Market Overview

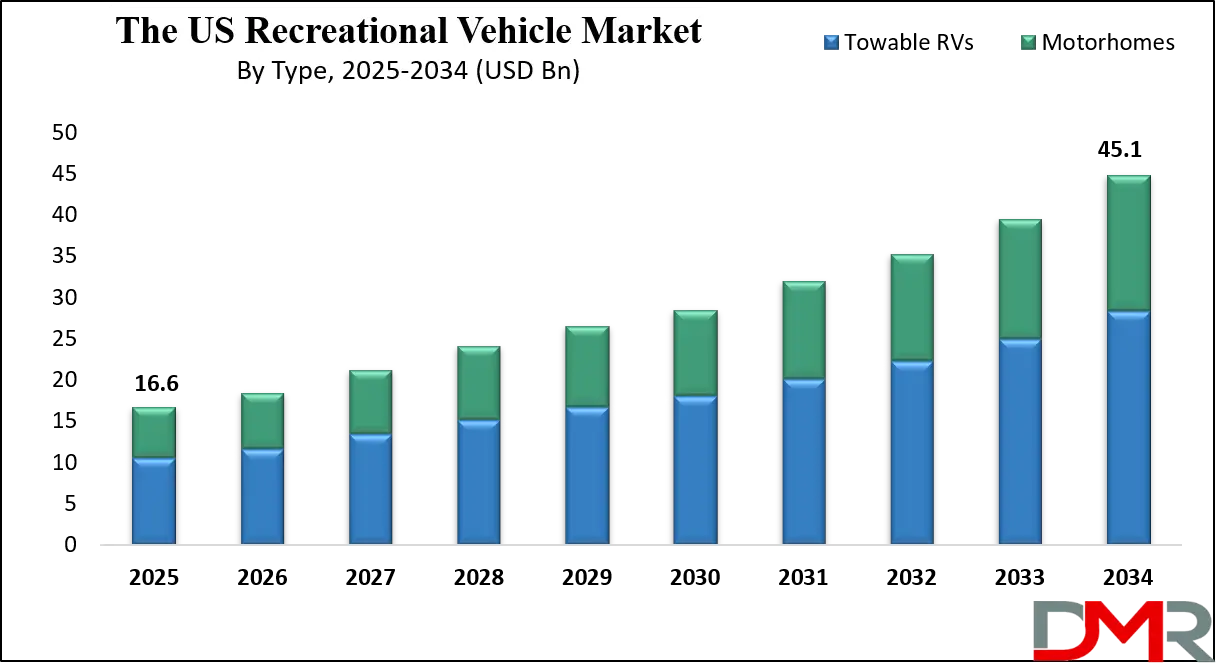

The US Recreational Vehicle Market is projected to reach USD 16.6 billion in 2025 and grow at a compound annual growth rate of 11.7% from there until 2034 to reach a value of USD 45.1 billion.

The U.S. Recreational Vehicle (RV) market stands as a symbol of freedom, flexibility, and the enduring appeal of life on the open road. Traditionally driven by retirees and seasonal vacationers, the market has undergone a notable transformation, now appealing to a broader consumer base that includes millennials, Gen Z adventurers, digital nomads, remote workers, and young families. The evolving American lifestyle centered on outdoor living, work-from-anywhere flexibility, and experience-driven travel has significantly boosted demand for RVs of all types and sizes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is segmented into motorhomes and towable RVs, each with subcategories designed to meet different user preferences and budgets. Motorhomes, including Class A (luxury), Class B (camper vans), and Class C (mid-size with over-cab sleeping), offer self-contained mobility, while towables such as travel trailers, fifth wheels, toy haulers, and pop-up campers provide cost-effective flexibility for vehicle owners.

Among these, Class B motorhomes have seen a surge in popularity due to their compact size, urban drivability, and high fuel efficiency. Towable RVs, on the other hand, dominate in unit sales, especially among first-time buyers looking for affordable and adaptable travel solutions.

Innovation and technology are redefining the RV ownership experience. Modern RVs are equipped with smart connectivity, solar charging, lithium-ion battery systems, and compact yet high-end appliances. Interiors now resemble tiny luxury homes, complete with Wi-Fi boosters, ergonomic workstations, and voice-controlled lighting. Moreover, growing environmental awareness is pushing manufacturers toward electrification and the use of sustainable building materials, promoting greener road travel.

Beyond recreational use, RVs are being reimagined for commercial and lifestyle applications, serving as mobile clinics, remote offices, pop-up retail spaces, and mobile classrooms. Rental platforms and peer-to-peer RV sharing services are further expanding access to RV experiences without long-term ownership. Financing flexibility, a strong dealer and service network, and campground infrastructure continue to support market expansion.

Geographically, demand is robust across all regions, with significant traction in states boasting national parks, open highways, and developed camping facilities such as California, Texas, Florida, Colorado, and Arizona. Seasonal events, RV expos, and adventure travel influencers are also driving visibility and aspirational value among younger audiences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In essence, the U.S. recreational vehicle market reflects broader shifts in how Americans live, work, and travel. It is no longer just a mode of transportation; it’s a lifestyle ecosystem, blending mobility with modern comfort and sustainability. As consumers seek more control over their travel environments and prioritize personal well-being, the RV market is expected to remain resilient and continue evolving to meet the diverse needs of modern explorers.

The US Recreational Vehicle Market: Key Takeaways

- The US Market Size Insights: The US Recreational Vehicle Market size is estimated to have a value of USD 16.6 billion in 2025 and is expected to reach USD 45.1 billion by the end of 2034.

- The US Market Growth Rate: The market is growing at a CAGR of 11.7 percent over the forecasted period of 2025.

- Key Players: Some of the major key players in the US Recreational Vehicle Market are Forest River, Thor Industries, Winnebago Industries, Keystone RV, Jayco, Grand Design, Coachmen, Heartland RVs, Alliance RV, Newmar, and many others.

- Type Segment Insights: Towable RVs is poised to lead due to affordability, flexibility, and ease of towing. Their wide variety suits families and occasional travelers, making them the most preferred RV type across the U.S. market.

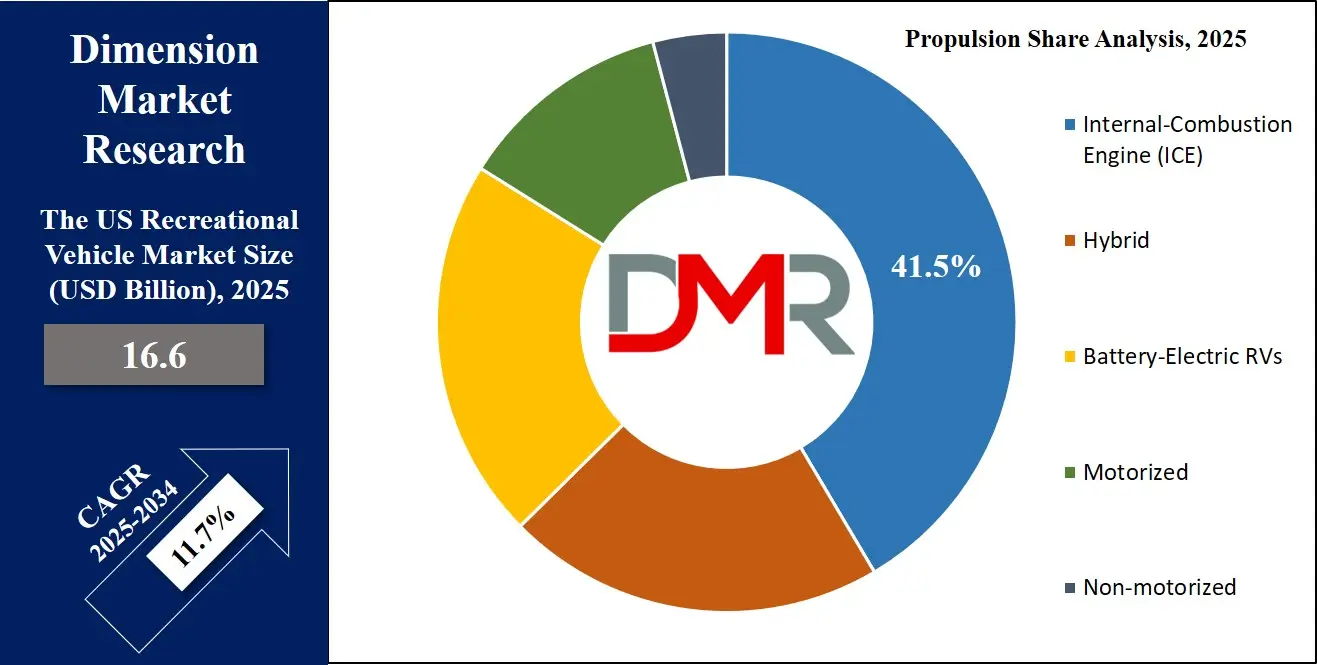

- ICE Power in Fuel Type Segment: Internal combustion engine RVs are anticipated to dominate thanks to existing fuel infrastructure and long-range capability. Electric and hybrid options remain limited and costly, keeping ICE models in the lead for now.

- 20–30 ft RVs Preferred: Mid-sized RVs balance space and mobility well. Ideal for families, they are easier to handle and park while offering ample living comfort, driving their popularity in the U.S. market.

- Infrastructure Supports Current Trends: Fuel stations, campsite designs, financing options, and dealership availability all favor towable, ICE-powered, mid-sized RVs. These ecosystem factors reinforce the dominance of existing segments in the U.S. RV market.

The US Recreational Vehicle Market: Use Cases

- Leisure Travel and Camping: RVs provide families and individuals with a cost-effective and flexible way to explore national parks, scenic highways, and remote destinations. They offer the convenience of bringing home comforts along for the journey, including sleeping space, kitchens, and restrooms, making them ideal for long road trips, seasonal vacations, and spontaneous weekend getaways.

- Full-Time Mobile Living: A growing number of Americans are adopting RVs for full-time living, driven by rising housing costs and a desire for minimalism. These users, often digital nomads or retirees, outfit their RVs with workstations, off-grid power systems, and internet connectivity, turning their vehicle into a permanent, mobile residence that supports both work and lifestyle on the move.

- Remote Work and Mobile Offices: With remote work becoming mainstream, RVs are being converted into mobile offices, allowing professionals to work while traveling. Many modern RVs now feature built-in desks, Wi-Fi boosters, and solar-powered energy systems, enabling users to work from remote areas without sacrificing connectivity or productivity, blending work-life balance with adventure.

- Mobile Medical and Emergency Units: Healthcare organizations and local governments use RVs as mobile clinics, vaccination sites, and emergency response units. These specially modified RVs provide essential medical services in underserved or disaster-struck areas. They can be rapidly deployed with medical equipment, power supplies, and sanitation systems to offer care where brick-and-mortar facilities are unavailable.

- Event and Commercial Rentals: RVs are increasingly rented for festivals, sporting events, film production, and pop-up retail. Event organizers and businesses use them as on-site command centers, VIP lounges, or branded promotional vehicles. Their mobility, adaptability, and comfort make them perfect for temporary commercial use in both urban and rural settings, offering convenience and visibility.

The US Recreational Vehicle Market: Stats & Facts

Federal Highway Administration / NHTSA

- U.S. traffic fatalities in 2022 totaled approximately 42,795; in 2023, nearly 41,000 a 3.6% decline year-over-year.

- The fatality rate per 100 million vehicle-miles traveled dropped from 1.33 in 2022 to 1.26 in 2023.

- In 2022, distracted-driving crashes resulted in about 3,308 deaths and around 289,310 injuries.

- Approximately 20% of distracted-driving fatalities were non-vehicular road users (pedestrians and bicyclists).

U.S. Department of Transportation / National Highway System

- In 2022, Americans drove roughly 67.5 billion more miles than the previous year (a 2.1% increase).

- The Interstate Highway System covers approximately 48,890 miles and accounts for nearly one-quarter of all vehicle-miles driven annually.

- More than 5,000 vehicle fatalities occurred on U.S. Interstates annually, with over 5,600 in 2022 alone.

RV Industry Association (RVIA)

- Total RV shipments in 2024 reached 333,733 units, a 6.6% increase from 2023.

- Towable RV shipments in December 2024 rose 11.4% year-over-year, totaling about 20,814 units.

- Motorhome shipments for the same month dropped 17.7%, reaching approximately 2,339 units.

- In 2022, total RV shipments were around 356,000 units, reflecting an 8% year-over-year increase.

Indiana State Economic Development (Public Sector Data)

- Indiana produces around 85% of all RVs manufactured in the United States.

- Elkhart County accounts for about two-thirds of Indiana’s RV output.

- The RV industry in Indiana contributes approximately USD 32.4 billion to the state economy.

- It supports around 126,140 jobs and generates roughly USD 3.1 billion in taxes and USD 7.8 billion in wages annually.

U.S. Household Ownership and Registrations

- As of March 2021, about 11.3 million U.S. households owned an RV, a 26% increase over a decade.

- There are over 10 million registered RVs in the U.S. as of 2023.

Industry Employment & Infrastructure (Publicly Reported)

- RV-related jobs in the U.S. number over 600,000.

- Total RV industry wages in 2022 exceeded USD 48 billion.

- The U.S. RV dealer network included approximately 30,363 businesses in 2022–2023.

- There are more than 16,000 RV parks and campgrounds across the U.S.

- Peak campground occupancy rates exceed 70–85% during travel seasons.

The US Recreational Vehicle Market: Market Dynamic

Driving Factors in the US Recreational Vehicle Market

Rising Popularity of Domestic Travel and Outdoor Tourism

The U.S. RV market is witnessing robust expansion due to the growing popularity of domestic travel and outdoor recreational tourism. Following the COVID-19 pandemic, American consumers have increasingly favored socially distanced, nature-centric travel modes, redefining vacation norms. RVs allow for personalized, flexible itineraries without the health risks associated with air travel, hotels, or crowded tourist spots. National parks, rural towns, and coastal highways have become top destinations as travelers seek scenic and immersive experiences.

This has led to surging demand for RV rentals and ownership, especially among younger families, retirees, and digital nomads. According to data from the National Park Service, over 325 million visits to U.S. national parks were recorded in 2023, with RV travelers contributing significantly. Moreover, the "van life" and mobile living trends continue to gain traction, turning RVs into both travel and lifestyle solutions.

Increased Availability of Financing and Rental Platforms

Another powerful growth driver is the improved accessibility of RV financing, leasing options, and digital rental platforms across the United States. Banks, credit unions, and fintech companies are now offering specialized RV loan programs with flexible terms, low interest rates, and extended repayment periods, thereby expanding ownership among middle-income Americans. Peer-to-peer rental services like Outdoorsy and RVshare have revolutionized how consumers access RVs, making them available on demand without long-term financial commitment.

These platforms offer a range of RV types, Class A, B, C, fifth-wheel, and travel trailers, enabling wider participation from both urban and rural consumers. They also provide insurance, roadside assistance, and online booking tools that simplify the rental process. In parallel, many RV dealerships now offer subscription-based ownership, allowing consumers to rotate between different models seasonally. As the RV market becomes more financially inclusive, first-time buyers and vacationers who previously found RVing cost-prohibitive are entering the market in large numbers.

Restraints in the US Recreational Vehicle Market

High Initial Purchase Cost and Maintenance Expenses

One of the most prominent restraints in the U.S. RV market is the high cost of acquisition and ongoing maintenance, which limits accessibility for many consumers. Entry-level travel trailers may start at USD 20,000, while luxury Class A motorhomes can exceed USD 300,000. Beyond the initial cost, ownership entails recurring expenses such as insurance, registration, repairs, fuel, and winter storage. Diesel-powered motorhomes, in particular, have higher maintenance requirements and fuel costs. Additionally, fluctuations in commodity prices (e.g., steel, aluminum, rubber) can drive up manufacturing costs, leading to price hikes across new models.

Depreciation is also a major concern RVs lose up to 30% of their value in the first three years. For first-time buyers, unexpected repair bills and poor resale value can result in a negative ownership experience. The absence of widespread RV repair and parts networks in some regions adds to the burden. These financial hurdles create an affordability gap, especially for lower- and middle-income households.

Parking, Zoning, and Regulatory Challenges

Regulatory and zoning issues are significant restraints limiting RV market expansion, especially in urban and suburban regions of the U.S. Many cities have strict ordinances against parking RVs on residential streets or driveways for extended periods. HOA rules and local codes often restrict RV storage or mandate off-site parking, forcing owners to rent costly third-party storage units. Moreover, long-term occupancy of RVs is banned in many municipalities, impacting users who wish to live full-time in their vehicles.

Even in rural areas, local land use regulations can make it difficult to establish private RV parks or boondocking sites. There are also complications with licensing requirements for larger Class A or towable RVs that exceed certain weight thresholds. Additionally, campground permitting and zoning processes can be lengthy and inconsistent across states, deterring infrastructure investment. These fragmented regulatory landscapes pose significant barriers for both manufacturers and consumers.

Opportunities in the US Recreational Vehicle Market

Electrification and Development of Zero-Emission RVs

A massive growth opportunity for the U.S. RV market lies in the electrification of RV platforms and the push for zero-emission mobility. With the federal government offering tax incentives for clean transportation and emissions regulations tightening, electric RVs (e-RVs) represent an untapped frontier. While most existing e-RVs are prototypes or concept vehicles, significant investment is underway to commercialize them at scale. Companies like Winnebago and Thor Industries are developing fully electric Class B and C motorhomes, integrating battery packs with solar arrays and regenerative braking systems.

As EV charging infrastructure expands nationwide, range anxiety, a major hurdle for e-RV adoption, is expected to diminish. Off-grid camping enthusiasts also show high interest in e-RVs equipped with energy storage and smart load management. This aligns with national goals under the U.S. Infrastructure Investment and Jobs Act, which allocates USD 7.5 billion to expand charging networks. Electrification not only addresses environmental goals but also creates differentiation in a saturated market.

Expansion of RV-Friendly Infrastructure and Digital Nomadism

The growing development of RV-friendly infrastructure presents another strong opportunity. With a surge in remote work and hybrid work models, professionals are increasingly adopting mobile lifestyles, using RVs as mobile offices. This shift has prompted local governments and private players to invest in RV-centric infrastructure such as high-speed Wi-Fi-enabled campgrounds, off-grid hookups, EV charging at parks, and long-term stay permits.

Companies are also developing co-working RV parks and modular campsites, blending productivity with outdoor living. Additionally, broadband expansion in rural areas spearheaded by federal programs like the BEAD initiative makes remote working in RVs more feasible than ever. RV tourism agencies and municipalities across states like Colorado, Utah, and Oregon are promoting “workcation” destinations tailored for RV users. Meanwhile, campground software platforms are optimizing reservation and amenities management to streamline the user experience.

Trends in the US Recreational Vehicle Market

Rise of Eco-Friendly and Lightweight RV Models

A major trend reshaping the U.S. recreational vehicle market is the rapid shift toward eco-friendly, lightweight, and sustainable RV designs. Manufacturers are responding to growing environmental concerns and evolving federal fuel-efficiency standards by producing travel trailers and motorhomes with composite materials, aerodynamic features, and electrified powertrains. Lightweight aluminum frames, solar-integrated roofs, lithium-ion batteries, and energy-efficient appliances are replacing traditional fuel-guzzling components.

This transition is being driven by both regulatory frameworks and rising consumer preferences for lower carbon footprints and better fuel economy during long-distance travel. Additionally, innovations in hybrid-electric RV platforms are expanding the appeal of RV ownership to environmentally-conscious millennials and Gen Z buyers, helping to rejuvenate the market’s demographic reach. With sustainability becoming central to brand identity, OEMs like Airstream and Winnebago are investing heavily in R&D for all-electric models.

Integration of Smart Technology and IoT in RVs

Another transformative trend influencing the U.S. RV market is the rapid integration of smart technologies and Internet of Things (IoT) capabilities across both motorized and towable units. Consumers now expect digital comfort, automation, and connectivity, mirroring the smart-home experience while on the road. RVs are being equipped with centralized touchscreens, mobile apps, voice-activated systems, remote monitoring, GPS tracking, and energy management dashboards. These technologies allow real-time diagnostics, security surveillance, and wireless control over lighting, HVAC, generators, and slide-outs.

The rising demand for smart-enabled RVs is particularly pronounced among younger, tech-savvy consumers and digital nomads who require seamless internet connectivity and workplace functionality during travel. OEMs are also integrating predictive maintenance software and cloud-based services for remote troubleshooting. With companies like Thor Industries and Forest River innovating in digital features, the industry is aligning RV lifestyles with smart living standards.

The US Recreational Vehicle Market: Research Scope and Analysis

By Type Analysis

Towable RVs, including travel trailers, fifth-wheel trailers, pop-up campers, and toy haulers, are projected to account for the largest share of the U.S. RV market. Their dominance is largely attributed to their affordability, versatile configurations, and ease of ownership. Unlike motorhomes, towable RVs do not have engines, making them significantly more cost-effective in terms of both purchase price and ongoing maintenance. This appeals to a wide consumer base, from first-time buyers to experienced campers.

Their detachability from the towing vehicle is another strong advantage, allowing users to set up camp and still use their vehicle for local exploration. Travel trailers, which are the most popular subtype within this category, offer diverse sizes and layouts to accommodate everything from solo travelers to large families.

Towable RVs are also more widely available through dealerships and online platforms, further driving accessibility. The ownership flexibility extends to the type of towing vehicle; many midsize SUVs and trucks can tow smaller models, expanding the market beyond just heavy-duty truck owners. In the post-pandemic era, consumer trends favor outdoor experiences, road trips, and mobile lifestyles, all of which are easily met by towable RVs. Moreover, insurance, storage, and repair costs are lower compared to motorhomes.

Rental businesses and campgrounds also prefer towable RVs due to their simplicity and lower capital investment. The growing ecosystem of RV parks and towing accessories further supports this segment’s dominance. Overall, the combination of economic efficiency, modular utility, and adaptability ensures that towable RVs remain the top choice among U.S. recreational vehicle users.

By Propulsion Analysis

Internal-combustion engine (ICE) powered RVs are expected to dominate the propulsion segment of the U.S. recreational vehicle market due to well-established fuel infrastructure, high reliability, and technological maturity. ICE-powered RVs are available in both gas and diesel variants and have been the industry standard for decades.

Their dominance stems from a blend of extensive model availability, affordable refueling, and repair familiarity across the country. Since fueling stations for gasoline and diesel are abundant, ICE RV users can travel coast to coast without range anxiety or the need for charging infrastructure, making them ideal for long-distance travel.

The upfront cost of ICE RVs is also significantly lower than that of electric or hybrid alternatives, and they are widely available across dealerships, resale platforms, and rental services. Manufacturers have fine-tuned ICE models over decades, offering options that deliver better fuel efficiency, smoother rides, and increased towing capabilities.

In contrast, battery-electric RVs (e-RVs) and hybrids are still at a nascent stage, with limited real-world performance data and fewer offerings on the market. Additionally, EV charging networks in remote areas, campgrounds, and national parks are sparse, reducing practicality for widespread recreational use.

Consumer trust and familiarity with ICE technology further reinforce its dominance. Repair shops, parts availability, and maintenance services are easily accessible in most parts of the U.S., which adds another layer of convenience for owners. Until significant advancements are made in battery density, charging infrastructure, and cost-efficiency, ICE-powered RVs are expected to maintain their leading position. Their blend of proven performance, ease of operation, and cost accessibility makes ICE the go-to propulsion type for American RV users.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Length Category Analysis

Recreational vehicles ranging between 20 to 30 feet in length are poised to dominate the U.S. RV market due to their optimal balance of interior space, maneuverability, and affordability. These mid-size RVs appeal to both first-time buyers and experienced RVers because they provide enough living area for small families or couples while remaining compact enough to easily navigate highways, backroads, and campgrounds. Larger RVs, while luxurious, can be challenging to drive, park, and store. Conversely, models below 20 feet often lack the comfort and space needed for extended travel.

The 20–30 ft category often includes class C motorhomes, lightweight travel trailers, and fifth-wheel models, offering diverse configurations such as slide-outs, bunk beds, full kitchens, and bathrooms. This segment allows manufacturers to deliver a residential feel without excessive bulk. Consumers benefit from a full range of amenities in a footprint that is acceptable in most national parks and RV campgrounds, which typically have length restrictions that larger RVs exceed.

Fuel efficiency is another reason this segment leads. Compared to heavier, longer RVs, mid-size models are generally easier on gas, reducing operational costs over long trips. Towing is also more manageable many half-ton trucks and large SUVs can tow trailers in this size range without requiring specialized towing packages or heavy-duty vehicles.

In essence, RVs between 20 and 30 feet are considered the "sweet spot" in terms of usability, affordability, and comfort. Their versatility meets the lifestyle needs of seasonal vacationers, snowbirds, and weekend campers alike, making them the most favored length category in the highly competitive U.S. RV market.

By Application Analysis

Domestic or personal use is anticipated to dominate the application segment of the U.S. recreational vehicle market, driven by cultural preferences, lifestyle shifts, and the emotional appeal of freedom and exploration. Americans have a deep-rooted affinity for road trips, camping, and family adventures, and RVs offer a mobile, cost-efficient way to experience the outdoors without sacrificing comfort. The rise of remote work, van life movements, and post-pandemic travel behavior changes have further fueled demand for personal RV ownership.

For many, an RV is a home away from home. Domestic users prioritize flexibility and affordability, factors well-supported by the wide range of towable and motorized RVs available at multiple price points. Whether for weekend getaways, seasonal migration (e.g., snowbirds traveling south during winter), or full-time mobile living, RVs cater to a broad spectrum of recreational needs.

Additionally, families with children, retirees, and outdoor enthusiasts prefer RVs for their ability to combine transport and accommodation into one unit, reducing travel planning complexity and lodging costs.

In contrast, commercial applications such as mobile offices, event rentals, or film production units represent a smaller but growing share of the market. While these uses are gaining ground due to innovations in customization and business mobility, they still lag behind in volume compared to personal use cases.

The personal RV market is further bolstered by financing options, tax deductions on interest for qualified buyers, and widespread dealership networks across the U.S. This segment’s dominance reflects a broader cultural embrace of independent travel, family bonding, and leisure experiences, ensuring personal RV usage remains the core driver of growth in the American RV industry.

The US Recreational Vehicle Market Report is segmented on the basis of the following:

By Type

- Towable RVs

- Travel Trailers

- Fifth-Wheel Trailers

- Folding Camp Trailers

- Truck Campers

- Motorhomes

- Class A

- Class B (Camper Vans)

- Class C

By Propulsion

- Internal-Combustion Engine (ICE)

- Hybrid

- Battery-Electric RVs

- Motorized

- Non-motorized

By Length Category

- Below 20 ft

- 20 - 30 ft

- Above 30 ft

By Application

- Domestic/Personal Use

- Commercial

Impact of Artificial Intelligence in the US Recreational Vehicle Market

- Smart Navigation and Route Optimization: AI-powered navigation systems in RVs optimize travel routes based on traffic patterns, road conditions, and terrain. These systems help drivers plan fuel-efficient, time-saving trips and avoid areas unsuitable for larger vehicles, improving overall safety and travel experience.

- Predictive Maintenance and Vehicle Health Monitoring: AI algorithms monitor engine performance, tire pressure, battery status, and fluid levels in real time. They can predict mechanical issues before breakdowns occur, reducing repair costs and downtime while enhancing the longevity and reliability of the RV.

- Voice-Activated Smart Controls: Integration of AI-based virtual assistants like Alexa or Google Assistant allows voice control of RV functions such as lighting, HVAC, entertainment systems, and appliances. This hands-free functionality boosts convenience and accessibility for users during travel and camping.

- Autonomous Driving Assistance: Advanced driver-assistance systems (ADAS) using AI, such as adaptive cruise control, lane-keeping assist, collision avoidance, and parking aids, are increasingly being integrated into motorhomes. These features enhance safety and make driving large RVs less stressful, especially for first-time users.

- AI-Enhanced Energy Management Systems: AI improves energy efficiency by regulating power usage based on occupancy, weather, and appliance use. In off-grid settings, it optimizes battery usage and solar input, ensuring sustainable energy consumption during extended stays.

- Personalized User Experiences: AI collects data on user preferences to personalize in-cabin climate settings, entertainment content, and trip recommendations. This level of customization creates a more enjoyable, home-like experience, especially for full-time or frequent RV travelers.

The US Recreational Vehicle Market: Competitive Landscape

The U.S. Recreational Vehicle (RV) market is highly competitive and marked by a blend of established industry giants, niche manufacturers, and emerging players adopting advanced technologies. Companies like Thor Industries, Forest River Inc., Winnebago Industries, REV Group, and Grand Design RV dominate the market, collectively accounting for a significant share of overall RV production and sales across the country. These brands have built strong reputations through product innovation, dealer networks, and brand loyalty.

Mergers, acquisitions, and strategic partnerships are common in this space. Thor Industries, for instance, has expanded through multiple acquisitions, enhancing its product offerings and global reach. Companies are also actively investing in research and development, particularly around lightweight materials, energy efficiency, and integration of smart technologies, to cater to evolving consumer preferences.

Moreover, a rising number of startups are entering the market with compact, customizable, and eco-friendly models that appeal to younger and urban consumers. In response to sustainability demands, key players are increasingly focusing on hybrid and electric RV prototypes, although these remain in nascent stages.

Distribution channels are also undergoing digital transformation, with virtual showrooms and online sales platforms gaining popularity. Brands are leveraging direct-to-consumer models to improve margins and customer relationships.

Aftermarket service providers and rental platforms like Cruise America and Outdoorsy are also shaping the competitive environment, providing accessibility without ownership, especially for newer or occasional users.

Overall, competition is intensifying as companies strive to balance affordability, innovation, and lifestyle appeal in a market driven by both traditional values and modern consumer expectations.

Some of the prominent players in the US Recreational Vehicle Market are:

- Forest River

- Thor Industries

- Winnebago Industries

- Keystone RV

- Jayco

- Grand Design

- Coachmen

- Heartland RVs

- Alliance RV

- Newmar

- REV Recreation Group

- Tiffin Motorhomes

- Airstream

- Palomino

- East to West

- Leisure Travel Vans

- Pleasure Way

- Oliver Travel Trailers

- Aliner

- SylvanSport

- Other Key Players

Recent Developments in the US Recreational Vehicle Market

June 2024

- Winnebago & Lippert Smart Tech Deal: The partnership integrates Lippert’s OneControl® system into Winnebago RVs, enabling app-based management of lighting, HVAC, and leveling. A pilot program launches in Q4 2024.

- REV Group’s Luxury RV Acquisition: The undisclosed deal expands REV’s high-end portfolio, adding a boutique brand known for custom interiors and hybrid powertrains. Expected to boost margins in 2025.

May 2024

- Airstream’s USD 30M Sustainability Push: Funds support solar-panel-equipped RVs and recycled material usage. Airstream also unveiled a prototype with a 400-mile EV range, targeting eco-conscious buyers.

- RV Retailer Summit (Las Vegas): Sessions covered digital retail tools, including VR showrooms and dynamic pricing algorithms. Dealers reported a 20% uptick in online leads post-event.

April 2024

- Camping World & GM EV Towing Project: Joint R&D focuses on optimizing Silverado EV and Hummer EV for RV towing, including battery impact studies and dedicated charging stations at Camping World locations.

- Florida RV SuperShow (Tampa): Attendance hit 52,000, with Jayco’s new Vista FLX (under 3,500 lbs) as the standout. Industry panels debated interest rates on financing.

March 2024

- THOR’s European Market Entry: The German acquisition (brand unnamed) gives THOR a production foothold in Europe, with plans to import diesel-powered models to the U.S. by late 2025.

- Lazydays’ USD 20M Florida Upgrade: The investment modernizes its Tampa flagship with augmented reality configurators and expanded service bays. A second phase will add RV rental hubs.

February 2024

- RVDA Convention (Orlando): Panels highlighted RV subscription models, with startups like RVshare reporting 30% growth. Dealers explored inventory-sharing platforms to combat supply chain delays.

- Cruise America & Tesla Charging Pilot: The rental giant tests Tesla’s V4 Superchargers for its EV-compatible fleet, addressing “range anxiety” for RV road trips.

January 2024

- Forest River’s USD 40M Oregon Facility: The expansion targets production of sub-3,000-lb travel trailers, capitalizing on the “van life” trend. New robotic welding lines will speed up output by 15%.

- Hershey RV Show (PA): A record 1,200 units were displayed, with Keystone’s Carbon Fiber Series drawing crowds. Seminars emphasized boondocking tech like composting toilets.

December 2023

- Blue Compass RV’s Texas Expansion: The dealership chain bought three stores in Austin/Dallas, adding USD 75M in annual revenue. Plans include on-site RV rentals and mobile service units.

November 2023

- RVIA Trade Show (Louisville): 2024 models debuted, with Grand Design’s Solitude S-Class winning “Best in Show.” Attendance topped 10,000, with electric RVs as a recurring theme.

- Winnebago’s USD 25M Innovation Lab: The Minnesota facility prototypes autonomous driving systems and modular interiors. First concepts will debut at CES 2025.

October 2023

- THOR & Amazon’s Alexa RV Integration: Future RVs will feature voice-controlled appliances, security, and predictive maintenance alerts via Alexa. Demo units roll out in mid-2024.

- Elkhart Open House: Over 300 suppliers showcased components, including Lippert’s new electric chassis. Forest River previewed its “Off-Grid Extreme” line.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 16.6 Bn |

| Forecast Value (2034) |

USD 45.1 Bn |

| CAGR (2025–2034) |

11.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Towable RVs, and Motorhomes), By Propulsion (Internal-Combustion Engine (ICE), Hybrid, Battery-Electric RVs, Motorized, and Non-motorized), By Length Category (Below 20 ft, 20–30 ft, and Above 30 ft), By Application (Domestic/Personal Use, and Commercial) |

| Regional Coverage |

The US |

| Prominent Players |

Forest River, Thor Industries, Winnebago Industries, Keystone RV, Jayco, Grand Design, Coachmen, Heartland RVs, Alliance RV, Newmar, REV Recreation Group, Tiffin Motorhomes, Airstream, Palomino, East to West, Leisure Travel Vans, Pleasure-Way, Oliver Travel Trailers, Aliner, SylvanSport, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Recreational Vehicle Market?

▾ The US Recreational Vehicle Market size is estimated to have a value of USD 16.6 billion in 2025 and is expected to reach USD 45.1 billion by the end of 2034.

What is the growth rate in the US Recreational Vehicle Market in 2025?

▾ The market is growing at a CAGR of 11.7 percent over the forecasted period of 2025.

Who are the key players in the US Recreational Vehicle Market?

▾ Some of the major key players in the US Recreational Vehicle Market are Forest River, Thor Industries, Winnebago Industries, Keystone RV, Jayco, Grand Design, Coachmen, Heartland RVs, Alliance RV, Newmar, and many others.