Market Overview

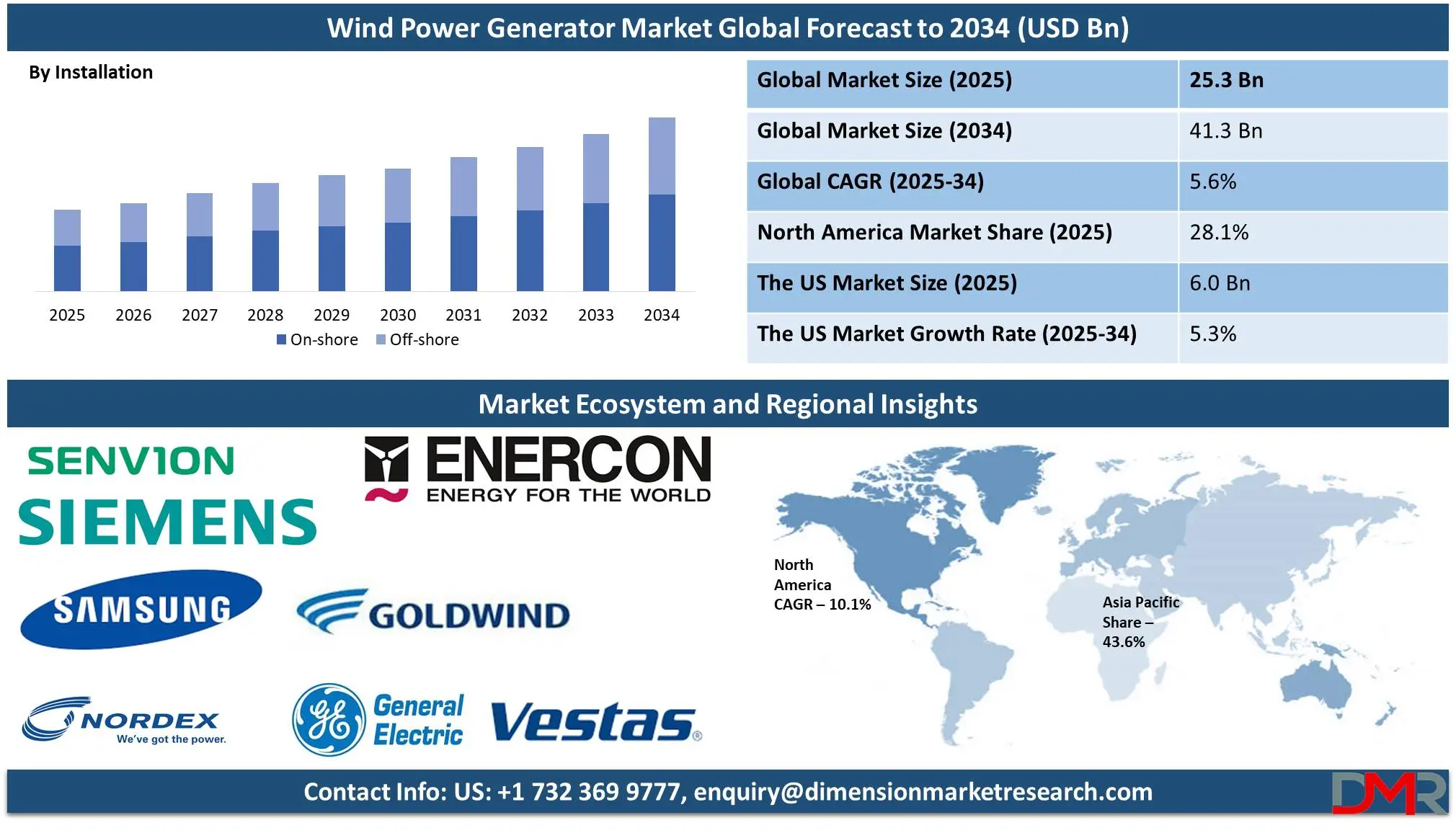

The global Wind Power Generator market is predicted to be valued at USD 25.3 billion in 2025 and is expected to grow to USD 41.3 billion by 2034, registering a CAGR of 5.6% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Wind power generators, commonly known as wind turbines, are devices that convert the kinetic energy of wind into electrical energy. They consist of rotor blades, a hub, a nacelle (housing the generator and gearbox), and a tower. As wind moves the blades, they spin the rotor, which drives a generator to produce electricity. Wind turbines can be installed onshore or offshore and vary in size, from small units powering individual homes to large-scale turbines for wind farms supplying electricity to the grid. Wind power is a clean, renewable energy source that reduces reliance on fossil fuels and lowers carbon emissions.

Wind power generator markets are being propelled forward by an international shift towards renewable energy sources, driven by increasing concerns regarding climate change, energy security, and fossil fuel depletion. Supportive government policies, incentives and advancements in turbine technology have further propelled market expansion. Offshore wind energy offers special promise due to its higher efficiency and reduced land constraints as well as rising energy demands in Asia-Pacific and Latin America markets. Furthermore, advances such as battery storage solutions or smart grid technologies offer further avenues of market expansion while simultaneously improving reliability for wind systems.

The US Wind Power Generators Market

The US Wind Power Generators market is projected to be valued at USD 6.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.5 billion in 2034 at a CAGR of 5.6%.

The growth of the US wind power generator market is fueled by a combination of environmental priorities and technological advancements. Government incentives and renewable energy targets encourage the adoption of wind energy as a sustainable alternative to fossil fuels. Additionally, improvements in turbine efficiency and lower manufacturing costs make wind power increasingly competitive.

The US wind power generator market is experiencing a shift toward offshore wind development and the integration of advanced technologies. Offshore projects are gaining traction due to stronger and more consistent wind patterns over water, maximizing energy output. Meanwhile, innovations such as smart turbines, real-time data analytics, and energy storage solutions are enhancing operational efficiency and reliability. Hybrid systems that combine wind with solar and storage are emerging as a popular solution to optimize energy generation.

Wind Power Generators Market: Key Takeaways

- Market Growth: The global thermal interface materials market is anticipated to expand by USD 8.0 billion, achieving a CAGR of 5.6% from 2026 to 2034.

- Installation Analysis: Onshore wind farms are predicted to dominate the global market with a revenue share based on product by the end of 2025.

- Application Analysis: Horizontal axis wind power generators (HAWTs) are predicted to dominate the wind power generator market with the highest revenue share in 2025.

- End User Analysis: Utility and power generation are predicted to lead the wind power market with the highest market share in 2025.

- Regional Analysis: Asia Pacific is projected to dominate the global thermal interface materials market, holding a market share of 43.6% by 2025.

Wind Power Generators Market: Use Cases

- Utility-Scale Power Generation: Wind power generators are widely used in utility-scale wind farms to supply electricity to national grids. These farms consist of multiple turbines and help reduce dependency on fossil fuels, contributing to sustainable energy production and lowering greenhouse gas emissions.

- Offshore Wind Farms: Offshore wind generators harness strong and consistent wind speeds over oceans and seas. They are ideal for large-scale energy production, supporting urban centers with limited land availability and advancing the global transition to clean energy.

- Community Wind Projects: Small-scale wind generators are deployed in community wind projects to provide localized energy solutions. These initiatives enable communities to generate renewable energy independently, lower electricity costs, and promote environmental sustainability.

- Remote and Rural Power Supply: Wind power generators serve as a reliable energy source for remote and rural areas. They ensure consistent electricity supply in off-grid locations, supporting agricultural operations, communication networks, and basic infrastructure.

Wind Power Generators Market: Stats & Facts

- According to TRVST, global wind energy capacity reached an extraordinary milestone in 2023, achieving 1,017 GW and officially surpassing the 1 TW mark. This remarkable achievement represents a year-on-year (YOY) growth of 13%, fueled by an additional 116 GW in capacity. Offshore wind also witnessed an impressive 17% growth, marking 2023 as the second-highest year for new offshore installations.

- The American Wind Energy Association (AWEA) reports that modern turbines, at a height of 295 feet (90 meters), have the potential to generate an annual 875,000 TWh of electricity by harnessing both onshore and offshore wind currents. Furthermore, wind power projects recover the carbon emissions associated with their construction within six months or less, after which they provide zero-emission energy for decades. The Global Wind Energy Council (GWEC) stresses the urgency for the wind industry to triple its installations by the end of this decade to help maintain global warming below the critical 1.5°C threshold, aiming to generate one-fifth of the world's electricity by 2030.

- In terms of economic benefits, data from IRENA shows that the onshore and offshore wind sector provided consistent employment for 1.4 million people globally in 2022. Nearly 48% of this workforce was concentrated in China, with the top ten countries collectively employing 1.23 million individuals. A 2013 study highlights wind energy's energy return on investment (EROI), which ranges from 18:1 to 20:1, showcasing its efficiency in energy generation.

- From an environmental viewpoint, a 2.5 KW wind energy system can save 1-2 tonnes of CO2 emissions annually while 6 KW wind systems save 2.5-5 tonnes. According to calculations by the World Energy Commission, one million kWh of wind energy saves approximately 600 tonnes. Furthermore, wind power could contribute 27% of all needed reductions towards meeting Paris Agreement targets by 2050 as global CO2 emissions decline by 6 gigatonnes by then; moreover IRENA projects that by then onshore and offshore wind will account for 35% of global electricity generation, making wind the leading energy source.

- The National Renewable Energy Laboratory (NREL) emphasizes the role altitude plays in wind energy efficiency, noting a significant increase in wind speed when turbines are placed at greater altitudes (from 80 meters up to 160 meters), potentially increasing wind speeds by one or 1.5 meters per second in many US regions and thus expanding energy generation potential.

- Technological advancements have enabled significant milestones in wind turbine design and installation. One example is SANY's SY1310A turbine measuring 430 feet long - this record-setting machine boasts an immense rotor diameter covering nearly three football fields! China's Goldwind turbine also made headlines when they produced 384.1 megawatt-hours in 24 hours during Typhoon Haikui which is enough electricity was generated here to power 170,000 homes.

- According to IRENA, the cost of electricity from new onshore wind projects has significantly decreased, with the global average dropping from $0.035/kWh to $0.033/kWh. Offshore wind projects saw a slight cost increase, reaching $0.081/kWh in 2022. In the U.S., wind energy costs average $48/MWh, driven down by improved turbine designs and more efficient wind capture technologies.

Wind Power Generators Market: Market Dynamic

Driving Factors in the Wind Power Generators Market

Growth in Global Energy Demand

Wind power has emerged as an economically viable, clean, scalable, and sustainable way to meet the ever-growing demand for energy globally without extracting finite resources. Wind energy does not fall into the same resource and environmental problems that are progressively confined to traditional energy sources like coal and oil. It is potential for scaling and sustainability has made it a critical driver of the global energy transition and an essential factor in the growth of wind generator markets across the globe.

Energy Security

Wind power increases energy security by diversifying energy sources and reducing dependence on imported fossil fuels, making it an attractive solution for governments and industries worldwide. This strategic benefit has driven the adoption and growth of wind power in global markets, particularly in regions with limited local energy resources. Countries reliant on imports face price volatility and geopolitical risks, which wind power helps mitigate. By exploiting vast windmill farms full of abundant and renewable wind energy, the supply should be stabilized, vulnerability to external shocks reduced, and energy independence strengthened as the adoption of wind power spreads across the world.

Restraints in the Wind Power Generators Market

Location and Availability of Resources

The effectiveness of wind power generation heavily depends on the availability of sufficient wind resources. Regions with low wind speeds are often unsuitable for generating electricity economically, making the construction of wind farms in such areas unfeasible. Additionally, many of the most productive wind farm sites are located far from urban and industrial centers where electricity is most needed. This necessitates the installation of long-distance transmission lines to deliver the power, which can be prohibitively expensive. Furthermore, the development of these transmission networks may face opposition from local communities due to environmental, social, or aesthetic concerns.

Regulatory and Policy Uncertainty

The wind power industry is highly sensitive to government policies, subsidies, and regulatory frameworks. Investors and developers may face significant uncertainty when governments modify or withdraw support systems, such as tax credits, feed-in tariffs, or renewable energy incentives. Sudden changes to these policies can affect project profitability and disrupt long-term planning for wind power installations. This regulatory unpredictability creates a volatile investment environment, discouraging both local and international stakeholders from committing resources to the wind energy sector, and ultimately slowing down market growth and adoption rates.

Opportunities in the Wind Power Generators Market

Technological advancements and cost reductions

Technological advancements in wind power have made it more efficient, reliable, and scalable with a significant decrease in the cost of wind energy production. Modern turbine designs and larger rotor diameters enable it to produce energy even at lower wind speeds and can be made using better materials. Innovations like floating offshore wind farms have allowed the geographical boundaries of wind energy to be further expanded into deeper waters where there is stronger, more consistent wind. These developments make wind power increasingly competitive with traditional energy sources and attract investments that speed up the adoption process around the world. Improving technology will continue to make long-term wind power a cornerstone of the global energy transition.

Economic Development and Job Creation

The wind energy industry contributes appreciably to regional economic activities by generating diversified employment opportunities across various aspects like manufacturing, erection, installation, and operation. With the onset of wind farms, it delivers economic benefits locally through job avenues and promotes various business opportunities including transportation and servicing. These features are frequently stressed by policy leaders to promote this source of wind energy. This sector fosters economic resilience while promoting sustainable development goals, including green jobs, enhanced energy independence, and reduced dependence on fossil fuels. Therefore, it forms the backbone of modern economic strategies.

Trends in the Wind Power Generators Market

Expansion of Offshore Wind Power

The global wind power market is currently shifting towards more offshore wind power generation because winds are stronger and more consistent than at onshore installation sites. More recently, floating turbine technology has extended the possibility of such projects to more significant depths offshore. This has been fueled by increased investment and government incentives combined with ambitious targets set by the countries for renewable energy. Offshore wind farms overcome land availability concerns and minimize the visual and noise-related issues that onshore turbines present. As a result, offshore wind farms are an ideal choice for sustainable large-scale energy generation.

Integration of Digital Technologies and Smart Systems

The wind power industry is undergoing a revolution with the integration of digital technologies, including AI, IoT, and advanced data analytics. These tools enable real-time monitoring, predictive maintenance, and optimization of turbine performance, leading to reduced operational costs and improved energy output. Seamless connection of wind power into the grid would be made easy by smart systems, ensuring that reliability and efficiency are developed. As such, this trend resonates with the growing emphasis on technological innovation as a means to improve the operational lifespan and cost-effectiveness of wind power generators at large.

Wind Power Generators Market: Research Scope and Analysis

By Installation

Onshore is likely to lead the global wind power generator market with revenue share in 2025 due to established infrastructure, cost-effectiveness, and ease of deployment. Because these turbines can be erected on various terrains without the complexities of offshore construction, developers can rapidly scale projects and secure financing. In addition, improved turbine designs and advances in grid integration bolster onshore wind reliability, making it an attractive option for investors and governments seeking to expand their renewable portfolios.

Despite onshore dominance, offshore wind energy is gaining traction as the second-largest market for 2025 due to its vast generation potential for large-scale projects and the opportunity to harness stronger, more consistent wind at sea. Although installing turbines in deep waters is more capital-intensive, technological breakthroughs and supportive policies are driving cost reductions, increasing investor interest in coastal developments. This expansion enables offshore wind to complement onshore capacity, contributing to a more diversified and resilient energy mix worldwide.

By Application

Horizontal axis wind power generators (HAWTs) are predicted to dominate the wind power generator market with the highest revenue share in 2025, primarily due to ongoing innovations in manufacturing, materials, and design that have significantly lowered production and installation costs. These improvements have made HAWTs increasingly cost-competitive compared to other renewable energy options. Moreover, global de-carbonization efforts have driven government support through subsidies, incentives, and favorable policies, further stimulating large-scale HAWT installations. Their superior capacity to generate electricity efficiently, combined with effective grid integration, has also bolstered their appeal.

In addition, HAWT projects create employment opportunities in manufacturing, construction, and maintenance, fostering economic growth in regions where they are deployed.

While HAWTs maintain the leading position, vertical-axis wind power generators (VAWTs) represent the second dominant segment in the market. VAWTs possess unique design advantages, such as the ability to operate effectively in turbulent and variable wind conditions, often found in urban environments. Their smaller footprint and quieter operation make them attractive for niche applications and installations in constrained spaces.

By End User

Utility and power generation are expected to dominate the wind power generator market with the highest revenue share in 2025 due to their vital role in large-scale energy production and distribution networks. Utilities have come to realize the benefits of wind power as an environmentally friendly energy solution, offering sustainable and cost-efficient ways to meet rising energy demands while decreasing carbon emissions. Wind farms tend to be constructed on a utility scale, using advanced technologies for maximum output and efficiency. Governments worldwide have also implemented favorable policies, subsidies, and renewable energy mandates encouraging utilities to adopt wind power as it provides scalability, reliability, and long-term cost benefits that make it ideal for utility companies transitioning towards cleaner sources of energy.

Commercial and industrial sectors are predicted to be the second dominating end users because they benefit from large-scale energy usage, stable site locations, and strict sustainability targets. These organizations often seek to cut operational expenses while meeting green energy mandates, driving them to adopt wind power solutions. Their steady power demand also ensures a predictable return on investment. Furthermore, they reduce reliance on external power grids.

The Global Wind Power Generators Market Report is segmented based on the following

By Installation

By Application

- Horizontal axis wind power

- Vertical axis wind power

By End User

- Utility and Power Generation

- Commercial and Industrial

- Others

Regional Analysis

Asia Pacific is projected to lead the wind power generator market with the highest

revenue share of 43.6% in 2025. Rapid population growth and higher living standards drive the demand for sustainable energy solutions; as such, governments in this region actively support renewable energy adoption. China and India, two leading contributors to global greenhouse gas emissions, have begun turning toward renewable sources like wind power to decrease their dependence on fossil fuels while meeting environmental considerations.

China's government policies and investments in wind turbine development have catalyzed an explosion of this market. China's ideal geographic conditions for wind turbine installations combined with robust manufacturing capacities and cutting-edge technological innovations ensure its leadership position in the wind power generator market throughout the Asia Pacific region.

North America is expected to become the second-largest segment in the global wind power generator market by 2025. This growth can be attributed to supportive government policies, tax incentives, and an increasing emphasis on cutting carbon emissions to combat climate change. The United States plays an instrumental role with significant investments in wind energy infrastructure as well as innovative technologies. Furthermore, demand for clean energy coupled with strong commitments towards renewable energy goals have cemented North America as one of the key regions in the global wind power market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global wind power generator market is highly competitive, driven by the rising demand for renewable energy and the push to achieve net-zero carbon targets. Key players such as Siemens Gamesa, Vestas, GE Renewable Energy, and Nordex dominate the market, focusing on technological advancements, efficiency improvements, and offshore wind projects. China, Europe, and the U.S. are the largest markets, with China's domestic companies, like Goldwind, gaining significant market share. Emerging technologies, such as larger rotor diameters and higher capacity turbines, are reshaping competition.

Offshore wind projects are growing rapidly, with Europe and Asia-Pacific leading investments. Price pressures, supply chain constraints, and rare-earth material dependencies are significant challenges. New entrants and regional players are increasing competition by offering cost-effective solutions. Strategic collaborations, mergers, and investments in sustainable technologies are key trends as companies seek to maintain a competitive edge in this evolving industry.

Some of the prominent players in the global Wind Power Generators are

- ENERCON GmbH

- Siemens

- Vestas

- Senvion

- Goldwind

- General Electric

- Samsung Electronics,

- NORDEX SE

- Ming Yang Smart Energy Group Limited

- United Power

- Other Key Players

Recent Developments

- In April 2024, Mahindra Group, a diversified conglomerate with businesses ranging from technology to tractor manufacturing, announced an investment of INR 12 billion (USD 144 million) to develop solar and wind energy projects. These renewable energy initiatives, expected to have a hybrid capacity of 150 megawatts (MW), are likely to be undertaken by Mahindra Susten, the group's renewable energy arm.

- In November 2023, the UK government significantly increased subsidies for offshore wind farms by 66%. Ahead of Allocation Round 6 (AR6) in 2024, the maximum strike price for stalled offshore wind projects was raised by 52%, from EUR 116/MWh to EUR 176/MWh. Similarly, the strike price for active offshore wind projects was increased by 66%, from EUR 44 (USD 54.5)/MWh to EUR 73/MWh.

- In May 2023, Octopus Energy, a UK-based company, announced an investment of USD 1.8 billion to fund renewable energy projects, including wind and solar, across the Asia-Pacific region. The investment, planned to be executed by 2027, will also contribute to Japan's goal of expanding its offshore wind energy capacity by 150 GW by 2030. These efforts and investments are expected to drive the market between 2024 and 2029.

- In December 2023, Apraava Energy secured a 1,200 MW capacity project through the Inter-State Transmission System (ISTS) auction conducted by the Energy Corporation of India (SECI). This includes the construction of a 300 MW wind farm in Karnataka, India. The project, based on a 25-year Power Purchase Agreement (PPA), will operate at a competitive tariff of INR 3.24/kWh

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 25.3 Bn |

| Forecast Value (2033) |

USD 41.3 Bn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 6.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Installation (On-shore, and Off-shore), By Application (Horizontal axis wind power, and Vertical axis wind power), By End User (Commercial and Industrial, Utility and Power Generation, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ENERCON GmbH, Siemens, Vestas, Senvion, Goldwind, General Electric, Samsung Electronics, NORDEX SE, Ming Yang Smart Energy Group Limited, United Power,and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Wind Power Generators Market?

▾ The Global Wind Power Generators Market size is estimated to have a value of USD 25.3 billion in 2024 and is expected to reach USD 41.3 billion by the end of 2033.

Which region accounted for the largest Global Wind Power Generators Market?

▾ Asia Pacific is expected to be the largest market share for the Global Wind Power Generators Market with a share of about 43.6% in 2024.

Who are the key players in the Global Wind Power Generators Market?

▾ Some of the major key players in the Global Wind Power Generators Market are Siemens Gamesa, Vestas, and many others.

What is the growth rate in the Global Wind Power Generators Market?

▾ The market is growing at a CAGR of 5.6 percent over the forecasted period.

How big is the US Wind Power Generators Market?

▾ The US Wind Power Generators Market size is estimated to have a value of USD 6.0 billion in 2024 and is expected to reach USD 9.5 billion by the end of 2033.