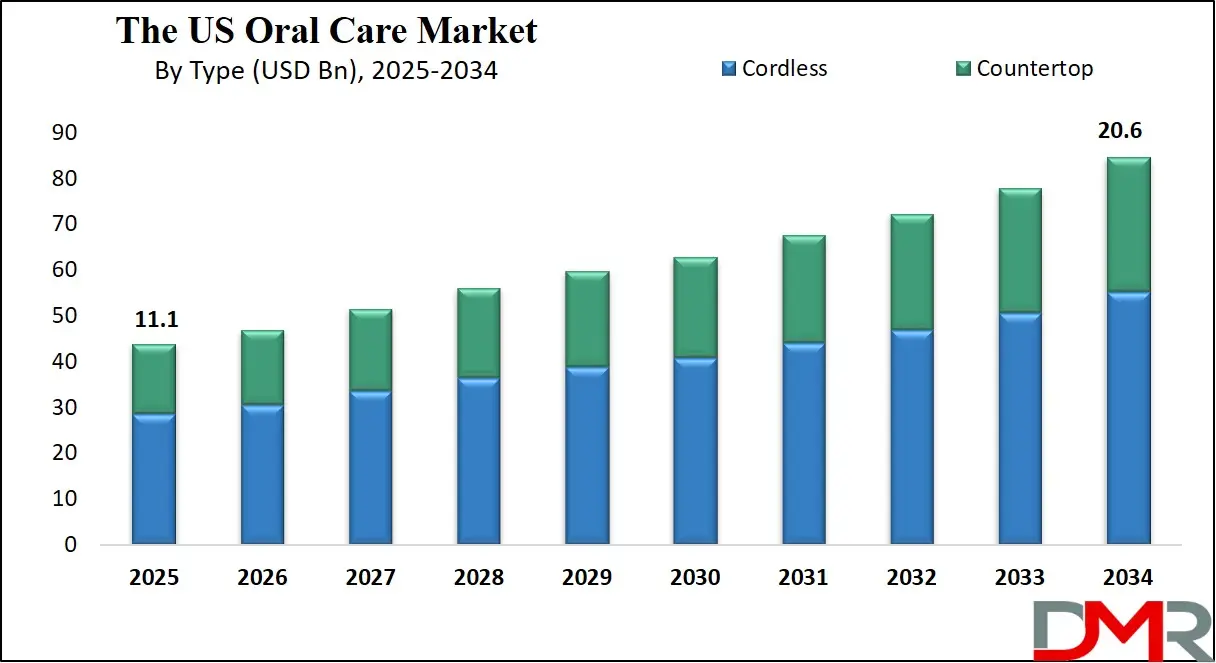

The US oral care market is projected to grow from USD 11.1 billion in 2025 to USD 20.6 billion by 2034, expanding at a CAGR of 7.1%. This growth is driven by rising consumer focus on dental hygiene, increasing adoption of preventive oral care products, and demand for advanced solutions such as electric toothbrushes, whitening treatments, and specialized gum care products. Expanding retail channels, including e-commerce and specialty stores, alongside innovation in oral health formulations, are further fueling market expansion.

Oral care encompasses the practices, products, and professional services dedicated to maintaining the health and hygiene of the teeth, gums, and overall mouth. It includes daily routines such as brushing, flossing, and rinsing, as well as periodic professional interventions like dental checkups and cleanings. The scope of oral care also extends to preventive and therapeutic products such as toothpaste, mouthwashes, dental floss, interdental brushes, and specialized devices for conditions like sensitive teeth or gum disease.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Advancements in oral care integrate technology through electric toothbrushes, water flossers, and smart devices that monitor oral hygiene habits. Overall, oral care plays a critical role not only in preventing dental problems but also in contributing to general health, confidence, and quality of life.

The US oral care market represents a dynamic and highly competitive segment within the broader personal care industry. Driven by rising consumer awareness about dental health, the market has witnessed significant innovation in product formulations, packaging, and delivery mechanisms. Key growth factors include increasing adoption of preventive care products, growing demand for natural and herbal oral care solutions, and the integration of digital and connected oral hygiene devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market covers a wide spectrum of offerings ranging from toothpaste, toothbrushes, and mouth rinses to dental floss, whitening products, and professional dental services, catering to diverse age groups and specific oral health needs.

In the United States, the oral care market is influenced by trends in lifestyle, dietary habits, and health consciousness, with a noticeable shift toward sustainable and eco-friendly products. Retail channels including e-commerce, supermarkets, and specialty stores play a pivotal role in reaching consumers, while marketing strategies emphasize product efficacy, clinical validation, and brand trust.

Innovations such as subscription-based oral care kits, smart toothbrushes with AI tracking, and specialized formulations for gum protection, sensitivity, and enamel strengthening have further expanded the market’s reach. The US oral care sector continues to evolve, driven by a combination of consumer preferences, technological advancements, and increasing investments in dental health education.

The US Oral Care Market: Key Takeaways

- Market Value: The US Oral Care market size is expected to reach a value of USD 20.6 billion by 2034 from a base value of USD 11.1 billion in 2025 at a CAGR of 7.1%.

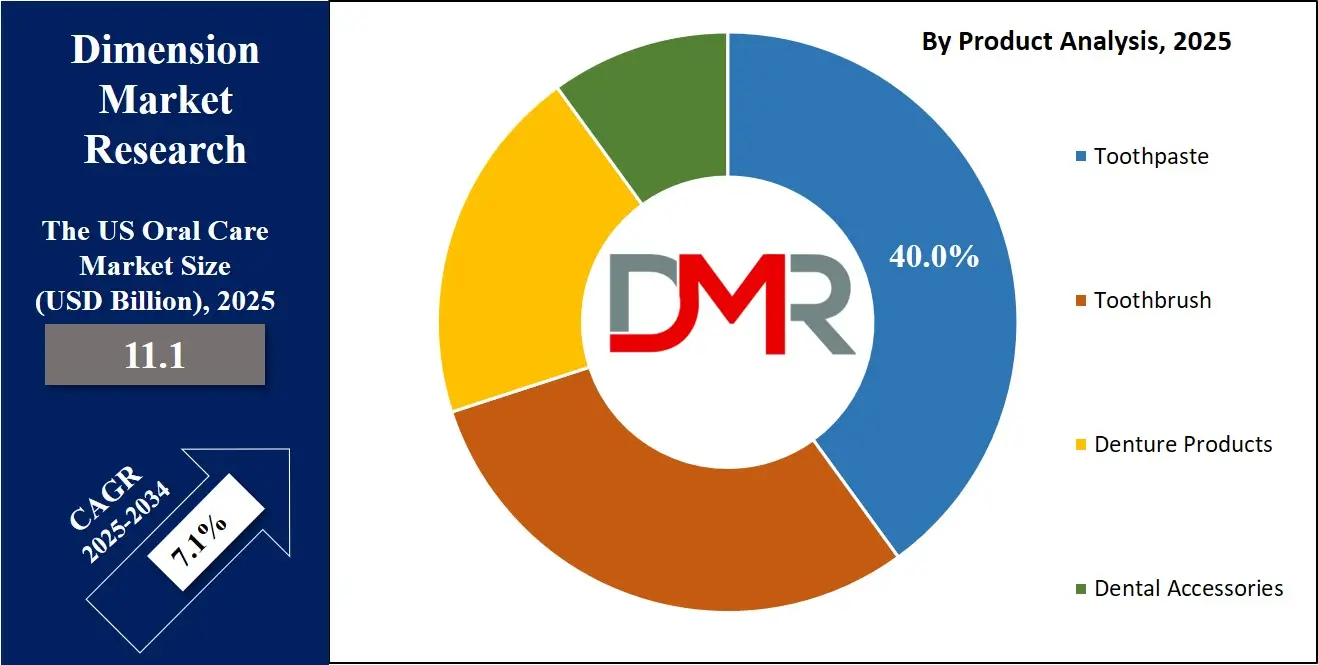

- By Product Segment Analysis: Toothpastes are anticipated to dominate the product segment, capturing 40.0% of the total market share in 2025.

- By Type Segment Analysis: Cordless is expected to maintain its dominance in the type segment, capturing 65.0% of the total market share in 2025.

- By Application Segment Analysis: Homecare applications will dominate the application segment, capturing 70.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Specialty Stores will dominate the distribution channel segment, capturing 35.0% of the market share in 2025.

- Key Players: Some key players in the US Oral Care market are Colgate‑Palmolive Company, Procter & Gamble, Church & Dwight Co., Inc., Unilever plc, Johnson & Johnson / Listerine, Oral-B, Crest, TheraBreath, Perrigo Company plc, Ultradent Products, Inc., Sunstar Suisse S.A., and others.

The US Oral Care Market: Use Cases

- Preventive Oral Care: US consumers focus on daily oral hygiene to prevent cavities, plaque, and gum disease. Toothpaste, toothbrushes, floss, and mouthwash are widely used, with electric brushes and water flossers gaining popularity for effective cleaning. Awareness of long-term dental wellness is driving steady demand.

- Whitening and Cosmetic Solutions: Teeth whitening products like toothpaste, strips, gels, and professional treatments are in demand for brighter smiles. Safe formulations and at-home kits complement dental services, supporting both aesthetic appeal and confidence.

- Specialized Sensitivity and Gum Care: Products for sensitive teeth, gum inflammation, and enamel protection are growing in adoption. Toothpaste, mouth rinses, and gels with natural or advanced ingredients provide relief and promote stronger teeth and gums.

- Digital and Connected Devices: Smart toothbrushes and AI-enabled oral care apps help monitor habits, provide recommendations, and track hygiene progress. Connected devices appeal to tech-savvy consumers, enhancing preventive care routines.

Impact of Artificial Intelligence on the US Oral Care market

Artificial intelligence is increasingly shaping the US oral care market by enabling smarter, data-driven oral hygiene solutions. AI-powered toothbrushes and connected devices analyze brushing patterns, provide real-time feedback, and personalize oral care routines for improved dental health. Predictive algorithms help identify potential dental issues such as early-stage cavities or gum problems, encouraging preventive interventions.

In addition, AI supports product innovation by analyzing consumer behavior and preferences, guiding formulation of toothpaste, mouthwash, and specialized oral care products. Tele-dentistry and AI-assisted diagnostic tools are also enhancing professional dental services, making oral care more accessible, precise, and effective. Overall, AI integration is driving efficiency, personalization, and engagement in the US oral care sector.

The US Oral Care Market: Stats & Facts

- CDC – Oral Health Facts & Surveillance Reports (2024)

- By age 9, about half of children in the U.S. (50 %) have had cavities in primary or permanent teeth.

- Among children aged 6–9 years, 50.1 % had one or more decayed or filled primary or permanent teeth.

- Among adults aged 20–64 years, nearly 21 % had at least one permanent tooth with untreated decay.

- For adults aged 20–64 years with any decayed, missing, or filled teeth, the average values were: 0.7 decayed teeth, 6.0 filled teeth, and 2.0 missing teeth (due to disease).

- Among older adults (65+), approximately 15.2 % were edentulous (no natural teeth). Among sub‑groups: 11.4 % of those aged 65–74, and 19.7 % of those 75+ were edentulous.

- The mean number of permanent teeth among dentate adults decreased with age: about 27 teeth on average for 20–34 years; dropping to ~23.3 for 50–64 years, ~21.7 for 65–74, and ~19.8 for 75+ years.

The US Oral Care Market: Market Dynamics

The US Oral Care Market: Driving Factors

Rising Consumer Awareness of Dental Hygiene

Increasing health consciousness among US consumers is a primary driver of the oral care market. Awareness about the link between oral health and overall wellness is encouraging regular use of toothpaste, toothbrushes, floss, and mouthwash. Preventive oral care routines are being adopted across age groups, with parents emphasizing early dental habits for children and adults investing in specialized products for gum protection, sensitivity, and enamel strengthening.

Technological Advancements in Oral Care Devices

Innovation in electric toothbrushes, water flossers, and AI-powered smart oral care devices is fueling market growth. These products provide enhanced cleaning efficiency, real-time feedback, and personalized oral hygiene recommendations. Integration of IoT and connected apps helps consumers track oral health progress, improving adherence to preventive care and encouraging the adoption of high-tech oral care solutions.

The US Oral Care Market: Restraints

High Cost of Advanced Oral Care Products

Premium oral care devices and specialized dental products often come at a high price, limiting accessibility for certain consumer segments. The cost barrier restricts widespread adoption of electric toothbrushes, AI-enabled devices, and professional-grade whitening or sensitivity treatments, especially among price-sensitive households.

Low Awareness in Certain Consumer Segments

Despite growing overall awareness, some demographics, particularly in rural or underserved areas, remain unaware of preventive oral care practices and products. Limited knowledge about gum disease, cavity prevention, and the benefits of specialized oral care solutions can hinder market growth in these segments.

The US Oral Care Market: Opportunities

Expansion of Natural and Herbal Oral Care Products

The demand for organic, chemical-free, and herbal oral care solutions is rising in the US. Consumers are increasingly seeking toothpaste, mouth rinses, and gels with natural ingredients that support sensitivity relief, gum health, and enamel protection. This trend presents opportunities for product diversification and brand differentiation.

Growth of E-commerce and Direct-to-Consumer Channels

Online platforms and subscription-based oral care kits are creating new avenues for reaching consumers. E-commerce facilitates convenient access to a wide range of products, including niche and premium offerings. Brands can leverage digital marketing, social media, and personalized recommendations to boost sales and engage with tech-savvy, health-conscious consumers.

The US Oral Care Market: Trends

Personalized Oral Care Solutions

Personalization is transforming the market, with AI-enabled toothbrushes, customized toothpaste formulations, and tailored dental care kits gaining popularity. These solutions address individual dental concerns, such as sensitivity, whitening, or gum protection, enhancing consumer satisfaction and loyalty.

Sustainability and Eco-Friendly Packaging

Consumers are increasingly concerned about environmental impact, driving brands to adopt recyclable packaging, biodegradable toothbrushes, and sustainable formulations. Eco-conscious oral care products not only reduce waste but also resonate with socially responsible buyers, influencing purchasing decisions and brand perception.

The US Oral Care Market: Research Scope and Analysis

By Product Analysis

In the US oral care market, toothpastes are expected to lead the product segment, accounting for an estimated 40% of the total market share in 2025. This dominance is driven by the essential role toothpaste plays in daily oral hygiene routines, including cavity prevention, plaque control, and enamel protection. Consumers are increasingly seeking specialized formulations that address specific dental concerns such as teeth whitening, sensitivity relief, gum health, and tartar control.

Innovations in fluoride technology, natural and herbal ingredients, and flavor variety also contribute to sustained demand. Toothpaste remains a core product for both preventive and cosmetic oral care, appealing to a broad demographic across age groups and income levels.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Toothbrushes represent another crucial segment within the US oral care market, with both manual and electric variants playing a significant role in maintaining oral hygiene. Electric toothbrushes, in particular, are gaining traction due to their advanced cleaning capabilities, timers, and pressure sensors that enhance brushing effectiveness. Consumers are also showing preference for ergonomic designs, soft bristles, and innovative features such as AI-powered brushing guidance or connectivity with mobile apps.

Manual toothbrushes continue to hold steady demand due to their affordability, convenience, and ease of use. Overall, toothbrushes remain integral to daily oral care routines, complementing toothpaste and other preventive products.

By Type Analysis

In the US oral care market, cordless devices are expected to dominate the type segment, accounting for approximately 65% of the total market share in 2025. The growing preference for cordless oral care products is driven by their portability, ease of use, and convenience for home and travel purposes. Cordless electric toothbrushes, water flossers, and other battery-operated oral care devices offer enhanced cleaning efficiency and advanced features such as multiple brushing modes, timers, and pressure sensors. Consumers are increasingly adopting these devices for personalized oral hygiene routines, as they combine effectiveness with user-friendly design and aesthetic appeal.

Countertop oral care devices, though less dominant, continue to hold a significant place in the market. These units, including countertop water flossers, sonic toothbrush stations, and integrated oral care systems, offer powerful performance and larger water reservoirs suitable for family use or individuals seeking more intensive cleaning. While they are less portable than cordless devices, countertop solutions are valued for their durability, advanced technology, and comprehensive oral care functions, appealing to consumers focused on long-term dental health management.

By Application Analysis

In the US oral care market, homecare applications are expected to lead the segment, capturing around 70% of the market share in 2025. This dominance is fueled by increasing consumer focus on daily oral hygiene routines and preventive dental care at home. Products such as toothpaste, toothbrushes, mouthwash, floss, and water flossers are widely used to maintain teeth and gum health, prevent cavities, and control plaque buildup. Rising awareness about the connection between oral health and overall wellness, along with the convenience and affordability of homecare solutions, drives strong adoption across all age groups.

Dentistry applications, while smaller in market share compared to homecare, play a critical role in the professional oral care segment. Dental clinics and professional services utilize specialized products like high-fluoride toothpaste, professional whitening agents, and prophylactic gels to treat and prevent oral health issues.

The dentistry segment also includes tools and devices used by dental professionals for diagnostics, cleaning, and treatments. Although professional services account for a smaller portion of overall usage, they are essential for managing complex oral conditions and complement the preventive care performed at home.

By Distribution Channel Analysis

In the US oral care market, specialty stores are expected to lead the distribution channel segment, accounting for approximately 35% of the market share in 2025. These stores, which include dental clinics, pharmacies, and dedicated oral care retailers, offer a wide range of products catering to specific oral health needs.

Consumers prefer specialty stores for their expert guidance, product variety, and availability of premium or niche oral care solutions such as electric toothbrushes, whitening kits, and sensitivity care products. The personalized service and professional recommendations provided by specialty stores help drive consumer trust and repeat purchases.

Hypermarkets and supermarkets also play a significant role in the distribution of oral care products. These large retail outlets provide convenient access to toothpaste, toothbrushes, mouthwash, and other daily-use oral hygiene products.

The competitive pricing, bundled offers, and wide product assortment available in hypermarkets and supermarkets make them popular among price-sensitive and bulk-buying consumers. While these channels may not offer the specialized advice found in specialty stores, they ensure mass-market reach and consistent availability, contributing substantially to overall sales in the US oral care market.

The US Oral Care Market Report is segmented on the basis of the following:

By Product

- Manual

- Electric (Rechargeable)

- Battery-Powered (Non-rechargeable)

- Others

- Cleaners

- Fixatives

- Floss

- Others

- Cosmetic Whitening Products

- Fresh Breath Dental Chewing Gum

- Tongue Scrapers

- Fresh Breath Strips

- Others

By Type

By Application

By Distribution Channel

- Specialty Stores

- Hypermarket & Supermarkets

- Drug Stores & Pharmacies

- Convenience Store

- Online Retailers

- Others

The US Oral Care Market: Competitive Landscape

The US oral care market is highly competitive, characterized by continuous innovation, aggressive marketing, and product differentiation strategies. Companies focus on launching new formulations, advanced oral care devices, and specialized solutions to address diverse consumer needs such as teeth whitening, sensitivity, and gum health.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Brand loyalty, pricing strategies, and distribution channel expansion play a critical role in gaining market share, while technological advancements like smart toothbrushes, AI-driven oral care devices, and connected dental apps are reshaping the competitive dynamics. Overall, the landscape is defined by constant product evolution, consumer-centric innovation, and a strong emphasis on preventive and personalized oral care solutions.

Some of the prominent players in the US Oral Care market are

- Colgate‑Palmolive Company

- Procter & Gamble

- Church & Dwight Co., Inc.

- Unilever plc

- Johnson & Johnson

- Oral‑B

- Crest

- TheraBreath

- Perrigo Company plc

- Ultradent Products, Inc.

- Sunstar Suisse S.A.

- 3M Company

- Lion Corporation

- GC Corporation

- Dr. Brite, LLC

- Burst Oral Care

- Haleon (ex‑GSK oral care business)

- Sunstar Group

- Henkel AG & Co. KGaA

- Hain Celestial Group

- Other Key Players

The US Oral Care Market: Recent Developments

- Nov 2025: A South‑Korean oral‑care brand expanded into the US market with its novel “foam‑format” toothpaste and mouthwash combo, marking a fresh entry into the US oral hygiene space.

- Aug 2025: A US oral‑care brand broadened its product line by launching a new set of toothpastes targeting gum health, deep clean, and whitening, responding to rising consumer demand for specialized oral hygiene solutions.

- Mar 2025: A leading dental‑tech firm secured over $525 million in new capital to support growth and further innovation, signaling rising investor interest in digital oral‑health solutions.

- Jan 2025: An AI‑powered dental software provider closed a USD 40 million Series B funding round to expand partnerships and scale its platform, underlining the momentum for AI and tech‑enabled solutions in oral care and dentistry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.1 Bn |

| Forecast Value (2034) |

USD 20.6 Bn |

| CAGR (2025–2034) |

7.1% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Toothpaste, Toothbrush, Denture Products and Dental Accessories), By Type (Cordless and Countertop), By Application (Home and Dentistry), By Distribution Channel (Specialty Stores, Hypermarket & Supermarkets, Drug Stores & Pharmacies, Convenience Stores, Online Retailers and Others) |

| Country Coverage |

The US |

| Prominent Players |

Colgate Palmolive Company, Procter & Gamble, Church & Dwight Co., Inc., Unilever plc, Johnson & Johnson / Listerine, Oral-B, Crest, TheraBreath, Perrigo Company plc, Ultradent Products, Inc., Sunstar Suisse S.A., and others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Oral Care market?

▾ The US Oral Care market size is estimated to have a value of USD 11.1 billion in 2025 and is expected to reach USD 20.6 billion by the end of 2034, with a CAGR of 7.1%.

Who are the key players in the US Oral Care market?

▾ Some of the major key players in the US Oral Care market are Colgate Palmolive Company, Procter & Gamble, Church & Dwight Co., Inc., Unilever plc, Johnson & Johnson / Listerine, Oral-B, Crest, TheraBreath, Perrigo Company plc, Ultradent Products, Inc., Sunstar Suisse S.A., and others.