There are various types of wood adhesives, including synthetic options such as polyurethane, polyvinyl acetate (PVA), and epoxy, each suited for different applications based on the required adhesive properties. With the rising demand for engineered wood products and sustainable construction materials, the market is witnessing accelerated adoption across multiple industries.

The global wood adhesives market includes the production, supply, and use of these adhesives for both commercial and industrial applications. As the demand for high-quality, durable wood products continues to rise, especially in construction and interior design sectors, the market for wood adhesives is experiencing steady growth.

This market encompasses not only the manufacturers of the adhesives but also the end-users across diverse industries that rely on strong, reliable bonding materials to produce wood-based products. The increasing focus on eco-friendly adhesives further strengthens opportunities for innovation in this sector, driving sustainable growth.

For newer businesses and those entering the market, opportunities lie in targeting niche segments and regional markets that are seeing significant growth. For example, providing custom adhesives for high-performance wood products like marine plywood or furniture, which require superior strength and resistance to environmental factors, can be a key strategy.

Emerging players can also benefit from the booming construction sector in regions like Asia-Pacific, where rapid urbanization is leading to increased demand for high-quality building materials, further driving the need for reliable wood adhesives. Additionally, as highlighted by MTCopeland, the strength of wood adhesives typically ranges between 3,600 and 4,000 psi, indicating their robustness. By focusing on improving adhesive strength and providing cost-effective solutions, new entrants can gain a competitive edge in the market.

Several key trends are shaping the wood adhesives market in 2024. One of the most significant trends is the increasing demand for eco-friendly adhesives. With growing environmental concerns, manufacturers and consumers alike are opting for water-based and bio-based adhesives that are made from renewable resources. These adhesives are gaining popularity due to their lower environmental impact and reduced levels of volatile organic compounds (VOCs), which makes them safer for both users and the environment.

Another important trend is the continuous technological advancement in adhesive formulations. The market is seeing the rise of innovative products that offer enhanced durability, faster curing times, and improved performance under extreme conditions. Adhesive solutions such as UV-cured and heat-activated adhesives are becoming more widely used due to their superior bonding strength and ease of application. These technologies are particularly beneficial for industries that require fast production cycles and high-performance standards.

Regional growth is also playing a pivotal role in the expansion of the wood adhesives market. The European Union, which accounts for approximately 5% of the world’s forests, remains a major player in the production of wood products. As the demand for high-quality plywood increases, particularly marine plywood, the need for reliable adhesives has risen significantly. The strong production and trade in wood products within the EU continue to drive the demand for advanced wood adhesives, positioning the region as a key market for growth.

Key takeaway

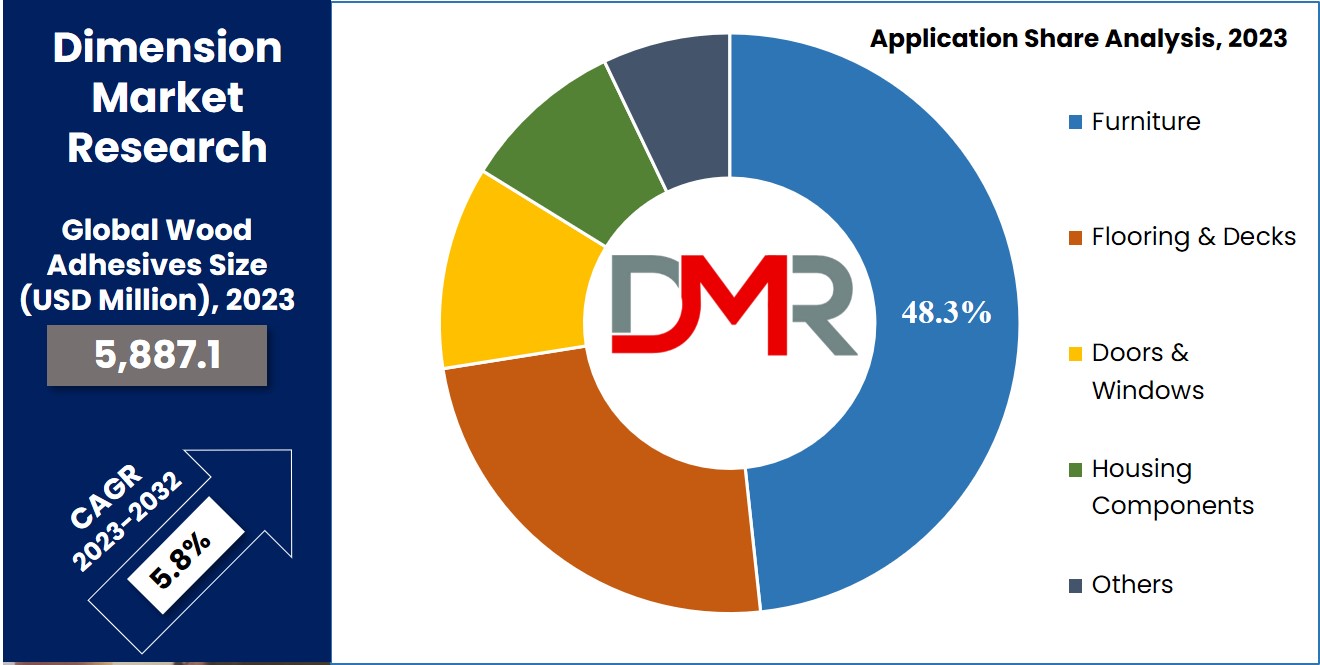

- The Global Wood Adhesives Market is projected to reach USD 5,887.1 million in 2023, with a CAGR of 5.8% from 2023 to 2032.

- Urea-formaldehyde (UF) adhesives dominate the market due to their high tensile strength and cost-effectiveness in wood applications.

- Particleboard (PB) leads the substrate category, driven by its cost-effectiveness, density, and uniformity.

- Water-based adhesives hold the largest market share due to their eco-friendliness and sustainability.

- The furniture application segment leads the market, driven by the growing use of wood panels for interior decor.

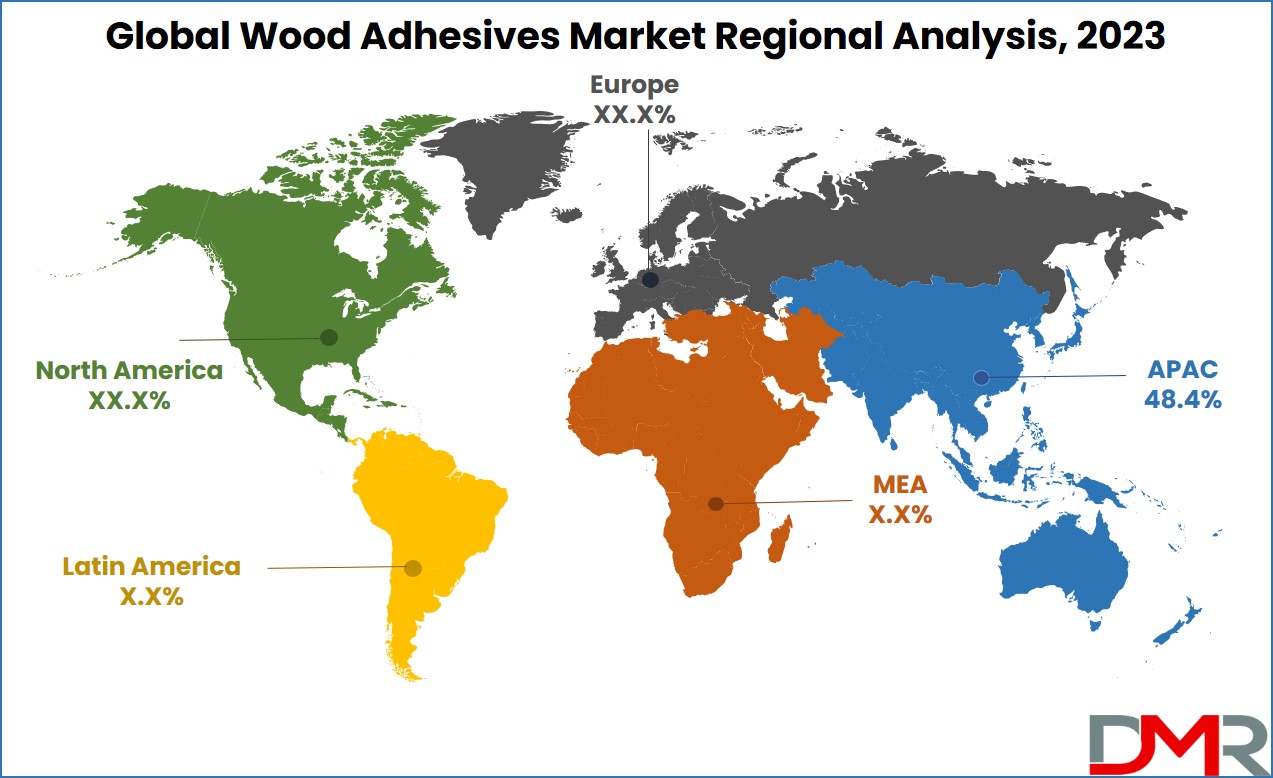

- The Asia Pacific region dominates the market, accounting for 48.4% of the revenue share, fueled by population growth and demand for affordable housing.

Use Cases

- Residential Construction & Flooring: Growing demand for affordable housing and interior remodeling fuels the use of wood adhesives in flooring, doors, windows, and housing components, ensuring durability, strength, and cost-effectiveness in residential projects.

- Commercial Furniture & Interior Design: Rising investments in office spaces, hospitality, and retail environments drive the adoption of wood adhesives in furniture and panel-based interiors, offering superior bonding, aesthetic appeal, and long-lasting performance.

- Industrial Manufacturing: Engineered wood products such as particleboard, MDF, and plywood rely heavily on adhesives for production efficiency, with polyurethane and UF adhesives delivering high tensile strength, cost savings, and scalability for large-scale manufacturing.

- Healthcare & Institutional Spaces: Hospitals, schools, and public facilities increasingly use eco-friendly, low-VOC wood adhesives in furniture and fixtures to meet strict environmental and safety regulations, supporting healthier indoor environments.

- Marine & Specialty Applications: The demand for high-performance wood adhesives is rising in marine plywood and exterior-grade panels, where resistance to water, humidity, and extreme conditions is critical, driven by growth in shipbuilding and infrastructure projects.

Market Dynamic

The

Polyurethane Foam Machines is influenced by regulatory standards similar to those in the Wood Adhesive Market, which operates under strict rules limiting formaldehyde emissions during wood panel production. These regulations are expected to drive demand for alternative adhesive types, including polyurethane, soy-based, and polyvinyl acetate, over the forecast period.

Additionally, the Polyurethane Foam Machines Market benefits from growth in renovation and construction activities. Government-led sustainability initiatives are further boosting demand for natural wood and engineered products, particularly in furniture applications for both commercial and residential sectors.

The demand for wood adhesives is also being driven by the renovation and remodeling trends due to upgraded standards of living. Furthermore, the growing service industries in developing nations are leading to the development of corporate buildings and office spaces, consequently increasing the need for wood furniture and, subsequently, bolstering the wood adhesives industry's growth.

Additionally, mounting concerns about global warming & deforestation have prompted a greater reliance on engineered wood panels, such as oriented strand board, plywood, & particle board, which depends on a substantial number of adhesive volumes. Moreover, a growing customer base, the rising awareness of environmental issues, and sustained research & development activities are expected to further boost the demand for bio-based wood adhesives in the market.

Notably, the development of

Medical Adhesives and Sealants has parallels with advancements in wood adhesives, as both markets emphasize performance, safety, and compliance with strict environmental standards.

Research Scope and Analysis

By Product

In 2023, the Urea-formaldehyde (UF) segment emerges as the dominant force in the market, capturing a significant revenue share. This dominance can be accredited to its extensive usage as a thermosetting resin in wood applications. UF resins offer notable advantages, such as flexural modulus & high tensile strength.

The addition of fillers & extenders to the resin allows for control over flow, resin penetration into the wood, and viscosity, making them a staple in the production of particleboard & interior plywood. However, it's worth noting that UF adhesives exhibit a significant drawback in terms of poor water resistance.

In contrast, MUF (melamine urea-formaldehyde resins) are gaining traction due to their better resistance to water when compared to other resins. A noteworthy trend in the market is the growing manufacturing of MUF resin adhesives for the manufacturing of tiles from bamboo or bamboo laminates. These types of resins are becoming the preferred choice for exterior panels as well, offering enhanced durability in challenging environmental conditions.

By Substrate

In 2023, the Particleboard (PB) segment stands out as the dominant player in the substrate category. This leadership position is accredited to Particleboard's cost-effectiveness, offering an alternative to materials like plywood. Its advantages, including higher density, lower cost, & uniformity, position it favorably in the market, with expectations of sustained demand growth in the upcoming years.

Wood adhesive utilization within the PB (Particle Board) segment is predicted to grow steadily by 2032. The Particleboard production process involves blending wood particles & flakes with adhesive, forming them into sheets, making it a popular choice, particularly in Europe.

Meanwhile, the OSB (Oriented Strand Board) segment presents another aspect of the market. OSB production comprises slicing logs into specific-sized strands, joining them together in wet bins, & subsequent drying is done. Incorporating adhesive to bind the dried strands, alongside a little utilization of wax to enhance moisture tolerance & water absorption, drives demand for OSB as a compelling substitute to solid boards & plywood, particularly in Europe and North America, positioning it for growth in the upcoming years.

By Technology

The Water Enhancer Market shares similarities with the wood adhesives sector, where water-based technology dominates due to its eco-friendly advantages. Water-based adhesives hold the largest market share, driven by increasing demand for sustainable and environmentally friendly solutions, giving them a competitive edge over solvent-based alternatives. This trend aligns with the

Water Enhancer, where consumers also prioritize health-conscious and sustainable products.

Further, both Europe & North America are constantly taking initiatives to rule out solvents & solvent-based adhesives, focusing on reducing VOC (volatile organic compound) emissions. This shift has seen a rising need for water-based & reactive adhesives. The Asia Pacific (APAC) region, the largest market by global revenue, is noticing a high growth rate, and this trend is anticipated to stay in the upcoming years. The introduction of the latest advisories related to solvents in the adhesive sector will further result in fueling the growth of water-based adhesives

By Application

In 2022, the furniture application segment took the lead in the market, commanding the highest revenue share. This dominance is accredited to the rising adoption of wood panels, prized for their, impeccable finish, lightweight nature & durability when compared to earlier utilized wood. These panels are capable of crafting robust and long-lasting interior decor items, which are expected to exert a positive influence on the growth of this segment over the forecast period.

The flooring sector, on the other hand, is poised for rapid expansion, projected to achieve the fastest compound annual growth rate (CAGR) by 2032. This surge is driven by the rising per capita income & a rising demand for spaces for residential purposes, which, in turn, fuels the need for quality flooring solutions. Plywood kind of flooring offers consumers an opportunity to attain aesthetics at a more affordable cost. The rise in refurbishment & restoration projects in developed countries is also set to bolster the demand for wooden type of flooring, thereby driving the growth of the adhesive industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Wood Adhesives Market Report is segmented on the basis of the following:

By Product

- Melamine Urea-formaldehyde (MUF)

- Urea-Formaldehyde (UF)

- Phenol-formaldehyde (PF)

- Isocyanates

- Polyvinyl Acetate (PVA)

- Soy- based

- Others

By Substrate

- Solid wood

- Oriented Strand Board (OSB)

- Plywood

- Particle Board (PB)

- Medium-density Fiberboard (MDF)

- High-density Fiberboard (HDF)

- Others

By Technology

- Solvent Based

- Water Based

- Solventless

By Application

- Furniture

- Doors & Windows

- Flooring & Decks

- Housing Components

- Others

Regional Analysis

The Asia Pacific region dominates the market in 2023 and is anticipated to hold 48.4% of the total revenue share. This can be ascribed to the remarkable population growth in Asia Pacific countries, coupled with a strong demand for cost-effective housing. Moreover, government initiatives promoting fundamental facilities like food and shelter have fueled growth in the construction sector within the Asia-Pacific region.

China in the Asia-Pacific region particularly holds significant economic importance in the wood panel sector, being the world's largest producer. The flourishing wood panel sector in the area, combined with the availability of wood products, is expected to fuel the growth of the wood adhesives industry. Moreover, the rapid pace of industrialization & urbanization is anticipated to be a driving force for market growth in the upcoming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Market is marked by its fragmentation, as it comprises a multitude of both global and regional players. Notable companies in this market include HB Fuller, Henkel AG & Co. KGaA, Bostik SA, 3M, and various smaller to medium-sized regional competitors.

Global corporations find themselves in fierce competition, not only amongst themselves but also against regional players who possess robust distribution networks and a deep understanding of suppliers and regulatory aspects. For instance, in June 2021, H.B. Fuller announced a strategic distribution partnership with Jubilant Agri and Consumer Products Limited (JACPL) to cater to the growing demand for wood adhesives, particularly in the B2B woodworking sector. Furthermore, companies within this market vie for market share by emphasizing the quality of their products and the advanced manufacturing technologies they employ.

Some of the prominent players in the Global Wood Adhesives Market are:

- Henkel AG & Co., KGaA

- Bostik S.A.

- H.B Fuller

- 3M

- Sika AG

- Ashland, Inc.

- Pidilite Industries Ltd.

- Jubilant Industries Ltd.

- AkzoNobel N.V

- Franklin Adhesives & Polymers

- DowDuPont Inc.

- Minnesota

- Other Key Players

Recent Developments