Market Overview

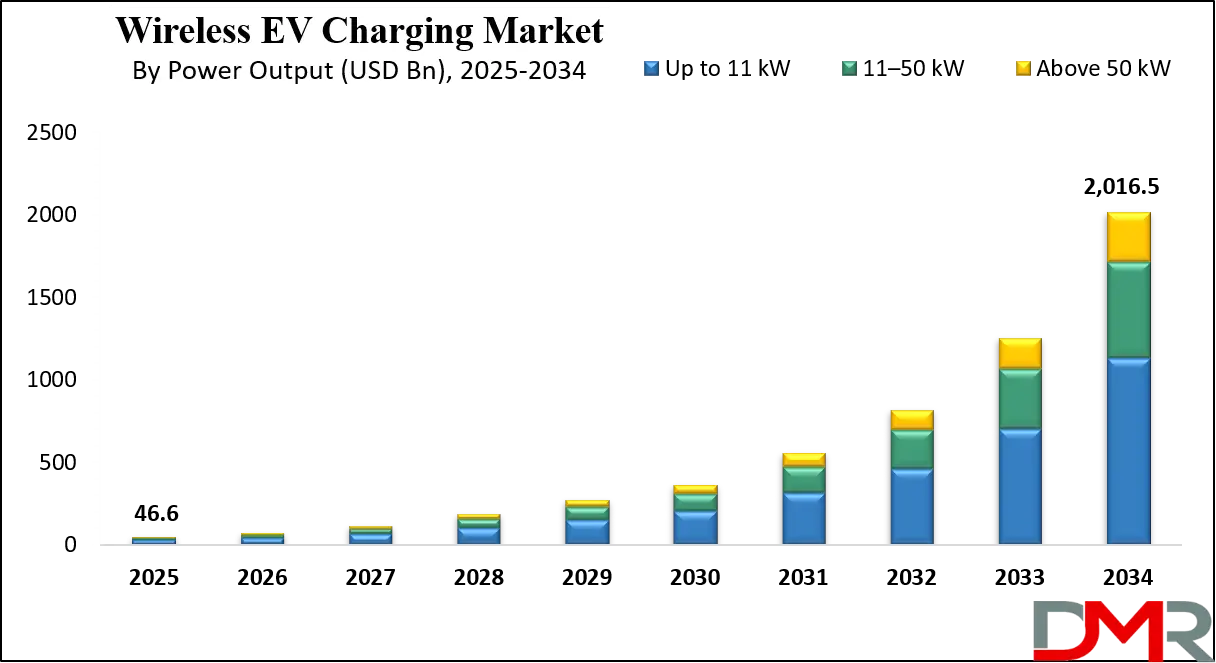

The global wireless EV charging market is projected to reach USD 46.6 billion in 2025 and expand to USD 2,016.5 billion by 2034, registering a strong CAGR of 52.0% driven by rising electric vehicle adoption, smart mobility solutions, and advanced charging infrastructure.

Wireless EV charging is an advanced power transfer technology that eliminates the need for physical cables or plugs to charge electric vehicles. It relies on electromagnetic fields created through inductive or resonant coupling between a ground-based charging pad and a receiver installed in the vehicle. This system offers enhanced convenience, safety, and automation for users as it enables seamless charging in home garages, parking lots, and public spaces. The approach also supports the future of autonomous mobility by allowing vehicles to charge without human intervention while aligning with smart city and sustainable transportation goals.

The global wireless EV charging market is gaining momentum as governments and private players invest in smart infrastructure to accelerate

electric vehicle adoption. The technology is evolving from pilot projects to commercial deployment, driven by the demand for efficient and user-friendly charging methods. Integration of wireless systems into passenger cars, buses, and commercial fleets is expanding, supported by strong incentives for clean energy solutions and stricter emission regulations. Key markets such as the United States, Germany, China, and Japan are at the forefront, implementing large-scale trials and partnerships between automakers and technology providers.

Market growth is further propelled by rapid advancements in inductive and resonant charging, high-power transfer capabilities, and the potential for dynamic in-road solutions that allow vehicles to charge while moving. Wireless charging is becoming a critical component of connected mobility ecosystems by supporting the Internet of Things, fleet electrification, and urban energy management. With growing consumer interest in sustainable and hassle-free charging, and continuous collaboration among technology firms, automakers, and governments, the industry is expected to witness exponential expansion over the next decade.

The US Wireless EV Charging Market

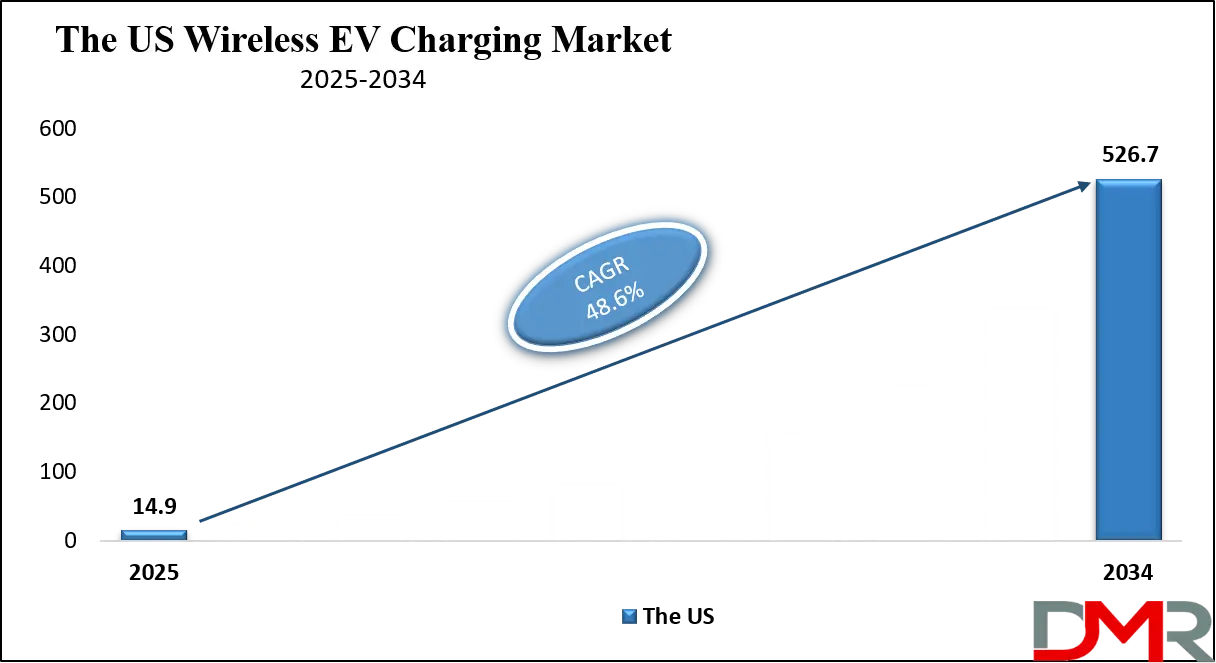

The U.S. Wireless EV Charging market size is projected to be valued at USD 14.9 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 526.7 billion in 2034 at a CAGR of 48.6%.

The wireless EV charging market is emerging as a transformative force in the electric mobility ecosystem, offering seamless power transfer without the need for cables or manual intervention. The adoption of inductive and resonant charging technologies is enhancing user convenience, reducing maintenance costs, and enabling integration with autonomous vehicles. Growing investment in smart transportation infrastructure, urban mobility, and energy-efficient solutions is accelerating the deployment of wireless charging pads across residential, commercial, and public environments.

Automakers are increasingly collaborating with technology providers to integrate wireless charging modules into passenger cars, buses, and logistics fleets, aligning with global sustainability and zero-emission goals.

Rising electric vehicle penetration across North America, Europe, and Asia-Pacific is driving demand for advanced EV charging infrastructure that supports scalability, reliability, and grid optimization. The market is also witnessing strong momentum from pilot projects in dynamic wireless charging, where vehicles can be powered while in motion, addressing range anxiety and improving fleet efficiency.

Integration with Internet of Things platforms and vehicle-to-grid technologies further strengthens the role of wireless charging in smart city development. With government incentives, stricter emission standards, and advancements in high-power transfer systems, the wireless EV charging industry is positioned for rapid growth, reshaping how energy is delivered to electric vehicles globally.

Europe Wireless EV Charging Market

The European wireless EV charging market is projected to reach approximately USD 13.9 billion in 2025, reflecting the region’s strong commitment to sustainable transportation and zero-emission mobility. This growth is primarily driven by extensive government incentives, stringent emission regulations, and growing investments in smart city infrastructure across countries such as Germany, the UK, France, and Norway.

European automakers are actively integrating wireless charging modules into passenger cars, commercial fleets, and public transport vehicles, enhancing convenience and promoting faster adoption of electric mobility. Additionally, growing urbanization and rising awareness of eco-friendly transportation are further fueling the demand for efficient and user-friendly wireless charging systems.

The market in Europe is expected to grow at a robust CAGR of 45.3% over the forecast period, supported by advancements in inductive charging technology and the deployment of high-power charging stations. Pilot projects in dynamic in-road charging and integration with vehicle-to-grid platforms are expanding the possibilities for continuous and seamless energy transfer.

Collaboration between technology providers, automotive companies, and municipal authorities is accelerating the commercialization of wireless EV charging, positioning Europe as one of the most advanced and rapidly growing regions in the global market. The emphasis on interoperability, standardization, and smart energy management systems will further strengthen market growth and adoption across diverse applications.

Japan Wireless EV Charging Market

The Japanese wireless EV charging market is projected to reach approximately USD 2.6 billion in 2025, reflecting the country’s strong emphasis on electric mobility and sustainable transportation infrastructure. Japan’s growth is supported by proactive government policies promoting EV adoption, incentives for clean energy solutions, and investments in smart city projects.

Leading automakers such as Toyota, Honda, and Nissan are actively integrating wireless charging technology into passenger cars and commercial fleets, while pilot projects for dynamic and high-power inductive charging are being implemented in urban centers and major highways. The growing demand for efficient, convenient, and cable-free charging solutions is further driving market adoption across residential, commercial, and public applications.

The market is expected to grow at a robust CAGR of 51.2%, indicating one of the fastest growth rates globally. Technological advancements in inductive charging, integrated with the deployment of vehicle-to-grid systems and IoT-enabled energy management platforms, are accelerating adoption across multiple sectors.

Collaboration between technology providers, automotive companies, and local governments is enabling scalable and interoperable wireless EV charging networks. As Japan continues to invest in smart transportation ecosystems and autonomous vehicle integration, the wireless EV charging market is set to play a pivotal role in the nation’s shift toward zero-emission and intelligent mobility solutions.

Global Wireless EV Charging Market: Key Takeaways

- Market Value: The global Wireless EV Charging market size is expected to reach a value of USD 2,016.5 billion by 2034 from a base value of USD 46.5 billion in 2025 at a CAGR of 52.0%.

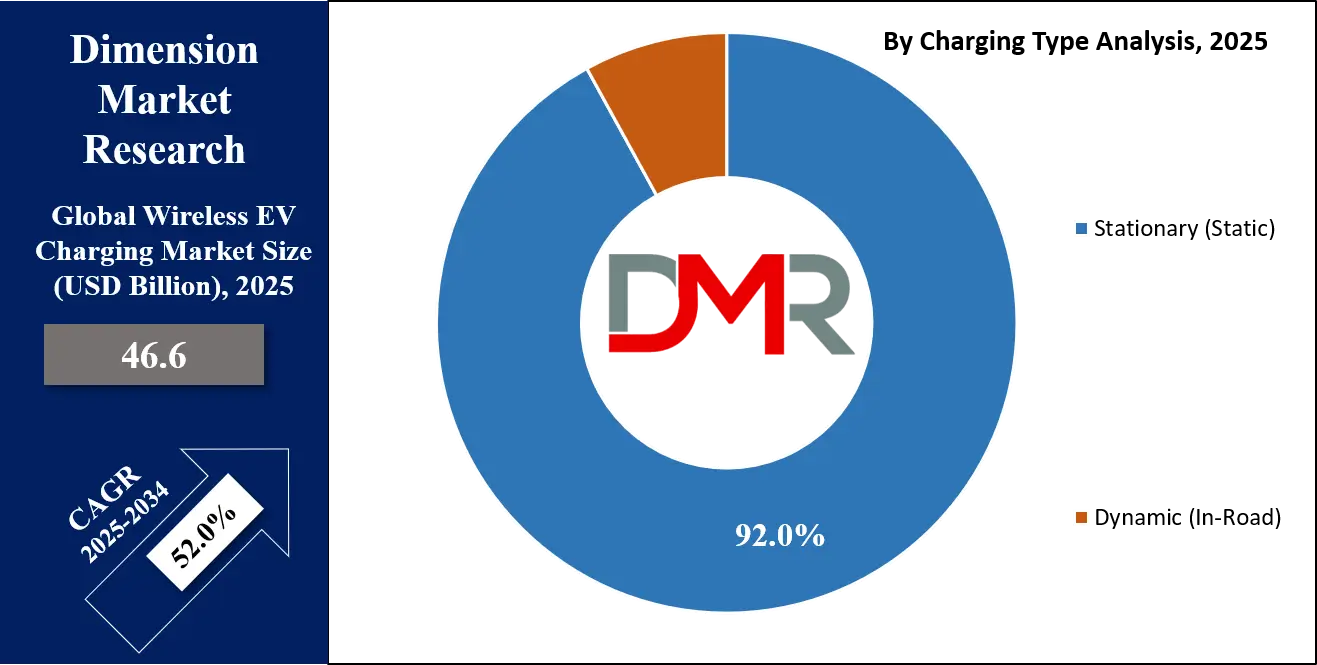

- By Charging Type Analysis: Stationary (Static) charging is anticipated to dominate the charging type segment, capturing 92.0% of the total market share in 2025.

- By Power Output Segment Analysis: Up to 11 kW output is expected to maintain its dominance in the power output segment, capturing 56.0% of the total market share in 2025.

- By Vehicle Propulsion Segment Analysis: Battery Electric Vehicles (BEVs) will dominate the vehicle propulsion segment, capturing 89.0% of the market share in 2025.

- By Vehicle Type Segment Analysis: Passenger Cars will account for the maximum share in the vehicle type segment, capturing 68.0% of the total market value.

- By Technology Segment Analysis: Inductive (IPT) technology will dominate the technology segment, capturing 66.0% of the market share in 2025.

- By Application Segment Analysis: Commercial applications capture the maximum share in the application segment, capturing 70.0% of the market share in 2025.

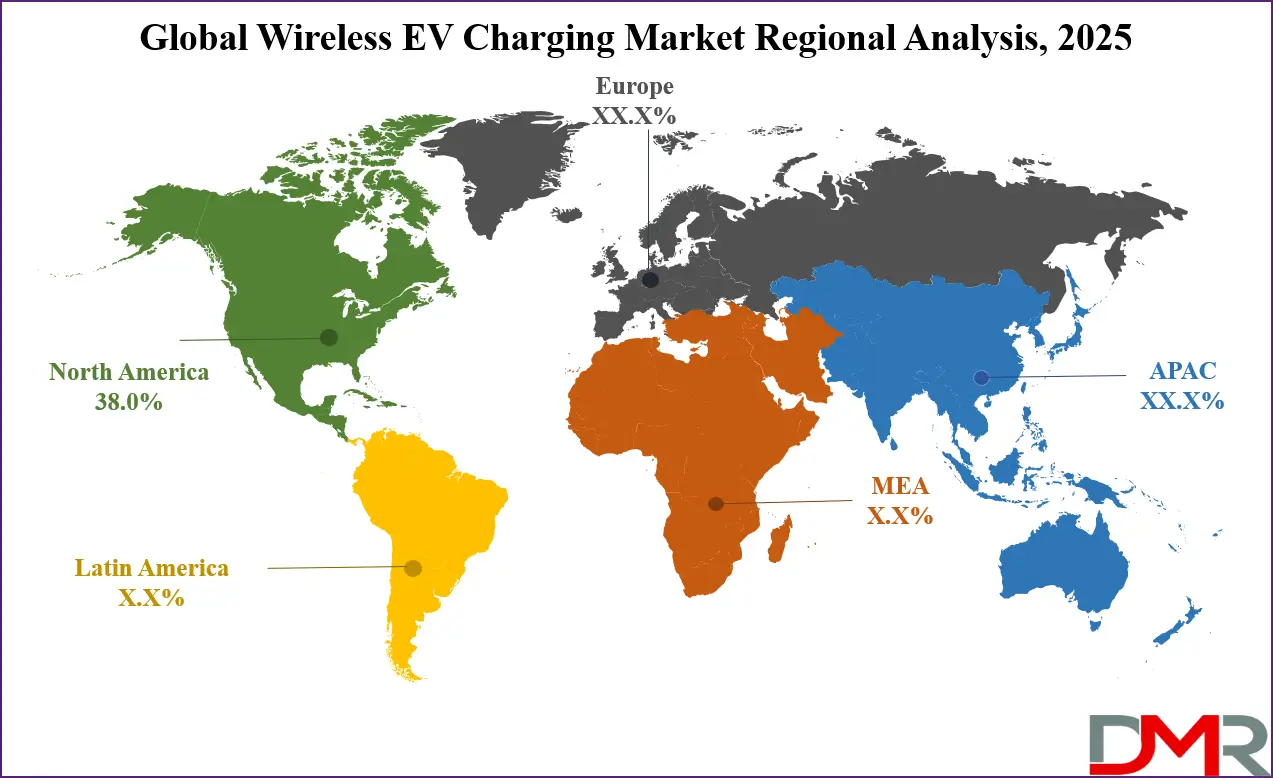

- Regional Analysis: North America is anticipated to lead the global Wireless EV Charging market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Wireless EV Charging market include WiTricity, Plugless Power (Evatran), Qualcomm Halo (now WiTricity), Momentum Dynamics, Electreon Wireless, HEVO Inc., IPT Technology, Elix Wireless, Mojo Mobility, Wave IPT (Ideanomics subsidiary), Toshiba Corporation, ZTE Corporation, Delta Electronics, Samsung Electronics, Continental AG, and Others.

Global Wireless EV Charging Market: Use Cases

- Residential Charging for Passenger Cars: Wireless EV charging is increasingly being adopted in home garages to provide seamless and cable-free charging experiences for passenger vehicles. Homeowners benefit from the convenience of simply parking over a charging pad without handling bulky cables, making it ideal for daily charging routines. This use case supports the rising adoption of electric vehicles in urban areas and aligns with smart home integration, IoT-based monitoring, and sustainable energy management.

- Public Charging Infrastructure in Smart Cities: Municipalities and energy providers are deploying wireless charging systems in public parking lots, shopping centers, and business districts to enhance urban mobility. These installations enable drivers to top up their batteries effortlessly while they work or shop, contributing to the development of connected smart city infrastructure. The focus is on reducing range anxiety, supporting zero-emission transport, and creating scalable EV charging networks that improve overall transportation efficiency.

- Fleet and Logistics Vehicle Electrification: Commercial fleets and logistics providers are embracing wireless charging to improve vehicle turnaround times and minimize operational downtime. Taxis, buses, and delivery vans can charge wirelessly during scheduled stops or loading periods, ensuring maximum utilization of electric assets. This use case is particularly valuable for high-mileage vehicles where efficiency, automation, and cost reduction are critical, making wireless charging a strategic enabler of fleet electrification.

- Dynamic In-Road Charging for Future Mobility: Dynamic wireless charging, where vehicles charge while driving on specially equipped roads, is being tested in pilot projects globally. This breakthrough addresses range limitations, eliminates frequent charging stops, and supports continuous operation of autonomous vehicles and heavy-duty trucks. By integrating vehicle-to-grid technology and smart road infrastructure, this use case positions wireless charging as a cornerstone for next-generation transportation systems and sustainable long-distance mobility.

Impact of Artificial Intelligence on Wireless EV Charging Market

Artificial intelligence is playing a transformative role in the wireless EV charging market by enabling smarter energy management, predictive maintenance, and optimized charging efficiency. AI-powered algorithms analyze vehicle data, grid demand, and user behavior to dynamically adjust charging speed, reduce energy losses, and balance loads across networks. In smart cities and fleet operations, AI enhances interoperability between charging pads and electric vehicles, ensuring seamless connectivity with Internet of Things platforms. By supporting autonomous driving ecosystems and vehicle-to-grid integration, artificial intelligence is accelerating the adoption of wireless charging as a core component of intelligent transportation infrastructure.

Global Wireless EV Charging Market: Stats & Facts

Global EV Outlook 2025 – International Energy Agency (IEA)

- In 2024, more than 1.3 million public charging points were added globally, marking a 30% increase from the previous year.

- By the end of 2024, Europe had over 1 million public charging points, with a growth rate exceeding 35% compared to 2023.

- Within the European Union, 11 out of 27 countries saw their public charging infrastructure increase by more than 50% in 2024.

Alternative Fuels Data Center – U.S. Department of Energy

- The United States had approximately 1.3 million public and private EV charging stations in 2024.

- As of 2024, the U.S. had over 100,000 Level 2 charging stations and more than 10,000 DC fast charging stations.

- The U.S. Department of Energy's Alternative Fuels Data Center provides quarterly reports on the growth of EV charging infrastructure.

Federal Transit Administration (FTA) – U.S. Department of Transportation

- In December 2024, the FTA published a report on the effectiveness of wireless charging for electric transit buses.

- The report highlighted that wireless charging could extend the operating range of buses, shorten charging times, and reduce battery size.

- The FTA's study on wireless charging for electric buses was mandated by the U.S. Congress in the 2023 appropriations bill.

Government Accountability Office (GAO) – U.S. Government

- The GAO's 2025 report on electric vehicle infrastructure discussed the establishment of priorities by the Joint Office for fiscal years 2023 to 2025.

- These priorities include providing technical assistance, staffing, and communication with stakeholders regarding EV infrastructure.

- The GAO noted that these priorities guide the efforts of the Joint Office but do not include measurable targets or time frames.

U.S. Department of Energy – Office of Energy Efficiency and Renewable Energy

- The U.S. Department of Energy's Office of Energy Efficiency and Renewable Energy supports the development of wireless EV charging technologies through various programs.

- These programs aim to advance the research and deployment of wireless charging solutions for electric vehicles.

- The department collaborates with industry stakeholders to promote the adoption of wireless charging infrastructure.

Global Wireless EV Charging Market: Market Dynamics

Global Wireless EV Charging Market: Driving Factors

Rising Adoption of Electric Vehicles

The global shift toward sustainable mobility and zero-emission transportation is driving strong demand for wireless EV charging solutions. Increasing EV penetration in passenger cars, commercial fleets, and public transport is fueling the need for efficient and user-friendly charging systems. Governments offering incentives and automakers integrating wireless modules into vehicles further boost adoption, creating a robust growth ecosystem.

Growing Investments in Smart Infrastructure

Smart city initiatives and the expansion of connected mobility ecosystems are accelerating the deployment of wireless charging infrastructure. Public authorities and private companies are focusing on integrating wireless charging pads in residential, commercial, and public areas. This factor is also tied to the adoption of Internet of Things technologies and vehicle-to-grid systems, enabling seamless energy management and urban electrification.

Global Wireless EV Charging Market: Restraints

High Installation and System Costs

Despite its benefits, the wireless EV charging market faces challenges due to the high cost of installation and specialized components. Developing charging pads, in-vehicle receivers, and grid integration technologies involves significant investment, limiting widespread adoption in price-sensitive markets.

Limited Standardization across Regions

Lack of global interoperability and standardized charging protocols restricts seamless adoption. Automakers and technology providers often develop proprietary systems, creating compatibility issues across vehicle types and geographies. This lack of standardization hinders scalability and slows infrastructure rollout.

Global Wireless EV Charging Market: Opportunities

Expansion of Dynamic In-Road Charging

Dynamic wireless charging, where vehicles charge while in motion, represents a major growth opportunity. Pilot projects in the United States, Europe, and Asia are demonstrating the potential to reduce range anxiety, increase fleet efficiency, and support autonomous vehicles. This innovative solution can transform long-distance electric mobility and commercial logistics operations.

Integration with Renewable Energy Sources

Linking wireless charging with solar, wind, and other renewable energy systems opens new possibilities for sustainable transportation. Smart energy management combined with wireless charging pads can reduce reliance on fossil fuels, lower grid pressure, and create eco-friendly urban charging ecosystems.

Global Wireless EV Charging Market: Trends

AI and IoT-Enabled Smart Charging

Artificial intelligence and Internet of Things technologies are being increasingly integrated into wireless EV charging networks. These solutions enable predictive analytics, dynamic load balancing, and real-time monitoring, improving efficiency while supporting grid stability and autonomous mobility systems.

Automaker and Tech Collaborations

Global automakers are partnering with wireless charging technology providers to integrate inductive and resonant systems into next-generation vehicles. Collaborations between companies such as WiTricity, BMW, Toyota, and Hyundai highlight a growing trend of embedding wireless charging capabilities directly at the manufacturing stage, accelerating mainstream adoption.

Global Wireless EV Charging Market: Research Scope and Analysis

By Charging Type Analysis

Stationary wireless charging is expected to dominate the charging type segment, capturing around 92.0% of the total market share in 2025. This dominance is driven by the practicality and scalability of static charging pads, which can be easily installed in home garages, office parking lots, shopping centers, and public charging stations.

Automakers and infrastructure providers are already deploying the technology as it requires minimal changes to existing roadways and ensures reliable energy transfer when vehicles are parked. Consumers prefer stationary charging for its convenience, cost-effectiveness, and compatibility with both passenger cars and commercial fleets, making it the leading solution in the current phase of market development.

Dynamic in-road wireless charging, although holding a much smaller share of the market, represents an innovative and high-potential technology. It allows electric vehicles to charge while in motion through embedded charging coils in roadways, reducing the need for frequent stops and tackling the challenge of range anxiety. While pilot projects in regions like Europe, the United States, and Asia-Pacific are showcasing the feasibility of this approach, large-scale adoption is still limited due to high infrastructure costs and the complexity of implementation.

However, as smart city projects expand and governments push for advanced mobility solutions, dynamic charging is expected to emerge as a crucial growth driver for long-distance transport, autonomous vehicles, and logistics fleets in the future.

By Power Output Analysis

Up to 11 kW wireless charging is projected to maintain its dominance in the power output segment, accounting for 56.0% of the total market share in 2025. This output range is well-suited for residential charging setups, private parking spaces, and small commercial installations where overnight or long-duration charging is feasible. Its relatively lower infrastructure cost, compatibility with most passenger vehicles, and ease of integration into existing energy systems make it the preferred choice for individual EV owners and small-scale fleet operators. The popularity of home-based charging further supports the growth of this segment, as consumers prioritize convenience and affordability.

The 11–50 kW wireless charging segment, while smaller in share, plays a vital role in supporting faster charging for commercial applications, public infrastructure, and fleet operations. This category is particularly beneficial for taxis, delivery vans, and buses that require shorter charging cycles to maximize operational efficiency.

The ability to deliver higher power output within limited timeframes makes this segment attractive for urban mobility hubs, workplace charging stations, and logistics depots. Although adoption is still emerging, the 11–50 kW range is gaining traction as cities expand EV-friendly infrastructure and as businesses seek reliable mid-range charging solutions to enhance vehicle utilization.

By Vehicle Propulsion Analysis

Battery electric vehicles are projected to dominate the vehicle propulsion segment, capturing 89.0% of the total market share in 2025. The rapid growth of BEVs is supported by government incentives, declining battery costs, stricter emission regulations, and growing consumer demand for zero-emission mobility. Wireless charging aligns perfectly with the needs of BEVs, as it offers a hassle-free and efficient solution for daily charging without manual plug-ins. Automakers are integrating wireless charging modules into next-generation BEVs to enhance convenience and support the transition to fully electric transportation, making this segment the clear leader in market adoption.

Plug-in hybrid electric vehicles, while occupying a smaller share of around 11.0%, continue to play a role in the wireless EV charging ecosystem. PHEVs are often viewed as a transitional technology, offering the flexibility of combining electric driving with a conventional fuel engine. Wireless charging for PHEVs provides added convenience for short-distance urban commutes, allowing drivers to maximize electric usage while relying on fuel for longer trips. Although their share is expected to decline as BEVs gain dominance, PHEVs remain relevant in regions where charging infrastructure is still developing and consumers prefer hybrid solutions for range security.

By Vehicle Type Analysis

Passenger cars are expected to account for the maximum share in the vehicle type segment, capturing 68.0% of the total market value in 2025. Rising consumer adoption of electric cars, growing urbanization, and government-backed incentives are fueling this dominance. Wireless charging offers a seamless and user-friendly solution for passenger vehicles, eliminating the need for cables and enabling effortless charging in residential garages, office complexes, and public parking spaces. Automakers are also focusing on integrating wireless charging modules into premium and mid-range electric cars, enhancing convenience for individual users while supporting the broader shift toward sustainable mobility.

Commercial and heavy vehicles, while representing a smaller share of around 32.0%, are becoming an important segment in the wireless EV charging market. This category includes buses, trucks, and logistics fleets that benefit from wireless charging solutions to reduce downtime and optimize operational efficiency. Wireless charging can be integrated at depots, bus stops, and loading bays, allowing vehicles to recharge during idle periods and improve fleet utilization. Although adoption is still at an early stage due to higher infrastructure costs and power requirements, the demand for electrified logistics and sustainable public transport is expected to drive significant growth in this segment over the coming years.

By Technology Analysis

Inductive (IPT) technology is expected to dominate the technology segment, capturing 66.0% of the market share in 2025. This technology relies on electromagnetic fields to transfer energy between a ground-based charging pad and a receiver in the vehicle, offering a reliable, safe, and cable-free charging solution. Its widespread adoption is driven by compatibility with most passenger cars and light commercial vehicles, ease of installation, and the ability to integrate seamlessly with existing parking and residential infrastructure. Inductive charging also supports smart mobility applications, including Internet of Things-enabled energy management and integration with autonomous vehicle systems, making it the preferred choice for the majority of the market.

Magnetic Gear Wireless Power Transfer (MGWPT) technology, while holding a smaller share of the market, is gaining attention for its high efficiency and capability to deliver higher power output over longer distances. MGWPT uses magnetic gearing principles to optimize energy transfer, making it suitable for heavy-duty vehicles, buses, and dynamic in-road charging applications. Although adoption is currently limited due to higher costs and complexity compared to inductive systems, MGWPT is expected to grow as fleets and commercial transport operators seek faster, more efficient charging solutions that can support high-capacity and continuous operations in urban and intercity environments.

By Application Analysis

Commercial applications are expected to capture the maximum share in the application segment, accounting for 70.0% of the total market share in 2025. This dominance is driven by the growing adoption of electric buses, delivery vans, taxis, and corporate fleets that require reliable and efficient charging solutions to maintain high operational uptime.

Wireless EV charging offers commercial operators the advantage of automated, cable-free energy transfer during loading, parking, or scheduled stops, improving fleet utilization and reducing downtime. Urban mobility projects, public transport electrification, and logistics operations are increasingly integrating wireless charging systems as part of smart city initiatives and sustainable transportation strategies.

Residential applications, while smaller in share at around 30.0%, remain a key segment supporting the growth of the wireless EV charging market. Home-based wireless charging provides convenience and ease of use for individual EV owners, allowing vehicles to charge safely overnight without manual plug-in connections.

This segment is gaining traction in urban and suburban areas where personal electric cars are becoming more prevalent. Integration with smart home systems, energy management platforms, and IoT-enabled monitoring enhances the user experience, making residential wireless charging an attractive solution for daily commuter vehicles and private EV owners.

The Wireless EV Charging Market Report is segmented on the basis of the following:

By Charging Type

- Stationary (Static)

- Dynamic (In-Road)

By Power Output

- Up to 11 kW

- 11-50 kW

- Above 50 kW

By Vehicle Propulsion

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid EVs (PHEVs)

By Vehicle Type

- Passenger Cars

- Commercial/Heavy Vehicles

By Technology

- Inductive (IPT)

- Magnetic Gear Wireless Power Transfer (MGWPT)

By Application

- Commercial

- Residential

- Capacitive (CWPT)

Global Wireless EV Charging Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global wireless EV charging market, accounting for 38.0% of total market revenue in 2025. The region’s dominance is driven by early adoption of electric vehicles, strong government incentives, and substantial investment in smart transportation infrastructure. The United States, in particular, is witnessing widespread deployment of wireless charging pads for passenger cars, commercial fleets, and pilot dynamic charging projects. Increasing collaborations between automakers and technology providers, combined with growing awareness of sustainable mobility solutions, are reinforcing North America’s position as the largest and most advanced market for wireless EV charging globally.

Region with significant growth

Asia-Pacific is poised to experience significant growth in the wireless EV charging market due to rapid electric vehicle adoption, supportive government policies, and large-scale investment in smart city and urban mobility projects. Countries such as China, Japan, and South Korea are leading the way with pilot programs, public charging infrastructure, and integration of wireless technology in commercial fleets. Rising demand for convenient, cable-free charging solutions, combined with advancements in inductive and high-power transfer systems, is positioning Asia-Pacific as one of the fastest-growing regions, with substantial opportunities for both passenger cars and commercial vehicle segments.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Wireless EV Charging Market: Competitive Landscape

The global wireless EV charging market features a competitive landscape driven by collaboration between automakers, technology providers, and infrastructure developers. Key players such as WiTricity, Plugless Power (Evatran), Momentum Dynamics, Electreon Wireless, and major automotive companies including BMW, Toyota, Hyundai, and Daimler are actively investing in research and development to enhance charging efficiency, expand product portfolios, and introduce innovative solutions like dynamic in-road charging and high-power inductive systems. Strategic partnerships, mergers, and pilot projects are shaping the market, while competition focuses on technological advancements, standardization, and integration with smart city and connected mobility ecosystems to gain a leading edge globally.

Some of the prominent players in the global wireless EV charging market are:

- WiTricity

- Plugless Power

- Qualcomm Halo

- Momentum Dynamics

- Electreon Wireless

- HEVO Inc.

- IPT Technology

- Elix Wireless

- Mojo Mobility

- Wave IPT (Ideanomics subsidiary)

- Toshiba Corporation

- ZTE Corporation

- Delta Electronics

- Samsung Electronics

- Continental AG

- Robert Bosch GmbH

- Toyota Motor Corporation

- BMW Group

- Daimler AG (Mercedes-Benz)

- Hyundai Motor Company

- Other Key Players

Global Wireless EV Charging Market: Recent Developments

- March 2024: WiTricity was featured in "This Month in Venture" by The Private Shares Fund, highlighting its ongoing efforts and developments in the wireless EV charging market.

- January 2024: WiTricity and ICON EV introduced the first-ever wirelessly charged electric golf carts at CES. These vehicles feature wireless charging technology and are set to be available in Summer 2024.

- January 2024: WiTricity unveiled its aftermarket wireless EV charging solution, the WiTricity Halo™ Charging. This system offers a complete, end-to-end, and hassle-free charging experience: just park and charge.

- January 2024: WiTricity announced the formation of the EV Wireless Power Transfer Council in Japan, alongside the establishment of its subsidiary, WiTricity Japan KK. This move aims to promote wireless power transfer projects in Japan.

- January 2024: WiTricity appointed Joe Benz as the company's new CEO, signaling a strategic leadership change to drive growth and innovation in the wireless EV charging sector.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 46.6 Bn |

| Forecast Value (2034) |

USD 2,016.5 Bn |

| CAGR (2025–2034) |

52.0% |

| The US Market Size (2025) |

USD 14.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Charging Type (Stationary/Static, Dynamic/In-Road), By Power Output (Up to 11 kW, 11-50 kW, Above 50 kW), By Vehicle Propulsion (Battery Electric Vehicles/BEVs, Plug-in Hybrid EVs/PHEVs), By Vehicle Type (Passenger Cars, Commercial/Heavy Vehicles), By Technology (Inductive/IPT, Magnetic Gear Wireless Power Transfer/MGWPT, Capacitive/CWPT), and By Application (Commercial, Residential) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

WiTricity, Plugless Power (Evatran), Qualcomm Halo (now WiTricity), Momentum Dynamics, Electreon Wireless, HEVO Inc., IPT Technology, Elix Wireless, Mojo Mobility, Wave IPT (Ideanomics subsidiary), Toshiba Corporation, ZTE Corporation, Delta Electronics, Samsung Electronics, Continental AG, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Wireless EV Charging market size is estimated to have a value of USD 46.6 billion in 2025 and is expected to reach USD 2,016.5 billion by the end of 2034.

The US Wireless EV Charging market is projected to be valued at USD 14.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 526.7 billion in 2034 at a CAGR of 48.6%.

North America is expected to have the largest market share in the global Wireless EV Charging market, with a share of about 38.0% in 2025.

Some of the major key players in the global Wireless EV Charging market are WiTricity, Plugless Power (Evatran), Qualcomm Halo (now WiTricity), Momentum Dynamics, Electreon Wireless, HEVO Inc., IPT Technology, Elix Wireless, Mojo Mobility, Wave IPT (Ideanomics subsidiary), Toshiba Corporation, ZTE Corporation, Delta Electronics, Samsung Electronics, Continental AG, and Others.

The market is growing at a CAGR of 52.0 percent over the forecasted period.