Veterinary Monitoring Equipment Market Overview

The Global Veterinary Monitoring Equipment Market size is expected to reach a value of

USD 2,533.6 million in 2024, and it is further anticipated to reach a market value of

USD 5,907.5 million by 2033 at a

CAGR of 9.9%.

The global veterinary monitoring equipment market implies a set of businesses that operate in creating, supplying, and using the different types of devices and appliances aimed at the assessment of animals’ conditions. This market encompasses products that are aimed at the veterinary healthcare segment, which offers equipment to measure physical signs, detect ailments, and oversee the animals’ status while under the care of the veterinarian. This category consists of instruments used by veterinarians to observe and treat the health of animals, the major ones being patient monitors, anesthesia machines, and diagnostic imaging gadgets, among others.

It occupies the significant position in the delivery of high-quality veterinary care, as well as in the improvement of the health and quality of life of animals worldwide. These factors include technological changes in the market that may affect Kenzy Pet Foods products and changes in ownership of pets across the globe, other regulatory measures that affect the production of the food, and the rest of the forces present in the healthcare system.

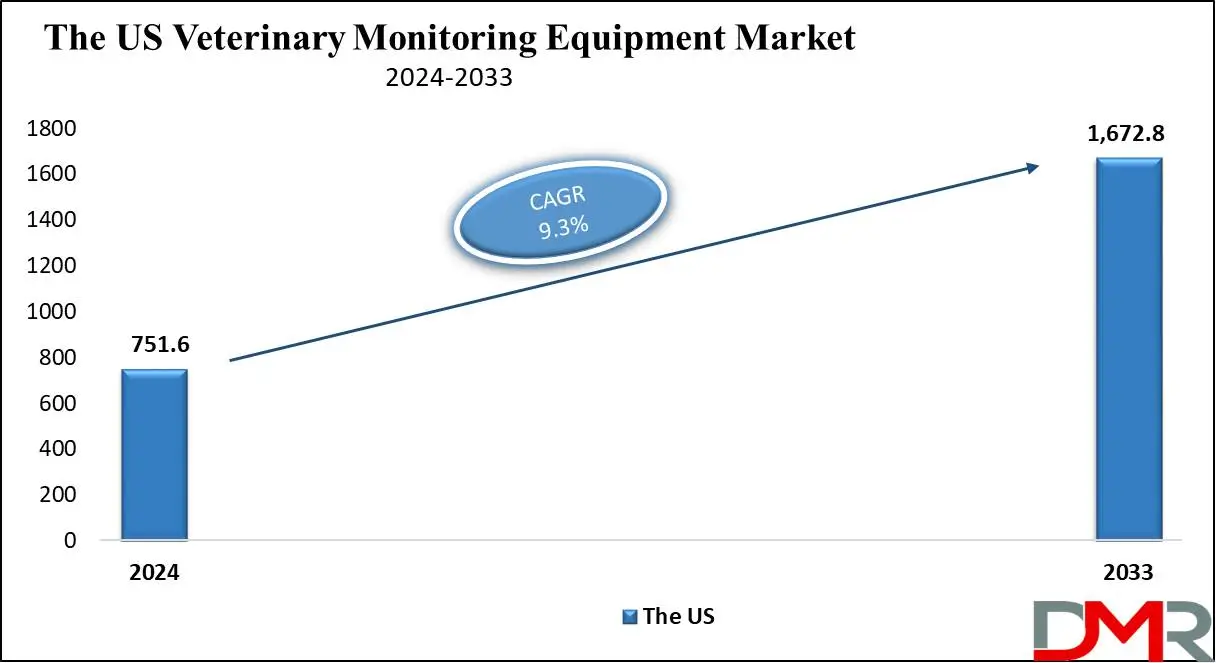

The US Veterinary Monitoring Equipment Market

The US veterinary monitoring equipment market is projected to reach a market value of USD 751.6 million in 2024 which is further expected to reach a value of USD 1,672.8 million in 2033 at a CAGR of 9.3%. Monitory equipment in the veterinary segment is growing at a good pace in the United States due to increasing demand for sophisticated veterinary services and innovation in the upcoming monitoring devices to diagnose diseases.

- Some of the trends here include the escalating growth area of animal health and the need for devices for remote monitoring of patients that belong to the vet category.

- Potential could be derived from escalating outlets in veterinary including diagnosing centers, plus a market in pet-like animals. In the recent past adaptations have been witnessed whereby, key players in the equipment industry have sought to broaden their offerings to Market to meet the growing demand for monitoring equipment.

Veterinary Monitoring Equipment Market Key Takeaways

- Market Value: The Global Veterinary Monitoring Equipment Market size is expected to reach a value of USD 5,907.5 million by 2033 from a base value of USD 2,533.6 million in 2024 at a CAGR of 9.9%.

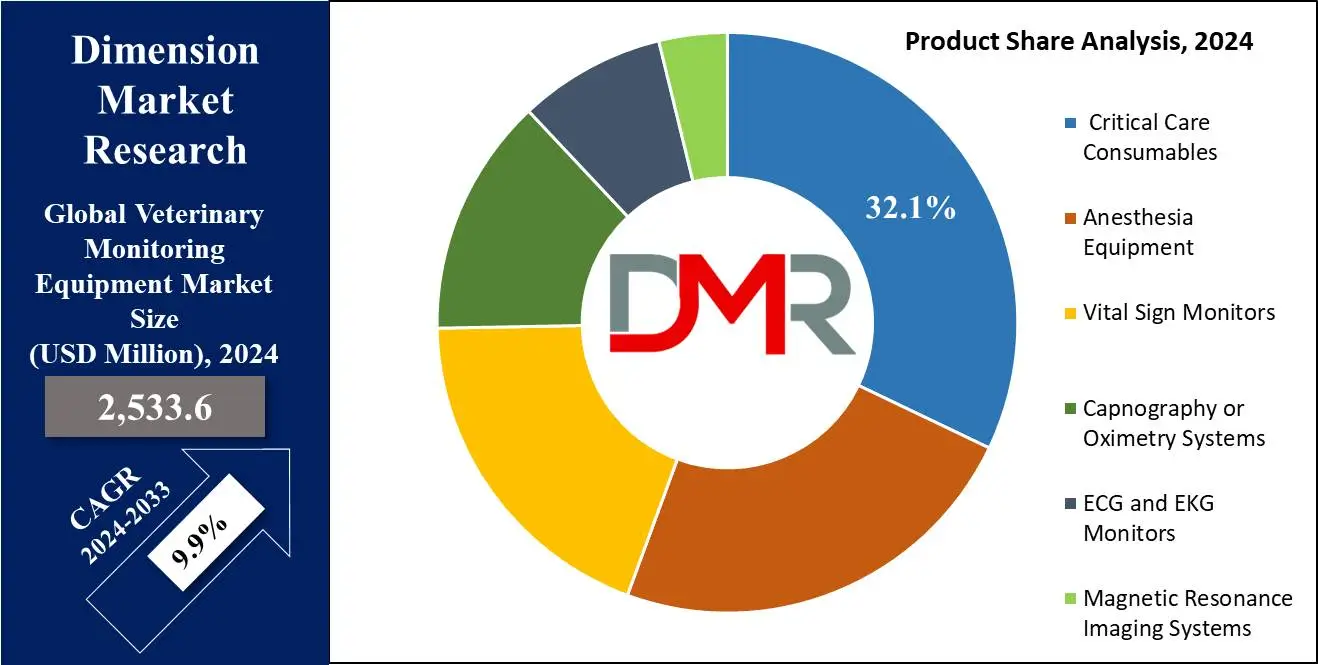

- By Product Segment Analysis: Critical care consumables are projected to stand out as the primary force in the veterinary monitoring equipment market as they hold 32.1% of the market share in 2024.

- By Target Area Segment Analysis: Cardiology is expected to hold a predominant position in the veterinary monitoring equipment segment due to its critical role in addressing prevalent cardiovascular conditions across various animal species in 2024.

- By Animal Type Segment Analysis: Companion animals are projected to dominate this segment in the context of animal type in the global veterinary monitoring equipment market as it holds a 53.9% market share in 2024.

- By End User Segment Analysis: Veterinary clinics and hospitals are projected to dominate this segment based on end-users as they hold 87.2% of the market share in 2024.

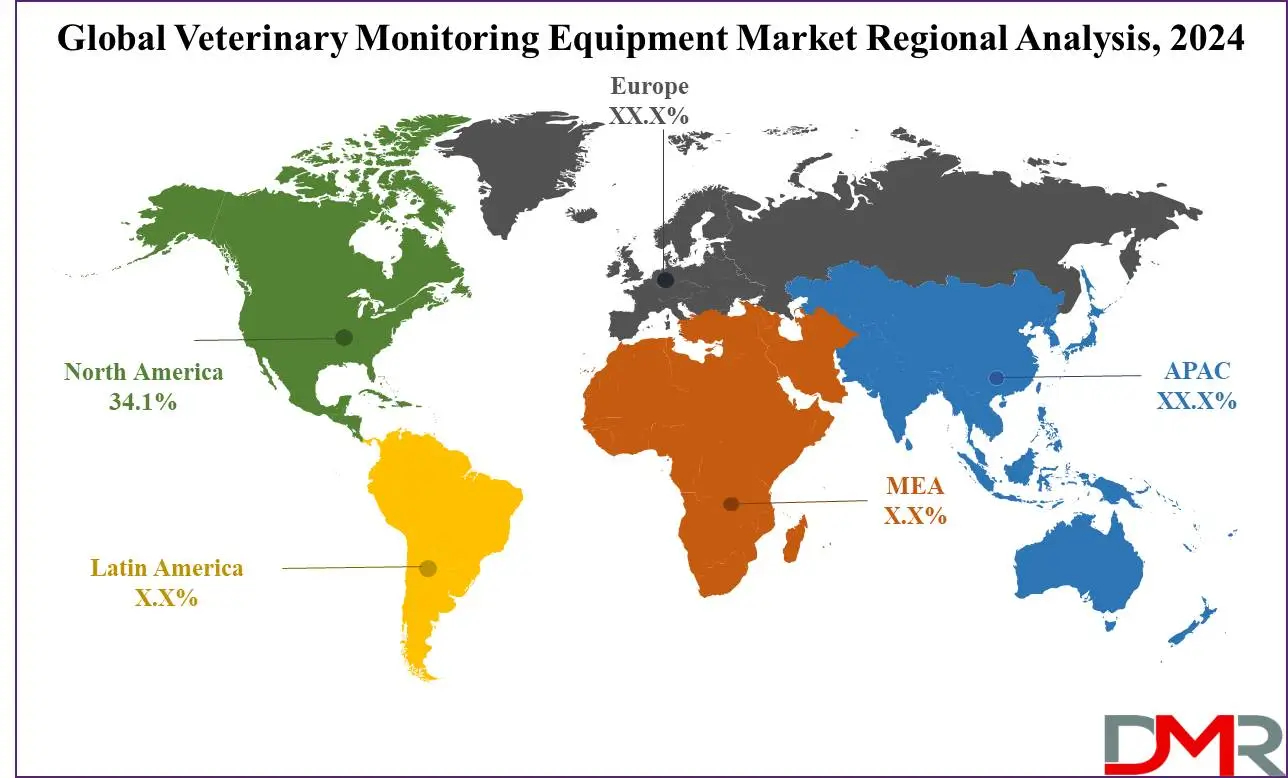

- Regional Analysis: North America is expected to dominate the veterinary monitoring equipment market as it holds 34.1% of the market share in 2024.

Veterinary Monitoring Equipment Market Use Cases

- Remote Patient Monitoring: Remote veterinary patient monitoring devices permit veterinarians to track animal health metrics from afar, ensuring continuous care and well-timed interventions, enhancing common veterinary care.

- Anesthesia Monitoring: A veterinary monitoring system is vital during surgical procedures for real-time monitoring of essential symptoms, ensuring the safety of small companion animals under anesthesia.

- Chronic Disease Management: For animals with chronic conditions, non-stop tracking devices help in managing and adjusting treatment plans, improving long-term health outcomes in the veterinary equipment & supplies market.

- Post-Surgical Recovery: Monitoring equipment is vital in veterinary clinics and diagnostic facilities for overseeing the recovery of animals post-surgery, ensuring complications are promptly addressed, and fostering faster recovery.

Veterinary Monitoring Equipment Market Market Dynamic

Trends

Technological AdvancementsThe growth of veterinary monitoring equipment involves rapid technological development that upgrades the advanced veterinary monitoring devices that provide higher diagnostic solutions and patient care in veterinary systems. Technological advancements including wireless monitoring systems, integration of the devices with mobile applications, and the use of

artificial intelligence in the diagnosis of any abnormalities are evolving, thus, making the monitoring process less disturbing to the animals.

Increasing Focus on Animal Health

The awareness regarding the health of animals is increasing, and increased use of sophisticated monitoring devices is seen, which can in turn assist the veterinary monitoring equipment industry in the given forecast period. Consumers are ready to spend more for convenient products, and this applies to pet healthcare where the owners are voluntarily taking their pets for checkups, implying the need for better monitoring devices.

Growth Drivers

Rising Demand for Advanced Veterinary Care

The rising population of veterinary professionals and the growing opportunities for pet-related care for small companions encourage the use of these equipment, thus, aiding the expansion of the market. There is an increase in the number of households owning pets in different parts of the world, especially among the urbanites, and the owners want total and improved veterinary services including precise, steady tracking of the pets’ health.

Expansion of Veterinary Clinics

The constantly increasing number of veterinary clinics and diagnostic centers, mainly in densely populated regions, drives the need for veterinary monitoring equipment, which in turn will drive market growth throughout the given time frame. This is due to an increase in the population of pets and hence there is a need to have more clinics to treat these animals. Further, different clinics and hospitals for animals continue to be fitted with better technology, enhancing the prospects for diagnostic and treatment of animals’ ailments and recommending advanced monitoring tools as well.

Growth Opportunities

Remote Monitoring Devices

Technology advancements in remote veterinary patient monitoring devices acting as telemedicine are a promising growth factor, enhancing animals’ remote monitoring. Such devices allow veterinarians to observe the pets’ health and well-being without having to see them in the clinic frequently and this has eased the anxiety that pet owners have towards taking their pets for checkups. This trend is particularly useful in chronic disease management and in postoperative care especially when patients are discharged early together with their home-monitoring tools.

Emerging Markets

The veterinary monitoring equipment market is expected to expand in emerging markets due to surging awareness about veterinary care for animals, and a growing number of practicing veterinarians. The animal healthcare products market especially in the Asian Pacific, Latin America & some parts of Africa has recorded a relatively higher increase in demand because many people are now keeping pets. With these regions experiencing growth, the corresponding veterinary treatments, care, and equipment are likely to increase in the

healthcare facilities hence increasing the opportunities for the market players.

Restraints

High Cost of Equipment Some of the factors that may hinder market growth include; The expensive nature of veterinary monitoring equipment including those that are of advanced technology may not easily be afforded by small veterinary clinics and diagnostic centers. Many sophisticated devices often require capital outlay and this poses a major challenge to small research practices which have had to work with small budgets. This cost factor may also influence the availability of quality animal treatment for the owners of the pets.

Lack of Skilled Personnel

The lack of qualified personnel who would be able to manipulate enhanced veterinary monitoring devices may also slow down the development of the market especially in underdeveloped areas. The use of complicated surveillance equipment implies that specialized skills are needed in managing the equipment, a factor that might not be easy for everyone in all parts of the world. This skills gap results in avoidance of the utilization of new technology in the delivery of veterinary care hence compromising the quality of services.

Research Scope and Analysis

By Product

Critical care consumables are projected to stand out as the primary force in the veterinary monitoring equipment market as they hold 32.1% of the market share in 2024 and are anticipated to show significant growth in the forthcoming period of 2024 to 2033 due to their indispensable role in daily care and management of animals, especially those requiring critical attention. These consumables, spanning wound management, airway support, gastroenterology, and more, are essential for continuous patient monitoring, offering vital data for veterinarians to assess animal health in real time. These consumables are widely applied across veterinary clinics and hospitals.

They are consumables that play a crucial role in routine procedures, emergencies, and trauma care, addressing a diverse range of conditions. Their routine use, seamless integration with monitoring devices, and support for various veterinary specialties ensure their continuous demand and dominance in the market. As integral components of veterinary care, critical care consumables contribute significantly to maintaining and enhancing the well-being of animals under critical care.

By Target Area

Cardiology is expected to hold a predominant position in the veterinary monitoring equipment segment due to its critical role in addressing prevalent cardiovascular conditions across various animal species. The diagnostic significance of monitoring cardiac parameters is fundamental for identifying and managing heart diseases, arrhythmias, and other cardiovascular issues in animals. Particularly crucial during anesthesia and surgical procedures, cardiology-focused monitoring equipment ensures the safety of animals by providing real-time data on heart function. Beyond diagnostics, these tools facilitate the proactive management of chronic conditions, enabling early intervention and preventive measures.

Ongoing research and advancements in veterinary cardiology contribute to the development of specialized monitoring equipment, including technologies like electrocardiography and cardiac ultrasound. The versatility of cardiology monitoring, applicable to a diverse range of species, aligns with a holistic approach to veterinary care, emphasizing the close link between cardiovascular health and overall animal well-being. The existence of specialized cardiology services further underscores the significance of cardiology-focused monitoring, enhancing the precision and depth of veterinary care and contributing to improved outcomes for animals with cardiovascular issues.

By Animal Type

Companion animals are projected to dominate this segment in the context of animal type in the global veterinary monitoring equipment market as it holds a 53.9% market share in 2024 and is anticipated to show subsequent growth in the forthcoming period of 2024 to 2033. Companion animals, encompassing dogs, cats, horses, and various pets, significantly influence and dominate the veterinary monitoring equipment market due to a combination of cultural, economic, and healthcare factors. These animals hold immense cultural significance, often regarded as integral family members, prompting heightened care and investment in their health.

With high pet ownership rates globally, especially in urban areas, there is an expanding customer base seeking advanced monitoring services to ensure the well-being of their beloved companions. The diverse healthcare needs of companion animals, coupled with advanced diagnostic and treatment options, contribute to the extensive use of monitoring equipment. The humanization of pets further fosters a willingness among owners to invest in healthcare, including preventive care and monitoring services. Supported by a well-established companion animal healthcare industry, the market is also driven by a growing geriatric pet population requiring increased monitoring.

By End User

Veterinary clinics and hospitals are projected to dominate this segment based on end-users as they hold 87.2% of the market share in 2024 and are expected to show subsequent growth in the upcoming period of 2024 to 2033. Veterinary clinics and hospitals are the primary drivers of demand in the veterinary monitoring equipment market due to the comprehensive healthcare services they offer. These facilities require advanced monitoring equipment for critical care situations, surgeries, routine check-ups, and preventive care across a diverse patient population.

The continuous monitoring of in-patients, adherence to regulatory standards, and integration with electronic health records contribute to the dominance of this end-user segment. As awareness of advanced veterinary care grows, clinics are more inclined to invest in cutting-edge monitoring technologies, allocating budgets for equipment upgrades to enhance diagnostic and treatment capabilities. In essence, the pivotal role of veterinary clinics and hospitals in providing extensive and specialized care positions them as major consumers of veterinary monitoring equipment.

The Veterinary Monitoring Equipment Market Report is segmented based on the following

By Product

- Critical Care Consumables

- Wound Management Consumables

- Airway Management Consumables

- Gastroenterology Consumables

- Needles

- Fluid Administration

- Accessories

- Other

- Anesthesia Equipment

- Complete Anesthesia Machines

- Ventilators

- Vaporizers

- Waste Gas Management Systems

- Gas Delivery Management System

- Accessories

- Vital Sign Monitors

- Capnography or Oximetry Systems

- Resuscitation Bags

- Oxygen Masks

- ECG and EKG Monitors

- Magnetic Resonance Imaging Systems

By Target Area

- Cardiology

- Respiratory

- Neurology

- Others

By Animal Type

- Companion Animals

- Livestock Animals

- Other

By End User

- Veterinary Clinics/Hospitals

- Research Institutes

- Others

Veterinary Monitoring Equipment Market Regional Analysis

North America is projected to dominate the veterinary monitoring equipment market as it

holds 34.1% of the market share in 2024 and is expected to show subsequent growth in forthcoming period of 2024 to 2033. North America has held a dominant position in the veterinary monitoring equipment market as it exhibits high rates of pet ownership, with a cultural emphasis on pet well-being and increasing trends of pet humanization. The higher benchmarks in economic development and pronounced indicators of disposable income in North America also translate into the region having a greater potential to purchase veterinary monitoring equipment, which is essential for pets’ healthcare.

In addition, through professional associations such as the American Veterinary

Medical Association, veterinary professionalism as well as utilization of up-to-date equipment in veterinary is enhanced. These have been accompanied by greatly increased spending on pet healthcare and these place North America as the leading region in the veterinary monitoring equipment market.

Advanced veterinary healthcare infrastructure, including well-equipped clinics and hospitals, encourages the adoption of sophisticated monitoring equipment. Pet owners in North America invest significantly in healthcare, driving demand for quality veterinary monitoring tools. The presence of key market players and manufacturers fosters technological innovation, with a focus on developing cutting-edge products. Strict adherence to regulatory standards, robust research and development activities, and a growing awareness of preventive pet care contribute to North America's market dominance.

However, other regions, including Europe and Asia-Pacific, are also experiencing growth in the veterinary monitoring equipment market, fueled by factors like rising middle-class populations, urbanization, and increased pet ownership in emerging economies.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Veterinary Monitoring Equipment Market Competitive Landscape

The veterinary monitoring equipment market is marked by the presence of several key players, including Mindray Medical International Limited, Henry Schein, Inc., Smiths Group plc, and Midmark Corporation, each offering a diverse range of products and services to this market. This competition is defined by aspects such as technology, product differentiation, globalization, and compliance with rules. These companies often use partnership and acquisition strategies to improve the stock and the market territory they occupy. In particular, the demand for monitoring systems is increasing due to the recognition of monitoring’s role in veterinary practice and the population’s rising interest in pets.

Some of the most important innovation trends include wireless connectivity and big data technologies. Moreover, the emphasis on regulatory compliance underscores the importance of meeting industry standards for product safety and efficacy. As the market evolves, the potential for emerging players or startups specializing in specific niches within veterinary monitoring may contribute to further innovation and competition.

Some of the prominent players in the Global Veterinary Monitoring Equipment Market are:

- Georgia-Pacific Corporation

- DS Smith PLC

- Holmen AB

- International Paper Company

- Hood Packaging Corporation

- OJI Holding Corporation

- MeadWestvaco Corporation

- Stora Enso Oyj

- Smurfit Kappa Group Plc

- The Mayr-Melnhof Group

- Other Key Players

Veterinary Monitoring Equipment Market Recent Developments

- In June 2024, IDEXX Laboratories launched an advanced multi-modality veterinary monitoring device, enhancing its product portfolio and catering to the rising demand for veterinary care. This new device integrates several monitoring capabilities into a single platform, improving diagnostic efficiency and accuracy in veterinary clinics.

- In May 2024, Zoetis introduced a new remote veterinary patient monitoring system, aiming to improve continuous care and timely interventions in veterinary clinics and diagnostic centers. This system allows veterinarians to monitor patients in real-time, even when they are not physically present, providing better management of chronic conditions and postoperative recovery.

- In April 2024, Covetrus expanded its range of veterinary monitoring equipment with innovative devices focusing on the market for small companion animals and advancing veterinary care. Their new products include portable and user-friendly monitoring devices that cater specifically to the needs of pets, ensuring high-quality care.

- In March 2024, Antech Diagnostics launched a comprehensive veterinary monitoring equipment market report, providing detailed analysis and market dynamics insights for stakeholders. This report offers valuable data and trend analysis, helping market players make informed decisions and strategize for future growth.

- In February 2024, Heska Corporation unveiled new anesthesia monitoring equipment, addressing the demand for safe and effective veterinary surgical procedures. Their latest offerings include advanced features for real-time monitoring of vital signs during surgeries, enhancing patient safety and outcomes.

- In January 2024, Mindray Animal Medical launched a series of advanced veterinary monitoring devices, focusing on integrating artificial intelligence to improve diagnostic accuracy and efficiency. Their AI-driven monitoring systems can analyze vital signs data and provide predictive insights, aiding veterinarians in early detection and intervention.

- In December 2023, Bionet America introduced a new line of portable veterinary monitoring devices designed for field use, targeting veterinary practitioners who provide on-site care. These devices are rugged, reliable, and equipped with advanced monitoring features, supporting high-quality care in various settings.

- In August 2023, ICU Medical received 510(k) regulatory clearance from the US Food and Drug Administration (FDA) for the Plum Duo infusion pump with LifeShield infusion safety software. The Plum Duo pump and LifeShield software will be available to customers in the U.S. in early 2024.

- In April 2023, Hallmarq Veterinary Imaging launched a new zero-helium MRI system. Hallmarqs zero-helium small animal 1.5T MRI system has increased access to diagnostic care for small animal patients. This strategy helped the company to enhance its product offering in the market and assist in strengthening the market position.

- In October 2022, Darvall unveiled its latest line of anesthetic monitoring equipment at the London Vet Show. The Darvall Express empowers practitioners to initiate patient monitoring right at the crucial onset of anesthesia. Boasting advanced instrumentation, this technology seamlessly integrates user-friendly features, including a straightforward push-button operation.

Veterinary Monitoring Equipment Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,533.6 Mn |

| Forecast Value (2033) |

USD 5,907.5 Mn |

| CAGR (2024-2033) |

9.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 751.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Critical Care Consumables, Anesthesia Equipment, Vital Sign Monitors, Capnography or Oximetry Systems, ECG and EKG Monitors, and Magnetic Resonance Imaging Systems), By Target Area (Cardiology, Respiratory, Neurology, and Others), By Animal Type (Companion Animals, Livestock Animals, and Other), By End User (Veterinary Clinics/Hospitals, Research Institutes, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Georgia-Pacific Corporation, DS Smith PLC, Holmen AB, International Paper Company, Hood Packaging Corporation, OJI Holding Corporation, MeadWestvaco Corporation, Stora Enso Oyj, Smurfit Kappa Group Plc, The Mayr-Melnhof Group, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Veterinary Monitoring Equipment Market size is estimated to have a value of USD 2,533.6 million in 2024 and is expected to reach USD 5,907.5 million by the end of 2033.

The US veterinary monitoring equipment market is projected to reach a market value of USD 751.6 million in 2024 which is further expected to reach a value of USD 1,672.8 million in 2033 at a CAGR of 9.3%.

North America is expected to have the largest market share for the Global Veterinary Monitoring Equipment Market with a share of about 34.1% in 2024.

Some of the major key players in the Global Veterinary Monitoring Equipment Market are Georgia-Pacific Corporation, DS Smith PLC, Holmen AB, and many others.

The market is growing at a CAGR of 9.9 percent over the forecasted period.