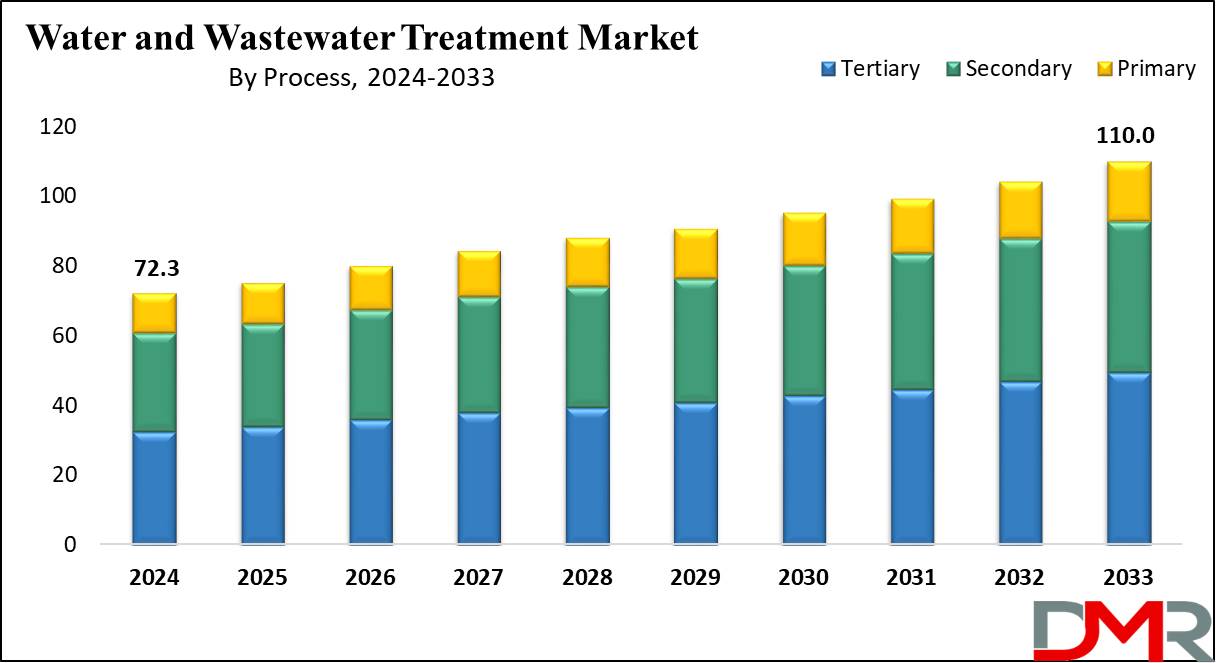

Market Overview

The

Global Water and Wastewater Treatment Market is projected to

reach USD 72.3 billion in 2024 and grow at a compound annual

growth rate of 4.8% from there until 2033 to reach a

value of USD 110.0 billion.

Wastewater treatment or sewage treatment, includes the removal of impurities from wastewater or sewage before it reaches bodies of water like lakes, rivers, oceans, or aquifers. Clean water does not exist in nature, so the definition of pure water versus polluted water is based on the type and concentration of impurities & the intended use of the water. Pollution of water is mostly caused by human activities, like the discharge of contaminated wastewater into surface water or groundwater. Wastewater treatment plays a major role in controlling water pollution and ensuring water quality.

Water and Wastewater Treatment Equipment is crucial for ensuring clean, safe water by removing contaminants from both industrial and municipal sources. This equipment plays a vital role in protecting public health and the environment by treating sewage through sewage treatment equipment and managing industrial discharge via industrial water treatment solutions.

As urbanization increases, the need for advanced wastewater treatment systems and efficient water filtration systems becomes more urgent.

The growth of this sector is driven by rising water scarcity, stricter regulations, and a push for sustainable municipal wastewater management, including sludge treatment technologies and UV disinfection units for safer reuse.

As per the Waterandwastewater report, with over 80% of global wastewater discharged untreated, the Water and Wastewater Treatment Market is under intense pressure. Primary treatment can cut BOD to 200 mg/L, reducing 50–70% of suspended solids, while secondary processes per the Water Environment Federation can reduce BOD by up to 95%.

The U.S.

EPA highlights that effective sludge treatment can divert 60% of organic waste from landfills. However, 60% of existing facilities operate with outdated infrastructure, risking non-compliance and fines. Advanced technologies now offer up to 100% water recovery, indicating strong growth potential for modernized treatment systems amid tightening environmental regulations.

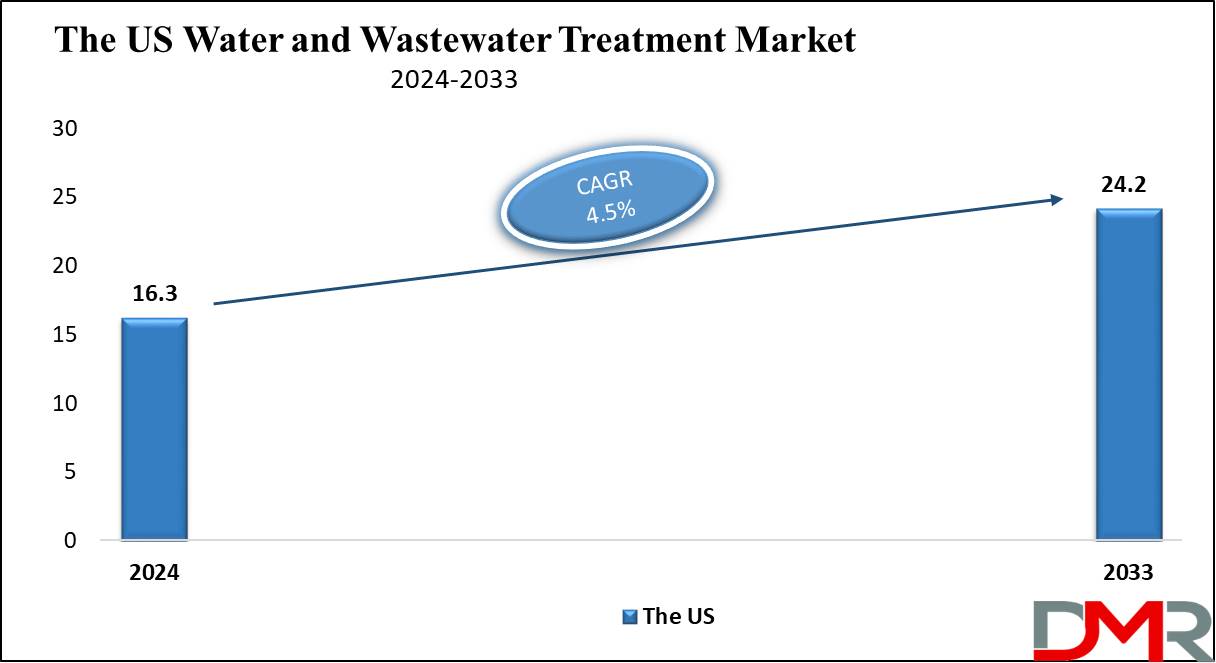

The US Water and Wastewater Treatment Market

The

US Water and Wastewater Treatment Market is projected to

reach USD 16.3 billion in 2024 at a compound annual

growth rate of 4.5% over its forecast period.

The water and wastewater treatment market in the US offers growth opportunities through infrastructure upgrades, driven by aging treatment systems and stricter environmental regulations. The higher investments in advanced technologies like membrane filtration, smart water management, and water reuse solutions further boost the market. The rise in industrial demand and government initiatives promoting sustainable water practices also create opportunities for innovation and expansion.

Further, growth in the market is driven by rising investments in modernizing aging infrastructure and stricter environmental regulations promoting sustainable practices. However, the high capital and operational costs of advanced treatment systems act as a key challenge, limiting adoption, especially for smaller municipalities and businesses with budget constraints.

Key Takeaways

- Market Growth: The Water and Wastewater Treatment Market size is expected to grow by 34.6 billion, at a CAGR of 4.8% during the forecasted period of 2025 to 2033.

- By Offering: The services segment is anticipated to get the majority share of the Water and Wastewater Treatment Market in 2024.

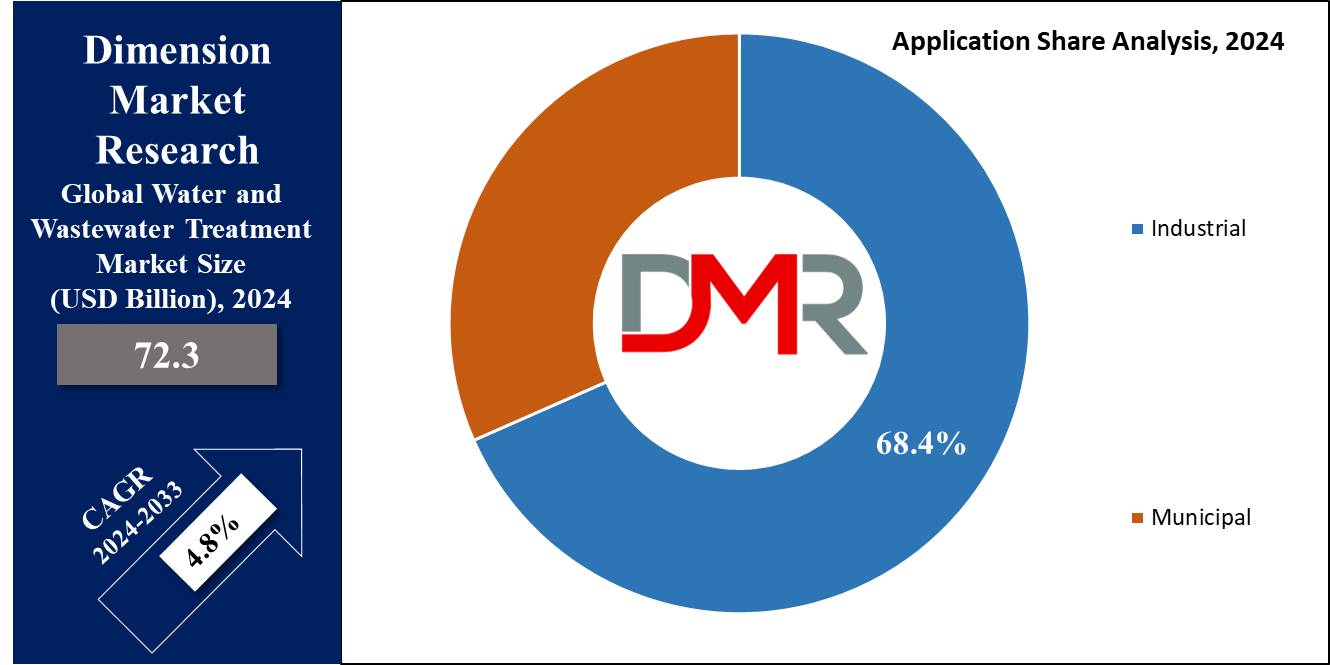

- By Process: The tertiary treatment process segment is expected to be leading the market in 2024

- By Application: The industrial segment is expected to get the largest revenue share in 2024 in the Water and Wastewater Treatment Market.

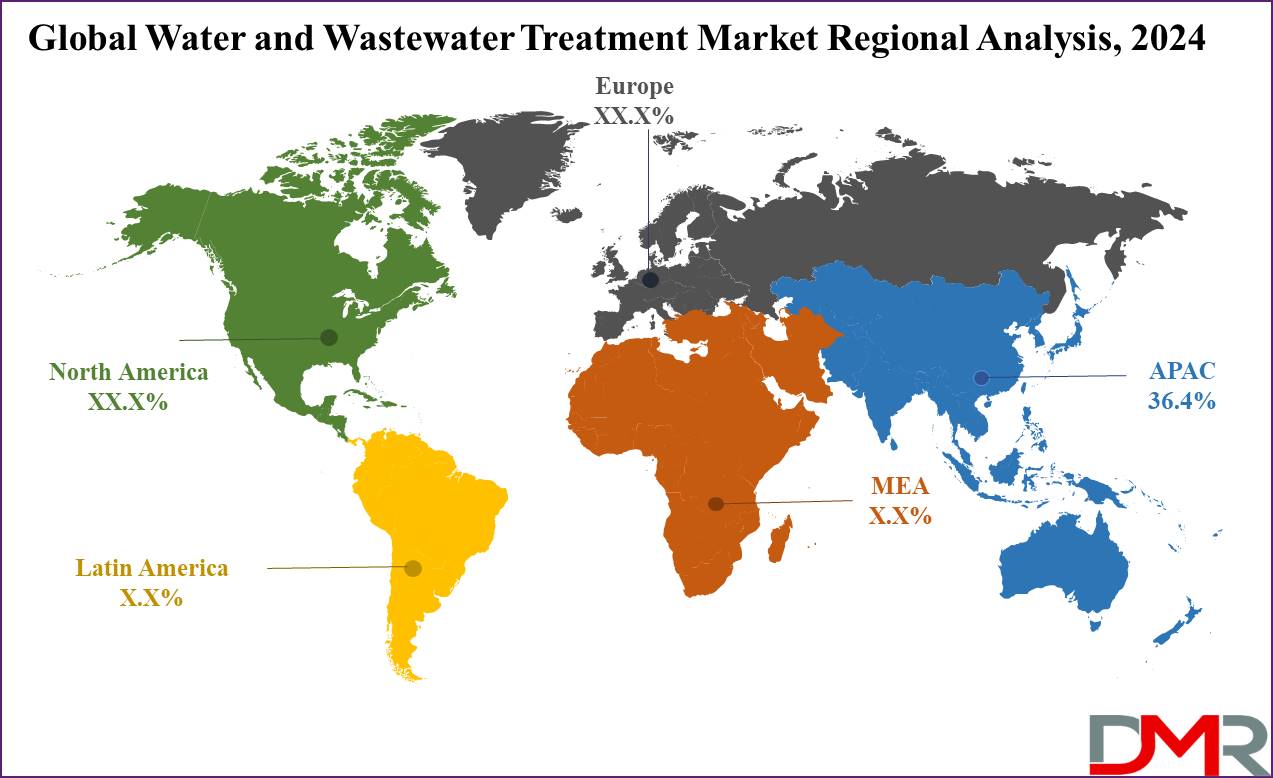

- Regional Insight: Asia Pacific is expected to hold a 36.4% share of revenue in the Global Water and Wastewater Treatment Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include drinking water treatment, municipal wastewater treatment, and more.

Use Cases

- Drinking Water Treatment: This process eliminates contaminants from raw water sources to make it safe for human consumption. Techniques include filtration, disinfection, and chemical treatment to remove impurities.

- Industrial Wastewater Treatment: Industries generate wastewater that contains hazardous substances. Treatment systems are engineered to remove pollutants through physical separation, biological treatment, and chemical reactions, ensuring compliance with environmental regulations before discharging back into water bodies.

- Municipal Wastewater Treatment: Municipal treatment plants process sewage & wastewater from households and businesses. They combine primary, secondary, and tertiary processes to remove organic matter and pathogens, returning treated water to the environment or repurposing it for non-potable uses.

- Reclaimed Water Systems: Treated wastewater can be reused for numerous applications, like irrigation, industrial processes, and even groundwater recharge. These systems support conserving freshwater resources, reducing environmental impact, and providing sustainable alternatives for water supply, especially in water-scarce regions.

Market Dynamic

Driving Factors

Increasing Water ScarcityRapid urbanization and population growth have led to higher demand for clean water. Water scarcity issues prompt governments and industries to invest in advanced treatment technologies and infrastructure to ensure sustainable water supply and effective management of wastewater.

Stringent Environmental Regulations

Governments across the world are implementing stricter regulations to protect water resources and ensure the safe discharge of treated wastewater. Compliance with these regulations drives investment in modern treatment facilities and technologies, driving market growth as industries look to minimize environmental impact and improve sustainability practices.

Restraints

High Capital and Operational Costs

The initial investment needed for advanced water and wastewater treatment technologies can be higher. In addition, the ongoing operational and maintenance costs can strain budgets, mainly for small municipalities and businesses, potentially limiting their ability to adopt new systems.

Technological Limitations and Complexity

The development and implementation of advanced treatment technologies can be complex, demanding specialized knowledge and expertise, which may lead to challenges in operation and maintenance, resulting in reluctance from some organizations to invest in newer, more specialized treatment solutions.

Opportunities

Emerging Technologies and Innovations

Developments in technologies like membrane filtration, advanced oxidation processes, and smart water management systems provide many growth opportunities. These innovations can enhance efficiency, reduce costs, and improve the effectiveness of treatment processes, attracting investments from both public and private sectors.

Growing Demand for Water Reuse and RecyclingWith the growth in awareness of water scarcity and environmental sustainability, there is a major trend toward water reuse and recycling initiatives, which creates opportunities for companies to develop and implement systems for reclaiming treated wastewater for agricultural, industrial, and potable uses, thus expanding their market reach and impact.

Trends

Integration of IoT and Smart TechnologiesThe adoption of

Internet of Things (IoT) technology is transforming water & wastewater management through live monitoring and data analytics. Smart sensors and automated systems improve operational efficiency, reduce water loss, and enhance decision-making, leading to more effective treatment and resource management.

Sustainable Treatment Solutions

There is a primary focus on sustainable practices within the water and wastewater treatment sector, driven by environmental concerns and regulatory pressures. Innovations like energy-efficient treatment processes, the utilization of renewable energy sources, and the recovery of valuable resources from wastewater are becoming highly prevalent, aligning with global sustainability goals.

Research Scope and Analysis

By Offerings

The water and wastewater treatment market is divided into chemicals, equipment, and services. In 2024, the services segment is expected to have the largest market share, which covers activities like designing, installation, operations, maintenance, and other related services. Companies are highly focused on building new treatment plants while ensuring existing facilities run efficiently, which is driving growth. The demand to upgrade outdated sewage treatment systems, mainly in developed countries, is also boosting the demand for services.

In addition chemicals segment includes disinfectants, coagulants and flocculants, pH conditioners, antifoam agents, and scale and corrosion inhibitors. Among these, coagulants and flocculants play a key role in sludge treatment by helping sedimentation. The equipment segment, on the other hand, biological systems, covers filtration, demineralization, disinfection, sludge treatment, and more.

Moreover, filtration equipment is expected to have a significant market share, but disinfection equipment is expected to grow the fastest. Governments are planning major investments in disinfection technologies to control the spread of diseases through drinking water, fueling the demand for this equipment.

By Process

The tertiary treatment process is anticipated to dominate the water and wastewater treatment market in 2024 and grow the fastest during the forecast period. The tertiary treatment improves the effluent quality before the water is reused or discharged into the environment, which removes any remaining inorganic chemicals, viruses, germs, and parasites after earlier treatments, making the water safe for reuse.

In primary treatment, heavy sediments and floating debris are eliminated by passing wastewater through various tanks and filters to separate water from pollutants. Over time, the wide application of primary treatment is expected to grow, driven by its low operating costs and strong market visibility. Further, the secondary treatment process is anticipated to be a significantly growing category in the coming years. It looks at removing soluble organic matter, like compounds like phosphorus and nitrogen, using methods like trickling filters, bio-towers, rotating biological contactors, and activated sludge systems.

In addition, secondary treatment can involve either aerobic or anaerobic biological processes. A more advanced solution is the membrane bioreactor (MBR), which integrates traditional biological treatments with membrane filtration for more effective particle removal. MBRs use microfiltration or ultrafiltration membranes to improve solid-liquid separation, improving efficiency and ensuring better water quality.

By Application

The industrial sector is anticipated to lead the water and wastewater treatment market in 2024. Industrial operations produce numerous pollutants that need proper treatment before being released into the environment to meet strict environmental regulations. Regulatory authorities enforce strict wastewater discharge standards, driving industries to adopt effective treatment solutions. With developments in technology, it has become more practical for industries to treat wastewater on-site or recycle it for reuse within their operations.

Innovative methods like membrane filtration, biological treatments, and advanced oxidation processes provide effective and affordable ways to handle the complex pollutants found in industrial wastewater. These technologies not only help industries comply with regulations but also reduce operational costs by allowing water reuse, making treatment more sustainable and cost-effective over time.

The Water and Wastewater Treatment Market Report is segmented on the basis of the following

By Offerings

- Chemicals

- pH Conditioners

- Coagulants & Flocculants

- Disinfectants & Biocidal Products

- Scale & Corrosion Inhibitors

- Antifoam Chemicals

- Others

- Equipment

- Biological

- Filtration

- Sludge Treatment

- Disinfection

- Demineralization

- Others

- Services

- Designing & Installation

- Operations

- Maintenance

- Others

By Process

- Primary

- Primary Clarifier

- Sludge Removal

- Grit Removal

- Pre-Treatment

- Others

- Secondary

- Activated Sludge

- Sludge Treatment

- Others

- Tertiary

- Tertiary Clarifier

- Filters

- Chlorination Systems

- Others

By Application

- Municipal

- Industrial

- Food & Beverage

- Power Generation

- Pharmaceuticals

- Pulp & Paper

- Oil & Gas

- Petrochemical

Regional Analysis

Asia Pacific as a region is anticipated to hold the largest share of the water and wastewater treatment market,

accounting for 36.4% of the total revenue in 2024, and is expected to maintain steady growth in the coming years. A rise in awareness among consumers & industries about the importance of water conservation and environmental protection is a major factor driving market growth.

The region also benefits from the presence of several well-established and emerging companies in the water treatment industry, including key players like SUEZ SA and Veolia Water Solutions and Technologies. These companies are actively contributing to the development and adoption of advanced treatment technologies, further enhancing the region's market position.

Further, the Latin American market is expected to grow significantly over the forecast period. Governments & regulatory bodies in the region are building new initiatives to improve water quality and promote sustainable water management practices, which focus on sustainability and are boosting demand for advanced treatment solutions. In addition, the presence of key industries, such as pharmaceuticals, food and beverage, and chemicals, is creating a need for effective wastewater treatment systems to comply with environmental regulations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The water and wastewater treatment market is highly competitive, with numerous global and regional players providing various solutions. Companies compete by developing advanced technologies, like membrane filtration, biological treatments, and smart monitoring systems, to enhance efficiency and meet regulatory standards. Innovation, sustainable practices, and cost-effective solutions are key factors driving competition.

Market players also look to expand their service offerings, form strategic partnerships, and target emerging markets to strengthen their position. As environmental regulations become stricter & demand for water treatment grows, competition is expected to intensify, with companies striving to stay ahead through continuous improvement and innovation.

Some of the prominent players in the global Water and Wastewater Treatment are

- DuPont

- 3M

- Xylem

- Veolia

- Suez world

- Kemira

- Ecolab

- Acciona

- BioMicrobics

- Trojan Technologies

- Other Key Players

Recent Developments

- In September 2024, Axius Water announced the acquisition of MITA Water Technologies, which follows the successful partnership forged in 2022 to use Axius’ U.S.-based manufacturing facility in Columbia, Missouri to become the manufacturing facility for Made-in-America MITA pile cloth filters for North American customers.

- In April 2024, Thermax Ltd plans to have an over INR 1000 CR order book in its water and wastewater solutions business FY 2024, as it announced the opening of its first manufacturing facility for water and wastewater treatment solutions in Pune.

- In March 2024, Iraq plans on constructing new water treatment supports for essential housing developments and other regions lacking such infrastructure, as the selected consultancy firm will undertake comprehensive studies to determine the requisite number of units and associated costs.

- In January 2024, Thames Water unveiled the sewage sludge will be used to heat homes in West London early, after delivering its second gas-to-grid (G2G) project at its Mogden Sewage Treatment Works (STW), as they utilize the firm established at Deephams STW in North London in 2021, where biogas is converted into biomethane to heat homes in Enfield, served as the blueprint for Mogden project.

- In January 2024, ABB acquired Canadian company Real Tech, which allows real-time water monitoring and testing. With, as it allows the company to expand its strong presence in the water segment and complement its product portfolio with optical technology important for smart water management.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 72.3 Bn |

| Forecast Value (2033) |

USD 110.0 Bn |

| CAGR (2024-2033) |

4.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 16.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offerings (Chemicals, Equipment, and Services), By Process (Primary, Secondary, and Tertiary), By Application (Municipal and Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

DuPont, 3M, Xylem, Veolia, Suez world, Kemira, Ecolab, Acciona, BioMicrobics, Trojan Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Water and Wastewater Treatment Market size is expected to reach a value of USD 72.3 billion in 2024 and is expected to reach USD 110.0 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Water and Wastewater Treatment Market with a share of about 36.4% in 2024.

The Water and Wastewater Treatment Market in the US is expected to reach USD 16.3 billion in 2024.

Some of the major key players in the Global Water and Wastewater Treatment Market are DuPont, 3M, Xylem, and others.

The market is growing at a CAGR of 4.8 percent over the forecasted period.