Market Overview

The Global Water and Wastewater Treatment Equipment Market is expected to attain a value of USD 69.9 billion in 2023 and is anticipated to grow with a CAGR of 4.9% for the forecast period (2023-2032).

This growth can be accredited to various factors, like urbanization, the rise in population & industrialization, complimented by the implementation & adoption of strict environmental rules & regulations. The increasing consciousness & awareness regarding pollution in the environment & the urgent need for effective & efficient wastewater management solutions further contribute to the expansion of the market.

One of the key drivers for the market's growth is the adoption of advanced & developed technologies, like activated sludge treatment, biological treatment, and membrane filtration. These cutting-edge solutions offer significant benefits, including reduced impact on the environment, enhanced quality of water, & improved people’s health.

As governments worldwide adopt & implement stricter rules & regulations regarding the discharge of wastewater, key firms in the market are engaging in partnerships with users to encourage & promote these newer and advanced technologies, fostering innovation & development. This trend aligns with broader advancements in the

Industrial Filtration and the

Water Testing Equipment, which play a vital role in ensuring the safety and compliance of treated water.

As per Global Water Intelligence Global wastewater treatment plant capacity was approximately 434 billion liters per day(114 billion gallons) in 2022. By 2025, the capacity is expected to grow to 523 billion liters per day(138 billion gallons), driven by rising demand for wastewater treatment services. The Asia-Pacific region accounted for 33% of the global capacity in 2022.

As per (IEA) - "Water-Energy Nexus" Wastewater treatment plants consume about 3% of global electricity, or 104 TWh annually (International Energy Agency). By 2030, energy use in this sector is expected to rise to 134 TWh due to urbanization and water scarcity. In 2020, the United States accounted for 29% of global energy consumption in wastewater treatment.

Due to rising concerns over water scarcity, pollution and sustainability issues, the market for water and wastewater treatment equipment is expanding quickly. With growing urbanization taking place both developed and developing regions are investing infrastructure to enhance treatment processes such as membrane filtration, UV disinfection systems and monitoring systems in order to create more cost-efficient solutions.

This is also creating synergies with the Environmental Monitoring Market as industries seek real-time data-driven insights to improve water safety and compliance.

Opportunities exist throughout Asia-Pacific, where urbanization and industrialization are straining water resources. Stricter environmental regulations worldwide have forced industries to embrace advanced water treatment technologies; as worldwide concerns about water scarcity and environmental protection arise, water and wastewater treatment equipment companies could experience substantial growth potential from investing in this market.

Recent industry developments include the adoption of AI-powered systems and real-time water quality monitoring. At the 2023 World Water Congress, advancements in smart water technologies were showcased, which are helping improve water management and detect contamination more accurately.

Aging infrastructure upgrades across municipalities worldwide is also contributing to an increasing need for modern treatment equipment. The expansion of the

Waste Recycling Services is further complementing these efforts, emphasizing the circular economy approach in water and waste management.

Water and Wastewater Treatment Equipment Key Takeaways

- Market Growth Outlook: The global water and wastewater treatment equipment market reached USD 69.9 billion in 2023 and is projected to expand at a CAGR of 4.9% (2023–2032), driven by urbanization, population growth, and stricter environmental regulations.

- Technological Advancements: Adoption of membrane filtration, UV disinfection, AI-powered monitoring, and biological treatment systems is reshaping the industry, offering improved efficiency, cost-effectiveness, and sustainability.

- Rising Energy Demand: Wastewater treatment plants account for 3% of global electricity use (104 TWh annually), expected to rise to 134 TWh by 2030 due to urbanization and water scarcity, intensifying the need for energy-efficient solutions.

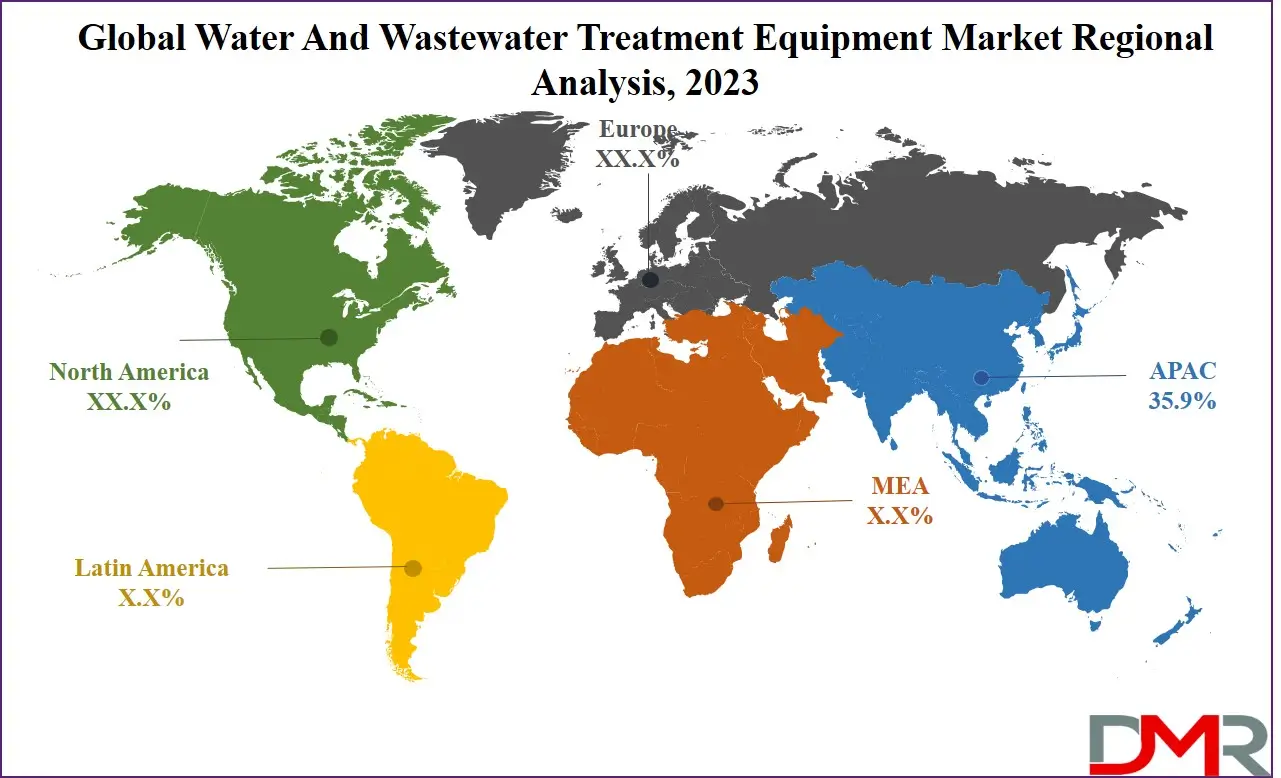

- Regional Insights: Asia-Pacific leads the market with a 35.9% share in 2023, fueled by industrialization, rapid urbanization, and strong government initiatives. Latin America is set for strong growth, supported by regulatory reforms and sustainability programs.

Water and Wastewater Treatment Equipment Use Cases

- Municipal Water Treatment: Used by cities and towns to purify drinking water and treat sewage before safe discharge or reuse, ensuring public health and compliance with regulations.

- Industrial Wastewater Management: Applied in industries like pulp & paper, chemicals, pharmaceuticals, and food & beverage to remove contaminants, heavy metals, and toxic substances before disposal or recycling.

- Power Generation Sector: Essential in thermal power plants and renewable energy facilities, where treated water is required for cooling, boiler operations, and maintaining efficiency while reducing environmental impact.

- Agriculture & Irrigation: Supports water recycling and reuse in farming, providing clean water for irrigation while reducing stress on freshwater sources and helping combat water scarcity.

- Smart & Sustainable Infrastructure: Integration of AI-powered monitoring, membrane filtration, and UV disinfection in smart city projects to enhance water quality, detect contamination in real-time, and support sustainable urban development.

Water and Wastewater Treatment Equipment Market Dynamics

Spending on R&D to enhance the efficiency of technology is also propelling market growth. Small & medium-sized companies are supporting new & more developed water & wastewater treatment technologies, creating ample opportunities for growth & the expansion market. For instance, Yorkshire Water, a company of water supply, partnership with LTIMindtree Limited which is an IT company.

This partnership leads to the transformation of operations of business across diverse sectors such as asset management, water, & wastewater showcasing the potential for technological advancements in the sector.

The usage of UV disinfection technologies & membrane filtration is also increasing because of their high efficiency in treating water & wastewater. These developments in terms of technologies provide a competitive edge for key players in the market, enticing them to adopt such techniques to cater to the growing demand for efficient & more sustainable wastewater treatment systems.

With the market providing substantial opportunities for further growth & the rising potential for continuous advancements in technologies, competitors are in a better position to capitalize on the growing requirements for water & wastewater treatment equipment globally.

Another factor leading to the growth of the market is the growing paper & pulp sector. In the paper & pulp sector, effective water & wastewater treatment techniques like ion exchange, reverse osmosis, UV disinfection, & biological treatment play a crucial role in discarding particles & particulate matter and decreasing the toxicity of the effluent.

These advanced techniques are important to comply with environmental rules & regulations & therefore make the industry sustainable. The government of Canada has observed the importance of this sector and is actively encouraging its growth. In 2021, the Minister of Natural Resources announced a substantial investment of approximately US$3.8 million through Sustainable Development Technology Canada (SDTC) in Red Leaf Pulp, a Kelowna-based company.

Similarly, India's paper and paperboard industry is also poised for significant expansion, with Invest India estimating an annual growth rate of 6-7%. With India currently using 15 kilograms of paper per person annually, the increasing pulp and paper sector will necessitate advanced water and wastewater treatment technologies to manage waste streams, thereby driving industrial expansion in the foreseeable future.

Water and Wastewater Treatment Equipment Market Research Scope and Analysis

By Equipment

The segment of tertiary treatment dominates The Global Water and Wastewater Treatment Equipment with a maximum share in 2023. This segment is expected to grow with a high compound annual growth rate by 2032. Water and wastewater treatment equipment play a crucial role in the proper management and treatment of wastewater, making it safe for discharge into the environment or for reuse. The process of treatment involves several steps, each deploying particular equipment & processes.

During the phase of primary treatment, specially designed equipment such as oil-water separators, dissolved air flotation systems & primary clarifiers are used to discard inorganic & organic solids from the wastewater. This step is important in avoiding situations like clogging, & damage to equipment involved in the downstream treatment process.

In the second phase, after the primary treatment, secondary treatment comes. In secondary treatment, suspended & dissolved organic matter, and nutrients, are efficiently removed from the wastewater. This happens due to the use of equipment like rotating biological contactors, trickling filters, & activated sludge systems, which use microbes to break down nutrients & organic matter. In this way decreasing the load of pollutants.

The tertiary treatment process, a final process, includes the removal of impurities & contaminants from the treated water. Enhanced equipment such as disinfection systems & membrane filtration systems are used in this step to make sure that the already treated wastewater complies with safety standards for discharge or reuse in the environment.

With increasing attention towards the quality of water & sustainable management of wastewater, the water and wastewater treatment equipment market is anticipated to fuel the markets’ demand.

By Application

The Application segment of Municipal dominates the water and wastewater treatment equipment market in 2023, with a maximum share in the market. This lead can be accredited to the increasing need & desire for wastewater treatment solutions in developing economies like India & China.

Moreover, the application segment of industrial is anticipated to grow with a maximum compound annual growth rate by 2032. This expansion is driven by the escalating desire for both processed & fresh water, fueled by enhanced technological developments, rapid urbanization, and the proliferation of manufacturing units in several sectors. Therefore, the industrial sector's water & wastewater treatment requirements are increasing, prompting a surge in demand for advanced equipment for treatment to meet evolving needs.

In both the segments of industrial & municipal, water & wastewater treatment equipment play a crucial role in purifying water for safe human consumption & treating wastewater before its release into the environment. Advanced technologies like membrane filtration systems (e.g., reverse osmosis & ultrafiltration) are utilized to remove dissolved bacteria, solids, & other contaminants from water, while UV disinfection systems efficiently discard harmful microbes.

Moreover, several materials & equipment, such as sand & gravel filters, UV disinfection systems, activated carbon, and membranes, are extensively employed in the treatment processes to ensure water safety and environmental protection in both application segments. In the industrial sector, treatment equipment becomes instrumental in addressing diverse contaminants, such as chemicals, heavy metals, and organic compounds, commonly found in industrial wastewater.

Biological treatment systems, such as anaerobic digestion & activated sludge, depend on microorganisms to decompose organic matter & impurities, while chemical treatments such as coagulation & flocculation deal with particular contaminants to be discarded.

The Global Water and Wastewater Treatment Equipment Market Report is segmented on the basis of the following:

By Equipment

- Primary Treatment

- Primary Clarifier

- Sludge Removal

- Grit Removal

- Pre-Treatment

- Others

- Secondary Treatment

- Activated Sludge

- Sludge Treatment

- Others

- Tertiary Treatment

- Tertiary Clarifier

- Filters

- Chlorination systems

- Others

By Application

Water and Wastewater Treatment Equipment Market Regional Analysis

The Asia Pacific region dominates the water and wastewater treatment equipment market in 2023 with a maximum share of 35.9%. This region is anticipated to further lead the market with a high compound annual growth rate by 2032.

This growth is majorly driven by the rising consciousness among customers & various sectors regarding the benefit of conservation of water & protection of the environment in the Asia-Pacific region. As a result, the need & desire for water & wastewater treatment equipment is observing a substantial rise.

Moreover, Latin America is also anticipated to observe substantial growth in the market with a maximum Compound annual growth rate by 2032. This growth is accredited to the bold steps & initiatives taken by regulatory bodies & governments in the region to enhance the quality of water & encourage practices of sustainable water management.

Furthermore, the region's various sectors, like pharmaceuticals, chemicals, & food and beverage are generating a demand for effective & efficient wastewater treatment solutions to adhere to strict environmental policies & regulations, further contributing to this region’s market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Water and Wastewater Treatment Equipment Market Competitive Landscape

Manufacturers in the water and wastewater treatment equipment market employ a range of strategic initiatives to adapt to evolving technological needs and expand their presence across diverse applications, including municipal and industrial sectors.

These strategies encompass mergers, product developments, joint ventures, geographical expansions, and acquisitions. By adopting such approaches, companies aim to bolster their market penetration and cater effectively to the demands of their target customers. A recent example of these strategies can be seen in February 2023 when Evoqua Water Technologies successfully completed the acquisition of an industrial water treatment service division from Kemco Systems.

This strategic move enables Evoqua to enhance its aftermarket services in the North American market, further strengthening its capabilities to support and cater to the needs of its industrial clientele. Such initiatives demonstrate the industry's proactive response to market dynamics and its commitment to providing cutting-edge solutions and services to meet the growing demands for water and wastewater treatment equipment.

Some of the prominent players in the Global Water and Wastewater Treatment Equipment Market are:

- Pentair plc.

- Ecolab Inc.

- Xylem Inc.

- Evoqua Water Technologies LLC

- DuPont

- Aquatech International LLC

- Veolia Group

- Evonik Industries AG

- Calgon Carbon Corporation

- Toshiba Water Solutions Private Limited

- Lenntech B.V.

- Other Key Players

Recent Developments

- In February 2025: Perenfra is in the process of raising $125 million for its Perennial Infrastructure Fund I, aimed at financing new water main and treatment facility projects across the U.S. The fund is backed by strategic partners including Garney Equity Holdings and Ferguson Ventures, and targets rapidly growing regions where municipalities struggle to meet infrastructure demand.

- In August 2025: The San Antonio Water System (SAWS) secured a $26.7 million state loan to design and expand its underground aquifer storage and recovery system at the H2Oaks facility, aiming to double capacity from 30 to 60 million gallons per day as part of broader Texas water infrastructure enhancements.

Water and Wastewater Treatment Equipment Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 69.9 Bn |

| Forecast Value (2032) |

USD 107.4 Bn |

| CAGR (2023-2032) |

4.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Equipment (Primary treatment, secondary treatment & tertiary treatment), By Application (Industrial, and Municipal). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Pentair plc., Ecolab Inc., Xylem Inc., Evoqua Water Technologies LLC, DuPont, Veolia Group, Evonik Industries AG, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited, Lenntech B.V and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Water and Wastewater Treatment Equipment Market is expected to attain a value of USD

69.9 billion in 2023

The Global Water and Wastewater Treatment Equipment Market is expected to reach a CAGR of 4.9%

during the forecast period from 2023 to 2032.

The Asia Pacific region dominates the water and wastewater treatment equipment market, with a

maximum share of 35.9% in 2023.

Some of the prominent players in the Global Water And Wastewater Treatment Equipment Market

include Pentair plc., Ecolab Inc., Xylem Inc., Evoqua Water Technologies LLC, DuPont, Aquatech

International LLC, etc.