Market Overview

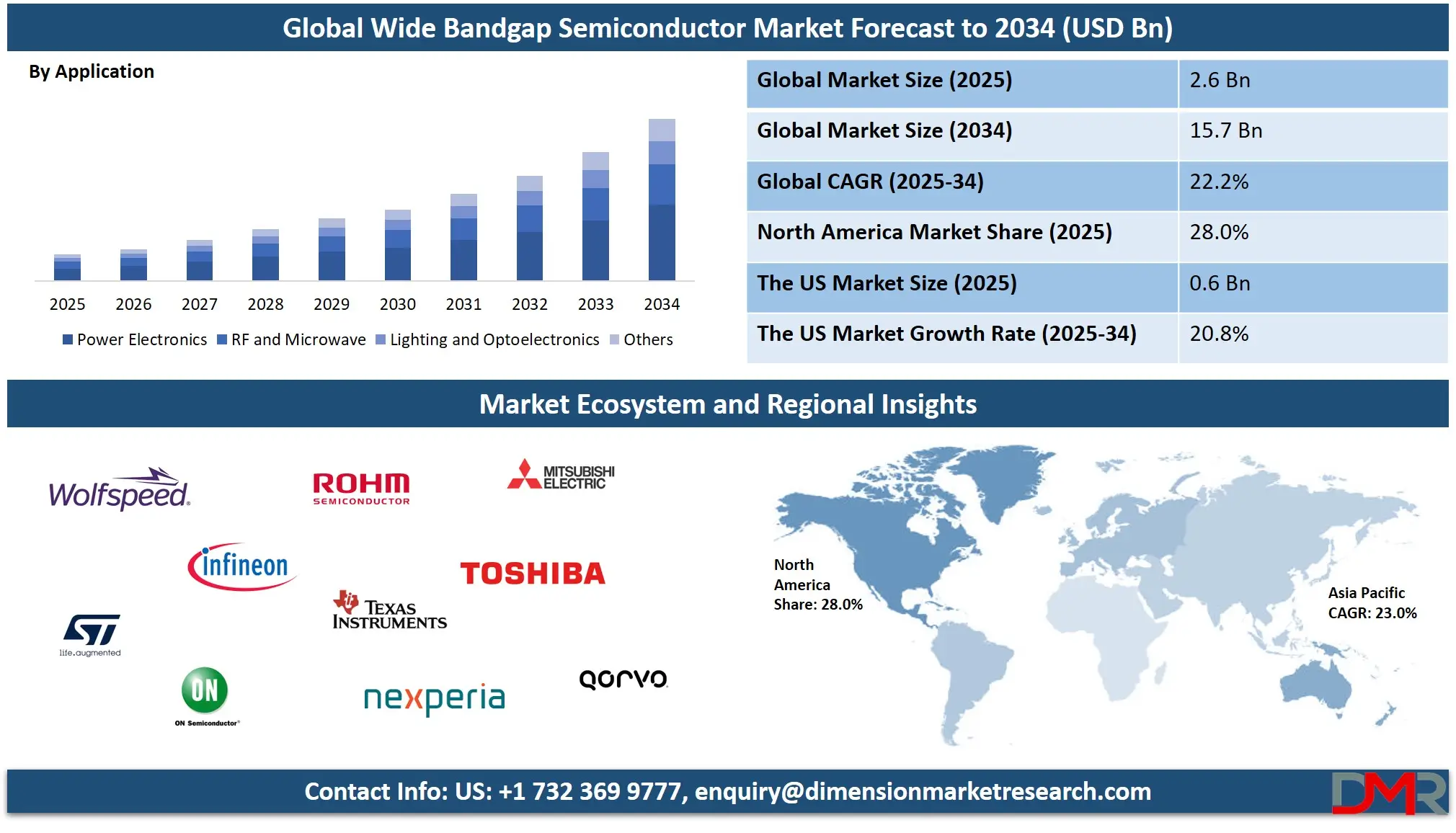

The Global Wide Bandgap Semiconductor Market is projected to grow from USD 2.6 billion in 2025 to USD 15.7 billion by 2034, expanding at a robust CAGR of 22.2%. This growth is driven by rising demand for energy-efficient power electronics, high-frequency devices, and next-gen materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) across EVs, renewables, and RF applications.

Wide bandgap semiconductors are advanced materials characterized by a larger energy gap between the valence band and conduction band compared to traditional silicon-based semiconductors. This wider energy band enables devices to operate at higher voltages, temperatures, and frequencies with greater efficiency and lower power losses.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Materials such as silicon carbide and gallium nitride exemplify wide bandgap semiconductors, providing superior thermal conductivity, high electron mobility, and strong breakdown voltage, which make them ideal for applications in power electronics, radio frequency amplification, and high temperature environments. These properties allow engineers to design smaller, lighter, and more reliable electronic components that meet the growing demands of electric vehicles, renewable energy systems, telecommunications infrastructure, and industrial automation.

The global wide bandgap semiconductor market is witnessing rapid growth due to increasing adoption in energy-efficient power conversion systems, electric vehicle inverters, and high-frequency telecommunications equipment. Manufacturers and technology providers are investing in research and development to improve material quality, device performance, and production scalability. The market is driven by rising demand for compact, high-performance, and energy-efficient electronic components capable of operating under extreme conditions while reducing cooling requirements and system size.

Expansion in sectors such as automotive, industrial, and renewable energy is further propelling the global wide bandgap semiconductor market, as these industries require reliable and high efficiency power devices. In electric vehicles, wide bandgap semiconductors enable lighter and more efficient inverters and onboard chargers, while in renewable energy applications, they enhance the performance and durability of solar inverters and wind turbine systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With increasing deployment in smart grids, aerospace, and next generation communication networks, wide bandgap semiconductors are becoming a cornerstone technology, offering opportunities for innovation, cost reduction, and enhanced system efficiency across diverse industrial applications.

The US Wide Bandgap Semiconductor Market

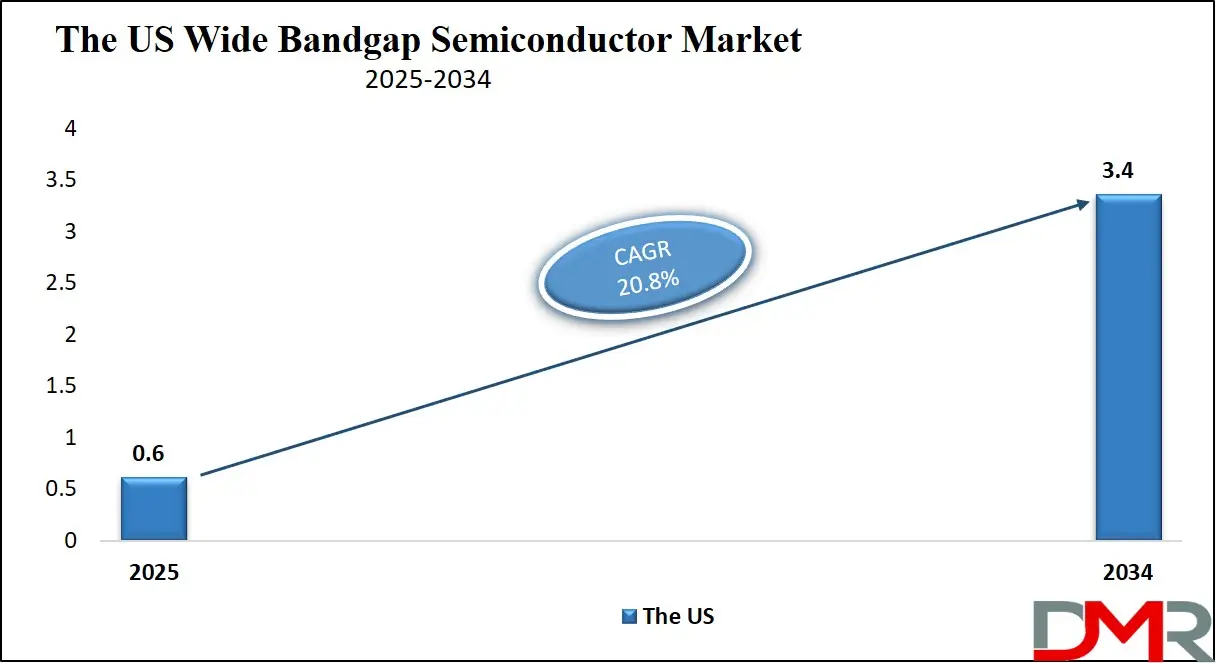

The U.S. Wide Bandgap Semiconductor market size is projected to be valued at USD 0.6 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.4 billion in 2034 at a CAGR of 20.8%.

The US Wide Bandgap Semiconductor market is witnessing substantial growth, propelled by growing adoption of high-performance materials such as silicon carbide (SiC) and gallium nitride (GaN) across critical sectors including electric vehicles, aerospace and defense, and renewable energy systems. As the nation accelerates its shift toward electrification and sustainable infrastructure, wide bandgap technologies are playing a pivotal role in enhancing energy conversion efficiency, reducing thermal losses, and enabling compact power system designs.

The surge in EV manufacturing, along with aggressive federal policies supporting clean energy and domestic semiconductor production, is further strengthening the US market position. Additionally, leading American semiconductor firms are heavily investing in R&D and capacity expansion to secure their supply chains and meet rising demand for wide bandgap-based power electronics.

Moreover, the US is emerging as a hub for next-generation RF devices and high-frequency applications, driven by the rollout of 5G infrastructure, satellite communications, and military radar systems. Wide bandgap materials, particularly GaN, offer significant performance advantages in these high-power RF and microwave systems, supporting higher frequencies, faster switching, and greater thermal stability.

Strategic collaborations between public agencies like the Department of Energy and private semiconductor manufacturers are fostering innovation and the commercialization of advanced power devices. With growing emphasis on national semiconductor independence and high-power density systems, the U.S. wide Bandgap Semiconductor market is positioned for strong long-term growth across automotive, industrial automation, and aerospace segments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Wide Bandgap Semiconductor Market

The Europe wide bandgap semiconductor market is projected to reach approximately USD 500 million in 2025, reflecting the region’s growing commitment to energy efficiency, electrification, and technological advancement. Key sectors driving this demand include electric vehicles, renewable energy systems, and industrial automation.

European nations, particularly Germany, France, and the Nordic countries, are accelerating their transition to electric mobility and sustainable energy infrastructure, where silicon carbide (SiC) and gallium nitride (GaN) devices are essential for enabling high-efficiency power conversion. The region also hosts several leading automotive OEMs and power electronics companies that are increasingly integrating wide bandgap solutions into EV drivetrains, fast charging stations, and solar inverters.

With a projected CAGR of 20.3% from 2025 to 2034, Europe's wide bandgap semiconductor market is expected to grow rapidly, supported by government-backed initiatives, R&D funding, and supply chain localization strategies. The European Union's emphasis on semiconductor sovereignty and green energy policies further fuels investment in SiC and GaN technologies.

In addition, partnerships between regional semiconductor firms and global players are fostering innovation and expanding production capabilities. As industries continue to prioritize high-voltage, compact, and thermally efficient solutions, Europe is set to play a vital role in shaping the global trajectory of wide bandgap semiconductor adoption.

Japan Wide Bandgap Semiconductor Market

Japan’s wide bandgap semiconductor market is estimated to reach USD 200 million in 2025, driven by the country's deep-rooted strength in electronics manufacturing, advanced automotive technologies, and industrial innovation. Japanese companies are leveraging silicon carbide (SiC) and gallium nitride (GaN) devices across electric vehicles, railway electrification, consumer electronics, and factory automation systems. With automotive giants like Toyota and Honda accelerating their transition to EV platforms, and electronics leaders such as Panasonic and Toshiba investing in WBG integration, Japan is steadily advancing its adoption of high-efficiency power semiconductors. The country's robust supply chain, integrated with its expertise in precision engineering, positions it as a key contributor to global WBG development.

Projected to grow at a CAGR of 18.7% between 2025 and 2034, Japan’s market expansion is further supported by government initiatives promoting carbon neutrality, domestic semiconductor production, and R&D in next-gen materials. The deployment of GaN-based RF devices in communication infrastructure and radar systems is also gaining momentum, especially as Japan strengthens its digital and defense capabilities. With growing demand for miniaturized, energy-efficient, and high-performance electronics, Japan is poised to remain a strategically important player in the global wide bandgap semiconductor landscape, focusing on both innovation and industrial-scale adoption.

Global Wide Bandgap Semiconductor Market: Key Takeaways

- Market Value: The global wide bandgap semiconductor market size is expected to reach a value of USD 15.7 billion by 2034 from a base value of USD 2.6 billion in 2025 at a CAGR of 22.2%.

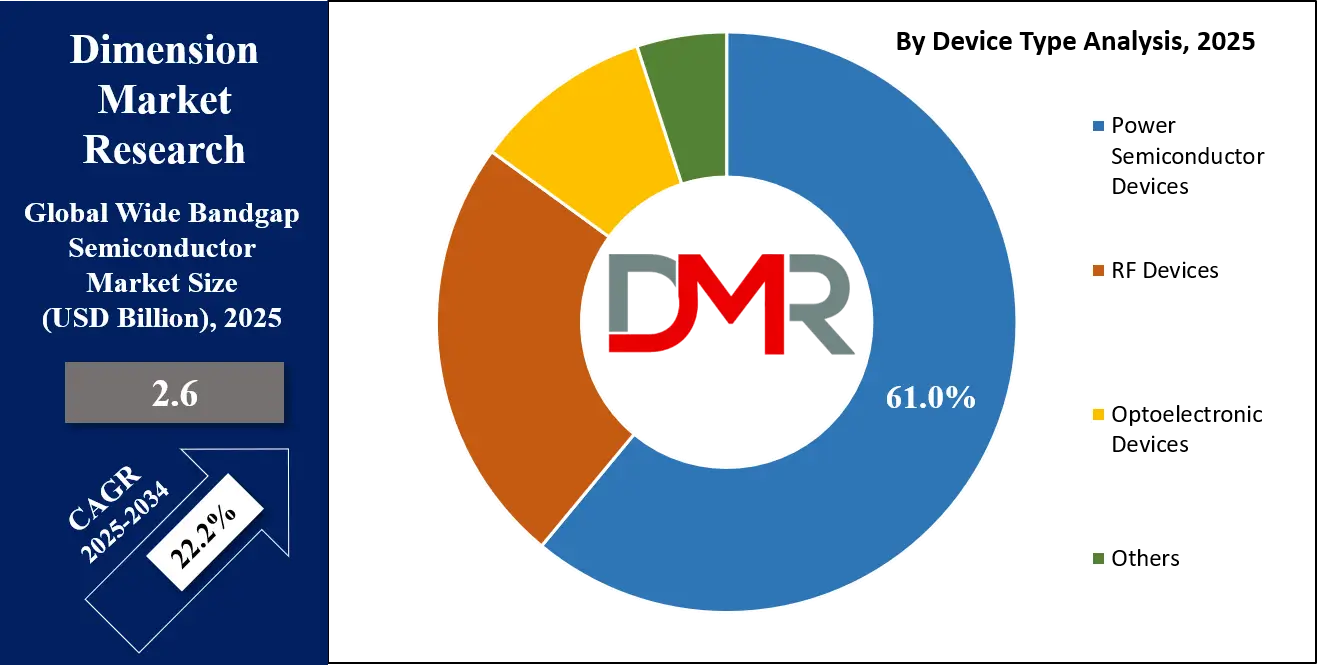

- By Device Type Segment Analysis: Power Semiconductor Devices are anticipated to dominate the device type segment, capturing 61.0% of the total market share in 2025.

- By Application Segment Analysis: Power Electronics applications are expected to maintain their dominance in the application segment, capturing 47.0% of the total market share in 2025.

- By End-Use Industry Segment Analysis: The Automotive industry is poised to consolidate its dominance in the tourist type segment, capturing 34.0% of the market share in 2025.

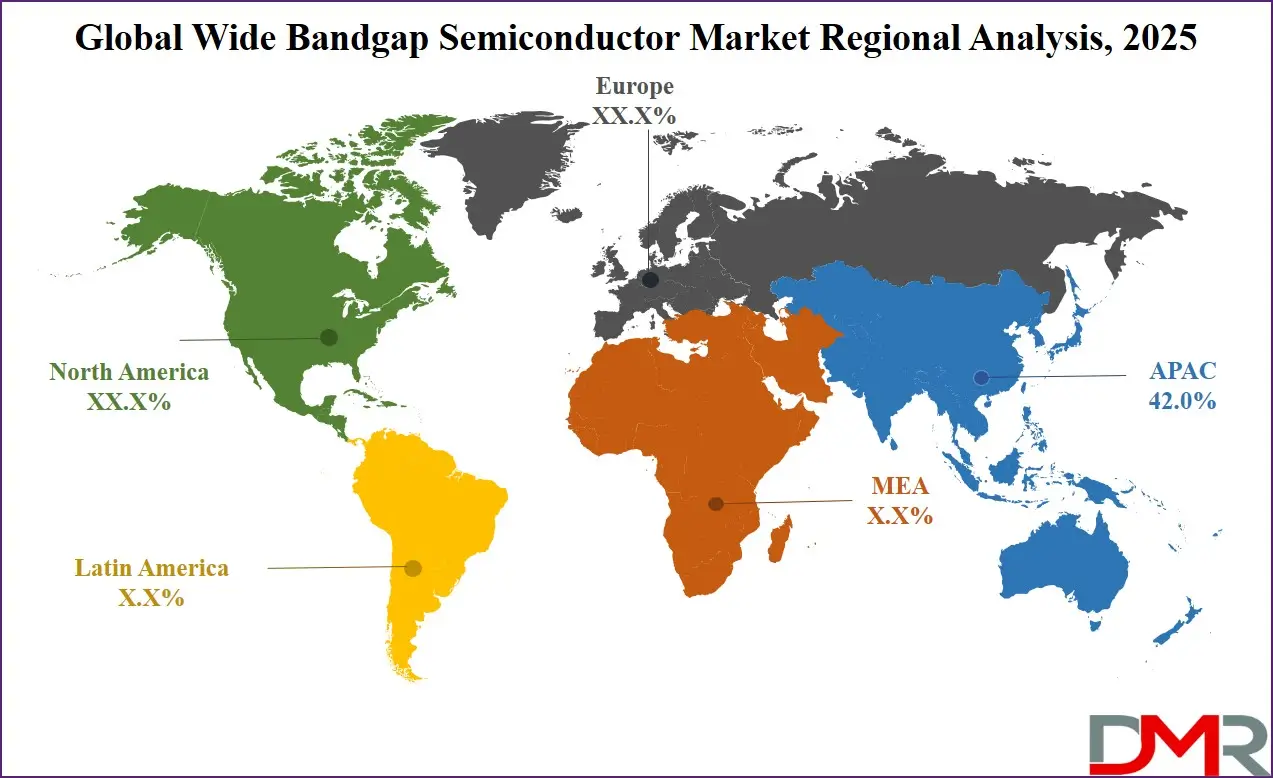

- Regional Analysis: Asia Pacific is anticipated to lead the global wide bandgap semiconductor market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global wide bandgap semiconductor market are Wolfspeed, Infineon Technologies, STMicroelectronics, ON Semiconductor, ROHM Semiconductor, Texas Instruments, Mitsubishi Electric, Toshiba Corporation, Nexperia, Qorvo, Transphorm Inc., GaN Systems, Efficient Power Conversion (EPC), Navitas Semiconductor, Microchip Technology, II-VI Incorporated, Skyworks Solutions, and Others.

Global Wide Bandgap Semiconductor Market: Use Cases

- Electric Vehicles (EVs) and Fast Charging Infrastructure: Wide bandgap semiconductors, especially Silicon Carbide (SiC), are revolutionizing EV powertrains by enabling high-voltage inverters, onboard chargers (OBCs), and DC fast charging systems. SiC MOSFETs reduce switching losses, increase power density, and improve thermal management, leading to extended battery range and faster charging. Automakers are integrating WBG devices to enhance vehicle efficiency and meet zero-emission mandates, while charging station manufacturers use SiC to deliver compact and energy-efficient ultra-fast chargers.

- Renewable Energy Systems and Solar Inverters: In solar photovoltaic systems and wind turbines, wide-bandgap power devices play a critical role in DC-AC conversion and power optimization. SiC-based inverters enable higher switching frequencies and lower energy losses, improving the overall output of solar farms and residential setups. Their ability to operate at high temperatures and voltages makes them ideal for utility-scale renewable energy systems, driving adoption in the push for decarbonization and grid modernization.

- 5G and RF Communication Infrastructure: Gallium Nitride (GaN) semiconductors are key to enabling high-frequency, high-efficiency RF power amplifiers in 5G base stations, satellites, and radar systems. GaN’s superior electron mobility and power density allow for compact and thermally efficient RF front ends. Telecom operators and defense sectors are leveraging GaN-based RF devices for enhanced signal transmission, low latency, and wide bandwidth performance, supporting the growing demand for faster and more reliable wireless connectivity.

- Industrial Motor Drives and Power Supplies: Wide bandgap materials are increasingly used in industrial automation, particularly in motor drives, power converters, and UPS systems. SiC and GaN devices offer higher efficiency, reduced cooling requirements, and compact form factors, which are essential for modern factory systems. These advantages lead to lower operational costs and better energy efficiency, aligning with the goals of Industry 4.0, smart manufacturing, and sustainable industrial infrastructure.

Impact of Artificial Intelligence on Wide Bandgap Semiconductor Market

Artificial Intelligence (AI) is significantly influencing the Wide Bandgap (WBG) Semiconductor Market by enhancing design efficiency, accelerating manufacturing processes, and expanding end-use applications. AI-driven tools are increasingly being used in the design and simulation of SiC and GaN power devices, enabling precise modeling, faster prototyping, and performance optimization. This reduces time-to-market and helps manufacturers innovate more efficiently. AI algorithms can also analyze large sets of operational data to predict material behavior under various conditions, improving device reliability and thermal management.

In manufacturing, AI supports predictive maintenance, defect detection, and yield optimization in semiconductor fabs. Machine learning models monitor and control complex process variables in real-time, especially for WBG materials, which are more sensitive to defects during epitaxy and wafer processing.

Additionally, the growing adoption of AI-powered systems in electric vehicles, smart grids, and 5G infrastructure is fueling demand for high-performance WBG power devices. As AI applications expand in energy, automotive, and telecom sectors, they indirectly drive the need for faster, more efficient, and thermally stable semiconductors, solidifying the role of WBG materials in next-gen electronics.

Global Wide Bandgap Semiconductor Market: Stats & Facts

- U.S. Department of Energy (DOE) – PowerAmerica & Workforce Development

- PowerAmerica has trained more than 400 master's and PhD students, 300 short course attendees, 1,800 tutorial participants, and 9,000 K‑12 students (including 2,000 in hands‑on training programs) since its inception.

- DOE renewed its funding for PowerAmerica in 2023, providing an initial USD 8 million, with potential to scale to USD 32 million over the following four fiscal years.

- DOE – Power Grid Modernization (ULTRAFAST Program)

- In November 2023, DOE allocated USD 42 million across 15 R&D projects spanning 11 states to develop advanced power semiconductor technologies for grid reliability, resiliency, and flexibility.

- DOE – Support for Advanced Manufacturing & Innovation

- AMMTO (Advanced Materials & Manufacturing Technologies Office) invested USD 45 million across 14 projects in 2023—including USD 15 million led by GE Research and USD 30 million for 13 other initiatives—to advance clean energy manufacturing technologies.

- The Clean Energy Smart Manufacturing Innovation Institute (CESMII) and the Institute for Advanced Composites Manufacturing Innovation (IACMI) were each renewed with initial USD 6 million, with further funding possible across four future fiscal years.

- DOE – Ultra-Wide Bandgap Research at NREL

- NREL, backed by DOE’s AMMTO, Office of Science, and internal programs, is executing projects such as “Accelerated Qualification of Gallium Oxide Semiconductor Gas Sensor Reliability (2024–2025)” to explore Ga₂O₃ in extreme environments.

- Another active NREL initiative, “Center for Power Electronics Materials and Manufacturing Exploration (2025–2028),” focuses on next-gen power electronics materials and interfaces.

Global Wide Bandgap Semiconductor Market: Market Dynamics

Global Wide Bandgap Semiconductor Market: Driving Factors

Surge in Electric Vehicle Adoption and Electrification of Transportation

The growing demand for electric vehicles (EVs) is a primary driver for the wide bandgap semiconductor market, particularly for Silicon Carbide (SiC)-based components. SiC MOSFETs and diodes enhance EV powertrains by improving energy efficiency, reducing power loss, and supporting fast charging. Government incentives for zero-emission vehicles and expanding EV infrastructure globally are boosting the need for high-efficiency power electronics in automotive applications.

Rising Demand for High-Efficiency Power Conversion Systems

With the global push for energy efficiency across sectors, WBG devices are increasingly used in power conversion systems, including solar inverters, UPS systems, and industrial motor drives. Their ability to operate at higher voltages, frequencies, and temperatures makes them superior to traditional silicon components. This is crucial for reducing system size and cooling requirements in compact electronic designs.

Global Wide Bandgap Semiconductor Market: Restraints

High Manufacturing Costs of SiC and GaN Devices

Despite performance advantages, the cost of wide bandgap semiconductors remains a major barrier. The production of defect-free SiC wafers and GaN epitaxial layers involves complex processes and specialized equipment, resulting in higher per-unit costs compared to silicon. This limits adoption, especially in cost-sensitive industries like consumer electronics.

Limited Availability of Skilled Workforce and Design Expertise

Designing and integrating WBG semiconductors require advanced knowledge in thermal management, device physics, and circuit optimization. The scarcity of experienced engineers and technicians in WBG technology can slow down product development and deployment, especially among small and mid-sized enterprises.

Global Wide Bandgap Semiconductor Market: Opportunities

Expansion of 5G and Satellite Communication Networks

The rollout of 5G infrastructure and the growing interest in Low Earth Orbit (LEO) satellites are creating significant opportunities for GaN-based RF devices. These components support higher frequencies and power densities, making them ideal for high-speed, high-frequency communication systems. WBG semiconductors are expected to be central to future telecom architectures.

Government Support for Semiconductor Independence

Several countries, including the US, Japan, and members of the EU, are investing in domestic semiconductor ecosystems to reduce reliance on foreign supply chains. This includes funding R&D and setting up local fabs for SiC and GaN wafers. These policy measures are expected to lower costs and stimulate innovation in WBG technologies.

Global Wide Bandgap Semiconductor Market: Trends

Integration of AI and Machine Learning in Device Design and Manufacturing

AI and machine learning are becoming vital tools in the development and fabrication of wide bandgap devices. They enhance defect detection, optimize wafer yields, and improve simulation accuracy during device modeling. This trend is helping manufacturers reduce lead times and improve product performance through data-driven engineering.

Miniaturization and Higher Power Density in End Devices

The industry trend toward compact, lightweight electronics with greater power efficiency is growing the demand for WBG semiconductors. SiC and GaN components support smaller form factors and reduce the need for large cooling systems. This makes them ideal for applications in wearables, drones, electric two-wheelers, and portable power tools.

Global Wide Bandgap Semiconductor Market: Research Scope and Analysis

By Device Type Analysis

Power semiconductor devices are expected to lead the device type segment in the global wide bandgap semiconductor market, accounting for an estimated 61.0% of the total market share in 2025. This dominance is primarily driven by the rising adoption of high-efficiency power conversion systems across electric vehicles, renewable energy, industrial automation, and power infrastructure. Silicon carbide (SiC) MOSFETs and Schottky diodes are widely used in inverters, chargers, and power modules due to their ability to operate at higher voltages, frequencies, and temperatures than conventional silicon-based components.

These devices offer significant advantages in terms of energy efficiency, reduced switching losses, and smaller system sizes, making them ideal for modern power electronics applications where performance and thermal management are critical. The transition to electrified transportation and the growing need for compact power supplies in both residential and industrial sectors further fuel the demand for WBG-based power semiconductors.

RF devices, on the other hand, are another important segment within the wide bandgap semiconductor market, particularly driven by the growing deployment of 5G infrastructure, satellite communication systems, and defense radar technologies. Gallium nitride (GaN) is the preferred material in this segment due to its superior electron mobility, high breakdown voltage, and excellent thermal conductivity.

These properties enable GaN-based RF transistors and amplifiers to operate at high frequencies and power levels, making them essential for next-generation wireless networks and high-power microwave systems. As global telecom providers expand 5G networks and governments invest in advanced radar and communication technologies, the RF device segment is expected to witness steady growth, contributing significantly to the overall adoption of wide bandgap semiconductors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Power electronics applications are projected to remain the dominant force in the wide bandgap semiconductor market, accounting for 47.0% of the total market share in 2025. This strong position is driven by the widespread use of silicon carbide and gallium nitride devices in high-efficiency power conversion systems across electric vehicles, solar inverters, industrial drives, and energy storage systems. Wide bandgap semiconductors enable power electronics to operate with minimal energy loss, high voltage tolerance, and improved thermal performance, which are crucial for achieving compact and lightweight system designs.

Their ability to function under harsh conditions makes them ideal for automotive and renewable energy sectors, where performance, durability, and efficiency are critical. As global industries continue to prioritize electrification and energy optimization, the integration of wide bandgap materials into power electronic systems is expected to grow rapidly.

RF and microwave applications represent another significant segment in the wide bandgap semiconductor market, with gallium nitride playing a central role. GaN-based RF devices are widely used in high-frequency and high-power scenarios such as 5G base stations, satellite communications, radar systems, and wireless infrastructure.

These devices offer superior power density, fast switching speed, and better thermal stability, which are essential for handling the increased bandwidth and speed requirements of modern communication systems. The expansion of 5G networks and growing investments in space and defense technologies are accelerating the demand for advanced RF and microwave components. As communication networks evolve and demand for low-latency, high-capacity data transmission rises, wide bandgap semiconductors are becoming increasingly indispensable in this segment.

By End-Use Industry Analysis

The automotive industry is expected to solidify its dominance in the end-use industry segment of the wide bandgap semiconductor market, capturing 34.0% of the total market share in 2025. This growth is primarily driven by the rapid global shift toward electric mobility and the growing adoption of electric vehicles (EVs), hybrid vehicles, and advanced driver-assistance systems (ADAS). Silicon carbide (SiC) and gallium nitride (GaN) devices are critical in electric vehicle applications such as onboard chargers, traction inverters, and DC-DC converters, where high efficiency, compact size, and superior thermal performance are essential.

These materials enable faster charging, longer driving range, and reduced energy losses, making them vital to next-generation EV architecture. In addition to passenger EVs, commercial and off-road electric vehicles are also beginning to integrate wide bandgap components, further expanding their footprint in the automotive sector.

In the industrial sector, wide bandgap semiconductors are gaining strong traction due to their role in improving the performance of motor drives, industrial power supplies, automation equipment, and energy management systems. SiC and GaN devices offer benefits such as higher efficiency, smaller footprint, and reduced cooling requirements, which are crucial in manufacturing environments where space and energy costs are key concerns.

Industries are increasingly implementing wide bandgap technology in robotics, process control systems, and heavy machinery to enhance productivity while reducing energy consumption. As factories transition toward digitalization and smart manufacturing under the Industry 4.0 framework, the demand for reliable, high-power density semiconductor solutions is rising, positioning the industrial segment as a strong contributor to the overall market growth.

The Wide Bandgap Semiconductor Market Report is segmented on the basis of the following:

By Device Type

- Power Semiconductor Devices

- RF Devices

- Optoelectronic Devices

- Others

By Application

- Power Electronics

- RF and Microwave

- Lighting and Optoelectronics

- Others

By End-Use Industry

- Automotive

- Industrial

- Consumer Electronics

- Telecom & Data Centers

- Energy & Power

- Aerospace & Defense

- Others

Global Wide Bandgap Semiconductor Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to dominate the global wide bandgap semiconductor market in 2025, capturing 42.0% of the total market revenue, driven by the region's robust semiconductor manufacturing ecosystem, strong presence of consumer electronics producers, and rapid adoption of electric vehicles. Countries like China, Japan, South Korea, and Taiwan are at the forefront of technological innovation and mass production of silicon carbide and gallium nitride devices, supported by government incentives and industrial policies aimed at enhancing domestic semiconductor capabilities.

Additionally, the expanding deployment of 5G infrastructure, rising investments in renewable energy, and growing demand for power-efficient electronics across automotive and industrial sectors further contribute to the region’s leadership. With major foundries and OEMs based in Asia Pacific, the region is expected to remain a key growth engine for the wide bandgap semiconductor market over the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

North America is expected to witness significant growth in the wide bandgap semiconductor market over the coming years, driven by strong investments in electric vehicles, renewable energy integration, and advanced defense technologies. The United States, in particular, is boosting domestic semiconductor production through government-backed initiatives and incentives aimed at reducing dependence on foreign supply chains.

The region is also a hub for innovation in gallium nitride (GaN) and silicon carbide (SiC) technologies, supported by leading players and research institutions. Rising demand for high-efficiency power devices in 5G infrastructure, aerospace applications, and industrial automation is further accelerating adoption. As the focus on energy efficiency and next-generation communication systems grows, North America is poised to emerge as a key high-growth region in the global wide bandgap semiconductor landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Wide Bandgap Semiconductor Market: Competitive Landscape

The global competitive landscape of the wide bandgap semiconductor market is characterized by intense innovation, strategic partnerships, and capacity expansions among key players aiming to secure leadership in silicon carbide (SiC) and gallium nitride (GaN) technologies. Companies such as Wolfspeed, Infineon Technologies, STMicroelectronics, and ROHM Semiconductor are investing heavily in SiC wafer production and device fabrication to meet rising demand from electric vehicles and industrial power applications. Meanwhile, players like Navitas Semiconductor, GaN Systems, and EPC are advancing GaN-based solutions for RF, telecom, and consumer electronics markets.

The industry is also witnessing increased collaboration between semiconductor firms, automakers, and energy solution providers to accelerate product development and application-specific customization. In addition, government-backed initiatives in the US, Europe, and Asia are fostering regional semiconductor ecosystems, adding to the competitive dynamics. With continuous R&D in material science and manufacturing processes, the market is evolving rapidly, with a clear focus on performance, scalability, and supply chain resilience.

Some of the prominent players in the global wide bandgap semiconductor market are:

- Wolfspeed

- Infineon Technologies

- STMicroelectronics

- ON Semiconductor

- ROHM Semiconductor

- Texas Instruments

- Mitsubishi Electric

- Toshiba Corporation

- Nexperia

- Qorvo

- Transphorm Inc.

- GaN Systems

- Efficient Power Conversion (EPC)

- Navitas Semiconductor

- Microchip Technology

- II-VI Incorporated

- Skyworks Solutions

- Analog Devices

- Renesas Electronics

- Panasonic Corporation

- Other Key Players

Global Wide Bandgap Semiconductor Market: Recent Developments

- June 2024: STMicroelectronics launched its third-generation 1200V SiC MOSFETs targeting high-efficiency electric vehicle powertrains and industrial applications, offering improved thermal performance and reduced conduction losses.

- April 2024: Wolfspeed introduced its new 650V silicon carbide MOSFET platform optimized for high-frequency power conversion in data centers, solar inverters, and electric vehicle charging stations.

- March 2024: ON Semiconductor acquired GT Advanced Technologies to strengthen its control over SiC crystal growth and supply chain, aiming to scale up its production capabilities for automotive and industrial SiC devices.

- January 2024: Navitas Semiconductor completed its acquisition of GeneSiC Semiconductor, expanding its portfolio of SiC-based high-voltage power devices for use in electric vehicles, aerospace, and industrial systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.6 Bn |

| Forecast Value (2034) |

USD 15.7 Bn |

| CAGR (2025–2034) |

22.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Device Type (Power Semiconductor Devices, RF Devices, Optoelectronic Devices, Others), By Application (Power Electronics, RF and Microwave, Lighting and Optoelectronics, Others), and By End-Use Industry (Automotive, Industrial, Consumer Electronics, Telecom & Data Centers, Energy & Power, Aerospace & Defense, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Wolfspeed, Infineon Technologies, STMicroelectronics, ON Semiconductor, ROHM Semiconductor, Texas Instruments, Mitsubishi Electric, Toshiba Corporation, Nexperia, Qorvo, Transphorm Inc., GaN Systems, Efficient Power Conversion (EPC), Navitas Semiconductor, Microchip Technology, II-VI Incorporated, Skyworks Solutions, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global wide bandgap semiconductor market?

▾ The global wide bandgap semiconductor market size is estimated to have a value of USD 2.6 billion in

2025 and is expected to reach USD 15.7 billion by the end of 2034.

What is the size of the US wide bandgap semiconductor market?

▾ The US wide bandgap semiconductor market is projected to be valued at USD 0.6 billion in 2025. It is

expected to witness subsequent growth in the upcoming period as it holds USD 3.4 billion in 2034 at a

CAGR of 20.8%.

Which region accounted for the largest global wide bandgap semiconductor market?

▾ Asia Pacific is expected to have the largest market share in the global wide bandgap semiconductor

market, with a share of about 42.0% in 2025.

Who are the key players in the global wide bandgap semiconductor market?

▾ Some of the major key players in the global wide bandgap semiconductor market are Wolfspeed,

Infineon Technologies, STMicroelectronics, ON Semiconductor, ROHM Semiconductor, Texas

Instruments, Mitsubishi Electric, Toshiba Corporation, Nexperia, Qorvo, Transphorm Inc., GaN Systems,

Efficient Power Conversion (EPC), Navitas Semiconductor, Microchip Technology, II-VI Incorporated,

Skyworks Solutions, and Others.

What is the growth rate of the global wide bandgap semiconductor market?

▾ The market is growing at a CAGR of 22.2 percent over the forecasted period