Video Analytics Market Overview

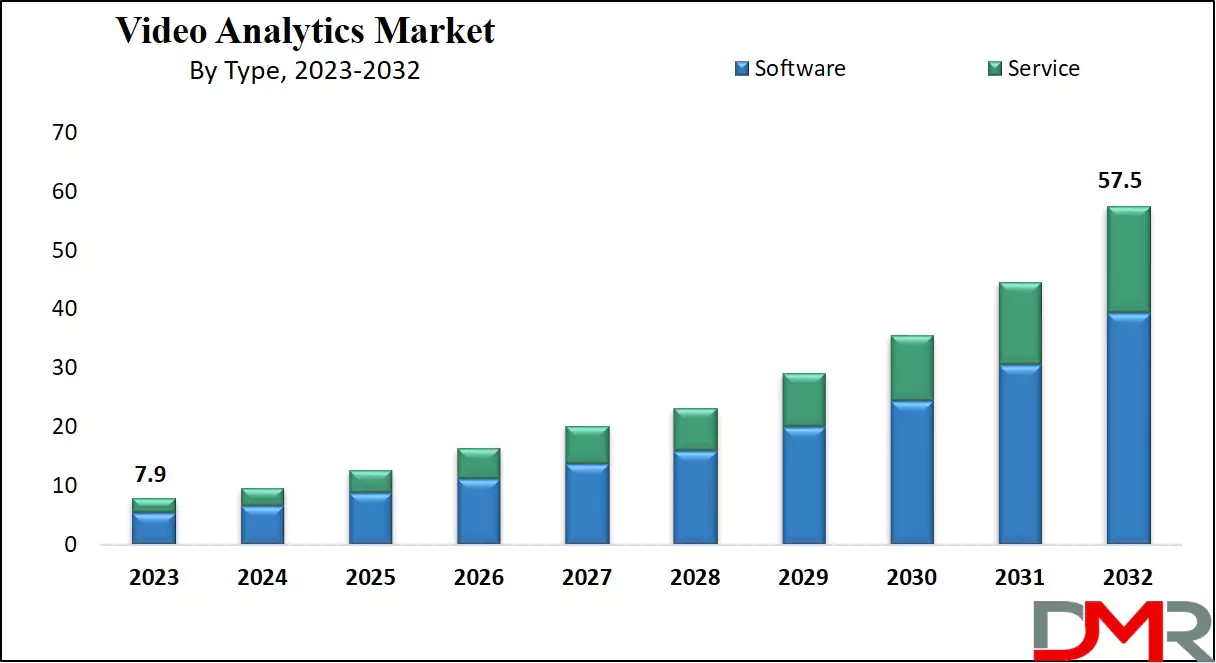

The Global Video Analytics Market is expected to reach a value of USD 7.9 billion in 2023, and it is further anticipated to reach a market value of USD 57.5 billion by 2032 at a CAGR of 24.7%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Video analytics, integrated into surveillance systems, automates video feed monitoring, providing live analysis for enhanced security and reporting. Highly sought after in security, healthcare, & retail, the software allows visitor & employee safety by identifying intruders & suspicious situations. It quickly alerts security personnel, allowing preemptive actions to prevent incidents before they occur. Increasing adoption of intelligent video surveillance technologies further accelerates growth by enabling predictive security measures and advanced incident detection.

Also, video analytics is increasingly being deployed across cities, retail stores, vehicles and worksites in order to gain valuable insights for decision making. Video surveillance uses video analytics as an integral component in threat detection, recognition mitigation and impact monitoring - particularly China which has made significant investments into facial recognition technology - expected to reach CNY 40 billion (USD 5.73 billion), according to NetEase estimates. With the rise of real-time video monitoring solutions, governments and enterprises can manage critical infrastructure and large-scale events more effectively.

Zenith reported an upward trend in global advertising spending last year total expenditures reached USD 722.84 million with projections showing it will hit $885 billion by the end of 2024. A large part of this budget goes toward consumer insights; video analytics becomes an indispensable tool for heat mapping, customer service enhancement and shrinkage reduction - creating ample growth prospects in retail sector environments. The integration of AI-powered video analytics is further boosting retail businesses by offering personalized recommendations and operational efficiency.

The COVID-19 pandemic saw an increased uptake of analytics-driven surveillance systems, such as CCTV cameras and video streaming solutions, among multiple industries such as healthcare, retail, construction, government and travel. Their use increased for public safety purposes such as mask compliance monitoring and crowd density management. With organizations prioritizing security solutions over monitoring solutions the demand for video analytics should increase significantly leading to market expansion in coming years.

Key Takeaways

- By Type, Software segment takes the lead in 2023.

- By Application, the Crowd Management segment takes the lead in 2023.

- In addition, the Facial Recognition segment is expected to have robust growth over the forecasted period.

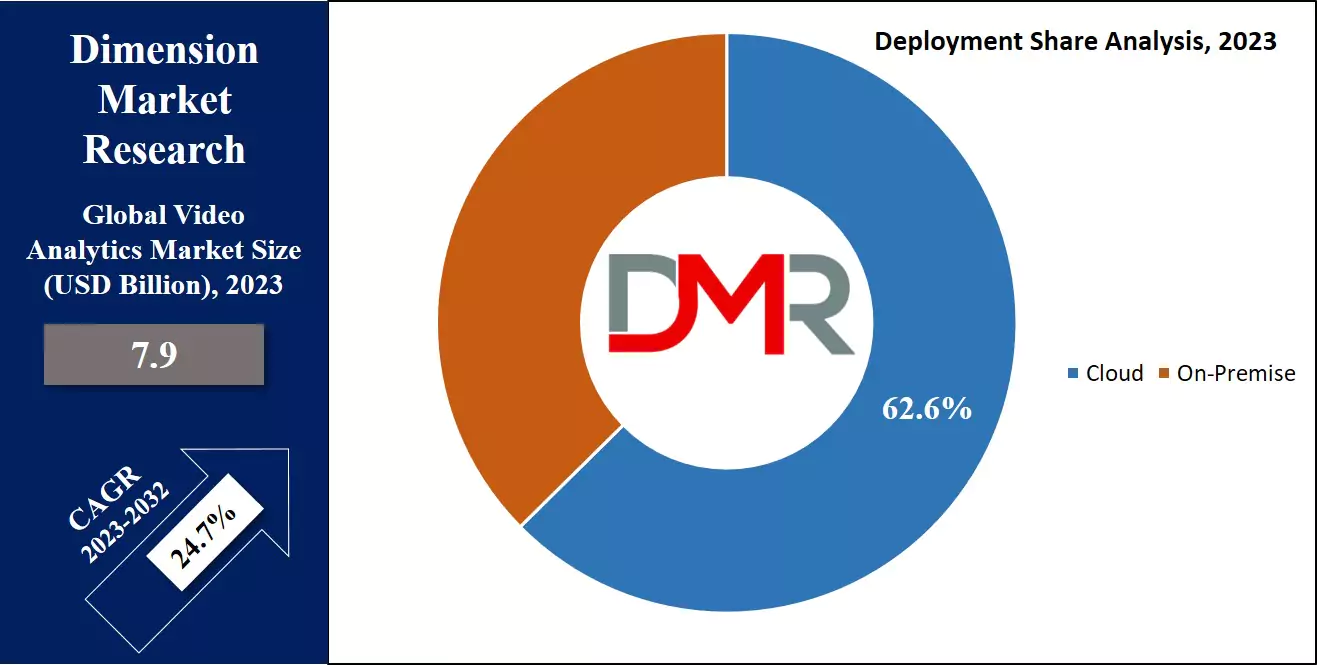

- By Deployment, Cloud mode take the lead & drive the market in 2023.

- North America has a 45.8% share of revenue in the Global Video Analytics Market in 2023.

Use Cases

- Security & Surveillance: Identifies suspicious activities, unauthorized access, and perimeter breaches in public and private spaces.

- Retail & Customer Insights: Tracks customer movement patterns to optimize store layout and product placement for increased sales.

- Traffic Management & Smart Transportation: Automates toll collection, identifies stolen vehicles, and manages parking enforcement.

- Healthcare & Patient Monitoring: Alerts healthcare staff in real-time if a patient falls, ensuring immediate medical assistance.

- Manufacturing & Workplace Safety: Ensures workers wear protective gear like helmets and gloves, reducing workplace hazards.

Video Analytics Market Dynamic

Over the past few years, drone usage has surged, particularly in the aerospace and defense industries. The logistics & transportation sector, in particular, has embraced video surveillance, reaping benefits like behavior analysis, crowd management, enhanced safety measures, incident recording, & blind spot detection.

Video analytics plays a critical role in transforming transportation, ensuring better safety & efficiency for commuters. With capabilities like object tracking, facial recognition, unidentified object detection, & intelligent traffic monitoring, logistics & transportation companies can avert disasters & identify potential threats to infrastructure & vehicular safety.

However, implementing an efficient video analytics system necessitates strong IT infrastructure & stable connections, leading to higher maintenance costs. Further, public spaces & underdeveloped nations often lack the needed infrastructure for continuous observation, requiring regular maintenance for system reliability. The considerable maintenance expenses & higher initial investments pose challenges for suppliers in the global video analytics market, potentially restraining market growth in the coming future.

Driver

Growing Demand for Increased Security and Surveillance

The rising need for robust security solutions across industries drives the video analytics market forward. Organizations are increasingly turning to video analytics to bolster their surveillance systems, providing real-time monitoring, anomaly detection and rapid responses for any incidents that arise. Increased threats such as terrorism, cybercrime, and theft have resulted in greater need for advanced analytics within public safety as well as private sectors.

Governments worldwide are making investments in smart city initiatives that integrate video analytics for traffic control, law enforcement, and crowd monitoring - which has contributed to its steady expansion. This rise in proactive security measures is fuelling this market growth even further.

Trend

Integration of AI and Deep Learning Technologies

Artificial intelligence (AI) and deep learning technologies are revolutionizing video analytics market landscape. These technologies enable advanced capabilities like facial recognition, behavior analysis and predictive analytics that improve surveillance system accuracy and efficiency.

AI-powered video analytics can quickly process vast amounts of data in real time, making them ideal for large-scale applications like smart cities and industrial automation. Cloud-based analytics solutions have also gained in popularity recently due to their scalability and remote accessibility - this trend redefining traditional surveillance approaches and driving innovation within industries such as retail, healthcare and transportation.

Restraint

High Initial Costs and Data Privacy Concerns

Initial costs associated with video analytics deployment - hardware, software and integration expenses - represent an obstacle to market adoption. Small and medium-sized enterprises (SMEs) frequently struggle to justify investments despite potential long-term benefits, due to privacy and security considerations when using video analytics technology to process sensitive information.

Compliance with stringent regulations such as GDPR and regional laws can make implementation challenging, further compounded by an absence of skilled professionals capable of handling advanced systems, impeding widespread adoption of video analytics solutions in developing regions.

Opportunity

Expanding Applications in Retail and Healthcare

Video analytics market presents vast opportunities in industries like retail and healthcare. Analytic solutions in retail can be used to track customer behavior, optimize store layouts and drive more sales through targeted marketing efforts. Video analytics is widely utilized in healthcare to monitor patients, ensure safety protocols are being adhered to and increase operational efficiencies.

With the rise of e-commerce and telemedicine services these applications have only expanded further.

Edge computing and IoT integration present opportunities to expand video analytics capabilities, providing businesses with tailored solutions the chance to take advantage of this burgeoning market.

Video Analytics Market Research Scope and Analysis

By Type

The video analytics market sees its largest revenue contribution from the software industry in 2023, primarily driven by a growing necessity to monitor structures & facilities for potential physical threats or suspicious activities. The growing requirement for video analytics software is fueled by factors like real-time processing capabilities, precise image analysis, diverse visual inputs, & improved accuracy in threat detection.

Moreover, the service category is expected to experience the highest growth rate throughout the projection period, which growth is due to the widespread adoption of digital technology across several industries & the growing emphasis on providing advanced services. Video analytics services play a vital role in assisting businesses by offering configuration, project guidance, security monitoring, installation, & other essential security-related services, meeting the changing needs of industries in the digital age.

By Deployment

The video analytics market is categorized by deployment into on-premise & cloud segments, among cloud segment includes Software as a Service (SaaS), offering unified process management & using an on-demand subscription model based on subscription counts. Further On-premise operations occur at the user company's site, using a dedicated server exclusively for itself, with no external server linkage, & in such cases, the company owns the software entirely.

Further, there has been a major trend of organizations transitioning from traditional on-premise setups to cloud deployments. The cloud-based solutions, incorporating SaaS models, provide high scalability & facilitate live incident analyses, supporting an unlimited number of cameras, which switch reflects a rise in preference for the flexibility & scalability offered by cloud-based video analytics solutions, contributing to the anticipation of significant growth in the cloud-based segment over the forecast period.

By End User

There has been a transformative shift in the global demand for video analytics, spurred by evolving customer needs, where the retail sector emerged as the dominant force in the market in 2023, attributed to the large application of video analytics within the retail landscape, which is expected to persist, maintaining the retail segment's leadership throughout the forecast period.

Further end-use segments, including government, BFSI, education, transportation, city, & critical infrastructure, are experiencing a notable impact. In addition, end users are no longer solely focused on basic security surveillance instead, there is a rise in emphasis on understanding crowd patterns & deciphering individual behavior, which has propelled the widespread adoption of video analytics across different applications, ranging from retail establishments to city management & government operations.

By Application

Governments & police departments often face formidable challenges in managing & monitoring crowds during major events and festivals, integrating intelligent surveillance systems with video analytics proves invaluable in these situations, providing critical situational alerts. Video analytics is highly applied in crowd management, including tasks like estimating crowd size, identifying dominant patterns, analyzing crowd statistics, & detecting suspicious activities.

Further in video analytics applications, the facial recognition segment is expected to be the fastest-growing over the forecast period, which is attributed to its diverse applications, like identifying individuals with criminal records, aiding in fraud detection for passports and visas, and facilitating attendance tracking & management. The higher reliance on facial recognition technology is anticipated to play a main role in improving security measures & operational efficiency in different domains.

The Video Analytics Market Report is segmented on the basis of the following:

By Type

By Deployment

By End User

- BFSI

- City

- Critical Infrastructure

- Education

- Government

- Retail

- Transportation

- Others

By Application

- Crowd Management

- Facial Recognition

- Intrusion Detection

- License Plate Recognition

- Motion Detection

- Others

How Does Artificial Intelligence Contribute To Improve Video Analytics Market ?

- Real-time Object Detection & Recognition: AI-powered Facial Recognition: Enhances security by identifying individuals in real-time at airports, offices, and public spaces.

- Behavior Analysis & Anomaly Detection: Unusual Activity Alerts: AI detects suspicious behaviors like loitering or sudden crowd formation, triggering instant security alerts.

- Automated Video Summarization: Quick Footage Review: AI compresses long video feeds into short clips, helping security teams analyze incidents faster.

- Predictive Analytics & Decision-Making: Traffic Congestion Prediction: AI analyzes historical data to optimize traffic lights and reduce road congestion in smart cities.

- Edge AI for Faster Processing: On-device Processing: AI-enabled cameras analyze video footage locally, reducing the need for cloud-based processing and improving response time.

Video Analytics Market Regional Analysis

North America leads the regional video analytics market in 2023, commanding a substantial

45.8% share, primarily due to the significant presence of key industry players, where the US stands out as the world's largest consumer of video analytics, benefitting from fast technological developments fueled by strong economic growth.

Further, organizations in the region are highly prioritizing security & safety, driving the integration of analytics into their operations. Also, there's a visible shift from traditional on-premise video analytics deployment to cloud-based solutions, reflecting evolving customer needs.

Further, Asia Pacific emerges as the second-largest market in terms of revenue share, which is largely attributed to the strong economic growth in countries like China, India, and Indonesia. These nations are investing in intelligent security surveillance systems to improve the safety of their populations. The increased adoption of industry-specific solutions, mainly in Japan, China, & India, further contributes to the region's prominence in the global video analytics landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Video Analytics Market Competitive Landscape

In the global software solutions & services arena, competition is intense & dominated by key players, collectively holding the largest market share. To maintain a competitive edge, industry players use strategic measures like collaborations, new product developments, investments in capabilities partnerships, expansion, R&D initiatives, and frequent mergers & acquisitions. Companies also prioritize application development & customized products to enhance their market position.

In October 2023, Remark Holdings, Inc., a key player in AI-based video analytics, announced a strategic sales & marketing partnership with Arrow Electronics and Intel, which expands Remark's market presence to over 200,000 customers of Arrow. Further, the collaboration provides Intel-powered AI servers hosting Remark's Smart Safety Platform, with Arrow handling distribution & sales logistics, improving accessibility & support for the innovative solution.

Some of the prominent players in the global Video Analytics Market are

- Cisco System

- Axis Communication

- Genetec

- Intellivision

- Intuvision

- Avigilon Corp

- Honeywell International

- Puretech Systems

- ISS Corp

- Briefcam

- Other Key Players

Recent Developments

- In August 2023, Sabio Holdings Inc., a key provider of connected TV & over-the-top advertising platforms, reported about its wholly-owned business, App Science, and unveiled a fresh AI feature in their Insights analytics dashboard, using NPL, which streamlines the analysis of metrics, providing automated insights, which aims to simplify the process for media agencies & brands, facilitating better comprehension of their data sets.

- In September 2023, YouTube introduced a set of generative AI tools for creators, joining the trend in the tech world, as the platform focuses on empowering everyone to become content creators, leveraging AI to simplify complex tasks & turn ambitious ideas into reality. Further, the organization emphasizes that these innovative tools should be accessible to a broad audience, & they plan to test a feature called Dream Screen, allowing creators to generate AI-driven video or image backgrounds effortlessly.

- In March 2023, Vicon Industries, Inc., a subsidiary of Cemtrex Inc. specializing in video surveillance & access control technology, unveiled an AI-driven analytics solution., which streamlines post-incident video searches by filtering out irrelevant content, improving users' ability to quickly access pertinent information. Further, the integration of Vicon's advanced Roughneck AI Cameras & the latest Valerus 23.1 VMS release enhances its position as a comprehensive solutions provider, providing powerful AI-based features for object classification, tracking, recording, & forensic searching.

Video Analytics Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 7.9 Bn |

| Forecast Value (2032) |

USD 57.5 Bn |

| CAGR (2023-2032) |

24.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Software and Services), By Deployment (Cloud and On-premise), By End User (BFSI, City, Critical Infrastructure, Education, Government, Retail, Transportation, and Others), By Application (Crowd Management, Facial Recognition, Intrusion Detection, License Plate Recognition, Motion Detection, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cisco System, Axis Communication, Genetec, Intellivision, Intuvision, Avigilon Corp, Honeywell International, Puretech Systems, ISS Corp, Briefcam, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Video Analytics Market size is estimated to have a value of USD 7.9 billion in 2023 and is

expected to reach USD 57.5 billion by the end of 2032.

North America has the largest market share for the Global Video Analytics Market with a share of about

45.8% in 2023.

Some of the major key players in the Global Video Analytics Market are Cisco System, Axis

Communication, Genetec, and many others.

The market is growing at a CAGR of 24.7 percent over the forecasted period.