Market Overview

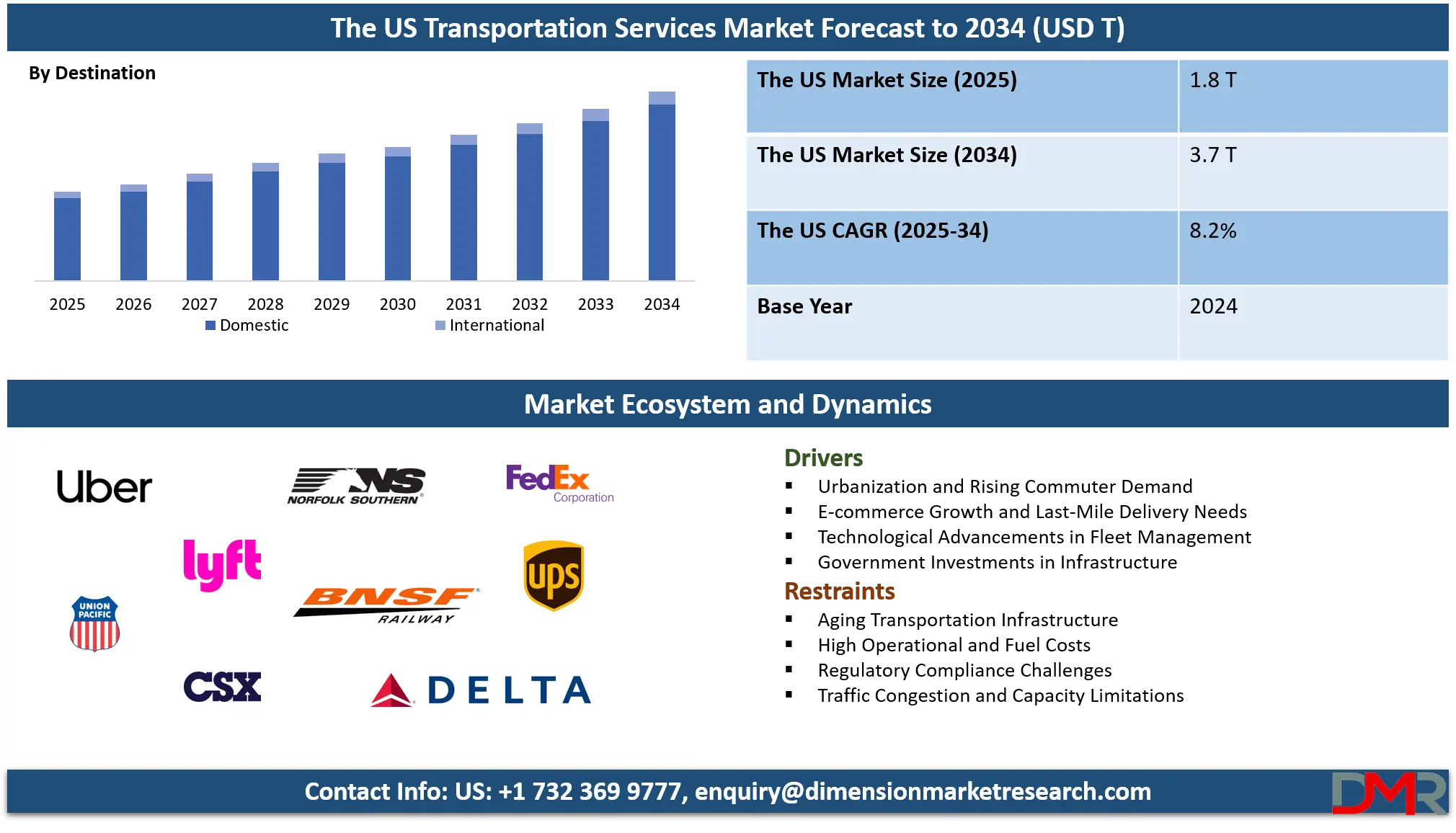

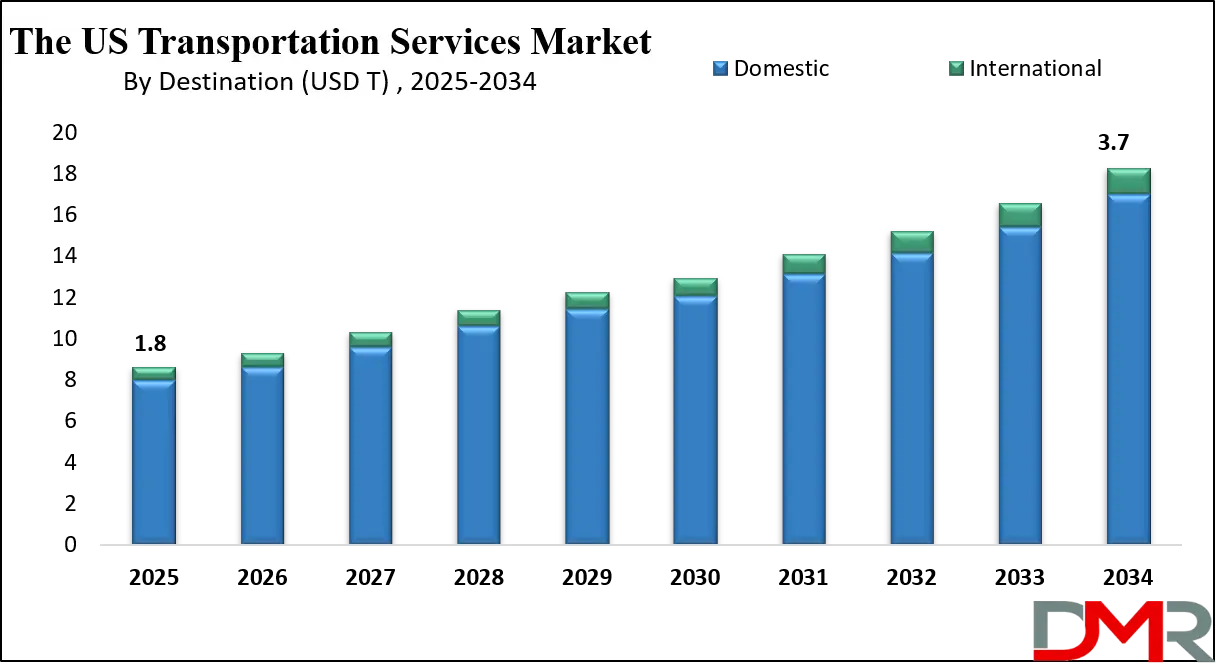

The US transportation services market was valued at approximately USD 1.8 trillion in 2025 and is projected to reach around USD 3.7 trillion by 2034, growing at a CAGR of 8.2% during the forecast period, driven by rising freight movement, expanding passenger mobility, growth in logistics and supply chain services, and increasing adoption of digital transportation and mobility solutions.

Transportation services refer to the organized movement of people and goods from one location to another using various modes such as road, rail, air, and water. These services include passenger mobility, freight transportation, logistics operations, last mile delivery, public transit systems, and specialized transport for commercial and industrial purposes. Transportation services form the backbone of economic activity by enabling trade, workforce mobility, supply chain continuity, and access to essential goods and services. They integrate infrastructure, vehicles, fuel systems, digital platforms, and regulatory frameworks to ensure safe, efficient, and cost effective movement across short and long distances.

The US transportation services market represents one of the largest and most diversified mobility and logistics ecosystems in the world, driven by a vast geographic area, high consumer demand, and strong industrial output. The market includes passenger transportation such as urban transit, ride hailing, intercity travel, aviation, and maritime services, along with freight transportation covering trucking, rail cargo, air freight, and inland waterways. Growth is supported by rising e commerce volumes, expanding urban populations, infrastructure modernization programs, and increasing adoption of digital fleet management and mobility platforms.

In addition, the US transportation services market is being reshaped by sustainability goals, electrification of vehicle fleets, autonomous driving technologies, and smart transportation systems. Federal and state investments in highways, rail corridors, ports, and public transit are strengthening network efficiency and intermodal connectivity. The market also benefits from strong demand across manufacturing, retail, healthcare, and energy supply chains. As fuel efficiency standards tighten and demand for faster deliveries grows, service providers are focusing on asset optimization, green logistics, and data driven operations to remain competitive.

The US Transportation Services Market: Key Takeaways

- Market Value: The US Transportation Services market size is expected to reach a value of USD 3.7 trillion by 2034 from a base value of USD 1.8 trillion in 2025 at a CAGR of 8.2%.

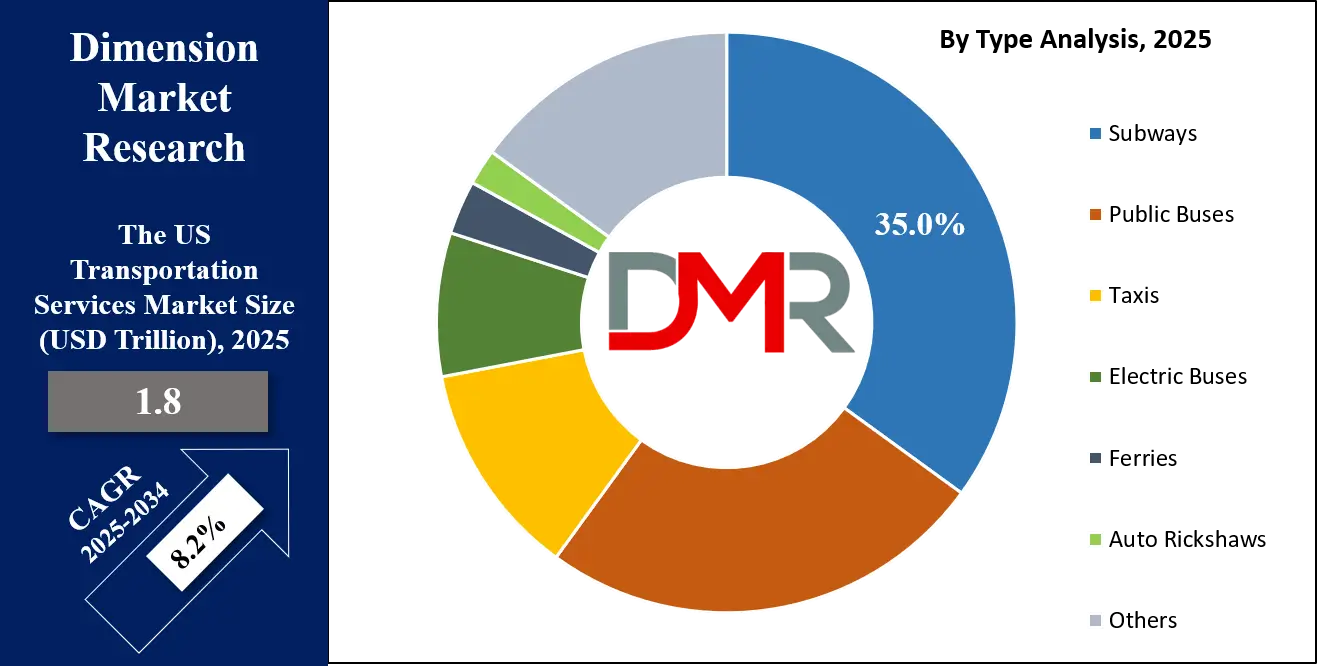

- By Type Segment Analysis: Subways are anticipated to dominate the type segment, capturing 35.0% of the total market share in 2025.

- By Destination Segment Analysis: Domestic destinations are expected to maintain their dominance in the destination segment, capturing 93.0% of the total market share in 2025.

- By Purpose Segment Analysis: Commuter Travel will account for the maximum share in the purpose segment, capturing 38.0% of the total market value.

- Key Players: Some key players in the US Transportation Services market are Uber Technologies Inc., Lyft Inc., Union Pacific Corporation, CSX Corporation, Norfolk Southern Corporation, BNSF Railway, FedEx Corporation, United Parcel Service (UPS), Delta Air Lines Inc., American Airlines Group Inc., Southwest Airlines Co., J.B. Hunt Transport Services Inc., XPO, Inc., Ryder System, Inc., Old Dominion Freight Line, Inc., Knight-Swift Transportation Holdings Inc., and Others.

The US Transportation Services Market: Use Cases

- Passenger Mobility: The US transportation services market is driven by growing demand for passenger mobility, including ride hailing, urban transit, and intercity travel, which supports economic activity and workforce connectivity.

- Freight and Logistics: Freight and logistics services form a core segment, with trucking, rail, air cargo, and last mile delivery enabling supply chain efficiency and timely goods movement across diverse industries.

- Airlines and Aviation: Airlines and aviation services contribute significantly through domestic and international passenger travel, cargo transport, and integrated logistics solutions, supported by fleet modernization and route optimization.

- Technology and Innovation: Technological adoption including digital fleet management, autonomous vehicles, and smart mobility platforms is transforming operations, enhancing efficiency, reducing costs, and improving service reliability in the US market.

Impact of Artificial Intelligence on the US Transportation Services market

Artificial Intelligence is rapidly transforming the US transportation services market by enabling smarter fleet management, predictive maintenance, and optimized routing for passenger and freight operations. AI-powered analytics improve demand forecasting, reduce fuel consumption, and enhance delivery efficiency across trucking, rail, air cargo, and last mile logistics. In passenger mobility, AI supports dynamic ride-hailing pricing, traffic pattern prediction, and autonomous vehicle development, while in aviation, it aids air traffic management and operational safety. Overall, AI adoption drives cost efficiency, reliability, and sustainability across the US transportation ecosystem.

The US Transportation Services Market: Stats & Facts

Bureau of Labor Statistics (BLS) — Employment & Workforce, 2023–2024

- In June 2024, the total employment in the U.S. transportation and warehousing industry was ~ 6.6 million workers, representing about 5% of all private‑sector jobs.

- Among those employed in transportation & warehousing in 2023, roughly 75.1% were men and 24.9% were women; breakdown by sub‑industry shows truck transportation having the highest male share at 88.1%.

- In 2023, about 34% of workers in transit and ground passenger transportation were age 55 or over, indicating an aging workforce in that sub‑sector.

- Projected employment growth (2022–2032) for the transportation and warehousing sector is +8.6%, with sub‑categories like couriers & messengers expected to grow ~17.9% and warehousing/storage ~13.1%, reflecting long-term structural demand growth.

U.S. Department of Transportation / BTS / FHWA — Road Travel & Infrastructure, 2024

- U.S. drivers logged 3.28 trillion vehicle‑miles of travel (VMT) in 2024 — the highest on record — marking a 1% increase over 2023 and surpassing pre‑COVID‑19 levels for the first time, signaling recovery in personal mobility and freight road travel volumes.

- According to the 2024 Transportation Statistics Annual Report (TSAR), as of 2024 the United States maintained ~4.2 million centerline miles of public roads, underscoring the vast scale of road infrastructure supporting both passenger and freight transport.

BTS / DOT — Aviation & Multi-modal Transport, 2024/2025 (partial data)

- For August 2025, U.S. airlines recorded ~87.227 million revenue passenger enplanements (scheduled + non-scheduled).

- In the same period, airline available seat miles (ASM) for August 2025 measured ~123.313 million (000s), indicating capacity and connectivity levels in domestic and international air travel.

The US Transportation Services Market: Market Dynamics

The US Transportation Services Market: Driving Factors

Rising E-commerce and Last-Mile Delivery Demand

The rapid growth of e-commerce in the United States is significantly driving demand for efficient transportation services. Increased online shopping has boosted last-mile delivery volumes, requiring advanced logistics, fleet optimization, and faster shipment solutions. Companies are investing in real-time tracking, route optimization, and integrated supply chain management systems to meet consumer expectations for quick and reliable deliveries, thereby fueling growth in trucking, parcel, rail cargo, and courier services.

Urbanization and Passenger Mobility Expansion

Expanding urban populations and rising workforce mobility are increasing reliance on public transit, ride-hailing services, and intercity passenger transportation. Growing urbanization encourages investment in smart mobility solutions, electric buses, and metro systems, while increasing commuter demand drives technological adoption in traffic management, mobility-as-a-service platforms, and shared transportation networks, further supporting the growth of the US transportation services market.

The US Transportation Services Market: Restraints

Infrastructure Constraints and Congestion

Aging infrastructure and traffic congestion in major US cities hinder efficient transportation operations. Poor road conditions, limited rail capacity, and congested urban corridors increase transit times and operational costs for freight and passenger services. These bottlenecks can reduce reliability, delay deliveries, and impact customer satisfaction, constraining market growth despite rising demand for mobility and logistics services.

Rising Operational and Fuel Costs

High operational expenses, including fuel prices, vehicle maintenance, labor costs, and compliance with environmental regulations, pose a challenge for transportation service providers. Fluctuating diesel and aviation fuel prices directly affect trucking, rail, and airline profitability. Rising costs limit investment capacity in fleet expansion and technological upgrades, slowing the overall growth potential of the US transportation services market.

The US Transportation Services Market: Opportunities

Adoption of Electric and Autonomous Vehicles

The shift toward electric vehicles and autonomous driving technologies presents a major opportunity for cost reduction, sustainability, and operational efficiency. Fleet electrification and AI-powered autonomous transport systems can lower fuel and labor expenses while supporting government carbon reduction initiatives. Early adoption of these technologies positions companies to capture the growing demand for green transportation and smart mobility solutions in urban and intercity networks.

Integration of Digital Logistics and AI Platforms

Digital logistics platforms and AI-driven solutions offer opportunities for optimizing supply chains, predictive maintenance, and real-time shipment tracking. Transportation providers leveraging big data analytics, IoT sensors, and cloud-based fleet management systems can enhance delivery speed, reduce operational downtime, and improve customer experience, creating competitive advantage in a market increasingly reliant on technological efficiency and service reliability.

The US Transportation Services Market: Trends

Sustainability and Green Transportation Initiatives

Environmental consciousness is driving the adoption of sustainable practices across the transportation sector. Companies are integrating electric buses, low-emission trucks, and eco-friendly shipping solutions, while government policies incentivize reduced carbon footprints. Sustainability trends influence fleet procurement, route planning, and operational strategies, promoting environmentally responsible growth in the US transportation services market.

Growth of Multimodal and Intermodal Networks

Intermodal transportation combining road, rail, air, and maritime solutions is increasingly popular for improving efficiency and reducing costs. Companies are investing in integrated logistics hubs, digital coordination platforms, and flexible shipment options to enable seamless cargo movement. This trend supports faster deliveries, better resource utilization, and enhanced connectivity between urban and regional transportation networks.

The US Transportation Services Market: Research Scope and Analysis

By Type Analysis

In the US transportation services market, subways are expected to lead the type segment, accounting for approximately 35.0% of the total market share in 2025. Their dominance is primarily driven by high population density in major metropolitan areas such as New York, Washington D.C., Boston, and San Francisco, where daily commuter demand is substantial. Subways provide a reliable, cost-effective, and efficient mode of urban transport, helping reduce traffic congestion and carbon emissions. The extensive rail networks, frequent service schedules, and integration with other transit modes make subways a preferred choice for millions of daily passengers, reinforcing their position as the dominant segment in the US transportation ecosystem.

Public buses also play a significant role in this market segment, serving as a flexible and accessible mode of transportation for urban, suburban, and rural populations. They complement subways and rail services by covering areas that are not accessible by fixed rail lines, offering extensive route networks and frequent stops.

The growth of public bus services is further supported by increasing investments in fleet modernization, adoption of cleaner fuel technologies, and integration with smart transit systems that improve operational efficiency and passenger experience. Public buses remain essential for last-mile connectivity, affordable commuting, and reducing private vehicle dependency, maintaining a strong presence within the US transportation services market.

By Destination Analysis

In the US transportation services market, domestic destinations are projected to dominate the destination segment, accounting for approximately 93.0% of the total market share in 2025. This strong position is driven by the extensive demand for internal passenger travel, freight movement, and logistics operations across the country. Domestic travel includes daily commuting, intercity transport, and commercial freight services that connect key industrial, commercial, and agricultural hubs. The growth of e-commerce, urbanization, and regional trade further reinforces domestic transport demand. Well-developed highways, rail networks, and regional airports support efficient movement of goods and passengers, making domestic travel the backbone of the US transportation services market.

International destinations, while representing a smaller portion of the market, play a crucial role in connecting the US with global trade and travel networks. International travel includes air passenger flights, maritime shipping, and cross-border freight, facilitating imports, exports, and global business operations.

Although the market share is limited compared to domestic travel, demand for international transportation is growing steadily due to global supply chain integration, tourism, and multinational business activities. Investments in international airport infrastructure, port expansions, and air cargo handling systems help improve connectivity and service efficiency, ensuring that international transportation remains an important, albeit smaller, segment within the US transportation services market.

By Purpose Analysis

Commuter travel is expected to account for the largest share of the purpose segment in the US transportation services market, capturing approximately 38.0% of the total market value in 2025. This dominance is largely driven by the high volume of daily passenger movement within urban and suburban areas for work, education, and essential errands. Growing urbanization, increasing employment rates, and expanding metropolitan regions contribute to rising demand for reliable and efficient public transit, ride-hailing services, and commuter rail networks. Investments in smart mobility solutions, real-time scheduling, and integrated transit systems further enhance convenience and accessibility, reinforcing commuter travel as the leading purpose segment.

Shipping and delivery travel forms a critical component of the purpose segment, driven by the surge in e-commerce, online retail, and fast-moving consumer goods demand. This segment includes last-mile deliveries, freight shipments, courier services, and logistics operations across road, rail, and air networks.

The need for timely, reliable, and cost-effective delivery solutions encourages transportation service providers to adopt route optimization, digital tracking, and automated warehouse management systems. Rising consumer expectations for same-day and next-day deliveries, combined with growing business-to-business shipment volumes, position shipping and delivery travel as a rapidly expanding purpose segment within the US transportation services market.

The US Transportation Services Market Report is segmented on the basis of the following:

By Type

- Public Buses

- Electric Buses

- Subways

- Taxis

- Auto Rickshaws

- Ferries

- Others

By Destination

By Purpose

- Commuter Travel

- Cargo and Freight Travel

- Tourism and Leisure Travel

- Business Travel

- Shipping and Delivery Travel

The US Transportation Services Market: Competitive Landscape

The US transportation services market is highly competitive, characterized by a mix of established and emerging players across passenger mobility, freight, and logistics segments. Companies are increasingly focusing on technological innovation, digital fleet management, autonomous vehicle integration, and smart mobility platforms to enhance operational efficiency and service reliability.

Market competitiveness is also driven by investments in sustainability initiatives, fleet electrification, and last-mile delivery optimization. Firms continuously strive to expand network coverage, improve customer experience, and adapt to regulatory changes, creating a dynamic environment that encourages efficiency, innovation, and differentiation in service offerings.

Some of the prominent players in the US Transportation Services market are:

- Uber Technologies Inc.

- Lyft Inc.

- Union Pacific Corporation

- CSX Corporation

- Norfolk Southern Corporation

- BNSF Railway

- FedEx Corporation

- United Parcel Service (UPS)

- Delta Air Lines Inc.

- American Airlines Group Inc.

- Southwest Airlines Co.

- J.B. Hunt Transport Services Inc.

- XPO, Inc.

- Ryder System, Inc.

- Old Dominion Freight Line, Inc.

- Knight-Swift Transportation Holdings Inc.

- Expeditors International of Washington, Inc.

- C.H. Robinson Worldwide, Inc.

- Schneider National, Inc.

- Werner Enterprises, Inc.

- Other Key Players

The US Transportation Services Market: Recent Developments

- November 2025: Uber Freight expanded its logistics footprint by entering last‑mile delivery through a strategic partnership and minority investment in Better Trucks. This move allows Uber Freight to offer end‑to‑end logistics services, extending deliveries from fulfillment centers directly to consumers’ doorsteps, improving coverage, real‑time visibility and delivery speed across urban and suburban markets.

- November 2025: Harbinger Motors, an American electric truck startup, raised USD 160 million in a Series C round co‑led by FedEx, THOR Industries and Capricorn’s Technology Impact Fund — and secured an initial order for 53 medium‑duty electric delivery trucks. This funding and order reflect growing demand for sustainable, electric commercial vehicles to support parcel delivery and freight services across the U.S.

- July 2025: Union Pacific Corporation and Norfolk Southern Corporation announced a proposed merger to create the first coast‑to‑coast freight‑rail operator in the United States. The deal will combine their networks to span more than 50,000 miles across 43 states, connecting over 100 ports, aiming to strengthen supply‑chain efficiency and improve rail freight’s competitive position against trucking.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.8 T |

| Forecast Value (2034) |

USD 3.7 T |

| CAGR (2025–2034) |

8.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Public Buses, Electric Buses, Subways, Taxis, Auto Rickshaws, Ferries, and Others), By Destination (Domestic, and International), By Purpose (Commuter Travel, Cargo and Freight Travel, Tourism and Leisure Travel, Business Travel, and Shipping and Delivery Travel) |

| Regional Coverage |

The US |

| Prominent Players |

Uber Technologies Inc., Lyft Inc., Union Pacific Corporation, CSX Corporation, Norfolk Southern Corporation, BNSF Railway, FedEx Corporation, United Parcel Service (UPS), Delta Air Lines Inc., American Airlines Group Inc., Southwest Airlines Co., J.B. Hunt Transport Services Inc., XPO, Inc., Ryder System, Inc., Old Dominion Freight Line, Inc., Knight-Swift Transportation Holdings Inc., and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

Some of the major key players in the US Transportation Services market are Uber Technologies Inc., Lyft Inc., Union Pacific Corporation, CSX Corporation, Norfolk Southern Corporation, BNSF Railway, FedEx Corporation, United Parcel Service (UPS), Delta Air Lines Inc., American Airlines Group Inc., Southwest Airlines Co., J.B. Hunt Transport Services Inc., XPO, Inc., Ryder System, Inc., Old Dominion Freight Line, Inc., Knight-Swift Transportation Holdings Inc., and Others.