Market Overview

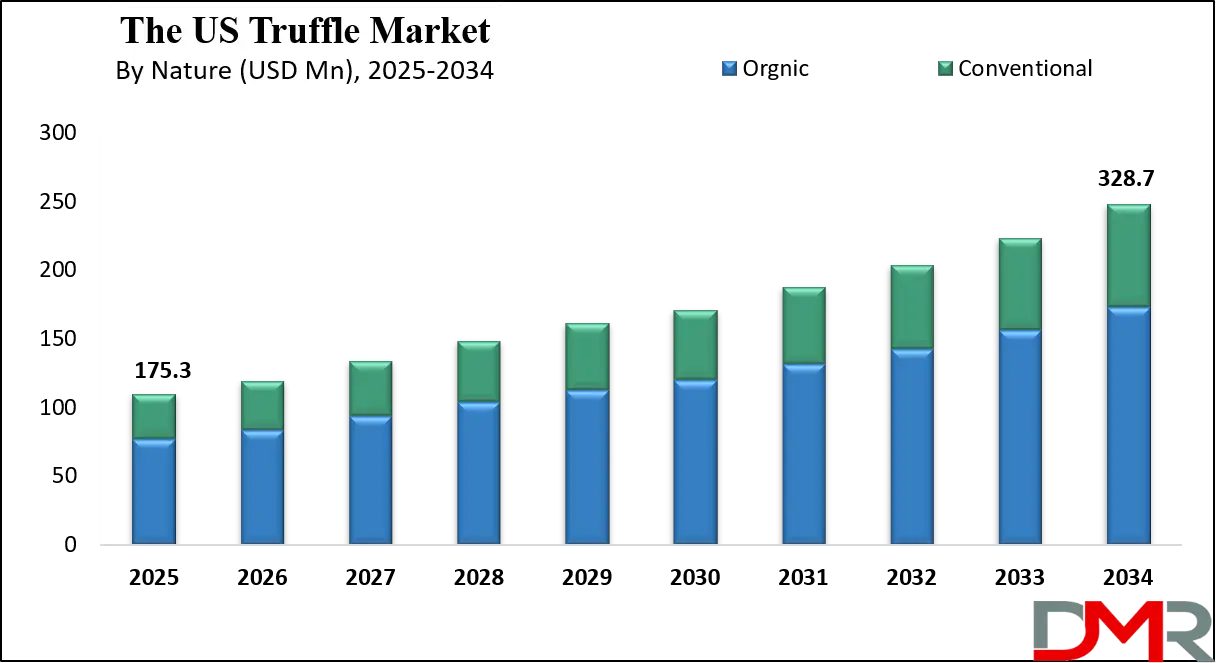

The US truffle market is set to grow from USD 175.3 million in 2025 to USD 328.7 million by 2034 at a CAGR of 7.2%, driven by rising demand for fresh and processed truffles, truffle oils, fine dining, and specialty retail, supported by domestic cultivation and European imports.

A truffle is a rare and highly prized type of edible fungus that grows underground in symbiotic association with the roots of certain trees, such as oaks, hazelnuts, and beeches. Known for their intense and distinctive aroma, truffles are considered a luxury ingredient in the culinary world and are used to enhance the flavor of a wide range of dishes, from gourmet sauces to cheeses and oils. Their growth is highly dependent on specific soil conditions, climate, and the presence of host trees, making them difficult to cultivate and harvest.

Truffles are typically located using trained animals such as dogs or pigs, which can detect their pungent scent beneath the soil. Beyond their culinary value, truffles are also appreciated for their nutritional content, including proteins, antioxidants, and essential minerals. Due to their scarcity, seasonal availability, and labor-intensive harvesting process, truffles command premium prices in global markets, making them a significant commodity in the luxury food industry.

The US truffle market has been witnessing steady growth driven by increasing consumer awareness of gourmet and luxury food products, along with a rising demand from fine dining restaurants and specialty food retailers. The market includes a variety of truffle types such as black truffles, white truffles, and summer truffles, supplied both as fresh produce and in processed forms like oils, sauces, and preserves.

The growth of organic and sustainable food trends has further propelled the adoption of domestically grown and imported truffles, making the United States an important destination for premium truffle products. The market is also supported by specialized distributors and online platforms that enhance accessibility for both retail and institutional buyers, while collaborations with international truffle producers strengthen the supply chain.

Consumer preferences in the US truffle market are increasingly influenced by culinary innovation and luxury food culture, with high-end restaurants and gourmet chefs driving the need for consistent quality and diverse truffle varieties. Domestic cultivation efforts in states like Oregon and California are complementing imported supplies from Europe, enabling a more balanced market and reduced dependence on seasonal imports. Market participants are focusing on brand differentiation, quality certifications, and traceability to meet regulatory standards and appeal to discerning consumers.

The expanding interest in truffle-infused products in retail and online channels is creating new opportunities for market growth, while efficient distribution networks ensure that these premium products reach consumers without compromising quality. The US truffle market continues to evolve in response to changing culinary trends, the premiumization of food offerings, and strategic collaborations across the value chain.

The US Truffle Market: Key Takeaways

- Market Value: The US truffle market size is expected to reach a value of USD 328.7 million by 2034 from a base value of USD 175.3 million in 2025 at a CAGR of 7.2%.

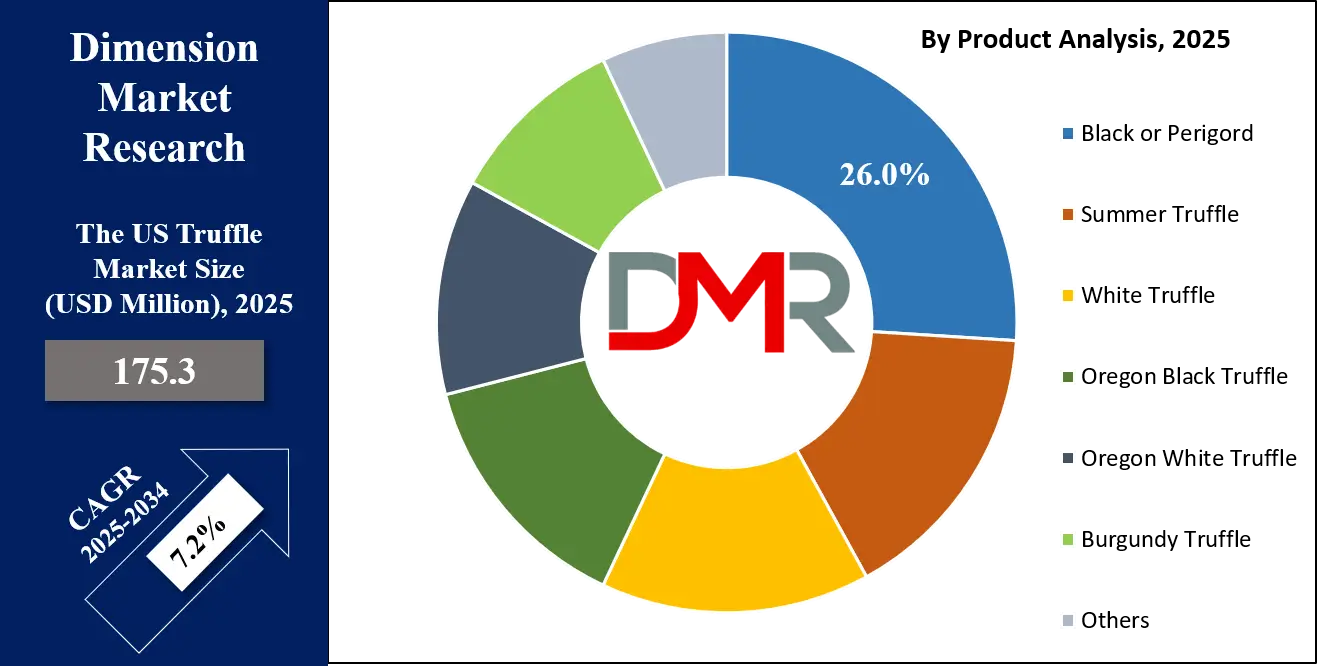

- By Product Type Segment Analysis: Black or Perigord products are anticipated to dominate the product type segment, capturing 26.0% of the total market share in 2025.

- By Nature Segment Analysis: Organic truffle is expected to maintain its dominance in the nature segment, capturing 70.0% of the total market share in 2025.

- By Form Segment Analysis: Fresh truffle will account for the maximum share in the form segment, capturing 38.0% of the total market value.

- By Distribution Channel Segment Analysis: B2B channels will dominate the distribution channel segment, capturing 20.0% of the market share in 2025.

- By End-User Segment Analysis: Food & Beverages will dominate the end-user segment, capturing 47.0% of the market share in 2025.

- Key Players: Some key players in the US truffle market are Sabatino Tartufi, Urbani Tartufi (Urbani Truffles S.r.l.), La Maison Plantin (Marcel Plantin), TruffleHunter Ltd., Gazzarrini Tartufi, The Truffle & Wine Co., Truffle Hill, Bianconi Tartufi, Laumont Truffles, Vittorio Giordano (Vittorio Giordano USA), Savini Tartufi, Les Frères Jaumard, Tartuflanghe S.r.l., Tartufi Morra S.r.l., Arotz Foods S.A., and Others.

The US Truffle Market: Use Cases

- Gourmet and Fine Dining Applications: Truffles are extensively used in fine dining restaurants and luxury culinary experiences to elevate flavor profiles. Chefs incorporate fresh truffles, truffle oils, and truffle-infused sauces into pasta, risotto, meats, and appetizers, enhancing taste and aroma. This segment drives demand for premium and consistent quality truffles in the US market.

- Specialty Retail and Online Sales: High-end grocery stores, gourmet shops, and online platforms sell fresh truffles, truffle oils, and processed truffle products to home cooks and enthusiasts. Consumers increasingly seek authentic, traceable, and sustainably sourced truffles, fueling retail growth and expanding e-commerce channels.

- Processed Food and Ingredient Industry: Truffles are used in the production of truffle-flavored oils, butters, sauces, and seasonings. Food manufacturers leverage these ingredients to create premium packaged products, tapping into the growing demand for gourmet and indulgent convenience foods.

- Domestic Cultivation and Supply Chain Development: US-based truffle farms, especially in Oregon and California, contribute to local supply, reducing dependence on imports from Europe. Investments in cultivation, storage, and distribution infrastructure support market expansion while maintaining freshness and consistent quality for both retail and food service sectors.

Impact of Artificial Intelligence on the US Truffle market

Artificial intelligence is increasingly transforming the US truffle market by enhancing efficiency across cultivation, harvesting, and supply chain operations. AI-powered sensors and predictive analytics help farmers monitor soil conditions, moisture levels, and tree health, optimizing truffle growth and yield. In harvesting, AI-assisted detection systems, including machine vision and trained algorithms, support the identification of truffle locations, reducing reliance on traditional animal-assisted methods. Within logistics and distribution, AI enables better inventory management, demand forecasting, and temperature-controlled transportation, ensuring freshness and reducing spoilage.

Additionally, AI-driven data insights help producers and retailers understand consumer preferences, track market trends, and tailor product offerings, supporting strategic marketing and premium pricing. Overall, AI integration enhances productivity, lowers operational risks, and strengthens the competitiveness of the US truffle market.

The US Truffle Market: Stats & Facts

United States Department of Agriculture (USDA) / National Agricultural Statistics Service (NASS) — Mushroom Reports

- According to the 2024–2025 mushroom crop report, the U.S. mushroom crop sales volume reached 670 million pounds, up 2% from the previous season.

- The total value of those sales was USD 1.10 billion, up 1% compared with the previous season.

- The average price reported per pound was USD 1.64 for the 2024–2025 season.

Trade data — Fresh or Chilled Truffles Imports (per HS code)

- In 2023, the U.S. imported 25,605 kg of fresh or chilled truffles (HS code 070952), with a declared import value of USD 62.15 thousand.

- Export data for 2023 shows the U.S. exported 1,611 kg of fresh or chilled truffles, valued at USD 36.32 thousand.

Trade data — Dried Mushrooms and Truffles Imports

- In 2023, imports of “Dried mushrooms and truffles” (HS code 071230) into the U.S. amounted to 4,662,030 kg.

- The total import value for dried mushrooms and truffles in 2023 was USD 34,184.56 thousand.

The US Truffle Market: Market Dynamics

The US Truffle Market: Driving Factors

Rising Demand for Gourmet and Luxury Foods

The growing popularity of fine dining and luxury culinary experiences in the US has fueled demand for high-quality fresh and processed truffles. Consumers increasingly seek premium ingredients such as black truffles, white truffles, and truffle oils to enhance flavor profiles in restaurants and home kitchens, supporting consistent market growth.

Expansion of Domestic Cultivation

Efforts to cultivate truffles domestically in states like Oregon and California are boosting supply stability. Controlled cultivation techniques and investment in truffle orchards reduce reliance on European imports, ensuring consistent availability for specialty retailers, food service providers, and gourmet product manufacturers.

The US Truffle Market: Restraints

High Cost and Seasonal Availability

Truffles remain a costly ingredient due to labor-intensive harvesting, specific growth conditions, and limited seasonal availability. These factors restrict access for price-sensitive consumers and smaller food service businesses, limiting overall market penetration.

Perishability and Storage Challenges

Fresh truffles have a short shelf life and require specialized cold chain storage and rapid distribution. Inadequate handling can lead to quality degradation, posing challenges for supply chain management and increasing operational costs for producers and distributors.

The US Truffle Market: Opportunities

Growth of Truffle-Infused Processed Products

There is significant potential in expanding processed truffle-based products, including oils, sauces, butters, and seasonings. Increasing consumer preference for gourmet convenience foods and premium packaged ingredients opens new avenues for product innovation and retail expansion.

E-Commerce and Specialty Retail Channels

Online platforms and specialty gourmet stores offer opportunities to reach a wider audience, providing traceable, sustainably sourced, and premium truffle products. Digital marketing and direct-to-consumer sales can enhance brand visibility and drive growth in both fresh and processed truffle segments.

The US Truffle Market: Trends

Sustainability and Organic Cultivation Practices

US consumers are increasingly favoring organically grown and sustainably sourced truffles. Producers adopting environmentally friendly cultivation practices and transparent supply chains align with consumer values, driving market differentiation and premium pricing.

Technological Integration in Supply Chain

The adoption of smart logistics, AI-driven monitoring, and predictive analytics is shaping the US truffle market. Technology helps optimize cultivation, track quality during transport, and improve inventory management, ensuring freshness while minimizing losses and operational inefficiencies.

The US Truffle Market: Research Scope and Analysis

By Product Type Analysis

In the US truffle market, black or Perigord truffles are expected to lead the product type segment, accounting for approximately 26.0% of the total market share in 2025. Known for their rich aroma and deep, earthy flavor, black truffles are highly sought after by gourmet chefs and luxury food enthusiasts. Their versatility allows them to be used in fresh form, truffle oils, sauces, and infused products, making them a preferred choice for both fine dining establishments and specialty retail. The premium pricing and consistent demand for black truffles also contribute to their dominant position in the market, supported by both imported varieties from Europe and emerging domestic cultivation in states like Oregon and California.

Summer truffles, on the other hand, represent a lighter, milder alternative in this market segment. They are generally more affordable than black and white truffles and have a shorter shelf life, which makes them ideal for seasonal offerings and experimental culinary applications. While they do not command the same premium pricing as black or white truffles, summer truffles are gaining popularity among chefs and home cooks for their subtle flavor and aroma, providing an accessible entry point for consumers exploring gourmet ingredients. Their availability during specific months also helps diversify product offerings and supports year-round engagement with truffle-based culinary products.

By Nature Analysis

In the US truffle market, organic truffles are expected to maintain a dominant position in the nature segment, capturing around 70.0% of the total market share in 2025. The growing consumer preference for natural, chemical-free, and sustainably sourced food products has significantly boosted the demand for organic truffles. These truffles are cultivated without synthetic fertilizers or pesticides, ensuring higher quality, superior flavor, and safer consumption.

Organic truffles also align with the rising trend of health-conscious eating and environmentally responsible farming practices, making them highly sought after by both fine dining establishments and specialty retail outlets. The premium pricing associated with organic truffles reflects their quality and ethical cultivation methods, further reinforcing their leading position in the market.

Conventional truffles, in contrast, are cultivated using traditional methods that may include chemical fertilizers and non-organic practices. While generally more affordable than organic truffles, they are often considered less desirable by consumers who prioritize sustainability and natural ingredients. Despite this, conventional truffles continue to play a role in the market, particularly in processed products, seasonal offerings, and price-sensitive segments. They provide broader accessibility for restaurants and consumers who want to experiment with truffle flavors without incurring the higher costs associated with organic options, thereby complementing the overall product mix in the US truffle market.

By Form Analysis

In the US truffle market, fresh truffles are expected to account for the largest share in the form segment, capturing around 38.0% of the total market value. Fresh truffles are highly valued for their intense aroma, rich flavor, and culinary versatility, making them the preferred choice for fine dining restaurants, gourmet chefs, and specialty retailers. Their use in high-end dishes, such as risottos, pastas, and meat preparations, drives consistent demand.

The handling of fresh truffles requires careful cold chain management and rapid distribution to maintain quality and freshness, which adds to their premium positioning in the market. Domestic cultivation in regions like Oregon and California, along with imports from Europe, ensures steady availability to meet consumer and commercial demand.

Processed truffles, on the other hand, include truffle oils, sauces, butters, pastes, and seasonings. These products offer convenience, longer shelf life, and easier integration into a variety of recipes, appealing to both home cooks and food manufacturers. Although they typically carry a lower price point than fresh truffles, processed truffle products are witnessing growing popularity due to their accessibility and versatility. They also enable brands to expand distribution through specialty retail stores, supermarkets, and e-commerce platforms, contributing significantly to overall market growth and providing a reliable revenue stream across different consumer segments.

By Distribution Channel Analysis

In the US truffle market, B2B distribution channels are expected to dominate, capturing approximately 20.0% of the market share in 2025. These channels primarily serve restaurants, hotels, catering services, and specialty food retailers, providing a consistent supply of fresh and processed truffle products. The emphasis on bulk orders, quality assurance, and reliable delivery schedules makes B2B transactions essential for maintaining the premium nature of truffle offerings.

Businesses benefit from direct partnerships with truffle growers, distributors, and importers, ensuring product authenticity, traceability, and freshness. This structured supply chain allows chefs and retailers to meet growing consumer demand for luxury culinary ingredients while maintaining operational efficiency and reducing procurement risks.

Food processing industries also play a significant role in this market segment by utilizing truffles as key ingredients in the production of oils, sauces, butters, and seasonings. These processed products cater to both commercial and retail consumers, offering extended shelf life and convenient usage in various culinary applications.

The integration of truffles into processed foods not only enhances flavor and aroma but also adds a premium and gourmet appeal to packaged products. This segment benefits from growing demand for ready-to-use gourmet ingredients and supports the expansion of truffle-based products across specialty retail and e-commerce channels, contributing to overall market growth.

By End-User Analysis

In the US truffle market, the food and beverages segment is expected to dominate the end-user category, capturing around 47.0% of the market share in 2025. This is driven by the widespread use of truffles in fine dining, gourmet restaurants, and specialty food products. Fresh truffles, truffle oils, and truffle-infused sauces are incorporated into a variety of dishes, enhancing flavor and aroma, while processed truffle products cater to home cooks and packaged food manufacturers. The growing consumer preference for luxury and premium culinary experiences, along with the expansion of specialty retail and online channels, supports steady demand in this segment.

Truffles are also increasingly used in cosmetics and personal care products, creating a niche yet growing market segment. Truffle extracts are valued for their antioxidant properties, skin-nourishing benefits, and natural anti-aging effects, making them a sought-after ingredient in high-end creams, serums, and lotions. Luxury beauty brands leverage truffles to differentiate their products and appeal to consumers seeking premium and natural skincare solutions. Although smaller than the food and beverages segment, the cosmetics and personal care market provides an opportunity for innovation and product diversification, contributing to the overall growth of the US truffle market.

The US Truffle Market Report is segmented on the basis of the following:

By Product Type

- Black or Perigord

- Summer Truffle

- White Truffle

- Oregon Black Truffle

- Oregon White Truffle

- Burgundy Truffle

- Others

By Nature

By Form

- Fresh

- Processed

- Dried

- Oil

- Frozen

- Canned

- Others

By Distribution Channel

- B2B

- Food Processing Industries

- Food Service Restaurants

- Cosmetics and Personal Care Industry

- Pharmaceuticals

- B2C

- Store-Based Retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Independent Grocery Stores

- Specialty Stores

- Discounters

- Other Retailers

- Online Retailing

By End-User

- Food & Beverages

- Cosmetics & Personal Care Products

- Pharmaceuticals

The US Truffle Market: Competitive Landscape

The US truffle market is highly competitive, with a mix of domestic cultivators and international suppliers vying for market share across fresh and processed truffle products. Key players such as Sabatino Tartufi, Urbani Tartufi, La Maison Plantin, and TruffleHunter Ltd. focus on maintaining product quality, authenticity, and consistent supply to meet the demands of gourmet restaurants, specialty retailers, and online consumers.

Companies differentiate themselves through premium offerings, organic certification, innovative truffle-infused products, and strong distribution networks. Strategic partnerships, collaborations with fine dining establishments, and investments in domestic cultivation and cold chain logistics further intensify competition. The market landscape is shaped by continuous product innovation, traceability initiatives, and marketing efforts aimed at capturing the growing demand for luxury culinary ingredients in the US.

Some of the prominent players in the US Truffle market are:

- Sabatino Tartufi

- Urbani Tartufi (Urbani Truffles S.r.l.)

- La Maison Plantin (Marcel Plantin)

- TruffleHunter Ltd.

- Gazzarrini Tartufi

- The Truffle & Wine Co.

- Truffle Hill

- Bianconi Tartufi

- Laumont Truffles

- Vittorio Giordano (Vittorio Giordano USA)

- Savini Tartufi

- Les Frères Jaumard

- Tartuflanghe S.r.l.

- Tartufi Morra S.r.l.

- Arotz Foods S.A.

- Monini S.p.A.

- Soria Natural

- Trivelli Tartufi S.r.l.

- Terra Ross

- Australian Truffle Traders

- Other Key Players

The US Truffle Market: Recent Developments

- Mar 2025: La Rustichella launched a 100 % certified organic truffle-product range, including truffle oil, pâté, and carpaccio, targeting both foodservice providers and premium retail buyers. The new range emphasizes sustainable sourcing and high-quality ingredients, allowing chefs and gourmet consumers to access authentic truffle flavors with convenience. This launch reflects growing consumer demand for organic and natural luxury ingredients in the US market.

- Dec 2024: Sabatino Tartufi expanded its North American warehouse and production facility in West Haven, Connecticut, consolidating auxiliary distribution operations and increasing production capacity by approximately 40%. The expansion enables the company to streamline logistics, improve cold chain management, and meet the rising demand from restaurants, specialty retailers, and online platforms across the United States.

- Jun 2024: TRUFF expanded its hot-sauce line with a new Buffalo Sauce flavor, blending the brand’s signature truffle essence with popular spicy flavors. This product innovation aims to attract both existing gourmet consumers and new audiences seeking premium, convenient, and versatile condiments. The launch strengthens TRUFF’s presence in the US specialty foods and premium sauces market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 175.3 Mn |

| Forecast Value (2034) |

USD 328.7 Mn |

| CAGR (2025–2034) |

7.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Black/Perigord, Summer, White, Oregon Black/White, Burgundy, Others), By Nature (Organic, Conventional), By form (Fresh, Processed, Dried, Oil, Frozen, Canned, Others), By Distribution channel (B2B, B2C), and By End-use (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals) |

| Regional Coverage |

The US |

| Prominent Players |

Sabatino Tartufi, Urbani Tartufi (Urbani Truffles S.r.l.), La Maison Plantin (Marcel Plantin), TruffleHunter Ltd., Gazzarrini Tartufi, The Truffle & Wine Co., Truffle Hill, Bianconi Tartufi, Laumont Truffles, Vittorio Giordano (Vittorio Giordano USA), Savini Tartufi, Les Frères Jaumard, Tartuflanghe S.r.l., Tartufi Morra S.r.l., Arotz Foods S.A., and Others., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US truffle market size is estimated to have a value of USD 175.3 million in 2025 and is expected to reach USD 328.7 million by the end of 2034, with a CAGR of 7.2%.

Some of the major key players in the US truffle market are Sabatino Tartufi, Urbani Tartufi (Urbani Truffles S.r.l.), La Maison Plantin (Marcel Plantin), TruffleHunter Ltd., Gazzarrini Tartufi, The Truffle & Wine Co., Truffle Hill, Bianconi Tartufi, Laumont Truffles, Vittorio Giordano (Vittorio Giordano USA), Savini Tartufi, Les Frères Jaumard, Tartuflanghe S.r.l., Tartufi Morra S.r.l., Arotz Foods S.A., and Others., and Others.