Market Overview

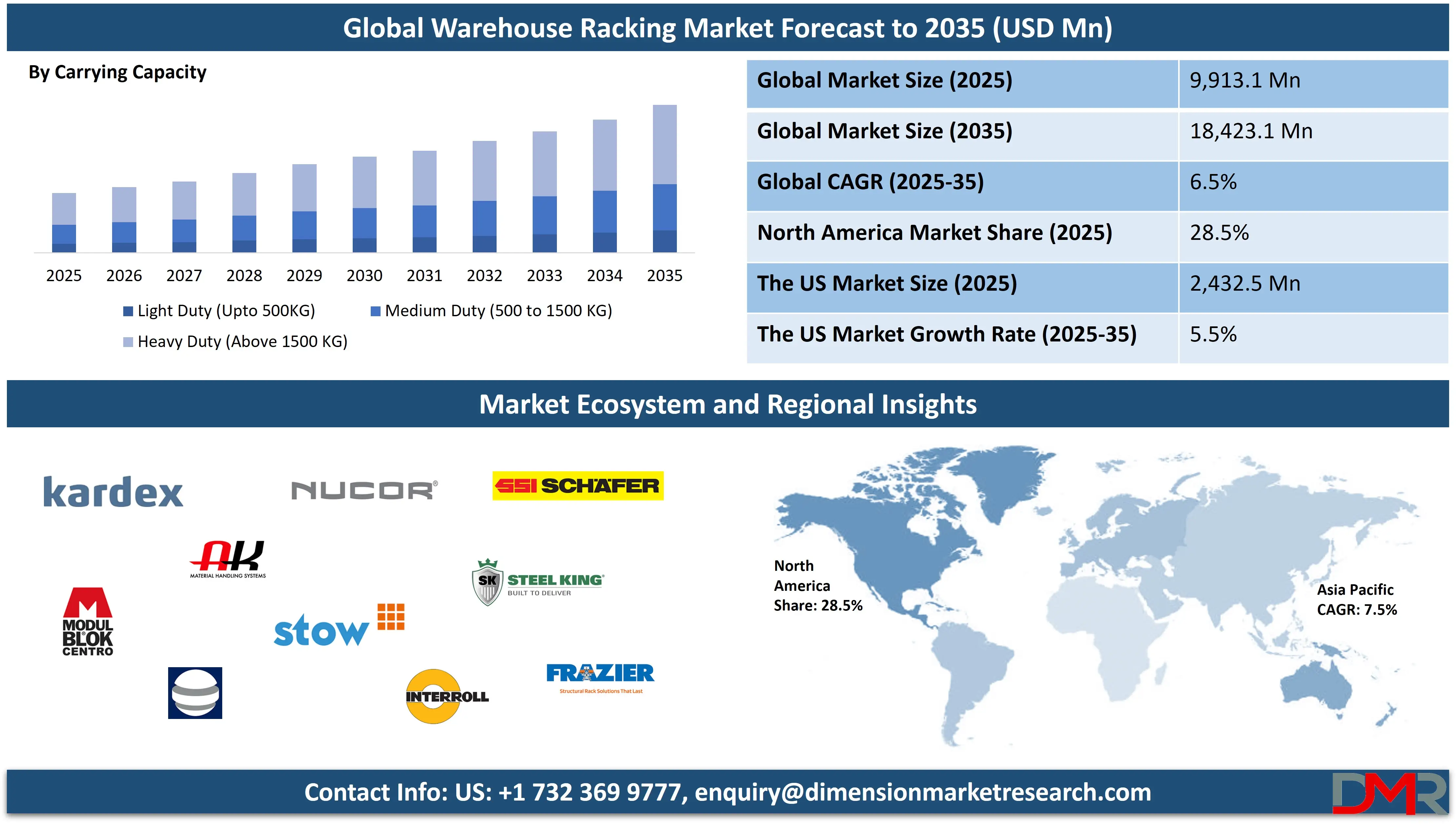

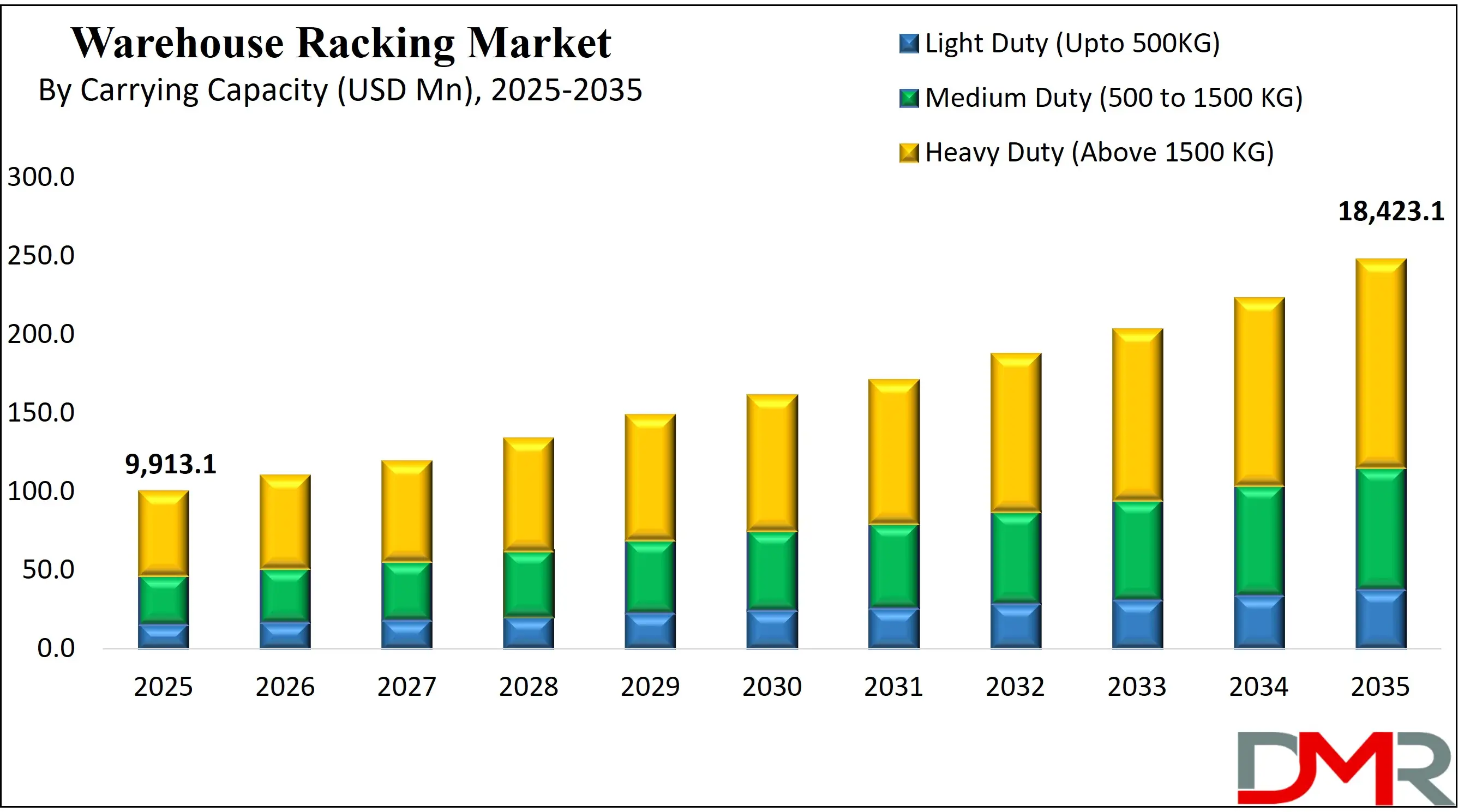

The Global Warehouse Racking Market size is estimated to be valued at USD 9,913.1 million in 2025 and is further anticipated to reach USD 18,423.1 million by 2035 at a CAGR of 6.5%.

The market growth is fueled by the rapid expansion of e-commerce, rising adoption of automated storage systems, and increasing demand for efficient material handling and space optimization across logistics, manufacturing, and retail industries. This expansion is strongly supported by the rising need for industrial storage solutions across large-scale distribution networks.

Warehouse racking refers to a structured storage system designed to efficiently organize, store, and manage goods within a warehouse or distribution center. It consists of multi-level frameworks, typically made from high-strength steel, that enable the vertical stacking of materials, optimizing floor space and improving inventory accessibility.

Different types of racking systems such as selective pallet racking, drive-in racking, cantilever racking, and push-back racking are used based on the nature of stored goods and warehouse operations, including specialized sectors like chemical logistics, where safe and compliant storage solutions are essential. These systems form a core part of the broader pallet racking systems market used for high-density storage applications.

These systems are integral to modern logistics and supply chain management as they facilitate faster material handling, enhance workflow efficiency, reduce product damage, and support automation technologies like automated storage and retrieval systems (ASRS) and robotic picking. The continued adoption of advanced warehouse shelving systems is further improving throughput and inventory visibility within large fulfillment centers.

The global warehouse racking market represents a rapidly evolving industry driven by the expansion of e-commerce, the rise in global trade, and the increasing demand for efficient warehousing solutions. As businesses strive to improve operational efficiency, the need for space optimization, quick inventory turnover, and enhanced material handling capabilities has surged.

Companies are investing in advanced racking systems integrated with sensors, IoT-enabled tracking, and modular designs that cater to both small-scale and large-scale warehousing requirements. These innovations are increasingly aligned with the rise of smart warehousing, where automation, real-time data monitoring, and connected technologies enhance storage efficiency. Emerging economies are also contributing to market growth as rapid industrialization and the development of logistics infrastructure increase demand for organized storage systems.

Furthermore, the market is witnessing a shift toward sustainable and durable racking solutions that align with green warehousing initiatives. Manufacturers are focusing on lightweight yet high-strength materials, corrosion-resistant coatings, and customized configurations suitable for cold storage, retail distribution, and manufacturing sectors.

Technological advancements, including smart warehouse management systems and automated retrieval mechanisms, are enhancing the efficiency and flexibility of warehouse operations globally. This dynamic market continues to expand as supply chain modernization and automation become key priorities for industries seeking to reduce costs and improve throughput efficiency.

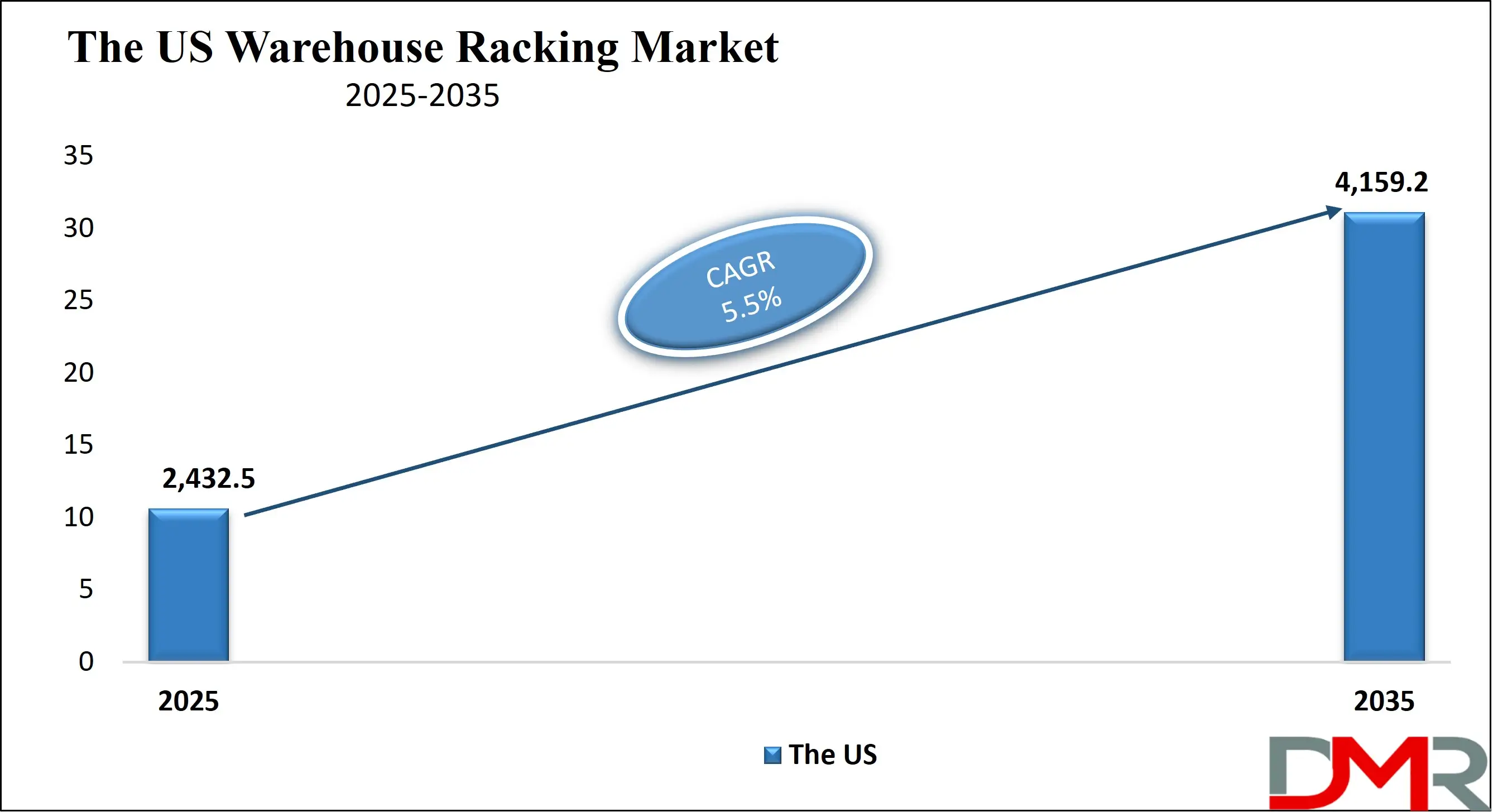

The US Warehouse Racking Market

The U.S. Warehouse Racking market size is projected to be valued at USD 2,432.5 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4,159.2 million in 2035 at a CAGR of 5.5%.

The US warehouse racking market is witnessing substantial growth driven by the accelerating expansion of e-commerce, third-party logistics (3PL) providers, and the modernization of supply chain infrastructure. With the rise of online retail giants and the growing need for faster order fulfillment, warehouses across the United States are increasingly adopting advanced racking systems to optimize space utilization and improve inventory management.

Selective pallet racking, drive-in racking, and push-back racking systems are widely implemented to enhance storage density and material flow efficiency. Moreover, the trend toward automation and smart warehousing has led to the integration of warehouse management systems (WMS), IoT-enabled monitoring, and robotic picking solutions, creating a demand for compatible racking designs that support automated storage and retrieval systems (ASRS). The surge in cold chain logistics, coupled with growing investments in last-mile delivery centers, is further contributing to the market’s expansion.

In addition, the US market is characterized by strong demand for sustainable and customizable racking solutions tailored to diverse sectors such as food and beverage, pharmaceuticals, automotive, and retail distribution. Manufacturers are focusing on corrosion-resistant, high-strength steel racks with modular designs that enable flexibility and scalability for dynamic warehouse operations.

The emphasis on energy-efficient and safety-compliant warehouse infrastructure, supported by OSHA and ANSI standards, is promoting the adoption of durable and eco-friendly racking systems. Furthermore, the development of large fulfillment centers in states like California, Texas, and Illinois is driving significant investments in high-density racking solutions to accommodate increasing inventory volumes. With continuous advancements in warehouse automation and logistics technologies, the US warehouse racking market is poised for consistent growth and innovation over the coming decade.

Europe Warehouse Racking Market

The warehouse racking market in Europe is projected to reach USD 2,349.4 million in 2025, driven by the region’s advanced logistics infrastructure, high e-commerce penetration, and modernization of supply chain operations. European warehouses are increasingly adopting high-density storage solutions such as selective pallet racks, drive-in systems, and multi-tier shelving to optimize space utilization and improve inventory management. The demand for efficient warehouse operations is particularly strong in countries like Germany, the United Kingdom, France, and the Netherlands, where large distribution centers and fulfillment hubs support both domestic and cross-border trade. The growing need for rapid order fulfillment, lean warehousing practices, and high-volume inventory storage is further fueling market adoption.

The European warehouse racking market is expected to grow at a CAGR of 6.7%, supported by technological advancements and the increasing integration of smart warehouse solutions. Companies are implementing automated storage and retrieval systems (ASRS), IoT-enabled racking, and AI-driven inventory management to enhance operational efficiency, reduce labor dependency, and ensure real-time inventory tracking.

Additionally, the focus on sustainable and energy-efficient racking systems, coupled with strict safety regulations and compliance standards, is driving investment in durable and environmentally friendly storage solutions. These factors position Europe as a significant growth region within the global warehouse racking market.

Japan Warehouse Racking Market

The warehouse racking market in Japan is projected to reach USD 610.8 million in 2025, reflecting robust growth driven by the country’s highly developed industrial and logistics sectors. The increasing adoption of e-commerce, rapid expansion of retail distribution networks, and the rising need for efficient warehouse operations are key factors contributing to market growth.

Japanese companies are investing in advanced racking systems such as selective pallet racks, drive-in racks, and automated storage and retrieval systems (ASRS) to optimize space utilization, streamline inventory management, and enhance order fulfillment speed. The demand for high-density storage solutions is particularly strong in urban areas where warehouse space is limited, prompting operators to implement multi-tier racking structures and modular systems.

The market in Japan is expected to grow at a CAGR of 6.9%, supported by technological advancements and the integration of smart warehouse solutions. Companies are increasingly adopting IoT-enabled racking systems, AI-driven inventory management, and robotics to improve operational efficiency and reduce labor costs. Additionally, stringent safety regulations and compliance standards encourage the use of durable, high-strength materials and well-engineered racking designs. The focus on automation, space optimization, and sustainable warehouse practices is expected to further drive the expansion of the Japanese warehouse racking market, positioning it as a critical segment within the broader Asia Pacific region.

Global Warehouse Racking Market: Key Takeaways

- Market Value: The global Warehouse Racking market size is expected to reach a value of USD 18,423.1 million by 2035 from a base value of USD 9,913.1 million in 2025 at a CAGR of 6.5%.

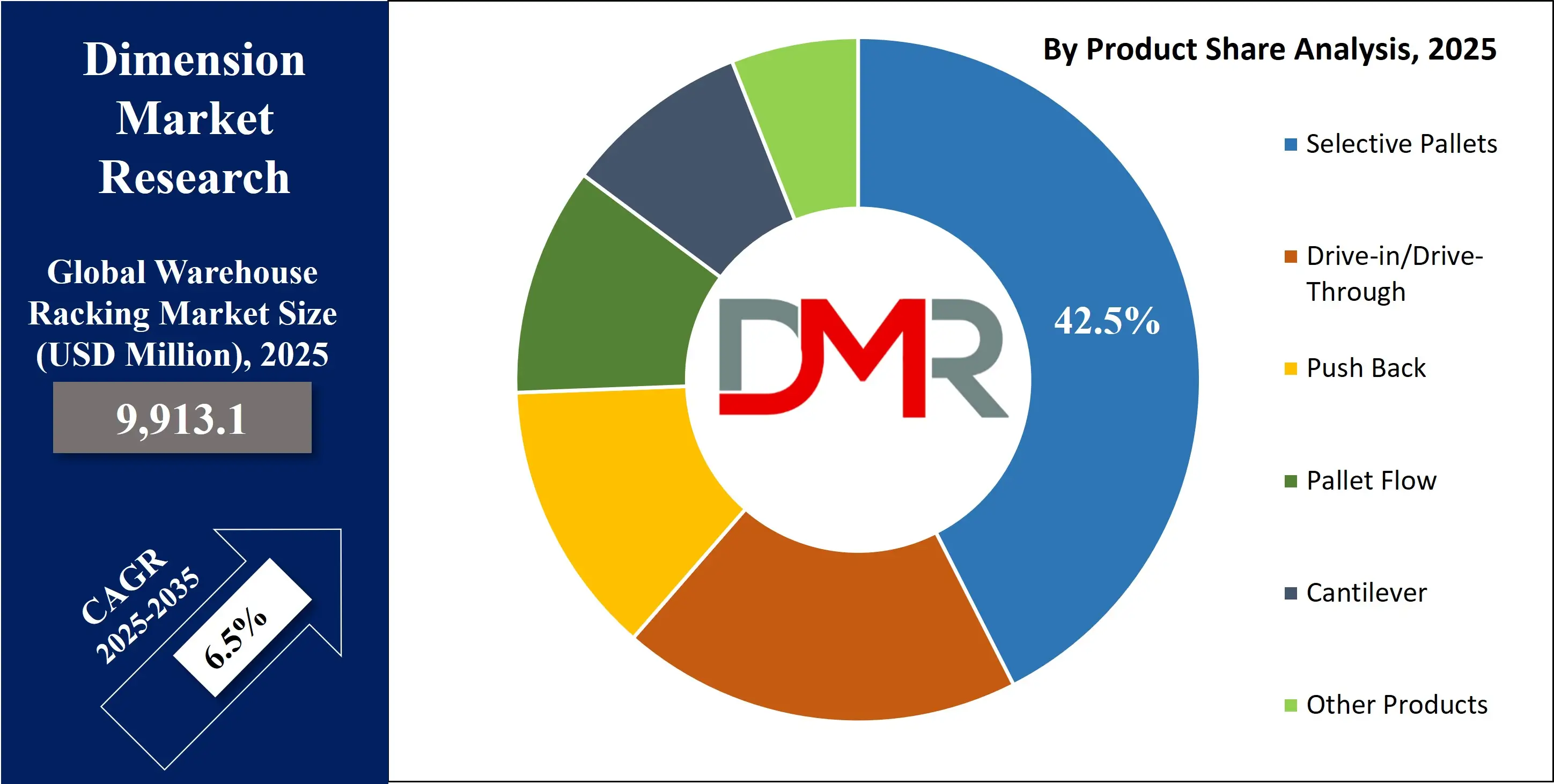

- By Product Segment Analysis: Selective Pallets are expected to maintain their dominance in the product segment, capturing 42.5% of the total market share in 2025.

- By Carrying Capacity Segment Analysis: Heavy Duty (Above 1500 KG) will dominate the carrying capacity segment, capturing 53.5% of the market share in 2025.

- By Application Segment Analysis: Retail applications will account for the maximum share in the application segment, capturing 27.9% of the total market value.

- Regional Analysis: Asia Pacific is anticipated to lead the global Warehouse Racking market landscape with 39.5% of total global market revenue in 2025.

- Key Players: Some key players in the global Warehouse Racking market are Nucor Corporation, Dematic (Kion Group), Jungheinrich AG, Daifuku, Kardex Group, Interroll Group, Stow Group, SSI Schaefer Group, Konstant, Mecalux International, Steel King Industries Inc., Frazier Industrial Company, STILL GmbH, Modulblok, Emrack International, and Others.

Global Warehouse Racking Market: Use Cases

- E-commerce Fulfillment Optimization: In the global warehouse racking market, e-commerce fulfillment centers are among the primary adopters of advanced racking systems. To manage high product variety and fast-moving inventories, companies are implementing selective pallet and multi-tier racking systems integrated with automated storage and retrieval systems (ASRS). These solutions enhance order picking speed, improve inventory accuracy, and maximize warehouse space utilization. The increasing demand for next-day delivery and efficient logistics operations is fueling the adoption of high-density and modular racking structures across major e-commerce hubs worldwide.

- Cold Storage and Food Distribution Efficiency: Cold chain operators and food distributors are utilizing specialized warehouse racking systems designed for temperature-controlled environments. Drive-in and mobile racking systems enable efficient use of space while maintaining product integrity under low temperatures. These systems allow for FIFO and LIFO inventory management, critical for perishable goods. As global demand for frozen foods, dairy, and pharmaceuticals rises, companies are investing in corrosion-resistant, heavy-duty racking solutions that improve operational efficiency and energy conservation in refrigerated warehouses.

- Automotive Component Storage Optimization: Automotive manufacturers and suppliers are leveraging customized racking systems to store bulky, irregularly shaped, and heavy components such as engines, tires, and chassis parts. Cantilever and double-deep pallet racking systems are preferred due to their ability to handle large loads and facilitate quick access to components. The integration of automated conveyors and robotic picking arms enhances warehouse productivity and reduces manual labor. This use case highlights how warehouse racking supports lean manufacturing practices, just-in-time inventory systems, and optimized material handling in the automotive sector.

- Retail and FMCG Inventory Management: Retail and fast-moving consumer goods (FMCG) companies are increasingly deploying flexible racking systems to manage seasonal inventory fluctuations and high product turnover. Adjustable pallet racking, carton flow racks, and shelving systems are widely used to streamline goods movement from distribution centers to retail outlets. These solutions support rapid restocking, reduce order cycle times, and improve space efficiency. As omni-channel retailing expands, warehouse racking systems are becoming essential to maintaining real-time inventory visibility and enhancing supply chain responsiveness in the global retail landscape.

Impact of Artificial Intelligence on the global Warehouse Racking market

- Enhanced Warehouse Automation and Efficiency: Artificial intelligence is revolutionizing warehouse racking systems by enabling predictive analytics, automated inventory tracking, and intelligent storage allocation. AI-powered warehouse management systems optimize racking layouts, reduce manual errors, and improve picking accuracy, leading to faster order fulfillment and better space utilization.

- Predictive Maintenance and Safety Optimization: AI-driven sensors and machine learning algorithms monitor the structural health of racking systems, detecting wear, overloads, or potential faults before failures occur. This predictive maintenance approach minimizes downtime, enhances worker safety, and extends the lifespan of racking infrastructure across large-scale warehouses.

- Integration with Robotics and Smart Warehousing: AI facilitates seamless integration between racking systems and autonomous robots such as automated guided vehicles (AGVs) and robotic picking arms. This synergy improves operational agility, supports real-time decision-making, and allows dynamic reconfiguration of racking layouts based on inventory flow and demand fluctuations.

Global Warehouse Racking Market: Stats & Facts

-

U.S. Census Bureau – Economic Indicators

- The value of shipments in the U.S. warehouse and storage industry was estimated at USD 100 billion in 2023.

- This figure is expected to rise to USD 105 billion by 2025, indicating a steady growth trajectory.

-

European Commission – Eurostat

- In 2023, the European Union's logistics sector contributed approximately €1.2 trillion to the economy.

- By 2025, this contribution is anticipated to increase to €1.3 trillion, reflecting the expanding need for efficient warehouse racking systems.

-

Australian Bureau of Statistics (ABS)

- The Australian warehousing industry generated USD 30 billion in revenue in 2023.

- This revenue is expected to reach USD 32 billion by 2025, indicating a robust demand for warehouse racking systems.

-

United Nations Economic Commission for Europe (UNECE)

- In 2023, the UNECE region's logistics sector accounted for 8% of global warehousing capacity.

- By 2025, this share is projected to increase to 8.5%, highlighting the region's growing role in global warehouse racking.

-

U.S. Department of Transportation (DOT)

- The U.S. spent USD 1.5 billion on warehouse infrastructure improvements in 2023.

- An additional USD 1.6 billion is allocated for 2024, supporting the expansion of racking systems in warehouses.

-

European Investment Bank (EIB)

- The EIB financed €500 million in warehouse modernization projects in 2023.

- An estimated €550 million is earmarked for similar projects in 2024, promoting the adoption of advanced racking solutions.

-

Japan External Trade Organization (JETRO)

- JETRO reports a 10% increase in warehouse automation projects in Japan from 2023 to 2025.

- This trend is expected to drive demand for sophisticated racking systems tailored to automated environments.

Global Warehouse Racking Market: Market Dynamics

Global Warehouse Racking Market: Driving Factors

Rising Demand for Efficient Storage Solutions in E-commerce and Logistics

The rapid expansion of the e-commerce sector and the surge in global logistics activities are major driving forces behind the growth of the global warehouse racking market. With increasing online orders and fast delivery expectations, companies are investing in high-density racking systems to maximize storage capacity and improve order-picking efficiency. Selective pallet racking, push-back systems, and automated racking structures are being adopted to enhance material flow and warehouse productivity. This demand is further supported by the rise in third-party logistics (3PL) providers and the growing need for scalable warehouse infrastructure across major trade regions.

Expansion of Automated and Smart Warehousing Systems

The increasing adoption of warehouse automation and smart technologies is accelerating market growth. Companies are integrating warehouse management systems (WMS), automated storage and retrieval systems (ASRS), and IoT-enabled sensors with racking designs to streamline inventory control and reduce human dependency. Artificial intelligence and robotics are improving operational accuracy, optimizing space utilization, and enabling real-time inventory tracking. These advancements are transforming traditional storage facilities into intelligent warehouses, enhancing overall supply chain efficiency.

Global Warehouse Racking Market: Restraints

High Initial Investment and Maintenance Costs

One of the primary challenges restraining market growth is the high capital investment required for advanced racking systems and automation integration. Setting up modular or automated racking structures demands significant financial resources for equipment, software, and skilled labor. Additionally, ongoing maintenance, regular inspections, and safety compliance further increase operational expenses, making adoption challenging for small and medium-sized enterprises (SMEs).

Space Constraints and Retrofitting Challenges in Existing Warehouses

Many existing warehouses face structural limitations when implementing modern racking solutions. Older facilities often lack sufficient ceiling height, load-bearing capacity, or space for automated machinery. Retrofitting such warehouses with advanced racking systems requires redesigning layouts or reinforcing structures, which can lead to downtime and added costs. These challenges hinder the widespread implementation of high-density and automated storage systems in legacy warehouses.

Global Warehouse Racking Market: Opportunities

Growing Investments in Emerging Logistics Hubs and Industrial Infrastructure

Developing economies are witnessing rapid growth in logistics and industrial infrastructure, presenting significant opportunities for warehouse racking manufacturers. Governments and private players are investing in modern logistics parks, fulfillment centers, and cold storage facilities to support global trade and e-commerce growth. Countries across Asia-Pacific, the Middle East, and Latin America are adopting advanced storage solutions to enhance supply chain efficiency and attract international logistics operators.

Increasing Focus on Sustainable and Eco-friendly Racking Solutions

The growing emphasis on sustainability is creating new opportunities in the warehouse racking market. Manufacturers are shifting toward recyclable materials, low-emission coatings, and energy-efficient production processes. The demand for durable, lightweight, and reusable racking systems is increasing as companies aim to reduce their carbon footprint and align with green warehousing standards. This trend is fostering innovation in product design and material engineering across the industry.

Global Warehouse Racking Market: Trends

Integration of AI, IoT, and Data Analytics in Warehouse Operations

A key trend shaping the warehouse racking market is the integration of artificial intelligence, Internet of Things (IoT), and real-time analytics into warehouse infrastructure. Smart sensors embedded in racking systems enable continuous monitoring of load capacity, temperature, and inventory movement. Data-driven insights help in predictive maintenance, efficient space utilization, and improved warehouse safety. This digital transformation is redefining storage optimization and operational visibility in modern warehouses.

Rising Adoption of Modular and Customizable Racking Designs

The demand for modular and easily reconfigurable racking systems is increasing as businesses require flexible storage solutions to accommodate fluctuating inventory levels. Adjustable pallet racks, mobile shelving, and boltless racking systems allow quick adaptation to changing operational needs. This trend is particularly strong among e-commerce and manufacturing sectors, where scalability and cost-effective storage play crucial roles in maintaining competitive efficiency.

Global Warehouse Racking Market: Research Scope and Analysis

By Product Analysis

Selective pallet racking is projected to remain the leading product segment in the global warehouse racking market, accounting for 42.5% of the total market share in 2025. Its dominance can be attributed to its versatility, cost-effectiveness, and ease of installation, making it a preferred choice for warehouses across industries such as retail, logistics, food and beverage, and manufacturing. This system allows direct access to every pallet, improving inventory turnover and enabling efficient stock management, especially for operations dealing with a wide range of SKUs.

The design flexibility of selective pallet racks also supports both FIFO (First In, First Out) and LIFO (Last In, First Out) inventory methods, depending on warehouse requirements. Additionally, their compatibility with various handling equipment, including forklifts and automated systems, enhances operational efficiency and space utilization in both small-scale and large distribution centers.

The drive-in and drive-through racking systems, on the other hand, are gaining traction in facilities that prioritize high-density storage and space optimization. These systems allow forklifts to enter the racking lanes directly, maximizing cubic storage capacity by eliminating multiple aisles. Drive-in racks are ideal for storing large quantities of homogeneous products with lower turnover rates, while drive-through racks allow access from both ends, facilitating more flexible inventory flow.

Commonly used in cold storage, food processing, and bulk material warehousing, these racking systems provide excellent storage density, although they typically offer less selectivity compared to selective pallet racks. The growing need for compact and cost-efficient storage solutions in space-constrained facilities continues to support the adoption of drive-in and drive-through racking systems globally.

By Carrying Capacity Analysis

Heavy-duty racking systems, designed to handle loads above 1500 kilograms, are expected to dominate the carrying capacity segment of the global warehouse racking market, capturing 53.5% of the market share in 2025. Their widespread adoption is driven by the growing demand from industries such as automotive, manufacturing, and heavy machinery, where large, bulky, and high-weight materials need secure and stable storage.

These racking systems are engineered with reinforced steel frames, high-strength beams, and advanced bracing techniques to ensure durability and safety under substantial loads. Their ability to support heavy pallets and containers makes them essential for warehouses dealing with bulk production, industrial components, and large-scale logistics operations. Additionally, heavy-duty racks are often integrated with automated handling equipment and forklifts, facilitating faster material movement while maintaining operational safety and efficiency in high-volume storage environments.

Medium-duty racking systems, designed for loads ranging from 500 to 1500 kilograms, cater to industries with moderate-weight storage requirements, such as consumer goods, pharmaceuticals, and light manufacturing. These racks offer a balance between load capacity and cost-effectiveness, making them suitable for warehouses that handle varied SKUs with moderate weight.

They allow efficient storage of palletized goods, cartons, and components while maintaining easy access for material handling operations. Medium-duty systems are often modular and adjustable, providing flexibility to accommodate changing inventory needs. Their growing adoption is fueled by the need for optimized storage solutions that combine safety, accessibility, and space utilization in small to medium-scale warehouses and distribution centers.

By Application Analysis

Retail applications are expected to account for the largest share in the application segment of the global warehouse racking market, capturing 27.9% of the total market value. The dominance of this segment is driven by the rapid growth of omni-channel retailing, e-commerce expansion, and increasing consumer demand for faster product availability.

Retail warehouses require versatile racking solutions to manage a wide variety of SKUs, seasonal products, and high turnover inventories. Systems such as selective pallet racks, adjustable shelving, and multi-tier racks are widely used to ensure efficient space utilization and easy access to goods.

The adoption of automated storage and retrieval systems (ASRS) and warehouse management systems (WMS) further enhances inventory control, reduces picking errors, and improves operational efficiency in retail distribution centers. As retailers expand their distribution networks globally, the demand for high-density, flexible, and scalable racking solutions continues to grow.

The food and beverage sector also represents a significant application segment within the warehouse racking market. Warehouses in this sector require specialized racking systems that accommodate temperature-controlled environments, perishable items, and high-volume storage of packaged goods.

Drive-in, mobile, and pallet racking systems are commonly used to optimize space while maintaining proper inventory rotation through FIFO (First In, First Out) methods. The rising demand for frozen, processed, and packaged foods, along with stringent hygiene and safety standards, is encouraging operators to adopt corrosion-resistant and durable racking solutions.

Additionally, integration with cold storage technology and automated picking systems helps improve efficiency and reduce spoilage, making advanced racking systems essential for modern food and beverage warehousing operations.

The Warehouse Racking Market Report is segmented on the basis of the following

By Product

- Selective Pallets

- Drive-in/Drive-Through

- Push Back

- Pallet Flow

- Cantilever

- Other Products

By Carrying Capacity

- Light Duty (Upto 500 KG)

- Medium Duty (500 to 1500 KG)

- Heavy Duty (Above 1500 KG)

By Application

- Retail

- Food & Beverage

- Automotive

- Packaging

- Manufacturing

- 3PL/Logistics

- Other Applications

Global Warehouse Racking Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global warehouse racking market landscape, accounting for 39.5% of total global market revenue in 2025. The region’s dominance is driven by rapid industrialization, the expansion of e-commerce, and growing investments in modern logistics infrastructure across countries such as China, India, Japan, and South Korea.

Rising demand for efficient storage solutions, high-density racking systems, and automated warehouse technologies is supporting market growth. Additionally, the establishment of large distribution centers, cold storage facilities, and third-party logistics hubs is fueling the adoption of advanced racking systems. Favorable government policies, infrastructure development, and the increasing need for optimized material handling and inventory management further reinforce Asia Pacific’s leadership position in the global warehouse racking market.

Region with significant growth

Asia Pacific (APAC) is expected to be the region with significant growth in the global warehouse racking market, driven by rapid industrialization, the surge in e-commerce, and expanding logistics and distribution infrastructure. Countries such as China, India, Japan, and South Korea are witnessing large-scale investments in modern warehouses, fulfillment centers, and cold storage facilities to meet rising consumer demand and improve supply chain efficiency. The adoption of automated storage and retrieval systems (ASRS), high-density racking solutions, and smart warehouse management technologies is accelerating, enabling optimized space utilization and faster inventory turnover.

Additionally, government initiatives supporting industrial parks, trade facilitation, and smart logistics hubs are further boosting market growth. The increasing focus on efficient material handling, lean warehousing practices, and technological integration reinforces APAC’s role as a key growth driver in the global warehouse racking market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Warehouse Racking Market: Competitive Landscape

The global warehouse racking market is highly competitive, characterized by continuous innovation, technological integration, and strategic expansions. Key players are focusing on developing advanced racking solutions that cater to automated storage systems, high-density warehouses, and industry-specific requirements.

Companies are investing in research and development to offer durable, modular, and customizable racking systems, while also emphasizing sustainability and compliance with international safety standards. Strategic partnerships, mergers, and acquisitions are being leveraged to expand regional presence and strengthen distribution networks. The market’s competitive intensity is further driven by the growing demand for smart warehouse technologies, IoT-enabled monitoring, and AI-integrated inventory management solutions that enhance operational efficiency and space optimization.

Some of the prominent players in the global Warehouse Racking market are

- Nucor Corporation

- Dematic (Kion Group)

- Jungheinrich AG

- Daifuku

- Kardex Group

- Interroll Group

- Stow Group

- SSI Schaefer Group

- Konstant

- Mecalux International

- Steel King Industries Inc.

- Frazier Industrial Company

- STILL GmbH

- Modulblok

- Emrack International

- AK Material Handling Systems

- Other Key Players

Global Warehouse Racking Market: Recent Developments

- July 2025: Brookfield acquired a USD 428 million portfolio of 53 U.S. warehouses across Houston, Dallas, Nashville, and Atlanta. The acquisition targets older warehouses for upgrades, allowing Brookfield to implement advanced racking solutions, improve operational efficiency, and attract long-term tenants seeking cost-effective, modernized storage facilities with optimized workflow.

- April 2025: DSV acquired Deutsche Bahn’s logistics division, DB Schenker, for €14.3 billion. The merger doubled DSV’s revenue, expanded its global warehouse network, and integrated advanced racking systems. The acquisition strengthens operations in Europe and Asia, enhancing automated storage, distribution, and multimodal logistics capabilities for industrial and commercial clients.

- February 2025: CMA CGM acquired Bolloré Logistics for €4.85 billion, gaining 900,000 sqm of warehouse space and 13,500 employees. The acquisition integrates Bolloré’s warehouses into CMA CGM’s global network, optimizing storage capacity, automation, and inventory management while improving cross-border logistics efficiency in Europe, Africa, and Asia-Pacific regions.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 9,913.1 Mn |

| Forecast Value (2035) |

USD 18,423.1 Mn |

| CAGR (2025 - 2035) |

6.5% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 2,432.5 Mn |

| Forecast Data |

2026 – 2035 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Selective Pallets, Drive-in/Drive-Through, Push Back, Pallet Flow, Cantilever, Other Products), By Carrying Capacity (Light Duty up to 500 KG, Medium Duty 500 to 1500 KG, Heavy Duty Above 1500 KG), and By Application (Retail, Food & Beverage, Automotive, Packaging, Manufacturing, 3PL/Logistics, Other Applications). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Nucor Corporation, Dematic (Kion Group), Jungheinrich AG, Daifuku, Kardex Group, Interroll Group, Stow Group, SSI Schaefer Group, Konstant, Mecalux International, Steel King Industries Inc., Frazier Industrial Company, STILL GmbH, Modulblok, Emrack International, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global Warehouse Racking market size is estimated to have a value of USD 9,913.1 million in 2025 and is expected to reach USD 18,423.1 million by the end of 2035.

The US Warehouse Racking market is projected to be valued at USD 2,432.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,159.2 million in 2035 at a CAGR of 5.5%.

Asia Pacific is expected to have the largest market share in the global Warehouse Racking market, with a share of about 39.5% in 2025.

Some of the major key players in the global Warehouse Racking market are Nucor Corporation, Dematic (Kion Group), Jungheinrich AG, Daifuku, Kardex Group, Interroll Group, Stow Group, SSI Schaefer Group, Konstant, Mecalux International, Steel King Industries Inc., Frazier Industrial Company, STILL GmbH, Modulblok, Emrack International, and Others.

The market is growing at a CAGR of 6.5 percent over the forecasted period.