The walking assist devices are wearable assists that might be intended to enhance locomotion and ergo-protection for those with locomotor disabilities or boundaries. These devices help in walking, status, or transferring by presenting help, and stability as well as assistance in managing weight-bearing activities. These include walkers, canes, crutches, rollators, gait belts, lift vests, electricity scooters, and armed exoskeletons, a category closely related to the Exoskeleton Market and Wearable Medical Devices.

They are employed with the aid of the elderly in addition to with the aid of those with disabilities. People who're on the mend from injuries or surgeries and people who suffer from continual illnesses use them too. Walking Assist Devices offer improved independence, protection, and satisfaction of lifestyles which allow individuals to transport around in their environments, participate in everyday sports, and perform rehabilitation physical games or exercise packages with more self-belief and comfort, a key focus in the Home Healthcare.

This market is also undergoing rapid development, together with lightweight material, ergonomic designs, and smart functions that enhance product quality. The dynamics of this healthcare market are also affected by the actions of regulators that can change things like rules, coverage, and reimbursement. Technically, the competition is one of the toughest in this marketplace drivers ongoing research and evolution to improve their products and services in line with the ever-changing customer needs. In general, the strolling assistance tool market is expected to grow due to the effect of demographic factors, technological improvements, and the development of mobility solutions.

Walking Assist Devices Market Research Scope and Analysis

By Product

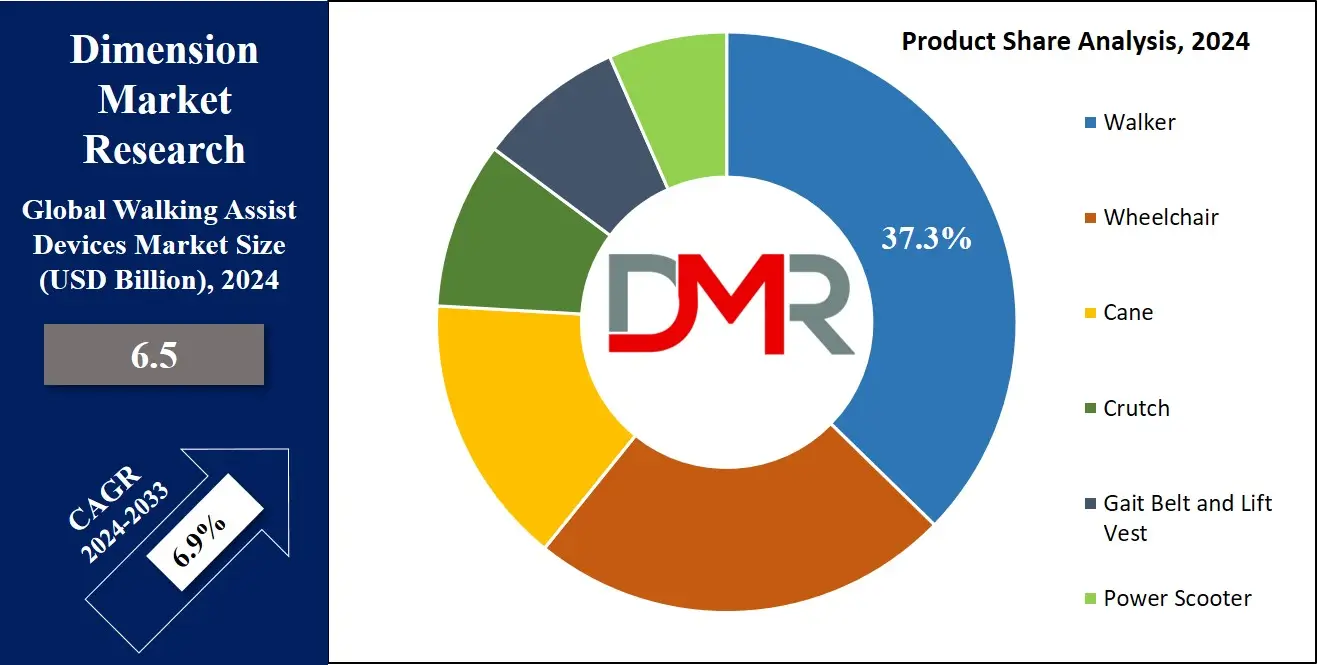

Walker is projected to dominate the walking assist device market in the context of the product as it holds 37.3% of the market share by the end of 2024 and is further anticipated to show the following growth prospects in the upcoming period of 2024 to 2033.

Walkers occupy the largest share of the walking assist device market due to their diversity, availability, convenience, ease of use, affordability, stability, safety features, customization options, and contribution to rehabilitation. To be extensively available through multiple channels, walkers provide support to different mobility constraints and are tailored to the needs of users of every age group. These characteristics as their simplicity of design and cost competitiveness appeal to many segments of the market with the safety features increasing the confidence of the users.

Individualized options respond to personal requirements, whereas their high demand for rehabilitation services demonstrates their leading position in the market. Overall, the popularity of walkers is due to their broad appeal and usability, which makes them a choice for many consumers looking for reliable mobility assistance.

By Distribution Channel

Offline distribution channels are anticipated to dominate this segment in the global walking assist device market in 2024. The offline distribution channels retail stores, medical devices supply shops, and pharmacies, provide a try-on facility to customers which allows clients to test gadgets earlier than purchase. As the offline channels provide facilities like personalized guidance, fitting, and maintenance of these devices over a given period boost the popularity of these channels due to customer satisfaction. As in offline channels, these products are available most of the time which is advantageous for them in the context of consumers who need the product urgently.

In-person consultations with healthcare professionals build trust and confidence in the product, while fitting services ensure comfort and safety. Hands-on experiences enable informed decision-making based on individual preferences and needs. Local support services, including repairs and warranty assistance, offer convenience and peace of mind. Trust and credibility are established through reputable brick-and-mortar stores, fostering long-term customer loyalty. Overall, offline channels play a pivotal role in providing personalized consultations, immediate access, fitting services, hands-on experiences, local support, and trusted expertise, contributing significantly to meeting consumers' mobility needs.

By End User

Non-hospital organizations like clinics, urgent care centers, homecare, and rehabilitation centers are projected to show their dominance in the global walking assist device market as they hold 67.1% of the market share of this market in 2024.

This predominance of the walk-assist device market in non-hospital organizations is recognized due to diverse factors. Senior people tend to prefer aging in the same places, where rehabilitation centers, and domestic care services, provide individual support, independence, and mobility support. Personalized solutions offered by these devices help the people who need those kinds of solutions while preventive care programs encourage proactive health management.

Through technological advancements, it is becoming possible to make these devices much more usable even in non-hospital settings, therefore making these a popular option. Such things as aging demography, rehabilitation needs, home care services, retail accessibility, insurance coverage, personalized solutions, preventive care, and technological innovations highlight the whole market’s drift toward non-hospital end users.

The Walking Assist Devices Market Report is segmented on the basis of the following:

By Product

- Walker

- Wheelchair

- Cane

- Crutch

- Gait Belt and Lift Vest

- Power Scooter

By Distribution Channel

By End User

Walking Assist Devices Market Regional Analysis

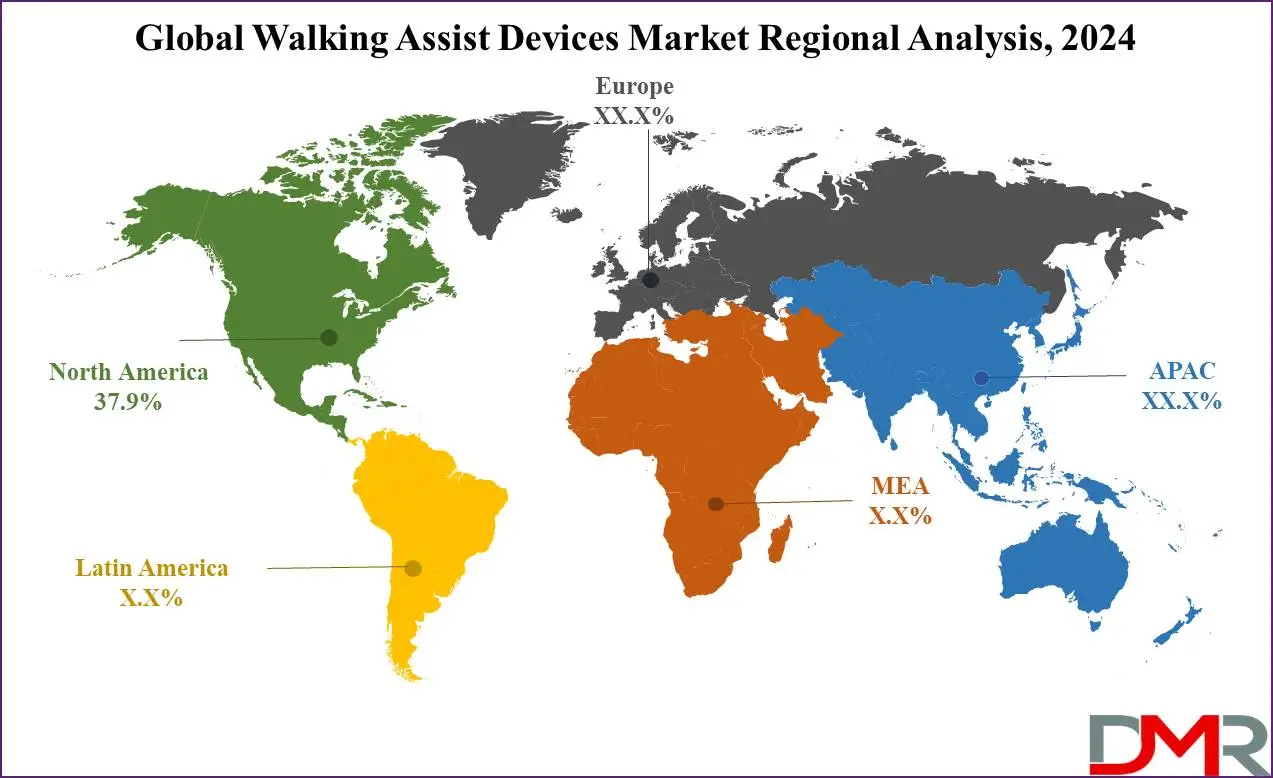

North America is projected to dominate the global walking assist device market as it commands

37.9% of total revenue by the

end of 2024 and is further anticipated to show the following growth in the forthcoming period of

2024 to 2033.

The North American region, especially Canada and the United States now harbors one of the largest growing aging populations which pushes the demand for walking assist devices. The elderly in most cases suffer from arthritis, balance issues, and muscle weakness which pushes the growth of this market in North America. The governments in this region spend a large part of their economic budget on healthcare infrastructure which gives individuals a chance to access these medical devices at a reasonable price.

Also, this region fosters various major walking assist device manufacturers who are now primarily focused on the changing consumer demand and offering products with various qualities like the devices are made up of lightweight materials, have ergonomic designs, and smart functionalities. This region also has established distribution networks that supply these scientific devices, which include taking walks to assist gadgets. This allows the provision and accessibility of these products to clients across the location. Collectively, all these factors together with the well-developed healthcare ecosystem and infrastructure of this region establish and solidify North America's position in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Walking Assist Devices Market Competitive Landscape

The global walking assist device market is rapidly growing as it fosters various international walking assist device manufacturers that are solidifying their position in this market by offering products according to the changing demands of the customers. Companies like Invacare Corporation, offer mobility aid devices like walkers and canes that focus on user comfort and innovation. This market can be characterized by the presence of various smaller and regional companies and emerging startups making this market more competitive and pushing them further into research and development.

Various companies in this market are also working to integrate artificial intelligence into their products so it can assist the disabled person in various situations. The major focus of the companies in this market is providing products with more functions, comfort, and affordable walking assist devices.

Some of the prominent players in the global Walking Assist Devices market are

- Karman

- Benmor Medical

- Briggs Healthcare

- Carex Health Brands

- TOPRO

- Invacare Corporation

- Drive Medical design

- Eurovema AB

- HUMAN CARE

- Phoenix Instinct

- Other Key Players

Recent Development

- In February 2024, The Irish government announces over €1 billion investment since 2020 for walking and cycling infrastructure, aiming to enhance safety and accessibility. Major projects planned for 2024.

- In January 2024, Harvard and Boston University researchers developed a wearable robot to assist Parkinson's patients in walking, reducing freezing episodes and improving mobility, as reported in Nature Medicine.

- In November 2023, MEBSTER, winner of 2023 EIT Health Attract to Invest, developed UNILEXA, a passive exoskeleton aiding mobility, addressing healthcare challenges with user-centric innovation.

- In September 2023, Amazon plans to invest up to $4 billion in Anthropic, an AI startup, aiming to compete with rivals like Microsoft and Google in AI development.

- In July 2022, Cionic has introduced bionic apparel aimed at assisting individuals experiencing challenges with walking due to neurological disorders like multiple sclerosis, Parkinson's disease, and cerebral palsy.

- In June 2022, Mobilities created the CAN Go, a cutting-edge smart cane utilizing data to enhance mobility. Crafted from aircraft-grade aluminum, it offers comfort, durability, and safety with a sleek design.

Walking Assist Devices Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 6.5 Bn |

| Forecast Value (2033) |

USD 11.9 Bn |

| CAGR (2023-2032) |

6.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Walker, Wheelchair, Cane, Crutch, Gait Belt and Lift Vest, and Power Scooter), By Distribution Channel (Online, and Offline), By End User (Non-Hospitals, and Hospitals) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Karman, Benmor Medical, Briggs Healthcare, Carex Health Brands, TOPRO, Invacare Corporation, Drive Medical design, Eurovema AB, HUMAN CARE, Phoenix Instinct , and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |