Water testing equipment is crucial for assessing water safety and quality by measuring various parameters like pH, turbidity, total dissolved solids (TDS), temperature, and potential contaminants. These devices are vital in sectors ranging from municipal water treatment and industrial purification to environmental monitoring and residential safety. They ensure that water complies with health and environmental regulations.

The water testing equipment market is set to grow in 2024, driven by increasing demands for clean water, tightening global water quality standards, and advances in technology. Both established companies and new entrants have significant opportunities in this expanding market.

Smaller firms can make a mark with portable, user-friendly testing kits suitable for remote or developing areas. These companies can also form strategic alliances with governmental and non-governmental organizations to boost water quality monitoring efforts.

Larger firms are enhancing their market presence by integrating advanced technologies like the Internet of Things (IoT), which boosts the accuracy of water quality measurements.

For example, studies have shown that IoT-based systems can achieve 95% accuracy in measuring critical water parameters, a noticeable improvement over the 85% accuracy of traditional methods. This not only improves the reliability of water testing but also enhances data analysis, leading to more informed water management decisions.

Current trends in the market include the adoption of smart technologies like IoT and artificial intelligence, which facilitate real-time data monitoring and predictive analytics. These innovations are revolutionizing water management by allowing proactive measures against contamination and optimizing system operations.

Additionally, there is a growing emphasis on sustainability, with technologies that help reduce waste and improve water efficiency. These efforts align with global sustainability goals and appeal to environmentally conscious consumers.

Stricter regulatory standards worldwide are also pushing the demand for sophisticated water testing equipment to ensure compliance and safeguard public health. The need for such advanced solutions is underscored by WHO data from 2022, revealing that at least 1.7 billion people globally used drinking water sources contaminated with feces, and 292 million faced difficulties in accessing clean water.

Key Takeaways

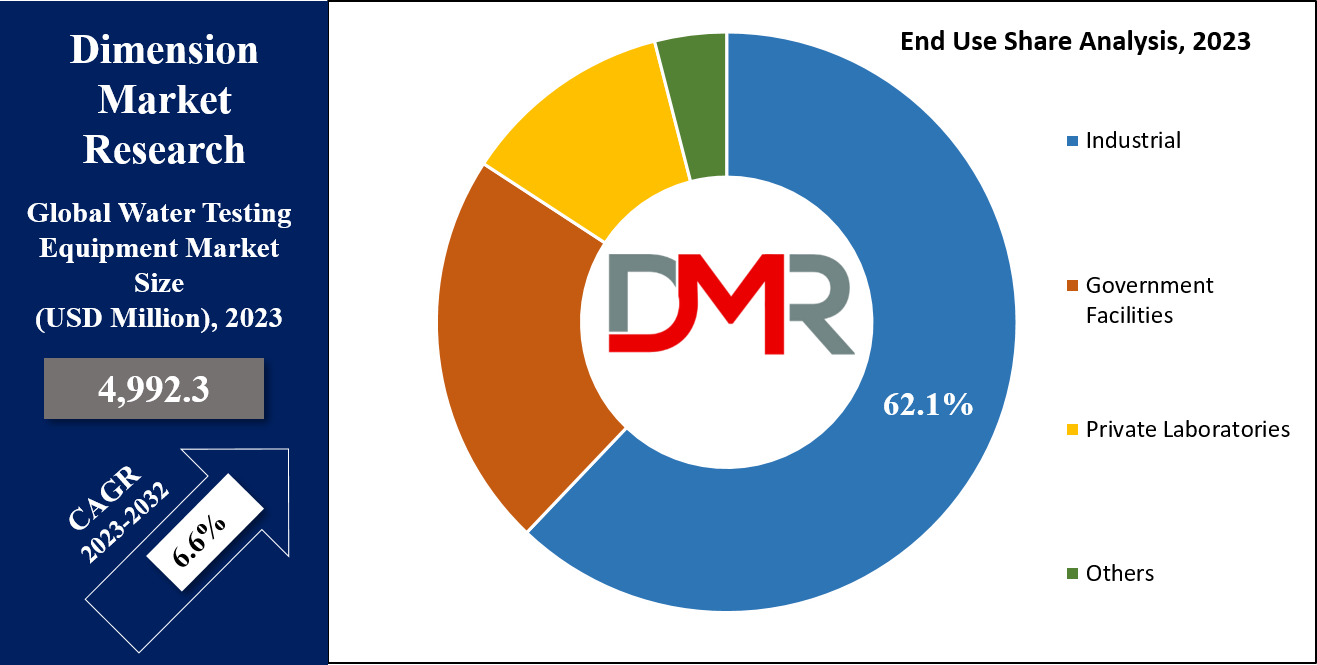

- The Global Water Testing Equipment Market is anticipated to reach a value of USD 4,992.3 million in 2023, with a CAGR of 6.6% from 2023 to 2032.

- Electrochemistry is the leading segment in 2023, preferred for its chemical selectivity, compact size, versatility, and minimal waste production.

- Benchtop or stationary devices dominate the market, valued for their portability and comprehensive testing capabilities, especially in remote rural areas.

- Physical tests hold a significant market share in 2023, driven by heightened awareness of waterborne diseases.

- Spectrometers lead the instrument segment by assessing water purity and quality across multiple applications.

- The industrial segment leads in market share in 2023, capitalizing on extensive water use in sectors such as food & beverages, chemicals, and mining.

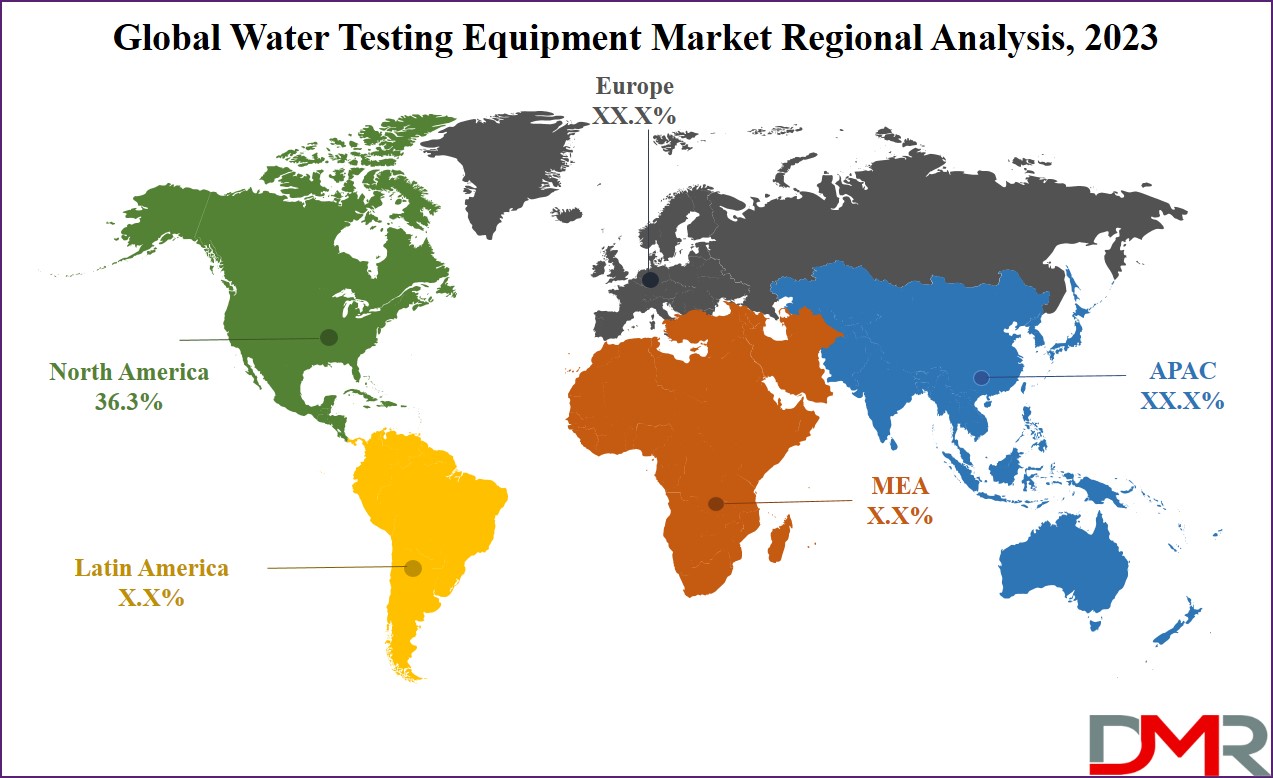

- North America holds the largest market share at 36.3% in 2023, bolstered by stringent regulations like the Clean Water Act, which enforces water quality standards.

Market Dynamic

The increasing desire for bottled water is fostered by customers' preferences for better-quality water for drinking, concerns related to diseases arising from contaminated tap water, & the convenience of portable bottled water. However, the ecological impact of

plastic pollution poses a barrier to the growth of the market. Additionally, there are

health concerns related to the consumption of water from water bottles.

Nevertheless, the market may find growth opportunities via the development of environmentally friendly packaging & flavored water with regulated components. In emerging nations, such as China & India, strict government policies on the usage of water in the beverages, food &

pharmaceutical sectors lead to entry barriers for players that depend on tested water. These players are expected to fix water testing equipment & follow the strict norms.

The acceptance of stringent water quality testing protocols & the increasing demand for advanced & developed techniques present further growth prospects for the water testing equipment market during the forecast period (2023-2032). Nonetheless, the market faces challenges because of the high costs of the equipment & a shortage of trained laborers & experts.

Research Scope and Analysis

By Technique

Electrochemistry emerges as the leading segment, contributing the maximum share in 2023. Electrochemical methods are usually preferred because of their chemical selectivity, compact size, application versatility, & minimal secondary waste generation.

Equipment for electrochemical Measurement is used to look for several variables, such as conductivity, pH, dissolved oxygen, redox, and TDS (total dissolved solids). This technique provides the benefit of on-site applicability & is defined by its ability to adapt to several environments, ease of use, portability, & straightforward operation.

By Device

Under the segmentation, By Device, the benchtop or stationery product type dominates the market, contributing the highest share in 2023. These highly portable, & lightweight systems are mostly made for backpack use & can check both physicochemical & microbiological parameters. They are particularly useful for water engineers involved in monitoring or testing in remote rural areas with challenging geographical areas.

The significant share of portable & handheld devices in the market is driven by the increasing need for tools of water testing that provide portability and can be utilized in makeshift laboratories & fields to assess chemical, microbiological & physical pollutants. Furthermore, this segment is expected to achieve the highest compound annual growth rate in the upcoming years.

By Test

Physical tests dominate the market, scoring a good chunk of shares in 2023. The need for these tests is expected to surge because of the increased awareness & consciousness regarding waterborne diseases. Physical tests look for several parameters like total solids, color, turbidity, dissolved solids, odor, suspended solids, & taste in water.

Color tests are used as an indicator of the effectiveness of the water treatment system. Turbidity, caused by suspended solids & colloidal matter, can result from microbial growth or soil erosion, elevating the increased filtration costs when the levels of turbidity are high.

Moreover, chemical tests check for pH, the existence of particular chemical parameters, biocides, hardness, highly toxic chemicals, & B.O.D. (Biochemical Oxygen Demand). pH measurement checks the hydrogen ions concentration & indicates water's acidity or alkalinity.

B.O.D. measures the amount of oxygen microbes require to break down degradable organic matter in aerobic environments. High B.O.D. levels suggest organic pollution & insufficient oxygen for living organisms. These chemical tests play a crucial role in water quality assessment & management.

By Instrument

Spectrometers, under the segment of the instrument, lead the market, accounting for the maximum share of the global revenue in 2023. Spectrometers are used to evaluate the purity & quality of water in several applications, such as processed water, drinking water, & wastewater.

TOC (Total Organic Carbon) analysis is an extensively used method to quantify the total carbon content of organic compounds in pure water & aqueous systems. Laboratories & organizations use this analytical technique to assess how well a solution aligns with their processes. Via TOC analysis, several parameters such as total inorganic carbon, total carbon, non-purgeable organic carbon, purgeable organic carbon, & dissolved organic carbon can be accurately checked.

By End Use

The industrial end-use segment dominates the market with a maximum share in 2023. It offers vast opportunities for the utilization of both fresh & processed water across diverse sectors, like food & beverages, chemicals, refineries, mining, and paper & pulp.

The continuous process of urbanization, advancements in technologies & the establishment of numerous manufacturing units have led to a substantial rise in the demand for processed & fresh water, consequently driving market growth in this sector.

In developing nations like China, Turkey, Thailand, India, & Bangladesh, the increasing urban population, growing investments, & supportive government policies aimed at the development of infrastructure are anticipated to result in significant demand for such systems for testing water in the municipal domain. All these reasons are anticipated to fuel the expansion of the water testing equipment industry in these regions.

The Water Testing Equipment Market Report is segmented on the basis of the following:

By Technique

- Molecular Spectroscopy

- Atomic Spectroscopy

- Chromatography & Mass Spectrometry

- Process Analyzer

- Electrochemistry

By Device

- Portable & Handled

- Stationery or Bench-Top

By Test

- Physical

- Chemical

- Biological

By Instrument

- pH Meter

- Dissolved Oxygen Meter

- Conductivity Meter

- Turbidity Meter

- TOC Meter

- Spectrometer

- Chromatograph 4

By End Use

- Industrial

- Governmental Facilities

- Private Laboratories

- Others

Regional Analysis

North America emerges as the leading market, contributing to

36.3% of the share in 2023. The region's strong position can be attributed to various regulations, such as the Clean Water Act, which mandates the designation of surface waters utilized for drinking purposes and the establishment of standards for the quality of water in the United States.

Additionally, this Act mandates initiatives to obstruct the influx of pollutants into these water bodies, & SDWA (Safe Drinking Water Act) guarantees the safety of drinking water for the public in the United States, both of which are anticipated to propel market expansion in the area throughout the projected timeframe.

In the Middle East & Africa, the demand for water testing equipment is projected to experience a significant compound annual growth rate for the period of 2023-2032. The region's market growth can be attributed to increasing investments in the establishment of facilities for the treatment of water, particularly in the Middle East. Moreover, the increasing desire for processed water in the food & beverages sector further propels the market's expansion in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Driven by the increasing demand for tested water, key players in the market are actively expanding their facilities and product portfolios. To gain a competitive edge, companies compete on various aspects, such as service offerings, geographical coverage, and advancements in technologies.

Moreover, players go beyond basic water testing services and provide additional offerings like shelf-life testing, residue and contaminant analysis, and microbiological testing of water. Water testing and analysis are vital components of the food safety ecosystem, ensuring the safety of drinking water, thereby intensifying the competition within the industry

Some of the prominent players in the Global Water Testing Equipment Market are:

- DENSO CORPORATION

- Alpha MOS

- Honeywell International Inc.

- Figaro Engineering Inc.

- SAMSUNG

- AMETEK Inc.

- Microchip Technology Inc.

- Tintometer GmbH

- Agilent Technologies, Inc.

- SGS SA

- Thermo Fisher Scientific, Inc.

- Other Key Players

Recent Developments

- In January 2024, Water-Tech Start-Up Boon shifts its focus to B2C clients, aiming to enhance the accessibility of clean water through innovative consumer-oriented solutions.

- In March 2024, FLC receives $75,000 in funding from the EPA to innovate in water quality testing, enhancing public health and safety measures.

- In July 2024, Pace® Analytical Services expands its environmental testing capabilities with the strategic acquisition of Environmental Services Laboratories.

- In February 2024, ABB enhances its position in the smart water management market by completing the acquisition of Real Tech, a leader in smart water technology.

- In September 2024, Water Engineering broadens its industrial scope by acquiring Gotham Refining Chemical Corp., a move aimed at strengthening its chemical treatment offerings.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 4,992.3 Mn |

| Forecast Value (2032) |

USD 8,909.6 Mn |

| CAGR (2023-2032) |

6.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technique (Molecular Spectroscopy, Atomic

Spectroscopy, Chromatography & Mass

Spectrometry, Process Analyzer, and

Electrochemistry), By Device (Portable & Handled,

Stationery or Bench-Top), By Test (Physical, Chemical,

and Biological), By Instrument (pH Meter, Dissolved

Oxygen Meter, Conductivity Meter, Turbidity Meter,

TOC Meter, Spectrometer, and Chromatography),

and By End-Use (Industrial, Governmental Facilities,

Private Laboratories, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

DENSO CORPORATION, Alpha MOS, Honeywell

International Inc., Figaro Engineering Inc., SAMSUNG,

AMETEL Inc., Microchip Technology Inc., Tintometer

GmbH, Agilent Technologies, Inc., SGS SA, Thermo

Fisher Scientific, Inc, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |