US Tire Recycling Market Overview

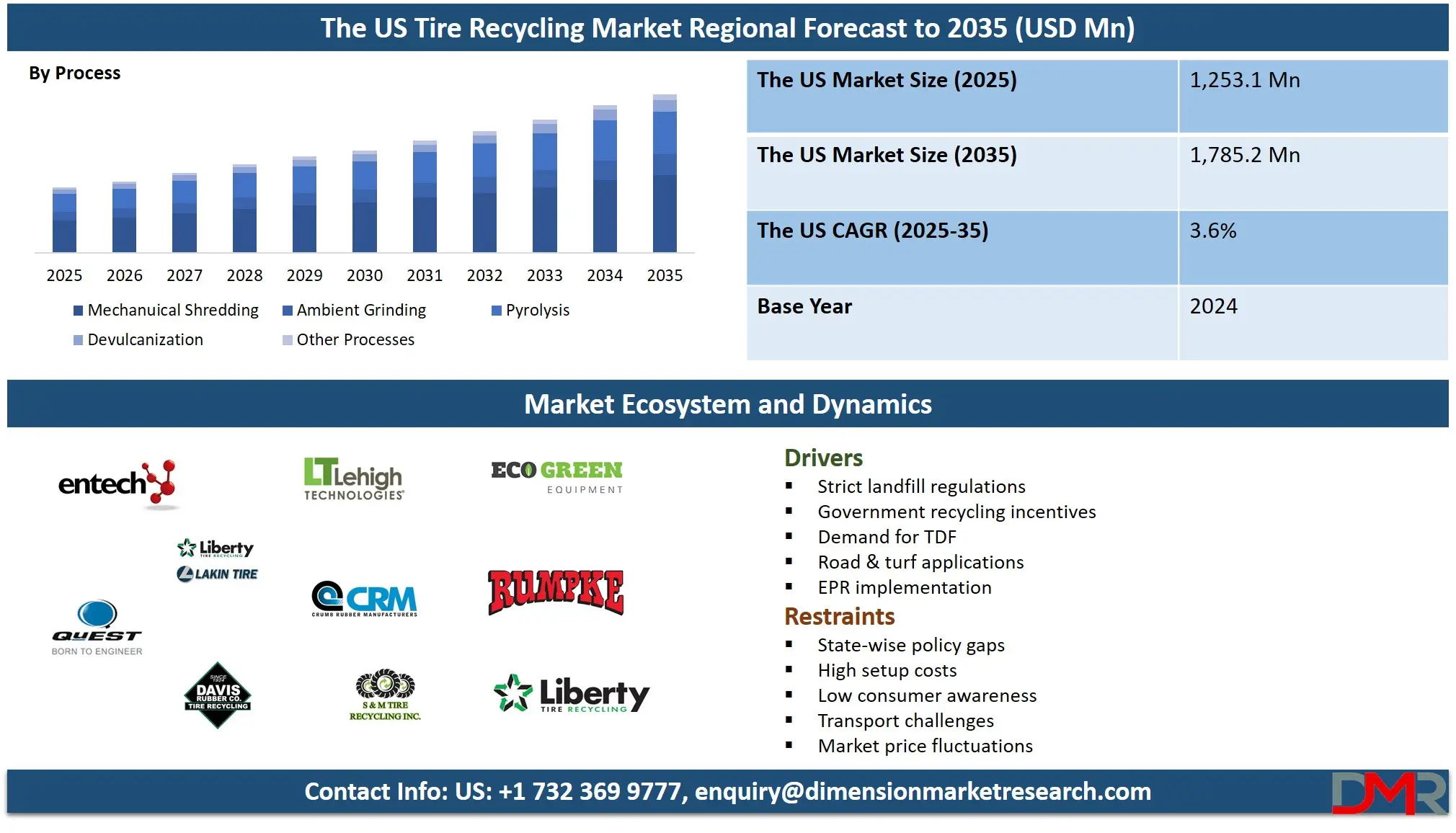

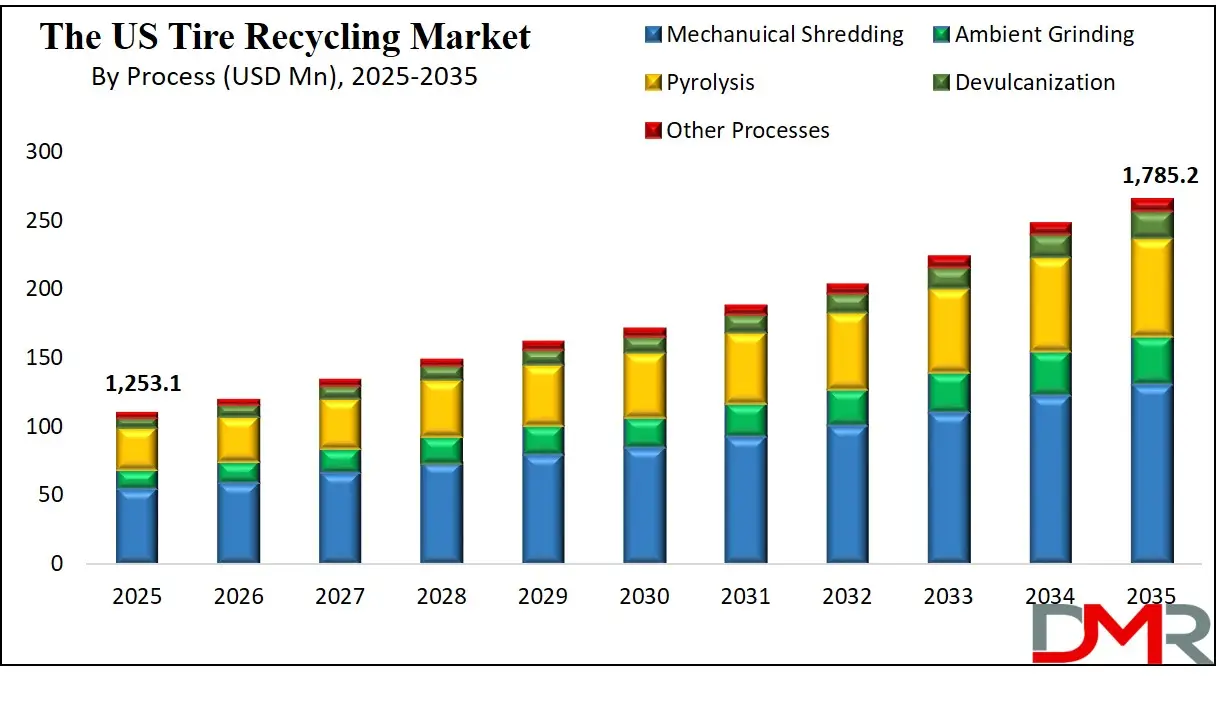

The US tire recycling market is projected to grow from USD 1,253.1 million in 2025 to USD 1,785.2 million by 2035, registering a CAGR of 3.6%. This growth is driven by rising demand for tire-derived products, increased scrap tire generation, and supportive recycling regulations. The market reflects expanding applications in rubberized asphalt, tire-derived fuel, and molded rubber goods, alongside a growing focus on sustainable waste management and circular economy practices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Tire Recycling refers to the process of converting end-of-life tires into reusable materials through mechanical, chemical, or thermal methods. These discarded tires, if left unmanaged, pose significant environmental and health hazards due to their bulk and non-biodegradable nature. Recycling enables the recovery of valuable resources such as rubber, steel, and textile fibers, which are repurposed into a wide range of products, including rubberized asphalt, playground surfaces, fuel, and construction materials. The process not only reduces landfill dependency and fire hazards but also helps conserve natural resources and minimize greenhouse gas emissions. Advanced techniques like pyrolysis, cryogenic grinding, and devulcanization have expanded the scope of tire reuse, contributing to the development of a circular economy within the waste management and materials recovery sectors.

The US tire recycling market is a mature and evolving landscape shaped by strict environmental regulations, strong public-private partnerships, and growing demand for sustainable materials. With over 250 million scrap tires generated annually, the country has established a well-connected infrastructure for collection, processing, and repurposing. State-led initiatives and federal funding programs have driven the development of processing facilities and end-use applications, supporting industries such as civil engineering, molded rubber goods, and tire-derived fuel production. The market is influenced by fluctuating raw material prices, technological innovations, and end-user industries’ emphasis on carbon footprint reduction. Government regulations such as landfill bans, performance-based grants, and recycling mandates continue to play a pivotal role in shaping tire recovery strategies and boosting investment in advanced recycling technologies.

In recent years, the US tire recycling industry has witnessed growing traction from the private sector, with startups and established players investing in scalable and eco-friendly solutions. The rise of green construction, infrastructure upgrades, and the adoption of circular economy models have further widened the demand for recycled rubber products and tire-derived materials. Key market dynamics include regional disparities in processing capacity, export restrictions on tire-derived products, and the growing emphasis on cradle-to-cradle lifecycle assessments. While traditional applications like TDF and ground rubber remain dominant, new value chains are emerging through innovations in rubber asphalt, synthetic turf infill, and devulcanized rubber for manufacturing. This shift underscores the market’s role in supporting sustainable development, reducing environmental risks, and unlocking economic value from waste tires.

The US Tire Recycling Market: Key Takeaways

- Market Value: The US tire recycling market size is expected to reach a value of USD 1,785.2 million by 2035 from a base value of USD 1,253.1 million in 2025 at a CAGR of 3.6%.

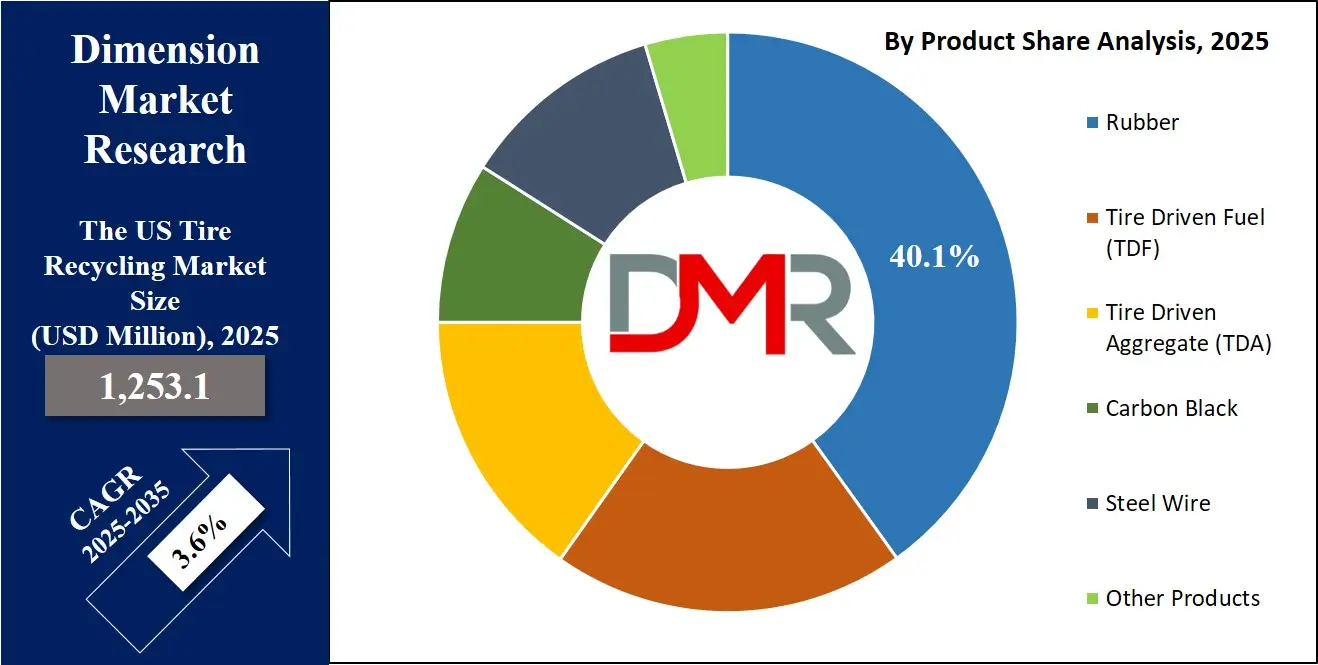

- By Product Segment Analysis: Rubber products are anticipated to dominate the product segment, capturing 40.1% of the total market share in 2025.

- By Process Type Segment Analysis: Mechanical Shredding is expected to maintain its dominance in the process type segment, capturing 49.3% of the total market share in 2025.

- By Tire Type Segment Analysis: Passenger car tires are expected to consolidate their position in the tire type segment, capturing 71.9% of the market share in 2025.

- By End-User Segment Analysis: Construction users are poised to consolidate their dominance in the end-user segment, capturing 29.5% of the total market share in 2025.

- Key Players: Some key players in the US tire recycling market Entech Inc., Lakin Tire, Quest (Questrmg), Davis Rubber Company Inc., Lehigh Technologies, CRM, S&M Tire Recycling Inc., Eco Green Equipment, Rumpke, Liberty Tire Recycling, BDS Tire Recycling, Front Range Tire Recycling Inc., Technical Rubber Company (TRC), FBS Tire Recycling, and other prominent players.

The US Tire Recycling Market: Use Cases

- Rubberized Asphalt in State Highway and Municipal Road Projects: Rubberized asphalt is a significant application of recycled tires in the US, widely adopted by departments of transportation (DOTs) across states like Arizona, California, and Texas. Crumb rubber from processed scrap tires is blended into asphalt to improve durability, skid resistance, and noise reduction. This sustainable infrastructure solution also offers superior crack resistance and a longer lifecycle, reducing maintenance costs. Federal and state-level funding under initiatives like the Bipartisan Infrastructure Law further incentivizes the use of eco-friendly materials in public works. The demand for tire-derived asphalt continues to rise, aligning with both emission reduction goals and circular economy practices in transportation engineering.

- Tire-Derived Fuel (TDF) for Cement and Pulp & Paper Industries: Tire-derived fuel plays a vital role in energy recovery from end-of-life tires in the US. TDF is utilized as a supplemental fuel in energy-intensive industries such as cement manufacturing and paper mills, particularly in the Midwest and Southeast regions. With high BTU content, TDF offers a cleaner-burning alternative to coal, reducing fuel costs and overall emissions. EPA-recognized as a viable resource recovery solution, TDF supports environmental regulations and sustainability goals. This use case reflects the growing push toward alternative fuels and waste-to-energy models in industrial operations, creating a steady demand channel for tire recyclers.

- Crumb Rubber in Sports Fields and Playground Surfaces: The use of crumb rubber in athletic fields, playgrounds, and landscaping products is well established in the US. Local governments, schools, and recreational centers source recycled rubber mulch and infill for synthetic turf systems due to its shock absorption, durability, and low maintenance. States like New York and Florida have been at the forefront of adopting these solutions, with safety and environmental performance as key criteria. As public demand grows for resilient and eco-conscious outdoor surfaces, especially in urban settings, the market for tire-derived crumb rubber continues to expand across educational and municipal projects.

- Molded Recycled Rubber Products for Commercial and Industrial Use: US manufacturers are incorporating recycled tire rubber into molded products such as loading dock bumpers, railroad crossing mats, parking lot curbs, and flooring tiles. These products offer long service life and resistance to weather and abrasion. With rising interest in sustainable building materials and recycled-content certifications like LEED, demand is growing in both the commercial construction and transportation sectors. Companies in the Northeast and Midwest are leveraging these materials for green construction and infrastructure development, supporting both environmental compliance and cost savings. This use case underscores the role of tire recycling in creating market-ready, high-performance rubber products that align with modern sustainability standards.

Impact of Artificial Intelligence on the US Tire Recycling Market

Artificial Intelligence (AI) is emerging as a transformative force in the US tire recycling market, driving efficiency, automation, and innovation across the entire value chain. From collection and sorting to processing and quality control, AI-powered technologies are optimizing operational workflows, reducing human error, and enabling predictive maintenance. The integration of machine learning algorithms and smart sensors in shredding equipment and conveyor systems allows real-time monitoring of tire conditions and contamination levels, significantly improving material recovery rates and plant productivity.

AI is also enhancing decision-making through data analytics, helping recyclers forecast scrap tire supply trends, track inventory, and streamline logistics. By analyzing historical data and market patterns, AI tools can predict demand for tire-derived products like crumb rubber, rubberized asphalt, and tire-derived fuel, enabling companies to adjust production and reduce waste. Moreover, AI-driven robotic sorting systems are being deployed to identify and separate usable components such as steel, fiber, and rubber with greater precision.

The impact of AI extends to environmental compliance and regulatory reporting as well. Smart monitoring systems ensure facilities meet emissions and safety standards while reducing the administrative burden of manual documentation. As sustainability becomes a competitive differentiator, AI-powered platforms help tire recyclers align with ESG goals, improve supply chain transparency, and provide traceability across recycled materials.

Overall, the adoption of artificial intelligence is positioning the US tire recycling market for a smarter, more sustainable future, supporting circular economy objectives while reducing operational costs and enhancing material recovery efficiency.

The US Tire Recycling Market: Stats & Facts

- USTMA (U.S. Tire Manufacturers Association) – 2023 Data & 2025 Outlook

- In 2023, the U.S. generated approximately 250 million end-of-life tires (ELTs); 79% of them were recycled or reclaimed, up from 71% in 2021.

- Tire-derived fuel (TDF) remained the largest reuse market, consuming 33% of ELTs, while 28% went into ground rubber applications.

- ELT exports nearly tripled between 2021 and 2023, and rose 83% compared to 2019.

- USTMA’s vision is for 100% ELT circularity by mid-2020s, to eliminate all remaining 48 million stockpiled tires by 2025.

- The U.S. tire industry had a total economic impact of USD 170.6 billion in 2023–24.

- It supported 291,000 direct jobs and over 801,000 total jobs across its supply chain.

- Total U.S. tire shipments in 2023 were 325.4 million units, down from 332.0 million in 2022 (−2%).

- Replacement passenger tire shipments were 210.5 million units (−1.5% YoY).

- Replacement light-truck tire shipments stood at 35.9 million units (−3.6%).

- Replacement truck/bus tire shipments dropped to 22.4 million units (−16%).

- OE (Original Equipment) passenger tires reached 43.9 million units (+5.6%).

- EPA (U.S. Environmental Protection Agency) – Lifecycle & Recycling Insights (2023)

- Over 90% of ELTs in the U.S. go through mechanical grinding or open-loop recycling methods (EPA WARM Model, 2023).

- EPA’s WARM tool identifies major reuse pathways: rubber aggregate, steel recovery, and fuel blending as top channels.

- Lifecycle analysis reveals significant environmental gains from reusing tires in infrastructure projects (e.g., roads, levees, landfills).

- ELT recycling helps reduce landfill pressure and emissions, replacing fossil fuels and virgin raw materials in industrial processes.

- EPA continues to model environmental and health impacts of tire leachates, microplastics, and pyrolysis byproducts (2023 study cohort).

- U.S. tire recycling infrastructure is integrated with EPA-approved sustainable materials recovery programs at the state level.

The US Tire Recycling Market: Market Dynamics

The US Tire Recycling Market: Driving Factors

Growing Scrap Tire Generation and Environmental Regulations

The rising volume of end-of-life tires generated annually across the United States is a primary driver of the tire recycling market. With over 250 million scrap tires produced each year, effective waste tire management has become a national priority. Federal and state environmental agencies have enforced strict landfill bans, recycling mandates, and tire disposal fees to combat illegal dumping and reduce fire hazards. These policies are fueling investments in advanced tire recycling facilities, pushing the market toward sustainable material recovery and circular economy integration.

Expansion of Infrastructure and Green Construction Projects

Increased adoption of recycled rubber products in construction, especially in rubberized asphalt, noise barriers, and impact-absorbing surfaces, is accelerating market growth. Supported by federal infrastructure spending and initiatives promoting eco-friendly building materials, tire-derived products are being incorporated into roads, parking lots, and recreational facilities. This aligns with the push for carbon footprint reduction and long-term cost-efficiency, driving consistent demand for crumb rubber and tire-derived raw materials.

The US Tire Recycling Market: Restraints

Volatile Market for Tire-Derived Products

Fluctuations in the demand and pricing of tire-derived fuel (TDF) and crumb rubber can impact the profitability of tire recyclers. Competition from low-cost virgin materials and inconsistent buyer demand, especially in the cement and energy industries, limits stable revenue streams. This volatility discourages long-term investments in recycling infrastructure and may affect the operational scalability of small- to mid-sized recyclers.

High Initial Costs of Recycling Equipment and Technology

Setting up a tire recycling plant requires substantial capital investment in shredders, granulators, cryogenic systems, and pollution control mechanisms. While automation and AI-based sorting systems improve efficiency, the upfront costs pose a significant barrier for new entrants. Additionally, maintenance and skilled labor need further increase operating expenses, especially in states with limited recycling subsidies or support programs.

The US Tire Recycling Market: Opportunities

Integration of AI and Automation in Recycling Operations

The use of artificial intelligence, robotics, and machine vision technology presents a major opportunity for recyclers to improve throughput, reduce contamination, and increase product purity. Smart conveyor systems and automated material sorting enhance efficiency, enabling recyclers to meet growing quality standards for tire-derived materials. This technology also supports real-time monitoring and predictive maintenance, optimizing operational costs and expanding capacity.

Rising Demand for Sustainable Consumer and Industrial Products

As industries and consumers shift toward eco-conscious manufacturing and products, there’s growing interest in using recycled rubber in automotive components, flooring, mats, and landscaping solutions. Government incentives for green procurement and sustainability certifications like LEED are encouraging businesses to source recycled-content goods, creating new market segments and expanding the use cases for tire-derived inputs.

The US Tire Recycling Market: Trends

Shift toward Circular Economy and Closed-Loop Systems

The US tire recycling market is embracing closed-loop recycling models, where waste tires are transformed back into raw materials for high-value applications. Companies are focusing on devulcanization technologies that allow recycled rubber to be reused in tire manufacturing or molded products, reducing dependency on virgin resources. This trend supports corporate ESG goals and aligns with national sustainability frameworks.

Emergence of Pyrolysis and Advanced Thermal Processing

Innovations in pyrolysis and gasification are gaining traction as viable alternatives to mechanical recycling. These thermal methods break down tires into oil, carbon black, and syngas, which can be reused in energy generation and chemical industries. With advancements in emission control systems, pyrolysis is being seen as a scalable solution for processing non-recyclable tire residues, contributing to zero-waste targets and new revenue streams.

The US Tire Recycling Market: Research Scope and Analysis

By Product Analysis

In the US tire recycling market, rubber products are projected to dominate the product segment, accounting for approximately 40.1% of the total market share in 2025. This dominance is driven by the widespread use of recycled rubber in various applications such as playground surfaces, rubber tiles, flooring, molded goods, and automotive components. The durability, shock absorption, and cost-efficiency of crumb rubber make it an attractive alternative to virgin materials, particularly in construction and recreational sectors. Additionally, the growing demand for sustainable and recycled materials in green building projects and infrastructure development further contributes to the growing share of rubber-based products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Tire-Derived Fuel (TDF) is another key product segment within the US tire recycling market, utilized primarily by the cement, pulp and paper, and industrial boiler sectors. TDF offers a high calorific value and serves as an effective substitute for traditional fossil fuels like coal and petroleum coke. It contributes to reduced fuel costs and emissions, aligning with cleaner energy practices. Although it holds a smaller share compared to rubber products, the consistent demand for alternative fuel sources in energy-intensive industries ensures TDF remains a critical revenue stream for tire recyclers. However, its growth is somewhat restrained by regulatory scrutiny and concerns about emissions, prompting the industry to adopt more advanced and cleaner combustion technologies.

By Process Analysis

Mechanical shredding is expected to remain the leading process type in the US tire recycling market, accounting for approximately 49.3% of the total market share in 2025. This dominance is attributed to the widespread availability, cost-effectiveness, and operational simplicity of shredding systems. Mechanical shredding involves the physical breakdown of tires into chips, granules, or crumb rubber, which are then used in various applications such as rubberized asphalt, molded goods, and playground surfaces. The process does not require complex technology or high energy inputs, making it the preferred choice for many recycling facilities across the country. Its compatibility with existing infrastructure and its ability to produce high-quality tire-derived materials further strengthen its position in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Pyrolysis, on the other hand, represents an emerging process type that is gaining attention for its ability to convert end-of-life tires into valuable byproducts such as pyrolysis oil, recovered carbon black, and synthetic gas. Unlike mechanical methods, pyrolysis involves the thermal decomposition of tires in an oxygen-free environment, offering a solution for handling tires that are not suitable for material recovery. While its current market share is smaller, pyrolysis is gradually gaining traction due to its potential in waste-to-energy applications and the circular use of tire-derived outputs in industrial and chemical sectors. However, challenges such as high capital investment, emission controls, and regulatory approvals are limiting its widespread adoption, although ongoing technological advancements and environmental incentives may help accelerate its growth in the coming years.

By Tire Type Analysis

Passenger car tires are projected to hold a dominant position in the tire type segment of the US tire recycling market, capturing around 71.9% of the total market share in 2025. This is primarily due to the high volume of passenger vehicles on American roads, which leads to a steady and significant generation of end-of-life tires. The widespread use of passenger cars for daily commuting, combined with regular tire replacement cycles, ensures a consistent inflow of scrap tires into the recycling stream. These tires are also more uniform in size and composition, making them easier and more cost-effective to process through mechanical shredding or grinding. Recycled materials from passenger car tires are commonly used in applications such as rubber mulch, flooring, playground surfaces, and rubber-modified asphalt, contributing to their large share in the overall market.

Light truck and SUV tires, while occupying a smaller portion of the market, represent a growing segment within tire recycling. The growing popularity of SUVs and pickup trucks in both urban and rural areas is leading to a rise in the disposal volume of these tire types. These tires are generally larger and more robust than passenger car tires, containing more steel and thicker rubber, which can make them more challenging to process. However, they also yield higher quantities of valuable materials such as crumb rubber and tire-derived fuel. As the demand for larger vehicles continues to grow across the US, especially in suburban and off-road usage areas, the recycling of light truck and SUV tires is expected to gain momentum and contribute more significantly to the overall market dynamics.

By End-User Analysis

In the US tire recycling market, the construction sector is projected to dominate the end-user segment, capturing around 29.5% of the total market share in 2025. This strong position is largely driven by the growing use of recycled rubber in infrastructure and civil engineering projects. Crumb rubber derived from scrap tires is being widely used in rubberized asphalt for roads, shock-absorbing flooring, sound barriers, and erosion control systems. These applications offer improved durability, reduced maintenance, and enhanced safety performance, making them a preferred choice for municipalities and contractors. Additionally, government-backed infrastructure programs and incentives promoting green construction practices are encouraging the adoption of tire-derived products, reinforcing the sector’s leadership in the recycling value chain.

The manufacturing sector also plays a vital role in the US tire recycling ecosystem, contributing significantly to demand for recycled tire materials. Reclaimed rubber is used in the production of molded goods such as automotive mats, industrial gaskets, conveyor belts, and rubber seals. Manufacturers are integrating recycled rubber into their product lines to reduce reliance on virgin materials and lower production costs. This shift is supported by the growing emphasis on sustainability, circular economy practices, and the need to meet environmental compliance standards. As a result, the manufacturing segment is expected to witness steady growth, driven by innovation in material formulation and expanding industrial use cases for tire-derived products.

The US Tire Recycling Market Report is segmented on the basis of the following:

By Product

- Rubber

- Tire Driven Fuel (TDF)

- Tire Driven Aggregate (TDA)

- Carbon Black

- Steel Wire

- Other Products

By Process

- Mechanical Shredding

- Ambient Grinding

- Pyrolysis

- Devulcanization

- Other Processes

By Tire Type

- Passenger Car Tires

- Light Truck and SUV Tires

- Commercial Truck/ Bus Tires

- Other Tire Types

By End-User

- Automotive

- Construction

- Manufacturing

- Rubber and Plastics

- Other End Users

The US Tire Recycling Market: Competitive Landscape

The competitive landscape of the US tire recycling market is characterized by a mix of established players and regional operators, each contributing to a well-structured yet highly dynamic ecosystem. Major companies such as Liberty Tire Recycling, Lakin Tire, Entech Inc., and CRM dominate through nationwide collection networks, advanced processing capabilities, and diversified product portfolios including crumb rubber, tire-derived fuel, and molded rubber goods. These players invest heavily in automation, environmental compliance, and end-market development to maintain a competitive edge.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

At the same time, smaller and mid-sized recyclers cater to localized demand, often specializing in specific processes like shredding, pyrolysis, or devulcanization. Strategic partnerships with municipalities, manufacturers, and construction firms are common across the industry, enabling consistent scrap tire flow and application-based revenue generation. As sustainability goals and circular economy initiatives gain momentum, competition is intensifying around innovation, regulatory alignment, and the ability to deliver high-quality, recycled tire materials at scale.

Some of the prominent players in the US Tire Recycling Market are:

- Entech Inc.

- Lakin Tire

- Quest (Questrmg)

- Davis Rubber Company Inc.

- Lehigh Technologies

- CRM

- S&M Tire Recycling Inc.

- Eco Green Equipment

- Rumpke

- Liberty Tire Recycling

- BDS Tire Recycling

- Front Range Tire Recycling Inc.

- Technical Rubber Company (TRC)

- FBS Tire Recycling

- Other Key Players

The US Tire Recycling Market: Recent Developments

- July 2025: Ecore International, a reclaimed rubber product manufacturer based in Lancaster, PA, acquired HTI Recycling of Lockport, NY (including Edge Rubber and D&G). This acquisition strengthens Ecore’s supply chain and expands its crumb-rubber production footprint in the Northeast. It adds 81 employees and aligns with Ecore’s circular economy strategy by enhancing its capacity to convert end-of-life tires into surfacing and flooring products.

- March 2025: Toyota Tsusho America announced its intent to acquire Radius Recycling, a scrap-metal and tire-derived materials operator, for USD 30/share (approximately USD 1.34 billion). The acquisition integrates tire-derived fuel and rubber into Toyota Tsusho’s automotive supply chain and marks a major push into circular materials infrastructure for automotive manufacturing and remanufacturing.

- January 2024: Liberty Tire Recycling acquired two Florida-based processors, Empire Tire (Edgewater) and McGee Tire (Apopka), enhancing its scrap tire collection, hauling, and processing operations in central Florida. The move expands Liberty’s regional footprint and operational capacity.

- December 2023: Ecore acquired Ameritread, a Pennsylvania-based network specializing in culling, refurbishing, and remanufacturing truck tires. The acquisition secures consistent feedstock and adds remanufacturing expertise, supporting Ecore’s drive to expand its material offerings in flooring and landscaping rubber products.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,253.1 Mn |

| Forecast Value (2035) |

USD 1,785.2 Mn |

| CAGR (2025–2035) |

3.6% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2035 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Rubber, Tire Derived Fuel (TDF), Tire Derived Aggregate (TDA), Carbon Black, Steel Wire, and Other Products), By Process (Mechanical Shredding, Ambient Grinding, Pyrolysis, Devulcanization, and Other Processes), By Tire Type (Passenger Car Tires, Light Truck and SUV Tires, Commercial Truck/Bus Tires, and Other Tire Types), and By End-User (Automotive, Construction, Manufacturing, Rubber and Plastics, and Other End Users) |

| Regional Coverage |

The US |

| Prominent Players |

Entech Inc., Lakin Tire, Quest (Questrmg), Davis Rubber Company Inc., Lehigh Technologies, CRM, S&M Tire Recycling Inc., Eco Green Equipment, Rumpke, Liberty Tire Recycling, BDS Tire Recycling, Front Range Tire Recycling Inc., Technical Rubber Company (TRC), FBS Tire Recycling, and other prominent players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the US Tires Recycling Market?

▾ The US tire recycling market size is estimated to have a value of USD 1,253.1 million in 2025 and is expected to reach USD 1.785.2 million by the end of 2035.

Who are the key players in the US tire recycling market?

▾ Some of the major key players in the US tire recycling market are Entech Inc., Lakin Tire, Quest (Questrmg), Davis Rubber Company Inc., Lehigh Technologies, CRM, S&M Tire Recycling Inc., Eco Green Equipment, Rumpke, Liberty Tire Recycling, BDS Tire Recycling, Front Range Tire Recycling Inc., Technical Rubber Company (TRC), FBS Tire Recycling, and other prominent players.

What is the growth rate in the US Tires Recycling Market?

▾ The market is growing at a CAGR of 3.6 percent over the forecasted period.