Market Overview

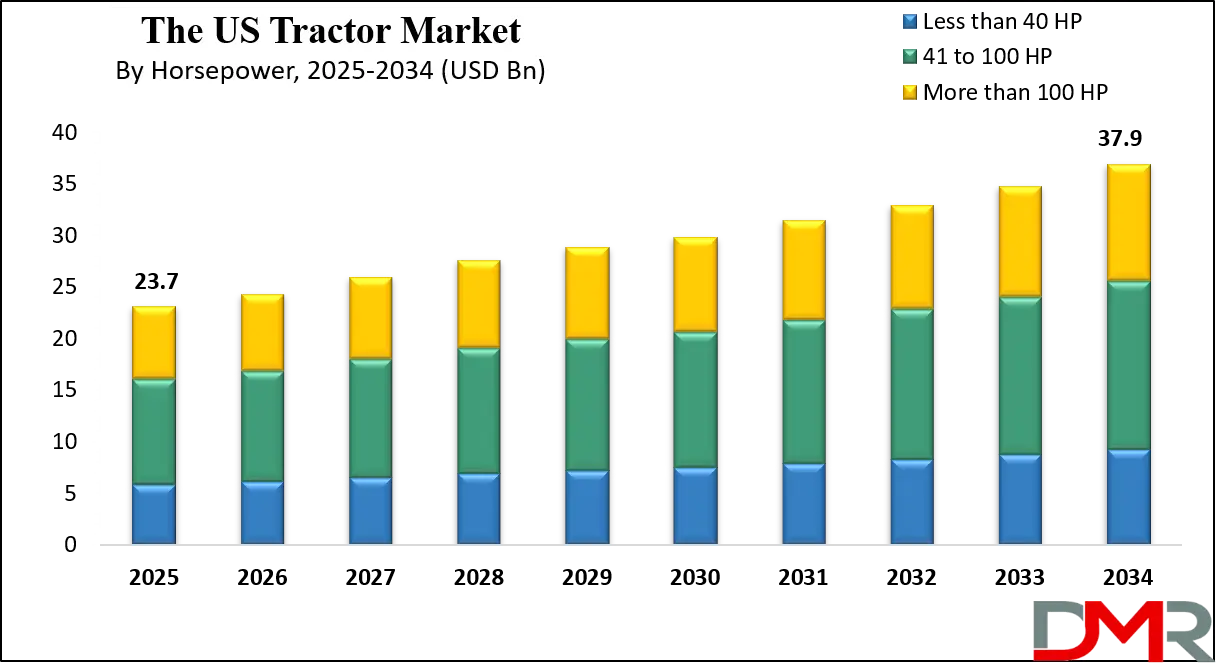

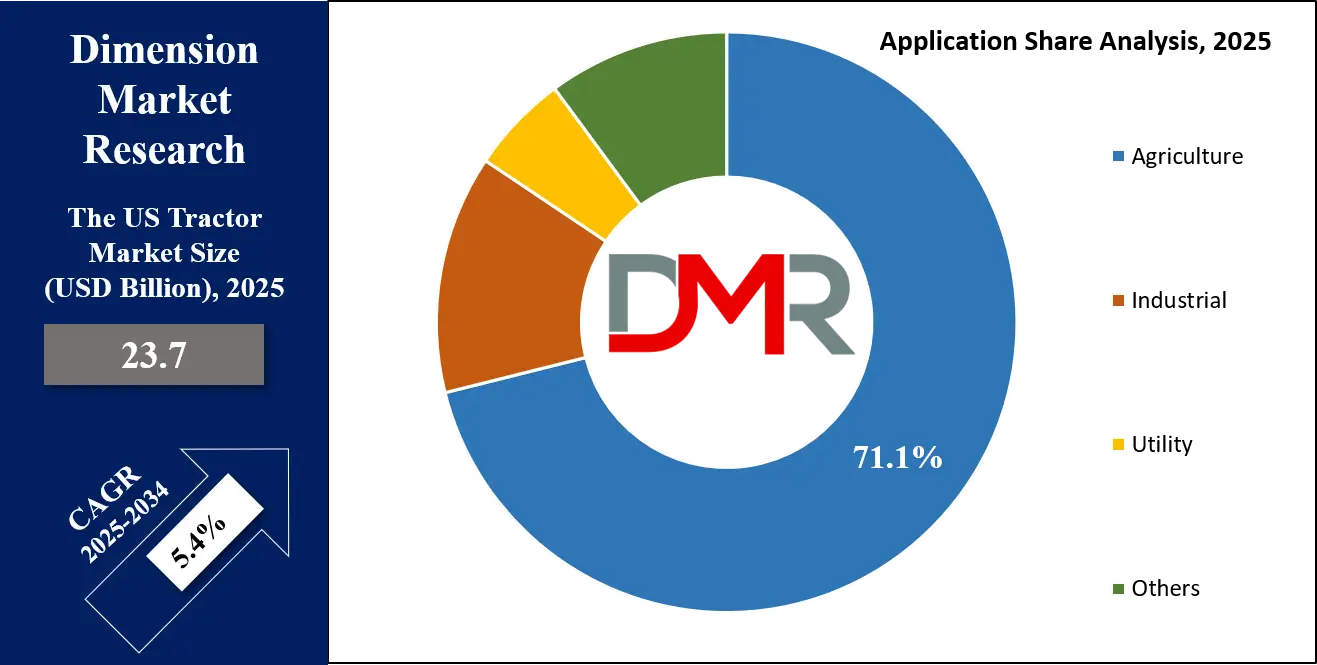

The U.S. Tractor Market is projected to reach USD 23.7 billion by 2025 and is expected to expand steadily at a compound annual growth rate (CAGR) of 5.4% through 2034, ultimately attaining a market value of USD 37.9 billion. This growth trajectory is being fueled by rising demand for advanced agricultural machinery, increasing mechanization in farming practices, and the adoption of precision farming technologies.

The sector is further supported by government subsidies, technological innovations in tractors such as autonomous and electric models, and the growing need for high-horsepower tractors in large-scale commercial farming. Additionally, infrastructure development, landscaping activities, and expanding construction applications are contributing to market expansion, positioning the U.S. as a significant player in the global tractor industry.

The U.S. tractor market stands as one of the most advanced globally, driven by the widespread adoption of precision agriculture and the mechanization of farming operations across both large and small holdings. Demand continues to rise as farmers seek higher efficiency and improved productivity through modern equipment. The growing shift toward autonomous tractors and smart farming machinery highlights how digital technologies are reshaping agricultural practices, ensuring long-term stability for manufacturers while opening avenues for innovation across equipment categories.

Trends within the market reveal strong momentum toward connected machinery, with GPS guidance systems, telematics, and data-driven platforms becoming integral features of tractors. Compact and utility tractors are gaining traction not only among smaller farms but also in landscaping, maintenance, and light construction, extending the market’s influence beyond agriculture. The push toward sustainable farming practices has also triggered the development of eco-friendly machinery, including hybrid and electric tractor models, reflecting the increasing importance of environmental considerations in purchasing decisions.

Opportunities in the U.S. tractor market are rooted in the rapid pace of technological advancement and the expansion of farm automation. Government incentives supporting smart agriculture are encouraging fleet modernization, while the versatility of tractors in non-agricultural applications such as municipal services, grounds maintenance, and infrastructure development creates new channels of revenue for manufacturers. The openness of the U.S. market to innovation continues to attract both domestic and global companies, reinforcing its position as a hub for agricultural technology.

Restraints facing the sector include the high cost of advanced machinery, which can limit adoption among smaller farms and independent operators. Volatility in farm incomes, fluctuating commodity prices, and rising input costs add uncertainty to purchasing decisions. Labor shortages in rural areas also impact the pace of mechanization in some regions. Even so, with continuous innovation, increasing digital adoption, and supportive policy frameworks, the U.S. tractor market holds strong growth prospects well into the future.

The US Tractor Market: Key Takeaways

- The Market Size Insights: The US Tractor Market size is estimated to have a value of USD 23.7 billion in 2025 and is expected to reach USD 37.9 billion by the end of 2034.

- The Market Growth Rate Insights: The market is growing at a CAGR of 5.4% over the forecasted period of 2025.

- Technology Integration: Leading players like John Deere, AGCO, and CNH Industrial are heavily investing in AI, automation, and precision farming technologies, signaling a shift toward smart and connected tractors.

- Manufacturing Expansion: CNH Industrial, Yanmar, and LS Tractor USA are strengthening U.S. manufacturing and assembly capabilities to reduce import reliance and improve supply chain resilience.

- Compact Tractor Demand: Kubota, Mahindra, and LS Tractor are increasingly focusing on compact and mid-sized tractors to serve small farms, landscaping businesses, and rural communities.

- Sustainability Push: Companies such as CLAAS and John Deere are emphasizing fuel efficiency, hybrid systems, and reduced emissions to align with sustainability-driven farming practices.

- Dealer Network Growth: Kubota and Mahindra are actively expanding their dealer networks and after-sales support across the U.S. to improve accessibility and customer service.

- Autonomous Solutions: Case IH and John Deere are pioneering autonomous tractor prototypes, addressing labor shortages and showcasing the future of driverless farming equipment.

- Strategic Partnerships: Collaborations like John Deere with SpaceX (Starlink) and AGCO with Trimble highlight the growing role of partnerships in enhancing connectivity, precision, and digital integration in U.S. agriculture.

The US Tractor Market: Use Cases

- Row Crop Farming: Tractors are extensively used for planting, cultivating, and harvesting large-scale crops such as corn, soybeans, and wheat, ensuring efficiency and higher yields through precision agriculture.

- Livestock and Dairy Operations: Farmers rely on tractors for hauling feed, cleaning barns, transporting bales, and managing heavy-duty tasks that support daily livestock and dairy farm activities.

- Construction and Infrastructure: Beyond agriculture, tractors fitted with loaders and backhoes are used in road building, land grading, and infrastructure development projects for versatile earth-moving tasks.

- Municipal and Landscaping Services: Compact tractors support city maintenance, snow removal, lawn care, and landscaping businesses, offering cost-effective and efficient solutions for public works and commercial services.

- Forestry and Land Management: Specialized tractors are employed in forestry for hauling logs, clearing land, and maintaining trails, contributing to sustainable forest operations and land conservation efforts.

The US Tractor Market: Stats & Facts

USDA- 2022 Census of Agriculture (NASS)

- There were about 1.9 million farms and ranches in the United States in 2022.

- Total land in farms reported in 2022 was ≈880 million acres.

- The average farm size reported in 2022 was about 463 acres.

- The Census reported total U.S. agricultural production value of ≈USD543.1 billion (value of agricultural products sold, 2022).

- The Census indicates the largest ~105,000 farms accounted for ~80% of U.S. farm sales in 2022.

- Family-owned and -operated farms accounted for about 95% of U.S. farms (Census typology).

- The Census’s machinery inventory tables record millions of tractors on U.S. operations (Census machinery tables list the national tractor inventory by horsepower classes).

USDA National Agricultural Statistics Service (NASS) Technology / Farm Computer Usage reports

- In a recent NASS technology report, ≈85% of U.S. farms reported having internet access.

- NASS reported ≈50% of farms used the internet to purchase agricultural inputs (recent technology survey).

- NASS reported ≈29% of farms used the internet to market agricultural activities in the most recent survey.

- NASS QuickStats and Census indicate broad year-to-year increases in farm adoption of digital tools and online purchasing (trend documented across NASS releases).

USDA Economic Research Service (ERS)

- ERS estimates GPS applications were used on about 40% of all U.S. farm and ranchland acreage for on-farm production (estimate from ERS precision-ag research).

- ERS reports that autosteer/guidance systems expanded from single-digit adoption in the early 2000s to majority shares on many row-crop acres (example: autosteer grew from ~5.3% of planted corn acres in 2001 to a majority by mid-2010s).

- ERS finds yield mapping is used on roughly 40% of U.S. corn and soybean acres (ERS technology summaries).

- ERS reports variable-rate technology (VRT) use on corn/soy acres generally in the high-20s to mid-30s percent range for adopters (ERS estimates).

- ERS shows precision-ag adoption rises steeply with farm size (adoption much higher on midsize/large farms than on small farms).

U.S. Government Accountability Office (GAO)

- GAO’s review of USDA data found that about 27% of U.S. farms or ranches reported using precision agriculture practices to manage crops or livestock in 2023.

U.S. Bureau of Labor Statistics (BLS)

- BLS (May 2023 OES) reports employment for Agricultural Equipment Operators of about 28,910 (national estimate for the occupation).

- BLS reports a mean hourly wage for Agricultural Equipment Operators of about USD20.12 (May 2023 OES).

- BLS reported 146 fatal work injuries involving tractors occurred in 2018 (CFOI data note; historically the lowest in that multi-year series).

U.S. Environmental Protection Agency (EPA)

- EPA’s Tier-4 nonroad diesel emission standards (phased 2008–2015) required technologies that reduced PM and NOx emissions from regulated nonroad engines by roughly 90% compared with earlier tiers.

- EPA maintains Tier-4 certification and 40 CFR provisions for off-road/agricultural engines (tractors use engines regulated under the nonroad program).

Centers for Disease Control & Prevention (CDC) / NIOSH / National Ag Safety bodies

- CDC/NIOSH documentation notes tractor overturns historically accounted for the largest single cause of fatal injuries on U.S. farms on average, about 130 deaths per year (historical national estimate).

- CDC/NIOSH analysis reported 1,412 tractor overturn deaths between 1992 and 2005, representing a substantial share of agricultural production fatalities in that period.

- Public-health summaries have noted that a large proportion of older tractors historically lacked rollover protective structures (ROPS) (NIOSH/CDC highlight of ROPS as a prevention priority).

USDA Farm Production Expenditures & ARMS

- USDA’s Farm Production Expenditures reports show average total expenditures per crop farm and per livestock farm differ by major line items, with published summaries indicating average total expenditures for a crop farm and for a livestock farm on the order of hundreds of thousands of dollars (ARMS/farm expenditure summaries).

- USDA expenditure summaries list fuel, repair and maintenance, and machinery services as consistently large operating expense categories for U.S. farms (farm costs breakdown).

U.S. Department of Transportation / Other Federal references

- Federal heavy-duty vehicle and engine rule-making (EPA/DOT processes) have established multi-year phased compliance timelines that affect heavy machinery and off-road equipment technologies, influencing manufacturers of large tractors and attachments.

US Tractor Market: Market Dynamic

Driving Factors in the US Tractor Market

Technological innovation and automation in farming

One of the strongest growth drivers in the U.S. tractor market is the continuous wave of technological innovation and automation. Farmers are under constant pressure to increase yields, lower costs, and optimize land use amid fluctuating commodity prices and rising input costs.

Advanced tractors equipped with GPS-based auto-steering, telematics, and IoT-enabled diagnostics provide real-time performance insights, reducing downtime and increasing overall productivity. The integration of artificial intelligence, machine vision, and autonomous driving systems is making tractors more efficient and reducing reliance on manual labor, a significant concern in U.S. agriculture. Automation allows for precision planting, spraying, and harvesting, ensuring optimal resource utilization while minimizing waste.

As farming becomes more capital-intensive, these innovations deliver measurable returns by enhancing profitability and sustainability. Leading manufacturers are investing heavily in R&D to launch next-generation tractors that address both efficiency and environmental concerns. This technological momentum is driving steady adoption across the market, ensuring long-term demand from progressive farmers seeking competitive advantages in a highly consolidated and efficiency-driven agricultural landscape.

Government programs and supportive agricultural policies

Supportive policies and incentive programs represent another key growth driver for the U.S. tractor market. Federal and state governments frequently provide subsidies, tax incentives, and low-interest loans for agricultural mechanization, encouraging farmers to modernize their equipment. Programs under the USDA and other agricultural bodies actively promote smart farming and resource conservation, indirectly supporting tractor adoption.

Additionally, initiatives that encourage sustainable farming practices and climate-smart agriculture are boosting demand for modern tractors capable of supporting precision technologies.

Funding opportunities through conservation and infrastructure programs also encourage purchases of compact tractors for municipal and non-farming uses. Policies supporting renewable energy and low-emission vehicles are further encouraging the adoption of hybrid and electric tractors, aligning agricultural practices with environmental goals.

These government-backed initiatives significantly reduce the financial burden on farmers, particularly small and mid-sized operators who might otherwise delay investment in new machinery. As a result, policy-driven incentives play a pivotal role in sustaining growth across the U.S. tractor market, balancing the challenges of cost with the long-term need for modernization and productivity improvements.

Restraints in the US Tractor Market

High equipment and ownership costs

One of the most significant restraints in the U.S. tractor market is the high cost of equipment and ownership. Modern tractors, especially those equipped with advanced technologies such as GPS, telematics, and autonomous systems, come with steep price tags that place them beyond the reach of many small and medium-sized farms. The financial burden extends beyond initial purchase costs to include maintenance, repairs, insurance, and fuel expenses, making total ownership a considerable challenge. Farmers with limited capital or those operating in regions with low margins are often forced to extend the life of older machinery instead of upgrading to new models.

This reluctance to replace outdated tractors not only slows market growth but also limits the adoption of innovations such as precision farming and automation. Financing programs do exist, but volatile farm incomes and fluctuating commodity prices add uncertainty to repayment capacity. As a result, high upfront and lifecycle costs represent a persistent barrier for the widespread adoption of new tractors in the U.S. market.

Labor shortages and demographic challenges in agriculture

Another key restraint for the U.S. tractor market stems from labor shortages and demographic shifts within the farming population. While automation and smart tractors can help alleviate labor constraints, the aging workforce in American agriculture continues to pose challenges. A significant proportion of farm operators are nearing retirement age, with limited numbers of younger individuals entering farming.

This demographic imbalance reduces long-term demand for new machinery, as older farmers are often reluctant to invest in costly equipment upgrades. Furthermore, the shortage of skilled operators and technicians capable of managing advanced tractors equipped with digital systems limits the full utilization of available technologies.

Training and knowledge gaps add to inefficiencies, reducing the effectiveness of modern machinery adoption. Combined with uncertainties around farm succession planning, this demographic trend contributes to slower replacement cycles and subdued demand for cutting-edge tractors. Unless mitigated by increased training programs and incentives to attract younger farmers, these demographic and labor-related restraints are likely to continue influencing the trajectory of the U.S. tractor market.

Opportunities in the US Tractor Market

Emergence of electric and hybrid tractors

A significant growth opportunity for the U.S. tractor market lies in the rising development and adoption of electric and hybrid tractors. With increasing pressure to reduce carbon emissions, the agriculture sector is undergoing a green transition similar to the broader transportation industry. Electric tractors offer reduced fuel dependency, lower emissions, and significantly lower operating costs due to fewer moving parts and minimal maintenance requirements.

Hybrid tractors, on the other hand, provide flexibility by combining traditional diesel power with electric efficiency, making them suitable for farmers who need reliability during long work hours. Early adoption is being driven by environmentally conscious farmers, municipalities, and organizations seeking sustainable equipment for agricultural and landscaping operations.

As advancements in battery technology improve operating range and charging speeds, the economic and operational viability of electric tractors is strengthening. This segment is poised to expand further with government incentives for clean energy adoption and rising corporate investment in sustainable agricultural practices. Manufacturers entering this space can gain a competitive edge by addressing environmental regulations while catering to a growing demand for eco-friendly farming equipment.

Expansion into non-agricultural applications

Another promising opportunity in the U.S. tractor market is the growing demand from non-agricultural applications such as construction, landscaping, forestry, and municipal maintenance. Tractors fitted with loaders, backhoes, and attachments are increasingly being utilized in road building, land clearing, snow removal, and infrastructure projects.

Municipal governments are investing in compact tractors for urban landscaping, park maintenance, and public works, while private contractors use them for commercial landscaping and property management. Forestry applications are also growing, with tractors employed for hauling logs and maintaining trails. These segments open new revenue channels for manufacturers, reducing dependency on agricultural cycles and commodity price fluctuations.

Additionally, the rise of lifestyle farming and rural property management has created demand from individuals who require versatile, cost-effective tractors for personal or small-scale farming activities. By diversifying product portfolios to cater to these markets, manufacturers can achieve greater resilience and tap into a broader customer base. This diversification trend positions tractors as multi-purpose machinery rather than agriculture-exclusive equipment, unlocking significant growth opportunities in the U.S. market.

Trends in the US Tractor Market

Adoption of precision agriculture and smart tractors

A major trend shaping the U.S. tractor market is the rapid adoption of precision agriculture and smart farming technologies. Farmers across the country are increasingly integrating GPS guidance, telematics, and data-driven platforms into their tractors to achieve higher efficiency and cost savings. This shift toward connected machinery allows real-time monitoring of fuel consumption, machine health, and field productivity, helping farmers make informed decisions and reduce downtime. Tractors with autonomous or semi-autonomous capabilities are also gaining attention as solutions to growing labor shortages in agriculture.

Beyond core farming, data integration enhances crop planning, yield forecasting, and resource management, allowing more efficient use of inputs such as seeds, fertilizers, and pesticides. This technological evolution is transforming tractors into intelligent systems that are no longer just mechanical workhorses but integral tools for digital farm management. U.S. farmers, particularly medium to large-scale operations, are adopting these technologies faster due to economies of scale, making smart tractors a defining trend in shaping the future of the agricultural machinery landscape.

Rise of compact and utility tractors in diverse applications

Another significant trend in the U.S. tractor market is the increasing demand for compact and utility tractors beyond traditional farming applications. While large tractors dominate row-crop farming, compact models are becoming highly popular among small farms, rural property owners, municipalities, and landscaping contractors.

These tractors are versatile, cost-effective, and easier to operate, making them attractive for non-agricultural tasks such as snow removal, lawn care, construction support, and grounds maintenance. The rising popularity of hobby farming and lifestyle farming in semi-rural areas also boosts sales of smaller tractors, as individuals seek efficient solutions for managing land, livestock, and personal food production.

Municipalities are increasingly using compact tractors for city maintenance projects, including park management and light infrastructure work, thereby expanding the customer base beyond agriculture. Moreover, manufacturers are focusing on enhancing comfort, ergonomics, and fuel efficiency in these segments, creating a blend of affordability and functionality. This trend highlights how tractors are evolving into multi-utility equipment suitable for varied applications, reflecting a broader transformation in consumer demand within the U.S. agricultural and non-agricultural machinery market.

The US Tractor Market: Research Scope and Analysis

By Horsepower Analysis

The 41–100 horsepower (HP) segment is projected to dominate the U.S. tractor market, primarily because of its adaptability to the operational scale of most American farms. This segment offers the perfect balance between power, affordability, and multi-functionality, allowing farmers to perform a wide range of tasks such as plowing, planting, spraying, harvesting, and baling without investing in high-cost heavy-duty tractors.

Unlike tractors below 40 HP, which are confined to niche uses like orchards, vineyards, and landscaping, and those above 100 HP, which are often restricted to large-scale row-crop production in the Corn Belt, the mid-range horsepower category provides versatility across diverse terrains and crop types. Its popularity is especially evident in the Midwest, Southeast, and dairy-producing regions of the Northeast, where mixed and mid-sized farming structures dominate.

Furthermore, this category aligns with the demographic profile of American agriculture, where the majority of farms are classified as small-to-medium-sized family-owned operations. Rising adoption of precision agriculture tools within this segment, such as GPS-guided implements, telematics, and semi-autonomous features, further cements its importance by making mechanization more efficient and sustainable. The continued emphasis on productivity, coupled with manageable fuel consumption and lower maintenance costs compared to larger tractors, ensures the 41–100 HP segment remains the backbone of U.S. tractor sales and registrations well into the forecast horizon.

By Driveline Analysis

The 2WD tractor segment is poised to lead the U.S. market due to its cost-effectiveness and alignment with the country’s farming structure. Two-wheel-drive tractors are the backbone of small and mid-sized farms, which constitute the largest proportion of agricultural enterprises in the U.S. Their affordability, fuel efficiency, and ease of maintenance make them highly attractive for farmers who operate under financial constraints, particularly in fragmented farmland areas such as the Northeast and Southeast.

2WD tractors are also highly maneuverable, giving them an edge in orchards, vineyards, and livestock farms where precision and compactness are essential. While 4WD tractors are gaining traction in large-scale farming operations across the Midwest and Great Plains for heavy-duty tillage and row-crop mechanization, their higher purchase cost, fuel consumption, and maintenance complexity hinder widespread adoption across smaller farms.

Governmental farm policies and financing schemes also play a role, as they promote grassroots mechanization and sustainable farming practices, which are better served by the affordability of 2WD tractors. Additionally, advancements in 2WD tractor models, including the integration of precision technologies and attachments, are enabling them to handle a wider range of tasks, further boosting their relevance. Given the structural dominance of small and mid-sized farms in the U.S., 2WD tractors will continue to dominate market volume, even as 4WD tractors contribute to value growth in industrial-scale farming.

By Application Analysis

Agriculture is expected to stand as the leading application for tractors in the U.S., accounting for the majority of sales due to the centrality of farming in the national economy and food supply system. Tractors are essential across America’s diverse agricultural landscape, supporting large-scale corn and soybean production in the Midwest, cotton farming in the South, dairy farming in Wisconsin and New York, specialty fruit and vegetable cultivation in California, and vineyard operations in the Pacific Northwest.

The sector’s diversity requires tractors across all horsepower categories, compact models for orchards and horticulture, mid-range models for row crops and livestock farms, and high-power tractors for industrial-scale grain production. With food security and productivity as national priorities, tractors are continuously adopted for essential processes such as tillage, planting, spraying, harvesting, and feed handling.

The growing role of precision agriculture strengthens this dominance further, as U.S. farmers integrate GPS guidance, telematics, smart sensors, and autonomous tractors to improve yields and reduce resource usage. While non-agricultural applications like construction, forestry, and municipal services are growing, they remain secondary contributors compared to farming.

Agriculture’s dominance is reinforced by government subsidies, crop insurance programs, and rural mechanization initiatives, which ensure tractors remain at the core of U.S. farming operations. As sustainability, efficiency, and labor shortages drive modernization, the agricultural sector will sustain its dominance as the largest application segment in the U.S. tractor market throughout the forecast period.

The US Tractor Market Report is segmented on the basis of the following:

By Horsepower

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Driveline

By Application

- Agriculture

- Industrial

- Utility

- Others

Impact of Artificial Intelligence in the US Tractor Market

- Precision Farming Enablement: AI-equipped tractors integrate sensors, drones, and computer vision to analyze soil conditions, crop health, and nutrient requirements, allowing farmers to optimize planting, spraying, and harvesting with reduced inputs and improved productivity.

- Autonomous Tractor Operations: AI enables driverless tractors that use LiDAR, GPS, and machine learning for navigation, ensuring accurate field operations, reducing dependency on manual labor, and addressing rising workforce shortages in U.S. agriculture.

- Predictive Maintenance: AI-based predictive analytics track engine performance, vibration, fuel efficiency, and wear patterns in real time, allowing proactive servicing, minimizing costly breakdowns, extending machinery lifespan, and improving operational efficiency for farmers.

- Enhanced Decision-Making: AI systems process satellite imagery, weather forecasts, and soil data to provide farmers with actionable insights, supporting data-driven decisions that improve crop yields, reduce risks, and optimize agricultural planning strategies.

- Sustainability Optimization: AI-driven tractors reduce excessive fuel use, optimize spraying precision, and minimize soil compaction, helping farmers achieve greater sustainability, meet environmental regulations, and align with U.S. sustainable farming and green agriculture initiatives.

The US Tractor Market: Competitive Landscape

The U.S. tractor market is characterized by intense competition, driven by both global manufacturers and regional players focusing on innovation, automation, and precision agriculture. Leading companies such as John Deere, CNH Industrial, AGCO Corporation, and Kubota dominate the landscape with extensive product portfolios, advanced technology integration, and robust dealer networks.

These firms continue to invest heavily in autonomous tractors, electric powertrains, and AI-enabled solutions, setting benchmarks for efficiency and sustainability in agricultural machinery. Alongside established brands, several mid-sized and emerging players are entering the market, targeting niche segments such as compact tractors, specialty farming, and livestock operations to strengthen their presence.

Technological differentiation has become a critical factor in competitive positioning, as farmers increasingly demand smart tractors equipped with GPS guidance, telematics, and predictive maintenance features. Partnerships with agri-tech firms, software providers, and research institutions are also shaping market competition, fostering innovations in data-driven farming. Moreover, after-sales service, financing options, and availability of spare parts remain important aspects influencing farmer loyalty and purchase decisions.

The market is further shaped by collaborations and acquisitions aimed at expanding product offerings and geographic coverage. With sustainability and productivity at the core of modern agriculture, competition in the U.S. tractor market is expected to intensify, where companies excelling in technology adoption and customer support are likely to maintain dominance.

Some of the prominent players in the US Tractor Market are:

- John Deere

- CNH Industrial (Case IH, New Holland)

- AGCO Corporation (Massey Ferguson, Fendt, Challenger)

- Kubota Tractor Corporation

- Mahindra USA

- CLAAS

- Yanmar America

- Kioti Tractor (Daedong-USA, Inc.)

- TYM-USA (Tong Yang Moolsan)

- LS Tractor USA

- Branson Tractors (part of TYM)

- Sonalika International Tractors (ITL)

- Escorts Kubota Limited (Farmtrac, Powertrac)

- Argo Tractors (McCormick, Landini)

- Deutz-Fahr (SDF Group)

- Zetor North America

- Same Deutz-Fahr America

- Ventrac (part of The Toro Company)

- Versatile (Buhler Industries)

- Massey Ferguson North America (AGCO brand)

- Other Key Players

Recent Developments in the US Tractor Market

- July 2024: John Deere introduced enhanced precision agriculture solutions integrated into mid-range tractors. These upgrades included advanced sensor systems and AI-enabled guidance to help farmers reduce fuel consumption and optimize tillage efficiency, reflecting the growing shift toward autonomous capabilities in the U.S. tractor market.

- June 2024: CNH Industrial announced expanded investments in its U.S.-based tractor manufacturing facilities. The move focused on scaling domestic production to reduce reliance on imports and address rising demand from both large-scale farms and rural communities, while also creating jobs in manufacturing hubs.

- May 2024: Kubota unveiled a new compact tractor line at a leading U.S. agricultural expo. The models were designed specifically for small and mid-sized farms, landscaping businesses, and municipal applications, reflecting the company’s strategy to cater to niche and diversified American farming operations.

- April 2024: AGCO Corporation entered into a partnership with Trimble to integrate AI-driven precision technologies into its tractor fleet. The collaboration emphasized real-time data collection, GPS steering, and machine learning applications, aiming to improve yield management for U.S. farmers.

- March 2024: Mahindra & Mahindra hosted a major dealer conference in Texas, showcasing its updated 2WD tractor lineup. The event emphasized affordability, versatility, and ease of maintenance, positioning Mahindra as a strong competitor in rural America and the hobby farming segment.

- February 2024: John Deere announced a collaboration with SpaceX’s Starlink to enable satellite connectivity in tractors. This innovation was aimed at improving telematics, precision farming, and predictive maintenance for farmers in remote U.S. regions with poor internet access.

- January 2024: Case IH launched a fully autonomous tractor prototype in the U.S. market. The machine highlighted the company’s focus on labor shortage solutions and advanced mechanization trends, showcasing the potential of driverless tractors for row-crop farming.

- December 2023: Kubota America expanded its dealer network across the Midwest. The expansion ensured better after-sales services, training facilities, and faster spare parts availability, reinforcing Kubota’s position in key agricultural states like Iowa, Illinois, and Ohio.

- November 2023: John Deere acquired a minority stake in a U.S.-based agri-tech startup specializing in AI-powered crop management solutions. This investment underlined Deere’s strategy of blending tractor equipment with digital farming ecosystems.

- October 2023: CLAAS participated in a major U.S. agricultural expo, unveiling updates to its tractor technology, particularly focusing on fuel efficiency and hybrid models to appeal to environmentally conscious farmers.

- September 2023: Yanmar America announced expanded tractor assembly capabilities in Georgia to serve growing U.S. demand for compact and mid-sized tractors. The investment also supported local sourcing of parts to strengthen supply chains.

- August 2023: LS Tractor USA launched an innovation program in North Carolina, introducing tractors with improved ergonomics and fuel efficiency for family-owned farms and ranches.

- July 2023: Versatile showcased its latest high-horsepower tractor series at a U.S. agri-machinery conference. The models were targeted at large-scale grain and corn producers seeking durability and pulling strength.

- June 2023: TYM-USA completed the integration of Branson Tractors under its U.S. operations, expanding its portfolio in the compact tractor category. The merger enhanced its competitiveness in the hobby farming and landscaping sectors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 23.7 Bn |

| Forecast Value (2034) |

USD 37.9 Bn |

| CAGR (2025–2034) |

5.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Horsepower (Less than 40 HP, 41 to 100 HP, and More than 100 HP), By Driveline (2WD, and 4WD), By Application (Agriculture, Industrial, Utility, and Others) |

| Regional Coverage |

The US |

| Prominent Players |

John Deere, CNH Industrial (Case IH, New Holland), AGCO Corporation (Massey Ferguson, Fendt, Challenger), Kubota Tractor Corporation, Mahindra USA, CLAAS, Yanmar America, Kioti Tractor, TYM-USA, LS Tractor USA, Branson Tractors, Sonalika International Tractors, Escorts Kubota Limited, Argo Tractors, Deutz-Fahr, Zetor North America, Same Deutz-Fahr America, Ventrac (Toro), Versatile, Massey Ferguson North America, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |