Market Overview

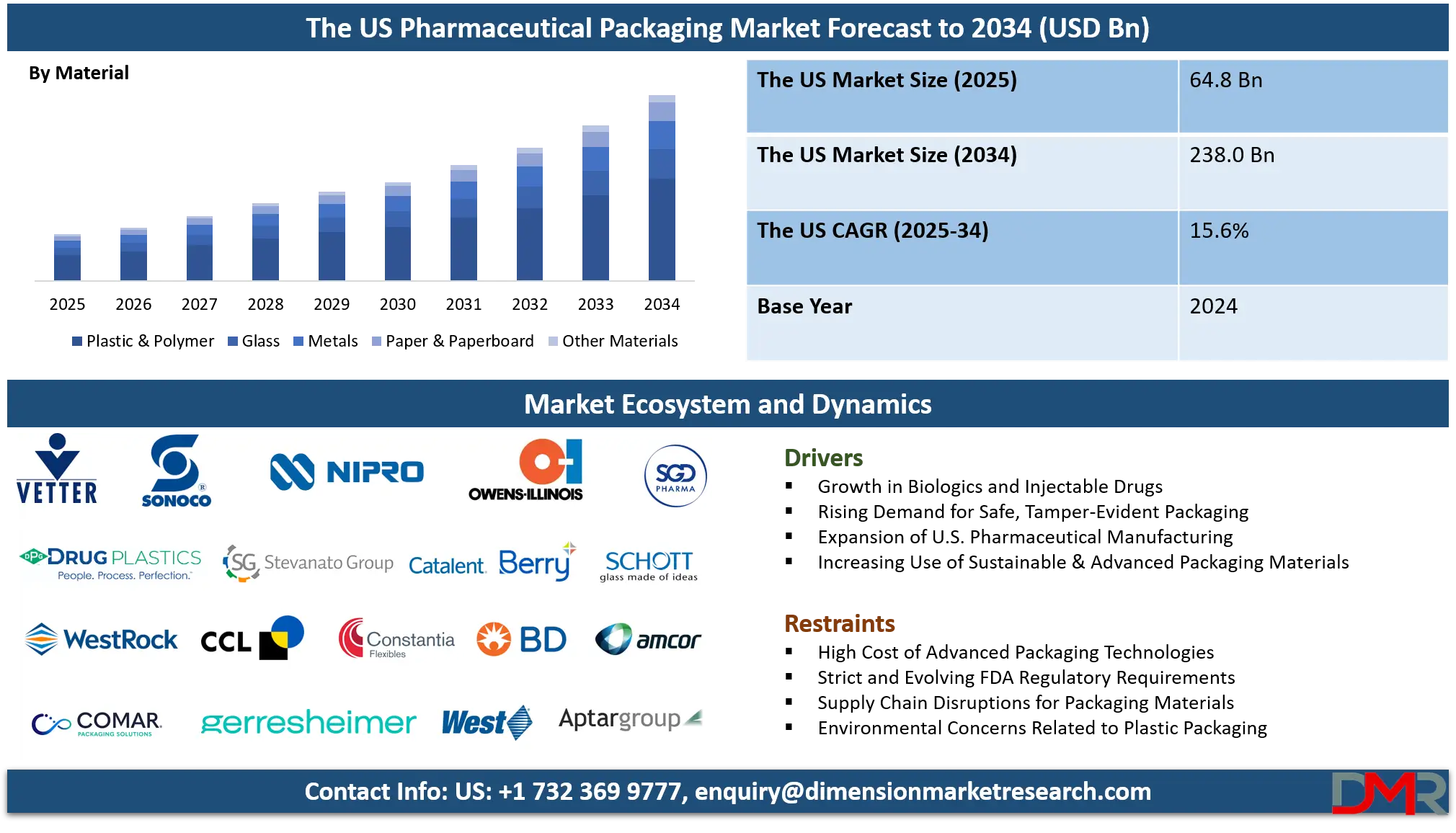

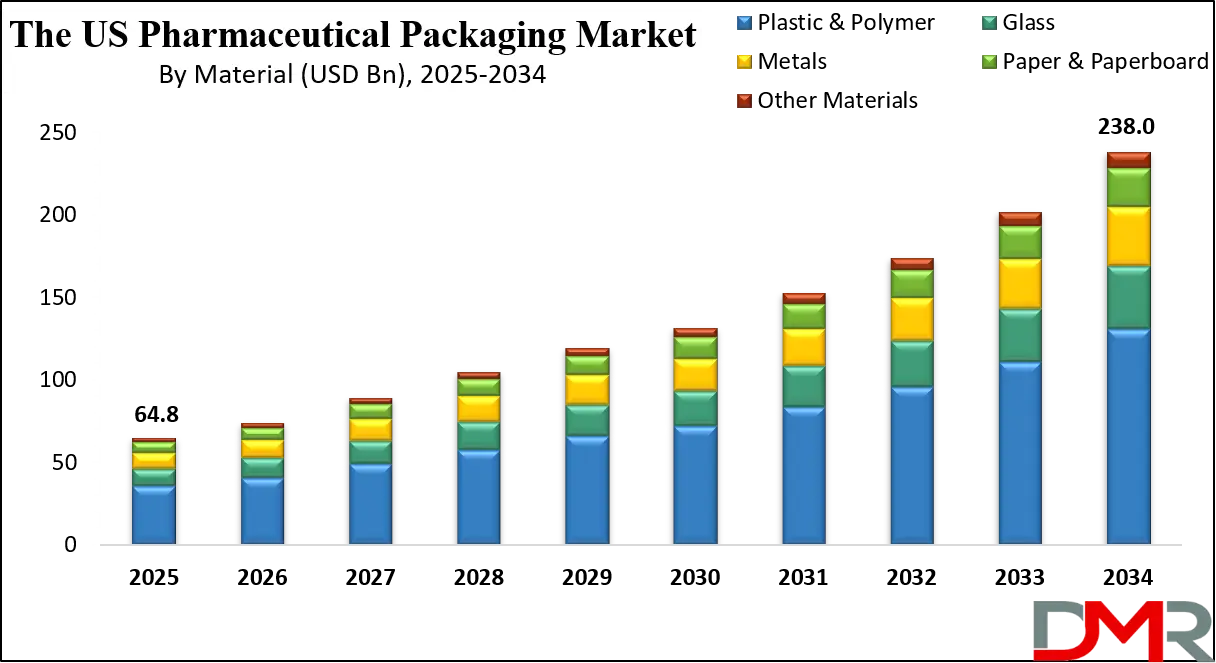

The U.S. Pharmaceutical Packaging Market is projected to be valued at USD 64.8 billion in 2025 and is expected to reach USD 238.0 billion by 2034, expanding at a robust CAGR of 15.6% over the forecast period.

This substantial growth is fueled by an aging population, rising chronic disease prevalence, expansion of specialty pharmaceuticals and biologics, stringent regulatory compliance requirements, and accelerated adoption of sustainable and smart packaging technologies. As the world's largest pharmaceutical market, the United States drives innovation in packaging solutions that ensure drug efficacy, patient safety, supply chain integrity, and regulatory compliance across increasingly complex therapeutic categories.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. market is characterized by its dual focus on technological advancement and regulatory rigor. With the Food and Drug Administration (FDA) maintaining some of the world's most stringent standards for drug packaging, American manufacturers lead in developing solutions that address evolving challenges: protecting sensitive biologics from degradation, enabling self-administration of complex therapies, preventing counterfeiting through serialization, and meeting growing consumer and regulatory demands for environmentally responsible materials.

The growth of personalized medicine, cell and gene therapies, and high-cost specialty drugs has transformed packaging from a passive container to an integral component of drug delivery systems that directly impacts therapeutic outcomes and patient adherence.

Several transformative trends are reshaping the landscape. Biologics and specialty drugs, which now represent over 40% of the U.S. pharmaceutical market, require advanced primary packaging with exceptional barrier properties, minimal leachables/extractables, and compatibility with cold chain logistics. Patient-centric design is driving innovation in packaging that improves ease of use for elderly populations, incorporates digital adherence tools, and supports home administration of formerly hospital-only treatments.

Serialization mandates under the Drug Supply Chain Security Act (DSCSA) have created a multi-billion dollar market for track-and-trace technologies integrated into packaging. Sustainability initiatives are accelerating the shift toward recyclable, reduced-plastic, and bio-based materials, supported by both regulatory pressures and Environmental, Social, and Governance (ESG) commitments from major pharmaceutical corporations.

The COVID-19 pandemic fundamentally accelerated several existing trends, particularly in vaccine packaging (vials, pre-filled syringes), home delivery of medications requiring robust secondary packaging, and telemedicine, driving redesign of prescription packaging for direct-to-patient shipping. These shifts have persisted, creating permanent changes in packaging requirements. Additionally, the Inflation Reduction Act's drug pricing provisions are increasing pressure on manufacturers to optimize packaging costs while maintaining quality, driving adoption of more efficient packaging formats and materials.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite strong growth drivers, the market faces challenges including complex regulatory compliance, high R&D costs for advanced materials, global supply chain vulnerabilities for key packaging components, and the technical difficulty of balancing sustainability with sterility and protection requirements. However, the fundamental demand drivers, demographic trends, therapeutic innovation, regulatory evolution, and sustainability imperatives ensure that pharmaceutical packaging remains a dynamic, innovation-driven market where advanced solutions command significant premiums and create competitive differentiation.

The US Pharmaceutical Packaging Market: Key Takeaways

- Exceptional Market Expansion: The U.S. market is projected to grow from USD 64.8 billion in 2025 to USD 238.0 billion by 2034, achieving a CAGR of 15.6% significantly outpacing general pharmaceutical market growth due to increasing value-added of advanced packaging solutions.

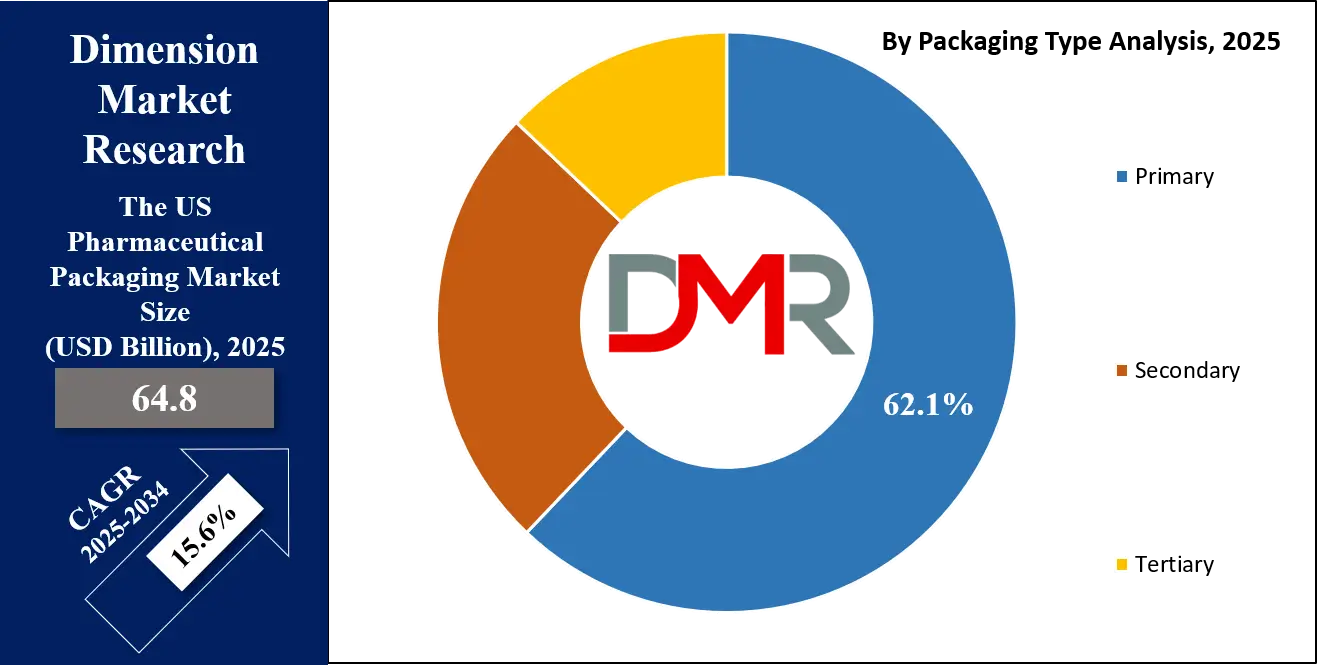

- Primary Packaging Dominance: Primary packaging accounts for over 62.1% of market value, driven by high-value innovations in biologics containment (pre-filled syringes, advanced vials), complex drug delivery systems (autoinjectors, inhalers), and specialty drug packaging requiring exceptional barrier properties.

- Biologics Driving Material Innovation: The biologics and specialty drugs segment is growing at a high rate, driving demand for Type I borosilicate glass and advanced polymer solutions (cyclic olefin copolymers, COC) that offer superior clarity, chemical resistance, and minimal interaction with sensitive drug formulations.

- Sustainability as Competitive Imperative: Sustainable packaging solutions represent the fastest-growing segment, which is driven by FDA draft guidance on packaging sustainability, corporate ESG commitments, state-level regulations (California, New York), and consumer preference for environmentally responsible healthcare products.

- Serialization Completing Implementation: Full implementation of the Drug Supply Chain Security Act (DSCSA) by November 2023 has created a sustained market for serialized packaging with integrated track-and-trace technologies, affecting virtually 100% of prescription drug packaging and creating ongoing demand for upgraded packaging lines and verification systems.

The US Pharmaceutical Packaging Market: Use Cases

- Specialty Biologic Drug Delivery: Pharmaceutical companies developing monoclonal antibodies, cell therapies, and other biologics utilize pre-filled syringes with ultra-clear borosilicate glass barrels, advanced polymer vials with reduced adsorption properties, and integrated delivery devices (autoinjectors, pen injectors) that combine primary packaging with patient administration.

- Oral Solid Dose Adherence Packaging: For chronic condition medications (hypertension, diabetes, cholesterol), manufacturers implement high-speed blister packaging with aluminum foil/PVC/PVDC structures that provide moisture, light, and oxygen barriers. Advanced systems incorporate calendar blister packs with day-of-week indicators, electronic adherence monitoring via smart blister packs with embedded sensors, and unit-dose packaging for institutional settings to reduce medication errors and ensure dose accountability.

- Vaccine Cold Chain Logistics: Vaccine manufacturers developing mRNA, viral vector, and traditional vaccines employ ultra-low temperature vials capable of withstanding -70°C storage, temperature-monitoring labels that provide visual confirmation of cold chain integrity, and secondary packaging with engineered thermal buffers for last-mile delivery.

- Pharmacy Dispensing & Patient Compliance: Retail and hospital pharmacies utilize prescription containers with child-resistant/senior-friendly (CR/SF) closures complying with US Poison Prevention Packaging Act requirements, amber plastic bottles for light-sensitive medications, and multi-dose compliance packaging that organizes medications by administration time.

- Ophthalmic & Topical Product Packaging: For eye drops, ointments, and dermatological products, manufacturers deploy specialized dispensers with precise dropper tips, airless pump systems that prevent contamination and oxidation, and tube packaging with laminated barrier structures that protect active ingredients from light, oxygen, and moisture while enabling controlled product dispensing without backflow contamination.

Impact of Artificial Intelligence on The US Pharmaceutical Packaging market

- Predictive Material Compatibility Analysis: AI algorithms analyze molecular structures of new drug compounds alongside material properties of potential packaging to predict interactions, adsorption rates, and stability issues before physical testing.

- Intelligent Quality Control and Defect Detection: Computer vision systems powered by deep learning perform 100% inspection of packaging components at production line speeds, detecting microscopic defects in glass vials (cracks, inclusions), imperfect seals on blister packs, misprinted serialization codes, and contamination in sterile packaging.

- Optimized Packaging Design through Generative AI: Generative design algorithms create optimized packaging structures that minimize material usage while maintaining strength, barrier properties, and usability. AI explores thousands of design variations for components like closures, syringe barrels, or blister cavities, identifying configurations that reduce material by 15-30% while meeting performance requirements, directly supporting sustainability goals and cost reduction.

- Supply Chain Resilience through Predictive Analytics: AI models analyze multiple data streams (supplier lead times, transportation delays, geopolitical risks, commodity prices) to predict packaging component shortages before they occur. Systems recommend alternative materials, secondary suppliers, or inventory adjustments, reducing vulnerability to supply chain disruptions that have caused critical drug shortages.

- Personalized Packaging through Machine Learning: Systems adjust label information, dosing instructions, and adherence support features based on individual patient profiles extracted from electronic health records, creating truly patient-centered packaging that improves outcomes while maintaining regulatory compliance.

The US Pharmaceutical Packaging Market: Stats & Facts

U.S. Government & Industry Data Sources

- U.S. Food and Drug Administration (FDA): Regulates pharmaceutical packaging as a drug delivery component under Current Good Manufacturing Practices (CGMP), with specific guidance for container-closure systems (FDA Guidance for Industry: Container Closure Systems for Packaging Human Drugs and Biologics).

- Drug Supply Chain Security Act (DSCSA): Under Title II of the Drug Quality and Security Act (2013), requires serialization, tracing, and verification for prescription drug packages, creating a multi-billion dollar compliance market completed by November 2023 implementation deadlines.

- U.S. Pharmacopeia (USP): Sets standards for pharmaceutical packaging materials through chapters including USP <661> (Plastic Packaging Systems and Their Materials of Construction) and USP <671> (Containers Performance Testing).

- Centers for Disease Control and Prevention (CDC): Provides guidelines for vaccine packaging and storage, particularly critical during pandemic response efforts requiring ultra-cold chain capabilities.

- Environmental Protection Agency (EPA): Regulations on packaging waste and recycling influence sustainability initiatives, with several states implementing Extended Producer Responsibility (EPR) laws affecting pharmaceutical packaging.

- U.S. Census Bureau: Data shows the pharmaceutical preparation manufacturing sector (NAICS 325412) exceeded $300 billion in annual shipments, with packaging representing approximately 15-20% of drug manufacturing costs.

Market Size & Economic Impact

- The U.S. accounts for approximately 45% of the global pharmaceutical market, driving proportional demand for advanced packaging solutions.

- Biologics represent over 40% of new drug approvals and command premium packaging requirements, with packaging costs often representing 8-12% of total drug manufacturing costs for complex biologics versus 3-5% for traditional small molecules.

- The contract packaging segment is growing at 9% CAGR as pharmaceutical companies outsource to specialists with expertise in complex regulatory compliance and advanced packaging technologies.

Regulatory Milestones

- DSCSA serialization requirements were fully implemented in November 2023, affecting approximately 6 billion prescription drug packages annually in the U.S.

- FDA's "Quality Metrics" initiative includes packaging performance indicators, driving investment in advanced inspection and monitoring systems integrated with packaging lines.

- State-level packaging laws in California, New York, Maine, and Oregon are driving sustainability initiatives, with more states considering similar legislation.

Material & Technology Trends

- Type I borosilicate glass maintains dominance for sensitive biologics despite polymer advances, with Valor glass innovations offering enhanced strength and reduced breakage.

- Polymer advances include cyclic olefin copolymers (COC/COP) for pre-filled syringes and vials, offering superior clarity, chemical resistance, and reduced protein adsorption compared to traditional materials.

- Smart packaging incorporating NFC, RFID, and QR codes for patient engagement and adherence monitoring is growing at over 15% CAGR, though from a small base.

Demographic & Healthcare Drivers

- The aging U.S. population (65+ growing from 54 million in 2020 to 80 million by 2040) drives demand for patient-friendly packaging with easier opening, clearer instructions, and adherence support.

- Chronic disease prevalence continues to rise, with approximately 60% of U.S. adults having at least one chronic condition requiring ongoing medication, sustaining demand for prescription packaging.

- Telemedicine expansion (over 40% of patients used telehealth in 2023) increases demand for robust direct-to-patient packaging capable of withstanding shipping without pharmacy dispensing.

The US Pharmaceutical Packaging Market: Market Dynamics

The US Pharmaceutical Packaging Market: Driving Factors

Specialty Drug Revolution and Biologics Expansion

The transformation of the pharmaceutical pipeline toward high-value specialty drugs and biologics represents the most powerful driver for advanced packaging innovation. These complex molecules, including monoclonal antibodies, gene therapies, cell therapies, and mRNA-based treatments, present unprecedented packaging challenges: extreme sensitivity to environmental factors (temperature, light, oxygen), propensity for protein aggregation or degradation, high viscosity requiring specialized delivery systems, and extraordinary cost (often exceeding $100,000 per treatment course), mandating absolute protection.

Regulatory Evolution and Serialization Mandates

The U.S. maintains the world's most comprehensive pharmaceutical packaging regulatory framework, continuously evolving to address emerging risks and opportunities. The Drug Supply Chain Security Act (DSCSA) represents the most significant regulatory driver in decades, requiring unit-level serialization, tracing, and verification for all prescription drugs. Full implementation in November 2023 created massive investments in serialization equipment, software systems, and packaging line upgrades that continue to drive market growth as companies optimize these systems.

The US Pharmaceutical Packaging Market: Restraints

Material Science Limitations and Compatibility Challenges

Despite significant advances, packaging materials still face fundamental limitations in meeting the conflicting demands of modern pharmaceuticals. Glass, while providing excellent barrier properties and clarity, remains brittle and prone to breakage, potentially generating particles that compromise sterility. Polymers offer design flexibility and break resistance but can interact with drug formulations through leachables/extractables, adsorption, or permeation. The development of new biologics with unique stability profiles often reveals previously unknown material interactions, requiring extensive compatibility testing that delays market entry and increases development costs.

Supply Chain Fragility and Geopolitical Vulnerabilities

The pharmaceutical packaging supply chain has revealed significant vulnerabilities in recent years, with shortages of critical components disrupting drug production and distribution. Glass vials and syringes experienced severe shortages during COVID-19 vaccine production, despite years of advance planning. Specialty polymers face supply constraints due to limited production capacity and geopolitical factors affecting raw material availability. Aluminum components for blister packs and closures face volatility from energy prices and trade policies. Building resilient, diversified supply chains requires significant investment and often conflicts with cost-containment pressures in competitive generic drug markets.

The US Pharmaceutical Packaging Market: Opportunities

Smart Packaging and Digital Integration Convergence

The convergence of physical packaging with digital technologies creates transformative opportunities beyond traditional containment functions. Smart packaging incorporating NFC, RFID, QR codes, or embedded sensors enables functions including: patient adherence monitoring (recording when packages are opened), authentication and anti-counterfeiting (verifying legitimate products), temperature monitoring (confirming cold chain integrity), and patient engagement (connecting to mobile apps for reminders, education, or support services). The Internet of Medical Things (IoMT) ecosystem allows packaging to become a data collection point in connected healthcare systems.

Sustainable Materials and Circular Economy Solutions

Growing regulatory, consumer, and investor pressure for environmental responsibility is creating significant opportunities for sustainable packaging innovations. The FDA's draft guidance on packaging sustainability (2023) signals regulatory support for reduced environmental impact while maintaining safety and efficacy. Bio-based polymers derived from renewable sources (sugarcane, corn, algae), recyclable monomaterial structures replacing multi-layer laminates, reduced material usage through design optimization, and reusable packaging systems for chronic medications all represent growing market segments. Major pharmaceutical companies have made public sustainability commitments (e.g., carbon neutrality, plastic reduction) that require packaging innovations.

The US Pharmaceutical Packaging Market: Trends

Patient-Centric Design and Accessibility Innovation

The shift toward patient-centered healthcare is driving fundamental redesign of pharmaceutical packaging to improve usability, accessibility, and health equity. Senior-friendly packaging with easy-open features, clear labeling with larger fonts, and simplified instructions addresses the needs of an aging population. Disability-inclusive design considers patients with arthritis, vision impairment, or limited dexterity. Multi-lingual and pictogram-based instructions improve understanding across diverse patient populations. Unit-dose packaging reduces medication errors in hospital and long-term care settings. Integrated drug delivery devices (autoinjectors, inhalers, patch pumps) transform complex administrations into simple patient-controlled processes.

Advanced Manufacturing and Industry 4.0 Integration

Pharmaceutical packaging operations are undergoing digital transformation through the adoption of Industry 4.0 technologies. Connected packaging lines with IoT sensors provide real-time monitoring of critical parameters (fill volumes, seal integrity, serialization accuracy), enabling predictive maintenance and reducing downtime. Digital twins simulate packaging processes before physical implementation, optimizing line design and reducing validation time.

Artificial intelligence and machine vision perform 100% inspection for defects at speeds impossible for human operators. Blockchain technology enhances DSCSA compliance by creating immutable transaction records across the supply chain. Additive manufacturing (3D printing) enables rapid prototyping of packaging components and small-batch production of customized delivery devices.

The US Pharmaceutical Packaging Market: Research Scope and Analysis

By Packaging Type Analysis

Primary Packaging is projected to represent the direct-contact container that houses the pharmaceutical product, accounting for the largest market share and highest innovation activity. This segment is characterized by increasing specialization based on drug type and delivery mode:

Plastic Bottles dominate oral solid dose packaging for tablets and capsules, particularly for generic medications and over-the-counter drugs. Innovation focuses on child-resistant/senior-friendly closures, amber coloring for light protection, and recyclable monomaterial structures (typically HDPE). The growth of unit-dose liquid medications (especially pediatric and geriatric formulations) drives demand for specialized bottles with integrated droppers or measuring caps.

Parenteral Containers (vials, ampoules, pre-filled syringes) represent the highest-value primary packaging segment, driven by biologics and injectable drugs. Type I borosilicate glass maintains dominance for most sensitive applications despite polymer advances, with innovations in coated glass reducing breakage and valor glass offering enhanced strength. Polymer solutions (cyclic olefin copolymers, COC/COP) are gaining share for pre-filled syringes and vials containing protein-based drugs where reduced adsorption is critical. Pre-filled syringes are experiencing exceptional growth (>10% CAGR) as they enable self-administration, reduce medication errors, and improve dosing accuracy for high-cost biologics.

Blister Packs serve oral solid dose medications requiring enhanced protection or unit-dose packaging. Aluminum foil-based structures provide superior moisture, light, and oxygen barriers for sensitive drugs. Cold-form foil blisters offer the highest barriers but at a higher cost. PVC/PVDC structures balance cost and performance for many applications. Innovation includes child-resistant blister designs, calendar packs for adherence, and recyclable polymer blisters replacing multi-material laminates.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Material Analysis

Plastics & Polymers are projected to constitute the largest material category by volume, valued for versatility, design flexibility, and cost-effectiveness. Different polymers serve specific applications: Polyvinyl Chloride (PVC) dominates blister packaging for oral solid doses, offering excellent clarity, formability, and moisture barrier when combined with PVDC coating. Environmental concerns regarding chlorine content and recycling challenges drive the development of PVC alternatives (PET, PP-based structures).

Polypropylene (PP) serves bottles, closures, and syringe barrels where chemical resistance and autoclavability are required. Random copolymer PP offers enhanced clarity for transparent applications, while homo-polymer PP provides higher stiffness for rigid containers. Innovation focuses on high-purity grades with reduced leachables for sensitive drugs.

Polyethylene (PE) in various densities serves diverse applications: HDPE for rigid bottles with excellent moisture barrier; LDPE/LLDPE for squeeze tubes, dropper bulbs, and flexible packaging requiring sealability. Recycled PE (particularly post-consumer recycled HDPE) is gaining acceptance for non-sterile applications where sustainability priorities outweigh virgin material requirements.

Polyethylene Terephthalate (PET) offers exceptional clarity and barrier properties for liquid medications, particularly replacing glass for cough syrups, oral solutions, and some eye drops. Recyclability of PET supports sustainability initiatives, though pharmaceutical-grade purity requires careful sourcing.

Engineering Plastics, including cyclic olefin copolymers (COC/COP), polycarbonate (PC), and polysulfone (PSU), serve high-performance applications like pre-filled syringes, vials, and medical devices where exceptional clarity, chemical resistance, and minimal drug interaction are critical. These premium materials command significant price premiums but enable advanced drug formulations.

Glass maintains irreplaceable roles for sensitive biologics and parenteral drugs despite polymer advances. Type I borosilicate glass (high chemical resistance) serves most injectable products. Type II treated soda-lime glass (surface dealkalized) offers reduced cost for less sensitive applications. Type III regular soda-lime glass serves oral and topical products. Innovations include coated glass reducing breakage and particles, valor glass with enhanced strength, and lighter-weight designs reducing material use and shipping costs.

By Drug Delivery Mode Analysis

Oral Drug Delivery Packaging is poised to constitute the largest segment by volume, encompassing bottles, blisters, sachets, and stick packs for tablets, capsules, powders, and liquids. Innovation focuses on patient adherence (calendar packs, smart packaging), child safety (CR closures), senior accessibility (easy-open features), and sustainability (recyclable monomaterials, reduced plastic). Injectable Packaging represents the highest-value segment, driven by biologics and specialty drugs. Includes vials (glass and polymer), ampoules, pre-filled syringes, cartridges for pen injectors, and IV bags. Critical requirements include sterility maintenance, compatibility with sensitive formulations, delivery accuracy, and user safety (needlestick prevention).

Topical Drug Delivery Packaging includes tubes (laminate, co-extruded, metal), jars, pumps, droppers, and patches. Requirements focus on product protection from oxidation and contamination, controlled dispensing, and user convenience. Airless packaging systems are gaining share for premium dermatological products. Pulmonary Drug Delivery Packaging encompasses metered dose inhalers (MDIs), dry powder inhalers (DPIs), nebulizer vials, and nasal sprays. Complex integration of drug formulation, delivery mechanism, and packaging requires sophisticated engineering. Sustainability concerns regarding propellants drive innovation in propellant-free systems and reusable devices.

Transdermal Drug Delivery Packaging serves patch-based systems for controlled drug release through the skin. Packaging must protect adhesive properties, maintain drug stability, and enable easy application. Includes pouches with specialized barrier films and disposable applicators for precise patch placement. Ocular Drug Delivery Packaging includes eye drop bottles with specialized tips preventing contamination, ointment tubes, and single-use vials. Requirements include sterility maintenance after opening, precise dosing, and patient comfort. Innovations include angled tips for easier application and preservative-free multi-dose systems.

By Sustainability Analysis

Recyclable Packaging is anticipated to represent the largest sustainability segment, driven by corporate commitments, consumer preferences, and regulatory pressure. Challenges include maintaining pharmaceutical requirements (sterility, barrier properties) with recyclable materials, collection infrastructure for medical packaging, and regulatory approval for recycled materials in direct contact with drugs. Innovations include monomaterial structures replacing multi-layer laminates, design for disassembly enabling material separation, and partnerships with recycling organizations developing pharmaceutical packaging streams.

Biodegradable Packaging utilizes materials that break down naturally under specific conditions. Applications are currently limited to secondary packaging and over-the-counter products where direct drug contact and sterility are less critical. Materials include PLA (polylactic acid from corn or sugarcane), PHA (polyhydroxyalkanoates from bacterial fermentation), and starch-based polymers. Challenges include compatibility with drug formulations, shelf life stability, and industrial composting infrastructure requirements.

Compostable Packaging represents a subset of biodegradable materials designed to break down in commercial composting facilities. Applications are primarily secondary packaging and accessories rather than primary drug contact. Standards include ASTM D6400 and certifications from organizations like the Biodegradable Products Institute (BPI). Growth is driven by institutional purchasers (hospitals, health systems) with sustainability goals and municipal regulations banning certain non-compostable packaging.

By End-User Analysis

Pharmaceutical Companies (branded innovators) are projected to represent the largest end-user segment and drive the highest-value packaging innovations. These companies invest in advanced primary packaging for new chemical entities and biologics, integrated drug delivery systems, and smart packaging for patient engagement. They maintain extensive packaging development departments, conduct compatibility studies, and navigate complex regulatory submissions that include packaging components.

Biopharmaceutical Companies specialize in large molecule drugs (proteins, antibodies, cell therapies) with particularly demanding packaging requirements. They are primary drivers of advanced vial systems, pre-filled syringes, cold chain packaging, and sterile barrier systems for aseptic processing. Packaging often represents a critical path in development timelines and requires specialized expertise in protein-material interactions.

Generic Pharmaceutical Companies focus on cost-optimized packaging that meets regulatory requirements while maximizing profitability. They typically adopt established packaging formats after patent expiry, with emphasis on supply chain efficiency, regulatory compliance (particularly DSCSA), and cost reduction through material optimization and high-volume purchasing. Sustainability initiatives are often driven by cost savings (lightweighting, material reduction) as well as environmental goals.

Contract Manufacturing Organizations (CMOs) provide manufacturing services including packaging operations. They invest in flexible packaging lines capable of handling multiple clients' products, serialization capabilities for DSCSA compliance, and quality systems meeting diverse client requirements. Growth is driven by pharmaceutical industry outsourcing trends and requires significant capital investment in advanced packaging equipment.

The US Pharmaceutical Packaging Market Report is segmented on the basis of the following:

By Packaging Type

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Pre-Fillable Inhalers

- Pre-Fillable Syringes

- Vials & Ampoules

- Blister Packs

- Bags & Pouches

- Jars & Canisters

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Material

- Plastic & Polymer

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo-Polypropylene

- Random-Polypropylene

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-density polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polystyrene (PS)

- Others

- Glass

- Type I (Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Regular Soda-Lime Glass)

- Metals

- Aluminum

- Stainless Steel

- Tin

- Other Metal Alloys

- Paper & Paperboard

- Other Material

By Drug Delivery Mode

- Oral Drug Delivery Packaging

- Injectable Packaging

- Topical Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Transdermal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Other Drug Delivery Mode

By Sustainability

- Recyclable Packaging

- Biodegradable Packaging

- Compostable Packaging

By End-user

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Packaging Organizations (CPOs)

The US Pharmaceutical Packaging Market: Competitive Landscape

The U.S. pharmaceutical packaging market features a multi-tier competitive structure with global diversified packaging companies, specialized pharmaceutical packaging suppliers, material science innovators, and regional contract packagers. The market is characterized by high barriers to entry (regulatory compliance, quality systems, capital intensity), increasing consolidation through mergers and acquisitions, and the growing importance of integrated solutions that combine materials, design, and services.

Global Diversified Packaging Companies, including Amcor, Berry Global, Sonoco, and WestRock, leverage scale across multiple packaging segments to serve pharmaceutical customers. These companies compete on global supply chain capabilities, material science expertise, and the ability to provide integrated solutions spanning primary, secondary, and tertiary packaging. They are making significant investments in sustainability initiatives and serialization capabilities to meet evolving market requirements.

Specialized Pharmaceutical Packaging Suppliers focus exclusively on healthcare applications, offering deep expertise in regulatory compliance and drug-specific requirements. Leaders include West Pharmaceutical Services (primary packaging components, delivery systems), Gerresheimer (glass and plastic primary packaging), Schott (specialty glass), and Aptar (drug delivery systems). These companies compete on technical expertise, proprietary technologies, and long-standing relationships with pharmaceutical manufacturers. They typically command premium pricing for high-value components like pre-filled syringe systems and advanced vial technologies.

Some of the prominent players in the US Pharmaceutical Packaging market are:

- Gerresheimer AG

- Amcor plc

- Berry Global, Inc.

- AptarGroup, Inc.

- Schott AG

- Stevanato Group S.p.A.

- West Pharmaceutical Services, Inc.

- Catalent, Inc.

- CCL Industries Inc.

- Constantia Flexibles

- SGD Pharma

- Nipro Corporation

- Vetter Pharma-Fertigung GmbH & Co. KG

- Bormioli Pharma S.p.A.

- Origin Pharma Packaging

- Intrapac Group

- Gaplast GmbH

- Ardagh Group SA

- Nolato AB

- WestRock Company

- Other Key Players

The US Pharmaceutical Packaging Market: Recent Developments

- March 2025: FDA finalized guidance on "Considerations for the Use of Recycled Plastics in Pharmaceutical Packaging," establishing pathways for the incorporation of post-consumer recycled materials in non-sterile applications, accelerating sustainability initiatives across the industry.

- January 2025: West Pharmaceutical Services launched its "NovaPure® elite" cyclic olefin copolymer vials with integrated sensing technology, providing real-time temperature and integrity monitoring for high-value cell therapies during transport and storage.

- December 2024: Amcor completed the acquisition of a leading smart packaging company specializing in NFC and sensor integration, expanding its capabilities in patient adherence monitoring and supply chain visibility solutions for pharmaceutical customers.

- October 2024: The Biden Administration announced a $500 million initiative to strengthen domestic production of critical pharmaceutical packaging components, focusing on glass vials, syringe barrels, and sterile barrier materials to reduce dependence on foreign suppliers.

- July 2024: Gerresheimer introduced its "EcoDesign" platform, offering carbon-neutral primary packaging through a combination of lightweight designs, renewable energy in manufacturing, and carbon offset programs for remaining emissions.

- May 2024: A consortium of major pharmaceutical companies (Pfizer, Merck, Johnson & Johnson) established the "Pharmaceutical Packaging Sustainability Alliance," committing to a 30% reduction in packaging material use and 50% increase in recycled content by 2030 across their portfolios.

- March 2024: The U.S. Pharmacopeia (USP) published updated Chapter <1660> on "Evaluation of Plastic Packaging Systems for Pharmaceutical Use," incorporating advanced testing methods for extractables and leachables from new polymer materials, facilitating innovation in sustainable packaging.

- January 2024: AptarGroup received FDA clearance for its "Digital Health Connector" platform that transforms standard pharmaceutical packaging into connected devices through attachable sensors, enabling adherence monitoring without requiring redesign of primary packaging.

- November 2023: Full implementation of the Drug Supply Chain Security Act (DSCSA) was achieved, with over 95% of prescription drug packages now featuring serialized 2D barcodes, though industry continues to optimize verification systems and address interoperability challenges.

- September 2023: Corning received FDA recognition for its "Valor Glass" as a standard material for pharmaceutical vials, following extensive compatibility testing showing reduced breakage and improved drug stability compared to traditional borosilicate glass.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.0 Bn |

| Forecast Value (2034) |

USD 25.7 Bn |

| CAGR (2025–2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By ACaaS Deployment (Hosted, Managed, Hybrid), By Authentication Method (Single-Factor, Multi-Factor, Mobile Credential/Bluetooth LE), By Connectivity Technology (RFID/NFC, Smart Cards, Bluetooth Low Energy, Ultra-Wideband), By Technology (Authentication Systems, Detection Systems, Alarm Panels, Communication Devices, Perimeter Security Systems), By End-Use Vertical (Commercial Buildings, Industrial & Manufacturing, Government & Public Sector, Military & Defense, Transport & Logistics, Healthcare, Residential & Smart Homes, Education & Research, Energy & Utilities, Hospitality & Entertainment, Retail & Customer-Facing, Financial Institutions, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ASSA ABLOY, dormakaba Group, Johnson Controls, Allegion plc, Honeywell International, Identiv Inc., Nedap N.V., Suprema Inc., Bosch Security Systems, Thales Group, AMAG Technology, Axis Communications, NEC Corporation, Gallagher Group, Brivo Systems, SALTO Systems, Genetec Inc., HID Global, Siemens, Cansec Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US pharmaceutical packaging market?

▾ The US pharmaceutical packaging market size is estimated to have a value of USD 64.8 billion in 2025 and is expected to reach USD 238.0 billion by the end of 2034, with a CAGR of 15.6%.

Who are the key players in the US pharmaceutical packaging market?

▾ Some of the major key players in the US pharmaceutical packaging market are Gerresheimer AG, Amcor plc, Berry Global, Inc., AptarGroup, Inc., Schott AG, Stevanato Group S.p.A., West Pharmaceutical Services, Inc., Catalent, Inc., CCL Industries Inc., Constantia Flexibles, SGD Pharma, Nipro Corporation, Vetter Pharma-Fertigung GmbH & Co. KG, Bormioli Pharma S.p.A., Origin Pharma Packaging, Intrapac Group, and Others.

What are the main drivers for market growth?

▾ Key drivers include: expansion of biologics and specialty drugs requiring advanced packaging; aging population increasing medication use; stringent regulatory requirements (DSCSA serialization); sustainability initiatives driving material innovation; and growth of patient-centric packaging improving adherence and outcomes.