The US Power Purchase Agreement Market Overview

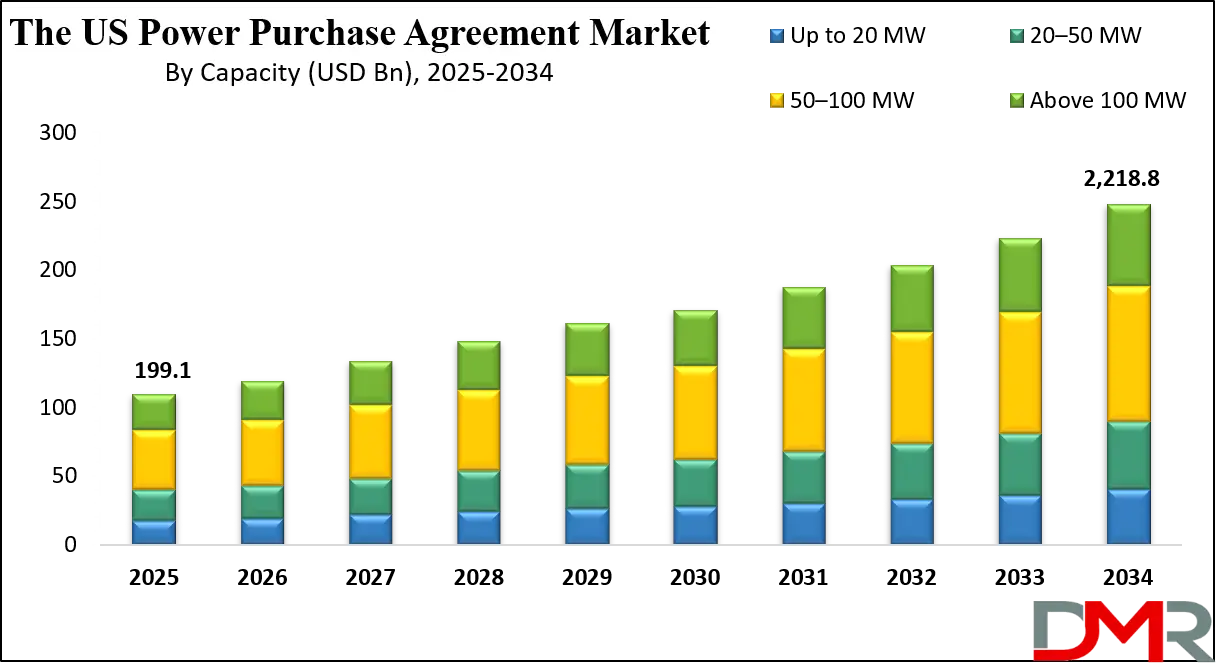

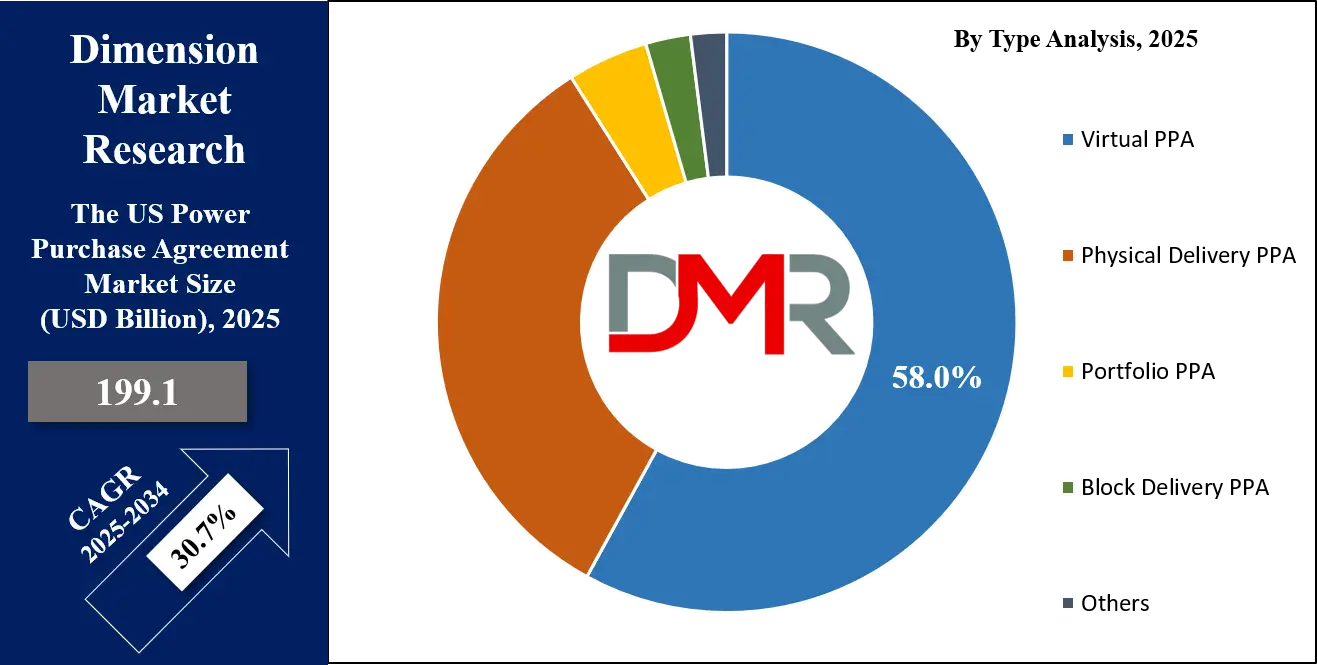

The US Power Purchase Agreement market is projected to reach USD 199.1 billion in 2025 and is expected to grow rapidly to USD 2,218.8 billion by 2034, registering a CAGR of 30.7%. This strong expansion reflects rising adoption of renewable energy contracts, increasing corporate clean energy procurement, and the growing role of virtual and physical PPAs in driving long-term energy security and sustainability.

The US Power Purchase Agreement refers to a long-term contractual arrangement between electricity producers, usually renewable energy developers, and energy buyers such as utilities, corporations, or government entities. Under this agreement, the buyer commits to purchasing a specified amount of power at a predetermined rate for a fixed duration, often ranging from 10 to 25 years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These agreements are vital in promoting clean energy adoption because they provide financial certainty to project developers while ensuring stable electricity pricing for consumers. In the United States, power purchase agreements are central to the renewable energy ecosystem as they encourage large-scale solar, wind, and hydropower projects, reduce reliance on fossil fuels, and contribute to achieving sustainability targets and decarbonization goals.

The US Power Purchase Agreement market is a dynamic segment of the country’s energy sector, driven by the rapid expansion of renewable energy capacity and corporate sustainability initiatives. Increasing demand for reliable and cost-efficient clean energy solutions has positioned PPAs as a preferred choice for businesses seeking to hedge against volatile utility prices while advancing their environmental, social, and governance commitments.

The market also benefits from supportive government policies and incentives that encourage investment in solar, wind, and other renewable projects, making PPAs an essential mechanism for both large corporations and utilities to transition toward low carbon operations.

The market has evolved beyond traditional physical delivery agreements to include innovative structures such as virtual PPAs, which allow companies to purchase renewable energy credits without directly taking delivery of electricity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This flexibility has attracted technology firms, manufacturing industries, and commercial establishments that operate across multiple states. As renewable energy becomes more competitive with conventional power sources, the US PPA market continues to attract global investors, energy developers, and corporate buyers who view these contracts as strategic tools for energy procurement, cost optimization, and long-term sustainability planning.

The US Power Purchase Agreement Market: Key Takeaways

- The US Market Value: The US Power Purchase Agreement Market is projected to be valued at USD 2,218.8 billion in 2034 from a base value of USD 199.1 billion.

- By Type Segment Analysis: Virtual PPAs are anticipated to dominate the type segment, accounting for 58.0% of the total market share in 2025.

- By Location Segment Analysis: Off-site PPAs are expected to lead the location segment, capturing 83.2% of the market share in 2025.

- By Category Segment Analysis: Corporate PPAs are projected to dominate the category segment, representing 86.5% of the overall market share in 2025.

- By Deal Type Segment Analysis: Wholesale PPAs are anticipated to dominate the deal type segment, securing 62.7% of the total market share in 2025.

- By Capacity Segment Analysis: PPAs with a capacity range of 50–100 MW are forecasted to dominate the capacity segment, accounting for 42.0% of the market share in 2025.

- By Application Segment Analysis: Solar PPAs are expected to dominate the application segment, capturing 51.0% of the total market share in 2025.

- By End-User Segment Analysis: Commercial users are anticipated to dominate the end-user segment, holding 49.1% of the market share in 2025.

- Key Players: Some of the major key players in the US Power Purchase Agreement Market are NextEra Energy Resources, Duke Energy Renewables, Invenergy, Clearway Energy Group, EDF Renewables North America, Pattern Energy Group Inc., Apex Clean Energy, Capital Dynamics, Enel Green Power North America, Dominion Energy Inc., Schneider Electric, RWE, ENGIE, Statkraft, Enel Spa, and many others.

- The US Market Growth Rate: The market is growing at a CAGR of 30.7 percent over the forecasted period.

The US Power Purchase Agreement Market: Use Cases

- Corporate Renewable Energy Procurement: Large corporations in the US are increasingly using power purchase agreements to meet sustainability goals and secure long-term energy cost stability. Companies in the technology, retail, and manufacturing sectors are signing virtual and physical PPAs to directly source renewable electricity from solar and wind projects. This approach not only reduces carbon footprints but also helps businesses hedge against volatile grid prices while strengthening their ESG performance.

- Utility-Scale Renewable Energy Development: Utilities and independent power producers leverage PPAs to finance and build large-scale renewable energy projects such as solar farms and wind parks. Long-term agreements provide guaranteed revenue streams, enabling developers to secure financing from investors and banks. This use case has been critical in scaling up renewable energy infrastructure across states like Texas, California, and Arizona, accelerating the national transition to clean energy.

- Government and Public Sector Adoption: Federal and state agencies are increasingly adopting power purchase agreements to meet renewable energy mandates and reduce operational costs. Public universities, military bases, and municipal authorities are using on-site and off-site PPAs to integrate solar, wind, and hydropower into their energy mix. These initiatives not only lower emissions but also enhance energy independence and resilience for government facilities.

- Industrial Energy Cost Optimization: Energy-intensive industries such as automotive, steel, and chemicals are turning to PPAs to manage operational costs and reduce reliance on fossil fuels. By locking in fixed electricity prices through long-term contracts, industrial players gain predictable energy expenses while improving their sustainability credentials. This use case is particularly valuable for companies competing in global markets where low-carbon operations are becoming a competitive advantage.

Impact of Artificial Intelligence on the US Power Purchase Agreement Market

Artificial intelligence is playing an increasingly important role in transforming the US power purchase agreement market by improving forecasting accuracy, optimizing energy procurement strategies, and enhancing grid integration. AI-powered predictive analytics enables renewable energy developers and corporate buyers to model electricity demand more precisely and anticipate fluctuations in solar and wind generation. This reduces risks associated with intermittent power supply and strengthens the financial viability of long-term PPAs.

AI-driven platforms also streamline contract management by automating risk assessment, pricing negotiations, and performance monitoring of PPA contracts. Utilities and corporations are using machine learning tools to evaluate multiple PPA structures, such as virtual PPAs and physical delivery agreements, ensuring cost-effective and sustainable energy sourcing. Additionally, AI facilitates real-time optimization of distributed energy resources and storage systems, making renewable energy more reliable for commercial and industrial consumers.

The integration of artificial intelligence is not only improving operational efficiency but also attracting more corporate buyers to the renewable PPA market. By enabling data-driven decision-making, minimizing curtailment risks, and supporting carbon accounting, AI accelerates the adoption of clean energy contracts across the United States. As a result, AI is emerging as a key enabler for scaling the US PPA market, driving both sustainability and long-term value creation.

The US Power Purchase Agreement Market: Stats & Facts

U.S. Energy Information Administration — Short-Term Energy Outlook (Aug 2025)

- Total U.S. electricity consumption: 4,097 billion kWh (2024), 4,186 billion kWh (2025 forecast), 4,284 billion kWh (2026 forecast).

- Sales to ultimate customers: 3,962 billion kWh (2024), 4,050 billion kWh (2025), 4,147 billion kWh (2026).

- Residential electricity sales: 1,490 billion kWh (2024), 1,515 billion kWh (2025), 1,510 billion kWh (2026).

- Average residential retail price: ~17 cents/kWh (2025), ~18 cents/kWh (2026).

U.S. Energy Information Administration — Capacity Additions & Inventory

- New utility-scale capacity additions: 48.6 GW (2024 actual), 63 GW (2025 expected).

- Share of 2025 additions from solar + battery storage: 81 percent.

- Solar’s contribution to 2025 additions: over 50 percent of total planned additions.

- Planned utility-scale solar additions in 2024: 36.4 GW.

- Planned battery storage additions in 2025: 19.6 GW.

- Battery storage added in 2024: 10.4 GW; cumulative utility-scale battery capacity >26 GW by end-2024.

- Battery storage share of total U.S. utility-scale capacity in 2024: ~2% of 1,230 GW.

- Planned additions of combined-cycle natural gas in 2025: 1.6 GW.

U.S. Energy Information Administration — Electric Power Monthly (May 2025)

- Net summer capacity showed year-over-year growth in utility-scale renewable capacity between May 2024 and May 2025.

- Renewable generation in early 2025 marked monthly records compared with 2023 and 2024 levels.

Bureau of Ocean Energy Management — Offshore Wind Pipeline & Approvals

- U.S. offshore wind pipeline capacity: 80,523 MW as of May 31, 2024.

- New England Wind 1 & 2 COP approved in July 2024: up to 2,600 MW.

- Empire Wind COP approved in February 2024: total capacity 2,076 MW.

- SouthCoast Wind Record of Decision in December 2024: up to 2,400 MW.

- New York Bight lease areas potential: up to 7 GW.

U.S. Department of Energy — Loan Programs Office (LPO)

- Deals announced under the current administration (as of January 2025): 53 deals totaling USD 107.57 billion in committed project investment.

- LPO financed portfolio (as of September 2024): USD 43.9 billion.

- FY 2023 closed loans: over USD 5 billion; conditional commitments: nearly USD 14 billion.

- Application pipeline (as of September 2024): 211 applications seeking USD 295.8 billion.

- Active applications (as of December 2024): 182, requesting USD 278.9 billion.

- In July 2025, DOE LPO terminated its conditional commitment for Grain Belt Express Phase 1 HVDC transmission.

The US Power Purchase Agreement Market: Market Dynamics

The US Power Purchase Agreement Market: Driving Factors

Rising Corporate Sustainability Goals

The increasing commitment of US corporations to achieve net-zero emissions is a primary driver for the growth of power purchase agreements. Large technology firms, retailers, and manufacturers are adopting renewable energy PPAs to decarbonize operations and meet ESG compliance standards. These agreements not only provide long-term cost stability but also enhance brand reputation by aligning with consumer demand for clean energy and climate responsibility.

Supportive Government Policies and Incentives

Federal and state-level renewable energy policies, tax credits, and incentives are fueling the expansion of PPAs in the United States. Programs such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC) have reduced the financial risks for developers and buyers, encouraging the adoption of both physical and virtual PPAs. Regulatory support continues to create favorable conditions for investment in solar and wind projects across the country.

The US Power Purchase Agreement Market: Restraints

Regulatory Complexity and Contractual Risks

The PPA market in the US faces challenges from complex regulatory frameworks that vary from state to state. Buyers and developers often encounter legal hurdles and contractual risks that can delay project execution. This complexity makes it difficult for smaller organizations to participate in PPA arrangements compared to large corporations with stronger legal and financial capabilities.

Market Price Volatility

Fluctuations in wholesale electricity prices can undermine the financial attractiveness of long-term PPA contracts. When market prices fall below the contracted rates, corporate buyers may face higher energy costs compared to spot market purchases. This volatility can discourage new entrants and slow down the pace of adoption in certain regions.

The US Power Purchase Agreement Market: Opportunities

Integration of Energy Storage Solutions

The growing deployment of battery power purchase agreement systems presents a significant opportunity for enhancing the value of PPAs. Coupling storage with solar and wind projects allows developers to provide a consistent power supply, reduce curtailment, and offer flexible delivery models. This integration is expected to make PPAs more attractive for industrial and commercial buyers seeking reliable renewable energy solutions.

Expansion into Emerging Sectors

Beyond traditional technology and manufacturing firms, sectors such as healthcare, real estate, and transportation are beginning to explore renewable PPAs. As these industries face increasing pressure to reduce emissions and comply with sustainability standards, the adoption of tailored PPA models will open new revenue streams and diversify the market base.

The US Power Purchase Agreement Market: Trends

Shift Toward Virtual Power Purchase Agreements

Virtual PPAs are gaining traction as corporations with multi-state operations seek flexible solutions for renewable energy procurement. Unlike physical delivery contracts, virtual PPAs allow buyers to benefit from renewable energy credits without directly receiving the electricity. This trend is particularly strong among global enterprises that prioritize carbon offset strategies.

Digitalization and AI-Driven Analytics

The adoption of digital tools, blockchain, and artificial intelligence is reshaping the US PPA market. Data-driven platforms are improving demand forecasting, automating contract management, and enabling transparent renewable energy credit tracking. This trend is enhancing efficiency, reducing transaction costs, and making PPAs more accessible to a wider range of buyers and developers.

The US Power Purchase Agreement Market: Research Scope and Analysis

By Type Analysis

Virtual PPAs are anticipated to dominate the type segment, accounting for 58.0% of the total market share in 2025. The rising demand is largely attributed to the flexibility virtual contracts provide for corporate buyers and large enterprises that operate across multiple states in the US. Unlike physical delivery agreements, where electricity is directly supplied to the buyer, virtual PPAs allow companies to enter into financial contracts for renewable energy without needing to take actual delivery of power. This makes them highly attractive for businesses seeking renewable energy credits, carbon offset benefits, and price stability, especially when physical infrastructure limitations prevent direct energy transfer.

Physical delivery PPAs, while smaller in market share, remain important for utilities and businesses with localized energy needs. In these contracts, renewable electricity is physically delivered from a specific solar, wind, or hydro project directly to the buyer through the grid. This type of agreement ensures actual renewable power consumption and is often favored by organizations with facilities located near generation assets or within deregulated markets where direct delivery is feasible. Although physical PPAs are less flexible compared to virtual agreements, they provide greater certainty of renewable energy use and are valuable for companies aiming to directly link consumption with clean power production.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Location Analysis

Off-site PPAs are expected to lead the location segment, capturing 83.2% of the market share in 2025. The dominance of off-site agreements is driven by their scalability and flexibility, as they enable corporations, utilities, and government agencies to procure renewable energy from large wind and solar farms located far from their own facilities. These contracts allow buyers to support renewable energy development without being restricted by limited space or infrastructure at their operational sites. Off-site PPAs are also attractive because they provide access to larger capacity projects, long-term price stability, and renewable energy credits, which play a critical role in meeting sustainability goals and regulatory compliance.

On-site PPAs, on the other hand, involve the installation of renewable energy systems such as rooftop solar panels or small-scale wind turbines directly at the buyer’s premises. In this arrangement, the developer owns, operates, and maintains the system while the consumer agrees to purchase the generated electricity at a fixed rate. On-site PPAs are particularly beneficial for commercial and industrial facilities that want to reduce utility bills, cut carbon emissions, and demonstrate visible commitment to sustainability. However, their adoption is limited compared to off-site agreements due to challenges such as space constraints, high upfront costs for installation, and lower scalability compared to utility-scale renewable energy projects.

By Category Analysis

Corporate PPAs are projected to dominate the category segment, representing 86.5 percent of the overall market share in 2025. The strong presence of corporate agreements is fueled by the growing demand from technology firms, manufacturers, retailers, and service providers who are actively pursuing renewable energy procurement to meet carbon neutrality and ESG targets. Corporate buyers prefer long-term PPA structures because they provide price certainty, protect against energy market volatility, and generate renewable energy credits that support sustainability reporting. These agreements are also becoming a strategic tool for businesses to strengthen their competitive edge, enhance brand value, and align with investor and consumer expectations for cleaner operations.

Government PPAs, though smaller in scale compared to corporate agreements, play an important role in driving renewable energy adoption in the United States. Federal, state, and municipal authorities are entering into PPAs to comply with renewable portfolio standards and to achieve carbon reduction mandates. Public institutions such as universities, military bases, and city administrations rely on government-backed PPAs to secure stable energy pricing and reduce operational costs over time. While government participation remains lower than corporate involvement due to budget constraints and lengthy procurement processes, it continues to contribute significantly to the overall growth of renewable energy in public infrastructure and community projects.

By Deal Type Analysis

Wholesale PPAs are anticipated to dominate the deal type segment, securing 62.7 percent of the total market share in 2025. The dominance of wholesale agreements is attributed to their ability to support large-scale renewable energy projects and provide long-term revenue stability for developers. In wholesale PPAs, energy is typically sold directly to utilities or large corporations at fixed contractual rates, which allows project developers to secure financing more easily and scale renewable generation capacity.

These agreements are a critical driver of the renewable energy transition in the US, as they enable the development of large wind farms, solar parks, and hybrid projects that feed power into the grid and contribute to national clean energy goals.

Retail PPAs, while smaller in share compared to wholesale agreements, are gaining traction among businesses and organizations that purchase electricity directly from renewable developers or through local retail energy providers. Retail PPAs allow smaller enterprises, community groups, and even residential consumers to access clean energy without being part of large-scale wholesale contracts.

These agreements are often more flexible and tailored to specific regional or customer needs, making them a practical solution for buyers who want to reduce carbon emissions, lower energy costs, and participate in localized sustainability initiatives. However, the fragmented structure of retail markets and regulatory differences across states can limit their growth compared to wholesale PPAs.

By Capacity Analysis

PPAs with a capacity range of 50–100 MW are forecasted to dominate the capacity segment, accounting for 42.0% of the market share in 2025. This dominance is linked to the rising demand for mid to large-scale renewable energy projects that balance affordability, scalability, and risk management. Contracts within this capacity range are attractive for utilities and corporations because they deliver significant volumes of clean electricity without the complexity and financial exposure of very large projects above 100 MW. They are also easier to integrate into existing grid infrastructure while still offering economies of scale, making them a preferred choice for corporate buyers seeking to meet sustainability goals and manage long-term energy costs effectively.

PPAs in the 20–50 MW range, while smaller in comparison, hold strategic importance for regional and community-focused renewable energy development. These agreements are often used by universities, industrial parks, and medium-sized businesses that want a tailored renewable energy solution without committing to very large-scale capacity.

This segment supports distributed generation projects that provide localized clean power and can be integrated more easily in states with limited grid capacity for utility-scale renewables. Although the overall share of 20–50 MW PPAs is lower than the 50–100 MW category, their flexibility and adaptability make them a valuable part of the market, particularly in areas aiming to promote decentralized renewable energy adoption.

By Application Analysis

Solar PPAs are expected to dominate the application segment, capturing 51.0% of the total market share in 2025. The leading position of solar power purchase agreements is driven by the declining cost of photovoltaic technology, rapid deployment of utility-scale solar farms, and strong policy support at both federal and state levels. Solar PPAs are highly attractive for corporate buyers and utilities because they provide predictable generation patterns during peak daylight hours, align with decarbonization strategies, and can be implemented in both on-site and off-site models. The scalability of solar projects, along with their relatively shorter development timelines compared to other renewable sources, continues to strengthen their role as the primary driver of clean energy adoption in the US.

Wind PPAs also account for a significant portion of the market, as wind power remains one of the most established renewable energy sources in the United States. Many large-scale wind farms in states such as Texas, Iowa, and Oklahoma are backed by long-term power purchase agreements with utilities and corporations.

Wind contracts are valued for their ability to generate large volumes of renewable electricity, particularly in regions with high wind capacity factors, making them ideal for wholesale PPAs. Although solar currently leads in share, wind PPAs remain a critical part of the energy mix, supporting grid diversification and helping buyers meet ambitious renewable energy procurement targets.

By End-User Analysis

Commercial users are anticipated to dominate the end-user segment, holding 49.1 percent of the market share in 2025. The dominance of the commercial segment is largely driven by the increasing demand from retail chains, data centers, office complexes, and service providers seeking renewable energy solutions to lower operating costs and strengthen sustainability commitments.

Power purchase agreements allow commercial entities to lock in long-term electricity prices, mitigate exposure to energy market volatility, and enhance their environmental, social, and governance performance. With many businesses under pressure from investors and customers to reduce emissions, commercial PPAs are expected to remain the largest contributor to market growth.

The residential segment, while smaller in overall share, is steadily gaining importance as homeowners and residential communities explore renewable energy procurement through aggregated or community solar PPAs. These agreements enable households to access clean power without the need for upfront investment in rooftop solar systems, making renewable energy more affordable and accessible.

Residential PPAs also provide predictable energy costs for households while contributing to broader decarbonization efforts. However, growth in this segment is slower compared to commercial adoption due to regulatory hurdles, limited awareness, and smaller contract sizes, but it remains a vital area for expanding renewable energy access at the consumer level.

The US Power Purchase Agreement Market Report is segmented on the basis of the following:

By Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

By Location

By Category

- Corporate

- Government

- Others

By Deal Type

By Capacity

- Up to 20 MW

- 20-50 MW

- 50-100 MW

- Above 100 MW

By Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and Storage

- Others

By End-User

- Commercial

- Residential

- Industrial

The US Power Purchase Agreement Market: Competitive Landscape

The US Power Purchase Agreement market features a highly competitive landscape shaped by a mix of renewable energy developers, utilities, technology providers, and corporate buyers driving demand for clean energy contracts. Leading players such as NextEra Energy Resources, Invenergy, Duke Energy Renewables, Clearway Energy, and EDF Renewables dominate utility-scale project development, while global firms like Enel Green Power, ENGIE, and RWE are strengthening their US presence through strategic partnerships and large-scale solar and wind projects.

Corporate-driven demand from companies including Amazon, Google, and Microsoft has intensified competition among developers to secure long-term contracts, particularly in the virtual PPA space. In addition, energy service providers such as Schneider Electric and Ameresco are playing a crucial role in advisory and contract management services, helping organizations navigate complex PPA structures. The market is characterized by frequent mergers, acquisitions, and financing agreements as firms compete to expand renewable portfolios, reduce costs, and capture a larger share of the rapidly growing demand for sustainable energy solutions.

Some of the prominent players in the US Power Purchase Agreement market are:

- NextEra Energy Resources

- Duke Energy Renewables

- Invenergy

- Clearway Energy Group

- EDF Renewables North America

- Pattern Energy Group Inc.

- Apex Clean Energy

- Capital Dynamics

- Enel Green Power North America

- Dominion Energy, Inc.

- Schneider Electric

- RWE

- ENGIE

- Statkraft

- Enel Spa

- Siemens

- Ameresco

- General Electric (GE)

- Shell

- Ecohz

- Other Key Players

The US Power Purchase Agreement Market: Recent Developments

- May 2025: Blackstone Infrastructure proposed the USD 11.5 billion acquisition of TXNM Energy, which owns regulated utilities including PNM in New Mexico. The deal is under scrutiny due to concerns over infrastructure costs tied to anticipated electricity demand from AI-driven data centers.

- April 2025: Exowatt, a U.S.-based renewable energy startup specializing in thermal storage solutions for AI-driven data centers, secured USD 70 million in Series A funding led by Felicis Ventures. The funding will support commercial deployment of Exowatt’s modular energy platform later in 2025, bringing its total funding to around USD 90 million.

- March 2025: Meta signed a long-term power purchase agreement with RWE for the offtake from the Waterloo Solar project in Texas. The 200 MW solar farm, scheduled for on-site construction later in the year, will supply 100% of the electricity output to Meta, boosting renewable energy sourcing for its data center operations.

- January 2025: Constellation Energy announced a USD 26.6 billion acquisition of Calpine, a leading operator of natural gas and geothermal power plants. The merger is expected to create the largest retail electricity supplier in the United States, serving approximately 2.5 million customers and offering nearly 60 GW of combined capacity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 199.1 Bn |

| Forecast Value (2034) |

USD 2,218.8 Bn |

| CAGR (2025–2034) |

30.7% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, Others), By Location (On-site, Off-site), By Category (Corporate, Government, Others), By Deal Type (Wholesale, Retail, Others), By Capacity (Up to 20 MW, 20–50 MW, 50–100 MW, Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, Others), and By End-User (Commercial, Residential, Industrial). |

| Regional Coverage |

The US |

| Prominent Players |

NextEra Energy Resources, Duke Energy Renewables, Invenergy, Clearway Energy Group, EDF Renewables North America, Pattern Energy Group Inc., Apex Clean Energy, Capital Dynamics, Enel Green Power North America, Dominion Energy Inc., Schneider Electric, RWE, ENGIE, Statkraft, Enel Spa, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |