Market Overview

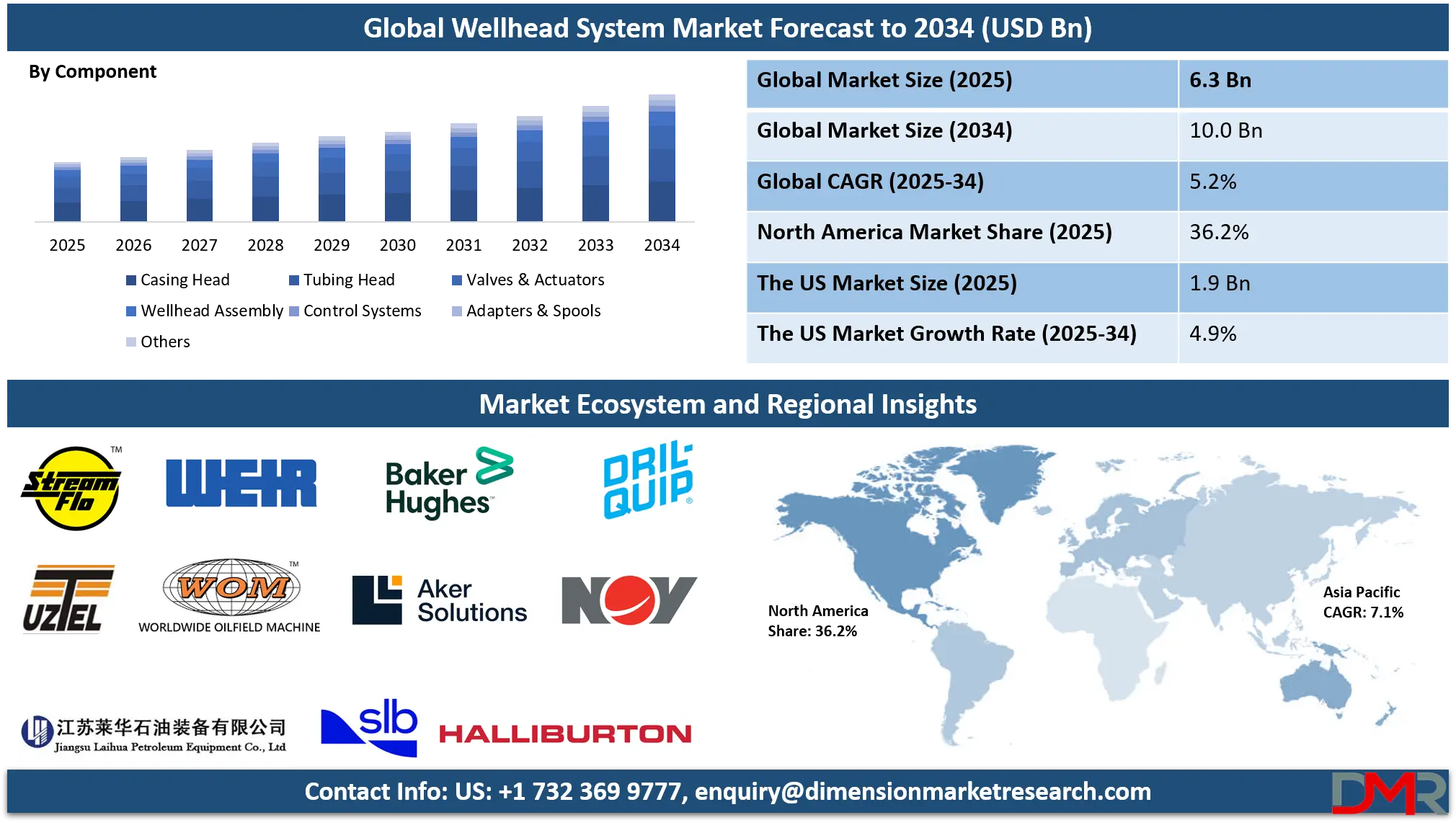

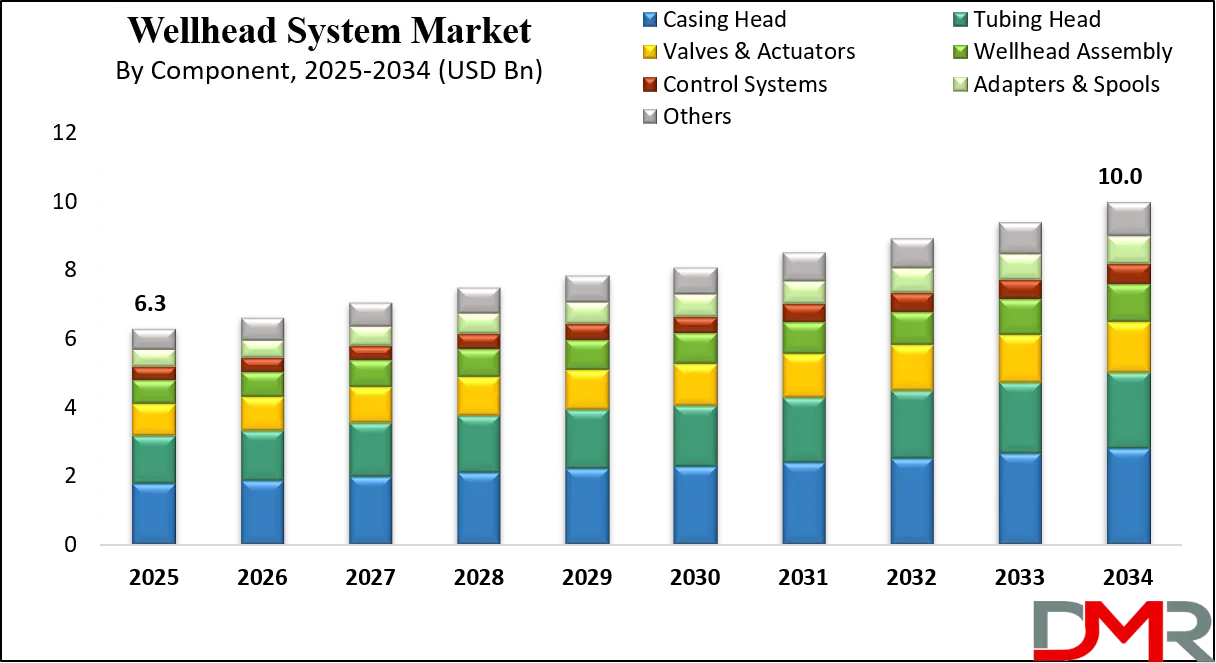

The Global Wellhead System Market is projected to reach USD 6.3 billion in 2025 and is expected to grow at a CAGR of 5.2% from 2025 to 2034, attaining a value of USD 10.0 billion by 2034. This steady growth is underpinned by resilient global energy demand, sustained upstream capital expenditure despite energy transition narratives, and the imperative to maintain and extend the life of billions of existing producing wells worldwide.

A wellhead system serves as the critical primary safety and pressure containment interface at the surface (or seabed) of a well, providing structural support for casing strings, housing the tubing head and Christmas tree, and enabling controlled production, injection, or well intervention activities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market evolution is characterized by a dual demand driver: high-volume, standardized systems for prolific onshore shale plays and technologically advanced, high-specification systems for complex offshore and deepwater environments. The post-pandemic recovery in oil prices, stabilization of supply chains, and strategic national focus on energy security are catalyzing new project sanctions, particularly in offshore Latin America, the North Sea, and the Middle East. Concurrently, the mature asset base in regions like North America and Asia-Pacific necessitates a continuous cycle of wellhead maintenance, workovers, and integrity upgrades, creating a robust and less cyclical aftermarket segment.

Technological innovation is a central theme, focused on enhancing safety, operational efficiency, and environmental compliance. Advancements include the integration of real-time digital monitoring sensors, the development of corrosion-resistant alloys and elastomers for sour service, the miniaturization and modularization of components for faster installation, and the emergence of all-electric actuation systems to replace hydraulic controls. Furthermore, the industry's digital transformation integrates wellheads into IoT-enabled asset performance management platforms and digital twin simulations, facilitating predictive maintenance and remote operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

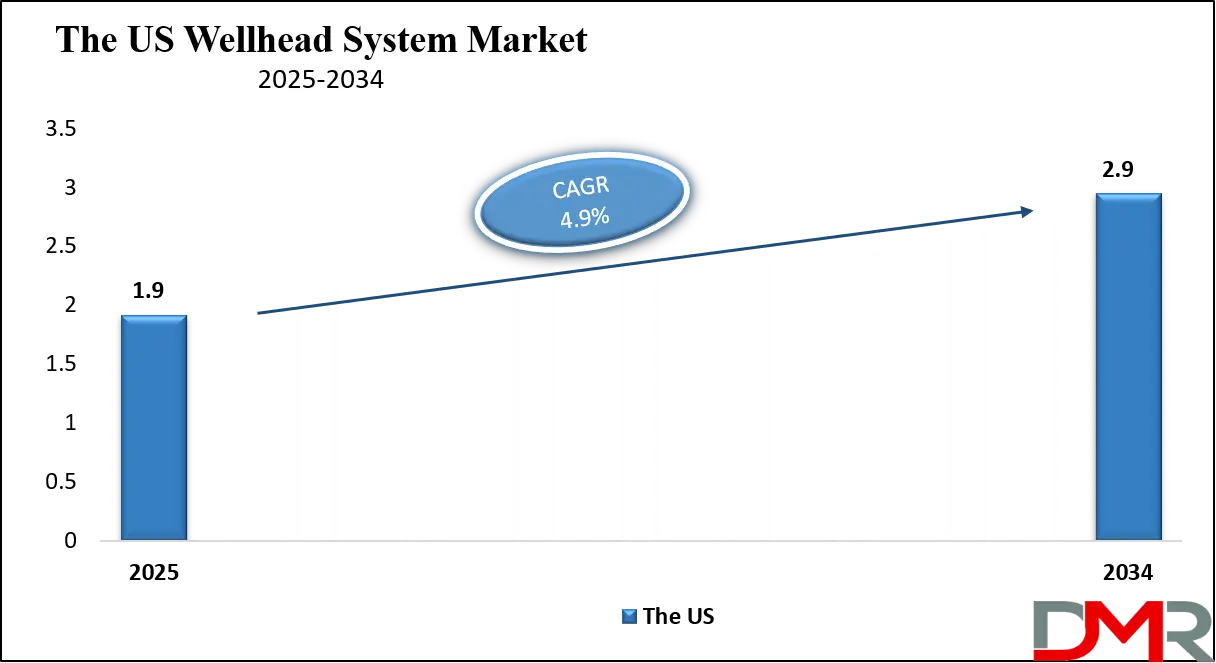

The US Wellhead System Market

The U.S. Wellhead System Market is a global bellwether, projected to reach USD 1.9 billion in 2025 and grow at a CAGR of 4.9%, reaching USD 2.9 billion by 2034. Its dominance is anchored in the world's most active and technologically advanced onshore drilling sector, centered on major shale plays like the Permian Basin, Eagle Ford, and Bakken. The high pace of drilling, completion, and workover operations in these regions generates consistent, high-volume demand for land wellhead systems. This demand is for robust, standardized equipment capable of withstanding the intense pressure cycles and large fluid volumes associated with modern multi-stage hydraulic fracturing.

Simultaneously, the U.S. Gulf of Mexico remains a critical arena for offshore and deepwater development, driving demand for sophisticated surface and subsea wellhead systems. Projects here often serve as technology proving grounds for high-pressure, high-temperature (HPHT) applications and advanced subsea tie-backs. Regulatory oversight from the Bureau of Safety and Environmental Enforcement (BSEE) mandates rigorous safety and environmental standards, continually pushing the specification envelope for equipment used in federal waters.

The competitive landscape is intensely served by both global oilfield service giants and specialized domestic manufacturers. Companies like Schlumberger (SLB), Halliburton, Baker Hughes, and NOV leverage their integrated service models, while specialists like Dril-Quip and Stream-Flo compete on engineering excellence and reliability. A key trend is the integration of digital monitoring solutions directly into wellhead equipment, allowing operators to optimize production, ensure safety compliance, and transition towards predictive maintenance models. The U.S. market's growth, while tied to commodity cycles, is structurally supported by vast hydrocarbon resources, extensive infrastructure, and a culture of continuous operational innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Wellhead System Market

The Europe Wellhead System Market, projected at approximately USD 1,125 million in 2025 and reaching around USD 1,865 million by 2034 (CAGR ~5.7%), is defined by its mature yet innovative offshore sector, particularly in the North Sea. The United Kingdom and Norway are the central hubs, where activity is characterized by a mix of new high-pressure/high-temperature (HPHT) field developments, subsea tie-backs to existing infrastructure, and major brownfield redevelopment projects aimed at extending field life. This environment demands highly engineered, reliable, and safety-critical wellhead systems.

European market dynamics are heavily influenced by stringent regulatory frameworks, such as the EU's Offshore Safety Directive and rigorous standards from bodies like the UK's Health and Safety Executive (HSE) and Norway's Petroleum Safety Authority (PSA). These regulations elevate the importance of equipment integrity, redundancy, and environmental protection.

Furthermore, the region is at the forefront of integrating digitalization and decarbonization into upstream operations. This includes piloting all-electric wellhead systems to eliminate hydraulic fluid leaks, employing digital twins for integrity management, and designing equipment with eventual decommissioning and recyclability in mind.

The Japan Wellhead System Market

The Japan Wellhead System Market is a specialized and technologically advanced segment, valued at approximately USD 285 million in 2025 and projected to reach USD 410 million by 2034, growing at a moderate CAGR of around 4.1%. This growth is primarily driven by the country's strategic focus on energy security and the need to maximize production from its declining, yet significant, domestic hydrocarbon resources. Japan possesses limited conventional reserves, with most activity concentrated in offshore fields, notably in the Sea of Japan and the East China Sea. Consequently, the market is dominated by demand for offshore platform and subsea wellhead systems, characterized by high engineering standards and reliability for challenging marine environments.

A key national driver is the sustained investment in upstream exploration by entities like INPEX and Japan Petroleum Exploration Co., Ltd. (JAPEX), supported by government incentives aimed at reducing reliance on energy imports. Furthermore, Japan's pivotal role as a global leader in LNG importation creates a parallel demand for wellhead systems associated with domestic natural gas production, which is prioritized as a cleaner transitional fuel.

The market is also influenced by Japan's world-class expertise in precision manufacturing, robotics, and corrosion-resistant materials, which are integrated into high-specification wellhead equipment, often supplied by international leaders through local partnerships. While the scale is smaller than major producing regions, Japan's market is defined by its emphasis on technological sophistication, safety, and maximizing efficiency in a mature and logistically complex operating environment.

Global Wellhead System Market: Key Takeaways

- Steady Global Expansion: The market is set to grow from USD 6.3 billion in 2025 to USD 10.0 billion by 2034, reflecting a stable CAGR of 5.2%, supported by foundational global energy needs and ongoing upstream investments.

- Technology as a Differentiator: Innovation in digital monitoring, materials science (HPHT/sour service), modular design, and all-electric systems is transforming wellhead functionality, focusing on safety, efficiency, and lifecycle cost reduction.

- Dual-Speed Market Dynamics: High-volume, cost-competitive demand from onshore shale (led by the U.S.) and Middle East mega-projects coexists with high-value, specification-intensive demand from complex offshore and deepwater projects (North Sea, Brazil, Guyana).

- Aftermarket as a Stability Pillar: The vast global installed base of wells creates a substantial, less cyclical aftermarket for maintenance, repair, parts, and integrity-related upgrades, providing revenue stability for service companies.

- Regional Leadership and Growth: North America, led by the U.S., holds the largest revenue share 36.2% in 2025, while Asia-Pacific is projected to exhibit the highest CAGR, driven by national energy security agendas in India, China, and Southeast Asia.

- Regulatory & Environmental Influence: Stringent safety and environmental regulations worldwide are non-negotiable drivers of wellhead system design, mandating higher integrity standards and influencing the adoption of cleaner technologies like electric actuation.

Global Wellhead System Market: Use Cases

- Multi-Well Offshore Platform Development: Installation of standardized surface wellhead systems on a fixed jacket or floating platform for a cluster of directional wells, enabling centralized processing and export. This use case emphasizes space optimization, modular installation sequences, and robust design for marine environments.

- Deepwater Subsea Tie-Back: Deployment of subsea wellhead systems on the seabed in water depths exceeding 1,500 meters, with production tied back via flowlines and risers to a floating production vessel many kilometers away. This highlights requirements for remote installation/intervention capability, ultra-high reliability, and corrosion resistance.

- Unconventional Shale Pad Drilling: High-density installation of land wellhead systems on a single pad serving dozens of horizontally drilled wells. This scenario demands rapid installation/commissioning cycles, equipment standardized for high-volume fracturing operations, and durability to handle significant pressure fluctuations.

- Mature Field Wellhead Integrity Management: A comprehensive program involving the systematic inspection, testing, repair, or replacement of aging wellhead components across a producing field. This use case is critical for preventing leaks, ensuring regulatory compliance, and extending safe operational life, leveraging digital monitoring and risk-based assessment.

- Carbon Capture, Utilization, and Storage (CCUS) Injection Well: Application of a specialized wellhead system for an injection well used to sequester CO2 underground. This requires unique materials resistant to CO2-induced corrosion, specialized valving for precise injection control, and enhanced monitoring for long-term containment verification.

Global Wellhead System Market: Stats & Facts

- According to the International Energy Agency (IEA), global oil demand is forecast to plateau near 106 billion barrels per day around 2030, requiring sustained investment in existing and new production assets, including wellhead infrastructure.

- Offshore production accounts for nearly 30% of global oil and 27% of global gas output, with the deepwater share rising, directly correlating to demand for advanced subsea wellhead systems.

- The American Petroleum Institute (API) Specification 6A for wellhead and Christmas tree equipment is the globally recognized benchmark, with over 20,000 certified products in the supply chain, ensuring interoperability and safety compliance.

- Rystad Energy analysis indicates that the global offshore capex cycle is strengthening, with project sanctions expected to drive annual spending above USD 200 billion by the late 2020s, a significant portion allocated to subsea hardware like wellheads.

- The U.S. land rig count, as reported by Baker Hughes, consistently numbers in the hundreds, with each new well requiring a complete wellhead system, underscoring the direct link between drilling activity and market volume.

Global Wellhead System Market: Market Dynamic

Driving Factors in the Global Wellhead System Market

Sustained Upstream Capital Expenditure and Energy Security Imperatives

Despite the energy transition, significant capital is being deployed into oil and gas exploration and production to meet ongoing demand and address energy security concerns, particularly following geopolitical disruptions. National oil companies in the Middle East and Asia are leading large-scale, long-term capacity expansion programs.

Furthermore, international oil companies are sanctioning high-return offshore projects in basins like Guyana, Brazil, and the North Sea. This investment directly fuels demand for new wellhead systems, with specifications varying from high-volume land units to complex subsea stacks. The strategic need to maintain and marginally increase production from existing basins ensures a steady stream of demand for wellhead equipment associated with infill drilling and field development.

Technological Evolution Enhancing Value Proposition

Continuous innovation is expanding the functional and economic value of wellhead systems. Key advancements include, Embedding sensors for real-time monitoring of pressure, temperature, vibration, and load enables condition-based maintenance, early leak detection, and integration with digital twin models for simulation and optimization. Development of nickel-based alloys, high-grade steels, and advanced elastomers allows wellhead systems to operate reliably in extreme HPHT and sour (H2S) service conditions, unlocking more challenging reservoirs.

Restraints in the Global Wellhead System Market

Capital Discipline and Commodity Price Volatility

The upstream industry has embraced capital discipline following the downturns of the past decade. Operators prioritize projects with shorter payback periods and higher returns, which can delay or scale back large, capital-intensive developments that require extensive wellhead systems, particularly in deepwater. The market remains inherently cyclical and sensitive to fluctuations in oil and gas prices. A sustained period of lower prices can lead to rapid reductions in drilling activity, immediately impacting demand for new wellhead equipment and pressuring manufacturer margins.

Regulatory Complexity and Cost Inflation

The regulatory landscape for upstream operations is becoming more complex and stringent globally. Regulations governing safety, emissions (e.g., methane), environmental protection, and decommissioning liabilities add layers of compliance cost and design complexity to wellhead systems. Furthermore, inflationary pressures on critical raw materials (e.g., steel, alloys), energy, and logistics increase manufacturing costs. These cost increases can be difficult to fully pass through to operators in competitive tender processes, squeezing supplier profitability and potentially impacting investment in R&D and capacity.

Opportunities in the Global Wellhead System Market

Deepwater and Ultra-Deepwater Frontier Development

The most significant high-value growth opportunity lies in deepwater and ultra-deepwater basins. Major discoveries in regions like the Stabroek block (Guyana), the Brazilian pre-salt, offshore West Africa, and the Eastern Mediterranean are driving a new wave of final investment decisions (FIDs). These environments demand the most advanced, reliable, and expensive subsea wellhead systems, often with remote intervention capabilities. Suppliers with proven technology in these areas can capture premium margins and establish long-term partnership agreements with operators.

Lifecycle Services and the Circular Economy

With a global installed base of billions of wells, the aftermarket for wellhead services is vast and resilient. Opportunities extend beyond basic maintenance and repair to include, Offering ongoing monitoring, analytics, and risk assessment subscriptions. Retrofitting older wellheads with modern safety valves, sensors, or actuators to meet new regulations or extend life. Specialized services for safely capping, cutting, and retrieving wellheads at end-of-life, with growing focus on component recycling and reuse. This shift towards total lifecycle management creates recurring revenue streams and deepens customer relationships.

Trends in the Global Wellhead System Market

Pervasive Digital Integration and the "Smart Wellhead"

The trend towards digitalization is fundamental. The "Smart Wellhead" concept involves embedding a suite of sensors that provide continuous operational and integrity data. This data is transmitted via SCADA or satellite to cloud-based platforms where AI and machine learning algorithms perform analytics. Key benefits include predictive maintenance (forecasting seal failure, corrosion rates), automated regulatory reporting, remote performance optimization, and enhanced safety through immediate anomaly detection. This transforms the wellhead from a passive mechanical component into an active, data-generating node in the digital oilfield.

Modularization and Standardization for Efficiency

To combat rising costs and accelerate project timelines, the industry is increasingly embracing modularization and standardization. Modular wellhead systems consist of pre-assembled, tested segments that can be quickly installed on the rig, dramatically reducing make-up time and human error. Driving standardization of interfaces and specifications across operators (e.g., through joint industry projects) aims to simplify the supply chain, improve inventory flexibility, and lower costs. This trend is evident in both high-volume land applications and complex subsea systems, where compact, modular designs reduce vessel deck space and installation time.

Global Wellhead System Market: Research Scope and Analysis

By Component Analysis

Within the component-based classification of the global wellhead system market, casing heads dominate overall demand. Casing heads are the primary load-bearing element of a wellhead system and are essential from the earliest stages of drilling through the full life cycle of the well. They provide structural support for casing strings, ensure pressure containment, and enable the installation of subsequent wellhead equipment. Because every oil, gas, injection, or geothermal well requires a casing head regardless of depth, location, or reservoir type, demand for this component remains consistently high across onshore and offshore projects.

Compared to tubing heads, valves, control systems, and adapters, casing heads benefit from universal application and higher replacement frequency due to wear, pressure cycling, and well upgrades. While blowout preventers and control systems are critical for safety and automation, they are typically deployed selectively depending on well complexity and regulatory requirements. Accessories such as seals, hangers, and spools support operations but represent smaller revenue contributions individually. The dominance of casing heads is reinforced by the global focus on well integrity, pressure management, and extended well life, making them indispensable across both conventional and unconventional drilling activities.

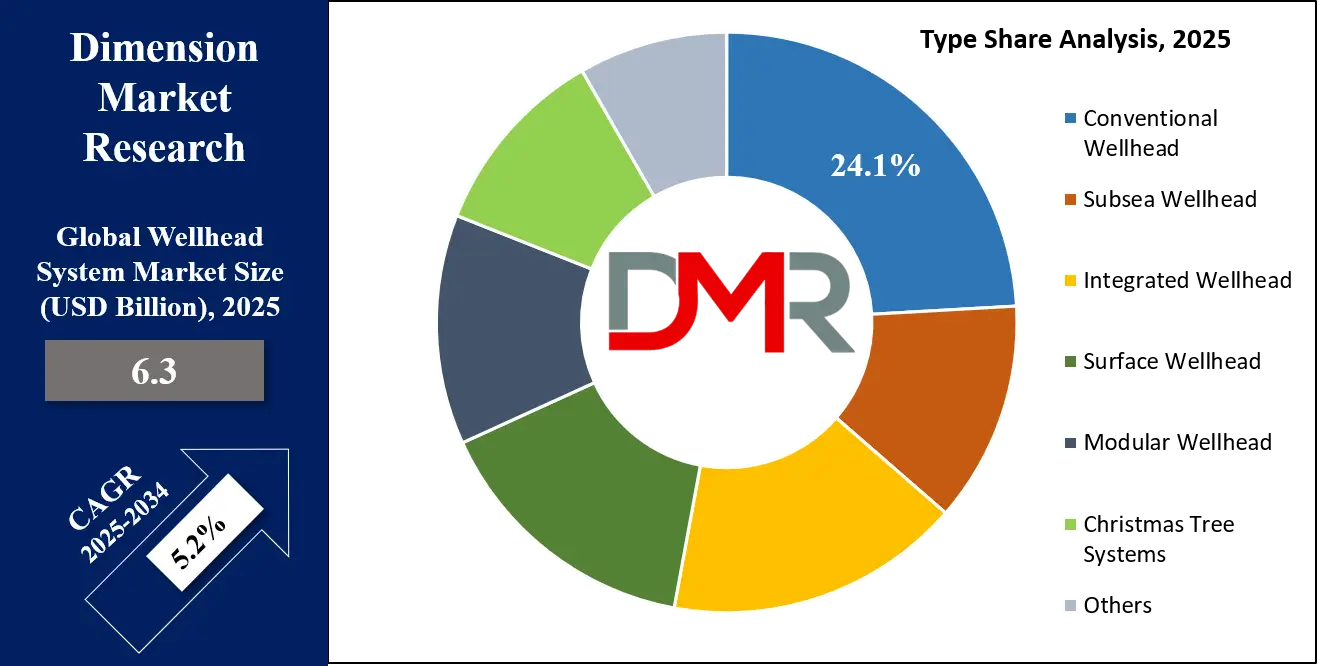

By Type Analysis

Among the various wellhead system types, conventional wellheads continue to dominate the global market. These systems are widely used due to their proven design, cost efficiency, and adaptability to a broad range of drilling environments. Conventional wellheads are especially prevalent in onshore fields and shallow offshore developments, where drilling conditions are well understood and operational simplicity is prioritized. Their long-standing use across mature oil-producing regions has created a strong installed base, driving continued demand for replacements, upgrades, and maintenance.

Although subsea and integrated wellhead systems are gaining traction in deepwater and technologically advanced fields, their adoption is limited by high capital costs and complex installation requirements. Modular wellheads and Christmas tree systems serve specific operational needs but do not match the volume of conventional installations. Conventional wellheads benefit from ease of installation, standardized components, and compatibility with existing infrastructure. As a result, they remain the preferred choice for operators seeking reliability, lower operating costs, and faster deployment timelines. This sustained applicability across diverse geological and economic conditions ensures their continued dominance in the global wellhead system landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Based on application, oil wells account for the largest share of wellhead system demand worldwide. Crude oil exploration and production continue to represent the majority of upstream drilling activity, particularly in regions with established hydrocarbon reserves. Oil wells typically require robust wellhead systems capable of handling high pressures, temperature variations, and long production cycles. The scale of oil field development projects often involving multiple wells per field drives higher overall equipment deployment compared to other applications.

While gas wells are expanding rapidly due to the global energy transition and growing natural gas consumption, oil wells still generate higher demand for wellhead systems because of larger drilling volumes and higher equipment intensity. Injection wells and geothermal wells play important roles in enhanced recovery and renewable energy development, but their deployment remains more limited in comparison. Oil wells also require frequent intervention, recompletion, and wellhead upgrades, further increasing equipment usage over time. This combination of volume, operational complexity, and long-term production needs positions oil wells as the dominant application area within the global wellhead system market.

By End User Analysis

In terms of end users, oil and gas operators, including national and international operators, dominate the global wellhead system market. These entities control the majority of upstream assets and are responsible for exploration planning, field development, drilling execution, and long-term production management. Their direct ownership of oil and gas fields means they make the primary investment decisions related to wellhead system procurement, specifications, and upgrades.

Operators typically manage large-scale projects involving multiple wells across onshore and offshore environments, resulting in sustained demand for wellhead equipment. Their emphasis on safety, regulatory compliance, and operational efficiency further drives the adoption of high-quality and reliable wellhead systems. Contractors, drilling companies, and well intervention service providers play critical roles in installation and maintenance, but they usually operate under contracts issued by operators and do not control purchasing decisions at the same scale. Consequently, operators remain the central force shaping demand patterns, technology adoption, and long-term growth trends in the global wellhead system market.

The Global Wellhead System Market Report is segmented on the basis of the following:

By Component

- Casing Head

- Tubing Head

- Valves & Actuators

- Wellhead Assembly

- Control Systems

- Adapters & Spools

- Others

By Type

- Conventional Wellhead

- Subsea Wellhead

- Integrated Wellhead

- Surface Wellhead

- Modular Wellhead

- Christmas Tree Systems

- Others

By Application

- Oil Wells

- Gas Wells

- Injection Wells

- Geothermal Wells

- Others

By End User

- Oil & Gas Operators (NOCs, IOCs)

- Contractors & Service Providers

- Drilling Contractors

- Well Intervention Service Companies

- Others

Impact of Artificial Intelligence in the Global Wellhead System Market

- Real-Time Integrity and Performance Monitoring: A network of sensors (pressure, temperature, acoustic, strain) provides continuous surveillance of the wellhead's health. This enables the immediate detection of leaks, seal degradation, or excessive loads, allowing operators to move from periodic manual inspections to continuous, data-driven integrity management, drastically improving safety and preventing environmental incidents.

- Predictive Maintenance and Asset Life Optimization: Machine learning algorithms analyze historical sensor data, operational patterns, and failure modes to predict remaining useful life of critical components like seals, valves, and actuators. This allows maintenance to be scheduled proactively during planned shutdowns, minimizing unplanned downtime, reducing intervention costs, and extending the overall lifecycle of the wellhead asset.

- Digital Twins for Simulation and Training: A virtual digital replica of the physical wellhead system is created. Engineers can use this twin to simulate various operating scenarios (e.g., emergency shut-in, wear over time), plan complex maintenance or workover procedures, and train personnel in a risk-free virtual environment. This improves operational preparedness, reduces errors, and optimizes performance.

- Remote Operations and Automation: Integration with Supervisory Control and Data Acquisition (SCADA) systems and secure cloud platforms enables the remote monitoring and control of wellhead functions from onshore centers. Valves can be actuated, chokes adjusted, and safety systems tested remotely, reducing the need for personnel to be exposed to hazardous offshore or remote locations, thereby enhancing safety and reducing operational expenditure.

- Data-Driven Compliance and Reporting: Digital systems automatically compile and log all operational data, maintenance records, pressure tests, and safety valve actuations. This facilitates automated generation of reports required for regulatory compliance (e.g., for BSEE, PSA, HSE), ensuring accuracy, traceability, and significant reductions in administrative burden and audit preparation time.

Global Wellhead System Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to command the largest share of the Global Wellhead System Market, estimated at approximately 36.2% in 2025. This leadership is unequivocally anchored by the United States, which hosts the world's most dynamic onshore drilling sector. The high rig count and intense development pace in shale plays like the Permian Basin generate enormous, recurring demand for land wellhead systems. Furthermore, the U.S. Gulf of Mexico remains a strategic arena for deepwater and shelf projects, demanding high-specification offshore equipment.

Canada's oil sands and conventional plays add stable, long-term demand. The region's advantages include a dense ecosystem of manufacturers and service providers, a culture of technological adoption (e.g., digital oilfield tech), and a mature regulatory framework. Strong reimbursement models through operator CAPEX budgets and a focus on operational efficiency solidify North America's dominant position.

Region with the Highest CAGR

Asia-Pacific is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period of 2025-2034. This accelerated growth is fueled by concerted national efforts to boost domestic hydrocarbon production and ensure energy security, often in the face of rising imports. Key drivers include India's ambitious deepwater exploration in the Krishna-Godavari basin and robust onshore development. China continues its steady investment in both conventional fields and domestic shale gas exploration to enhance energy independence.

Southeast Asia maintains momentum with sustained offshore development in Indonesia, Malaysia, and Vietnam, alongside new frontier explorations. Australia contributes through its major LNG projects which require extensive associated gas wellhead infrastructure, although new project final investment decisions (FIDs) have recently slowed. Government-led initiatives, such as India's production enhancement policies and China's strategic push for energy self-sufficiency, are direct market catalysts.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Wellhead System Market: Competitive Landscape

The Global Wellhead System Market is moderately consolidated, with a mix of large diversified oilfield service conglomerates and specialized wellhead manufacturers. Leading players such as Schlumberger (SLB), Baker Hughes, Halliburton, and NOV dominate through their comprehensive well construction and completion portfolios, which include wellhead systems. These companies leverage global scale, R&D capabilities, and integrated service offerings.

Specialized wellhead manufacturers like Dril-Quip, Aker Solutions, TechnipFMC, and Stream-Flo hold strong positions, particularly in the high-specification offshore and subsea segments, renowned for their engineering expertise and reliable equipment. The aftermarket and rental segment features players like Weir Group (IDS) and Master Flo.

Competition is based on technical specifications (pressure ratings, material grades), reliability, safety features, delivery time, aftermarket service, and digital integration capabilities. Strategic partnerships with operators for long-term supply agreements and continuous investment in R&D for HPHT, digital, and compact solutions are key competitive strategies.

Some of the prominent players in the Global Wellhead System Market are:

- Schlumberger (SLB)

- Baker Hughes Company

- Halliburton

- NOV Inc.

- Dril-Quip, Inc.

- TechnipFMC plc

- Aker Solutions ASA

- Stream-Flo Industries Ltd.

- The Weir Group PLC (Integrated Drilling Services)

- Master Flo Valve Inc.

- Jiangsu Jianhua Petroleum Equipment Co., Ltd.

- Uztel S.A.

- Jereh Group

- PROSAFE SERVICES PTE LTD

- Frontier Oilfield Services

- Cameron International (Part of SLB)

- GE Oil & Gas (Part of Baker Hughes)

- Delta Corporation

- Worldwide Oilfield Machine (WOM)

- Other Key Players

Recent Developments in the Global Wellhead System Market

- November 2025: Baker Hughes Launches "Novo" All-Electric Subsea Wellhead System. Baker Hughes introduced its next-generation all-electric subsea wellhead and christmas tree system at a major industry conference. The system eliminates hydraulic fluid, reducing potential environmental impact and maintenance needs, while enabling faster valve actuation and seamless integration with digital control platforms for enhanced deepwater field optimization and GHG emission reduction.

- October 2025: NOV Secures Landmark Contract for Guyana's Whiptail Development. National Oilwell Varco (NOV) announced it was awarded a comprehensive contract valued in the hundreds of billions to supply integrated subsea wellhead systems, trees, and associated services for the Whiptail development in the Stabroek block, offshore Guyana. This contract reinforces NOV's position as a key supplier in one of the world's fastest-growing deepwater basins.

- September 2025: TechnipFMC and Dril-Quip Form Strategic Alliance for Compact Subsea Systems. The two engineering leaders announced a collaboration to jointly design and market a new series of ultra-compact, high-capacity subsea wellhead systems. The alliance aims to address operator needs for reduced system footprint and weight, enabling the use of lighter installation vessels and lowering overall development costs for subsea tie-back projects.

- August 2025: Schlumberger Unveils "Wellhead Insight" Digital Performance Suite. SLB launched a comprehensive digital suite focused on wellhead integrity and performance management. The cloud-based platform, "Wellhead Insight," combines real-time sensor data with AI analytics and a digital twin interface to provide predictive maintenance alerts, optimize valve performance, and generate automated regulatory compliance reports, aiming to significantly reduce non-productive time.

- July 2025: Stream-Flo Announces Expansion of HPHT Manufacturing Capacity in Texas. Stream-Flo Industries, a leader in wellhead equipment, unveiled a major expansion of its manufacturing facility in Houston, Texas. The expansion is specifically geared towards increasing production capacity for High-Pressure High-Temperature (HPHT) wellhead systems, responding to growing demand from operators in the Gulf of Mexico and Permian Basin for equipment capable of handling extreme reservoir conditions.

- June 2025: Middle East NOC Awards Decade-Long Wellhead Framework Agreement. A leading Gulf National Oil Company finalized a 10-year Long-Term Agreement (LTA) with a consortium of three international wellhead manufacturers for the supply of over 5,000 wellhead systems. The agreement includes commitments for local manufacturing content, technology transfer, and the establishment of a regional spare parts hub, highlighting the strategic importance of localization.

- April 2025: North Sea Regulators Update Guidelines to Encourage Digital Wellhead Monitoring. The UK's Health and Safety Executive (HSE) and Norway's Petroleum Safety Authority (PSA) jointly issued updated guidance notes strongly advocating for the implementation of real-time digital monitoring systems on critical wellhead safety components. This regulatory push is expected to accelerate the adoption of sensor-based integrity monitoring across the North Sea fleet.

- March 2025: Joint Industry Project Kicks Off to Standardize Modular Wellhead Interfaces. A consortium comprising several major IOCs, leading service companies, and equipment manufacturers initiated a Joint Industry Project (JIP). The goal of the JIP is to develop and promote industry-wide standardization for interfaces and specifications of modular wellhead systems, aiming to improve supply chain interoperability, reduce costs, and speed up project execution timelines globally.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.3 Bn |

| Forecast Value (2034) |

USD 10.0 Bn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 1.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Casing Head, Tubing Head, Valves & Actuators, Wellhead Assembly, Control Systems, Adapters & Spools, Others), By Type (Conventional Wellhead, Subsea Wellhead, Integrated Wellhead, Surface Wellhead, Modular Wellhead, Christmas Tree Systems, Others), By Application (Oil Wells, Gas Wells, Injection Wells, Geothermal Wells, Others), By End User (Oil & Gas Operators (NOCs, IOCs), Contractors & Service Providers, Drilling Contractors, Well Intervention Service Companies, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schlumberger (SLB), Baker Hughes Company, Halliburton, NOV Inc., Dril-Quip, Inc., TechnipFMC plc, Aker Solutions ASA, Stream-Flo Industries Ltd., The Weir Group PLC (Integrated Drilling Services), Master Flo Valve Inc., Jiangsu Jianhua Petroleum Equipment Co., Ltd., Uztel S.A., Jereh Group, PROSAFE SERVICES PTE LTD, Frontier Oilfield Services, Cameron International (Part of SLB), GE Oil & Gas (Part of Baker Hughes), Delta Corporation, Worldwide Oilfield Machine (WOM), and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Wellhead System Market?

▾ The Global Wellhead System Market size is estimated to have a value of USD 6.3 billion in 2025 and is expected to reach USD 10.0 billion by the end of 2034.

What is the growth rate in the Global Wellhead System Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 5.2 percent over the forecasted period from 2025 to 2034.

What is the size of the US Wellhead System Market?

▾ The US Wellhead System Market is projected to be valued at USD 1.9 billion in 2025. It is expected to witness subsequent growth, reaching USD 2.9 billion in 2034, expanding at a CAGR of 4.9% during the forecast period.

Which region accounted for the largest Global Wellhead System Market?

▾ North America is expected to have the largest market share in the Global Wellhead System Market, accounting for approximately 36.2% of the global revenue in 2025.

Who are the key players in the Global Wellhead System Market?

▾ Some of the major key players in the Global Wellhead System Market are Schlumberger (SLB), Baker Hughes Company, Halliburton, NOV Inc., Dril-Quip, Inc., TechnipFMC plc, Aker Solutions ASA, Stream-Flo Industries Ltd., The Weir Group PLC, and Master Flo Valve Inc., among many others.