Video streaming is a constant transmission of video files from a server to a client. Video streaming allows users to view videos online without having to download them. Streamed video content can be movies, TV shows, YouTube videos, and live-streamed content, contributing significantly to the rise of online video services worldwide.

Further, the term streaming is the continuous transmission of audio and video files from a server to a client. In video streams, content is sent in compressed form over the internet and is displayed by the viewer in real time. The media is sent in a constant stream of data and is played as it arrives, making it an essential part of modern digital media consumption patterns.

Social media and increasing internet connectivity have played a pivotal role in expanding global markets. Meta (formerly Facebook) reached over 2.40 billion users by May 2021; other platforms like WhatsApp and YouTube each exceeded 1 billion users. Rising engagement with OTT platforms has further accelerated viewership and content demand across regions

Rising video data traffic due to rising demand for HD videos has also contributed to market expansion. Players in this sector are developing advanced platforms in response to this burgeoning need, especially within education.

The COVID-19 Pandemic had an enormously beneficial effect on the market, driving its adoption of live streaming platforms and encouraging regulatory approval and decreasing in-person visits, leading to remarkable market growth rates of 5.7% in 2020 (compared with 9.8% in 2019) as revenue surged up to USD 297.40 billion due to an increasing shift towards digital solutions.

The US Video Streaming Market

The

US Video Streaming Market is projected to

reach USD 39.9 billion in 2024 at a compound annual

growth rate of 20.9% over its forecast period.

The video streaming market in the US provides many growth opportunities through ad-supported models, development for cost-conscious viewers, and the expansion of niche platforms targeting specific interests. Major mobile consumption drives demand for shorter, flexible content, while advanced technologies like

Artificial Intelligence improve personalization. In addition, original content production and bundling streaming with telecom services present further avenues for growth.

Moreover, the growth drivers include the growing demand for original content and the rise of ad-supported models, which attract budget-conscious consumers. However, challenges for the market include subscription fatigue, as viewers become overwhelmed by various services, and issues with content piracy, which can affect revenue. These dynamics shape the competitive landscape of the streaming industry

Key Takeaways

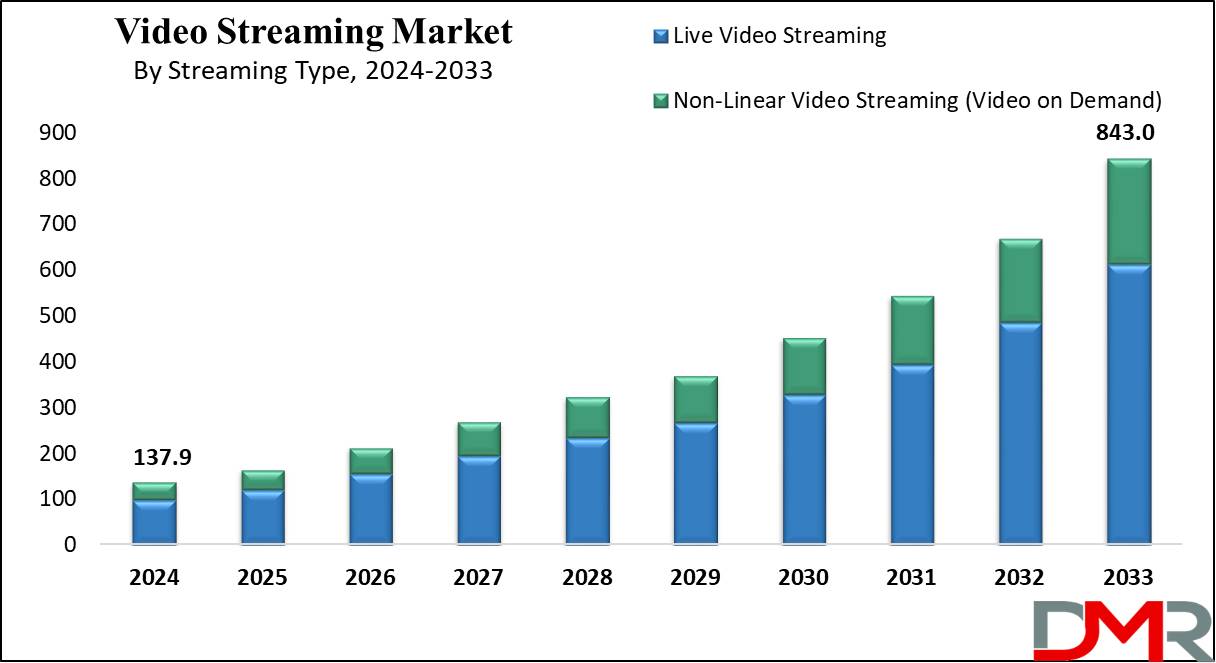

- Market Growth: The Video Streaming Market size is expected to grow by 677.5 billion, at a CAGR of 22.3% during the forecasted period of 2025 to 2033.

- By Streaming Type: The live video streaming segment is anticipated to get the majority share of the Video Streaming Market in 2024.

- By Revenue Model: The subscription segment is expected to be leading the market in 2024

- By End User: The consumer segment is expected to get the largest revenue share in 2024 in the Video Streaming Market.

- Regional Insight: North America is expected to hold a 32.5% share of revenue in the Global Video Streaming Market in 2024.

- Use Cases: Some of the use cases of Video Streaming include education & e-learning, live events & sports, and more.

Use Cases

- Entertainment Platforms: Streaming services like Netflix and Disney+ provide on-demand movies, series, and shows, improving user convenience with customized recommendations.

- Live Events & Sports: Platforms like YouTube Live and Hotstar stream sports events, concerts, and news in real time, allowing global access and audience interaction.

- Education & E-Learning: Services like Coursera and Udemy provide video lectures, webinars, and tutorials, delivering flexible learning opportunities for students & professionals.

- Corporate Communication: Companies utilize streaming for virtual meetings, webinars, and training sessions through platforms like Zoom or Microsoft Teams, ensuring seamless remote collaboration.

Market Dynamic

Driving Factors

Rising Internet Penetration and Mobile Usage

The higher access to high-speed internet and cost-efficient smartphones globally has driven the adoption of video streaming, which allows users across urban & rural areas to consume content anytime, accelerating subscriber growth for platforms.

Shift Towards On-Demand and Original Content

Changes in consumer preferences for binge-watching and customized viewing experiences have driven platforms to provide exclusive shows and movies. Investments in original content and local language productions further attract diverse audiences, driving market expansion.

Restraints

High Bandwidth and Data Costs

Video streaming requires higher internet bandwidth, which can be costly or inconsistent in many regions, which limits adoption, mainly in areas with poor network infrastructure or costly data plans, restricting user reach.

Intense Competition and Content Saturation

With various platforms competing for market share, content creation and licensing costs have surged. Subscriber churn becomes a challenge as users constantly switch services, making it harder for platforms to maintain long-term profitability.

Opportunities

Expansion into Emerging Markets

Regions like India, Southeast Asia, and Africa provide major growth potential due to growing internet access and smartphone adoption. Providing region-specific content and affordable subscription models can assist platforms tap into these untapped audiences.

Adoption of New Technologies

Developments like 5G,

5G services, AI, and virtual reality (VR) can improve streaming quality and personalization. Platforms using these technologies can enhance user experiences, drive engagement, and unlock new revenue streams through immersive and interactive content.

Trends

AI Integration in Streaming

AI is transforming the video streaming industry by improving customized recommendations, optimizing streaming quality in real time, and automating content creation. AI tools now handle predictive maintenance for simple infrastructure and help automated video editing, ensuring efficient workflows and better viewer experiences.

Hybrid Video-on-Demand (HVOD) Models

A major trend is the growth of hybrid models that blend subscription (SVOD), advertising-supported (AVOD), and free ad-supported TV (FAST) services. Platforms like Netflix & Disney have adopted this approach to diversify revenue & attract a broader audience, which helps cater to users with varying budgets & preferences, balancing growth with sustainable profitability

Research Scope and Analysis

By Component

The content delivery services segment is expected to dominate the video streaming market in 2024, due to the increasing adoption of OTT platforms by consumers. People are switching towards flexible streaming options, like video on demand (VOD) and live broadcasting, to enjoy entertainment on their terms, which is assisted by growth in consumer spending on digital content, which has grown highly in recent years due to greater access to high-speed internet and enhancement in streaming quality.

As audiences require smooth and high-quality viewing experiences, streaming providers are expanding their content delivery networks to ensure smooth playback across multiple devices. The integration of growing entertainment consumption, the convenience of OTT platforms, and a preference for on-demand and live content has driven the demand for efficient content delivery solutions, making it a leader of the market's growth, which is expected to continue as streaming platforms evolve to meet the increasing expectations of consumers.

By Streaming Type

The live streaming segment is projected to get the highest revenue in 2024, due to the growing use of digital media devices and faster internet access, making it easy to stream content remotely. Key factors contributing to this growth are viewers’ preference for ad-free experiences, mobile accessibility, audience analytics, and a large potential audience base.

Live streaming continues to thrive due to the popularity of live events like sports, concerts, and news, which attract massive audiences seeking immediate access to such experiences, as its ability to provide interactive, real-time engagement has solidified its value in the streaming industry.

Further, video-on-demand (VOD) is expected to grow significantly over the forecasted period due to the convenience of non-linear streaming. VOD enables users to watch content at their own pace and consists of series linking, live pause, and less buffering, better viewing experience. Its flexibility appeals to modern audiences, who choose not to be bound by broadcast schedules.

As VOD becomes more mainstream across age groups, both live and on-demand streaming are anticipated to coexist, with each type catering to different user needs, which reflects how the streaming market is transforming to meet varied consumer expectations, balancing the appeal of real-time engagement with the freedom of personalized viewing.

By Channel

The video streaming market is segmented into cable TV, satellite TV, IPTV, and OTT streaming. In 2024, cable TV is anticipated to maintain the largest market share due to its broad adoption across households around the world. Many viewers still prefer traditional cable TV for access to bundled content, like popular channels, live sports, and news. Cable services are mainly prevalent in regions with long-standing infrastructure, where households depends on it for both entertainment and information needs.

Further, OTT streaming is anticipated to experience the fastest growth during the forecast period, with the highest growth which is driven by the rapid adoption of OTT platforms in emerging markets like India, Brazil, and other developing countries, where better internet access and affordable streaming subscriptions are driving consumer demand.

OTT services provide flexibility, personalized content, and ad-free options, making them highly popular across diverse demographics. As these platforms expand into local languages and genres, they are anticipated to capture a significant share of future market growth.

By Platform

Smartphones and tablets are anticipated to generate the highest revenue in the streaming market in 2024, mainly due to the accessibility of affordable internet, growth in disposable incomes, and better living standards. These devices provide users with a simplified way to stream live and on-demand content due to reliable internet services.

Their portability and ability to access content remotely make them the prominent choice for consumers who want on-the-go entertainment without interruptions. Further, the smart TV segment is anticipated to experience higher growth during the forecast period.

Smart TVs combine traditional TV channels with video streaming services, providing viewers with a wide entertainment experience. The availability of popular streaming apps like Netflix, YouTube TV, and Hulu has increased interest in this segment.

In addition, tools like PLEX allow users to organize and stream many media files, further improving the smart TV experience. As more people transform toward integrated media platforms, smart TVs are becoming a vital part of modern households, driving their adoption.

By Revenue Model

The subscription segment is anticipated to generate the highest revenue in 2024, driven by the growing number of subscribers worldwide. Subscription-based models provide access to streaming content for a recurring fee, giving users flexibility through various plans. These models are popular because they provide unlimited access to a variety of content, like exclusive series and films.

Platforms often release original content, like premium series, to attract & retain subscribers, encouraging users to pay for constant access instead of free, ad-supported options.

In addition, subscription models have gained more momentum recently, as viewers highly prefer ad-free experiences with premium content. The combination of original productions and varied content libraries provided through subscriptions has positioned this model as the market leader, with OTT providers adopting it as a primary strategy for long-term growth.

Further, the advertising segment remains a key revenue stream, where platforms develop income by hosting ads within their content. Advertisers are willing to invest highly in these platforms to reach large & targeted audiences through on-demand streaming services. As a result, advertising plays a major role in monetizing free or low-cost streaming options.

By End User

The consumer segment is anticipated to lead the streaming market in 2024, driven by the increase in the demand for live streaming services and video on demand (VOD). Smartphones are playing a major role, mainly among younger audiences, in promoting the use of various streaming platforms. In addition, the higher popularity of video games has driven the demand for streaming services, as gamers mostly engage with platforms for gameplay broadcasts, e-sports events, and walkthroughs.

The rapid expansion of global gaming communities further strengthens this trend, making video streaming a key entertainment medium for varied consumer groups. Further, the enterprise segment, on the other hand, is anticipated to grow at the fastest rate over the coming years.

Companies are highly adopting video streaming solutions for activities like employee training, remote consulting, and virtual meetings. Technological developments like real-time transcoding, better video codecs, and automatic captioning are driving the adoption of streaming in business environments.

These tools not only enhance communication within organizations but also provide flexibility for remote work. On-demand videos allow employees to get training resources at their convenience, improving productivity. As businesses continue to embrace digital transformation, the role of streaming technology in boosting operational efficiency is expected to expand significantly.

The Video Streaming Market Report is segmented on the basis of the following

By Component

- Software

- Transcoding & Processing

- Video Delivery & Distribution

- Video Management

- Others

- Content Delivery Services

- Live Broadcasting

- VOD & Complementary Content

- Low Latency Video Streaming Services

By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming (Video on Demand)

By Channel

- Satellite TV

- Cable TV

- IPTV (Internet Protocol Television)

- OTT Streaming

By Platform

- Gaming Consoles

- Laptop & Desktops

- Smartphones & Tablets

- Smart TV

By Revenue Model

- Advertising

- Rental

- Subscription

By End User

- Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

Regional Analysis

The North American video streaming market is expected to have the largest revenue share, accounting for

32.5% in 2024, mainly due to the quick adoption of cloud-based streaming services. Big platforms like Netflix, Disney+, and Amazon Prime Video compete intensely, aiming at original content and various libraries to attract subscribers. In the US, the market is transforming quickly, with niche platforms emerging to target specific audiences, promoting strong community engagement.

The growth of mobile viewing is transforming platform strategies toward smooth user experiences and shorter content formats. In addition, ad-supported models are gaining traction as an alternative to paid subscriptions, further transforming the competitive landscape.

Further, the Asia-Pacific video streaming market is set to experience the fastest growth during the forecast period, driven by quick technological development, a high volume of mobile usage, and the growing popularity of online content.

The region provides new monetization opportunities through multichannel services bundled with mobile and broadband packages. Southeast Asia, in particular, is experiencing rapid internet adoption, accelerating the growth of streaming services.

In 2024, China is expected to lead the region’s market, with OTT platforms transforming content consumption. Telecom providers & multichannel operators are actively driving developing through advanced marketing strategies and business models that leverage video streaming to meet the evolving demands of viewers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The video streaming market is highly competitive, driven by numerous established platforms and new entrants competing for viewer attention. Companies compete by applying strategies like pricing strategies, providing original content, and user experience, and often providing personalized recommendations. With the growth in subscription fatigue, many providers are adopting hybrid revenue models combining ads with subscriptions.

Localization of content & advanced technologies like AI and 5G also play an important role in differentiation. As competition intensifies, retaining users has become challenging, pushing platforms to focus on exclusivity, better content discovery, and seamless streaming across devices

Some of the prominent players in the Global Video Streaming are

Recent Developments

- In October 2024, Warner Bros. Discovery announced its plans to launch its Max streaming service across seven Asian markets, making the platform available in more than 72 markets, with the availability of popular content from iconic brands like the DC Universe, HBO, Discovery, Harry Potter, and Cartoon Network in Malaysia, Indonesia, the Philippines, Singapore, Thailand, Taiwan and Hong Kong starting from November 2024.

- In October 2024, New Orleans, in partnership with Gray Media, announced the launch of Gulf Coast Sports & Entertainment Network, which would allow millions of viewers across the Gulf Coast to watch Pelicans games at home via free, over-the-air television. Gray Media would broadcast 75 of the 82 regular-season games on the Gulf Coast Sports & Entertainment Network, with the remaining games broadcast on National TV.

- In October 2024, Trump Media & Technology Group announced that it launched its Truth+ TV streaming service on the web, which will allow account holders to access a variety of Truth+ streaming options on computers, laptops, and mobile phones, while a limited version of Truth+ remains available directly on the Truth Social platform.

- In October 2024, InterDigital, Inc. announced that the company has signed new patent license agreements with TPV, a major manufacturer of numerous digital TVs under various brands, as it licenses TPV to InterDigital’s vast portfolio of HEVC patents along with DTV patents licensed through InterDigital´s joint licensing program with Sony.

- In September 2024, X announced that it is developing a new professional video conferencing tool called X TV to compete with Google Meet, MS Teams, and Zoom, which would let you stream movies and shows from various sources.