Market Overview

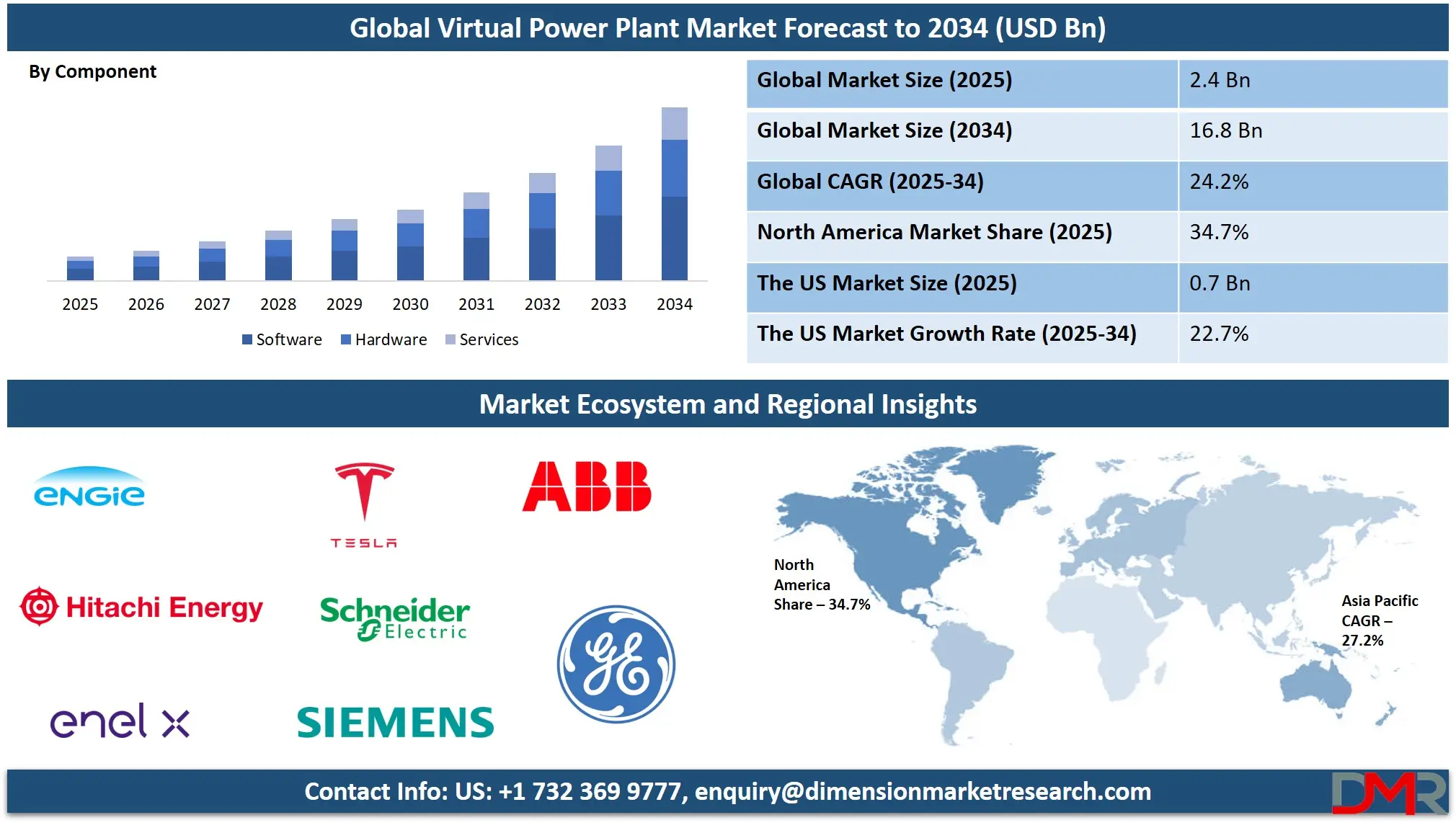

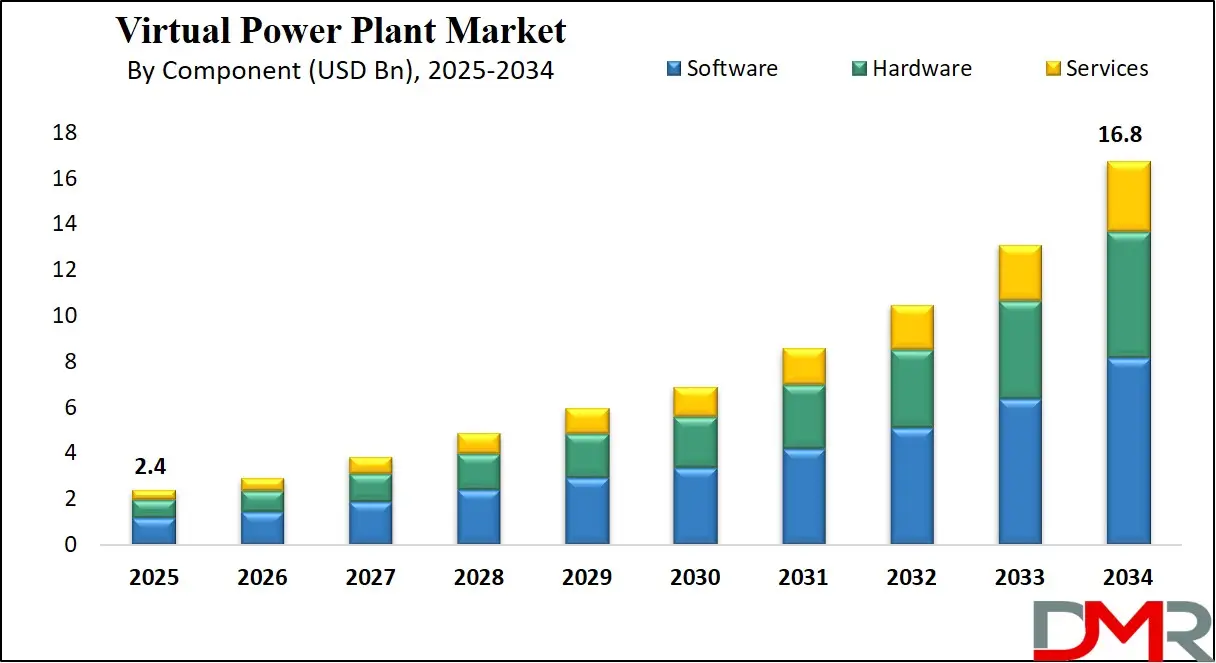

The Global Virtual Power Plant Market size is projected to reach USD 2.4 billion in 2025 and grow at a compound annual growth rate of 24.2% from there until 2034 to reach a value of USD 16.8 billion.

A Virtual Power Plant (VPP) is a digital system that brings together different types of small energy resources, like solar panels, wind turbines, batteries, and even smart appliances, and makes them work together as one big power plant. Instead of depending on a single power station, a VPP connects many distributed energy resources (DERs) using advanced software and communication technology. The goal is to balance electricity supply and demand more efficiently, support the main power grid, and reduce the need for fossil fuel-based power generation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, the demand for VPPs has grown due to several reasons. One major reason is the increase in renewable energy sources. Solar and wind energy are clean and popular, but they don’t always produce power when it’s needed. VPPs help manage this by using batteries and smart systems to store or share energy at the right time. Another reason is the rising need for grid flexibility. As more electric vehicles, heat pumps, and smart devices are connected to the grid, VPPs make it easier to control when and how electricity is used.

Several important trends are shaping the VPP industry. One trend is the use of artificial intelligence (AI) and machine learning to improve how VPPs predict energy use and generation. Another trend is the increase in residential participation—more homeowners are being included in VPPs through rooftop solar, home batteries, and smart meters. Also, many utility companies are starting to rely on VPPs to reduce the strain on traditional grids during peak times, like hot summer days when air conditioners are used the most.

Many key events have helped drive attention to VPPs. For example, major power outages caused by storms or heatwaves have shown the need for more reliable and flexible energy systems. Governments and regulators in places like the U.S., Germany, and Australia have also introduced policies and pilot projects to support VPP growth. These projects often involve partnerships between utilities, technology providers, and households to test how VPPs can support the energy grid.

VPPs are also becoming important tools for helping to meet climate goals. Because they make better use of clean energy and reduce dependence on fossil fuels, they support national efforts to cut carbon emissions. They also make it easier to add more renewable power to the grid without causing instability. VPPs are especially helpful in rural or remote areas where it’s hard or costly to build large power plants or transmission lines.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Looking ahead, the future of VPPs seems bright. As more devices become connected and smarter, and as energy prices and environmental concerns rise, the need for flexible, efficient energy systems will keep growing. VPPs offer a way to turn homes, businesses, and small energy sources into active parts of the energy system. With continued support from governments and innovation in technology, VPPs are expected to play a major role in shaping modern energy networks around the world.

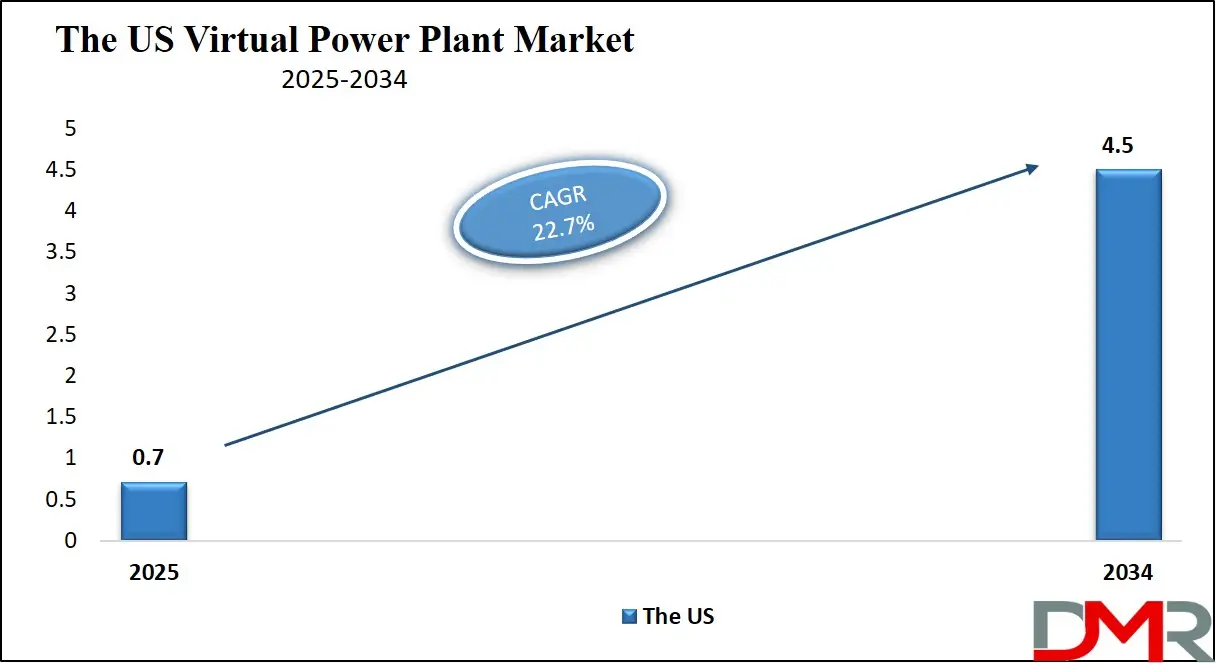

The US Virtual Power Plant Market

The US Virtual Power Plant Market size is projected to reach USD 0.7 billion in 2025 at a compound annual growth rate of 22.7% over its forecast period.

The US plays a leading role in the Virtual Power Plant (VPP) market due to its strong push for clean energy, advanced grid infrastructure, and supportive regulations. The country has been quick to adopt distributed energy resources like rooftop solar, home batteries, and electric vehicles, which are essential components of VPPs.

Government initiatives, pilot programs, and funding support from agencies like the Department of Energy are encouraging VPP development. Utilities across the US are also exploring VPPs to enhance grid stability, manage peak loads, and reduce reliance on fossil fuels. The US is home to many tech firms and energy innovators, making it a hub for VPP software platforms, AI-based energy management, and large-scale implementation of smart grid solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Virtual Power Plant Market

Europe Virtual Power Plant Market size is projected to reach USD 0.7 billion in 2025 at a compound annual growth rate of 23.3% over its forecast period.

Europe plays an important role in the Virtual Power Plant (VPP) market, driven by its strong commitment to renewable energy and climate goals. Many European countries are aggressively phasing out fossil fuels and increasing their reliance on wind, solar, and other decentralized energy sources, which creates a major need for smart systems like VPPs to manage variable energy generation and ensure grid stability.

The European Union supports VPP adoption through funding programs, policy frameworks, and innovation projects. Several regional energy markets in Europe are already testing VPP models to enable demand response and real-time energy trading. Europe’s advanced energy infrastructure, focus on digitalization, and collaboration between utilities and technology firms make it a key region shaping the global VPP landscape.

Japan Virtual Power Plant Market

Japan Virtual Power Plant Market size is projected to reach USD 0.1 billion in 2025 at a compound annual growth rate of 26.4% over its forecast period.

Japan plays an important role in the Virtual Power Plant (VPP) market as it focuses on building a cleaner and more resilient energy system. Following its shift away from traditional energy sources, Japan has placed strong emphasis on renewable energy, especially solar power. To support this transition, the government has launched various initiatives and pilot programs encouraging the use of VPPs.

These systems help manage energy from distributed sources like home batteries, electric vehicles, and solar panels. Japanese companies are actively developing advanced technologies such as AI, IoT, and vehicle-to-grid systems to support VPP networks. With strong policy backing, growing public interest, and increasing private sector participation, Japan is steadily moving toward large-scale implementation of VPPs to enhance energy efficiency and grid reliability.

Virtual Power Plant Market: Key Takeaways

- Market Growth: The Virtual Power Plant Market size is expected to grow by USD 13.9 billion, at a CAGR of 24.2%, during the forecasted period of 2026 to 2034.

- By Charging Type: TheAC Charging segment is anticipated to get the majority share of the Virtual Power Plant Market in 2025.

- By Application: The Commercial segment is expected to get the largest revenue share in 2025 in the Virtual Power Plant Market.

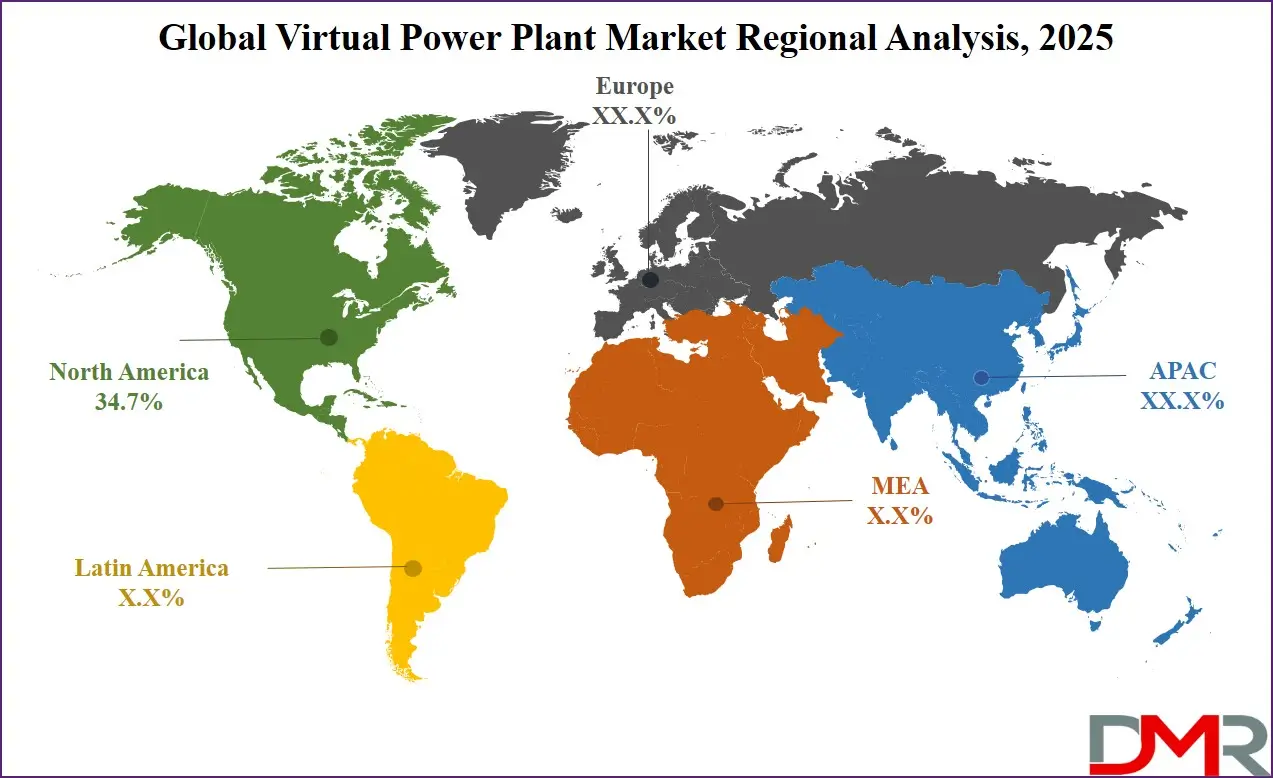

- Regional Insight: North America is expected to hold a 34.7% share of revenue in the Global Virtual Power Plant Market in 2025.

- Use Cases: Some of the use cases of Virtual Power Plant include grid stabilization, renewable energy integeration, and more.

Virtual Power Plant Market: Use Cases

- Grid Stabilization: Virtual Power Plants help maintain a stable power supply by balancing energy production and consumption in real-time. They reduce stress on the central grid during peak hours or outages. By using distributed resources, they respond quickly to changes in demand.

- Renewable Energy Integration: VPPs make it easier to use solar, wind, and other clean energy sources by managing their variable output. They store excess power in batteries and release it when generation drops. This helps avoid wastage and ensures a steady energy flow.

- Demand Response Programs: VPPs allow consumers to reduce or shift their energy use during high-demand periods in exchange for incentives. This coordinated effort eases pressure on the grid and cuts the need for expensive backup power sources.

- Backup Power for Critical Sites: Hospitals, data centers, and emergency services can use VPPs to stay powered during outages. VPPs ensure energy is stored and ready, offering reliable backup without relying only on diesel generators.

Market Dynamic

Driving Factors in the Virtual Power Plant Market

Rising Demand for Renewable Energy and Grid Flexibility

As countries shift towards cleaner energy sources, Virtual Power Plants play a key role in managing the intermittent nature of renewables like solar and wind. These energy sources often produce power when it’s not needed or fall short during high demand. VPPs help by intelligently coordinating distributed energy resources (DERs), storing excess energy, and releasing it when required.

This flexibility supports a more stable and efficient grid, reducing the need for fossil-fuel-based backup power. With climate policies pushing for higher renewable energy adoption, the need for VPPs is growing rapidly. They allow for better integration of decentralized systems, which is vital for modern grids. This trend is expected to drive strong growth in both advanced and emerging energy markets.

Government Support and Technological Advancements

Many governments across the world are introducing supportive regulations, pilot projects, and financial incentives to promote VPPs as part of their clean energy strategies. These initiatives encourage the development and deployment of smart grids, energy storage, and real-time monitoring technologies. At the same time, rapid advancements in artificial intelligence, machine learning, and IoT devices are improving the capabilities of VPP platforms.

These technologies allow for better forecasting, faster response times, and smoother coordination between energy producers and consumers. As digital infrastructure improves and more devices become interconnected, VPPs are becoming easier to deploy and manage. This combination of policy push and tech innovation is significantly driving market expansion.

Restraints in the Virtual Power Plant Market

High Initial Setup Costs and Complex Integration

One of the major restraints in the Virtual Power Plant market is the high cost involved in setting up and integrating various distributed energy resources into a unified platform. Building the digital infrastructure, including communication networks, control systems, and software platforms, requires significant investment.

Additionally, the process of connecting different types of energy assets each with unique technologies, standards, and performance levels can be technically complex and time-consuming. These factors often discourage smaller players and developing regions from adopting VPP solutions. The return on investment may also take time, which makes financial planning difficult for many stakeholders. Until setup becomes more affordable and integration standards are streamlined, adoption rates may be limited in certain markets.

Regulatory Challenges and Lack of Standardization

The Virtual Power Plant market faces obstacles due to inconsistent regulatory frameworks across regions. Many energy systems are still governed by traditional rules that do not recognize or fully support the operation of VPPs. This includes unclear policies around energy trading, data sharing, and the role of third-party aggregators.

In addition, the lack of standard protocols for device interoperability and communication makes it harder to scale VPP projects efficiently. Without uniform standards, utilities and operators may struggle with compatibility issues and security risks. These gaps in policy and regulation can slow down project approvals, limit cross-border collaboration, and hinder investment. A clearer, supportive regulatory environment is needed for widespread VPP growth.

Opportunities in the Virtual Power Plant Market

Expansion in Emerging Markets and Rural Electrification

Virtual Power Plants provides various opportunities in emerging economies where access to stable electricity is still limited. Many rural and remote regions lack large-scale grid infrastructure, making VPPs a cost-effective and flexible solution. By combining small-scale solar, wind, and battery systems, VPPs can deliver reliable power without the need for expensive transmission lines.

Governments and NGOs are increasingly exploring decentralized energy models for these areas. As digital technologies become more accessible and affordable, implementing VPPs in underserved regions becomes more practical. This not only addresses energy poverty but also opens new markets for energy companies and technology providers. The opportunity to leapfrog traditional power systems with smart, clean energy makes VPPs highly attractive in these regions.

Corporate Sustainability Goals and Energy-as-a-Service Models

The major focus on sustainability among businesses is creating a strong demand for flexible and clean energy solutions like VPPs. Many corporations are setting net-zero targets and looking for ways to optimize energy use across their facilities. VPPs allow them to participate actively in energy markets, lower carbon emissions, and reduce costs through demand response and distributed generation.

At the same time, the rise of Energy-as-a-Service (EaaS) business models enables companies to access VPP benefits without owning the infrastructure. Service providers handle the setup, operation, and maintenance, making adoption easier and more scalable, which creates a major opportunity for VPP providers to expand into the commercial and industrial sectors.

Trends in the Virtual Power Plant Market

Rise of AI‑Driven Energy Optimization

A recent trend in the Virtual Power Plant market is the growing use of artificial intelligence to optimize how energy is generated, stored, and used. These smart systems can analyze weather data, energy prices, and usage patterns to predict demand and adjust resources before changes happen. That means fewer surprises and a smoother balance between supply and demand.

The systems learn from past operations, getting better over time and reducing waste. With AI, VPPs are becoming faster at responding to grid needs and more cost‑effective to operate. This shift is making virtual power plants smarter, more reliable, and more attractive to utilities and end users alike.

Platform Integration with Smart City Infrastructure

Another trend involves combining virtual power plants with smart city networks such as traffic lights, public lighting, and electric vehicle charging points. By integrating with these systems, VPPs can play a key role in managing city‑wide energy usage. For example, EV chargers can be coordinated to charge when renewable energy is plentiful, and streetlights can adjust according to energy availability.

This creates a more dynamic urban energy system that can respond to real‑time conditions. The trend reflects a move toward holistic planning where energy, mobility, and digital services work together. As cities look to become greener and more connected, VPP integration is becoming a central strategy in urban planning.

Research Scope and Analysis

By Component Type Analysis

Software as a component type is expected to be leading in the Virtual Power Plant market in 2025 with a share of 48.6%, driven by its essential role in energy coordination, real-time monitoring, and intelligent load balancing. Software solutions allow distributed energy resources like solar panels, wind turbines, and storage systems to be managed from a single digital platform. These systems use advanced algorithms to forecast energy demand, optimize supply, and respond instantly to grid signals.

As more utilities and energy providers shift towards flexible and automated power systems, the demand for cloud-based VPP software, energy management platforms, and predictive analytics tools is growing. This component type supports seamless integration of renewable energy, improves grid stability, and enables smarter use of energy across regions. With rising investments in digital infrastructure and the need for scalable virtual energy networks, software is set to remain the core engine of VPP operations during the forecast period.

Hardware as a component type is expected to show significant growth over the forecast period in the Virtual Power Plant market, supported by increasing deployment of smart meters, battery storage systems, and distributed generation units. This segment includes all the physical devices that collect, store, and transmit energy data, enabling efficient operation of virtual energy networks. With the rise in rooftop solar, electric vehicle charging stations, and energy storage units, reliable and connected hardware is becoming more important than ever.

Advanced sensors and control units ensure that energy flows can be measured, tracked, and managed across the network. As countries modernize their power grids and encourage the adoption of clean energy technologies, hardware infrastructure forms the backbone of a responsive and decentralized energy system. The growing focus on grid automation and real-time control is expected to further drive the demand for robust and scalable hardware solutions within the VPP landscape.

By Technological Analysis

In 2025, demand response as a technology will be leading the Virtual Power Plant market with a projected share of 42.5%, driven by its ability to balance supply and demand in real-time. It enables energy consumers to adjust or reduce their electricity use during peak periods in response to signals from utilities or price changes, which helps stabilize the grid, avoid blackouts, and reduce the need for expensive power generation. Demand response plays a vital role in supporting clean energy goals by making the grid more flexible and responsive to renewable sources like wind and solar.

As electricity markets evolve and digital energy systems expand, utilities are increasingly relying on automated demand-side management to cut costs and enhance reliability. This technology is being widely adopted across industrial, commercial, and residential sectors, helping Virtual Power Plants operate more efficiently and deliver measurable benefits to grid operators and end users.

Mixed assets as a technology type is gaining strong traction in the growth of the Virtual Power Plant market, showing significant expansion over the forecast period. This approach combines various distributed energy resources such as solar panels, wind turbines, battery storage, electric vehicles, and controllable loads into one unified and flexible platform. By using a mix of energy assets, operators can balance fluctuations in energy supply and demand more effectively, increasing system resilience.

The ability to coordinate diverse technologies through intelligent software allows for better grid reliability, improved energy optimization, and faster response times during peak load or disruptions. Mixed asset VPPs are especially valuable in complex energy markets where flexibility and control are crucial. As the energy transition progresses and clean technologies become more diverse, the mixed assets model is expected to become a preferred strategy for maximizing grid efficiency and supporting large-scale renewable energy integration.

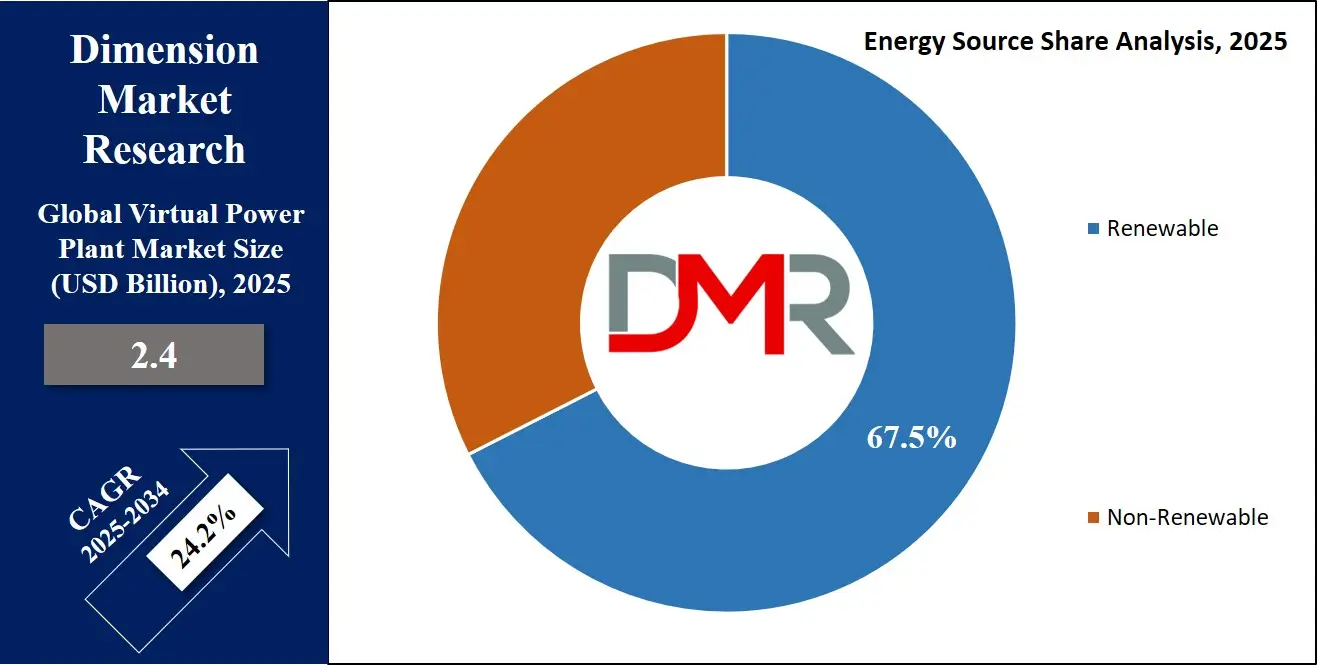

By Energy Source Analysis

Renewable energy as an energy source will be dominating the Virtual Power Plant market in 2025 with a projected share of 67.5%, driven by the global shift toward cleaner, sustainable power generation. Technologies like solar, wind, and small hydro are being rapidly deployed across residential, commercial, and utility-scale applications. These energy sources naturally align with the decentralized structure of VPPs, enabling more flexible and reliable grid operations.

Their integration is supported by digital control systems and storage solutions that help smooth out variability and ensure steady energy flow. Growing environmental awareness, supportive policies, and falling costs of renewable technologies continue to drive their adoption in VPP models. As countries work to decarbonize their energy sectors and reduce grid congestion, the combination of renewables and virtual coordination platforms offers an efficient, scalable way to meet energy needs while supporting global climate goals.

Non-renewable energy as an energy source is showing significant growth over the forecast period in the Virtual Power Plant market, especially in regions where fossil fuel infrastructure still plays a critical role in power generation. While VPPs are known for integrating renewables, many systems also include traditional sources such as natural gas generators or diesel units to ensure reliability and fill supply gaps during peak demand. These assets offer controllability and stability, making them useful in hybrid VPP models that aim for balanced performance.

Their presence allows VPPs to maintain energy security during weather disruptions or when renewable output is low. Additionally, in developing markets where renewable infrastructure is still growing, non-renewable energy helps support gradual grid modernization. By integrating both traditional and new-generation energy systems, non-renewable sources continue to play a transitional role in the broader adoption of smart, distributed power solutions within virtual energy networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End Use Analysis

Utilities as an end use segment will be leading the Virtual Power Plant market in 2025 with a projected share of 35.8%, supported by their increasing need to modernize grid operations and manage growing energy demand. Power utilities are under pressure to reduce operational costs, cut emissions, and improve grid flexibility, and VPPs offer a smart, scalable solution to achieve these goals. By aggregating distributed energy resources like solar, wind, and storage systems, utilities can balance load, prevent outages, and ensure more stable electricity supply across wide service areas.

The integration of advanced energy management systems and real-time monitoring tools is making it easier for utilities to adopt and operate VPP platforms. As energy markets become more dynamic and decentralized, utilities are becoming key drivers in deploying virtual energy solutions that enhance grid reliability and support large-scale renewable energy integration.

Residential as an end use segment is witnessing significant growth over the forecast period in the Virtual Power Plant market, driven by the rising adoption of home solar panels, battery storage systems, and smart energy devices. Homeowners are becoming more energy-conscious and are turning to technologies that not only lower electricity bills but also allow participation in demand response programs. VPPs help residential users connect their energy systems to a broader network, offering grid support and receiving incentives in return.

This setup transforms individual homes into active energy contributors rather than passive consumers. The increasing popularity of smart meters, home automation, and decentralized energy production is pushing residential participation in VPP networks. With growing awareness about energy independence and sustainability, households are playing a more prominent role in shaping the future of digital, distributed energy systems through active VPP engagement.

The Virtual Power Plant Market Report is segmented on the basis of the following:

By Component Type

- Software

- Hardware

- Services

By Technology

- Demand Response

- Distributed Generation

- Mixed Asset

By Energy Source

-

Renewable Energy

- Non-renewable Energy

- Diesel Generators

- Natural Gas

By End Use

- Residential

- Commercial

- Industrial

- Utilities

Regional Analysis

Leading Region in the Virtual Power Plant Market

North America will be leading the Virtual Power Plant (VPP) market in 2025 with a share of 34.7%, play a major role in driving the growth of this technology worldwide. The region benefits from advanced energy infrastructure, strong digital networks, and a growing presence of distributed energy resources such as rooftop solar, wind turbines, and battery storage. The US, in particular, supports VPP development through government-backed programs, regulatory reforms, and clean energy policies focused on grid modernization and decarbonization.

Utility providers across North America are actively investing in VPP solutions to improve energy management, reduce peak load stress, and integrate renewable sources more efficiently. At the same time, technology firms and energy startups are creating intelligent software platforms that make VPPs easier to scale and operate. With high consumer awareness and corporate demand for clean and reliable power, North America continues to be a key region shaping the future of VPPs through innovation, partnerships, and strong policy support.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Virtual Power Plant Market

Asia Pacific is expected to show significant growth in the Virtual Power Plant (VPP) infrastructure market over the forecast period due to rising investments in smart grid technologies, renewable energy expansion, and increasing electricity demand. Countries like China, Japan, South Korea, and India are actively developing decentralized energy systems supported by digital energy platforms and demand response programs.

Government policies promoting energy transition, combined with the rapid adoption of distributed energy resources such as solar rooftops and battery storage systems, are creating strong market momentum. It is estimated that the region will continue expanding its VPP capacity as utilities and technology providers work together to modernize grid infrastructure and improve energy efficiency.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Virtual Power Plant market is becoming highly competitive as more players enter from different parts of the energy and technology sectors. Companies involved in software development, energy storage, renewable energy, and utilities are all trying to create smart, connected energy systems. Many are focusing on advanced control platforms, real-time energy management, and integrating smart devices to stand out.

Partnerships and collaborations are common, especially between energy providers and tech firms. As governments support clean energy goals, more firms are racing to offer scalable and flexible VPP solutions. The competition also includes startups with new ideas and large companies with strong infrastructure. This mix is pushing the market to grow faster, improve services, and lower costs for both utilities and end users.

Some of the prominent players in the global Virtual Power Plant are:

- Siemens AG

- General Electric (GE)

- Schneider Electric

- ABB Ltd.

- Tesla Inc.

- Enel X (Enel Group)

- Hitachi Energy

- ENGIE

- NextEra Energy

- Shell Energy

- Sunrun

- Enbala Power Networks (acquired by Generac)

- Generac Grid Services

- E.ON

- Centrica plc

- EDF (Électricité de France)

- NRG Energy

- Doosan GridTech

- Wartsila

- Vandebron

- Voltaware

- Orka Energy

- Other Key Players

Recent Developments

- In May 2025, Sonnen partnered with Abundance Energy and Energywell Technology Licensing to launch a battery-powered virtual power plant (VPP) in Texas. Using sonnenConnect residential batteries, the VPP aims to enhance grid stability and reduce energy costs. With an initial capacity of 60MWh, the SOLRITE Abundance VPP is expected to surpass Tesla’s VPP in Texas by mid-2026. The project spans the ERCOT market, focusing on Dallas, Fort Worth, and Houston, and integrates Energywell’s Proton platform for real-time battery management and market optimization.

- In May 2025, German energy company 1KOMMA5° has reached a major milestone, claiming control of 500MW of flexible capacity through its virtual power plant (VPP), now said to be Europe’s largest for residential use. This achievement follows three years after launching its Heartbeat AI energy management software, which currently manages over 50,000 systems. The company states that this capacity can cover the base load of more than one million buildings, helping households across Germany, Denmark, Sweden, and the Netherlands cut CO2 emissions and save significantly on electricity costs.

- In March 2025, Pacific Gas & Electric Company (PG&E) has launched the Seasonal Aggregation of Versatile Energy (SAVE), a first-of-its-kind virtual power plant (VPP) demonstration under the EPIC program. This initiative taps into residential distributed energy resources to ease local grid strain. Partnering with aggregators and Demand Side Analytics, the program will involve up to 1,500 homes with battery storage and 400 with smart panels. Scheduled for up to 100 hours from June to October 2025, it will provide peak demand relief in high-load neighborhoods.

- In November 2024, EnergyHub, a key player in grid-edge flexibility, has partnered with FranklinWH Energy Storage Inc., known for whole-home energy management solutions, to integrate FranklinWH’s system with EnergyHub’s Edge DERMS platform. This collaboration aims to expand customer hardware options and boost the development of virtual power plants (VPPs). By combining technologies, the partnership enhances the ability to reduce peak electricity demand and deliver critical grid services, supporting a more resilient and responsive energy network through smarter, connected residential energy systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.4 Bn |

| Forecast Value (2034) |

USD 16.8 Bn |

| CAGR (2025–2034) |

24.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component Type (Software, Hardware, and Services), By Technology (Demand Response, Distributed Generation, and Mixed Asset), By Energy Source (Renewable Energy and Non-renewable Energy), By End Use (Residential, Commercial, Industrial, and Utilities) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, General Electric, Schneider Electric, ABB Ltd., Tesla Inc., Enel X (Enel Group), Hitachi Energy, ENGIE, NextEra Energy, Shell EnergySunrun, Enbala Power Networks, Generac Grid Services, E.ON, Centrica plc, EDF (Électricité de France), NRG Energy, Doosan GridTech, Wartsila, Vandebron, Voltaware, Orka Energy, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Virtual Power Plant Market?

▾ The Global Virtual Power Plant Market size is expected to reach a value of USD 2.4 billion in 2025 and is

expected to reach USD 16.8 billion by the end of 2034.

Which region accounted for the largest Global Virtual Power Plant Market?

▾ North America is expected to have the largest market share in the Global Virtual Power Plant Market,

with a share of about 34.7% in 2025.

How big is the Virtual Power Plant Market in the US?

▾ The Virtual Power Plant Market in the US is expected to reach USD 0.7 billion in 2025.

Who are the key players in the Global Virtual Power Plant Market?

▾ Some of the major key players in the Global Virtual Power Plant Market are Tesla, Inc., ChargePoint

Holdings, Inc., ABB Ltd., and others

What is the growth rate in the Global Virtual Power Plant Market?

▾ The market is growing at a CAGR of 24.2 percent over the forecasted period.