Market Overview

The US Risk Analytics Market size is projected to reach

USD 14.5 billion in 2025 and grow at a compound annual growth rate of

12.0% from there until 2034 to reach a value of

USD 40.3 billion.

Risk analytics in the US refers to the process of using data analysis, statistical models, and machine learning tools to identify, measure, and manage risks across various industries. These risks may include financial losses, cyber threats, compliance issues, operational failures, and more.

By analyzing large amounts of data, risk analytics helps organizations make informed decisions, avoid potential problems, and prepare for future uncertainties. Companies across finance, insurance, healthcare, energy, and manufacturing are increasingly relying on risk analytics to manage growing complexities in today’s business world.

Over the past few years, demand for risk analytics in the US has grown steadily, which is due to growing regulatory requirements, an increase in data breaches, and global economic uncertainties. Businesses need better tools to manage credit risks, fraud, cybersecurity issues, and supply chain disruptions.

As risks become more unpredictable and interconnected, companies are investing in advanced technologies such as artificial intelligence (AI) and big data analytics. These tools help them detect patterns, forecast risks early, and develop proactive strategies. As a result, risk analytics has become a vital part of strategic planning.

One major trend is the shift from traditional risk management to predictive and real-time risk monitoring. Instead of depending on past data alone, modern systems use real-time data to alert companies to potential problems before they occur, which is supported by cloud computing and the Internet of Things (IoT), which provide large streams of live data. Another key trend is the growing focus on cyber risk. With more companies going digital, there is a greater need to assess threats like data theft, ransomware attacks, and system failures, which has led to a stronger demand for cybersecurity risk analytics tools.

The COVID-19 pandemic was a major event that pushed many businesses to rethink their approach to risk. It highlighted weaknesses in global supply chains, employee health and safety, and financial planning. In response, companies began using more specialized analytics to predict future disruptions and respond quickly, which has also led to more attention on operational risk and business continuity planning. Many firms that had already invested in risk analytics were better prepared to handle the crisis.

Recent years have also seen changes in government policies and compliance requirements. Financial institutions, for example, face stricter rules from regulatory bodies like the Federal Reserve and the Securities and Exchange Commission (SEC). These rules require better reporting and risk assessment. To meet these demands, companies are adopting risk analytics platforms that can track compliance, assess credit exposure, and simulate different risk scenarios. This makes analytics not just a support tool, but a requirement for doing business in regulated industries.

US Risk Analytics Market: Key Takeaways

- Market Growth: The Risk Analytics Market size is expected to grow by USD 24.2 billion, at a CAGR of 12.0%, during the forecasted period of 2026 to 2034.

- By Component: The software segment is anticipated to get the majority share of the US Risk Analytics Market in 2025.

- By Risk Type: The financial risk is expected to get the largest revenue share in 2025 in the US Risk Analytics Market.

- Use Cases: Some of the use cases of Risk Analytics in the US include financial risk management, regulatory compliance monitoring, and more.

US Risk Analytics Market: Use Cases:

- Financial Risk Management: Banks and financial firms use risk analytics to assess creditworthiness, detect fraud, and manage exposure to market shifts. By analyzing transaction data and economic indicators, they can forecast potential losses and take steps to reduce them, which helps ensure financial stability and better investment decisions.

- Cybersecurity Threat Detection: Organizations apply risk analytics to monitor network traffic, user behavior, and system activity to spot unusual patterns, which helps identify cyber threats such as data breaches or ransomware attacks early. It allows companies to respond quickly and prevent major damage to systems and data.

- Regulatory Compliance Monitoring: It helps companies stay in line with changing laws and industry regulations. By tracking compliance metrics and generating reports, businesses can avoid fines and legal trouble. It also supports audits and builds trust with stakeholders and regulators.

- Supply Chain Risk Assessment: Businesses use analytics to identify weak spots in their supply chains, such as delays, vendor risks, or transportation issues. By using real-time and historical data, they can make smarter decisions to reduce disruptions. This ensures smoother operations and better customer service.

Market Dynamic

Driving Factors in the US Risk Analytics Market

Increased Digitalization and Data Generation

As businesses across the US continue to adopt digital tools and platforms, the amount of data being generated has surged. From customer transactions and employee records to supply chain logs and cybersecurity logs, organizations now have access to a large volume of information, which presents both opportunities and risks, making it essential for companies to use analytics to extract insights and identify potential threats.

Risk analytics tools help convert raw data into actionable strategies, enabling businesses to stay ahead of risks before they cause harm. The digital transformation across sectors like finance, healthcare, and manufacturing is pushing demand for smart, automated analytics solutions. With cloud computing and IoT expanding, the need for real-time risk assessment is only growing. This ongoing shift continues to be a major driver for the risk analytics market.

Growing Regulatory Pressure and Compliance Needs

In recent years, US businesses have faced increasing regulatory demands, mainly in industries like banking, healthcare, and energy. Regulatory bodies require companies to maintain transparency, monitor risk exposure, and report data accurately and on time. Failing to meet these standards can result in serious penalties, making compliance a top priority.

Risk analytics tools provide the ability to track key metrics, conduct scenario analysis, and produce reports that align with regulatory expectations, which makes them essential for avoiding fines and maintaining operational licenses. As rules become more complex and frequent, mainly around data privacy and financial practices, businesses are turning to analytics platforms to stay compliant. The need to manage compliance efficiently and reduce legal risks is driving more organizations to invest in risk analytics solutions.

Restraints in the US Risk Analytics Market

High Implementation Costs and Complexity

One of the key restraints facing the U.S. risk analytics market is the high cost and complexity of implementing advanced analytics systems. Many risk analytics platforms require significant investment in software, hardware, and skilled personnel. Small and mid-sized businesses may find it difficult to allocate the necessary budget or resources to adopt these technologies.

Additionally, integrating risk analytics tools with existing systems can be technically challenging and time-consuming. The process often involves data migration, training, and ongoing support, which can further increase costs. For organizations without in-house expertise, relying on external consultants adds to the expense. These barriers can delay or limit adoption, mainly among companies with limited digital infrastructure.

Data Privacy Concerns and Limited Data Quality

Another major restraint is the concern around data privacy and the quality of data being analyzed. Risk analytics depends heavily on collecting and processing large volumes of sensitive information, which raises concerns about how that data is stored, used, and protected. With strict data privacy regulations like the California Consumer Privacy Act (CCPA), businesses must be cautious about how they handle customer and employee data.

At the same time, poor data quality, such as incomplete, outdated, or inconsistent information, can reduce the accuracy of analytics results, which limits the value of the insights and may lead to wrong decisions. Companies must invest in data governance and cleaning processes, which can be resource-intensive, especially for firms still developing their data infrastructure.

Opportunities in the US Risk Analytics Market

Adoption of Artificial Intelligence and Machine Learning

The growing use of artificial intelligence (AI) and machine learning (ML) presents a major opportunity for the US risk analytics market. These technologies can enhance the accuracy and speed of risk detection by learning from patterns in large data sets. AI-driven tools can predict potential threats earlier, automate decision-making processes, and reduce the need for manual monitoring, which is mainly valuable in sectors like finance, where quick responses to market changes are critical.

As AI continues to evolve, its ability to adapt to new risk scenarios will enhance, offering even more value to businesses. Companies that invest in AI-powered risk analytics stand to gain a competitive advantage. The rising interest in AI across industries creates strong growth potential for innovative risk analytics solutions.

Expansion across Non-Traditional Sectors

Traditionally, risk analytics has been heavily used in finance and insurance, but there is a growing opportunity in newer sectors like retail, manufacturing, healthcare, and logistics. These industries are mainly recognizing the value of data-driven risk management to protect operations, reputation, and profitability. For instance, healthcare providers can use risk analytics to minimize patient safety incidents, while retailers can assess supply chain vulnerabilities.

As these sectors embrace digital transformation, their demand for advanced analytics tools is growing, which provides new markets for solution providers and allows for more customize applications based on industry-specific risks. The broadening of risk analytics use beyond traditional users signals a promising expansion path for the US market.

Trends in the US Risk Analytics Market

Integration of ESG Factors into Risk Analytics

A notable trend in the US risk analytics market is the increasing incorporation of Environmental, Social, and Governance (ESG) factors into risk assessment frameworks. Organizations are recognizing the importance of evaluating risks related to climate change, social responsibility, and corporate governance to ensure long-term sustainability. By integrating ESG considerations, businesses can better identify potential vulnerabilities and align their strategies with broader societal expectations. This holistic approach to risk management not only enhances decision-making but also fosters transparency and accountability. As stakeholders demand greater corporate responsibility, the emphasis on ESG integration within risk analytics is expected to grow, driving innovation and adoption in this area.

Advancements in AI and Machine Learning for Predictive Risk Modeling

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming the landscape of risk analytics in the U.S. These advanced tools enable organizations to analyze vast datasets, uncover complex patterns, and predict potential risks with greater accuracy. By leveraging AI and ML, businesses can move from reactive to proactive risk management, identifying threats before they materialize.

This shift enhances operational efficiency and supports more informed decision-making. As technological capabilities continue to evolve, the integration of AI and ML into risk analytics is anticipated to become increasingly sophisticated, offering deeper insights and more robust predictive models.

Research Scope and Analysis

By Component Analysis

Software segment will be leading in 2025 with a share of 61.7%, driven by the growing need for advanced platforms that can quickly process and analyze large sets of risk-related data. Businesses across sectors are relying on software tools to improve decision-making, reduce uncertainties, and comply with regulations. These tools offer real-time insights, customizable dashboards, and integration with existing systems, making them a preferred choice.

As risks become more complex, companies need flexible and scalable software solutions that can adapt to new challenges. The rise of cloud-based platforms and user-friendly interfaces is also encouraging more adoption. With the growing volume of structured and unstructured data, the software component is playing a key role in helping organizations monitor financial, cyber, and operational risks effectively. Its importance is expected to grow as digital transformation deepens across industries.

Further, services segment is having significant growth over the forecast period, driven by the rising demand for consulting, support, and system integration services in risk analytics. Many companies lack in-house expertise to deploy and manage analytics platforms, so they turn to service providers for help in customizing tools, training staff, and ensuring smooth implementation.

These services are essential for maximizing the value of risk analytics investments, especially in industries with strict compliance needs. As technology continues to evolve, businesses are also seeking ongoing maintenance and upgrades, which adds to the service segment’s value. The need for expert guidance in interpreting risk data and building strategies makes this component a critical part of the market’s expansion.

By Deployment Mode Analysis

In 2025, Cloud deployment mode will dominate in the US market with a share of 57.1%, driven by the growing need for flexibility, cost-efficiency, and remote access in risk analytics solutions. Cloud platforms allow businesses to scale their operations easily and access data anytime, from anywhere, which is especially important in today’s fast-paced and mobile work environment. Companies benefit from faster setup, automatic updates, and reduced hardware costs when using cloud-based risk analytics tools.

These platforms also offer enhanced data storage capacity and real-time collaboration across departments and locations. As more businesses move their systems to the cloud, the demand for secure, reliable, and high-performance analytics solutions continues to rise. With built-in disaster recovery and easier integration options, cloud deployment is becoming the preferred choice for organizations focused on digital transformation and proactive risk management.

Also, the on-premises deployment mode will have significant growth over the forecast period, driven by companies that prioritize complete control over their data and system infrastructure, as it is preferred by businesses in highly regulated industries, like finance, defense, and healthcare, where data privacy, compliance, and internal security are critical. On-premises solutions allow organizations to customize their systems to meet specific operational needs while keeping sensitive information within their network.

Despite the growing popularity of cloud, many enterprises still rely on in-house IT teams and physical servers to manage risk analytics platforms. The ability to ensure data confidentiality and meet internal policy requirements makes on-premises deployment a strong option for risk-averse businesses. Its steady growth is supported by organizations that seek stable, long-term infrastructure investments for advanced risk monitoring and analysis.

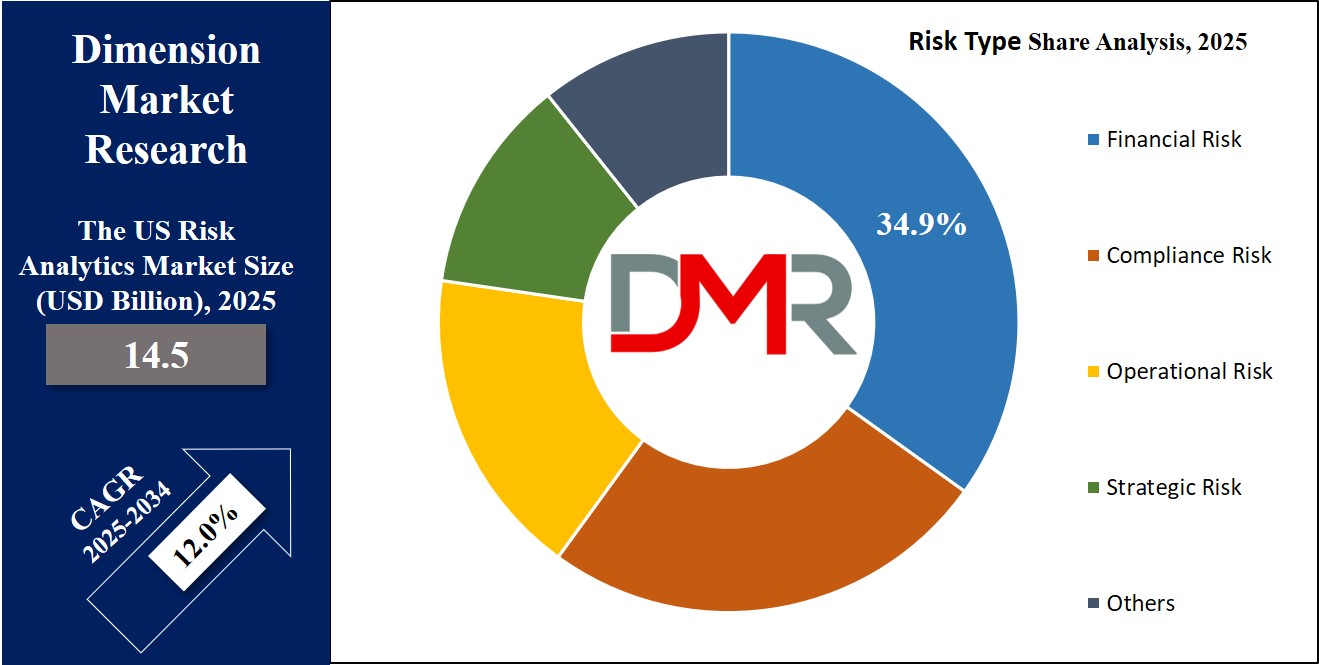

By Risk Type Analysis

The financial risk segment is set to have a prominent position in the US Risk Analytics Market in 2025 with a share of 34.9%, fueled by the rising need among businesses to manage market volatility, credit exposure, and liquidity issues. Companies in banking, insurance, and investment sectors are using risk analytics tools to monitor cash flow, detect fraud, and evaluate creditworthiness in real time. With the economy facing uncertainty and interest rates fluctuating, financial institutions are under pressure to maintain stability and protect their assets.

Analytics solutions help assess risks tied to loans, investments, and currency shifts, allowing firms to make smarter, data-backed decisions. The focus on improving forecasting accuracy and reducing losses is driving adoption. As financial regulations tighten and global markets remain unpredictable, the demand for advanced financial risk analysis will continue to support market expansion and innovation in analytics technology.

Also, the Compliance risk segment is having significant growth over the forecast period, driven by the increasing complexity of regulatory frameworks across various U.S. industries. Organizations are under constant pressure to meet legal and policy requirements, especially in sectors like healthcare, finance, and energy. Failure to comply can result in heavy penalties, reputational damage, and operational disruptions.

Risk analytics tools help companies track compliance metrics, monitor reporting processes, and ensure timely updates to meet changing laws. These solutions offer real-time alerts and detailed reporting to support internal audits and external reviews. As businesses face stricter guidelines and more frequent inspections, the need for effective compliance risk management is rising. The focus on transparency, accountability, and risk prevention is fueling demand for analytics platforms that help stay ahead of regulatory issues.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

The large enterprises segment will be leading in 2025 with a share of

71.5%, driven by their complex risk management needs and larger budgets for advanced analytics solutions. These organizations typically face more diverse risks, ranging from financial and operational to cybersecurity and compliance. To address these, large businesses rely heavily on risk analytics tools to monitor and assess risks across various departments in real-time.

The scale and diversity of their operations make it crucial to have robust, integrated systems that can handle large volumes of data, provide accurate forecasts, and optimize decision-making. Additionally, large enterprises often have the resources to invest in cutting-edge technologies like artificial intelligence and machine learning, further driving the demand for sophisticated risk analytics solutions.

SME segment is set to have significant growth over the forecast period, driven by their increasing awareness of the need for risk management tools despite smaller budgets. Small and medium-sized enterprises are facing growing challenges in areas like cybersecurity, supply chain disruptions, and financial uncertainty. To remain competitive, many SMEs are turning to risk analytics solutions that offer cost-effective ways to assess potential risks and protect their operations.

These tools help smaller organizations monitor risks more effectively, even without extensive in-house teams. As the accessibility of risk analytics platforms improves, more SMEs are adopting these solutions to strengthen their decision-making and safeguard against potential threats, contributing to their steady market growth.

By Application Analysis

Based on application, the fraud detection & prevention application will be leading in 2025 with a share of 27.1%, as businesses increasingly prioritize protecting their operations and customers from financial fraud. With the rise of digital transactions and online activity, organizations are facing a higher risk of fraudulent activities such as identity theft, payment fraud, and cyberattacks. Risk analytics tools equipped with fraud detection capabilities help companies monitor transactions in real-time, identify suspicious behavior, and prevent fraudulent activities before they escalate.

By using advanced algorithms and pattern recognition, these tools improve the accuracy and speed of fraud detection, reducing financial losses and safeguarding the company’s reputation. As fraud schemes become more sophisticated, the demand for advanced fraud detection solutions continues to grow, making this application a key driver of market expansion.

Also, real-time situation awareness applications are having significant growth over the forecast period, driven by the increasing need for organizations to respond quickly to emerging risks and threats. With the rise of digital environments and global operations, businesses must be able to monitor potential disruptions in real time to make informed decisions. Risk analytics tools that offer real-time alerts and situational insights allow companies to act swiftly and prevent significant losses.

Whether dealing with cybersecurity breaches, market fluctuations, or supply chain disruptions, real-time awareness helps businesses stay agile and minimize the impact of unforeseen events. As the business landscape becomes more interconnected and volatile, the demand for tools that provide immediate insights and actionable intelligence is growing, making this application a critical part of risk management strategies.

By End Use Industry Analysis

In 2025, BFSI (Banking, Financial Services, and Insurance) will be leading 2025 with a share of 39.1%, driven by the growing need for financial institutions to manage risks such as credit, market, operational, and liquidity risks. With increasing regulations and market uncertainties, BFSI companies rely on risk analytics solutions to gain deeper insights into risk exposures, improve decision-making, and ensure compliance with evolving rules.

These tools help identify potential fraud, detect anomalies in transactions, and optimize investment strategies in real-time. By using advanced analytics, banks, insurance firms, and other financial service providers can minimize losses, enhance operational efficiency, and safeguard against financial uncertainties. As the industry becomes more digitized and interconnected, the demand for sophisticated risk management tools continues to rise, solidifying BFSI’s leading role in the growth of the US risk analytics market.

Also, Healthcare is experiencing significant growth over the forecast period, as the healthcare industry faces increasing risks related to patient data security, regulatory compliance, and operational inefficiencies. Healthcare providers are turning to risk analytics tools to assess and manage these challenges effectively. Risk analytics helps healthcare organizations monitor patient safety, predict potential health risks, and improve resource management.

It also aids in detecting fraud and ensuring compliance with regulations such as HIPAA. With the growing complexity of healthcare delivery, including telemedicine and electronic health records, the demand for advanced risk management solutions is rising. As healthcare becomes more data-driven, organizations are adopting analytics tools to safeguard both patient care and their operations, contributing to the sector’s significant growth in the risk analytics market.

The US Risk Analytics Market Report is segmented on the basis of the following:

By Component

- Software

- Risk Calculation Engines

- ETL Tools

- Scorecard and Visualization Tools

- Dashboard Analytics and Risk Reporting Tools

- Services

- Professional Services

- Managed Services

By Deployment Mode

By Risk Type

- Strategic Risk

- Operational Risk

- Financial Risk

- Compliance Risk

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- Fraud Detection and Prevention

- Credit Risk Management

- Liquidity Risk Management

- Risk Reporting and Monitoring

- Regulatory and Compliance Risk

- Real-time Situation Awareness

By End Use Industry

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and Consumer Goods

- Energy and Utilities

- Government and Defense

- Transportation and Logistics

- Others

Competitive Landscape

The competitive landscape of the US risk analytics market is dynamic and growing quickly, with many players providing tools and services to help businesses manage risk more effectively. Some companies focus on financial risk, while others specialize in cybersecurity, compliance, or operational risk. The market contains both long-established firms and newer tech-driven entrants that use artificial intelligence and big data.

Competition is based on factors like technology, accuracy, ease of use, and the ability to provide real-time insights. Cloud-based solutions and customizable platforms are becoming more popular as businesses look for flexible, scalable options. As regulations and threats evolve, companies in this space are constantly improving their products to stay ahead and meet the changing needs of their customers.

Some of the prominent players in the US Risk Analytics are:

- SAS

- SAP

- IBM

- FIS

- MSCI

- BAE Systems

- Accenture

- Aon

- Experian

- Resolver

- ZRisk

- n Task

- Kyriba

- LogicGate

- CloudRisk

- CubeLogic

- Finastra

- VComply

- Riskalyze

- Other Key Players

Recent Developments

- In May 2025, Behavox launched its Data Risk Controls and Reconciliation Program to strengthen organizational data risk management amid growing regulatory pressure. Over the past four years, Behavox has partnered with Global Systemically Important Banks and Commodities Traders to improve data controls in line with global regulations. As scrutiny from internal and external bodies like the SEC, FCA, ASIC, and FINRA intensifies, firms are increasingly focused on data integrity and governance. Behavox has helped clients successfully meet audit and remediation requirements.

- In May 2025, KatRisk acquired Gamma, a leader in location intelligence and property-level risk assessment, which strengthens KatRisk’s capabilities in delivering advanced risk analytics and innovative technologies for better decision-making. Gamma is known for its trusted property risk data and its flagship platform, Perilfinder™, which provides detailed address-level risk assessment and exposure management. The solution is widely used by major global insurers for underwriting and risk evaluation.

- In January 2025, Moody’s Corporation announced its plans to acquire CAPE Analytics, a leading provider of geospatial AI for residential and commercial property risk analysis, which will merge Moody’s Intelligent Risk Platform and catastrophe risk modeling expertise with CAPE’s AI-driven property insights, creating a powerful, address-specific property risk database. Further, the integration responds to customer demand for more precise and actionable risk data, enhancing property risk analytics and improving decision-making across the entire insurance value chain.

- In October 2024, Duck Creek Technologies acquired Risk Control Technologies, Inc. (RCT), a Toronto-based provider of risk management and loss control solutions, to enhance how insurers prevent losses and manage risk, which integrates advanced AI and machine learning to address growing global threats like climate change and cyber risks. Further, the partnership aims to help insurers collaborate more closely with policyholders to improve safety and future preparedness.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.5 Bn |

| Forecast Value (2034) |

USD 40.3 Bn |

| CAGR (2025–2034) |

12.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (On-Premise and Cloud), By Risk Type (Strategic Risk, Operational Risk, Financial Risk, Compliance Risk, and Others), By Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), By Application (Fraud Detection and Prevention, Credit Risk Management, Liquidity Risk Management, Risk Reporting and Monitoring, Regulatory and Compliance Risk, and Real-time Situation Awareness), By End Use Industry (BFSI, Healthcare, IT and Telecom, Manufacturing, Retail and Consumer Goods, Energy and Utilities, Government and Defense, Transportation and Logistics, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

SAS, SAP, IBM, FIS, MSCI, BAE Systems, Accenture, Aon, Experian, Resolver, ZRisk, n Task, Kyriba, LogicGate, CloudRisk, CubeLogic, Finastra, VComply, Riskalyze, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the US Risk Analytics Market?

▾ The Global Risk Analytics Market size is expected to reach a value of USD 14.5 billion in 2025 and is expected to reach USD 40.3 billion by the end of 2034.

Who are the key players in the US Risk Analytics Market?

▾ Some of the major key players in the US Risk Analytics Market are SAS, SAP, IBM, and others

What is the growth rate in the US Risk Analytics Market?

▾ The market is growing at a CAGR of 12.0 percent over the forecasted period.