Market Overview

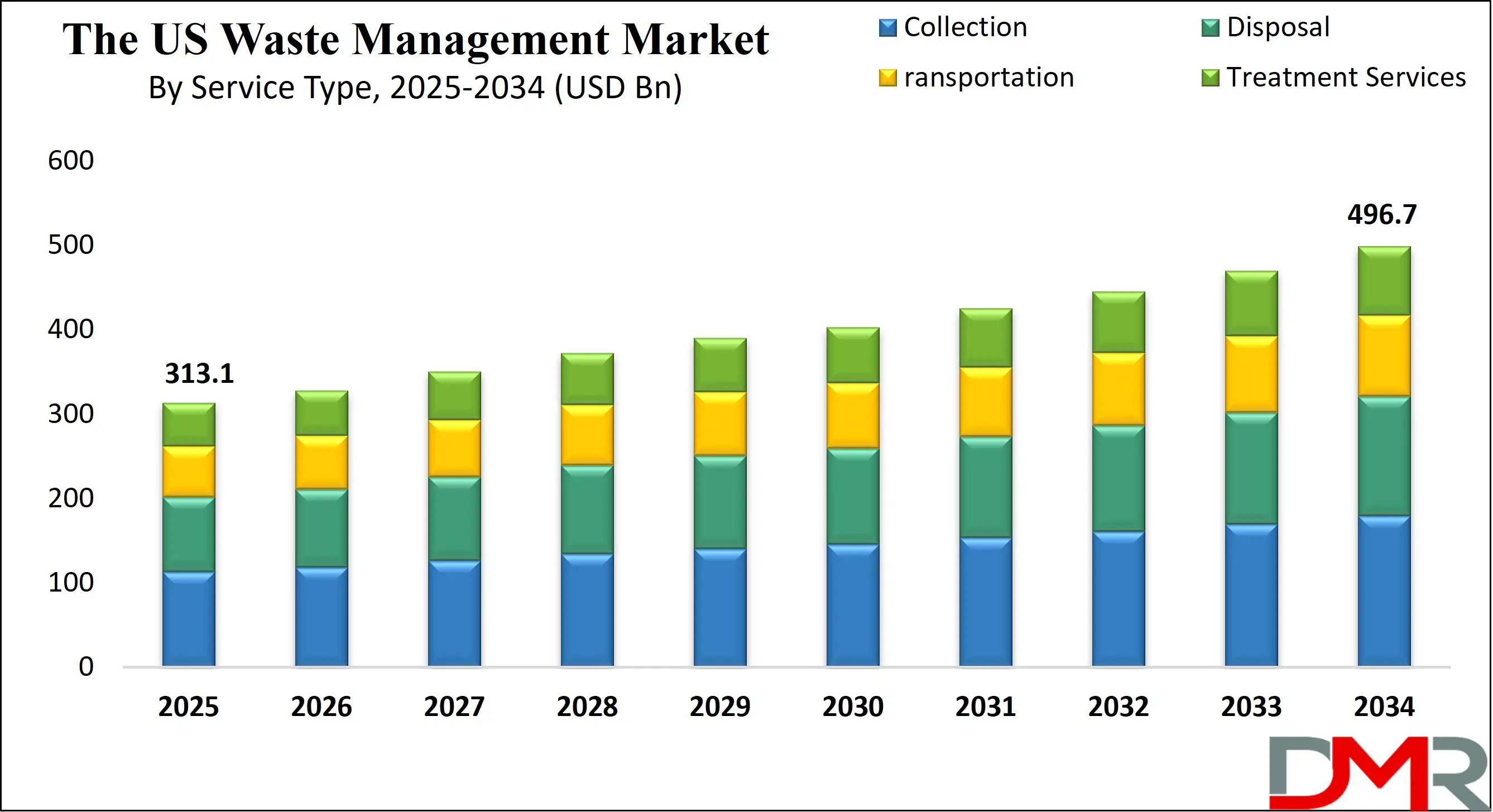

The US Waste Management Market is projected to reach

USD 313.1 billion in 2025 and grow at a compound annual

growth rate of 5.3% from there until 2034 to reach a value of

USD 496.7 billion.

The US waste management market is experiencing significant transformation, driven by rapid urbanization, population growth, and increasing consumerism. With over 292 million tons of municipal solid waste generated annually, there is a rising demand for efficient collection, treatment, and disposal solutions. The integration of technology in waste tracking, route optimization, and data analytics is enhancing operational efficiency and regulatory compliance across the sector. Recycling and sustainable practices are gaining traction, encouraged by both environmental policies and public awareness, shifting the industry’s focus from simple disposal to resource recovery and circular economy models.

Opportunities in the market are abundant, particularly in advanced recycling technologies, waste-to-energy initiatives, and organic waste treatment like composting and anaerobic digestion. The surge in electronic waste, medical waste, and plastic waste presents lucrative avenues for specialized services and infrastructure investment. Additionally, government incentives and extended producer responsibility (EPR) programs are supporting the development of innovative waste management systems. Private-public partnerships are also emerging as effective models for upgrading aging waste infrastructure and expanding service reach into underserved regions.

Despite the market's potential, several restraints hinder its progress. Stringent environmental regulations, high capital costs for advanced waste treatment technologies, and inconsistent recycling standards across states present operational challenges. Labor shortages and supply chain disruptions further exacerbate the situation, especially for smaller operators lacking the scale to invest in automation or diversification. Moreover, illegal dumping and the decline in global recycling commodity prices impact the profitability and sustainability of recycling programs.

Looking forward, the US waste management market is projected to grow steadily, fueled by technological innovation, stricter environmental mandates, and rising public and corporate commitments to sustainability. Growth prospects remain strong in smart waste management systems, bioenergy production, and hazardous waste treatment. As ESG factors become central to business strategies, waste management is poised to play a critical role in meeting environmental goals and building a more resilient, circular economy.

The US Waste Management Market: Key Takeaways

- Market Size Insights: The US Waste Management Market size is estimated to have a value of USD 313.1 billion in 2025 and is expected to reach USD 496.7 billion by the end of 2034.

- By Service Type Segment Insights: In the U.S. waste management market, collection services are projected to dominate service type segment with highest market share by the end of 2025.

- By Waste Type Segment Insights: Non-hazardous waste is anticipated to dominate the U.S. waste management market with the largest revenue share in 2025.

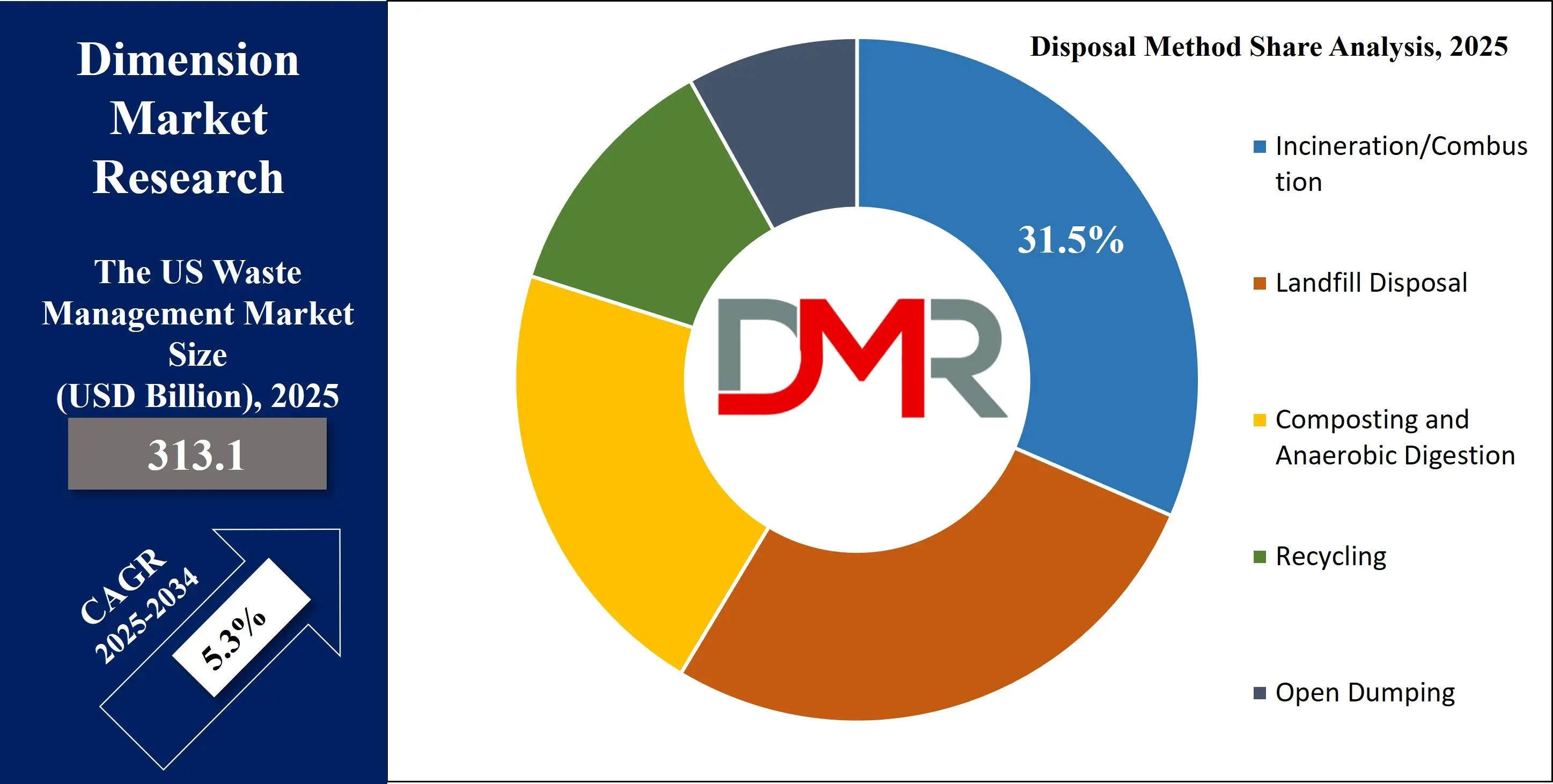

- By Disposal Method Insights: Incineration/combustion is poised to lead as a disposal method in the U.S. waste management market with highest market share in 2025.

- Key Players Insights: Some of the major key players in the US Waste Management Market are Waste Management, Inc., Republic Services, Inc., Waste Connections, Inc., GFL Environmental, Inc., Clean Harbors, Inc., Stericycle, Inc., Covanta (Reworld Holding Corp.), Casella Waste Systems, Inc., Recology, Inc., Waste Pro USA, Advanced Disposal Services, and many others.

- Market Growth Rate Insights: The market is growing at a CAGR of 5.3 percent over the forecasted period of 2025.

The US Waste Management Market: Use Cases

- Smart Waste Collection: Cities like San Diego use IoT-enabled bins and route optimization software to streamline waste collection, reducing fuel use and labor hours. This approach minimizes overflow incidents and boosts operational efficiency while supporting real-time monitoring and service planning.

- E-Waste Recycling Programs: Companies like ERI and Best Buy partner to collect and process e-waste. These programs safely recover valuable metals and reduce environmental risks from improper disposal, aligning with sustainability and compliance goals.

- Medical Waste Treatment: Stericycle offers secure, compliant treatment of medical waste, including sharps and biohazard materials, for hospitals and clinics. This ensures regulatory adherence and public health protection while enabling safe, environmentally sound disposal.

- Waste-to-Energy Conversion: Covanta transforms municipal solid waste into electricity at waste-to-energy plants, providing power to local grids and reducing landfill dependence. This dual benefit approach addresses both energy needs and waste volume reduction.

- Commercial Recycling Initiatives: Retailers and manufacturers adopt closed-loop recycling systems to manage packaging and product waste. These initiatives reduce raw material dependency, cut emissions, and improve brand image through visible environmental stewardship.

The US Waste Management Market: Stats & Facts

Municipal Solid Waste (MSW) Overview – U.S. EPA

- In 2018, the United States generated approximately 292.4 million tons of municipal solid waste (MSW).

- The average American produced 4.9 pounds of MSW per day in the same year.

- MSW in 2018 consisted of about 23.1% paper and paperboard, 33.7% food and yard trimmings, 12.2% plastics, and smaller portions of metals, wood, glass, rubber, and other materials.

- The largest category of waste by product type was containers and packaging, which made up 28.1% of MSW, followed by durable goods (19.5%), food (21.6%), and yard trimmings (12.1%).

- Roughly 32.1% of MSW in 2018 was recovered through recycling and composting, totaling nearly 93.9 million tons.

- Composting alone accounted for about 27% of all recovered MSW in that year.

- Approximately 11.8% of MSW was disposed of through incineration with energy recovery (waste-to-energy).

- A majority, about 63.5%, of MSW was landfilled, amounting to over 186 million tons in 2018.

- MSW landfills were responsible for emitting around 270 million metric tons of CO₂ equivalent, which is roughly 5% of U.S. energy-related carbon emissions.

- The national average landfill tipping fee in 2023 was $56.80 per ton, showing a slight decrease from the previous year.

Landfills and Greenhouse Gases – U.S. EPA

- Landfills contributed to 17% of the United States' methane emissions in 2021, equivalent to about 1.9% of total U.S. greenhouse gas emissions.

- In 2019, 38% of food waste ended up in landfills and was responsible for approximately 18% of methane emissions from landfills.

- In 2022, 63 waste-to-energy plants combusted 26.6 million tons of MSW, generating 12.8 billion kilowatt-hours of electricity.

- About 45% of the electricity generated from MSW combustion in 2022 came from biogenic sources like paper and food waste.

Recycling Access and Material Recovery – U.S. EPA

- Over 53% of American households had access to curbside recycling services as of recent years, and 82% of those use single-stream recycling systems.

- Households with curbside recycling generated 42% less waste on average than those without.

- In 2018, the recycling rates of selected materials were especially high: 97% for corrugated cardboard, 99% for lead-acid batteries, 65% for newspapers, 60% for major appliances, and 50% for aluminum cans.

- From 1990 to 2018, the total quantity of materials recycled or composted in the U.S. nearly tripled, reaching close to 94 million tons annually.

- Waste Trends and Efficiency – University of Michigan (Center for Sustainable Systems)

- Since 1980, U.S. MSW generation has grown by approximately 93%, reaching 292 million tons by 2018.

- Per capita waste generation increased from 3.7 pounds/day in 1980 to 4.9 pounds/day in 2018.

- In 2021, the U.S. generated 28 pounds of MSW per $1,000 of GDP, which is higher than countries like Germany (26 lbs), the United Kingdom (21 lbs), and Sweden (16 lbs).

- In recent years, about 29% of U.S. MSW has been managed through recycling and composting, 7.6% through incineration, and 63.5% sent to landfills.

Food Waste Statistics – U.S. EPA and USDA

- It is estimated that 30–40% of the U.S. food supply, or around 133 billion pounds, is wasted each year.

- In 2019 alone, about 66 million tons of food were wasted by consumers, retailers, and food service providers, with 60% of it going to landfills.

- An additional 40 million tons of food waste was generated during food processing and manufacturing.

- In 2019, food waste was managed in several ways: 7.8% was donated, 2.3% was used as animal feed, 3.5% was processed into bio-based materials, and 5% was composted.

- Only 0.8% of food waste was treated using anaerobic digestion, while 14.6% was incinerated and 6% ended up in sewage systems.

- The USDA and EPA have set a national goal to reduce food waste by 50% by 2030, using 2010 levels as the baseline.

The US Waste Management Market: Market Dynamics

Driving Factors in the US Waste Management Market

Increasing Urbanization and Population Density Rapid urbanization in the United States is intensifying the demand for efficient waste management systems. As more people move to cities, the volume and complexity of waste streams are expanding. High-density urban areas generate more household waste, construction debris, and e-waste, putting pressure on existing collection and disposal infrastructure. Moreover, cities are becoming hubs for economic activity, which brings additional commercial and industrial waste. Local governments are compelled to upgrade their waste services, adopt more sustainable methods, and ensure compliance with state and federal regulations. Urbanization also increases the visibility of waste management issues, prompting stronger public demand for cleaner environments.

This results in policy actions like mandatory recycling ordinances, zero-waste targets, and restrictions on landfill use. Consequently, private sector participation is growing, and public-private partnerships (PPPs) are increasingly common. Investment in urban waste infrastructure—including smart bins, recycling centers, and waste-to-energy facilities—is also accelerating. As cities continue to grow, their commitment to efficient and environmentally responsible waste management will be a key market driver.

Policy and Regulatory Push for Sustainable Waste Practices

Federal and state regulations are playing a central role in shaping the waste management landscape. Policies such as landfill diversion mandates, recycling quotas, and bans on single-use plastics are pushing municipalities and businesses to adopt sustainable waste practices. The U.S. Environmental Protection Agency (EPA) and state agencies are promoting the Sustainable Materials Management (SMM) framework, encouraging lifecycle-based waste reduction. Furthermore, several states have adopted Extended Producer Responsibility (EPR) laws requiring manufacturers to take responsibility for post-consumer packaging and products. These regulatory efforts are incentivizing innovations in design for recyclability, compostable packaging, and reverse logistics systems.

Additionally, tax credits and grants for composting, anaerobic digestion, and waste-to-energy technologies are stimulating investment in green waste infrastructure. Compliance with evolving waste standards is no longer optional—it is becoming a competitive necessity. As the regulatory environment becomes stricter, companies that proactively align with sustainable practices are positioned for growth, while laggards face increasing operational and reputational risks.

Restraints in the US Waste Management Market

High Capital Investment and Operational Costs

One of the primary restraints facing the U.S. waste management market is the high capital investment required to build and maintain modern facilities. Whether developing a recycling center, WTE plant, or composting facility, upfront costs can range in the tens or even hundreds of millions of dollars. Additionally, regulatory permitting processes are time-consuming and expensive, often involving multiple environmental assessments and public hearings. Operational expenses also remain high due to labor, fuel, and maintenance costs. For instance, maintaining sorting systems, controlling emissions, and ensuring compliance with OSHA and EPA regulations require ongoing financial input.

Smaller municipalities and rural regions often lack the resources to invest in advanced infrastructure, leading to dependence on outdated systems or long-distance waste hauling. Moreover, price volatility in recyclable materials—especially plastics and paper—can affect the profitability of recycling operations, sometimes forcing facilities to close or scale back. These financial barriers can deter new entrants, slow innovation, and widen the gap between urban and rural service levels.

Fragmented Regulations and Inconsistent Policies Across States

The absence of unified federal waste management standards poses a significant challenge to consistent market development. Waste regulations in the U.S. are highly fragmented, varying considerably across states and even municipalities. While some states like California and Oregon have progressive zero-waste laws, others rely heavily on landfilling with minimal recycling mandates. This inconsistency creates operational complexity for companies working across multiple jurisdictions, as they must navigate differing compliance requirements, reporting standards, and collection guidelines. It also hampers investment in scalable technologies, as solutions viable in one region may not be economically or legally feasible in another.

For manufacturers and retailers, fragmented Extended Producer Responsibility (EPR) laws complicate packaging design and reverse logistics. From a policy perspective, the lack of standardized national goals impedes the collective ability to address climate and sustainability targets. As a result, opportunities for collaboration, innovation, and infrastructure alignment are often missed. Achieving a more harmonized regulatory landscape could unlock efficiencies and spur industry-wide advancements.

Opportunities in The US Waste Management Market

Expansion of Organics and Food Waste Diversion Programs

Food and organic waste represent nearly 30% of the U.S. municipal waste stream, making their diversion a significant growth opportunity. Programs targeting composting, anaerobic digestion, and food rescue are gaining momentum across states and municipalities. As more jurisdictions enact food waste bans from landfills, service providers are expanding composting infrastructure and launching residential organics collection programs. Institutional generators like schools, hospitals, and restaurants are increasingly adopting food waste tracking systems and recovery partnerships.

Technologies such as in-vessel composting and small-scale anaerobic digesters are making on-site treatment viable even in urban areas. The EPA and USDA’s shared goal to halve food waste by 2030 is driving funding and public-private collaborations. Retailers and food manufacturers are also investing in waste minimization and redistribution systems to comply with emerging regulations and meet sustainability targets. For the waste management industry, this opens new revenue streams in hauling, processing, and selling compost or biogas, while significantly reducing landfill reliance and methane emissions.

Investment in Waste-to-Energy (WTE) and Advanced Recovery Technologies

As landfill capacity shrinks and environmental regulations tighten, waste-to-energy (WTE) technologies present a promising growth path. Modern WTE facilities offer dual benefits—volume reduction of solid waste and generation of renewable electricity. The U.S. currently has about 63 operational WTE plants, but interest is rising in expanding capacity and exploring next-generation solutions like gasification, pyrolysis, and plasma arc technologies. These advanced thermal processes enable higher energy yields and lower emissions than conventional incineration. Public resistance due to environmental concerns is gradually declining as cleaner technologies emerge and emissions controls improve.

State-level renewable energy mandates and federal tax incentives for low-carbon energy production are accelerating project development. Additionally, integrating WTE with district heating, carbon capture, and biochar production adds economic viability. For municipalities and private players, investing in WTE creates diversified revenue streams from tipping fees, energy sales, and recovered metals. As circular economy models expand, WTE is also gaining acceptance as a complementary solution to recycling and composting, especially for non-recyclable residual waste.

Trends in the US Waste Management Market

Rise of Circular Economy Practices

The U.S. waste management market is increasingly aligning with circular economy principles, driven by environmental concerns and corporate sustainability commitments. Circular models emphasize the reuse, recycling, and recovery of resources rather than traditional linear waste practices. This trend is evident in the shift from waste disposal to materials recovery facilities (MRFs), advanced sorting technologies, and the adoption of extended producer responsibility (EPR) policies in several states. Companies are designing packaging with recyclability in mind and investing in closed-loop systems to reclaim post-consumer materials. Municipalities are also adjusting waste policies to incentivize source separation and organics diversion.

These practices are not only reducing landfill pressure but are creating secondary raw material markets, encouraging innovation in

biodegradable packaging, and driving demand for recycled content. Circular economy models are also being supported by public awareness campaigns and educational initiatives. As environmental regulations tighten and landfill space declines, this trend is expected to gain further momentum, transforming the business models of waste service providers and material manufacturers alike.

Digitization and Smart Waste Technologies

The integration of digital technologies into waste management operations is revolutionizing the industry. Smart sensors in waste bins, GPS-enabled route optimization for collection trucks, and AI-powered sorting systems at recycling facilities are improving efficiency and reducing costs. Municipalities and private operators are adopting these technologies to monitor waste levels in real time, minimize fuel consumption, and improve service delivery. Data analytics is also enabling predictive maintenance, operational transparency, and performance benchmarking. For example, RFID tracking in waste bins helps measure waste generation per household, supporting pay-as-you-throw (PAYT) models and enhancing recycling participation.

Digital platforms are also streamlining customer service, billing, and compliance reporting. These advancements are particularly valuable in urban centers where waste generation is dense and logistics are complex. Over the long term, digitization is expected to support the development of smart cities by integrating waste systems with energy, water, and transportation infrastructure. However, successful implementation requires investment in infrastructure, workforce training, and cybersecurity safeguards.

The US Waste Management Market: Research Scope and Analysis

By Service Type Analysis

In the U.S. waste management market, collection services are projected to dominate primarily due to their indispensable role in the waste management lifecycle. Every waste disposal process begins with the collection of waste from households, businesses, and industrial facilities. Regardless of the type or volume of waste, it must be gathered, sorted, and transported before any processing can occur, making collection a foundational component of the industry.

A vast population spread across suburban and urban areas contributes to high daily waste generation, necessitating frequent and consistent collection services. Municipal contracts and private companies invest heavily in truck fleets, labor, and route optimization technologies to manage this demand efficiently. Additionally, with increasing urbanization and a rise in residential complexes, the scale and frequency of waste collection have expanded significantly.

Another factor bolstering the dominance of collection is the trend toward outsourcing municipal waste collection to private companies. This public-private partnership model ensures specialized service delivery and cost efficiency, boosting the commercial scale of the collection segment. The advent of smart bins and IoT-enabled route management systems also enhances operational effectiveness, making waste collection more sustainable and attractive to investors.

Moreover, collection services encompass not just municipal solid waste but also recycling pickups, yard waste, and bulky item collection, further expanding its market share. Given its centrality to every waste handling process, collection remains the largest and most vital service type in the U.S. waste management market.

By Waste Type Analysis

Non-hazardous waste is anticipated to dominate the U.S. waste management market due to its sheer volume, regulatory simplicity, and diverse sources. This category includes everyday waste generated from residential, commercial, and institutional sources, such as food scraps, packaging materials, paper, plastics, and yard trimmings. The widespread and continuous production of such waste across all sectors makes it the largest contributor to overall waste volumes.

The dominance of non-hazardous waste is also tied to its less stringent regulatory requirements compared to hazardous waste. While hazardous waste management involves complex handling, treatment, and disposal protocols regulated by the EPA and other agencies, non-hazardous waste is managed through more standardized procedures, reducing operational costs and facilitating scalability for waste management companies.

Moreover, with increasing consumerism, urbanization, and industrial activity, the generation of non-hazardous waste continues to increase. Municipal solid waste (MSW), which is largely non-hazardous, makes up a significant portion of the waste collected, treated, and landfilled or recycled in the U.S. annually. This provides a continuous stream of business opportunities for waste collection, recycling, composting, and disposal service providers.

In addition, the growth in sustainability initiatives has led to expanded recycling programs, particularly for non-hazardous materials like plastics, cardboard, and metals. These efforts not only divert waste from landfills but also create new value chains within the non-hazardous category. Its combination of scale, regulatory ease, and recyclability ensures that non-hazardous waste remains the dominant segment in the

U.S. waste management industry.

By Disposal Method Analysis

Incineration/combustion is poised to lead as a disposal method in the U.S. waste management market primarily due to its efficiency in reducing waste volume and its potential for energy recovery. Unlike landfilling, incineration can reduce the weight of solid waste by up to 90% and its volume by about

75%, making it an effective solution for areas with limited landfill space or high population density.

Waste-to-energy (WTE) incineration plants are particularly prevalent in urbanized states with strong environmental regulations and limited land availability, such as New York and Massachusetts. These facilities not only manage waste but also generate electricity and heat through combustion processes, contributing to local power grids and reducing dependence on fossil fuels. This dual-purpose utility gives incineration a competitive advantage over simple landfilling.

Moreover, incineration is seen as a practical method for disposing of non-recyclable waste and materials contaminated with pathogens or hazardous substances that pose health risks. Modern incineration facilities are equipped with advanced pollution control technologies that significantly reduce the emission of dioxins, furans, and other pollutants, addressing environmental concerns historically associated with this method.

In addition, federal and state incentives supporting renewable energy and waste reduction contribute to the growth of incineration technologies. The ability to combine waste disposal with energy generation aligns with the circular economy model, making it an attractive, scalable, and sustainable solution. Consequently, incineration/combustion remains a dominant and evolving method of waste disposal in the U.S. market.

By End‑User Analysis

The residential sector is projected to dominates the U.S. waste management market due to its large population base and consistent daily generation of municipal solid waste. Residential households produce a variety of waste types—including organic waste, recyclables, and mixed garbage—making them a primary source of demand for waste collection and disposal services.

Urban sprawl and suburban growth have led to millions of households producing predictable volumes of waste, requiring regular pick-up and management services. Local governments typically contract or manage waste services for these residents, ensuring a stable revenue stream for

waste management providers. This reliable and recurring nature of residential waste generation underpins the sector's dominance.

Additionally, residential waste tends to be less complex to manage compared to industrial or hazardous waste. It usually involves routine processes like curbside collection, sorting, recycling, and landfill disposal or incineration. As a result, service providers can optimize operations and scale efficiently, especially in densely populated areas.

The surge in e-commerce and home delivery services has also increased residential packaging waste, further bolstering the volume and demand for residential waste management. Environmental awareness among homeowners is also contributing to the growth of household recycling and composting programs, adding new service dimensions within the residential sector.

Finally, public awareness campaigns, municipal recycling mandates, and green infrastructure investments often start at the household level, reinforcing the residential sector’s central role in waste diversion and sustainability goals. For these reasons, the residential end-user segment remains the largest and most critical in the U.S. waste management market.

The US Waste Management Market Report is segmented on the basis of the following

By Service Type

- Collection

- Disposal

- Transportation

- Treatment Services

By Waste Type

- Non-Hazardous

- Industrial Waste

- Construction and Demolition Waste

- Municipal Solid Waste (MSW)

- Hazardous Waste

- Medical Waste

- Electronic Waste (E-Waste)

- Plastic Waste

- Other Waste Types

By Disposal Method

- Incineration/Combustion

- Landfill Disposal

- Composting and Anaerobic Digestion

- Recycling

- Open Dumping

By End‑User

- Residential

- Industrial

- Commercial

The US Waste Management Market: Competitive Landscape

The U.S. waste management market is highly competitive and consolidated, with a few major players dominating a significant share. Key industry leaders include Waste Management Inc., Republic Services Inc., Waste Connections Inc., and Stericycle Inc. These companies offer comprehensive waste handling services, including collection, recycling, landfill management, and energy recovery, leveraging vast networks and advanced infrastructure.

The market also includes numerous regional and specialized firms that cater to local or niche needs, such as hazardous waste, medical waste, or construction debris. This fragmentation at the regional level fosters competition and innovation, especially in areas like recycling technologies, route optimization, and sustainable disposal methods.

Strategic partnerships, mergers, and acquisitions are common, enabling larger players to expand service offerings and geographic reach. For instance, Waste Management’s acquisitions have solidified its position as the largest provider in North AmericCompanies also compete on service reliability, environmental compliance, and technological innovation, such as IoT-based collection systems and AI-driven sorting processes.

Environmental regulations and public demand for sustainability have pushed companies to invest in eco-friendly solutions, including composting, waste-to-energy, and zero-waste initiatives. The competitive edge increasingly hinges on a company’s ability to combine operational efficiency with environmental responsibility in a rapidly evolving regulatory landscape.

Some of the prominent players in the US Waste Management Market are

- Waste Management, Inc.

- Republic Services, Inc.

- Waste Connections, Inc.

- GFL Environmental, Inc.

- Clean Harbors, Inc.

- Stericycle, Inc.

- Covanta (Reworld Holding Corp.)

- Casella Waste Systems, Inc.

- Recology, Inc.

- Waste Pro USA

- Advanced Disposal Services

- US Ecology, Inc.

- Heritage Environmental Services

- ACTenviro

- Triumvirate Environmental

- Aevitas

- Clean Earth

- National Environmental Group (NEG)

- SCS Engineers

- Texas Disposal Systems

- Other Key Players

Recent Developments in the US Waste Management Market

May 2025

PACK EXPO International 2024 (Reported May 2025): Dow, PMMI, and Independent Recycling Services collaborated to divert 284.9 tons of waste (51% diversion rate), conserving 2 million gallons of water and over 1 million kWh of electricity.

February 2025

Triumvirate Environmental Investment: Berkshire Partners acquired a stake in Triumvirate Environmental, valuing the medical and special waste firm at approximately US$ $1.8 billion.

GFL Environmental Divestiture: GFL agreed to sell its Environmental Services division to Apollo Global Management and BC Partners for roughly C$8 billion (~US$ $5.6 billion), retaining C$1.7 billion in equity.

January 2025

GFL Recapitalization: GFL completed the Environmental Services sale, using approximately C$6.2 billion in net proceeds for debt repayment and share repurchase.

December 2024

Reworld Acquires EnviroVac: Reworld acquired EnviroVac, enhancing its hazardous and non-hazardous waste processing capabilities and strengthening its zero-waste logistics offerings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 313.1 Bn |

| Forecast Value (2034) |

USD 2,203.8 Bn |

| CAGR (2025–2034) |

5.3% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Collection, Disposal, Transportation, Treatment Services), By Waste Type (Non-Hazardous, Hazardous Waste, Other Waste Types), By Disposal Method (Incineration/Combustion, Landfill Disposal, Composting and Anaerobic Digestion, Recycling, Open Dumping), By End-User (Residential, Industrial, Commercial |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Waste Management Inc., Republic Services Inc., Waste Connections Inc., GFL Environmental, Inc., Clean Harbors, Inc., Stericycle, Inc., Covanta (Reworld Holding Corp.), Casella Waste Systems, Inc., Recology, Inc., Waste Pro USA, Advanced Disposal Services, US Ecology, Inc., Heritage Environmental Services, ACTenviro, Triumvirate Environmental, Aevitas, Clean Earth, National Environmental Group (NEG), SCS Engineers, Texas Disposal Systems, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The US Waste Management Market size is estimated to have a value of USD 313.1 billion in 2025 and is expected to reach USD 496.7 billion by the end of 2034.

Some of the major key players in the US Waste Management Market are Waste Management, Inc., Republic Services, Inc., Waste Connections, Inc., GFL Environmental, Inc., Clean Harbors, Inc., Stericycle, Inc., Covanta (Reworld Holding Corp.), Casella Waste Systems, Inc., Recology, Inc., Waste Pro USA, Advanced Disposal Services, and many others.

The market is growing at a CAGR of 5.3 percent over the forecasted period of 2025.