Market Overview

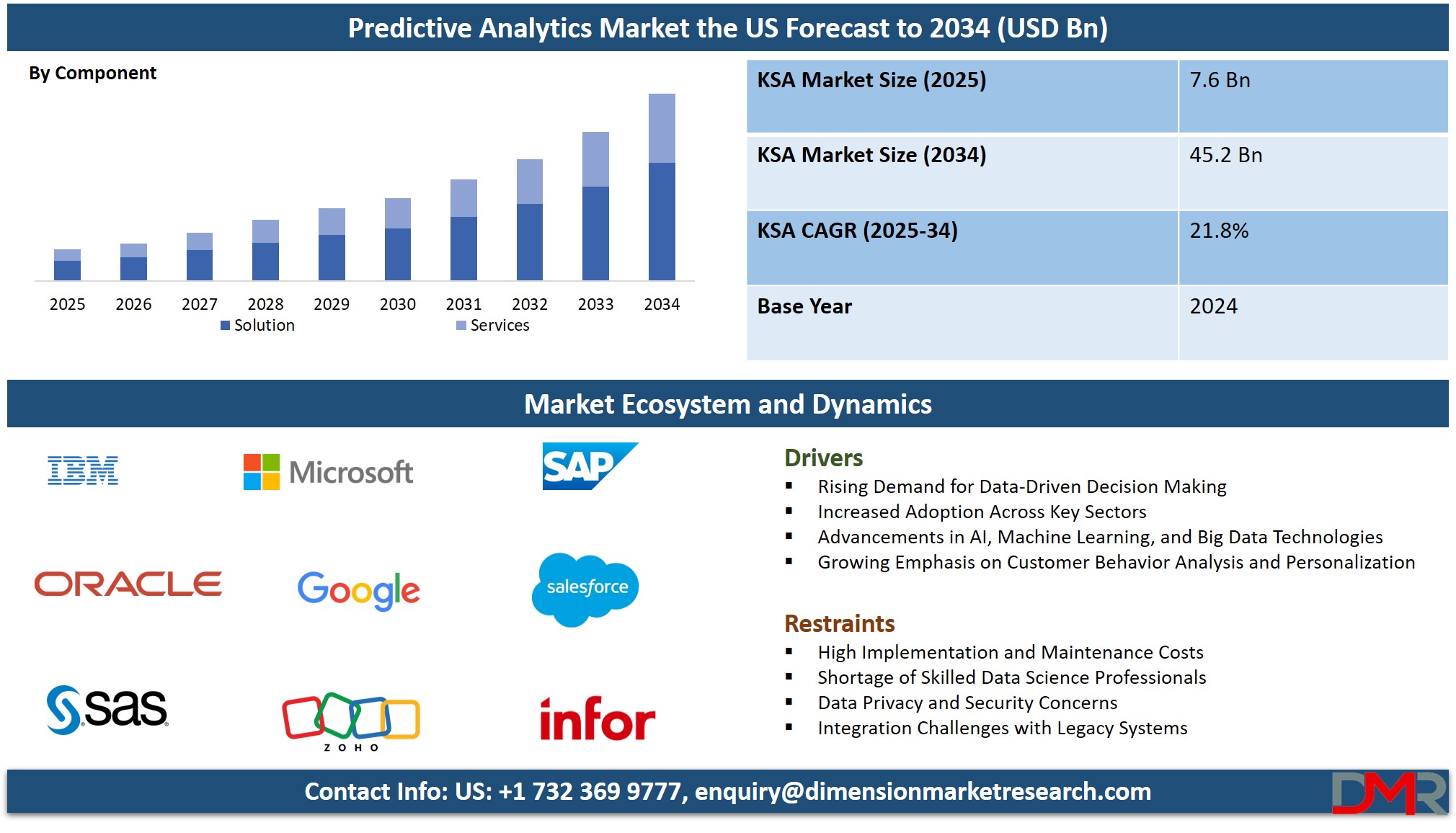

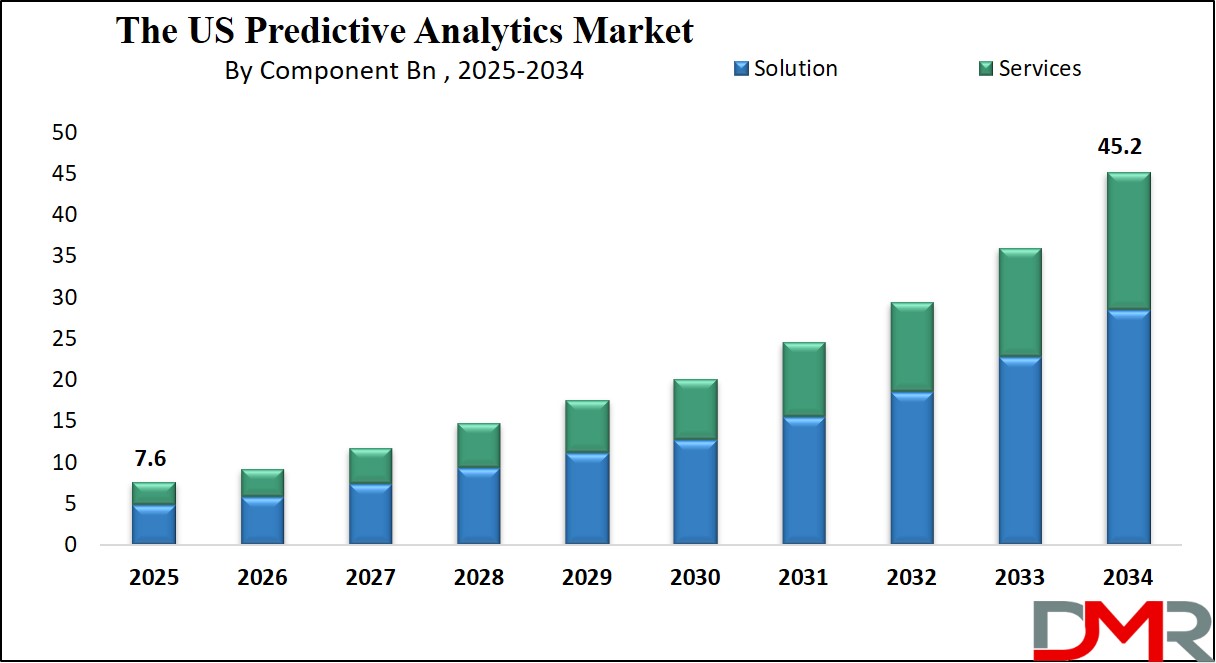

The U.S. Predictive Analytics Market size is projected to reach USD 7.6 billion in 2025 and grow at a compound annual growth rate of 21.8% from there until 2034 to reach a value of USD 45.2 billion.

Predictive analytics is a branch of data analysis that uses historical data, statistics, and machine learning to make predictions about future events. In the United States, this method is used across many sectors such as healthcare, retail, finance, and government. It helps businesses and organizations anticipate future trends, customer behavior, and risks, so they can plan better. By using tools like artificial intelligence, big data, and algorithms, predictive analytics gives insights that can guide decisions before problems happen.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demand for predictive analytics has grown rapidly in recent years. Many companies are now collecting large amounts of data from different sources, such as customer feedback, online activity, and transaction history. With better tools and faster computers, they can now process this data quickly and predict what is likely to happen next. For example, retailers use it to forecast product demand, while hospitals use it to predict patient readmissions. As the value of accurate forecasting becomes clearer, more sectors are adopting these methods.

In healthcare, predictive analytics plays an important role in prevention. Hospitals use it to predict which patients are at risk of certain conditions, such as heart disease or diabetes. This allows doctors to take early steps to prevent serious issues. Insurance companies also use these tools to assess risk and set policies. During the COVID-19 pandemic, predictive models were used to estimate the spread of the virus and prepare medical resources in advance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One major trend in the US is the move toward real-time predictive analytics. Instead of just using old data, many systems now update predictions as new data comes in. This is especially useful in sectors like finance or transportation, where conditions change quickly. For example, ride-sharing apps use predictive models to estimate arrival times and adjust routes. In banking, fraud detection tools now rely on real-time data to stop suspicious transactions instantly.

Government agencies have also started using predictive analytics for public safety and services. Police departments use it to predict where crimes might happen and patrol those areas. Cities use it to improve traffic flow and public transport planning. Schools and universities analyze student data to identify those at risk of dropping out and offer support early.

In recent years, privacy concerns and data ethics have become more important. Since predictive analytics relies on personal data, it is important to use it responsibly. New laws and guidelines are being developed to ensure transparency and fairness. As predictive tools become more common, balancing innovation with protection of privacy will continue to shape how this technology grows in the US.

US Predictive Analytics Market: Key Takeaways

- Market Growth: The US Predictive Analytics Market size is expected to grow by USD 36.1 billion, at a CAGR of 21.8%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the US Predictive Analytics Market in 2025.

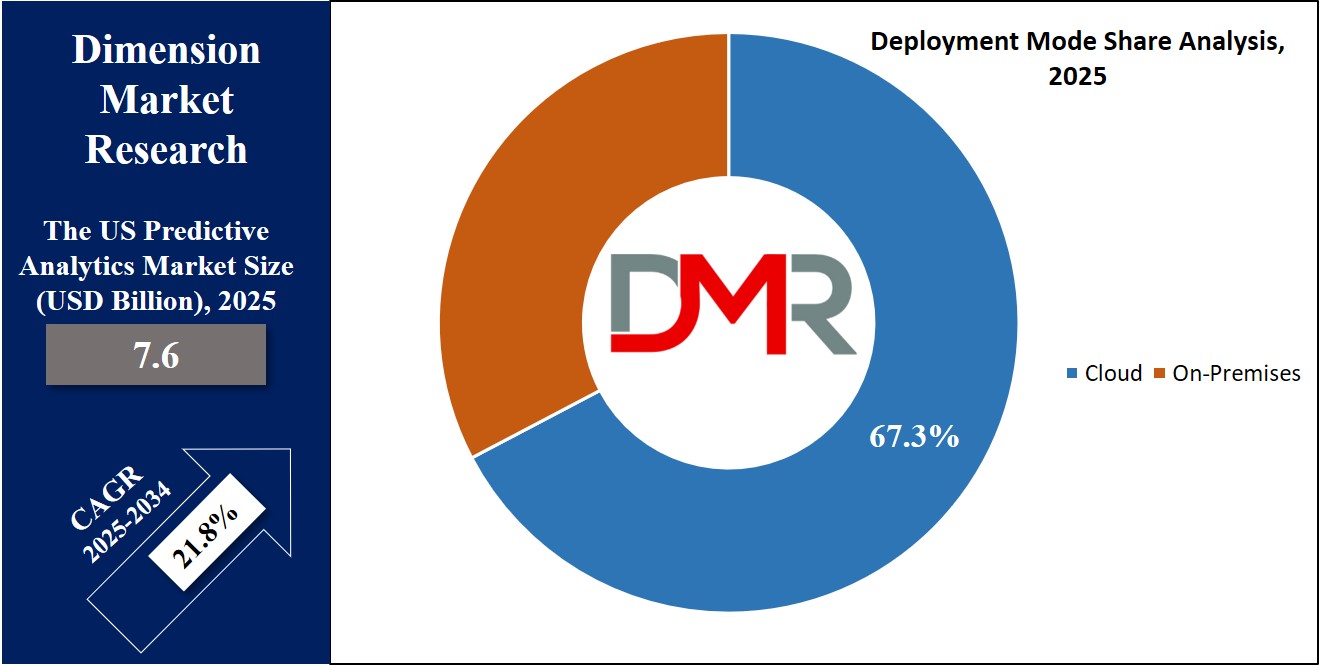

- By Deployment Mode: The cloud segment is expected to get the largest revenue share in 2025 in the US Predictive Analytics Market.

- Use Cases: Some of the use cases of Predictive Analytics include financial fraud detection, retail demand forecasting, and more.

US Predictive Analytics Market: Use Cases:

- Healthcare Risk Prediction: Hospitals and clinics use predictive analytics to identify patients who may develop serious conditions like heart disease or diabetes. By analyzing past medical records, lifestyle data, and lab results, doctors can take early steps to manage health risks. This helps improve patient care and reduce emergency visits.

- Retail Demand Forecasting: Retailers apply predictive models to forecast which products customers will buy and when. Using purchase history, seasonal trends, and online behavior, stores can stock shelves more efficiently. This reduces overstock, cuts waste, and boosts sales by meeting customer needs on time.

- Financial Fraud Detection: Banks and financial institutions use predictive analytics to catch fraud in real time. By tracking patterns in transactions and identifying unusual activity, systems can flag and block suspicious behavior. This helps protect both businesses and customers from financial losses.

- Transportation and Logistics Planning: Shipping and logistics companies use data to predict delays, optimize delivery routes, and manage fleet operations. Predictive tools factor in traffic, weather, and fuel costs to improve efficiency. This leads to faster deliveries and lower operational costs.

Stats & Facts

- According to DOIT, although 80% of business leaders say improved data access enhances decision-making, only 60% of companies actually provide that level of access to their teams, creating a significant gap between strategy and execution that impacts operational efficiency. Exploding Topics reports that 91.9% of organizations saw measurable value from their data and analytics investments in 2023, demonstrating a strong ROI and affirming the strategic importance of data initiatives across industries.

- DOIT highlights a growing crisis in data quality, estimating that poor data causes companies to lose between 15% and 25% of their revenue annually, with the broader U.S. economy suffering an estimated $3.1 trillion loss each year due to data-related inefficiencies.

- As noted by Exploding Topics, 3 in 5 organizations are leveraging data analytics not just for insight but as a driver of innovation, reshaping how businesses develop new products, services, and internal processes.

- DOIT projects that by 2025, data generated annually by IoT devices will surpass 90 zettabytes, fueled by a rapidly expanding network of 23.8 billion connected devices, which are transforming real-time analytics and industrial operations.

- According to Exploding Topics, cloud computing has emerged as the leading technological investment area for organizations prioritizing data and analytics, underscoring the shift toward scalable, agile infrastructure for modern data management.

- DOIT reveals a significant discrepancy in data utilization: while most leaders recognize its value, inconsistent access policies hinder organizational agility, suggesting that democratizing data remains a key barrier to widespread analytic maturity.

- Exploding Topics notes that 56% of data leaders are planning to increase their budgets this year, indicating strong momentum and prioritization of data capabilities as companies compete on analytics-driven decision-making.

Market Dynamic

Driving Factors in the US Predictive Analytics Market

Data Privacy and Security Concerns

A significant restraint in the US predictive analytics market is the growing concern over data privacy and security. As more personal and sensitive data is collected and analyzed, the risk of misuse or unauthorized access increases. Many businesses face strict regulations such as HIPAA for healthcare and GDPR-like state laws for general data use.

These rules require companies to handle data carefully, adding legal and operational burdens. Consumers are also becoming more aware of how their data is used, and any breach can harm a company's reputation. This can slow adoption, as businesses may hesitate to invest in predictive tools if they are unsure how to stay compliant. Managing data responsibly requires extra resources, which can limit smaller firms' participation.

High Implementation Costs and Skill Gaps

The cost of implementing predictive analytics solutions can be high, especially for companies without existing infrastructure or technical expertise. Developing custom models, purchasing software, and hiring skilled data scientists can be expensive. Smaller businesses may find it hard to justify the investment, especially if the returns are not immediate.

Moreover, there is a shortage of professionals with the right combination of domain knowledge and analytics skills. This talent gap makes it harder for companies to fully use predictive analytics, leading to delays or underperformance. While automation is improving, setting up effective systems still requires careful planning and expertise. These challenges can hold back the wider adoption of predictive tools in some parts of the US market.

Restraints in the US Predictive Analytics Market

Data Privacy and Security Concerns

A significant restraint in the US predictive analytics market is the growing concern over data privacy and security. As more personal and sensitive data is collected and analyzed, the risk of misuse or unauthorized access increases. Many businesses face strict regulations such as HIPAA for healthcare and GDPR-like state laws for general data use. These rules require companies to handle data carefully, adding legal and operational burdens. Consumers are also becoming more aware of how their data is used, and any breach can harm a company's reputation. This can slow adoption, as businesses may hesitate to invest in predictive tools if they are unsure how to stay compliant. Managing data responsibly requires extra resources, which can limit smaller firms' participation.

High Implementation Costs and Skill Gaps

The cost of implementing predictive analytics solutions can be high, especially for companies without existing infrastructure or technical expertise. Developing custom models, purchasing software, and hiring skilled data scientists can be expensive. Smaller businesses may find it hard to justify the investment, especially if the returns are not immediate. Moreover, there is a shortage of professionals with the right combination of domain knowledge and analytics skills. This talent gap makes it harder for companies to fully use predictive analytics, leading to delays or underperformance. While automation is improving, setting up effective systems still requires careful planning and expertise. These challenges can hold back the wider adoption of predictive tools in some parts of the US market.

Opportunities in the US Predictive Analytics Market

Expansion in Small and Medium Enterprises (SMEs)

An emerging opportunity in the US predictive analytics market lies in the growing interest among small and medium-sized enterprises. As cloud-based analytics tools become more affordable and easier to use, SMEs can now access capabilities once limited to large corporations. These businesses are beginning to see the value in using data to improve operations, understand customers, and stay competitive.

Predictive analytics can help them make better marketing decisions, manage inventory, and reduce operational costs. The availability of subscription-based models and user-friendly platforms reduces the need for heavy upfront investments. As SMEs adopt digital tools, service providers have the chance to expand their market reach. This creates a new wave of demand beyond traditional enterprise users.

Integration with Emerging Technologies

The integration of predictive analytics with emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and edge computing presents a major opportunity for growth. By combining real-time data from connected devices with predictive models, businesses can gain deeper insights and automate decisions more effectively.

For instance, in manufacturing, sensors can collect equipment data to predict failures before they happen. In smart cities, IoT data can help forecast traffic or energy usage. These tech integrations allow predictive analytics to go beyond reports and become part of active systems that react and adapt on their own. As these technologies continue to mature, the potential for innovative and intelligent predictive solutions in various industries will expand significantly.

Trends in the US Predictive Analytics Market

Integration of Weather-Based Predictive Models in Retail

Retailers in the United States are increasingly incorporating weather data into their predictive analytics strategies to better manage inventory and marketing efforts. By analyzing weather forecasts, businesses can anticipate changes in consumer demand for certain products. For instance, if a wet autumn is predicted, stores might adjust their stock levels for items like raincoats or umbrellas accordingly. This approach helps in optimizing inventory, reducing waste, and enhancing customer satisfaction by ensuring the availability of relevant products. The growing unpredictability of weather patterns due to climate change has made such predictive modeling even more crucial for retail operations.

Adoption of Explainable AI (XAI) in Predictive Analytics

Another emerging trend in the U.S. predictive analytics market is the adoption of Explainable AI (XAI). XAI focuses on making the decision-making processes of AI models more transparent and understandable to humans. This is particularly important in sectors like finance and healthcare, where understanding the rationale behind predictions is essential for compliance and trust.

For example, a bank using predictive analytics for loan approvals can benefit from XAI by providing clear explanations for each decision, thereby enhancing customer trust and meeting regulatory requirements. The move towards more interpretable AI models is helping organizations make more informed and accountable decisions.

Research Scope and Analysis

By Component Analysis

Solution segment is set to lead in 2025 with a share of 68.6%, showing its strong impact on the growth of the U.S. predictive analytics market. Businesses across industries are turning to ready-to-use software and platforms that help them analyze data quickly and accurately. These solutions come with built-in tools for data mining, forecasting, and visualization, making it easier for companies to make smart decisions without building systems from scratch.

As more firms adopt cloud computing, these analytics solutions are becoming more accessible and scalable. They support use cases like customer behavior prediction, risk assessment, and process optimization. The ease of integration with existing systems and the ability to deliver real-time insights make these tools valuable. With user-friendly dashboards and automated reporting, solution-based platforms continue to drive demand and improve data-driven strategies in business operations.

The services segment will also show significant growth over the forecast period, playing a key role in supporting the adoption and success of predictive analytics across the U.S. market. These services include consulting, system integration, support, and training, helping businesses make the most of their analytics tools. Many companies lack in-house expertise to fully understand and apply predictive models, so they rely on external service providers for guidance.

These providers help set up systems, clean data, build custom models, and ensure smooth operation. As predictive analytics becomes more complex with AI and machine learning, demand for specialized services is increasing. Continuous updates, data maintenance, and user training also contribute to long-term success. Services add value by customizing solutions to meet specific business needs, making them an essential part of the market's overall growth and effectiveness.

By Deployment Mode Analysis

Based on deployment mode, the Cloud segment will dominate in 2025 with a share of 67.3%, showing its major role in the growth of the U.S. predictive analytics market. Cloud-based platforms make it easier for businesses to access powerful analytics tools without needing heavy hardware or large IT teams. They allow data to be stored, managed, and analyzed remotely, giving users flexibility and speed.

Many companies prefer cloud solutions because they can scale up or down based on demand and reduce upfront costs. Real-time insights, seamless software updates, and easy collaboration across teams also make cloud deployment popular. As remote work and digital operations grow, more organizations are shifting to the cloud for data analysis. The ability to connect with other systems, handle large volumes of data, and support advanced features like AI and machine learning adds to its strong market position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

On-premises segment is also expected to have significant growth over the forecast period, especially among businesses that need full control over their data and systems. Companies in sectors like healthcare, banking, and government often choose on-premises deployment due to strict security, compliance, or privacy rules. This setup allows them to manage sensitive data within their own infrastructure without relying on third-party servers.

While it requires more investment in hardware and maintenance, it offers strong data protection and customization. Some businesses also prefer on-premises solutions because they have existing systems in place and want to avoid major changes. With improved internal IT capabilities, many organizations continue to expand their in-house analytics operations. This approach supports deeper integration, higher performance for certain tasks, and helps maintain control over business intelligence strategies.

By Organization Size Analysis

The large enterprise segment is set to dominate with a share of 60.3% in 2025, driving significant growth in the U.S. predictive analytics market. Large organizations have the resources to invest in advanced technologies and the infrastructure needed to handle complex data analysis. These businesses apply predictive analytics across various departments like marketing, finance, operations, and customer service, making data-driven decisions to improve efficiency and drive growth.

The ability to process vast amounts of data helps large enterprises anticipate market trends, optimize supply chains, and personalize customer experiences. With strong budgets and skilled teams, these companies can adopt cutting-edge tools and continuously refine their analytics strategies. As more large businesses recognize the value of predictive analytics in staying competitive, their influence continues to shape market trends and innovations in the field.

SME segment is having significant growth over the forecast period, as more small and medium-sized businesses embrace predictive analytics to enhance decision-making. These businesses are increasingly adopting affordable, cloud-based analytics tools that allow them to gain valuable insights from their data without major upfront investments. Predictive analytics helps SMEs improve customer engagement, optimize inventory management, and streamline operations.

As cloud solutions become more accessible and easy to use, small and medium businesses can now leverage the power of big data to compete with larger enterprises. The scalability and cost-effectiveness of these tools are key drivers in SME adoption, allowing them to make smarter, data-backed decisions that enhance their competitiveness. With growing support from solution providers, SMEs are expected to continue embracing predictive analytics for their growth.

By Technology Analysis

The machine learning segment will be leading in 2025 with a share of 38.1%, playing a vital role in the expansion of the U.S. predictive analytics market. This technology helps systems automatically learn from data and improve outcomes without constant human input. Businesses use machine learning to forecast sales, detect fraud, personalize customer experiences, and manage risks more effectively. It is especially useful for handling large and complex data sets, uncovering patterns that traditional methods might overlook. With the rise of automation, companies rely on machine learning to make faster and more accurate decisions.

Its ability to adapt and refine predictions over time makes it valuable for industries like healthcare, finance, and e-commerce. As demand for smarter and more responsive data tools grows, machine learning continues to push innovation and support more efficient, real-time analytics solutions across the market.

Further, neural network segments are having significant growth over the forecast period, driven by its power to process complex information and identify deep patterns within data. Designed to mimic the human brain, neural networks are used in tasks that involve image recognition, voice processing, and advanced predictive modeling. This technology is especially helpful in sectors like healthcare, where it assists in disease prediction, and in finance, where it supports trend analysis.

Businesses value neural networks for their ability to manage unstructured data and produce high-quality forecasts. Although they require strong computing systems and skilled professionals, their results often outperform traditional methods. As companies seek more accurate and flexible analytics tools, neural networks are becoming an important part of advanced data strategies in the U.S. market. Their expanding role supports better decision-making and adds depth to predictive analytics applications.

By Application Analysis

Risk management segment is set to lead in 2025 with a share of 21.4%, contributing significantly to the growth of the U.S. predictive analytics market. As businesses face increasing uncertainties, predictive analytics helps them identify and mitigate potential risks before they become problems. By analyzing past data and trends, companies can forecast financial, operational, or market risks and take proactive measures to avoid losses.

For instance, in industries like finance and insurance, predictive models can help assess credit risk, optimize investment strategies, and ensure compliance with regulations. Additionally, risk management tools provide early warnings for supply chain disruptions, cybersecurity threats, or changing market conditions. As the need to protect assets and reduce uncertainties grows, predictive analytics plays a central role in helping businesses make informed, risk-aware decisions.

Fraud detection segment is having significant growth over the forecast period, as businesses increasingly use predictive analytics to combat fraudulent activities. Predictive tools analyze transaction data, customer behaviors, and historical trends to spot unusual patterns that could indicate fraud. In sectors like banking, e-commerce, and insurance, this technology helps companies detect and prevent financial fraud, saving millions of dollars in potential losses.

The ability to flag suspicious activities in real-time means that businesses can act quickly and minimize the impact of fraud. As fraud tactics become more sophisticated, predictive analytics continues to evolve, integrating machine learning and advanced algorithms to improve accuracy. This growing demand for faster, more reliable fraud detection systems is driving the expansion of this application within the U.S. predictive analytics market.

By Industry Vertical Analysis

The BFSI segment will leading in 2025 with a share of 21.4%, playing a key role in the growth of the U.S. predictive analytics market. The banking, financial services, and insurance (BFSI) industry relies heavily on predictive analytics to manage risk, optimize investments, and enhance customer experiences. By analyzing transaction data, market trends, and customer behavior, financial institutions can make smarter decisions regarding credit scoring, fraud detection, and portfolio management.

Predictive analytics also helps in personalizing services, improving customer retention, and identifying new business opportunities. With increasing regulatory requirements and a need for real-time insights, BFSI organizations are turning to predictive tools to stay competitive, reduce operational risks, and meet customer expectations. As these firms continue to adopt data-driven strategies, their reliance on predictive analytics continues to grow, driving market expansion.

IT & Telecom segment will be having significant growth over the forecast period, as the technology-driven nature of these industries creates high demand for predictive analytics. Companies in IT and telecommunications use predictive models to optimize network performance, reduce downtime, and predict customer needs. By analyzing data from connected devices and customer interactions, these companies can improve service delivery, prevent technical issues, and offer personalized products.

Predictive analytics also helps telecom firms plan infrastructure expansions, predict usage patterns, and forecast potential service disruptions. With the rapid evolution of technology and increasing competition, the need for efficient, data-driven decisions has made predictive analytics crucial. As IT and telecom companies strive to enhance operational efficiency and customer satisfaction, the adoption of predictive tools continues to grow in these sectors.

The US Predictive Analytics Market Report is segmented on the basis of the following:

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Deployment Mode

By Organization Size

By Technology

- Machine Learning

- Data Mining

- Natural Language Processing

- Neural Networks

- Statistical Methods

By Application

- Risk Management

- Sales & Marketing

- Operations & Supply Chain

- Customer & Workforce Management

- Financial Analytics

- Fraud Detection

- Inventory Management

- Other Applications

By Industry Vertical

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- IT & Telecom

- Manufacturing

- Government & Defense

- Transportation & Logistics

- Energy & Utilities

- Media & Entertainment

- Others

By Region

Competitive Landscape

The US predictive analytics market is highly competitive, with many companies offering tools and services that help others make better decisions using data. These businesses range from large technology firms to smaller, specialized startups. Some focus on specific industries like healthcare, retail, or finance, while others provide general-purpose tools that work across different fields. Cloud-based platforms, artificial intelligence, and machine learning are common features in their solutions.

Many of these companies compete by offering faster processing, better accuracy, easier integration, or more user-friendly systems. As demand grows, especially for real-time and automated insights, competition continues to increase. Businesses in this space also compete by helping clients keep data safe and follow privacy laws, which is becoming more important.

Some of the prominent players in the global US Predictive Analytics are:

- IBM

- Microsoft

- SAP

- Oracle

- Google Cloud

- H20.ai

- Altair

- FICO

- TIBCO

- Experian

- Sisense

- Zoho

- Infor

- DataRobot

- SAS

- Salesforce

- Teradata

- Other Key Players

Recent Developments

- In April 2025, dotData launched dotData Enterprise 4.0, a major upgrade to its no-code predictive analytics platform, which features a completely redesigned interface and a new core engine built on dotData's award-winning Feature Factory technology. Representing a fresh approach to end-to-end no-code automation, dotData Enterprise 4.0 empowers analytics professionals, regardless of machine learning expertise, to more easily build predictive models and accelerate their journey into advanced analytics

- In June 2024, Pecan AI, a leader in AI-driven predictive analytics for data analysts and business teams, has announced the launch of Predictive GenAI—a groundbreaking fusion of predictive analytics and generative AI that simplifies and accelerates predictive modeling. This innovation represents a significant advancement in enterprise AI adoption, enabling businesses to harness the combined power of generative and predictive AI to more effectively unlock and utilize the full potential of their data.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.6 Bn |

| Forecast Value (2034) |

USD 45.2 Bn |

| CAGR (2025–2034) |

21.8% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Cloud and On-Premises), By Organization Size (Large Enterprises and SMEs), By Technology (Machine Learning, Data Mining, Natural Language Processing, Neural Networks, and Statistical Methods), By Application (Risk Management, Sales & Marketing, Operations & Supply Chain, Customer & Workforce Management, Financial Analytics, Fraud Detection, Inventory Management, and Other Applications), By Industry Vertical (BFSI, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, Manufacturing, Government & Defense, Transportation & Logistics, Energy & Utilities, Media & Entertainment, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

IBM, Microsoft, SAP, Oracle, Google Cloud, H20.ai, Altair, FICO, TIBCO, Experian, Sisense, Zoho, Infor, DataRobot, SAS, Salesforce, Teradata, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the U.S. Predictive Analytics Market?

▾ The U.S. Predictive Analytics Market size is expected to reach a value of USD 7.6 billion in 2025 and is expected to reach USD 45.2 billion by the end of 2034.

Who are the key players in the U.S. Predictive Analytics Market?

▾ Some of the major key players in the U.S. Predictive Analytics Market are IBM, Google Cloud, Sap, and others

What is the growth rate in the U.S. Predictive Analytics Market?

▾ The market is growing at a CAGR of 21.8 percent over the forecasted period.