The global wearable activity tracker market has experienced substantial expansion due to increased

health awareness and continuous advancements in wearable technology. Key products of this market include fitness bands, smartwatches, and clothing capable of tracking physical activities like cardio workouts or sleep patterns and monitoring other parameters related to health.

An increasing focus among aging populations on fitness as a form of prevention is leading to further gains for wearable activity trackers, additional growth was driven by remote patient monitoring services during the COVID-19 pandemic outbreak. In addition, with increasing disposable incomes and the general proliferation of smartphones, wearable activity trackers are available to more people.

The Wearable Activity Tracker Market continues to experience rapid expansion, driven by increasing health consciousness and advancements in fitness technology. By 2023, wearable devices with health monitoring features like heart rate tracking, sleep analysis and fitness tracking were widely adopted globally; this surge was driven by global shift towards proactive health management following pandemic outbreaks.

Recent events have shown the rapid development of next-gen wearables by leading tech companies. Innovations like AI-powered health features and integration with IoT platforms have received immense media coverage; consumers are seeking trackers that provide tailored fitness recommendations, real-time health analytics, and integration with smart devices - driving up market demand in various regions across the globe.

As wearable activity trackers advance in sophistication, emerging markets such as Asia-Pacific and Latin America present a vast opportunity for their use. Rising smartphone adoption, combined with increased disposable income and health awareness are opening up new pathways of expansion. Furthermore, increasing use of wearables in healthcare, sports, and wellness sectors further extends this market potential, providing new revenue streams and growth prospects.

North America continues to dominate the market, with 40% of global wearable sales occurring in this region. In terms of device distribution, fitness bands hold a 55% market share, followed by smartwatches at 30%. The Asia-Pacific region is witnessing a surge, with China accounting for over 30% of global wearable shipments, driven by increased health awareness and tech adoption.

However, global market growth can face a problem associated with data privacy concerns and the high cost of advanced devices. North America dominates the market and is followed in the lead by Europe and the Asia-Pacific region. The dominant region harbors companies like Fitbit, Garmin, Apple, and Samsung.

These companies offer their products with different features and at different price points to capture the market. It also believes in the prospects of developing markets where rising disposable incomes and urbanization get smart wearable devices off the ground. A challenge to this area lies in data security concerns and the high costs of advanced devices that have to be worked on for long-term sustainability.

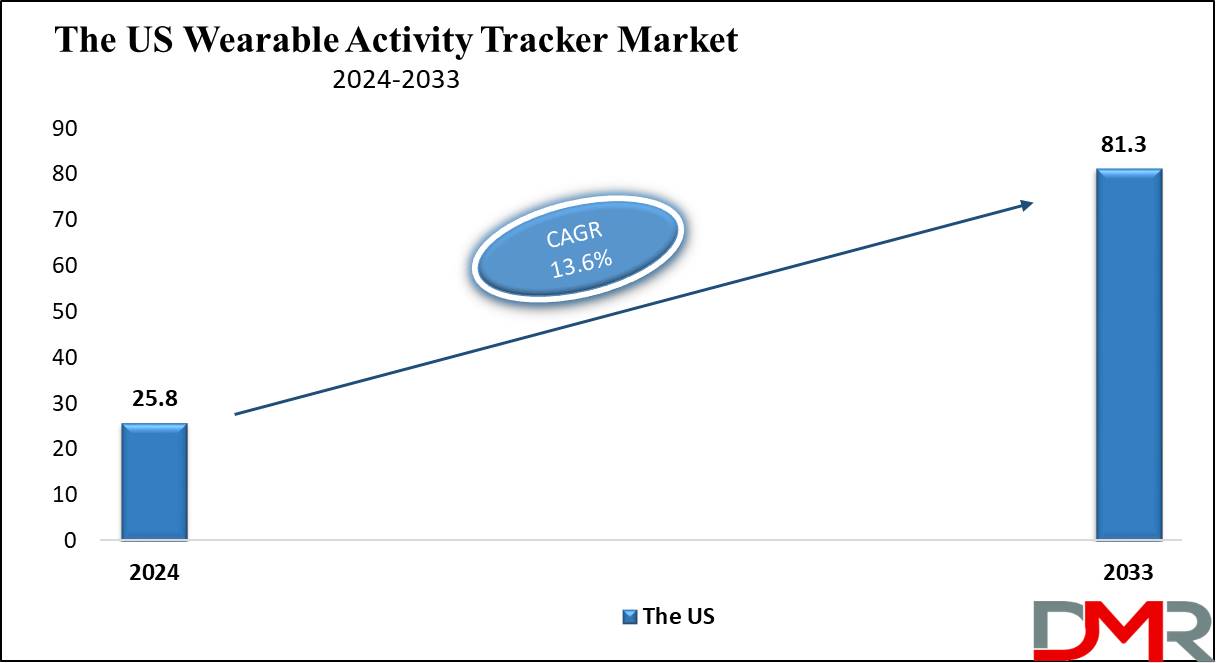

The US Wearable Activity Tracker Market

The US Wearable Activity Tracker Market is projected to be valued at USD 25.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 81.3 billion in 2033 at a CAGR of 13.6%. The US wearable activity tracker market is changing at a rapid speed due to improvements in technology and heightened health awareness of the consumer.

Some of the major trends have been the incorporation of

artificial intelligence and

machine learning that will produce customized, healthier insight and corresponding advice. Other such trends involve advanced sensors for better and more accurate tracking; and stylish designs that hold the ability to function diversely.

- Deals and acquisitions characterize developments in this market among major players looking to enhance their product offerings and market presence. For instance, the acquisition of Fitbit by Google underlines strategies building on its capability in technology and data analytics.

- Market opportunities are pretty high, driven by the growing demand for remote health monitoring solutions and accelerated even more so by the pandemic. Growing adoption within corporate wellness programs through wearable devices, and expanding applications in sports and fitness training, open strong growth opportunities. Moreover, an increase in chronic diseases and the aging population drive the need for continuous health monitoring, thereby fueling more market demand.

Key Takeaways

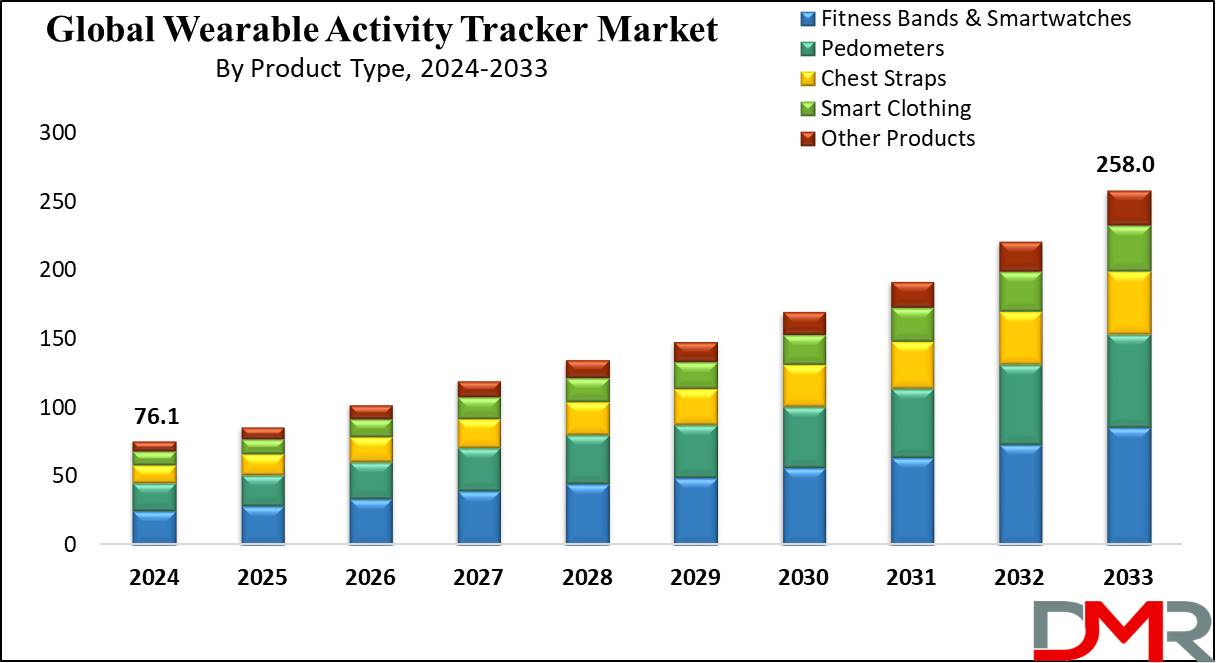

- Global Value: The global wearable activity tracker market size is estimated to have a value of USD 76.1 billion in 2024 and is expected to reach USD 258.0 billion by the end of 2033.

- The US Global Value: The US wearable activity tracker market is projected to be valued at USD 25.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 81.3 billion in 2033 at a CAGR of 13.6%.

- By Product Segment Analysis: Fitness Bands & Smartwatches are expected to command the product segment of this market as they hold 33.2% of the market share in 2024.

- By Component Segment Analysis: Hardware is anticipated to exert its dominance in the component segment in this market as it hold 56.9% of the market share in 2024.

- By Connectivity Segment Analysis: Bluetooth is projected to dominate the connectivity segment in the global wearable activity tracker market as it holds 43.0% of the market share in 2024.

- By Application Segment Analysis: Heart rate is projected to dominate the application segment as it holds 28.1% of the market share in 2024.

- By Distribution Channel Segment Analysis: The online distribution channels are projected to dominate this segment as it holds 57.8% of the market share in 2024.

- Regional Analysis: North America is expected to have the largest market share in the global wearable activity tracker market with a share of about 40.3% in 2024.

- Global Growth Value: The market is growing at a CAGR of 14.5 percent over the forecasted period.

Use Cases

- Fitness Monitoring: Fitness monitoring helps users set and achieve fitness goals by tracking steps taken, calories burned and distance covered, providing insight into maintaining an active lifestyle over time and measuring progress over time.

- Heart Rate Monitoring: Measures heart rate continuously to provide insights into cardiovascular health and workout intensity, helping users optimize their workout regimen and monitor for irregularities that might indicate health concerns.

- Sleep Tracking: Track sleep patterns and quality to help improve hygiene and well-being, offering insights that enable users to modify their behaviors to increase duration and quality.

- Stress Management: Analyzing physiological indicators to effectively track stress, offering relaxation techniques to combat it, and promoting mental wellness for users by helping identify and reduce daily stressors in their daily lives. This feature promotes mental well-being by aiding identification and management.

- Chronic Disease Management: Wearable devices provide effective means of chronic disease management by continually monitoring glucose levels and offering actionable data, aiding timely interventions for improved disease administration.

Market Dynamic

Trends

Integration of AI and ML

The incorporation of artificial intelligence (AI) and machine learning (ML) in wearable activity trackers enables personalized health insights and predictive analytics in wearable activity trackers. What these technologies do in such wearables is drive improved user experience with tailored advice and anomaly detection in health data for better preventive health care. AI-driven features, such as smart coaching, real-time health monitoring, and advanced fitness tracking, are becoming a standard and driving the growth of the market.

Advancements in Sensor Technology

The invention of world-class sensors has vastly advanced the accuracy and functionality of wearable of activity trackers. The new-generation sensors will be able to measure an extremely wide range of biometric data from ECG and SpO2 to hydration levels besides fundamental metrics such as steps and heart rate. These improvements make wearables more attractive to the health-conscious consumer and health provider, considering remote monitoring, further expanding the potential applications in the market.

Growth Drivers

Growing Health Awareness

Growing health consciousness and fitness, in general, are the primary driving forces for growth in the wearable activity tracker space. An increasing consumer base is utilizing wearables to monitor their physical activities, and weight management, and to avoid diseases related to lifestyle-related diseases. This trend further unfolds in the rise in incidences of chronic diseases and preventive healthcare globally.

Technological Advancements

Technological developments, such as the more advanced sensors that are being embedded, the increasing battery life, and improved connectivity features across wearable technologies, will continue to drive growth. Multifunctional devices being developed nowadays have combinations of both fitness tracking and health monitoring and also have smart features, hence apt for a wide range of consumers right from fitness enthusiasts to health professionals.

Growth Opportunities

Expansion in Emerging Markets

Emerging markets provide major growth opportunities for the wearable activity tracker market. Increasing disposable incomes, urbanization, and rising awareness of health in countries like India and China are driving the adoption of wearables. Government initiatives to promote

digital health and physical fitness further drive market expansion in these regions.

Corporate Wellness Programs

The increased adoption of wearable activity trackers in corporate wellness programs presents very good growth opportunities. Companies are increasingly making investments in health and wellness initiatives in order to improve productivity while at the same time improving the overall well-being of their employees. Wearable devices have started to be central to such initiatives, providing users with real-time health insights plus physical activity and reduction in expenses related to health through preventive measures.

Restraints

Data Privacy Concerns

The theft of sensitive health information by wearable activity trackers has led to major concerns about the privacy and security of the data. Data poses another major restraint in the wearable activity tracker market. With growing concern regarding privacy, the data that is collected from consumers regarding their health and habits becomes the most important to protect. Security problems can lead to broken trust among consumers and consequently to the reluctance to use such wearable equipment.

High Costs of Advanced Devices

The high cost of advanced wearable activity trackers can hamper their market growth, especially in price-sensitive markets. Even though basic fitness bands are relatively cheap, advanced features make a device expensive with ECG monitoring, GPS, and artificial intelligence integration. This basically creates a very wide price gap, limiting the diffusion of high-end wearables to a larger section of the consuming population.

Research Scope and Analysis

By Product Type

Fitness Bands & Smartwatches are projected to dominate the product segment of this market as they hold 33.2% of the market share in 2024. Fitness bands rule this wearable activity tracker product type segment due to the aspects of being inexpensive, easy, and simply very popular.

This device provides basic tracking features like step counting, calorie burn, heart rate monitoring, and sleep tracking at a low cost compared to the more technologically advanced smartwatches and smart clothing. Their relatively low price makes them more attractive to a bigger section of the market including those new to wearable technology and budget-conscious individuals.

The simplicity and user-friendliness of fitness bands also explain their dominance. The devices are characterized by simple interfaces and functions that best suit users who desire basic fitness and health monitoring. In sharp contrast to smartwatches, which can be complex and multifunctional, the fitness band focuses on key health metrics that appeal to the simplicity of users.

Moreover, fitness bands run for a longer time compared to smartwatches; they often run for days on a single charge. Convenience is one of the major benefits not only because the users do not have to charge their devices frequently but also to keep track of activities.

They just so happen to be versatile, so they can fit quite seamlessly into many lifestyles from casual users to fitness enthusiasts. Also, the lightweight and sleek design makes them very comfortable to wear all day. On the whole, it is the combination of affordability, simplicity, and functionality that has made fitness bands number one in the wearable activity tracker market.

By Component

Hardware is anticipated to exert its dominance in the component segment in the global wearable activity tracker market as it hold 56.9% of the market share in 2024. Hardware components dominate the market since they are used to enhance the functionality, performance, and reliability of a device. Hardware is the backbone of wearable activity trackers, endowed with essential elements such as sensors, processors, displays, and batteries. Data tracking in this respect relies on simple sensors such as accelerometers, gyroscopes, and heart rate monitoring.

At a higher level of sensor sophistication, such data inclusive of steps, distances, heart rate, and sleep pattern, among other important statistics can be recorded with a high degree of accuracy by the wearable device. Its further improvement and miniaturization enable greater functionality and increased adoption of wearables, hence driving market growth.

Another important hardware component includes processors. Processors process all your data, run applications, and ensure the smooth functioning of devices. High-performance and low-power processors support advanced capabilities such as real-time health monitoring, AI-driven insights, and seamless connectivity to other devices.

They can also be simple or advanced and offer an interface to the user with his device, his data, and notifications. The development of high-resolution, touch-sensitive, and energy-efficient displays improves the experience and satisfaction of users.

Overall, usability in wearable activity trackers is influenced by batteries. Hence, the selling point becomes longer battery life since continuous usage without frequent recharging of the device can be implemented. Further innovations in battery technology related to longer-running and faster-charging batteries are what encourage hardware dominance in this competitive market.

By Connectivity

Bluetooth is projected to dominate the connectivity segment in the global wearable activity tracker market as it hold 43.0% of the market share in 2024. The major share of wearable activity trackers in the market is owed to Bluetooth connectivity, which is widespread availability, low power consumption, and ease of use. Almost all smartphones, tablet computers, or notebooks that are contemporary concerning make is Bluetooth enabled, thus making this technology go in sync with wearable devices for easy connectivity.

This facilitates seamless integration and synchronization between a wearable device and other devices, thus ensuring consistency and reliability for the user. Of all the variants of Bluetooth low energy (BLE) technology stands out for its very low power consumption most suitable for wearables. Activity trackers are designed to be worn throughout, and BLE is energy-efficient, extending battery life while reducing time spent recharging. This feature guarantees engagement and satisfaction among users.

Moreover, Bluetooth ensures uninhibited and perfectly secure connectivity for data being transmitted by the wearables in question to their respective paired devices. The pairing process is easy and allows real-time data transfer, facilitating the instant view of health metrics or receiving notifications on wearable devices by end-users.

This ease of pairing with automatic reconnect makes Bluetooth a loved technology by both manufacturers and consumers. Overall, with universal compatibility, energy efficiency, and ease of use, this trio cements Bluetooth's position to lead in the connectivity segment of the wearable activity tracker market.

By Application

Heart rate is projected to dominate the application segment as it holds 28.1% of the market share in 2024. Heart rate tracking leads to more extent in the application segment of the wearable activity tracker market since this parameter is critical in health and fitness monitoring. Proper heart rate feed provides on-beat information related to cardiovascular health, exercising intensity, and level of fitness, hence, it turns out to be a core feature for the majority of users.

Heart rate monitoring in wearables enables the display of resting heart rate, checking on the variability of the heart rate, and measuring real-time heart rate during various activities such as running, cycling, and workouts. This information is very critical to any individual who desires an optimized training regime, stress management, and improvement of their physical performance.

Moreover, it does not represent an activity that is a favorite for fitness enthusiasts only; on the contrary, heart rate tracking appeals to a much larger population of people concerned about general health and well-being. Wearable activity trackers that supply their users with heart rate monitoring can alert them to irregular heart rhythms or possible cardiovascular illnesses; thus, it allows detection and elimination of the cause at an early stage. It has increased demand for wearables tracking heart rate in view of this health-related functionality and dominates the market accordingly.

Advanced sensors and algorithms have improved the accuracy and reliability of heart rate monitoring by a long shot in wearable devices, hence their popularity. On wearable devices, an aspect of activity trackers, heart rate remains one of the more imperative desirable features especially now with health consciousness at its peak worldwide.

By Distribution Channel

The online distribution channels are projected to dominate this segment as it holds 57.8% of the market share in 2024. The online distribution channel strongly dominates the market of wearable activity trackers, largely due to its convenience, rich variety of products, and competitive pricing. Through e-commerce portals, especially Amazon and eBay, and dedicated branded online stores, consumers can select their devices based on their choice from among the plethora of wearable devices available online.

This greatly facilitates feature-price comparison and customer review assessment. This very accessibility and availability of information empower customers to make well-reasoned decisions while purchasing products. Online shopping means that consumers can view product descriptions and shop right from their homes. This is an added advantage in today's world, where everything happens so fast. The ability to shop 24/7 without geographical limitations makes the online platform very attractive, especially to these tech-savvy shoppers who prefer digital transactions.

Furthermore, most online retailers offer competitive pricing with related discounts and promotional offers to make wearable activity trackers more affordable. Many payment options, including installment payments, are also included to enhance the attractiveness connected with online purchasing methods. This trend toward online shopping was also fueled by the COVID-19 pandemic, as most consumers have increased their preference for contactless transactions to be away from physical stores.

In doing so, these increased online sales of wearable devices, giving more impetus to the online distribution channel and further cementing its position. Moreover, it allows manufacturers and brands to enhance their market reach and provide direct-to-consumer sales, thereby cutting out intermediaries and trimming costs. By doing this, they increase the market spread and profitability, hence increasing the dominance of the online channel.

The Wearable Activity Tracker Market Report is segmented on the basis of the following:

By Product Type

- Fitness Bands & Smartwatches

- Pedometers

- Chest Straps

- Smart Clothing

- Other Products

By Component

• Hardware

- Sensors

- Processors

- Displays

- Batteries

- Other Hardware Components

• Software

- Mobile Applications

- Cloud Services

- Operating Systems

- Firmware

By Connectivity

- Bluetooth

- Wi-Fi

- Cellular

- NFC

- Others

By Application

- Heart Rate Tracking

- Stress Management

- Glucose Monitoring

- Running Tracking

- Cycling Tracking

- Other Applications

By Distribution Channel

Regional Analysis

North America is projected to dominate the global wearable activity tracker market as it commands over

40.3% of market share by the end of 2024. The wearable activity tracker market due to high consumer awareness, advanced health facilities, and the presence of major players. It has a highly health-conscious population with an overwhelming recent interest in fitness and wellness.

This awareness has driven demand for wearable activity trackers to track physical activities, heart rate, sleep patterns, and other health-related metrics. The well-developed infrastructure in the region facilitates the use of wearable devices not only for remote patient monitoring but also for the management of chronic diseases.

Wearable activity trackers form a part of telehealth services designed to go forward and provide health professionals with real-time data for effective patient care. This will be more important in the face of rapidly increasing cases of diabetes, heart problems, and other such chronic illnesses.

Many of the major wearable device manufacturers across the world are based in North America, for example, Apple, Fitbit, now part of Google, and Garmin. Innovation and competition spawned from these influential companies drive the development of high-quality wearable activity trackers. These firms are heavily invested in research and development, fast-tracking technological advancement, and enhancing product features that provide important value to consumers.

Additionally, the region has a high penetration of both smartphones and internet connectivity, which will help in the easy integration of wearable devices with mobile applications and cloud services. The strong digital infrastructure, coupled with a tech-savvy population, further boosts the market for wearable activity trackers in North America.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The wearable activity tracker market has many top players who are continuously evolving to enhance their market share. Large companies like Apple, Fitbit (a subsidiary of Google), Garmin, Samsung, and Huawei can easily capture a big chunk of the market through an advanced product offering with considerable brand presence. Apple leads the market with the Apple Watch, thanks to its seamless integration with iOS devices, advanced health tracking features, and an ease-of-use interface giving this watch a big edge over other products in the same category.

At the very core of Fitbit, there is a line of fitness trackers and smartwatches on the market, focusing on features such as health and general well-being. No wonder many people engaging in sports activities would be interested in this brand. Garmin holds enough potential to deliver highly prevalent wearables for outdoor activities and sports through the development of strong GPS capabilities and durability.

While Samsung and Huawei are big players in the space, this list runs the gamut from simple fitness tracking to more advanced smart features, such as notifications, music control, and contactless payments. These companies put their experience in mobile technology to work with functions and features that make their wearables so much in demand in the market.

Additionally, new entrants and startups within the market target niche segments or innovations in features. Many of these companies have differentiated by design, specialized functionality, and aggressive pricing. This heavy competition continues to accelerate innovation, leading to better products and more options for the end consumer buying a wearable activity tracker.

Some of the prominent players in the Global Wearable Activity Tracker Market are:

- Apple Inc.

- Fitbit Inc.

- Samsung Electronics

- Sony Corporation

- Xiaomi

- Garmin Ltd.

- Fossil Group

- Jawbone

- TomTom International BV

- Huawei Technologies Co., Ltd.

- Other Key Players

Recent Developments

- July 2024: Fitbit announced a new feature for its devices, integrating stress management tools using advanced sensors and AI algorithms. This feature helps users monitor their stress levels throughout the day, providing actionable insights and guided breathing exercises to manage stress effectively. The update is aimed at enhancing overall well-being and mental health.

- June 2024: Apple introduced new health features in the Apple Watch, including sleep apnea detection and advanced glucose monitoring capabilities. Sleep apnea detection uses machine learning algorithms to analyze breathing patterns during sleep, alerting users to potential issues. The glucose monitoring feature is designed to help diabetic users manage their blood sugar levels more effectively without the need for invasive procedures.

- May 2024: Garmin launched a new line of wearables focused on professional athletes, featuring enhanced performance metrics and recovery insights. These devices include advanced VO2 max tracking, lactate threshold monitoring, and personalized training plans. Garmin's new wearables also offer comprehensive recovery data, helping athletes optimize their training and avoid overtraining.

- April 2024: Huawei unveiled its latest smartwatch with improved battery life and new health tracking features, including SpO2 (blood oxygen) monitoring. The SpO2 sensor helps users keep track of their oxygen saturation levels, which is particularly useful for high-altitude activities and monitoring respiratory health. The new smartwatch also features enhanced fitness tracking and stress monitoring.

- March 2024: SAMSUNG released an update for its Galaxy Watch series, adding ECG (electrocardiogram) monitoring and blood pressure tracking. The ECG feature allows users to detect signs of atrial fibrillation, a common heart rhythm disorder, while the blood pressure monitoring feature helps users manage hypertension. These health-tracking capabilities make the Galaxy Watch a more comprehensive health tool.

- February 2024: WHOOP, a fitness and health tracking company, secured $100 million in funding to expand its wearable product line and research capabilities. The funding will be used to enhance WHOOP's existing offerings, which focus on recovery and performance optimization for athletes. The company plans to invest in advanced analytics and machine learning to provide deeper health insights.

- January 2024: Oura Ring announced a partnership with several healthcare providers to use its wearable rings for remote patient monitoring. The Oura Ring, known for its accuracy in tracking sleep and activity, will be used to monitor patients' vital signs and health metrics remotely. This partnership aims to improve patient outcomes by providing real-time health data to healthcare professionals.

- December 2023: Amazfit introduced a new fitness band with advanced AI-driven health insights and long battery life. The new fitness band features heart rate monitoring, sleep tracking, and personalized fitness recommendations. Amazfit's AI algorithms analyze user data to provide tailored health advice and activity suggestions, enhancing user engagement and health outcomes.

- November 2023: Google Fit integrated with more third-party apps, enhancing its ecosystem for wearable device users. This integration allows users to consolidate their health and fitness data from various sources, providing a more comprehensive view of their well-being. Google Fit's expanded ecosystem supports a wide range of health and fitness activities, from running and cycling to meditation and nutrition tracking.

- October 2023: Polar launched a new wearable focusing on recovery and sleep tracking for athletes and fitness enthusiasts. The device offers detailed insights into sleep quality, recovery status, and training load. Polar's new wearable is designed to help users balance their training and recovery, preventing overtraining and improving overall performance.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 76.1 Bn |

| Forecast Value (2033) |

USD 258.0 Bn |

| CAGR (2024-2033) |

14.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 25.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Fitness Bands & Smartwatches, Pedometers, Chest Straps, Smart Clothing, and Other Products), By Component (Hardware, and Software), By Connectivity (Bluetooth, Wi-Fi, Cellular, NFC, and Others), By Application (Heart Rate Tracking, Stress Management, Glucose Monitoring, Running Tracking, Cycling Tracking, and Other Applications), By Distribution Channel (Online, and Offline) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Apple Inc., Fitbit Inc., Samsung Electronics, Sony Corporation, Xiaomi, Garmin Ltd., Fossil Group, Jawbone, TomTom International BV, Huawei Technologies Co. Ltd., and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |