Market Overview

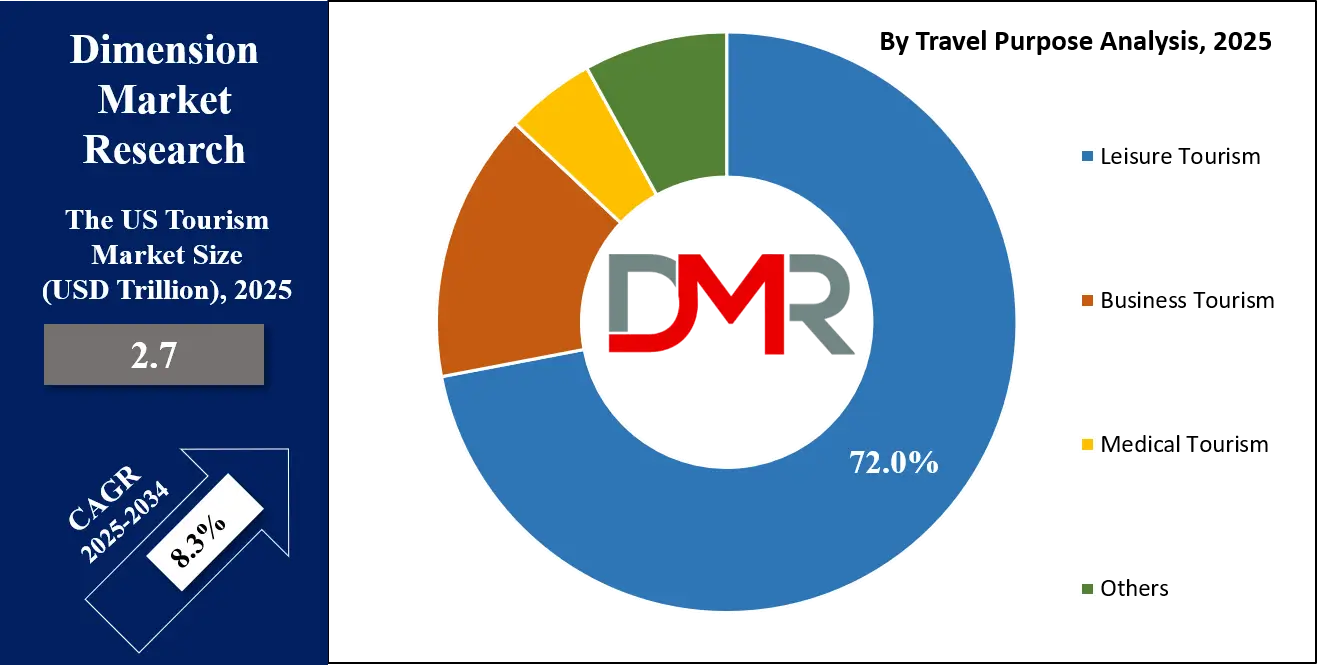

The US tourism market is projected to reach USD 2.7 trillion in 2024 and is expected to grow at a CAGR of 8.3% through 2033, ultimately achieving a market value of USD 5.6 trillion, driven by strong demand across leisure travel, business tourism, and online booking channels.

Tourism is the movement of people from one location to another for leisure, business, cultural exploration, or medical purposes, often involving travel beyond their usual surroundings. It is a dynamic social, cultural, and economic activity that encompasses not only the act of traveling but also the consumption of services such as accommodation, transportation, food and beverages, entertainment, and recreational activities. Tourism serves as a bridge for cultural exchange, contributes to regional development, and plays a pivotal role in shaping the identity of destinations while supporting millions of jobs and businesses across the globe.

The US tourism market represents one of the largest and most diverse travel economies in the world, attracting both domestic and international travelers with its mix of natural attractions, entertainment hubs, heritage sites, and modern infrastructure. The market includes leisure tourism, business travel, adventure tourism, medical travel, and educational trips, making it a multi-faceted sector with high economic significance.

Key contributors to this market are the hospitality industry, airlines, cruise operators, car rental services, online travel platforms, and theme parks, all of which work together to create seamless travel experiences for visitors. Growth in the US tourism market is also supported by government initiatives, visa reforms, and investments in sustainable tourism practices that appeal to environmentally conscious travelers.

Tourism in the United States is further fueled by its global reputation as a diverse destination ranging from national parks and cultural landmarks to bustling urban centers and luxury resorts. Domestic tourism plays a dominant role as millions of Americans engage in short trips, weekend getaways, and road travel, while international tourism continues to thrive due to the country’s iconic attractions such as New York City, Las Vegas, Orlando, and California’s coastlines. The US tourism market is characterized by constant innovation, adoption of digital booking channels, and rising interest in personalized experiences that align with changing traveler expectations, positioning it as a cornerstone of the global tourism economy.

The US Tourism Market: Key Takeaways

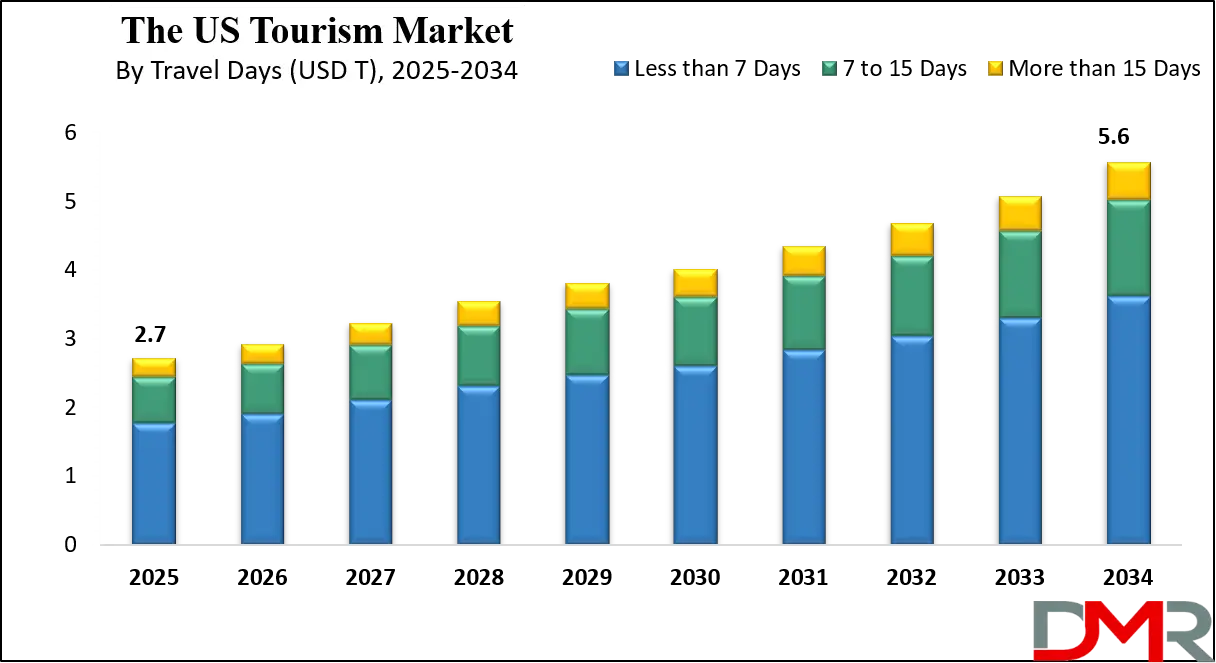

- Market Value: The US tourism market size is expected to reach a value of USD 5.6 trillion by 2034 from a base value of USD 2.7 trillion in 2025 at a CAGR of 8.3%.

- By Travel Purpose Segment Analysis: Leisure Tourism is anticipated to dominate the travel purpose segment, capturing 72.0% of the total market share in 2025.

- By Travel Type Segment Analysis: Group travel type is expected to maintain its dominance in the travel type segment, capturing 74.0% of the total market share in 2025.

- By Booking Mode Segment Analysis: Online Booking Mode will dominate the booking mode segment, capturing 61.0% of the market share in 2025.

- By Travel Days Segment Analysis: Less than 7 Days will account for the maximum share in the travel days segment, capturing 65.0% of the total market value.

- By Age Group Segment Analysis: 30 to 41 age groups are expected to consolidate their dominance in the age group segment, capturing 40.0% of the market share in 2025.

- Key Players: Some key players in the US tourism market are Expedia Group, Booking Holdings, American Express Global Business Travel, Airbnb, TripAdvisor, Delta Air Lines, United Airlines, American Airlines, Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Walt Disney Company (Disney Parks & Resorts), MGM Resorts International, Las Vegas Sands Corporation, and Others.

The US Tourism Market: Use Cases

- Growth of Online Travel Booking Platforms: The rapid expansion of online booking channels has transformed the US tourism market, making it easier for travelers to compare prices, plan itineraries, and access last-minute deals. Companies such as Expedia Group, Booking Holdings, and Airbnb dominate this space by offering diverse accommodation options, flights, and travel packages under one platform. This shift from traditional booking modes to digital platforms reflects evolving consumer preferences for convenience, personalization, and mobile-friendly services.

- Rising Demand for Leisure and Experiential Travel: Leisure tourism continues to be the backbone of the US tourism industry, driven by demand for cultural attractions, entertainment hubs, natural parks, and adventure tourism. Destinations like Orlando, Las Vegas, and national parks such as Yellowstone or Grand Canyon remain top choices for domestic and international tourists. Increasing interest in unique experiences, wellness travel, and sustainable tourism practices has fueled growth in this segment, highlighting the evolving expectations of modern travelers.

- Business and MICE Tourism Expansion: The US is a global hub for business travel and Meetings, Incentives, Conferences, and Exhibitions (MICE) tourism. With major cities such as New York, Chicago, and San Francisco hosting large corporate events, the demand for premium hospitality services, convention centers, and seamless transportation continues to grow. American Express Global Business Travel and major hotel chains like Hilton, Marriott, and Hyatt are capitalizing on this trend by offering integrated corporate travel solutions and customized event management services.

- Growth in Cruise and Theme Park Tourism: Cruise tourism and entertainment-based travel are unique growth drivers within the US tourism landscape. Companies like Carnival Corporation and Royal Caribbean Group dominate the cruise segment, while the Walt Disney Company and MGM Resorts play a key role in attracting families and international tourists through world-class theme parks and resorts. These segments are not only significant revenue contributors but also enhance the global appeal of the US as a top travel destination.

Impact of Artificial Intelligence on the US Tourism Market

Artificial intelligence is reshaping the US tourism market by enhancing personalization, streamlining operations, and improving customer engagement across the travel ecosystem. AI-powered chatbots and virtual assistants are enabling seamless customer service for airlines, hotels, and online travel agencies, while predictive analytics helps forecast demand, optimize pricing, and manage revenue more efficiently. In addition, AI-driven recommendation engines provide tailored travel suggestions, creating hyper-personalized experiences for leisure and business travelers.

The integration of AI in airport security, facial recognition check-ins, and smart hotel management systems further enhances convenience and efficiency. As the US tourism industry continues to adopt AI solutions, the sector is witnessing improved traveler satisfaction, higher conversion rates for online booking platforms, and increased competitiveness in attracting both domestic and international visitors.

The US Tourism Market: Stats & Facts

Bureau of Economic Analysis (Travel & Tourism Satellite Account)

- In 2023, real travel & tourism output grew 7.0% year over year.

- Travel & tourism prices rose 2.3% in 2023.

- Travel & tourism directly accounted for 3.03% of U.S. GDP in 2023.

- Direct travel & tourism employment reached 6.5 million jobs in 2023.

- Real gross output in 2023 exceeded the 2022 level across most core industries (air transportation, accommodations, food services).

National Travel & Tourism Office (U.S. Department of Commerce)

- International visitor arrivals to the U.S. reached 72.4 million in 2024 (forecast basis), up from 66.5 million in 2023.

- Arrivals are forecast to rise to 77.1 million in 2025 and 85.0 million in 2026.

- December 2024 international inbound visitor spending in the U.S. totaled USD 16.1 billion.

- February 2024 international inbound visitor spending totaled USD 14.5 billion.

- March 2024 saw 5,893,463 international visitors arrive to the U.S.

- U.S. resident outbound international trips were 9,009,700 in March 2024.

- 2024 surpassed multiple pre-pandemic monthly spending peaks as inbound travel exports recovered.

- 2023 total international arrivals (all modes) were 66.5 million, with steady monthly gains into 2024.

- NTTO’s long-range outlook anticipates continued growth through 2028 as air capacity expands and visa backlogs ease.

- Several top ports and gateway states regained or exceeded 2019 overseas visitation levels by late 2024.

Bureau of Transportation Statistics (U.S. DOT)

- U.S. airlines carried 101.4 million passengers in December 2024, the highest for any December on record.

- Of these, 77.5 million were domestic passengers in December 2024.

- International passengers totaled 23.9 million in December 2024.

- 2024 set multiple monthly passenger records (January, March, April, May, June, July) as system traffic surpassed prior highs.

Transportation Security Administration (DHS)

- TSA screened a single-day record of 3,083,009 passengers on June 23, 2025.

- TSA screened 3,013,413 passengers on July 7, 2024 (then a record).

- Multiple summer 2024 dates exceeded 2.9 million daily screenings as air travel demand surged.

National Park Service (U.S. DOI)

- National parks recorded 331.9 million recreation visits in calendar year 2024, a new all-time high.

- 2024 visitation was up by 6.36 million visits (+2%) versus 2023.

- The previous record was 330.97 million in 2016.

- 2023 visitation totaled 325.5 million, up 4% from 2022.

U.S. Department of State (Bureau of Consular Affairs / Visa Office)

- Passports issued reached 24,515,786 (books and cards) in FY2024.

- Passports issued were 24,021,257 in FY2023.

- Valid U.S. passports in circulation were nearly 170 million as of late 2024.

- The Department issued approximately 11.5 million visas in FY2024, an all-time record.

- CA received 20.4 million passport applications during FY2024.

The US Tourism Market: Market Dynamics

The US Tourism Market: Driving Factors

Strong Domestic Travel Demand

The US tourism market is primarily fueled by robust domestic travel, as millions of Americans engage in weekend getaways, road trips, and short leisure vacations. Well-connected infrastructure, widespread use of private vehicles, and the popularity of national parks and cultural destinations have amplified the growth of domestic tourism. This consistent demand provides a steady revenue stream for airlines, hotels, and local businesses while ensuring resilience against global travel disruptions.

Expansion of Online Booking and Digital Platforms

The growing adoption of online travel agencies, mobile applications, and AI-powered booking engines is significantly boosting market growth. Consumers increasingly prefer digital platforms for their convenience, dynamic pricing, and ability to compare travel packages in real time. This digital transformation has not only improved accessibility but also helped companies gather insights into consumer preferences, enabling more personalized tourism services.

The US Tourism Market: Restraints

Rising Travel Costs and Inflationary Pressures

High airfare, hotel tariffs, and fluctuating fuel prices are limiting travel affordability for a wide section of consumers. Inflationary pressures have made both leisure and business tourism more expensive, forcing many travelers to opt for shorter trips or budget-friendly destinations, which affects revenue for premium service providers in the US tourism sector.

Environmental Concerns and Sustainability Challenges

The increasing awareness of carbon emissions linked to air travel and large-scale tourism activities has posed challenges to the industry. Regulatory pressure for sustainable practices, along with traveler demand for eco-friendly options, is forcing stakeholders to invest in green technologies, sustainable hotel operations, and alternative transport, which require significant upfront costs.

The US Tourism Market: Opportunities

Growth in Medical and Wellness Tourism

The US is emerging as a preferred destination for high-quality healthcare and wellness retreats, attracting both domestic and international travelers. Advanced medical infrastructure, specialized treatment centers, and wellness resorts create opportunities for growth in this niche segment. The rising focus on preventive healthcare and holistic experiences further boosts demand in medical and wellness tourism.

Expansion of Experiential and Adventure Tourism

The growing popularity of experiential travel, including adventure sports, cultural immersion, and eco-tourism, is creating new opportunities in the US tourism market. Destinations that offer unique experiences such as hiking, skiing, wildlife exploration, and local heritage tours are drawing younger demographics who value personalized and authentic journeys.

The US Tourism Market: Trends

Integration of Artificial Intelligence and Smart Technologies

AI-driven solutions such as predictive analytics, voice-assisted booking, facial recognition, and personalized recommendation engines are reshaping traveler experiences. Hotels are leveraging smart room technologies, while airlines are optimizing routes and customer engagement with AI tools, driving efficiency and enhancing satisfaction in the tourism value chain.

Rise of Bleisure and Remote Work Travel

The blending of business and leisure, also known as bleisure travel, has become a significant trend in the US tourism market. With the rise of remote work, many professionals extend their business trips into leisure stays or choose destinations that offer work-friendly environments. This trend is creating demand for flexible accommodations, co-working spaces, and hybrid travel packages.

The US Tourism Market: Research Scope and Analysis

By Travel Purpose Analysis

Leisure tourism is set to dominate the travel purpose segment of the US tourism market, capturing around 72.0% of the total share in 2025. This dominance is driven by the country’s diverse attractions, ranging from national parks and cultural landmarks to entertainment hubs and coastal destinations that attract both domestic and international travelers.

Families, millennials, and Gen Z travelers are increasingly prioritizing vacations that combine relaxation with unique experiences, such as adventure tourism, wellness retreats, and sustainable travel options. The growth of digital booking platforms and social media influence has also made leisure tourism more accessible and appealing, encouraging travelers to explore short trips and customized itineraries.

Business tourism, on the other hand, continues to hold a strong position within the US tourism landscape, supported by the country’s role as a global business hub. Major cities such as New York, Chicago, and San Francisco host international conferences, trade shows, and corporate events, drawing a large influx of domestic and international business travelers.

The Meetings, Incentives, Conferences, and Exhibitions (MICE) sector plays a vital role here, with hotels, convention centers, and airlines adapting their services to meet the needs of corporate clients. The rise of bleisure travel, where professionals extend their business trips for leisure purposes, is further strengthening this segment and offering opportunities for hospitality providers to deliver hybrid travel experiences.

By Travel Type Analysis

Group travel type is projected to dominate the travel type segment in the US tourism market, capturing nearly 74.0% of the total share in 2025. This strong preference for group travel is largely influenced by families, friends, corporate teams, and tour groups who value shared experiences, convenience, and cost-effectiveness. Group packages offered by tour operators and online travel agencies often include bundled services such as accommodation, guided tours, and transportation, making them attractive for travelers seeking hassle-free planning.

Destinations like theme parks, cruise trips, and cultural circuits are especially popular for group travel, as they cater to collective enjoyment and maximize value for money. The demand for group travel is further supported by events, educational tours, and religious tourism, reinforcing its leading position in the market.

Solo travel, while smaller in share, continues to gain momentum, particularly among younger demographics and independent travelers. The segment is being driven by millennials and Gen Z who seek personal growth, self-discovery, and unique experiences away from conventional group settings. Solo travelers often prefer flexible itineraries, boutique accommodations, and immersive cultural experiences, supported by the rise of digital tools and mobile apps that make independent travel safer and more convenient. This segment is also benefiting from the growing popularity of wellness retreats, adventure travel, and offbeat destinations, positioning it as a steadily expanding niche within the overall US tourism market.

By Booking Mode Analysis

Online booking mode is expected to dominate the booking mode segment of the US tourism market, capturing around 61.0% of the market share in 2025. The shift toward digital platforms is being driven by consumer preference for convenience, transparency, and the ability to compare prices and packages in real time. Online travel agencies, mobile applications, and airline or hotel websites have simplified the process of booking flights, accommodations, and experiences, making them the go-to choice for modern travelers.

Personalization through artificial intelligence, integration of secure digital payments, and last-minute deal options further strengthen the adoption of online booking. Younger demographics, in particular, are driving this trend, with their reliance on smartphones, social media, and travel apps to plan seamless itineraries.

Physical booking, although gradually declining, continues to hold relevance, particularly among older travelers and customers who value human interaction and traditional service. Travel agencies, ticket counters, and offline booking centers cater to this segment by offering personalized guidance, curated packages, and support for complex itineraries such as cruises, multi-destination tours, or luxury travel experiences.

For certain demographics, physical booking is associated with reliability and trust, especially when handling high-value or international trips. Despite the dominance of online booking, this segment remains a steady contributor to the US tourism market, supported by niche customer groups and services requiring hands-on consultation.

By Travel Days Analysis

Less than 7 days will account for the maximum share in the travel days segment of the US tourism market, capturing nearly 65.0% of the total market value. Short-duration trips are popular among domestic travelers who prefer weekend getaways, city breaks, and quick vacations that fit into their busy work schedules. The availability of affordable flights, budget accommodations, and well-connected road networks has made shorter trips more accessible and frequent.

Popular destinations such as beach resorts, national parks, and urban attractions are often chosen for these trips, offering relaxation and recreation without the need for extended time off. The rising trend of micro-cations and spontaneous travel further supports the dominance of this segment, highlighting the demand for flexible and affordable tourism experiences.

The 7 to 15 days category holds a significant portion of the travel days segment, appealing to both domestic and international tourists seeking a balance between exploration and relaxation. This segment is favored for family vacations, extended road trips, and international visitors who require more time to explore multiple destinations.

Longer stays are often associated with higher spending on hotels, dining, entertainment, and cultural experiences, providing strong economic value to the tourism sector. Tour operators and travel agencies frequently design curated packages for this duration, covering popular circuits such as the East Coast, West Coast, or a combination of iconic cities and natural attractions. As travelers increasingly look for immersive experiences, the 7 to 15 days segment is positioned as a key contributor to revenue growth within the US tourism market.

By Age Group Analysis

The 30 to 41 age group is expected to consolidate its dominance in the US tourism market, capturing nearly 40.0% of the total market share in 2025. This age group represents a financially stable demographic with higher disposable incomes and a strong inclination toward both leisure and business travel. Travelers in this bracket often seek a blend of family vacations, luxury experiences, and adventure tourism, making them a highly valuable customer segment for airlines, hotels, and online booking platforms.

Their travel decisions are strongly influenced by convenience, premium services, and curated experiences, while digital platforms play a critical role in shaping their choices. The segment also contributes significantly to business tourism, as professionals within this age range frequently participate in conferences, corporate meetings, and incentive trips.

The below 30 years age group, while smaller in share, is a rapidly growing and highly dynamic segment in the US tourism market. This demographic is characterized by millennials and Gen Z travelers who prioritize unique experiences, budget-friendly options, and spontaneous trips. They are highly tech-savvy and rely extensively on online booking platforms, mobile apps, and social media for travel inspiration and planning.

Adventure tourism, cultural immersion, solo travel, and sustainable tourism practices resonate strongly with this age group, reflecting their preference for personalized and authentic experiences over traditional packaged tours. Their growing contribution to short-duration trips and experiential travel makes them an influential driver of emerging trends within the tourism sector.

The US Tourism Market Report is segmented on the basis of the following:

By Travel Purpose

- Medical Tourism

- Leisure Tourism

- Business Tourism

- Others

By Travel Type

By Booking Mode

- Physical Booking

- Online Booking

By Travel Days

- Less than 7 Days

- 7 to 15 Days

- More than 15 Days

By Age Group

- Below 30 years

- 30 to 41 years

- 42 to 49 years

- 50 years & above

The US Tourism Market: Competitive Landscape

The US tourism market features a highly competitive landscape with diverse players spanning airlines, hotel chains, online travel agencies, cruise operators, and entertainment companies. Leading firms such as Expedia Group, Booking Holdings, and Airbnb dominate the digital booking ecosystem, while major airlines including Delta, United, and American Airlines drive air travel demand. Global hospitality brands like Marriott International, Hilton, Hyatt, and IHG strengthen the accommodation segment through wide networks and loyalty programs.

In addition, cruise operators such as Carnival Corporation and Royal Caribbean Group, along with entertainment giants like Walt Disney Company and MGM Resorts, play a pivotal role in attracting both domestic and international visitors. The market is further shaped by car rental companies such as Enterprise Holdings and Hertz, providing integrated mobility solutions. Intense competition, innovation in customer experiences, and the adoption of smart technologies define the US tourism market’s growth trajectory, ensuring continuous evolution to meet shifting traveler preferences.

Some of the prominent players in the US Tourism market are:

- Expedia Group

- Booking Holdings

- American Express Global Business Travel

- Airbnb

- TripAdvisor

- Delta Air Lines

- United Airlines

- American Airlines

- Marriott International

- Hilton Worldwide

- Hyatt Hotels Corporation

- InterContinental Hotels Group (IHG)

- Carnival Corporation

- Royal Caribbean Group

- Walt Disney Company (Disney Parks & Resorts)

- MGM Resorts International

- Las Vegas Sands Corporation

- Enterprise Holdings (Enterprise Rent-A-Car, National, Alamo)

- Hertz Global Holdings

- Greyhound Lines

- Other Key Players

The US Tourism Market: Recent Developments

- August 2025: Luxury vacation rental startup Elivaas secured USD 10.4 million in funding led by Vertex Ventures Southeast Asia & India, aiming to bolster its upscale hospitality offerings and expand its operations.

- July 2025: The U.S. Department of Justice dropped its attempt to block the American Express Global Business Travel’s acquisition of CWT Holdings, clearing the way for the USD 570 million deal.

- July 2025: Expedia released its 2025 Island Hot List, offering a curated travel guide to trending island destinations based on verified travel data, traveler insights, and factors like accessibility and seasonality.

- June 2025: AI travel startup Airial Travel raised USD 3 million in seed funding to develop a platform that converts TikToks, Instagram Reels, and travel blogs into personalized, bookable itineraries using AI reasoning.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.7 T |

| Forecast Value (2034) |

USD 5.6 T |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

2019 – 2024 |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Travel Purpose (Medical Tourism, Leisure Tourism, Business Tourism, Others), By Travel Type (Solo, Group), By Booking Mode (Physical Booking, Online Booking), By Travel Days (Less than 7 Days, 7 to 15 Days, More than 15 Days), and By Age Group (Below 30 years, 30 to 41 years, 42 to 49 years, 50 years & above) |

| Regional Coverage |

The US |

| Prominent Players |

Expedia Group, Booking Holdings, American Express Global Business Travel, Airbnb, TripAdvisor, Delta Air Lines, United Airlines, American Airlines, Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Walt Disney Company (Disney Parks & Resorts), MGM Resorts International, Las Vegas Sands Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US tourism market is projected to be valued at USD 2.7 trillion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.6 trillion in 2034 at a CAGR of 8.3%.

Some of the major key players in the US tourism market are Expedia Group, Booking Holdings, American Express Global Business Travel, Airbnb, TripAdvisor, Delta Air Lines, United Airlines, American Airlines, Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Walt Disney Company (Disney Parks & Resorts), MGM Resorts International, Las Vegas Sands Corporation, and Others.