Market Overview

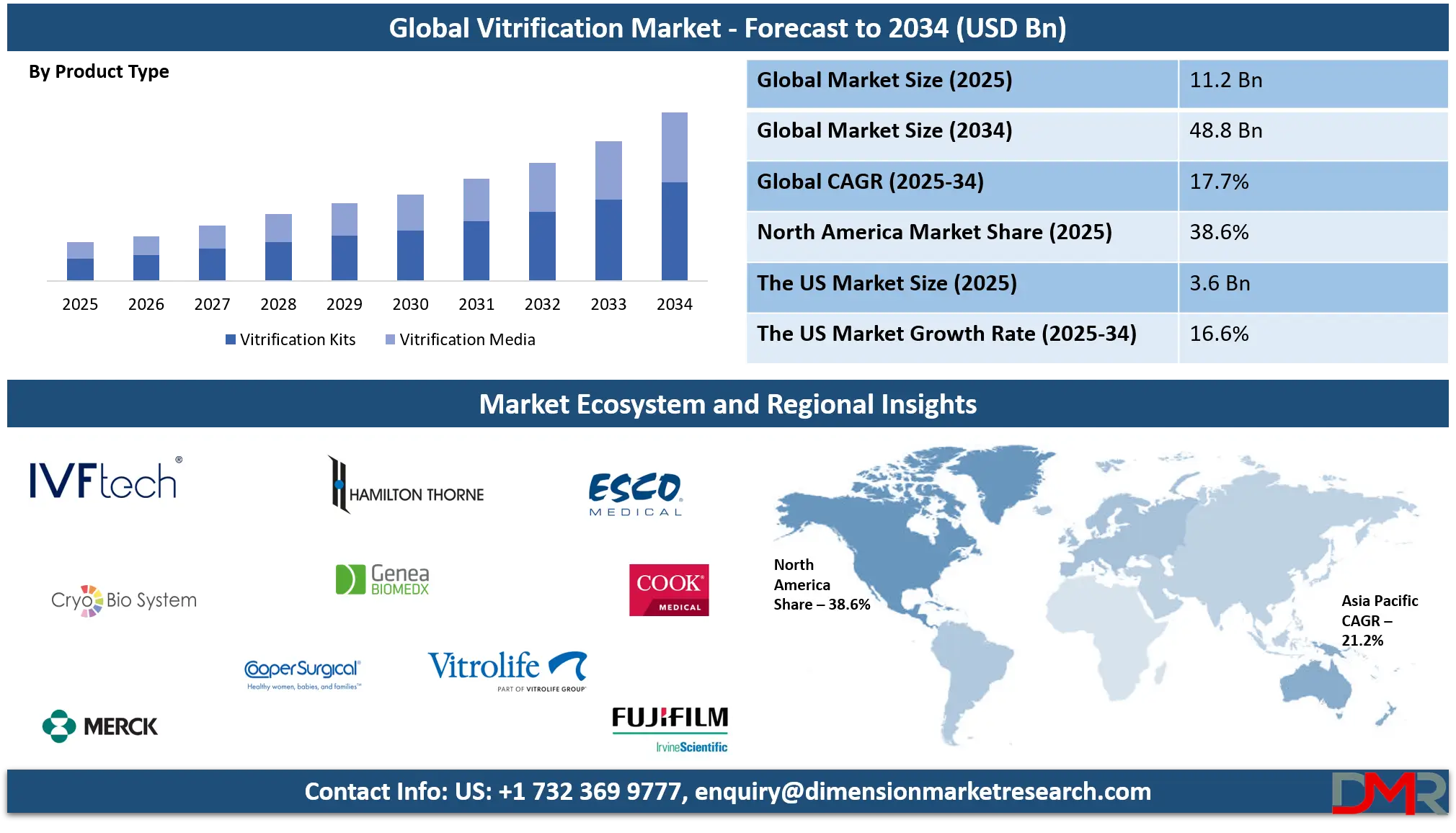

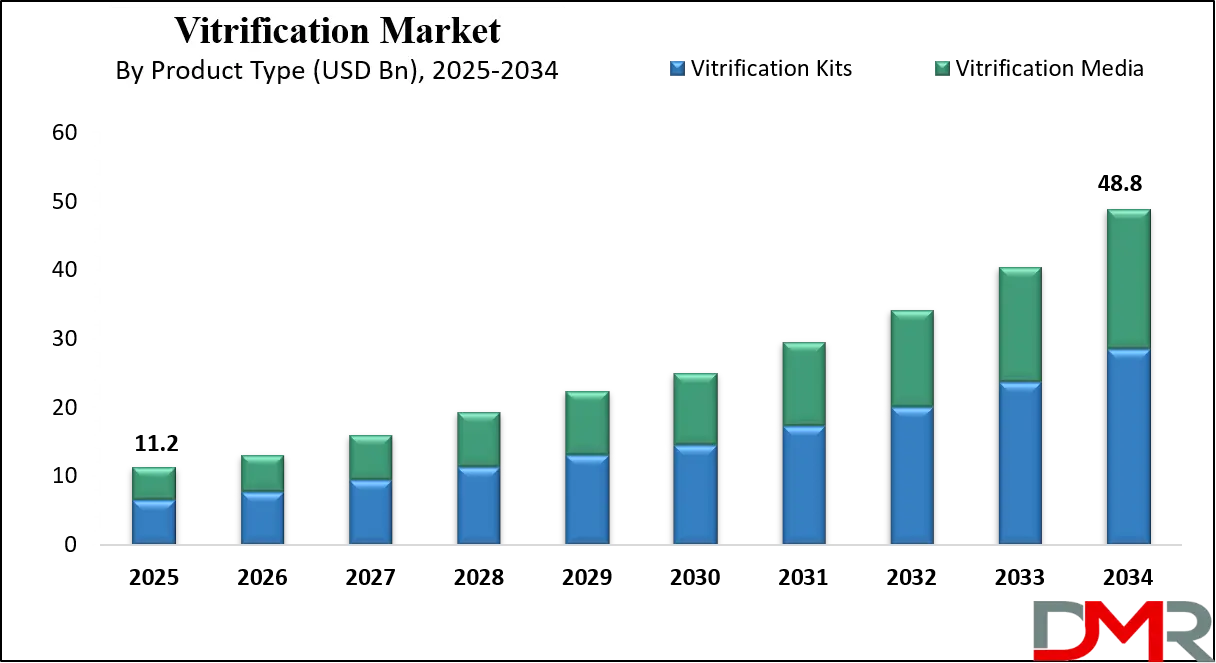

The Global Vitrification Market size is projected to reach USD 11.2 billion in 2025 and grow at a compound annual growth rate of 17.7% to reach a value of USD 48.8 billion in 2034.

Vitrification refers to an advanced cryopreservation technique used to preserve biological samples by rapidly cooling them into a glass-like state without ice crystal formation. In the healthcare and life sciences ecosystem, vitrification is primarily applied to embryos, oocytes, and stem cells, enabling long-term storage while maintaining high post-thaw viability. The market encompasses vitrification kits, media, consumables, cryogenic devices, and supporting technologies used across fertility clinics, hospitals, and cryobanks. Its importance has increased with the global rise in assisted reproductive technologies, fertility preservation demand, and regenerative medicine research.

Growth momentum is supported by increasing infertility prevalence, delayed parenthood trends, and higher success rates compared to slow-freezing methods. Advancements in cryoprotectant formulations, closed-system vitrification technologies, and improved storage safety standards are accelerating adoption. Regulatory clarity around assisted reproduction and ethical frameworks in developed economies has further strengthened market confidence and institutional uptake.

Ongoing innovation, combined with expanding applications beyond reproductive medicine into stem cell and biobanking domains, is reshaping the market’s trajectory. Emerging economies are witnessing rapid infrastructure development, while developed regions focus on automation, AI integration, and standardized protocols, collectively positioning vitrification as a critical enabler within modern reproductive and regenerative healthcare.

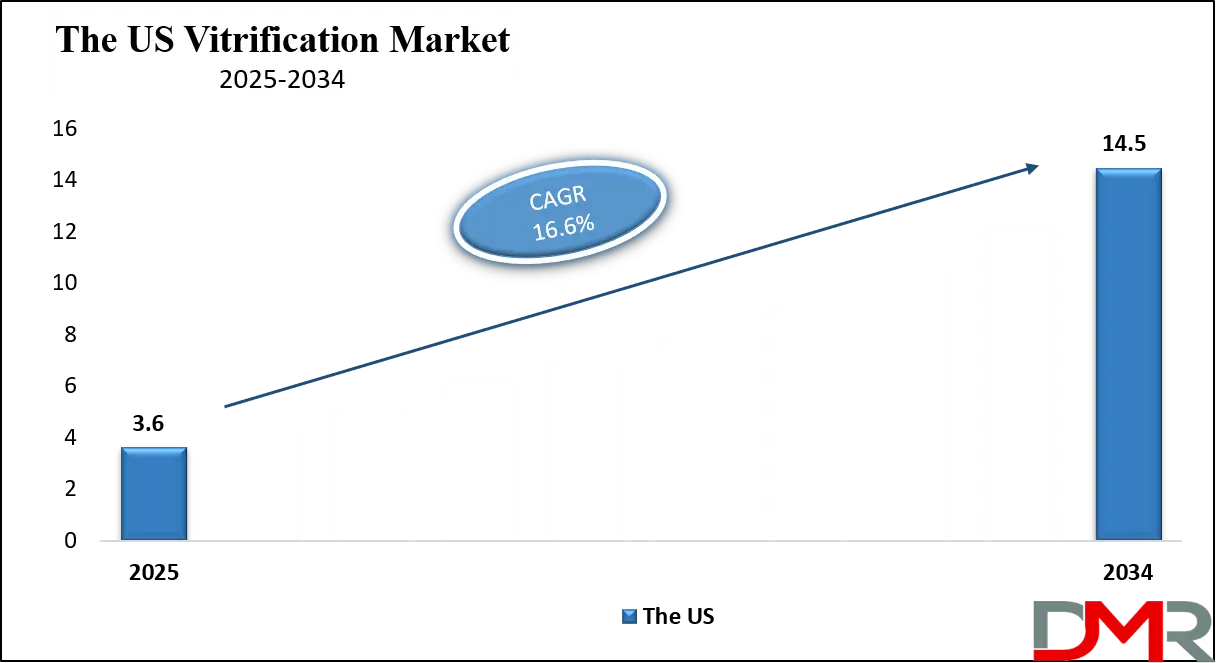

The US Vitrification Market

The US Vitrification Market size is projected to reach USD 3.6 billion in 2025 at a compound annual growth rate of 16.6% over its forecast period.

The US vitrification market benefits from advanced fertility infrastructure, a high concentration of specialized clinics, and strong adoption of assisted reproductive technologies. Favorable insurance coverage in select states, increasing awareness of fertility preservation, and growing demand for elective oocyte freezing are key growth contributors. Government oversight through agencies such as the CDC and FDA ensures standardized practices, supporting market maturity. Continuous investments in R&D, rapid uptake of closed vitrification systems, and expanding stem cell banking initiatives further reinforce the US as a technologically advanced and commercially attractive market.

Europe Vitrification Market

Europe Vitrification Market size is projected to reach USD 3.2 billion in 2025 at a compound annual growth rate of 16.0% over its forecast period.

Europe’s vitrification market is strongly influenced by regulatory harmonization, ethical guidelines, and public healthcare involvement. Policies aligned with reproductive health access and long-term biological preservation, along with initiatives under frameworks like the European Green Deal supporting sustainable medical technologies, contribute to steady adoption. Countries such as Germany, France, and the UK lead in IVF procedures and fertility research. The region emphasizes patient safety, closed-system technologies, and standardized cryopreservation protocols, resulting in gradual yet consistent innovation and widespread clinical acceptance.

Japan Vitrification Market

Japan Vitrification Market size is projected to reach USD 560 million in 2025 at a compound annual growth rate of 17.5% over its forecast period.

Japan’s vitrification market is shaped by demographic challenges, including declining birth rates and delayed marriage trends. Strong government support for fertility treatments, coupled with advanced medical infrastructure, has accelerated vitrification adoption. The country shows high utilization of oocyte and embryo preservation in urban centers, supported by technological precision and quality-focused healthcare standards. Challenges such as high treatment costs remain, but increasing awareness and subsidies are improving accessibility. Japan also presents opportunities in stem cell preservation due to its strong regenerative medicine research ecosystem.

Vitrification Market: Key Takeaways

- Market Growth: The Vitrification Market size is expected to grow by USD 35.8 billion, at a CAGR of 17.7%, during the forecasted period of 2026 to 2034.

- By Product Type: The vitrification kits segment is anticipated to get the majority share of the Vitrification Market in 2025.

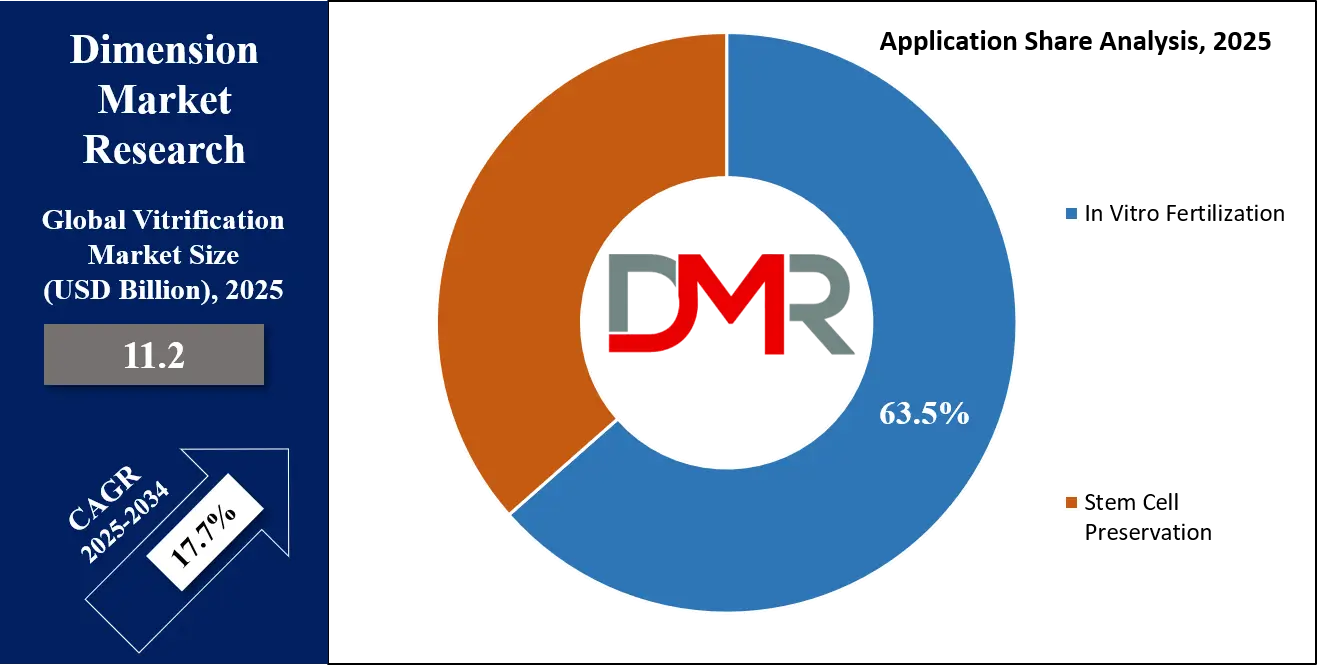

- By Application: The in vitro fertilization segment is expected to get the largest revenue share in 2025 in the Vitrification Market.

- Regional Insight: North America is expected to hold a 38.6% share of revenue in the Global Vitrification Market in 2025.

- Use Cases: Some of the use cases of virtrification include stem cell banking, oocyte cryopreservative, and more.

Vitrification Market: Use Cases

- Embryo Preservation: Enables long-term storage of embryos during IVF cycles with high post-thaw survival and implantation rates.

- Oocyte Cryopreservation: Supports elective and medical fertility preservation for women delaying childbirth or undergoing treatments.

- Stem Cell Banking: Preserves stem cells for regenerative medicine, research, and future therapeutic applications.

- Oncology Fertility Preservation: Assists cancer patients in preserving reproductive potential prior to chemotherapy or radiation.

Stats & Facts

- U.S. Centers for Disease Control and Prevention reported that over 326,000 ART cycles were performed in the US during 2024, with vitrification used in more than 90% of cryopreserved samples.

- European Commission Directorate-General for Health indicated in 2024 that assisted reproduction services grew by 7.8% across EU member states.

- Japan Ministry of Health, Labour and Welfare stated in 2025 that fertility preservation subsidies supported over 30,000 vitrification procedures annually.

- World Health Organization estimated in 2024 that infertility affects nearly 17.5% of the global adult population.

- National Institutes of Health reported in 2025 that stem cell biobanking investments increased by 11% year-over-year.

Market Dynamic

Driving Factors in the Vitrification Market

Rising Demand for Assisted Reproductive Technologies

The increasing prevalence of infertility, driven by lifestyle changes, delayed parenthood, and medical conditions, is a primary driver of the vitrification market. Assisted reproductive technologies rely heavily on effective cryopreservation to optimize success rates and treatment flexibility. Vitrification’s superior outcomes compared to traditional freezing methods have made it the preferred standard in fertility clinics. Additionally, greater social acceptance of fertility treatments and growing awareness of fertility preservation options among younger demographics are reinforcing sustained market expansion.

Technological Advancements in Cryopreservation

Continuous innovation in vitrification media, cryoprotectants, and closed-system technologies is enhancing safety, efficiency, and reproducibility. Automation and digital monitoring reduce human error and contamination risks, making vitrification more reliable for large-scale clinical use. Improved thawing protocols and higher survival rates are encouraging clinics to transition fully from slow freezing. These advancements not only improve clinical outcomes but also reduce long-term operational costs, directly influencing market adoption and scalability.

Restraints in the Vitrification Market

High Capital and Operational Costs

The adoption of vitrification requires specialized equipment, trained personnel, and strict adherence to regulatory standards, resulting in high upfront and operational costs. Smaller clinics and facilities in emerging markets often face financial constraints, limiting market penetration. Additionally, ongoing costs related to liquid nitrogen storage, quality control, and equipment maintenance create barriers for widespread adoption, particularly in resource-limited healthcare systems.

Regulatory and Ethical Challenges

Variations in reproductive health regulations, ethical considerations, and legal frameworks across regions can restrict market growth. In some countries, limitations on embryo storage duration, usage, or disposal create uncertainty for clinics and patients. These regulatory complexities increase administrative burdens and slow the adoption of technology, particularly in regions with conservative healthcare policies or fragmented regulatory oversight.

Opportunities in the Vitrification Market

Expansion in Emerging Economies

Rapid urbanization, rising healthcare investments, and increasing awareness of fertility preservation in emerging markets present significant growth opportunities. Governments in Asia-Pacific and Latin America are expanding reproductive healthcare access, while private players are investing in fertility clinic networks. As affordability improves and infrastructure develops, vitrification adoption is expected to accelerate, unlocking substantial untapped market potential.

Growth in Stem Cell and Biobanking Applications

Beyond fertility treatment, vitrification is increasingly used in stem cell preservation and biobanking for regenerative medicine. Growing research funding, personalized medicine initiatives, and long-term disease treatment strategies are driving demand. This diversification reduces market dependence on IVF alone and opens new revenue streams for technology providers and service operators.

Trends in the Vitrification Market

Shift Toward Closed-System Vitrification

Safety concerns related to contamination risks are driving a shift from open to closed vitrification systems. Clinics and regulatory bodies favor closed systems due to enhanced biosafety and compliance with international standards. This trend is accelerating innovation in device design and consumables, reshaping purchasing decisions and competitive differentiation across the market.

Integration of Digital and Automated Solutions

Automation, data tracking, and AI-assisted monitoring are becoming integral to vitrification workflows. Digital solutions improve sample traceability, storage management, and outcome analysis, enhancing operational efficiency. This trend supports scalability, reduces error rates, and aligns vitrification processes with broader digital transformation initiatives in healthcare.

Impact of Artificial Intelligence in Vitrification Market

- Process Optimization: Artificial Intelligence enhances cooling and warming protocols for consistent sample preservation outcomes.

- Quality Monitoring: Machine learning algorithms detect anomalies in storage conditions and sample viability.

- Workflow Automation: AI reduces manual handling and improves laboratory efficiency and throughput.

- Predictive Analytics: Data-driven insights improve IVF success predictions and treatment planning.

- Inventory Management: Intelligent systems optimize cryostorage utilization and reduce sample loss risks.

Research Scope and Analysis

By Product Type Analysis

Vitrification kits dominate the product type segment, accounting for 58.4% market share in 2025, largely due to their integrated, ready-to-use design that simplifies complex cryopreservation procedures. These kits typically combine vitrification media, carriers, and handling tools into standardized solutions, minimizing procedural variability and reducing dependence on operator skill. Fertility clinics and hospital-based reproductive units prefer kits because they ensure consistency, regulatory compliance, and reproducible clinical outcomes.

Their compatibility with both open and closed vitrification systems further enhances adoption. Continuous innovation by manufacturers has led to improved survival and thawing rates, reduced contamination risks, and shorter preparation times. High-volume IVF centers particularly value vitrification kits for workflow efficiency, staff training simplicity, and reduced error margins, reinforcing their leadership position across mature and emerging markets.

Vitrification media represent the fastest-growing product segment, driven by ongoing advancements in cryoprotectant chemistry and increasing demand for sample-specific preservation solutions. These media are formulated to prevent ice crystal formation while minimizing cellular toxicity, directly impacting post-thaw survival and developmental competence. Clinics are increasingly adopting advanced media to optimize outcomes for sensitive samples such as oocytes and embryos at different developmental stages.

Growth is further supported by rising global IVF procedure volumes and continuous R&D investments aimed at improving osmotic balance and reducing cellular stress. As clinics seek greater customization and flexibility beyond bundled kits, demand for high-performance vitrification media is expanding rapidly, particularly in research-oriented fertility centers and stem cell laboratories.

By Technology Analysis

Closed vitrification leads the technology segment with a 61.2% share in 2025, primarily due to its superior biosafety profile and strong alignment with regulatory standards. By preventing direct contact between biological samples and liquid nitrogen, closed systems significantly reduce contamination and cross-infection risks. This safety advantage has made closed vitrification the preferred option for fertility clinics, hospitals, and cryobanks operating under strict compliance requirements. Technological advancements have improved cooling efficiency, ease of handling, and compatibility with automated storage systems.

Additionally, growing patient awareness and institutional focus on long-term sample security have accelerated adoption. Closed vitrification is especially favored in developed regions where regulatory scrutiny, accreditation requirements, and risk mitigation are critical decision factors.

Open vitrification is the fastest-growing technology in cost-sensitive and emerging markets due to its simplicity, affordability, and minimal equipment requirements. This technique enables ultra-rapid cooling rates, resulting in high post-thaw survival when performed correctly. Smaller clinics and facilities with limited capital investment often favor open systems because they allow efficient vitrification without complex infrastructure.

Despite ongoing safety concerns related to contamination risk, improved laboratory protocols and handling standards have mitigated some of these challenges. The combination of lower upfront costs and proven clinical outcomes continues to support adoption, particularly in regions where access to fertility care is expanding rapidly and budget constraints influence technology selection.

By Sample Type Analysis

Embryo vitrification holds a 54.7% market share in 2025, driven by its central role in modern IVF protocols and consistently high clinical success rates. The ability to preserve embryos at various developmental stages allows clinics to optimize treatment timing, reduce multiple embryo transfers, and improve pregnancy outcomes. High implantation and survival rates following warming have made embryo vitrification the standard of care in assisted reproduction.

Additionally, elective freeze-all strategies and genetic screening practices further boost demand. Fertility clinics rely heavily on embryo vitrification to improve patient outcomes while offering flexible treatment schedules, reinforcing its dominant position across both public and private reproductive healthcare systems globally.

Oocyte vitrification is the fastest-growing sample type segment, fueled by rising elective fertility preservation and increasing awareness among women delaying childbirth for personal or medical reasons. Improved vitrification techniques have significantly enhanced oocyte survival and developmental potential, making the option more reliable and widely accepted.

Medical indications such as cancer treatment-related fertility preservation also contribute to growth. As social acceptance and education around reproductive planning increase, demand for oocyte vitrification continues to rise across both developed and emerging markets. Fertility clinics are expanding oocyte freezing services as a core offering, positioning this segment for sustained long-term expansion.

By Application Analysis

In vitro fertilization accounts for 63.5% of the vitrification market in 2025, supported by increasing infertility rates, delayed parenthood, and expanding access to assisted reproductive services. Vitrification is integral to IVF workflows, enabling embryo and oocyte preservation with high survival and implantation rates.

The technique allows clinics to improve cumulative pregnancy outcomes, reduce ovarian hyperstimulation risks, and offer flexible treatment scheduling. Expanding fertility clinic networks, technological improvements, and greater insurance coverage in select regions are further driving adoption. IVF-focused vitrification remains the primary revenue generator, reinforcing its dominant position across global reproductive healthcare markets.

Stem cell preservation is rapidly expanding as vitrification gains traction in regenerative medicine, biobanking, and clinical research. The ability to preserve stem cells with minimal viability loss is critical for long-term therapeutic applications. Increased funding for regenerative medicine and personalized healthcare is accelerating adoption. Research institutions and biobanks are increasingly investing in vitrification-based preservation to support future treatment pipelines. This application segment benefits from technological crossover from reproductive medicine, positioning it as a high-growth area beyond traditional fertility-focused use cases.

By End User Analysis

Fertility clinics dominate the end-user segment with a 59.8% share in 2025, driven by high procedural volumes, specialized infrastructure, and direct integration of vitrification into daily clinical practice. These facilities prioritize reliable, standardized cryopreservation solutions to ensure consistent patient outcomes. Continuous patient inflow, expansion of elective fertility services, and adoption of advanced vitrification systems reinforce clinic-level demand. Fertility clinics also benefit from trained embryologists and dedicated laboratories, allowing efficient implementation of both open and closed vitrification technologies. Their central role in assisted reproduction ensures sustained market leadership.

Cryobanks represent the fastest-growing end-user segment, supported by rising demand for long-term biological storage across fertility, stem cell, and research applications. Increasing awareness of fertility preservation, combined with expanding biobanking infrastructure, is driving rapid growth. Cryobanks increasingly serve as centralized storage hubs for clinics and hospitals, benefiting from economies of scale. Technological advancements in monitoring, automation, and sample tracking further enhance their appeal. As long-term preservation becomes a strategic priority, cryobanks are expected to play a more prominent role in the vitrification market ecosystem.

The Vitrification Market Report is segmented on the basis of the following:

By Product Type

- Vitrification Kits

- Vitrification Media

By Technology

- Open Vitrification

- Closed Vitrification

By Sample Type

By Application

- In Vitro Fertilization

- Embryo Vitrification

- Oocyte Vitrification

- Stem Cell Preservation

By End User

- Fertility Clinics

- Hospitals

- Cryobanks

Regional Analysis

Leading Region in the Vitrification Market

North America leads the vitrification market with an estimated 38.6% share in 2025, supported by a highly developed healthcare ecosystem and widespread adoption of assisted reproductive technologies. The region benefits from a dense network of fertility clinics, advanced hospital infrastructure, and well-established cryobanking facilities that enable large-scale vitrification procedures. Favorable reimbursement policies in select states, combined with high awareness of fertility preservation options, have increased patient acceptance and procedural volumes.

Strong regulatory oversight ensures standardized clinical practices, which enhances trust in vitrification technologies. Continuous technological innovation, including closed-system vitrification and automation, further strengthens market leadership. Additionally, significant investment in stem cell research and biobanking reinforces North America’s dominant position across both reproductive and regenerative medicine applications.

Fastest Growing Region in the Vitrification Market

Asia-Pacific is the fastest-growing region in the vitrification market, driven by rising infertility awareness, expanding healthcare investments, and supportive government initiatives aimed at improving reproductive health access. Rapid urbanization and lifestyle changes have contributed to increasing infertility rates, boosting demand for assisted reproductive technologies. Growing disposable incomes and the expansion of private fertility clinic networks are making vitrification services more accessible to a broader population.

Countries such as China, India, South Korea, and Japan are emerging as key growth hubs due to improving medical infrastructure and policy support for fertility treatments. Additionally, increasing acceptance of fertility preservation and stem cell banking is accelerating regional adoption, positioning Asia-Pacific as a critical growth engine for the global vitrification market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The vitrification market is characterized by moderate to high entry barriers due to regulatory requirements, technological complexity, and quality standards. Competitive strategies focus on continuous R&D investment, product differentiation, and workflow integration. Companies emphasize safety, automation, and closed-system innovations to maintain market positioning. Strategic partnerships with fertility clinics, research institutions, and biobanks, along with geographic expansion into emerging markets, are central to sustaining competitive advantage and long-term growth.

Some of the prominent players in the global Vitrification are:

- Vitrolife Group

- Cook Medical

- CooperSurgical

- Merck KGaA

- FUJIFILM Irvine Scientific

- Genea Biomedx

- CryoBioSystem

- Kitazato Corporation

- Hamilton Thorne

- NidaCon International

- Esco Medical

- Origio

- Reprolife

- IVFtech

- Minitube Group

- Thermo Fisher Scientific

- STEMCELL Technologies

- BioLife Solutions

- Sartorius

- Other Key Players

Recent Developments

- In September 2024, CooperSurgical announced a strategic acquisition of a specialized cryopreservation technology firm to expand its vitrification product portfolio. The acquisition aimed to strengthen its position in fertility and biobanking applications by integrating next-generation media formulations and automated storage compatibility.

- In March 2024, Kitazato Corporation launched an advanced closed vitrification system designed to enhance biosafety and post-thaw survival rates. The system integrates improved cryoprotectant formulations and ergonomic device design, targeting high-volume fertility clinics and hospitals seeking standardized and compliant cryopreservation solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.2 Bn |

| Forecast Value (2034) |

USD 48.8 Bn |

| CAGR (2025–2034) |

17.7% |

| The US Market Size (2025) |

USD 3.6 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Vitrification Kits and Vitrification Media), By Technology (Open Vitrification and Closed Vitrification), By Sample Type (Embryos and Oocytes), By Application (In Vitro Fertilization and Stem Cell Preservation), By End User (Fertility Clinics, Hospitals, and Cryobanks) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Vitrolife Group, Cook Medical, Irvine Scientific, CooperSurgical, Merck KGaA, FUJIFILM Irvine Scientific, Genea Biomedx, CryoBioSystem, Kitazato Corporation, Hamilton Thorne, NidaCon International, Esco Medical, Origio, Reprolife, IVFtech, Minitube Group, Thermo Fisher Scientific, STEMCELL Technologies, BioLife Solutions, Sartorius, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Vitrification Market size is expected to reach a value of USD 11.2 billion in 2025 and is expected to reach USD 48.8 billion by the end of 2034

North America is expected to have the largest market share in the Global Vitrification Market, with a share of about 38.6% in 2025.

The US vitrification market is expected to reach USD 3.6 billion by 2025.

Some of the major key players in the Global Vitrification Market include Vitrolife, Merck, Cook Medical, and others

The market is growing at a CAGR of 17.7 percent over the forecasted period.

Contents